I have many superpowers, but one of the most useful ones is picking market bottoms. It looks like another one is at hand.

The past week has been one of epic wreckage in the stock market. It’s as if Hurricanes Sandy and Katrina both hit at the same time and were followed by a good old California earthquake.

Your favorite share prices have gone from mildly irritating to disappointing to absolutely gobsmackingly awful in only five months.

As a result, some of the best buying opportunities of the decade are setting up, the kind that you will be able to will on to your grandchildren. This is when mortgages get paid off, college debt is retired, and retirements financed.

There are a couple of key measurements here to watch. When the number of stocks above their 200-day moving averages falls below 20%, it always signifies an important market bottom. At the Thursday low, we were at 15% for the (SPY) and 12% for NASDAQ. It’s just another technical indicator among the hundreds, but a useful one, nonetheless.

Another one that helps is that on Friday, we also saw the first 90% advancing day since June 2020. All correlations went to one last week, meaning that all asset classes went down in unison.

That puts the bottom for the S&P 500 at $3,800 with an initial upside target of $4,200. We are way overdue for an 8%-12% relief rally. If I am wrong, we are only dropping another 200 points, or 5%.

Except that this time, it’s different.

At $3,600, down 25% from the January high, the market will have fully discounted a fairly severe recession that isn’t going to happen. Amazing as it may seem, some of the stocks having the biggest falls are still seeing earnings grow nicely. They are simply being sold because they are widely owned. That snares them in all of the algorithm-driven high-frequency trading that is going on.

I know I’ve said this a million times, but you use markets like this to buy Rolls Royces at Volkswagen prices. I’m talking about Alphabet (GOOGL), Microsoft (MSFT), and Apple (AAPL).

These companies are solid as the Rock of Gibraltar, with massive cash flows, huge cash balances, unassailable moats, and steady, if not spectacular earnings prospects. People have not suddenly abandoned Google as a search engine, Microsoft still has a near-monopoly in PC operating software, and Apple will sell more new and more expensive iPhones than ever.

The other baby that is being thrown out with the bathwater here are the banks. Recession fears have given these shares a haircut by a third by recession fears that damage the credit quality of their loan books.

What if there is no recession? Then the bear market in banks goes up in a puff of smoke. It helps that this time, there is no liquidity or capital crisis to be seen whatsoever. Add JP Morgan (JPM), Bank of America (BAC), and Wells Fargo (WFC) to your growing “BUY” lists.

Buying the best stocks with a recession already baked in the price? Sounds like a winner to me.

As for the smaller tech stocks, I’d take a pass, at least for now. Most of these companies, which never made any money, now have shares down 70% to 90% and are not coming back. They provided to be perfect money destruction machines. Never confuse “gone down a lot” with “cheap.” Take away the punch bowl and suddenly the party becomes very boring.

The Mad Hedge Market Timing Index certainly earned its weight in gold last week. We saw a multi-year low of 6 on Thursday and I was sending out trade alerts to “BUY” as fast as I could write them. A 1,200-point snap-back rally ensued, setting up a bottom that could last for weeks, if not forever.

The other great thing to come out of this selloff is that we learned what a fantastic leading indicator of risk-taking Bitcoin has become. While the S&P 500 plunged by 20%, Bitcoin absolutely cratered by 60%. We saw the correlation on both the upside and the downside.

Bitcoin is basically the (SPY) X 3. Ignore Bitcoin at your peril, even if you think the whole thing is a scam. And keep reading your Mad Hedge Bitcoin Letter.

Was this the grand finale? Big tech stocks like Apple (AAPL) and Microsoft (MSFT) stubbornly held their ranges for months, supporting the market as a whole. That ended last week on no news with the decisive breakdown of the key names. Apple has lost a staggering $350 billion in market cap in a week. Does this signal the final washout of this correction? It could. The Volatility Index (VIX) has ceased rising, and bonds have begun a short-covering countertrend rally.

Jay Powell warns of more 50-basis point rate rises if the economic conditions justify it. He also can’t guarantee a soft landing for the economy. Thanks for telling us precisely nothing. The comments were made on NPR Radio’s marketplace program and immediately tanked Dow futures by 100 points.

Core Inflation moderates slightly, down from 8.5% to 8.3% in April, sparking a stock market rally. That is 0.2% lower than last month’s 8.5% print, hence the bond rally. It was the first decline in the inflation rate in seven months. The probability of a peak in inflation is increasing.

Producer Price Index soars 11.0% YOY and 0.5% in April alone. It is a red-hot number showing that inflation is getting worse. The Producer Price Index (PPI) program measures the average change over time in the selling prices received by domestic producers for their output.

Goldman Sachs quit the SPAC Market, citing unmanageable liability. More likely, they don’t want to get stuck with illiquid longs on SPACS they brought to the market. I warned you this was a roach motel market; you can check in but you can never check out. I have to admit that I never believed in this asset class for two seconds, regarding it as nothing more than a license to steal money from investors.

Bitcoin drops below $28,000, taking the cryptocurrency down to more than half its November peak. It’s acting more like a small-cap tech stock every day, not the thing to be right now. With the Fed shrinking liquidity at a record rate, this is not a favorable backdrop either.

Another crypto bites the dust, as the free fall continues. Tether, a stablecoin tied to the US dollar, has fallen to 69% of its face value. It turns out that backing by the US government is more reliable than support from a PO Box in the Cayman Islands. Expect more to fail. Avoid crypto at all cost.

Ford to unload 8 million Rivian shares, once a lockup expires. Other pick institutional blocks are waiting in the wings. The EV truck is smoking hot on the road, but the shares have been dead as a doorknob, down 85% from the peak and 16% on the day. Avoid (RIVN) while the sector is death warmed over.

Biden mulling dropping Chinese Tariffs to make a dent in inflation. It might help a bit. It just depends on what we might get in return. Such a move wouldn’t exactly protect American workers, a top Biden priority. Relations with China are still fraught at best.

US Dollar blasts through to 20-year high, but a cooling inflation number on Wednesday may signal the top. Soaring interest rates, a strong economy, and a weak Europe and Japan are the drivers. There’s a short play here someday, but not yet.

Housing Supply improves for the first time in three years. Supply of mid-sized single-family loans takes the lead. Inventories are showing smallest declines in a year. Finally, the buyers get a break….now that prices are falling. Almost all new loans are 5/1 ARMS.

Air Ticket Prices are through the roof and were the biggest single factor keeping the CPI inflation figure sky-high yesterday. Buyers cite as reasons a long time since visiting relatives, desperation to get outdoors, and a rush to travel before the next Covid wave hits. It may be a one-time pop only, as used car prices were in previous months.

30-Year Fixed Rate Mortgages Top 5.5% in the fastest rate rise in history. The housing market is still hot, now fueled by exploding adjustable-rate mortgages 1.5% cheaper. Refi’s, however, have gone to zero.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still historically cheap, oil peaking out soon, and technology hyper accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

With some of the greatest market volatility seen since 1987, my May month-to-date performance recovered to +0.91%. Friday was up +5.12%, the biggest one-day gain in the 14-year history of the Mad Hedge Fund Trader.

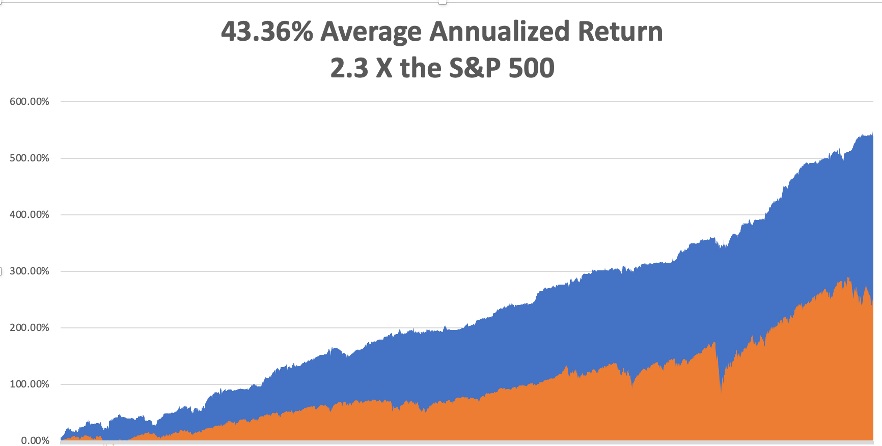

My 2022 year-to-date performance exploded to 31.09%, a new high. The Dow Average is down -12.67% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high 58.48%.

I used last week’s meltdown to cover shorts in the (SPY) and bonds (TLT) and to buy new longs in technology like (AAPL), (NVDA), and (BRKB). I would have sent out more trade alerts if I had more time and didn’t have Covid and a 102 degrees temperature.

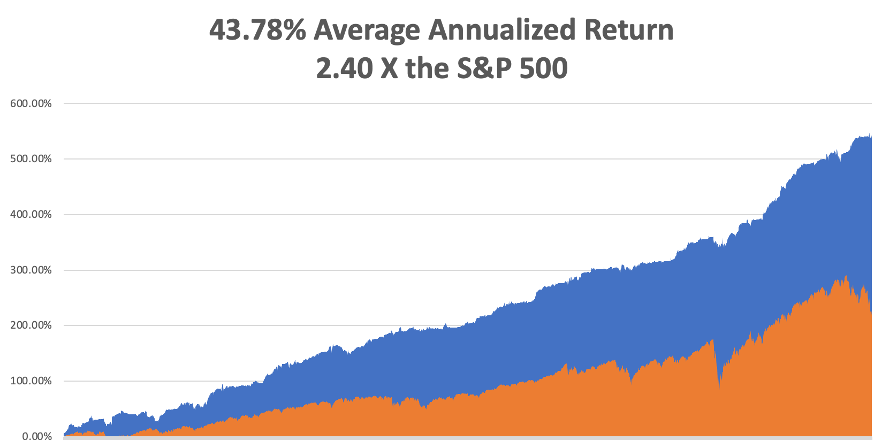

That brings my 14-year total return to 543.65%, some 2.40 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to 43.78%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 82.5 million, up 300,000 in a week, and deaths topping 1,000,000 and have only increased by 2,000 in the past week. You can find the data here.

On Monday, May 16 at 8:30 AM EST, the New York Empire State Manufacturing Index is released.

On Tuesday, May 17 at 8:30 AM, Retail Sales for April are released.

On Wednesday, May 18 at 8:30 AM, Housing Starts and Building Permits for April are published.

On Thursday, May 19 at 8:30 AM, Weekly Jobless Claims are disclosed. Existing Home Sales for April are printed.

On Friday, May 20 at 8:30 AM, the Baker Hughes Oil Rig Count is out.

As for me, the 1980s found me heading the Japanese equity warrant trading department for Morgan Stanley in London, a unit which eventually produced 80% of the company’s equity division profits. It was like running a printing press for $100 bills.

My east end kids in their twenties were catapulted from earning $10,000 a year to a half million. After buying West End condos, the latest Ferrari or Jaguar, and picking up fashion model girlfriends, they ran out of ideas on how to spend the money.

Maybe it was time to upgrade from pints of Fosters at the local pub to fine French wines?

The problem was that no one knew what to buy. Bordeaux alone produced 5,000 labels, and Burgundy a further 7,000. France had 360 appellations in 11 major wine-growing regions. Worse yet, all the names were in French!

Following a firmwide search, it was decided that I should become the in-house wine connoisseur. After all, I was from a wine-growing region in California, spoke French, and was part-French. How could they lose?

As with everything I do, I intensively threw myself into research. It turns out that the insurance exchange, Lloyds of London, was suffering the first of its claims in its history. US asbestos-related insurance claims were exploding. Then, a giant offshore natural gas rig, Piper Alpha, blew up. Suddenly Lloyd’s syndicates were getting their first-ever cash calls.

These syndicates were sold to members as guaranteed risk-free cash flow. Suddenly many members had to come up with $250,000 each in months. No one was ready. How did many meet their cash calls? By selling off 100-year-old wine cellars through auctions at Sotheby’s in London.

Now let me tell you about the international wine auction business. Single cases of the first growth wines, like the 1983 Chateaux Laffite Rothchild, are traded on open markets like any other investment. They appreciate in value like bonds, about 5% a year. However, mixed cases filled with odds and ends from different wineries and different years, have no investment value and traded at enormous discounts.

I found my market!

In short order, I put together a syndicate of 20 new wine consumers and went to work.

To separate out the sheep from the goats, I relied on a wine guide that The Economist magazine included at the back of every wallet diary. As each auction catalog came out, I rated every bottle in the mixed cases coming for sale. I then showed up at the bi-monthly auctions and bought every case.

It wasn’t long before I became the largest buyer of wine at Sotheby’s, picking up 20 cases per auction. The higher the Japanese stock market rose, the more money the traders made, and the more they had to spend on better French wines.

It wasn’t long before Morgan Stanley became famed for being a firm of wine authorities. Our guys were getting invited to high-end dinners just so they could pick the wines, including me.

Sotheby’s took note, and set me up with their in-house wine expert, the famed Serena Sutcliffe. I became her favorite customer. Serena knew everyone in Bordeaux. Who is the most popular person in any wine-growing area? Not the one who makes the wine but the one who sells it.

It wasn’t long before Serena set me up with private tours of the top Bordeaux wineries. I’m talking about Laffite Rothchild, Haut-Brion, Yquem (once owned by US Treasury Secretary C. Douglas Dillon), Chateaux Margaux, and Pomerol. I then flew the two of us down to Bordeaux in my twin-engine Cessna 340 for the wine tasting opportunity of a lifetime. I came back full up, with about 10 cases per flight.

I was guided through ancient, spider web-filled, fungus-infused caves and invited to drink their prime stock. Let me tell you that the 1873 Laffite Rothchild is to die for but is bested by the 1848 Chateaux Yquem.

The stories I heard were incredible. During WWII, one winery dumped its entire stock in a nearby pond to keep the Germans from getting it. But the labels floated to the surface. After the war, they fished out the bottles. But they couldn’t identify them until they opened the bottles, where the vintage was printed on the cork. It was free fishing for years for the locals and there are probably a few bottles still in there.

In sommelier school, you have to taste 5,000 wines to graduate. They tell you up front that it will change your life. After my experience as the biggest wine buyer in London for five years, I can tell you this is true.

One of my treasured buys was a bottle of 1952 Laffite Rothchild, the year I was born. Then it was only 40 years old and went down well with a fine dinner of Beef Wellington. I had the bottle for years until a cleaning lady found it on a shelf after a party and put it in the recycling bin.

A few months ago, I was at the Marin French Antique Show browsing for hidden treasures. What did I find but an empty case of 1985 Romanee Conti, the greatest Burgundy of France. The vendor had no idea what he had. To him, it was just a wood box. I offered him $10. He said thanks. It now adorns a place of honor in my own wine cellar to remind me of this grand experience.

And if we ever meet for dinner, don’t bother with the wine list. I’ll be making the pick.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Fill Her Up with Bordeaux