The airline business is booming but homebuilders are in utter despair. Hotel rooms are seeing extortionate 56% YOY price increases, while residential real estate brokers are falling flat on their faces.

It’s a recession that’s here, there, and nowhere.

Welcome to the rolling recession.

If you are lucky enough to work in a handful of in-demand industries, times have never been better. If you aren’t, then it’s Armageddon.

Look at single industries one at a time, as the media tends to do, business conditions are the worst since the Great Depression and pessimism is rampant. Look at Tesla, where there is a one-year wait to get a Model X, and there is either a modest recession on the menu, or simply slowing growth at worst.

Notice that a lot of commentators are using the word “normally”. News Flash: nothing has been normal with this economy for three years.

Which leaves us with dueling yearend forecasts for the S&P 500. It will either be at 3,900, where it is now, or 4,800. A market that is unchanged, worst case, and up 20% best case sounds like a pretty good bet to me. The prospects for individual stocks, like Tesla (TSLA), Microsoft (MSFT), or NVIDIA (NVDA) are even better, with a chance of 20% of downside or 200% of upside.

I’ll sit back and wait for the market to tell me what to do. In the meantime, I am very happy to be up 60% on the year and 90% in cash.

An interesting thing is happening to big-cap tech stocks these days. They are starting to command bigger premiums both in the main market and in other technology stocks as well.

That is because investors are willing to pay up for the “safest” stocks. In effect, they have become the new investment insurance policy. Look no further than Apple (AAPL) which, after a modest 14% decline earlier this year, managed a heroic 30% gain. Steve Jobs’ creation now boasts a hefty 28X earnings multiple. Remember when it was only 9X?

Remember, the stock sells off on major iPhone general launches like we are getting this week, so I’d be careful that my “insurance policy” doesn’t come back and bite me in the ass.

Nonfarm Payroll Report Drops to 315,000 in August, a big decline, and the Headline Unemployment Rate jumps to 3.7%. The Labor Force Participation Rate increased to 62.4%. The “discouraged worker” U-6 unemployment rate jumped to 7.0%. Manufacturing gained 22,000. Stocks loved it, but it makes a 75-basis point in September a sure thing.

Jeremy Grantham Says the Stock Super Bubble Has Yet to Burst, for the seventh consecutive year. If I listened to him, I’d be driving an Uber cab by now, commuting between side jobs at Mcdonald's and Taco Bell. Grantham sees stocks, bonds, commodities, real estate, precious metals, crypto, and collectible Beanie Babies as all overvalued. Even a broken clock is right twice a day unless you’re in the Marine Corps, which uses 24-hour clocks.

Where are the Biggest Buyers on the Dip? Microsoft (MSFT), Salesforce (CRM), and Disney (DIS), followed by Visa (V), and Boeing (BA). Analysts see 20% of upside for (MSFT), 32% for (CRM), and 21% for (DIS). Sure, some of these have already seen big moves. But the smart money is buying Cadillacs at Volkswagen prices, which I have been advocating all year. Take the Powell-induced meltdown as a gift.

The Money Supply is Collapsing, down for four consecutive months. M2 is now only up less than 1% YOY. This usually presages a sharp decline in the inflation rate. With a doubling up of Quantitative Tightening this month, we could get a real shocker of a falling inflation rate on September 13. Online job offers are fading fast and used cars have suddenly become available. This could put in this year’s final bottom for stocks.

California Heads for a Heat Emergency This Weekend, with temperatures of 115 expected. Owners are urged to fully charge their electric cars in advance and thermostats have been moved up to 78 as the electric power grid faces an onslaught of air conditioning demand. The Golden State’s sole remaining Diablo Canyon nuclear power plant has seen its life extended five years to 2030. This time, the state has a new million more storage batteries to help.

Oil (USO) Dives to New 2022 Low on spreading China lockdowns. Take the world’s largest consumer offline and it has a big impact. More lows to come.

NVIDIA (NVDA) Guides Down in the face of new US export restrictions to China. The move will cost them $400 million in revenue. These are on the company’s highest-end A100 and H100 chips which China can’t copy. (AMD) received a similar ban. It seems that China was using them for military AI purposes. The shares took a 9% dive on the news. Cathie Wood’s Ark (ARKK) Funds dove in and bought the lows.

Weekly Jobless Claims Plunge to 232,000, down from 250,000 the previous week for the third consecutive week. No recession in these numbers.

First Solar (FSLR) Increases Output by 70%, thanks to a major tax subsidy push from the Biden Climate Bill. The stock is now up 116% in six weeks. We have been following this company for a decade and regularly fly over its gigantic Nevada solar array. Buy (FSLR) on dips.

Home Prices Retreat in June to an 18% YOY gain, according to the Case Shiller National Home Price Index. That’s down from a 19.9% rate in May. Tampa (35%), Miami (33%), and Dallas (28.2%) showed the biggest gains. Blame the usual suspects.

Tesla (TSLA) Needs $400 Billion to expand its vehicle output to Musk’s 20 million units a year target. One problem: there is currently not enough commodity production in the world to do this. That sets up a bright future for every commodity play out there, except oil.

Bitcoin (BTC) is Headed Back to Cost, after breaking $20,000 on Friday. With the higher cost of electricity and mining bans, spreading the cost of making a new Bitcoin is now above $17,000. It doesn’t help that much of the new crypto infrastructure is falling to pieces.

My Ten-Year View

When we come out the other side of pandemic and the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With oil prices and inflation now rapidly declining, and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side will be far more efficient and profitable than the old. Dow 240,000 here we come!

With a very troublesome flip-flopping market, my August performance still posted a decent +5.13%.

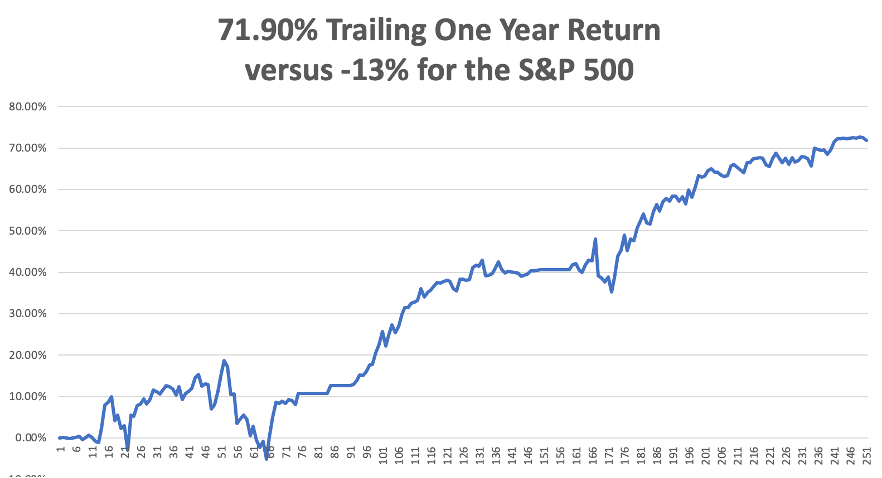

My 2022 year-to-date performance ballooned to +59.96%, a new high. The Dow Average is down -13.20% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high +71.90%.

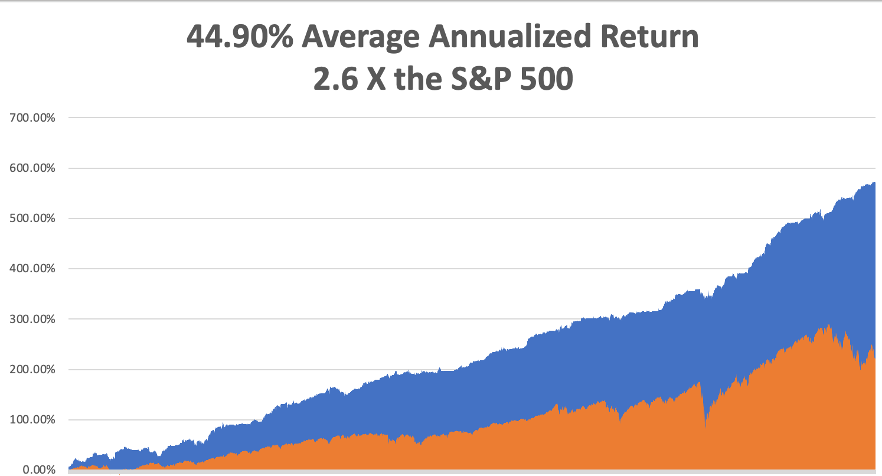

That brings my 14-year total return to +572.52%, some 2.60 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to +44.90%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 94.7 million, up 300,000 in a week and deaths topping 1,047,000 and have only increased by 2,000 in the past week. You can find the data here.

On Monday, September 5 markets are closed for Labor Day.

On Tuesday, September 6 at 7:00 AM, the ISM Non-Manufacturing PMI for August is out.

On Wednesday, September 7 at 11:00 AM, the Fed Beige Book for July is published.

On Thursday, September 8 at 8:30 AM, Weekly Jobless Claims are announced.

On Friday, September 9 at 2:00 the Baker Hughes Oil Rig Count is out.

As for me, the first thing I did when I received a big performance bonus from Morgan Stanley in London in 1988 was to run out and buy my own airplane.

By the early 1980s, I’d been flying for over a decade. But it was always in someone else’s plane: a friend’s, the government’s, a rental. And heaven help you if you broke it!

I researched the market endlessly, as I do with everything, and concluded that what I really needed was a six-passenger Cessna 340 pressurized twin turbo parked in Santa Barbara, CA. After all, the British pound had just enjoyed a surge again the US dollar so American planes were a bargain. It had a range of 1,448 miles and therefore was perfect for flying around Europe.

The sensible thing to do would have been to hire a professional ferry company to fly it across the pond. But what’s the fun in that? So, I decided to do it myself with a copilot I knew to keep me company. Even more challenging was that I only had three days to make the trip, as I had to be at my trading desk at Morgan Stanley on Monday morning.

The trip proved eventful from the first night. I was asleep in the back seat over Grand Junction, CO when I was suddenly awoken by the plane veering sharply left. My co-pilot had fallen asleep, running the port wing tanks dry and shutting down the engine. He used the emergency boost pump to get it restarted. I spent the rest of the night in the co-pilot’s seat trading airplane stories.

The stops at Kansas City, MO, Koshokton, OH, Bangor, ME proved uneventful. Then we refueled at Goose Bay, Labrador in Canada, held our breath and took off for our first Atlantic leg.

Flying the Atlantic in 1988 is not the same as it is today. There were no navigational aids and GPS was still top secret. There were only a handful of landing strips left over from the WWII summer ferry route, and Greenland was still littered with Mustang’s, B-17’s, B24’s, and DC-3’s. Many of these planes were later salvaged when they became immensely valuable. The weather was notorious. And a compass was useless, as we flew so close to the magnetic North Pole the needle would spin in circles.

But we did have NORAD, or America’s early warning system against a Russian missile attack.

The practice back then was to call a secret base somewhere in Northern Greenland called “Sob Story.” Why it was called that I can only guess, but I think it has something to do with a shortage of women. An Air Force technician would mark your position on the radar. Then you called him again two hours later and he gave you the heading you needed to get to Iceland. At no time did he tell you where HE was.

It was a pretty sketchy system, but it usually worked.

To keep from falling asleep, the solo pilots ferrying aircraft all chatted on frequency 123.45 MHz. Suddenly, we heard a mayday call. A female pilot had taken the backseat out of a Cessna 152 and put in a fuel bladder to make the transatlantic range. The problem was that the pump from the bladder to the main fuel tank didn’t work. With eight pilots chipping in ideas, she finally fixed it. But it was a hair-raising hour. There is no air-sea rescue in the Arctic Ocean.

I decided to play it safe and pick up extra fuel in Godthab, Greenland. Godthab has your worst nightmare of an approach, called a DME Arc. You fly a specific radial from the landing strip, keeping your distance constant. Then at an exact angle you turn sharply right and begin a descent. If you go one degree further, you crash into a 5,000-foot cliff. Needless to say, this place is fogged 365 days a year.

I executed the arc perfectly, keeping a threatening mountain on my left while landing. The clouds mercifully parted at 1,000 feet and I landed. When I climbed out of the plane to clear Danish customs (yes, it’s theirs), I noticed a metallic scraping sound. The runway was covered with aircraft parts. I looked around and there were at least a dozen crashed airplanes along the runway. I realized then that the weather here was so dire that pilots would rather crash their planes than attempt a second go.

When I took off from Godthab, I was low enough to see the many things that Greenland is famous for polar bears, walruses, and natives paddling in deerskin kayaks. It was all fascinating.

I called into Sob Story a second time for my heading, did some rapid calculations, and thought “damn”. We didn’t have enough fuel to make it to Iceland. The wind had shifted from a 70 MPH tailwind to a 70 MPH headwind, not unusual in Greenland. I slowed down the plane and configured it for maximum range.

I put out my own mayday call saying we might have to ditch, and Reykjavik Control said they would send out an orange bedecked Westland Super Lynch rescue helicopter to follow me in. I spotted it 50 miles out. I completed a five-hour flight and had 15 minutes of fuel left, kissing the ground after landing.

I went over to Air Sea rescue to thank them for a job well done and asked them what the survival rate for ditching in the North Atlantic was. They replied that even with a bright orange survival suit on, which I had, it was only about half.

Prestwick, Scotland was uneventful, just rain as usual. The hilarious thing about flying the full length of England was that when I reported my position in, the accents changed every 20 miles. I put the plane down at my home base of Leavesden and parked the Cessna next to a Mustang owned by a rock star.

I asked my pilot if ferrying planes across the Atlantic was also so exciting. He dryly answered “Yes.” He told me that in a normal year, about 10% of the planes go missing.

I raced home, changed clothes, and strode into Morgan Stanley’s office in my pin-stripped suit right on time. I didn’t say a word about what I just accomplished.

The word slowly leaked out and at lunch, the team gathered around to congratulate me and listen to some war stories.

Stay healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Flying the Atlantic in 1988

Looking for a Place to Land in Greenland

Landing on a Postage Stamp in Godthab, Greenland

No Such a Great Landing

No Such a Great Landing

Flying Low Across Greenland

Gassing Up in Iceland

Almost Home at Prestwick

Back to London in 1988