Now you see it, now you don’t.

The rip-roaring rally that started in October, with which we made so much money on, vaporized in a heartbeat. Traders lulled into a false sense of security with happy talk among themselves were suddenly throwing up on their shoes.

Fed governor Powell clearly indicated that interest rates will remain higher for longer, and therefore, stock prices lower. Powell promised us pain last summer and is delivering big time. Powell’s job is NOT to defend the stock market.

Personally, I’m looking for another 75 basis points on December 14, followed by 50 basis points on February 1 and another 25 basis points on March 22. This will bring us 4.75%-5.00% range for overnight Fed funds. After that, rates will fall for years as the Fed rushes to repair the damage it inflicted on the economy. Stocks will deliver the 800% return I have been promising.

I went into the Fed meeting short and used the ensuing meltdown to take profits.

As a result, my November month-to-date performance went off to the races, already achieving a hot +2.20%.

That leaves me with a very rare 100% cash position. With midterm election results out on Wednesday and the next report on the Consumer Price Index on Thursday, that sounds like a prudent place to be.

My 2022 year-to-date performance ballooned to +77.57%, a new high. The Dow Average is down -11.85% so far in 2022.

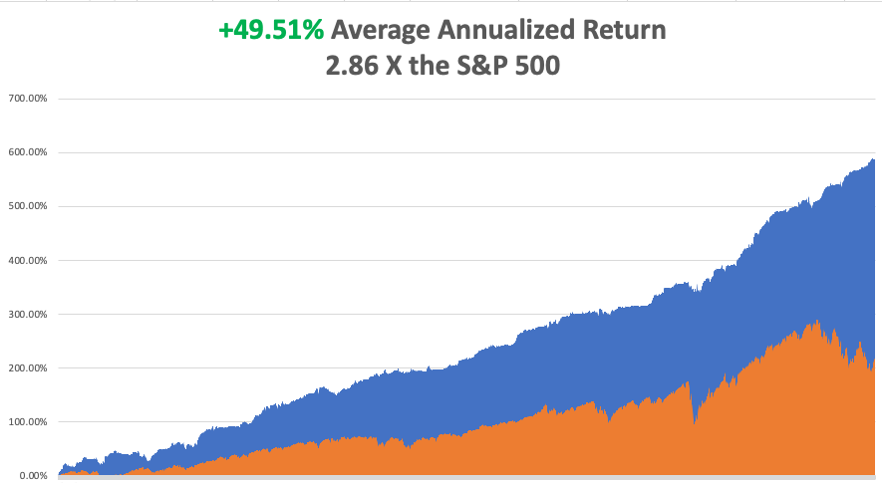

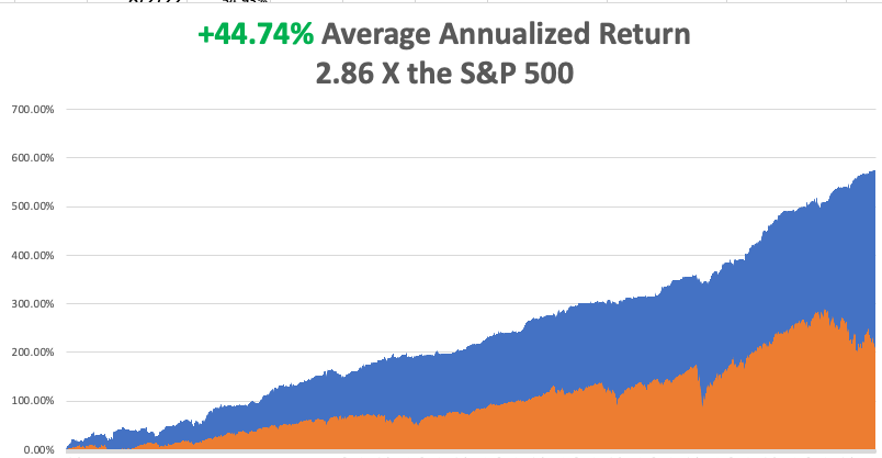

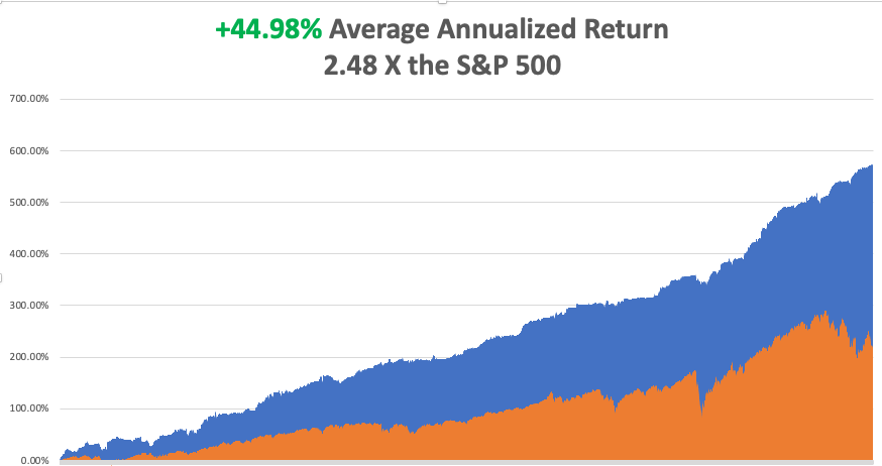

It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high +49.51%.

That brings my 14-year total return to +590.13%, some 2.86 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to +49.51%, easily the highest in the industry.

There is no doubt that the greatest buying opportunity of the century is setting up. Those who bought the Dotcom Crash bottom in 2003 snapped up Apple (AAPL) at 20 cents on its way to $186, split adjusted. During the 2009 Financial Crisis bottom, the savvy snapped up Microsoft (MSFT) at $11. Its top tick last year was $23.

A similar golden opportunity is setting up in the next year and will create immense wealth. Just remember that things always go down more than you think, and then rise far more than you believe possible.

However, one of the greatest questions of all time has finally been resolved. Can stock markets rise without big tech? The answer has been an overwhelming “YES.” Financial, where we have been very heavily involved, rose up to 25% while tech was falling 20%. Healthcare has been on fire as well. It all gives us a place to earn our crust of bread until the long-term trend up in tech resumes, however long that may take.

The turn will be called by the prospect of Fed interest rate CUTS sometime in 2023, and good luck calling that.

Further complicating matters near term is that this could be the greatest tax loss selling year of all time, with some stocks down up to 80% sold to offset gains elsewhere, such as in energy. But the mutual funds are already done, their tax year already ended. Whatever is left must be wound up by December 31.

Nonfarm Payroll Comes in at a Hot 261,000 in October, higher than hoped. The Headline Unemployment Rate crawled up to 3.7%, the highest since February. Average hourly earnings are up 4.7% YOY, far below the inflation rate. The U-6 “Discourage worker” rate rose from 6.7% to 6.8%. Anyone who thinks these numbers will lead to an earlier end to the Fed interest rate rises has a hole in their head.

JOLTS Beats Bigtime, with 10.7 million jobs opening, a million more than expected. No cooling of labor demand here.

ADP Rises 239,000, more than expected, nailing the coffin shut on the 75-basis point rate hike. The strong industries, like Airlines and Leisure & Hospitality, are still hiring like crazy.

Is Big Tech Dead Money? It may be for months, or even years, but Big Tech always comes back. It’s just a matter of how long it takes big double-digit earnings to return with the onset of the next robust economic recovery. Until then, expect a lot of differentiation. Apple (AAPL) will hold up best, followed by Amazon (AMZN) and Google (GOOGL). As for Meta (META), the old Facebook, it may never come back.

Tech Austerity Accelerates, with Apple (AAPL) announcing an unheard-of hiring freeze. The rest of big tech is following suit. The knees are about to be cut from under the market’s safest stock.

Fed Raises Interest Rates by 75 Basis Points but changed their language to be slightly more accommodative. Stocks rallied 500 points on the news. If this is bullish, it’s a stretch. They are still targeting a 2% inflation rate and will take into account cumulative tightening to date. Acknowledging they have already raised rates a lot is something. That is more dovish than expected.

Chicago PMI is Still Falling, from 47 estimated to 45.2 in October. Under 50 indicates a recessionary economy.

Morgan Stanley Says Rising Rates to End Soon, according to strategist Mike Wilson. The big pivot will happen sooner than later. I agree.

Twitter Hate Speech Spikes 500%, since Elon Musk took over the company, as racists and conspiracy theorists test his looser limits. The entire senior staff has been fired as they are still subject to fraud accusations from Musk. Musk thinks he can resell the company for a big premium in five years. Is this the end of democracy, or just Twitter (TWTR) whose stock no longer trades? More advertisers will bail after Musk paraded conspiracy theories in the wake of the Pelosi assassination attempt.

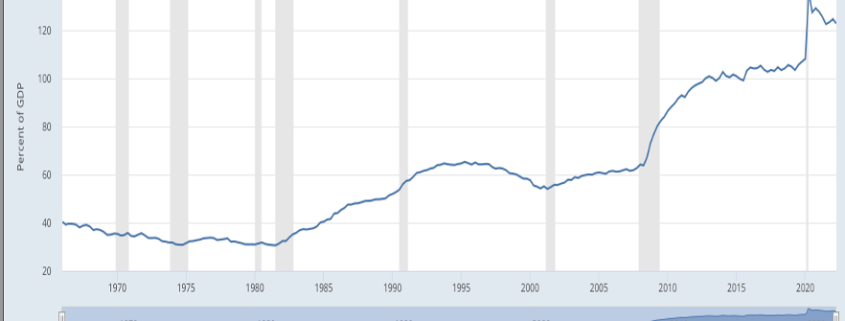

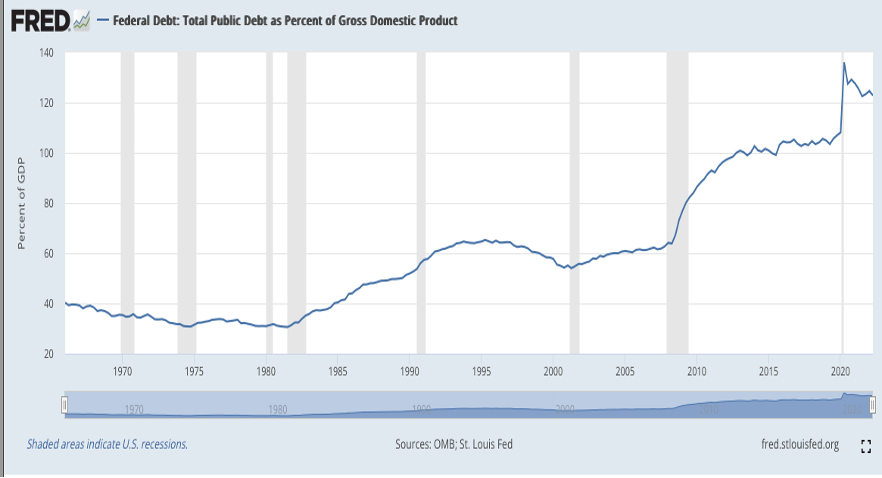

US Treasury to Borrow $550 Billion in Q4. It means the bond short (TLT) and (TBT) may have one more gasp to go.

Japan Spends $42 Billion to Support the Yen in October to no avail, as it threatens new lows. The yen will remain weak as long as interest rates remain near zero.

First Starship to Launch in December, the largest rock ever launched. The super heavy booster will return to earth while the capsule will land off the coast of Hawaii. Space X has a $3 billion contract from NASA to return to the moon by 2025.

US Banks Processed $1.2 Billion in Ransomware Payments this Year, triple the previous year’s level. Russia is the source of many of the attacks. And you wonder why we are supporting Ukraine?

Russian Economy Shrinks by 5% YOY in September as the sanctions take their toll. Only 45% to go. The call-up of 300,000 reservists has yet to hit the economy.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With the economy decarbonizing and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side will be far more efficient and profitable than the old. Dow 240,000 here we come!

On Monday, November 7 at 12:00 PM, the Consumer Credit for September is released.

On Tuesday, November 8, the US Midterm elections take place with 532 House and 34 Senate seats up for grabs.

On Wednesday, November 9 the entire day will be spent analyzing election results and tracking the ties.

On Thursday, November 10 at 8:30 AM, Weekly Jobless Claims are announced. We also get the US Core Inflation Rate for October.

On Friday, November 11 at 8:30 AM the University of Michigan Consumer Sentiment for November is printed. At 2:00 PM, the Baker Hughes Oil Rig Count is out.

As for me, I was recently in Los Angeles visiting old friends, and I am reminded of one of the weirdest chapters of my life.

There were not a lot of jobs in the summer of 1971, but Thomas Noguchi, the LA County Coroner, was hiring. The famed USC student jobs board had delivered! Better yet, the job included hours at night and free housing at the coroner's department.

I got the graveyard shift, from midnight to 8:00 AM. All I had to do was buy a black suit from Robert Halls, for $25.

Noguchi was known as the “coroner to the stars” having famously done the autopsies on Marilyn Monroe and Jane Mansfield. He did not disappoint.

For three months, whenever there was a death from unnatural causes, I was there to pick up the bodies. If there was a suicide, gangland shooting, or horrific car accident, I was your man.

Charles Manson had recently been arrested and I was tasked with digging up the victims. One, cowboy stuntman Shorty Shay, had his head cut off and neatly placed in between his ankles.

The first time I ever saw a full set of women’s underclothing, a girdle, and pantyhose, was when I excavated a desert roadside grave that the coyotes had dug up. She was pretty far gone.

Once, I and another driver were sent to pick up a teenage boy who had committed suicide in Beverly Hills. The father came out and asked us to take the mattress as well. I regretted that we were not allowed to do favors on city time. He then said, “can you take it for $200”, then an astronomical sum.

A few minutes later found a hearse driving down the Santa Monica Freeway on the way to the dump with a double mattress expertly tied on the roof with Boy Scout knots with a giant blood spot in the middle.

Once, I was sent to a cheap motel where a drug deal gone wrong had produced several shootings. I found $10,000 in a brown paper bag under the bed. The other driver found another ten grand and a bag of drugs and kept them. He went to jail. I didn’t.

The worst pick-up of the summer was also the most disgusting and even made the old veterans sick. A 300-pound man had died of a heart attack and was not discovered for a month. We decided to each grab an arm or leg and all tug on the count of three. One, two, three, and all four limbs came off!

Eventually, I figured out that handling dead bodies could be hazardous to your health, so I asked for rubber gloves. I was fired.

Still, I ended up with some of the best summer job stories ever.

Stay healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader