Global Market Comments

January 12, 2026

Fiat Lux

Featured Trades:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or RISK IS RISING),

(MSFT), (ABBV), ($VIX), (SPY), (AAPL), (CRWD), (GLD), (SLV), (TSLA), (MSTR), (NVDA)

Global Market Comments

January 12, 2026

Fiat Lux

Featured Trades:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or RISK IS RISING),

(MSFT), (ABBV), ($VIX), (SPY), (AAPL), (CRWD), (GLD), (SLV), (TSLA), (MSTR), (NVDA)

Global Market Comments

January 5, 2026

Fiat Lux

2026 Annual Asset Class Review

A Global Vision

FOR PAID SUBSCRIBERS ONLY

Featured Trades:

(SPY), (QQQ), (IWM), (AMZN), (AAPL), (GOOGL), (GS), (MS), (BAC), (C), (BLK), (ABBV), (BIIB), (AMGN), (TSLA), (DHI), (LEN), (PHM), (KBH), (TLT), (TBT), (JNK), (PHB), (HYG), (MUB), (LQD), (FXE), (EUO), (FXC), (FXA), (YCS), (FXY), (CYB), (FCX), (VALE), (DBA), (DIG), (RIG), (USO), (DUG), (UNG), (XOM), (OXY), (GLD), (DGP), (SLV), (PPLT), (PALL), (WPM), (NEM), (B)

Global Market Comments

March 24, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD or THE SPECIAL NO CONFIDENCE ISSUE)

(GM), (SH), (TSLA), (NVDA), (GLD), (TLT), (LMT), (BA), (NVDA), (GOOGL), (AAPL), (META), (AMZN), (PANW), (ZS), (CYBR), (FTNT), (COST)

(AMGN), (ABBV), (BMY), (TSLA), GM), (GLD), (BYDDF)

It’s official: Absolutely no one is confident in their long-term economic forecasts right now. I heard it from none other than the chairman of the Federal Reserve himself. The investment rule book has been run through the shredder.

It has in fact been deleted.

That explains a lot about how markets have been trading this year. It looks like it is going to be a reversion to the mean year. Forecasters, strategists, and gurus alike are rapidly paring down their stock performance targets for 2025 to zero.

When someone calls the fire department, it’s safe to assume that there is a fire out there somewhere. That’s what Fed governor Jay Powell did last week. It raises the question of what Jay Powell really knows that we don’t. Given the opportunity, markets will always assume the worst, that there’s not only a fire, but a major conflagration about to engulf us all. Jay Powell’s judicious comments last week certainly had the flavor of a president breathing down the back of his neck.

It's interesting that a government that ran on deficit reduction pressured the Fed to end quantitative tightening. That’s easing the money supply through the back door.

For those unfamiliar with the ins and outs of monetary policy, let me explain to you how this works.

Since the 2008 financial crisis, the Fed bought $9.1 trillion worth of debt securities from the US Treasury, a policy known as “quantitative easing”. This lowers interest rates and helps stimulate the economy when it needs it the most. “Quantitative easing” continued for 15 years through the 2020 pandemic, reaching a peak of $9.1 trillion by 2022. For beginners who want to know more about “quantitative easing” in simple terms, please watch this very funny video.

The problem is that an astronomically high Fed balance sheet like the one we have now is bad for the economy in the long term. They create bubbles in financial assets, inflation, and malinvestment in risky things like cryptocurrencies. That’s why the Fed has been trying to whittle down its enormous balance sheet since 2022.

By letting ten-year Treasury bonds it holds expire instead of rolling them over with new issues, the Fed is effectively shrinking the money supply. This is how the Fed has managed to reduce its balance sheet from $9.1 trillion three years ago to $6.7 trillion today and to near zero eventually. This is known as “quantitative tightening.” At its peak a year ago, the Fed was executing $120 billion a month quantitative tightening.

By cutting quantitative tightening, from $25 billion a month to only $5 billion a month, or effectively zero, the Fed has suddenly started supporting asset prices like stocks and increasing inflation. At least that is how the markets took it to mean by rallying last week.

Why did the Fed do this?

To head off a coming recession. Oops, there’s that politically incorrect “R” word again! This isn’t me smoking California’s largest export. Powell later provided the forecasts that back up this analysis. The Fed expects GDP growth to drop from 2.8% to 1.7% and inflation to rise from 2.5% to 2.8% by the end of this year. That’s called deflation. Private sector forecasts are much worse.

Just to be ultra clear here, the Fed is currently engaging in neither “quantitative easing nor “quantitative tightening,” it is only giving press conferences.

Bottom line: Keep selling stock rallies and buying bonds and gold on dips.

Another discussion you will hear a lot about is the debate over hard data versus soft data.

I’ll skip all the jokes about senior citizens and cut to the chase. Soft data are opinion polls, which are notoriously unreliable, fickle, and can flip back and forth between positive and negative. A good example is the University of Michigan Consumer Confidence, which last week posted its sharpest drop in its history. Consumers are panicking. The problem is that this is the first data series we get and is the only thing we forecasters can hang our hats on.

Hard data are actual reported numbers after the fact, like GDP growth, Unemployment Rates, and Consumer Price Indexes. The problem with hard data is that they can lag one to three months, and sometimes a whole year. This is why by the time a recession is confirmed by the hard data, it is usually over. Hard data often follows soft data, but not always, which is why both investors and politicians in Washington DC are freaking out now.

Bottom line: Keep selling stock rallies and buying bonds and gold (GLD) on dips.

A question I am getting a lot these days is what to buy at the next market bottom, whether that takes place in 2025 or 2026. It’s very simple. You dance with the guy who brought you to the dance. Those are:

Best Quality Big Tech: (NVDA), (GOOGL), (AAPL), (META), (AMZN)

Big tech is justified by Nvidia CEO Jensen Huang’s comment last week that there will be $1 trillion in Artificial Intelligence capital spending by the end of 2028. While we argue over trade wars, AI technology and earnings are accelerating.

Cybersecurity: (PANW), (ZS), (CYBR), (FTNT)

Never goes out of style, never sees customers cut spending, and is growing as fast as AI.

Best Retailer: (COST)

Costco is a permanent earnings compounder. You should have at least one of those.

Best Big Pharma: (AMGN), (ABBV), (BMY)

Big pharma acts as a safety play, is cheap, and acts as a hedge for the three sectors above.

March is now up +2.92% so far. That takes us to a year-to-date profit of +12.29% in 2025. That means Mad Hedge has been operating as a perfect -1X short S&P 500 ETF since the February top. My trailing one-year return stands at a spectacular +82.50%. That takes my average annualized return to +51.12% and my performance since inception to +764.28%.

It has been another busy week for trading. I had four March positions expire at their maximum profit points on the Friday options expiration, shorts in (GM), and longs in (GLD), (SH), and (NVDA). I added new longs in (TSLA) and (NVDA). This is in addition to my existing longs in the (TLT) and shorts in (TSLA), (NVDA), and (GM).

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 74 of 94 trades have been profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

UCLA Andersen School of Business announced a “Recession Watch,” the first ever issued. UCLA, which has been issuing forecasts since 1952, said the administration’s tariff and immigration policies and plans to reduce the federal workforce could combine to cause the economy to contract. Recessions occur when multiple sectors of the economy contract at the same time.

Retail Sales Fade, with consumers battening down the hatches for the approaching economic storm. Retail sales rose by less than forecast in February and the prior month was revised down to mark the biggest drop since July 2021.

This Has Been One of the Most Rapid Corrections in History, leaving no time to readjust portfolios and put on short positions.

The rapid descent in the S&P 500 is unusual, given that it was accomplished in just 22 calendar days, far shorter than the average of 80 days in 38 other examples of declines of 10% or more going back to World War II.

Home Builder Sentiment Craters to a seven-month low in March as tariffs on imported materials raised construction costs, a survey showed on Monday. The National Association of Home Builders/Wells Fargo Housing Market Index dropped three points to 39 this month, the lowest level since August 2024. Economists polled by Reuters had forecast the index at 42, well below the boom/bust level of 50.

BYD Motors (BYDDF) Shares Rocket, up 72% this year, on news of technology that it claims can charge electric vehicles almost as quickly as it takes to fill a gasoline car. BYD on Monday unveiled a new “Super e-Platform” technology, which it says will be capable of peak charging speeds of 1,000 kilowatts/hr. The EV giant and Tesla rival say this will allow cars that use the technology to achieve 400 kilometers (roughly 249 miles) of range with just 5 minutes of charging. Buy BYD on dips. It’s going up faster than Tesla is going down.

Weekly Jobless Claims Rise 2,000, to 223,000. The number of Americans filing new applications for unemployment benefits increased slightly last week, suggesting the labor market remained stable in March, though the outlook is darkening amid rising trade tensions and deep cuts in government spending.

Copper Hits New All-Time High, at $5.02 a pound. The red metal has outperformed gold by 25% to 15% YTD. It’s now a global economic recovery that is doing this, but flight to safety. Chinese savers are stockpiling copper ingots and storing them at home distrusting their own banks, currency, and government. I have been a long-term copper bull for years as you well know. New copper tariffs are also pushing prices up. Buy (FCX) on dips, the world’s largest producer of element 29 on the Periodic Table.

Boeing (BA) Beats Lockheed for Next Gen Fighter Contract for the F-47, beating out rival Lockheed Martin (LMT) for the multibillion-dollar program. Unusually, Trump announced the decision Friday morning at the White House alongside Defense Secretary Pete Hegseth. Boeing shares rose 5.7% while Lockheed erased earlier gains to fall 6.8%. The deal raises more questions than answers, in the wake of (BA) stranding astronauts in space, their 737 MAX crashes, and a new Air Force One that is years late. Was politics involved? You have to ask this question about every deal from now on.

Carnival Cruise Lines (CCL) Raises Forecasts, on burgeoning demand from vacationers, including me. The company’s published cruises are now 80% booked. Cruise lines continue to hammer away at the value travel proposition they are offering. However, the threat of heavy port taxes from the administration looms over the sector.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties is now looking at multiple gale-force headwinds. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. My Dow 240,000 target has been pushed back to 2035.

On Monday, March 24, at 8:30 AM EST, the S&P Global Flash PMI is announced.

On Tuesday, March 25, at 8:30 AM, the S&P Case Shiller National Home Price Index is released.

On Wednesday, March 26, at 1:00 PM, the Durable Goods are published.

On Thursday, March 27, at 8:30 AM, the Weekly Jobless Claims are disclosed. We also get the final report for Q1 GDP.

On Friday, March 28, the Core PCE is released, and important inflation indicator. At 2:00 PM, the Baker Hughes Rig Count is printed.

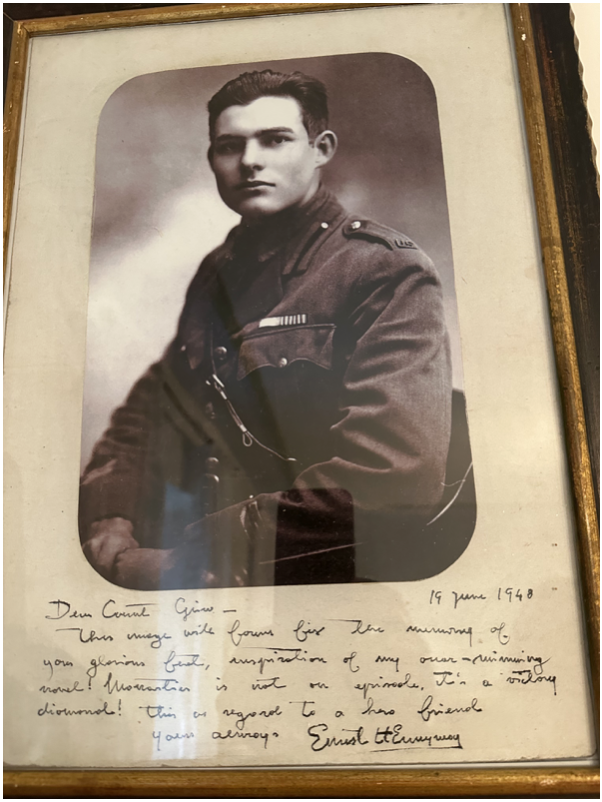

As for me, I received calls from six readers last week saying I remind them of Ernest Hemingway. This, no doubt, was the result of Ken Burns’ excellent documentary about the Nobel Prize-winning writer on PBS last week.

It is no accident.

My grandfather drove for the Italian Red Cross on the Alpine front during WWI, where Hemingway got his start, so we had a connection right there.

Since I read Hemingway’s books in my mid-teens I decided I wanted to be him and became a war correspondent. In those days, you traveled by ship a lot, leaving ample time to finish off his complete work.

I visited his homes in Key West, Cuba, and Ketchum Idaho.

I used to stay in the Hemingway Suite at the Ritz Hotel on Place Vendome in Paris where he lived during WWII. I had drinks at the Hemingway Bar downstairs where war correspondent Ernest shot a German colonel in the face at point-blank range. I still have the ashtrays.

Harry’s Bar in Venice, a Hemingway favorite, was a regular stopping-off point for me. I have those ashtrays too.

I even dated his granddaughter from his first wife, Hadley, the movie star Mariel Hemingway, before she got married, and when she was also being pursued by Robert de Niro and Woody Allen. Some genes skip generations and she was a dead ringer for her grandfather. She was the only Playboy centerfold I ever went out with. We still keep in touch.

So, I’ll spend the weekend watching Farewell to Arms….again, after I finish my writing.

Oh, and if you visit the Ritz Hotel today, you’ll find the ashtrays are now glued to the tables.

As for last summer, I stayed in the Hemingway Suite at the Hotel Post in Cortina d’Ampezzo Italy where he stayed in the late 1940’s to finish a book. Maybe some inspiration will run off on me.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Biotech and Healthcare Letter

March 4, 2025

Fiat Lux

Featured Trade:

(A PHARMA GIANT BUILT FOR THE LONG HAUL)

(ABBV)

I was sitting in my 1946 Ercoupe at the Nevada airfield last weekend, waiting for clearance to take off for a quick joy flight, when my phone buzzed with a text from a longtime Concierge client.

"What's the deal with AbbVie (ABBV)?" he wanted to know. "Is it worth adding to my portfolio now?"

The timing was perfect. I'd just spent the previous evening poring over AbbVie's financials while sipping a particularly good Napa Cabernet I'd picked up at an estate sale for $15 (retail: $95).

There's something about the methodical drone of analyzing pharmaceutical company balance sheets that pairs beautifully with a rich red wine.

With a market cap north of $340 billion, AbbVie isn't exactly flying under anyone's radar.

But what fascinates me about this pharmaceutical behemoth is how it's managed to construct a business that's both defensively positioned and aggressively growing. It's like finding a Sherman tank that can also win drag races.

Let's dissect this beast, shall we?

Half of AbbVie's revenue comes from its immunology portfolio. The rest flows from neuroscience, oncology, and—here's where it gets interesting—aesthetics. This diversity isn't just window dressing; it's strategic positioning in markets growing far faster than inflation or GDP.

Take the immunology market, which analysts project will deliver a 10.2% CAGR over the next decade. That's the kind of growth that makes central bankers nervous and investors giddy.

AbbVie dominates this space with Rinvoq, Skyrizi, and the now-patent-expired but still lucrative Humira.

Speaking of Humira, it's worth noting what happened when this superstar drug lost patent protection in 2023.

After nearly two decades of market dominance, Humira finally faced the onslaught of biosimilars (think generic drugs, but for biologic medications).

Most pharmaceutical companies would have curled into the fetal position watching their golden goose get plucked. But AbbVie had been preparing, transitioning patients to newer offerings like Rinvoq and Skyrizi.

How well did that strategy work? These two upstarts now command a jaw-dropping 50% market share in inflammatory bowel disease indications.

If you've ever had to overcome entrenched competition in a market, you'll appreciate just how remarkable that achievement is.

Then there's neuroscience, where AbbVie's footprint includes Botox (not just for smoothing frown lines, folks), Qulipta, and Ubrelvy.

This Central Nervous System therapeutics market is projected to grow at 10.5% annually through 2030. Again, that's the kind of growth that makes you sit up straight in your ergonomic office chair.

The oncology space is a bit more challenging for AbbVie, with other pharmaceutical giants claiming larger market shares.

Still, AbbVie managed 10.8% revenue growth in oncology for 2024. Not too shabby for a supposedly "smaller player."

But the real head-turner is aesthetics medicine, projected to grow at a blistering 12.8% CAGR through 2030.

AbbVie isn't just participating here – it's dominating with Botox and Juvéderm holding 60% and 40% market shares in the U.S. toxins segment, respectively.

I remember speaking with a plastic surgeon at a conference in New York last year who told me, "When someone walks in asking for 'Botox,' it's like when people ask for a 'Kleenex' instead of a tissue. The brand has become the generic term."

That's market penetration you simply can't buy with advertising.

AbbVie's growth strategy is two-pronged: aggressive R&D investment (which increased from 13.44% to 15.22% of revenue year-over-year) and strategic acquisitions.

The company maintains a robust pipeline of new products, with several in late-stage FDA approval processes. They're also not too proud to partner with other pharmaceutical companies to develop new offerings—a pragmatic approach I've always admired in business leaders.

For income-focused investors, AbbVie offers a particularly compelling story.

The company just declared a $1.64 quarterly dividend per share, translating to a 3.4% forward yield.

More impressively, AbbVie is a member of the S&P Dividend Aristocrats Index, meaning it has increased its dividend annually for at least 25 consecutive years.

Is AbbVie financially strong enough to maintain this dividend streak while funding growth? With over $7 billion in cash and moderate leverage, all signs point to yes.

The company's stellar profitability provides additional confidence, despite slightly higher R&D expenses eating into operating margins.

The latest quarterly earnings release should put any remaining doubts to rest, with Q4 year-over-year revenue growth accelerating to 5.6%—significantly better than previous quarters—and a slight improvement in gross margin.

Of course, no investment comes without risks.

Competition in pharmaceuticals is brutal, with both innovative giants and generic producers constantly nipping at AbbVie's heels.

The rapid decline in Humira revenue following patent expiration serves as a stark reminder of how quickly fortunes can change. While the company has successfully navigated this transition, there's no guarantee it will repeat this feat with future patent expirations.

Manufacturing complexity and supply chain vulnerabilities also present risks, though these aren't unique to AbbVie.

Perhaps more concerning is the political and regulatory uncertainty following Donald Trump's return to the White House, including potential trade wars and controversial appointments like vaccine critic Robert F. Kennedy Jr.

Despite these risks, AbbVie presents an exceptionally attractive combination of growth potential and income generation.

The company's diversified business mix, strong positions in growing markets, aggressive growth strategy, and shareholder-friendly capital allocation make it a compelling addition to almost any portfolio.

As I finally got clearance and my little Ercoupe lifted off the Nevada runway, I texted my Concierge client back: "ABBV is a buy on the dip. Rock-solid business with growth. Don't overthink this one."

One of the benefits of our Mad Hedge Concierge service is exactly this kind of real-time market guidance—though most questions don't catch me mid-takeoff.

Sometimes the best investment ideas aren't the most exotic or revolutionary. Sometimes they're just exceptionally well-run businesses selling products people need, returning value to shareholders, and positioned in growing markets.

AbbVie checks all of these boxes with room to spare.

Mad Hedge Biotech and Healthcare Letter

February 25, 2025

Fiat Lux

Featured Trade:

(WALL STREET'S MYOPIA IS YOUR OPPORTUNITY)

(REGN), (RHHBY), (AMGN), (AZN), (ABBV), (LLY)

While preparing my presentation for this week's Online Traders Conference, I came across a pattern that made me stop cold. You see, I've been gathering examples of how institutional investors quietly accumulate positions while retail traders are looking the other way.

And there it was, right in front of me - Regeneron Pharmaceuticals (REGN), displaying exactly the kind of setup I'll be warning traders about starting February 24.

You see, while everyone's been obsessing over the latest AI darlings, Regeneron has been quietly crushing it. Their Q4 revenue hit $3.79 billion, up 10.5% year-on-year.

But here's where it gets interesting - they beat consensus estimates by $43 million, and that's with their flagship eye drug Eylea taking a hit.

Speaking of Eylea, let's address the elephant in the room. Its sales dropped 11% to $1.19 billion, thanks to Roche's (RHHBY) Vabysmo muscling into their territory and Amgen's (AMGN) biosimilar crashing the party.

Four more biosimilars are waiting in the wings, held back only by patent disputes. Normally, this would send investors running for the hills.

But here's what the panic-sellers are missing.

Despite Eylea's challenges, Regeneron's non-GAAP EPS still climbed to $12.07, beating analyst expectations by 88 cents.

In fact, they've been playing jump rope with analyst estimates, leaping over them in 10 of the last 12 quarters. Yet their stock price has been doing its best impression of a sleeping cat - just lying there, barely moving.

As someone who's spent decades watching market cycles, I recognize this pattern.

We're in what technical analysts call an “accumulation phase.” While retail investors yawn and look elsewhere, institutional money is quietly building positions.

It's like watching a spring being compressed - boring until it isn't.

But here's what really got my attention: Regeneron just joined the dividend club. Starting March 20, they're paying $0.88 per quarter. Sure, the yield won't make income investors swoon, but that's not the point.

It reminds me of how AstraZeneca (AZN) played it - first, dominate growing markets, then gradually turn on the dividend spigot to attract the steady-money crowd.

They're also backing up the dividend with a $3 billion share buyback program.

With $9 billion in cash and short-term investments, they've got more dry powder than a Revolutionary War armory.

In Q4 alone, Regeneron spent $1.23 billion buying back shares - up 64.1% from last year.

And here's where it gets even more interesting. Their oncology franchise, led by Libtayo, is looking like a dark horse winner. Libtayo sales jumped 50.4% year-over-year to $367 million.

While that might not sound earth-shattering compared to cancer drug heavyweights like Merck's (MRK) Keytruda, Libtayo just pulled off something remarkable.

In their Phase 3 C-POST trial for high-risk skin cancer patients, Libtayo reduced death and disease recurrence risk by 68% compared to placebo.

Even better? Merck's competing trial for Keytruda in the same indication fell flat on its face. In this business, that's like watching your main competitor trip at the Olympic finals.

Looking ahead to 2029, I'm seeing revenue hitting $20.4 billion - think high single-digit growth each year. That would bring their price-to-sales ratio down from 5.12x to 3.53x.

Their non-GAAP EPS should hit $76.5, implying double-digit growth most years. With the stock currently trading at just 14.76x earnings - below most peers like AbbVie (19.06x) and Eli Lilly (64.96x).

On top of these, 2025 is packed with potential catalysts - clinical trial results and FDA decisions that could light a fire under the stock.

Analysts' average target is $929.37, suggesting about 38% upside. But in my experience, when you combine strong fundamentals, multiple growth drivers, and a market that's sleeping on the story, those targets often end up looking conservative.

Remember, the market loves nothing more than a comeback story.

With Regeneron, we might just be watching one unfold in slow motion. The question is: will you be holding shares when the spring finally releases?

For those who want to learn more about spotting these kinds of opportunities, I'll be diving deeper into institutional accumulation patterns at the Online Traders Conference running February 24 through March 1.

But don't wait for my presentation to take a serious look at Regeneron - the smart money isn't.

Mad Hedge Biotech and Healthcare Letter

January 28, 2025

Fiat Lux

Featured Trade:

(READY, RESET, GO)

(JNJ), (AAPL), (PFE), (ABBV), (RHHBY), (AZN), (SNY), (NVS)

I had to laugh when I saw Johnson & Johnson's (JNJ) Q4 earnings hit my screen earlier this month.

Here we have Wall Street wringing its hands over a slight revenue miss, sending shares down 3.5%, while management is busy plotting its path to pharma industry dominance.

The numbers tell an interesting story.

Q4 revenues grew 5.3% (or 5.7% on an adjusted operational basis) to $22.5 billion. Wall Street got the vapors because earnings came in at $1.41 per share, well below their $2.04 consensus.

Reminds me of the time analysts completely missed Apple's (AAPL) transformation into a services company.

For the full year 2024, JNJ delivered 4.3% sales growth (5.4% operational) to $88.8 billion, with earnings per share landing at $5.79, or $9.98 adjusted after swallowing a $(0.67) hit from acquired IPR&D charges.

Not too shabby for a company in transition.

Looking into 2025, management is guiding for 2.5-3.5% operational sales growth ($90.9-91.7 billion) and adjusted operational EPS of $10.75-$10.95.

That's 8.7% growth at the midpoint, though they're careful to hedge around legal proceedings and acquisition costs.

And here's where it gets interesting.

During last week's JP Morgan Healthcare Conference, CEO Joaquin Duato was practically bouncing in his chair about their drug pipeline. Let's look at what's got him so excited.

Darzalex, their multiple myeloma superstar, raked in $11.67 billion in 2024, up 20%.

The new kid Carvykti exploded 93% higher to $963 million. Tecvayli landed $550 million in its rookie year.

Depression med Spravato jumped 56% to hit the magic $1 billion mark. Tremfya, their Stelara successor, grew 17% to $3.7 billion.

Speaking of Stelara – there's the elephant in the room.

JNJ's crown jewel is losing patent protection, already showing up in Europe with a >12% sequential decline in Q4 to $2.35 billion. Expect a 30% "haircut" this year.

But here's what Wall Street is missing: JNJ saw this coming years ago.

They just dropped $14.6 billion on Intracellular Therapies, mostly debt-funded (they can afford it with only $31.3 billion in long-term debt and $19.98 billion in cash).

This brings them Caplyta, an antipsychotic med with blockbuster potential that's already approved for schizophrenia and bipolar disorders.

The medical device business isn't sitting still either.

Q4 worldwide revenues jumped 6.7% year-on-year. While Surgery was flat at $2.5 billion and Orthopedics grew a modest 2.5% to $2.32 billion, Vision popped 9% to $1.3 billion.

But the real story? Cardiovascular surged 24% to $2.1 billion. Those Shockwave and Abiomed acquisitions are looking pretty smart right about now.

For the year, MedTech grew 4% to $31.56 billion. Operating margins slipped a bit – Innovative Medicines down from 42% to 39.4%, MedTech from 23.7% to 21.6%.

Late-stage pipeline products nearing approval should ease R&D expenses in 2025, just as JNJ gears up for its next growth phase.

The foundation looks rock solid - $19.98 billion in cash, $31.3 billion in long-term debt, 2025 adjusted EPS guidance of $10.75-$10.95, and that reliable $1.24 quarterly dividend.

But forget the current numbers - the real money's in what's coming next.

Here's what the market is missing: JNJ is promising 5-7% compound annual growth between 2025-2030, with ten drugs hitting $5+ billion in annual sales by decade's end.

Sound ambitious? Maybe. But they've got the pipeline to back it up – from immunology stars nipocalimab and icotrokinra to neuroscience contenders seltorexant and aticaprant, plus oncology plays like TAR-200 for bladder cancer.

I've seen this movie before with AbbVie (ABBV), which navigated the loss of $20+ billion Humira without missing a beat.

And JNJ looks even better positioned - their pharma division is targeting $58 billion in 2024 revenues, which would make them the biggest player in Big Pharma, ahead of Pfizer (PFE), AbbVie (ABBV), Roche (RHHBY), AstraZeneca (AZN), Sanofi (SNY) and Novartis (NVS).

The only real wildcard? That pesky talc litigation.

JNJ's latest move – spinning the lawsuits into Red River Talc LLC and filing for bankruptcy – could cap the damage at $8.5 billion. They claim 75% of claimants are on board, with a court ruling expected this month.

So, what's my take? I think JNJ's 2025 will be a "reset" year, especially the first half. But just like buying straw hats in winter, there might be an opportunity here for patient investors. Management says the back half will be stronger, setting up 2026 for what could be a very interesting guidance call.

While the market frets about Stelara's patent cliff, smart money is quietly building positions. That's why I'm maintaining my stand to buy the dip.

After all, sometimes the best trades are the ones that make you a bit uncomfortable at first. And if you're worried about patent cliffs, just ask any AbbVie shareholder how that worked out for them.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.