Global Market Comments

April 20, 2022

Fiat Lux

Featured Trade:

(TESTIMONIAL),

(TEN MORE TRENDS TO BET THE RANCH ON),

(AAPL), (AMZN), (GOOGL), (TSLA), (CRSP), (EDIT), (NTLA)

Global Market Comments

April 20, 2022

Fiat Lux

Featured Trade:

(TESTIMONIAL),

(TEN MORE TRENDS TO BET THE RANCH ON),

(AAPL), (AMZN), (GOOGL), (TSLA), (CRSP), (EDIT), (NTLA)

Global Market Comments

April 8, 2022

Fiat Lux

Featured Trade:

(WEDNESDAY, JUNE 29, 2022 LONDON STRATEGY LUNCHEON)

(APRIL 6 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (TSLA), (TLT), (TBT), (AAPL), (IBB), (GOOGL), (ADBE), (NVDA), (FXE), ($BTCUSD)

Below please find subscribers’ Q&A for the April 6 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley.

Q: The iShares Biotechnology ETF (IBB) is down quite a bit—do I wait a bit longer to put on a debit call spread LEAPS for the end of this year and possibly the end of 2024?

A: This is really one of the two most interesting parts of the market right now. The biotech stocks have been absolutely destroyed over the past year—down 70, 80, 90% in some cases; and at that level, the worst-case scenario is in the price. Maybe we bounce along the bottom for another year. In the best case, these things all double or triple or even go up 10 times. We’re very close to putting on a 2024 call spread in the best biotech names, and if you get the Mad Hedge Biotech Letter (Click here for the link), you already know what they are because the downside risk on these things is getting close to nil, and the upside is 10 times. I like that kind of math—when the upside versus the downside is 10 to 1 in your favor. When I see specific LEAPS opportunities, I’ll send them out to you, but the answer is: not yet. We’re getting very close on biotech, however.

Q: I sold about a third of my ProShares UltraShort 20+ Year Treasury (TBT) position at $22.00 for a nice 40% gain, thank you very much. Should I hold the rest for a while? And is there a significant upside for 2022?

A: I’ve been telling everyone: hold those shorts. I know those of you who put on the December $150-$155 vertical bear put spread or the December $145-$150 vertical bear put spread already have substantial profits, but the time value on these options is still large, so there is still quite a lot of these profits to be made hanging on to all of your put spreads in the ProShares UltraShort 20+ Year Treasury Bond ETF (TLT). And is there a substantial downside from here? I think yes! If the Fed goes to a half-point rate hike schedule for the next 4 meetings, the (TLT) is absolutely going down to a $105 or $110 level or so. So, keep those shorts and add to shorts on rallies. We came close. I said sell on a $6 point rally and we got a $5 point rally. I didn't pull the trigger, and of course, now we’re here at new lows.

Q: Are we close to buying LEAPS in tech?

A: Yes, I think that once this current meltdown finishes, I want to go back in there. But I want to go long-dated.

Q: What does rapid unwind of the Fed balance sheet mean for the markets?

A: It’s terrible! The Fed has a balance sheet close to $9 trillion dollars. Before the financial crisis of ‘07, it was $800 million dollars, and in fact, in the last 4 years, it has gone up from $20 trillion to $30 trillion. So these are just bubblicious levels for the Fed to own. And what is QT or quantitative tightening? They sell those bonds. And of course, everyone knows they’re going to sell, so they’re dropping bids for bonds like crazy right now—that's why you’re getting the meltdown in the (TLT). This is bad for the stock market; there’s no world in which the stock market goes up with sharply rising interest rates. The best case is that you give up 20% and then make some of it back, and then give up 20% and then make some of it back. So yeah, expect to hear a lot about QT. We only ended QE or quantitative easing about 3 weeks ago, and it looks like we may go straight into QT as soon as May. And boy, the bond market is sure reflecting that today.

Q: How long will wage inflation last? Can I count on 10% pay increases forever?

A: No, it will last until the next recession. I have a feeling that the unemployment rate will hit all-time lows next month—probably 3.2% or 3.3%. And we’re essentially at a full employment economy right now. What happens next? Recession probably in one or two years. Then those wage hikes disappear completely, and people start getting laid off, and goodbye to inflation of all kinds since 60% or 70% of the inflation calculation is wage cost.

Q: What is a good age to retire?

A: Never. I can’t tell you how many friends I’ve had who retire and die within a year. I had one friend retire and he died the next day. What you could do is keep your old job and cut your hours by half, or you could retire from your old job to go on to a new job that you love, like opening a restaurant or a job built around your lifetime hobby, whatever that is. As long as you stay engaged, you keep Alzheimer’s at bay and you’re an active contributing person to society. As soon as you stop doing that and just start doing something like golf, your days are numbered.

Q: What factors will create a recession in 2022?

A: Well I don't think that's going to happen; that would be like multiple 1% rate rises by the Fed, and the Fed completely panicking like we said, and causing a premature recession. But I do think that by 2024 rates will be so high that we will get a recession, probably a short one, maybe 6 months. A lot also depends on the war and if Europe can replace their Russian gas/oil fast enough or they go into an oil shock and recession there.

Q: Will the Fed destroy the economy in order to save it?

A: Yes, they will, if we get inflation up into the teens, which we saw in the 1980s, they absolutely will raise rates. And then I think the 10-year made it to 12% in the early 80s when Volcker was around, and the overnight rate got to 18%. And I know that because I bought a coop in New York City with a mortgage rate of 18%. I took out one of the first floating rate mortgages and by the time I sold the house, the mortgage rate had dropped down to 11% and the value of the home had doubled.

Q: Google (GOOG), Adobe (ADBE), and Apple (AAPL) spreads are treading water.

A: That is a sign that these are the stocks that will lead the next recovery. So, only 20% down, top to bottom, in Apple while all other stocks were getting hammered for 40% or more means Apple is going to lead any recovery in the market. Watch these big tech stocks carefully—they are the new leaders, they just don’t know it yet.

Q: What will inflation do to the housing market? Should I sell or hold my investment properties?

A: Keep them. Housing is one of the biggest beneficiaries of inflation. Not only do the house prices go up, so does everything that goes into the house, like the copper, steel, lumber, kitchen appliances, etc. You really have the best play on inflation, and I don’t think interest rates will kill the housing market. I think all that will happen is people will move from 30-year fixed to 5-year adjustables, as they have done in previous high interest rate cycles.

Q: Where is the buy territory on the Mad Hedge Market Timing Index?

A: Below 20. It’s almost impossible to lose money when you buy at a market timing index of 20. You may get a day or two visit down into the teens, but if you hang on, that’ll become a big moneymaker for you. That’s been working for me for 50 years—it should work for you too.

Q: Do the chips and transports breaking down worry you about the general market?

A: No, I think they’re discounting a recession that isn’t going to happen. Remember half of all the recessions discounted in the market don’t actually happen, and I think that these are one of those non-recessionary selloffs. But it may take them a couple of months to figure out that this bull market still has a couple of years of life to it and that it’s too early to sell. By the way, once people realize that they discounted the recession too early, what are they going to pour back into the fastest? The semiconductor stocks. That's why I’ve got a laser focus on NVIDIA (NVDA).

Q: If there is no recession coming, are the retailers getting too oversold?

A: Yes, but in the world that’s out there, where you really only want to own two or three of the best sectors and avoid the other 97, retailers are the ones you want to avoid—unless there's some specific single company story that you know about.

Q: Housing prices can’t fall when there's such enormous demand coming from millennials, right?

A: That’s true. In fact, the number of houses that need to be built to meet this demand is anywhere from one to five million, so this is a shortfall that will take at least a decade to address, and house prices don’t fall in that situation. They may appreciate at a slower rate, but they will appreciate, nonetheless.

Q: Is there any level where you would consider a call spread in the TLT?

A: Well, I had the April $127-$130 vertical bull call spread and I had my head handed to me. So somewhere, but clearly not yet—again, it depends a lot on what the Fed does and how fast.

Q: What’s the outlook for the Euro (FXE), (NVDA)?

A: Lower. Until the Ukraine War ends, they get an economic recovery, and they wean themselves off of Russian energy and move over to American energy. And that's at least a year down the road, so I’m not rushing into any European investment—stocks, bonds, or currencies.

Q: Are rising interest rates good for banks?

A: Yes, but right now those benefits are being offset by recession fears which will probably go away in a couple of months. So that kind of makes banks a strong buy right here.

Q: When the Shanghai lockdown ends, will it create another surge in commodity prices?

A: Absolutely, yes. China is the world's largest consumer of commodities, and the restoration of any of their purchasing power will certainly be great for all commodity prices—food, energy, metals, you name it.

Q: Is Tesla (TSLA) a LEAPS candidate?

A: Yes but wait for it to take a run at the $700 low that we saw last month. We probably won’t get there, but $800 this time around is probably a great LEAPS candidate for Tesla going forward. I expect them to meet all of their goals for production this year.

Q: Won’t Bitcoin ($BTCUSD) keep falling if equity markets are lower?

A: Yes, but we don’t have that much lower to go in equity markets—maybe 10%. So just as we’re looking to buy equities and the smaller technology stocks on dips, we're also looking to buy Bitcoin on dips. If we can get back into the $30,000 handle, that might be a ripe buy territory for all the cryptocurrency plays.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Technology Letter

April 1, 2022

Fiat Lux

Featured Trade:

(THE CREATIVE CLOUD IS OVERSOLD)

(ADBE), (AAPL), (GOOGL)

Creative software giant Adobe (ADBE) has ironclad support at $440 on a technical basis and I am willing to go on a 13-day excursion with the underlying stock.

That being said, the macroeconomic picture leaves a lot to be desired and one could literally say that 100 times.

Many of the risks have yet to be unlocked if one rolls through the list of them like hyperinflation, spiking energy costs, the military conflict, rising rates, poor global government, and the list really could be added to for infinity at this point.

No need to beat a dead horse.

However, this breathtaking relief rally has turned into something that is probably more than just a relief rally and has told us investors one thing.

There is still way too much liquidity in the system and it’s still sloshing around.

And although I missed the bottom of the relief rally, I seek to benefit off the next stage of it with ADBE and GOOGL which are two highly sought-after tech stocks with a proven track record and whose technical picture looks positive in the short-term.

The cheat sheet for this exam is Apple (AAPL) whose bounce from $150 to $180 really summed up what’s going on in the tech ecosystem.

The best of breed is harvesting the bulk of the gains, and instead of fighting it from the other side, I’ll just traverse on the side of Apple and ride it up with them.

The dip-buying has been almost violent in this rally and although I do believe there will be some reduction in the pace of the up moves, it’s almost impossible to go completely bearish against tech right now.

Another key insight into recent stock movement is that the nominal size of the stock market at this point is so gigantic in terms of market cap that the leverage inside of it is causing volatility to go nuts.

I don’t think this will resolve itself in the near future and this sets the stage for some series of epic up moves moving forward to the second half of the year as a large swath of negativity has been priced into the news.

Tech could go back to its overshooting the rest of the market narrative and names like ADBE and GOOGL will perform splendidly with this type of boost.

Let’s get into the weeds and explain why I really do like ADBE as a standalone company?

The massive slide over the past few months was nothing structural. ADBE posted market-beating earnings for the first quarter, growing cloud revenue, one of the biggest markets in the tech world, to more than $2 billion. The firm has also been steadily shot up the digital subscription revenue ladder.

Yes, their product lines are slowing but they are at the cutting edge of digital innovation which with its terrific brand has great pricing power.

ADBE has transformed itself into a software behemoth, more than tripling its revenue since 2010. The company is famous for its namesake PDF-reader and photo-editing software Photoshop.

However, ADBE’s bread and butter is a full suite of software products monetized through a recurring subscription model.

ADBE transitioned from selling boxed software to recurring subscriptions in 2013 and revenues have gone parabolic since.

Readers must be practical at this point and not focus attention on the low end of tech.

Tightening conditions in the capital markets mean that there will be less resources to throw at the poor-quality tech names.

Practicality should be the foot forward with readers piling into the best of tech like APPL, AMZN, GOOGL, ADBE, and MSFT.

Don’t get too cute here.

Traders never go bankrupt from taking a profit.

Global Market Comments

March 29, 2022

Fiat Lux

Featured Trade:

(TESTIMONIAL)

(A BUY-WRITE PRIMER),

(AAPL)

There is always a way to make money in the stock market. Get the direction right and the rest is a piece of cake.

But what if the market is going nowhere, trapped in a range, with falling volatility? Yes, there is even a low risk, high return way to make money in this kind of market, a lot like the one we have now.

2022 may be a more subdued affair than recent years, with the Dow gaining a modest 10%. The average annualized return for the last ten years is 13.9%, including dividends.

And that’s the way markets work. It’s like watching a bouncing ball, with each successive bounce shorter than the previous one. Thank Leonardo Fibonacci for this discovery (click here for details.)

Which means a change in trading strategy is on order. The free lunch is over. It’s finally time to start working for your money.

When you’re trading off a decade low, it's pedal to the metal, full firewall forward, full speed ahead, damn the torpedoes. Your positions are so aggressive and leveraged that you can’t sleep at night.

Some 16 months into the bull market, not so much. It’s time to adjust your trades for a new type of market that continues to appreciate, but at a slower rate and not as much.

Enter the Buy-Write.

A buy-write is a combination of positions where you buy a stock and also sell short options on the same stock against the shares at a higher price, usually on a one-to-one basis.

“Writing” is another term for selling short in the options world because you are in effect entering into a binding contract. When you sell short an option, you are paid the premium the buyer pays and the cash sits in your brokerage account accruing interest.

If the stock rallies, remains the same price, or rises just short of the strike price you sold short, you get to keep the entire premium.

Most buy-writes take place in front month options and the strike prices are 5% or 10% above the current share price. I’ll give you an example.

Let’s say you own 100 shares of Apple (AAPL) at $140. You can sell short one August 2021 $150 call for $1.47. You will receive the premium of $147.00 ($1.47 X 100 shares per option). Remember, one option contract is exercisable into 100 shares.

As long as Apple shares close under $150 at the August 20 option expiration, you get to keep the entire premium. If Apple closes over $150, you automatically become short 100 Apple shares. Then you simply instruct your broker to cover your short in the shares with the 100 Apple shares you already have in your account.

Buy-writes accomplish several things. They reduce your risk, pare back the volatility of your portfolio, and bring in extra income. Do these right and it will enhance the overall performance of your portfolio.

Knowing when to strap these babies on is key. If the market is going straight up, you don’t want to touch buy-writes with a ten-foot pole as your stock will be called away and you will miss substantial upside.

It’s preferable to skip dividend-paying months, usually March, June, September, and December to avoid your short option getting called away mid-month by a hedge fund trying to get the dividend on the cheap.

You don’t want to engage in buy-writes in bear markets. Whatever you take in with option premium, it will be more than offset by losses on your long stock position. You’re better off just dumping the stock instead.

Now comes the fun part. As usual, the are many ways to skin a cat.

Let’s say that you are a cautious sort. Instead of selling short the $150 strike, you can sell the $155 strike for less money. That would bring in $79 per option. But your risk of a call-away drops too.

You can also go much further out in your expiration date to bring in more money. If you go out to the January 18, 2022 expiration, you will take in a hefty $6.67 in option premium, or $667 per option. However, the likelihood of Apple rising above $150 and triggering a call-away by then is far greater.

Let’s say you are a particularly aggressive trader. You can double your buy-write income by doubling your option short sales at the ratio of 2:1. However, if Apple closes above $150 by expiration day, you will be naked short 100 shares of Apple.

It is likely you won’t have enough cash in your account to meet the margin call for selling short 100 shares of Apple so you will have to buy the shares in the market immediately. It's something better left to professionals.

How about if you are a hedge fund trader, have a 24-hour trading desk, a good in-house research department, and serious risk control? Then you can entertain “at-the-money buy writes.”

In the case of Apple, you could buy shares and sell short the August 20 $140 calls against them for $4.45 and potentially take in $4.45 for each 100 Apple shares you own. Then you make a decent profit if Apple remains unchanged or goes up less than $4.45.

That amounts to a $3.18% return in 34 trading days and annualizes out at 26%. In bull markets, hedge funds execute these all day long, but they have the infrastructure to manage the position. It’s better than a poke in the eye with a sharp stick.

There are other ways to set up buy-writes.

Instead of buying stock, you can establish your long position with another call option. These are called “vertical bull call debit spreads” and are a regular feature of the Mad Hedge Trade Alert Service. “The “vertical” refers to strike prices lined up above each other. The “debit” means you have to pay cash for the position instead of getting paid for it.

How about if you are a cheapskate and want to get into a position for free? Buy one call option and sell short two call options against it for no cost. The downside is that you go naked short if the strike rises above the short strike price, again triggering a margin call.

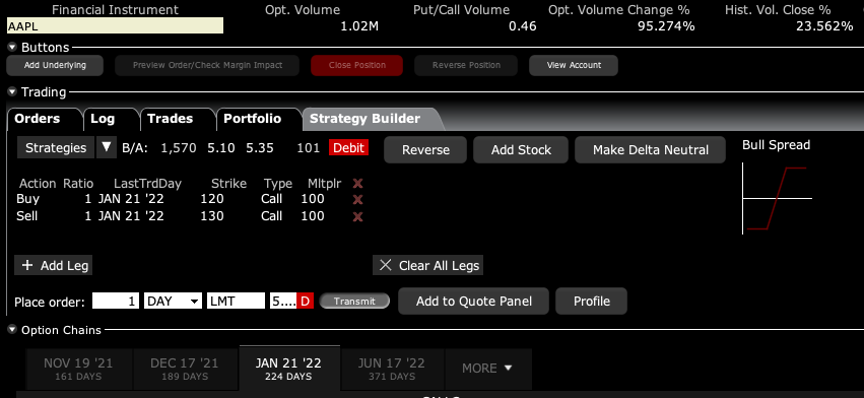

Here is my favorite, which I regularly execute in my own personal trading account. Buy long-term LEAPS (Long Term Equity Anticipation Securities) spreads like I recommended some time ago with the (AAPL) January 21 $120-$130 vertical bull call spread for $5.20.

On expiration day, it closed at $7.21, up 38.65%.

This is a bet that one of the world’s fastest-growing companies will see its share unchanged or higher in seven months. In Q1, Apple’s earnings grew by an astonishing 35% to $23.6 billion. Sounds like a total no-brainer, right?

If I run this position all the way to expiration, the total return would be ($10.00 - $5.20 = $4.80), or ($4.80/$5.20 = 92.31%) by the January 21, 2022 options expiration. This particular expiration benefits from the year-end window dressing surge, and the New Year asset allocation into equities.

Whenever we have a big up month in the market, I sell short front-month options against it. In this case, that is the August 20 $150 calls. This takes advantages of the accelerated time decay you get in the final month of the life of an option, while the time decay on your long-dated long position is minimal.

Keep in mind that the deltas on LEAPS are very low, usually around 10% because they are so long-dated. That means your front month short should only be 10% of the number of shares owned through your LEAPS in order to set delta neutral. Otherwise, you might get hit with a margin call you can’t meet.

After doing this for 53 years, it is my experience that this is the best risk/reward options position available in the market.

To make more than 92.31% in seven months, you have to take insane amounts of risk, or engage in another profession, like becoming a rock star, drug dealer, or Bitcoin miner.

I’m sure you’d rather stick to options trading, so good luck with LEAPS.

Global Market Comments

March 25, 2022

Fiat Lux

Featured Trade:

(THE MAD HEDGE TRADERS & INVESTORS SUMMIT VIDEOS ARE UP!)

(MARCH 23 BIWEEKLY STRATEGY WEBINAR Q&A),

(QQQ), (TSLA), (BA), (DEER), (CAT),

(AAPL), (SLV), (FCX), (TLT), (TBT)

Below please find subscribers’ Q&A for the March 23 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley.

Q: What is the best way to keep your money in cash?

A: That’s quite a complicated answer. If you leave cash in your brokerage account, they will give you nothing. If you move it to your bank account they will, again, give you nothing. But, if you keep the money in your brokerage account and then buy 2-year US Treasury bills, those are yielding 2.2% right now, and will probably be yielding over 3% in two years, so we’re actually being paid for cash for the first time in over ten years. And, as long as it’s in your brokerage account, you can then sell those Treasury bonds when you’re ready to go back into the market and buy your stock, same day, without having to perform any complicated wire transfers, which take a week to clear. Also, if your broker goes bankrupt and you hold Treasury bills, they are required by law to give you the Treasury bills. If you have your cash in a brokerage cash account, you lose all of it or at least the part above the SIPC-insured $250,000 per account. And believe me, I learned that the hard way when Bearings went bankrupt in the 1990s. People who had the Bearings securities lost everything, people who owned Treasury bills got their cashback in weeks.

Q: Is the pain over for growth stocks?

A: Probably yes, for the smaller ones; but they may flatline for a long time until a real earnings story returns for them. As for the banks, I think the pain is over and now it’s a question of just when we can get back in.

Q: Why did you initiate shorts on the Invesco QQQ Trust Series (QQQ) and SPDR S&P 500 ETF Trust (SPY) this week, instead of continuing with the iShares 20 Plus Year Treasury Bond ETF (TLT) shorts?

A: We are down 27 points in 10 weeks on the (TLT); that is the most in history. And every other country in the world is seeing the same thing. That is not shorting territory—you should have been shorting above $150 in the (TLT) when I was falling down on my knees and begging you to do so. Now it’s too late. If we get a 5-point rally, which we could get any time, that’s another story. It is so oversold that a bounce of some sort is inevitable. I’d rather be in cash going into that.

Q: Do you think Tesla (TSLA) has put in a bottom, or do you still see more downside? Is it time to buy?

A: The time to buy is not when it is up 50% in 3 weeks, which it has just done. The time to buy is when I sent out the last trade alert to buy it at $700. This was a complete layup as a long three weeks ago because I knew the German production was coming onstream very shortly; and that opens up a whole new continent, right when energy prices are going through the roof—the best-case scenario for Tesla. And the same is happening in the US—it’s a one-year wait now to get a new Model X in the US. In fact, I can sell my existing model X for the same price I paid for it 3 years ago, if I were happy to wait another year to get a replacement car.

Q: Will the Boeing (BA) crash in China damage the short-term prospects? And as a pilot, what do you think actually happened?

A: Boeing has been beat-up for so long that a mere crash in one of its safest planes isn’t going to do much. It could have been a maintenance issue in China, but the fact that there was no “mayday” call means only two or three possibilities. One is a bomb, which would explain there being no mayday call—the pilots were already dead when it went into freefall. Number two would be a complete structural failure, which is hard to believe because I’ve been flying Boeings my entire life, and these things are made out of steel girders—you can’t break them. And number three is a pilot suicide—there have been a couple of those over the years. The Malaysia flight that disappeared over the south Indian Ocean was almost certainly a pilot suicide, and there was another one in Germany and another in Japan about 20 years ago. So, if they come up with no answer, that's the answer. It’s not a Boeing issue, whatever it is.

Q: Is John Deer (DEER) or Caterpillar (CAT) a better trade right now?

A: It’s kind of six of one, half a dozen of the other. Caterpillar I’ve been following for 50 years, so I’m kind of partial to CAT, and Caterpillar has a much bigger international presence, but that could be a negative these days in a deglobalizing world.

Q: Apple (AAPL) has really caught fire past $170. Should I chase it here or wait until it’s too overbought?

A: I never liked chasing. Even a small dip, like we’re having today, is worth getting into. So always buy on the dips.

Q: Is Silver (SLV) still a good long-term play?

A: Yes, because we do expect EV production to ramp up as fast as they can possibly do it. Too bad the American companies don’t know how to make electric cars—they just haven’t been able to get their volumes up because of production problems that Tesla solved 12 years ago. So, long term, I think it will do better, but right now the risk-on move is definitely negative for the precious metals.

Q: How low will the iShares 20 Plus Year Treasury Bond ETF (TLT) go in April before the next Fed meeting?

A: I think we’re bottoming for the short term right around here. That’s why I had on that $127-$130 call spread in the (TLT) that I got stopped out of. And I may well end up being right, but with these call spreads, once you break your upper strike, the math goes against you dramatically. You go from like a 1-1 risk profile to like a 10-1 against you. So, you have to get out of those things when you break your upper strike, otherwise, you risk writing off the entire position with 100% loss. As long as Jay Powell keeps talking about successive half-point rate cuts, we will get lower lows, and my 2023 target for the TLT is $105, or about $20.00 points below here.

Q: Do you think we retest the bottoms?

A: Absolutely, yes; it just depends on where the test is successful—with a double bottom or with a retrace of half the recent moves. Keep in mind that stocks go up 80% of the time over the last 120 years, and that includes the Great Depression when they hardly went up at all for 10 years, so selling short is a professional’s game, and I wouldn’t attempt it unless you had somebody like me helping you. You're betting against the long-term trend with every short position. That said, if you’re quick you can make decent money. Most of the money we’ve made this year has been in short positions, both in stocks and in bonds.

Q: Where can we find this webinar?

A: The recording for this webinar will be posted on the website in about two hours. Just log into your account and you’ll find them all listed.

Q: When should I sell my tradable ProShares UltraShort 20+ Year Treasury ETF (TBT)?

A: You don’t have an options expiration to worry about, so I would just keep in until we hit $105 in the (TLT). If you do want to trade, I’d take a little bit off here and then try to re-buy it a couple of points lower, maybe 10% lower.

Q: What do you think of a Freeport McMoRan (FCX) $55-$60 vertical bull call spread?

A: The market has had such a massive move, that I’m reluctant to do out of the money call spreads from here unless we get a major dip. So, don’t reach for the marginal trade—that’s where you get your head handed to you.

Q: Will yield curve inversions matter this time and foretell a recession?

A: I think no, because corporate earnings are still growing, and by the summer, we probably will have a yield curve inversion.

Q: There seems to be some huge breakthrough in battery technology where batteries could be recharged within four minutes. I believe it’s the Chinese who have the tech, if so how will that impact on Tesla?

A: Every day of the year someone presents Tesla with a revolutionary new battery technology. It either doesn’t work, can’t be mass-produced, or is wildly uneconomical. So, I’ll confine my bet that Tesla will be able to eventually mass produce solid state batteries and get their 95% cost reduction that way.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

March 24, 2022

Fiat Lux

Featured Trade:

(TEN TECH TRENDS DEFINING YOUR FUTURE, or THE BEST TECH PIECE I HAVE EVER WRITTEN)

(TSLA), (GOOG), (AMZN), (AAPL), (CRSP)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.