Global Market Comments

August 15, 2018

Fiat Lux

Featured Trade:

(WHY BONDS CAN'T GO DOWN),

(TLT), (TBT), ($TNX), (TUR), (TSLA),

(HOW TO MAKE MORE MONEY THAN I DO),

(AMZN), (LRCX), (ABX), (AAPL), (TSLA), (NVDA)

Tag Archive for: (ABX)

By now, most of you have figured out that I love calling readers every day and milking them for ideas on how to improve my service.

Often, they think I am an imposter, a telephone salesman, a machine, or an algorithm. It's only after listening for a few seconds that they recognize my voice from the biweekly strategy webinars and realize that it's the real me.

I don't do this to get renewals, because everyone renews anyway. Where else do you get a 62% annual return with no serious drawdowns?

No, I do it because the information I pick up from subscribers is golden. Some of my best Trade Alerts are inspired by reader questions.

One of my favorite Einstein quotes is that "There are no stupid questions, only stupid answers."

In fact, I have discovered that a lot of subscribers are making much more money from my service than I do.

I'll tell you how they do it.

First, let me remind readers that every Trade Alert I send out includes recommendation for a call or put option spread, a single stock, or an ETF.

The trading performance charts that we published are based on the options spread positions only.

WARNING: What worked swimmingly over the past 10 years is no guarantee that it will work next year, but I thought you'd like to know anyway.

1) Raise the Strike Prices

Move the strike prices up by a dollar. So instead of buying the Barrick Gold (ABX) September $15-$16 deep in-the-money vertical bull call spread, you pick up the $16-$17 call spread instead.

Generally, you make a profit that is 50% greater on this higher spread than with the original recommendation. But you are also taking on higher risk.

When 90% or more of our Trade Alerts are successful this has been a pretty good bet to make.

2) Buy the Call Options Only

Instead of buying the call spread, you buy the call option only in half the size.

When it works, your upside is unlimited. When it doesn't, you just write off the total value of your investment.

This is a great approach when the stocks I recommend take off like a rocket and double or more, as have Apple (AAPL), Amazon, (AMZN), Tesla (TSLA), Lam Research (LRCX), and NVIDIA (NVDA).

Option spread buyers leave a lot of money on the table with this scenario, but get lower performance volatility.

I have observed that many of my Australia readers pursue this approach, as they are fighting a 14-hour time zone disadvantage with the New York Stock Exchange. Not many civilians want to trade at 4:00 AM no matter how much it pays.

The payoff is that they earn about double what I do trading the same stocks.

3) Buy a 2X or 3X Leveraged ETF

This is moving out even further off the risk curve.

Almost every one of the 101 S&P 500 sectors have listed for them 2X and 3X bull and bear ETF's. In theory, the best-case scenario for one of these funds is that they will rise three times as fast as the underlying basket.

In theory, I said.

By the time you take out management fees, tracking error, and execution costs, and wide spreads, you are more likely to get 2.5 times the basket appreciation, if not 2X.

I normally steer investors away from 3X funds. But 401k traders, who are not allowed to deal in stock options, swear by them.

4) Trade Futures

This is a favorite of foreign exchange, precious metals, and bond traders. A futures contract can deliver up to 100 times the performance of the underlying currency, metal, or Treasury bond.

Get a good entry point, run a tight stop loss, and the potential gains can be astronomical.

Every year we get a couple of followers who earn 1,000% profits using our market timing for entry and exit point, and they always do it through the futures markets. Yes, that is a 10X return.

This is also a much higher risk, but higher return strategy. Your broker will present greater disclosure requirements and need a higher clearance level.

But potentially retiring in a year is ample bait for many professionals to go through with this.

5) Read the Research

I know a lot of you only buy this service only for our industry beating Trade Alert service.

But my decade-long experience in watching readers succeed, or fail, in their executions is that the more research they read, the more money they make.

Don't try to skim though with a minimal effort.

It's really very simple. The more work you put into this, the more profit you take out.

Understanding fully what is happening in the markets, indeed the entire global economy, will give you the confidence you need to take on bigger positions and make A LOT more money.

There is no free lunch. There is no Holy Grail.

Having said all that, good luck and good trading.

Looks Like I Got Another One

The Armageddon crowd must be slitting their wrists today watching gold hit a new four month low in the wake of the global interest rate rally.

No flight to safety here.

The Armageddon crowd are the guys who are perennially predicting the collapse of the dollar, the default of the US government, hyperinflation, and the end of the world.

Better to keep all your assets in gold and silver, store at least a year?s worth of canned food, and keep your guns well oiled and supplied with ammo, preferably in high capacity magazines.

If you followed their advice, you lost your shirt.

I have broken many of these wayward acolytes of their money-losing habits. But not all of them. There seems to be an endless supply emanating from the hinterlands.

The Oracle of Omaha, Warren Buffet, often goes to great lengths to explain why he despises the yellow metal.

The sage doesn't really care about gold whatever the price. He sees it primarily as a bet on fear.

If investors are more afraid in a year than they are today, then you make money on gold. If they aren't, then you lose money.

The only problem now is that fear ain't working.

If you took all the gold in the world, it would form a cube 67 feet on a side, worth $5 trillion. For that same amount of money, you could own other assets with far greater productive earning power including:

*All the farmland in the US, about 1 billion acres, which is worth $2.5 trillion.

*8 Apples (AAPL), the largest capitalized company in the world, at $634 billion.

Instead of producing any income or dividends, gold just sits there and shines, making you feel like King Midas.

I don't know. With the stock market at an all time high, and oil trading at $50/barrel, a bet on fear looks pretty good to me right now.

I'm still sticking with my long term forecast of the old inflation-adjusted high of $2,300/ounce.

It is just a matter of time before emerging market central bank buying pushes it up there.

And who knows? Fear might make a comeback too.

Maybe Feeling Like King Midas is Not So Bad

Loyal followers of the Mad Hedge Fund Trader are well aware that I have been bearish on gold for the past five years.

However, it may be time for me to change that view.

A number of fundamental factors are coming into play that will have a long-term positive influence on the price of the barbarous relic. The only question is not if, but when the next bull market in the yellow metal will begin.

All of the positive arguments in favor of gold all boil down to a single issue: they?re not making it anymore.

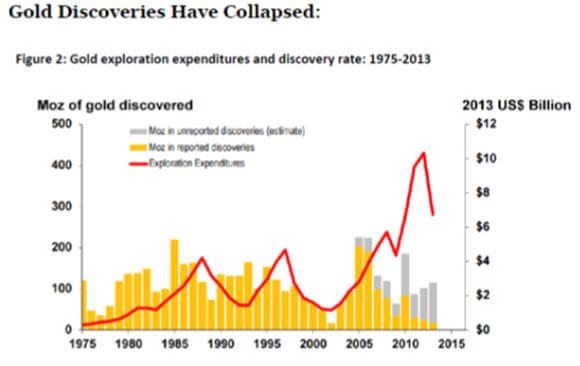

Take a look at the chart below and you?ll see that new gold discoveries are in free fall. That?s because falling prices have caused exploration budgets to fall off a cliff.

Gold production peaked in the fourth quarter of 2015, and is expected to decline by 20% for the next four years.

The industry average cost is thought to be around $1,400 and ounce, although some legacy mines can produce for as little as $600. So why dig out more of the stuff if it means losing more money?

It all sets up a potential turn in the classic commodities cycle. Falling prices demolish production, and wipe out investors. This inevitably leads to supply shortages.

When the buyers finally return, there is none to be had and price spikes can occur which can continue for years. In other words, the cure for low prices is low prices.

Worried about new supply quickly coming on-stream and killing the rally?

It can take ten years to get a new mine started from scratch by the time you include capital rising, permits, infrastructure construction, logistics and bribes. It turns out that the brightest prospects for new gold mines are all in some of the world?s most inaccessible, inhospitable, and expensive places.

Good luck recruiting for the Congo!

That?s the great thing about commodities. You can?t just turn on a printing press and create more, as you can with stocks and bonds.

Take all the gold mined in human history, from the time of the ancient pharaohs to today, and it could comprise a cube 63 feet on a side. That includes the one-kilo ($38,720) Nazi gold bars stamped with German eagles upon them, which I saw in Swiss bank vaults during the 1980?s.

In short, there is not a lot to spread around.

The long-term argument in favor of gold never really went away. That involves emerging nation central banks, especially those in China and India, raising gold bullion holdings to western levels. That would require them to purchase several thousand tonnes of the yellow metal!

So watch the iShares Emerging Market ETF (EEM). A bottom there could signal the end of the bear market for gold as well.

Sovereign wealth funds from the Middle East have recently been dumping gold to raise money. The collapse of oil prices has made it impossible to meet their wildly generous social service obligations.

Hint: governments in that part of the world that fail to deliver on promises are often taken out and shot.

When this selling abates, it also could well signal the final low in gold. That?s why I have been strongly advising readers to watch the price of Texas tea careful, as both it an gold should bottom on the same day.

Let me throw out one more possibility for you to cogitate over. Another big winner of rising precious metal prices is residential real estate, which people rush to buy as an inflation hedge. Remember inflation?

Tally ho!

Looks Like A ?BUY? to Me

Looks Like A ?BUY? to Me

I have not done a gold trade in yonks. That?s because it has been the asset class from hell for the past five years, dropping some 46% from its 2011 $1,927 high.

However, we are now in a brave new, and scarier world.

Given the extreme volatility of financial markets in recent months, all of a sudden keeping hedges on board looks like a good idea. I?m sure the next time stocks take a big dive, the barbarous relic will post a double digit gain.

So, this makes it an excellent hedge for my outstanding long S&P 500 (SPY) and short Treasury (TLT) ?RISK ON? positions.

Also supporting the yellow metal is what I call the ?Big Figure Syndrome?. And there is no bigger number than $1,000, the upper strike on this trade.

While rising interest rates is always bad for gold, the realization is sinking in that it is definitely NOT off to the raises now that the Federal Reserve has at last begun a tightening cycle.

Personally, I expect ?one and done? to gain credence by midyear, once implications of six months of Fed inaction starts to sink in. As long as rates rise slowly, or not at all, we have a gold positive environment.

The Treasury bond market has already figured this out, with yields now lower than when the Fed carried out its 25 basis point snugging.

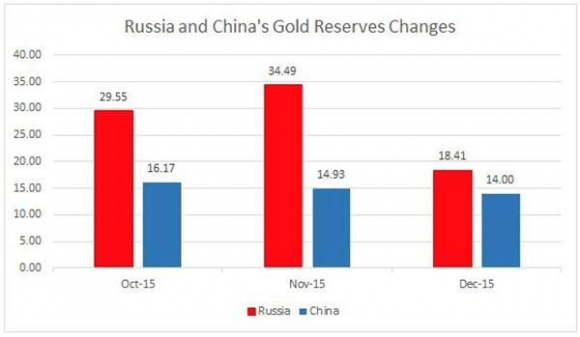

In addition, gold has recently found some new friends. Russia has come out of nowhere in recent months and emerged as one of the world?s largest buyers. This is because economic sanctions brought down upon them by the invasion of Crimea and the Ukraine is steering them away from dollar assets.

Keep in mind that this is only a trade worth about $200 to the upside. Then, I?ll probably sell it again.

I am avoiding the Market Vectors Gold Miners ETF (GDX) for now, as the next stock market swoon will take it down as well, no matter what the yellow metal does.

But get me a good price and a rising stock market, and I?ll be in there with another Trade Alert.

My interest might even expand to include the world?s largest gold miners, Barrick Gold (ABX) and Newmont Mining (NEM).

The new bull market in gold is still at least five years off. That?s when it picks up a huge tailwind from a massive demographic expansion by the Millennials, which eventually leads to much higher inflation.

Also by then, China and other emerging nations will begin to raise their gold reserve holdings to western levels. This will require the purchase of several thousand metric tonnes! That?s when my long-term forecast of $5,000/ounce will finally come true.

With conditions as grim as they were in 2015, you would have thought the price of gold was going to zero.

It didn?t.

While no one was looking, the average price of gold production has soared from $5 in 1920 to $1,300 today. Over the last 100 years, the price of producing gold has risen four times faster than the underlying metal.

It?s almost as if the gold mining industry is the only one in the world which sees real inflation, which has seen costs soar at a 15% annual rate for the past five years.

This is a function of what I call ?peak gold.? They?re not making it anymore. Miners are increasingly being driven to higher risk, more expensive parts of the world to find the stuff.

You know those tires on heavy dump trucks? They now cost $200,000 each. Barrick Gold (ABX) didn?t try to mine gold at 15,000 feet in the Andes, where freezing water is a major problem, because they like the fresh air.

What this means is that when the spot price of gold falls below the cost of production, miners will simply shout down their most marginal facilities, drying up supply. That has recently been happening on a large scale.

This inevitably leads to a shortage of supply, and a new bull market, i.e., the cure for low prices is low prices.

They can still operate and older mines carry costs that go all the way down to $600. No one is going to want to supply the sparkly stuff at a loss.

That should prevent gold from falling dramatically from here.

I am constantly barraged with emails from gold bugs who passionately argue that their beloved metal is trading at a tiny fraction of its true value, and that it is really worth $5,000, $10,000 or even $50,000 an ounce.

They claim the move in the yellow metal we are seeing is only the beginning of a 30-fold rise in prices similar to what we saw from 1972 to 1979, when it leapt from $32 to $950.

To match the 1936 monetary value peak, when the monetary base was collapsing and the double top in 1979 when gold futures first tickled $950, this precious metal has to increase in value by eight times, or to $9,600 an ounce.

I am long term bullish on gold, other precious metals, and virtually all commodities for that matter.

The seven year spike up in prices we saw in the seventies, which found me in a very long line in Johannesburg, South Africa to unload my own Krugerrand's in 1979, was triggered by a number of one off events that will never be repeated.

Some 40 years of demand was unleashed when Richard Nixon took the US off the gold standard and decriminalized private ownership in 1972. Inflation then peaked around 20%. Newly enriched sellers of oil had a strong historical affinity with gold.

South Africa, the world?s largest gold producer, was then a boycotted international pariah and teetering on the edge of disaster. We are nowhere near the same geopolitical neighborhood today, and hence my more subdued forecast.

But then again, I could be wrong.

The previous bear market in gold lasted 18 years, from 1980 to 1998, so don?t hold your breath.

What should we look for? When your friends start getting surprise, out of the blue pay increases, the largest component of the inflation calculation. That is happing now in the technology and the new US oil fields, but nowhere else.

It could be a long wait, possibly into the 2020?s, until shocking wage hikes spread elsewhere.

Ready For a Bounce

Ready For a Bounce

One of the most impressive moves in the wake of the Fed?s Thursday move to maintain ultra low interest rates was to be found in gold.

In the run up to the flash headline on the Fed non-announcement, the yellow metal rocketed $40. The action was even more impressive in silver (SLV), which tacked on 90 cents, or 6.6%.

Now, here is the really bad new.

The fundamentals for the barbarous relic are about to turn from bad to worse. The prospect is sending perma bulls rushing to update their life insurance policies.

This is the dilemma. To sell, or not to sell?

Gold does well when interest rates are low or falling. That reduces the opportunity cost of owning the barbarous relic, which doesn?t pay any interest or dividends. It just sits there, shines, and collects dust.

It also runs up storage and insurance fees, effectively hampering it with a real negative yield.

So what happens when the fundamentals flip from good to bad?

WARNING: if you have been carefully salting away one ounce American gold eagle coins in your safe deposit box for the past several years, you are not going to want to read this.

If I am right, and we have put in a generational high in bond prices and a low in yields, interest rates are going to rise. Initially, for the first couple of years, they may not do it a lot. But eventually they will.

That is terrible news for gold owners.

The market clearly thinks this is happening. Take a look at the charts below. Gold is making its third run at support at $1,100 over the past 18 months. Break this and cascading, stop loss selling will ensue, taking gold down to $1,000.

That, by the way, is my jeweler?s downside.

Caution: My jeweler is always right. There he plans to load the boat with bullion, which his business consumes in creating baubles for clients, like me.

It wasn?t supposed to be like this, as the arguments in favor of buying the yellow metal were so clear five years ago.

The exploding national debt was about to force the US government to default on its debt. It almost did, thanks to congressional gamesmanship.

Massive trade deficits with China and the Middle East were supposed to collapse the value of the US dollar.

The election of Barack Obama was predicted to lead to the creation of a socialist paradise. We were all going to need gold coins to bribe the border guards in order to get out of the country with only what we could carry.

The problem is that none of this happened.

The US budget deficit is falling at the fastest rate in history, from a $1.5 trillion peak to as low as $400 billion this year. Foreign capital pouring into the US has pushed the greenback to multiyear highs, and loftier altitudes beckon.

Since the 2009 inauguration, the S&P 500 has tripled off its intraday low. This has enriched the 1% more than any other group, who have seen their wealth increase at the fastest pace on record.

The trade deficit with China is now balancing out with America?s own burgeoning surpluses in services and education. As for the Middle East, we make our own oil now, thanks to fracking, so why bother.

To see such dismal price action in the barbarous relic now is particularly disturbing. Traditionally, the Indian ?Diwali? gift giving season heralded the beginning of a multi month bull run in gold. It ain?t happening.

In fact the dumping of speculative long positions by long-term traders used to this is accelerating the melt down. That?s because gold, silver, or any other inflation hedges have no place in a deflationary, reach for yield world.

Mind you, I don?t think gold is going down forever.

Eventually, emerging central banks will bid it back up, as they have to buy an enormous amount just to bring their reserve ownership up to western levels. Inflation is likely to return in the 2020?s, as my ?Golden Age? scenario picks up speed.

In the meantime, you might want to give those gold eagles to your grand kids. By the time they go to college, they might be worth something.

?

Better to Look than to Buy

Better to Look than to Buy

The news from Australia?s Perth Mint was horrific last week. The refiner for the world?s second largest producer reported that sales hit a new three year low.

And the worst is yet to come.

Shipments of gold coins and bars plunged to 21,671 ounces in May, compared to 26,545 ounces in April. Silver sales have seen similar declines.

I have been warning readers for the last four years that investors want paper assets paying dividends and interest, not the hard stuff, now that the world is in a giant reach for yield.

Ten-year US Treasury yields jumping from 1.83% to 2.43% this year is pouring the fat on the fire.

This all substantially raises the opportunity cost of owning the barbarous relic. With bond yields now forecast to reach as high as 3.0% by the end of the year, the allure of the yellow metal is fading by the day.

The gold perma bulls have a lot of splainin? to do.

Long considered nut cases, crackpots, and the wearers of tin hats, lovers of the barbarous relic have just suffered miserable trading conditions since 2011. Gold has fallen some 39% since then during one of the great bull markets for risk assets of all time.

Let me recite all the reasons that perma bulls used your money to buy the yellow metal all the way down.

1) Obama is a socialist and is going to nationalize everything in sight, prompting a massive flight of capital that will send the US dollar crashing.

2) Hyperinflation is imminent, and the return of ruinous double-digit price hikes will send investors fleeing into the precious metals and other hard assets, the last true store of value.

3) The Federal Reserve?s aggressive monetary expansion through quantitative easing will destroy the economy and the dollar, triggering an endless bid for gold, the only true currency.

4) To protect a collapsing greenback, the Fed will ratchet up interest rates, causing foreigners to dump the half of our national debt they own, causing the bond market to crash.

5) Taxes will skyrocket to pay for the new entitlement state, the government?s budget deficit will explode, and burying a sack of gold coins in your backyard is the only safe way to protect your assets.

6) A wholesale flight out of paper assets of all kind will cause the stock market to crash. Remember those Dow 3,000 forecasts?

7) Misguided government policies and oppressive regulation will bring financial Armageddon, and you will need gold coins to bribe the border guards to get out of the country. You can also sew them into the lining of your jacket to start a new life abroad, presumably under an assumed name.

Needless to say, things didn?t exactly pan out that way.

The end-of-the-world scenarios that one regularly heard at Money Shows, Hard Asset Conferences, and other dubious sources of investment advice all proved to be so much bunk.

I know, because I was once a regular speaker on this circuit. I, alone, a voice in the darkness, begged people to buy stocks instead.

Eventually, I ruffled too many feathers with my politically incorrect views, and they stopped inviting me back. I think it was my call that rare earths (REMX) were a bubble that was going to collapse was the weighty stick that finally broke the camel?s back.

By the way, Molycorp (MCP), then at $70 a share, recently announced it was considering bankruptcy. Rare earths didn?t turn out to be so rare after all.

So, here we are, five years later. The Dow Average has gone from 7,000 to 18,000. The dollar has blasted through to a 14 year high against the Euro (FXE).

The deficit has fallen by 75%. Gold has plummeted from $1,920 to $1,150. And no one has apologized to me, telling me that I was right all along, despite the fact that I am from California.

Welcome to the investment business. Being wrong never seems to prevent my competitors from prospering.

Gold has more to worry about than just falling western demand. The great Chinese stock bubble, which has seen prices double in only nine months, has citizens there dumping gold in order to buy more stocks on margin.

This is a huge headache for producers, as the Middle Kingdom has historically been the world?s largest gold buyer. As long as share prices keep appreciating, demand there will continue to ebb.

So now what?

From here, the picture gets a little murky.

Certainly, none of the traditional arguments in favor of gold ownership are anywhere to be seen. There is no inflation. In fact, deflation is accelerating.

The dollar seems destined to get stronger, not weaker. There is no capital flight from the US taking place. Rather, foreigners are throwing money at the US with both hands, escaping their own collapsing economies and currencies.

And with global bond markets having topped out, the opportunity cost of gold ownership returns with a vengeance.

All of which adds up to the likelihood that today?s gold rally probably only has another $50 to go at best, and then it will return to the dustbin of history, and possibly new lows.

I am not a perma bear on gold. There is no need to dig up your remaining coins and dump them on the market, especially now that the IRS has a mandatory withholding tax on all gold sales. I do believe that when inflation returns in the 2020?s, the bull market for gold will return for real.

You can expect newly enriched emerging market central banks to raise their gold ownership to western levels, a goal that will require them to buy thousands of tons on the open market.

Gold still earns a permanent bid in countries with untradeable currencies, weak banks, and acquisitive governments, India, another major buyer.

Remember, too, also that they are not making gold anymore, and that all of the world?s easily accessible deposits have already been mined. The breakeven cost of opening new mines is thought to be around $1,400 an ounce, so don?t expect any new sources of supply anytime soon.

These are the factors which I think will take gold to the $3,000 handle by the end of the 2020?s, which means there is quite an attractive annualized return to be had jumping in at these levels. Clearly, that?s what many of today?s institutional buyers are thinking.

Sure, you could hold back and try to buy the next bottom. Oh, really? How good were you at calling the last low, and the one before that?

Certainly, incrementally scaling in around this neighborhood makes imminent sense for those with a long-term horizon, deep pockets, and a big backyard.

Oops!

Oops!

Maybe It Doesn?t Look So Good After All

Maybe It Doesn?t Look So Good After All

After a prolonged, four year hibernation, it appears that the gold bulls are at long last back.

Long considered nut cases, crackpots and the wearers of tin hats, lovers of the barbarous relic have just enjoyed the first decent trading month in a very long time.

The question for the rest of us is whether there is something real and sustainable going on here, or whether the current rally will end with yet another whimper, to be sold into.

To find the answer, you?ll have to read until the end of this story.

Let me recite all the reasons that perma bulls used to buy the yellow metal.

1) Obama is a socialist and is going to nationalize everything in sight, prompting a massive flight of capital that will send the US dollar crashing.

2) Hyperinflation is imminent and the return of ruinous double digit price hikes will send investors fleeing into the precious metals and other hard assets, the last true store of value.

3) The Federal Reserve?s aggressive monetary expansion through quantitative easing will destroy the economy and the dollar, triggering an endless bid for gold, the only true currency.

4) To protect a collapsing greenback, the Fed will ratchet up interest rates, causing foreigners to dump the half of our national debt they own, causing the bond market to crash.

5) Taxes will skyrocket to pay for the new entitlement state, the government?s budget deficit will explode, and burying a sack of gold coins in your backyard is the only safe way to protect your assets.

6) A wholesale flight out of paper assets of all kind will cause the stock market to crash. Remember those Dow 3,000 forecasts?

7) Misguided government policies and oppressive regulation will bring the Armageddon, and you will need gold coins to bribe the border guards to get out of the country. You can also sew them into the lining of your jacket to start a new life abroad, presumably under an assumed name.

Needless to say, it didn?t exactly pan out that way. The end-of-the-world scenarios that one regularly heard at Money Shows, Hard Asset Conferences, and other dubious sources of investment advice all proved to be so much bunk.

I know, because I was a regular speaker on this circuit. I alone, a voice in the darkness, begged people to buy stocks at the beginning of the greatest bull markets of all time, which was then, only just getting started.

Eventually, I ruffled too many feathers with my politically incorrect views, and they stopped inviting me back. I think it was my call that rare earths (REMX) were a bubble that was going to collapse was the weighty stick that finally broke the camel?s back.

So, here we are, five years later. The Dow Average has gone from 7,000 to 18,000. The dollar has blasted through to a 12 year high against the Euro (FXE). The deficit has fallen by 75%. Gold has plummeted from $1,920 to $1,100. And no one has apologized to me, telling me that I was right all along, despite the fact that I am from California.

Welcome to the investment business.

Except that now, gold is worth another look. It has rallied a robust $200 off the bottom in a mere two months. Some of the most frenetic action was seen in the gold miners (GDX), where shares soared by as much as 50%. Even mainstay Barrick Gold (ABX) managed a 30% revival.

The gold bulls are now looking for their last clean shirt, sending suits out to the dry cleaners, and polishing their shoes for the first time in ages, about to hit the road to deliver almost forgotten sales pitches once again.

The news flow has certainly been gold friendly in recent weeks. Technical analysts were the first to raise the clarion call, noting that a string of bad news failed to push gold to new lows. Charts started putting in the rounding, triple bottoms that these folks love to see.

The New Year stampede into bonds gave it another healthy push. One of the long time arguments against the barbarous relic is that it pays no yield or dividend, and therefore has an opportunity cost.

Well guess what? With ten year paper now paying a scant 0.40% in Germany, 0.19% in Japan, and an eye popping -0.04% in Switzerland, nothing else pays a yield anymore either. That means the opportunity cost of owning precious metals has disappeared.

Then a genuine black swan appeared out of nowhere, improving gold?s prospects. The Swiss National Bank?s doffing of its cap against the Euro (FXE) ignited an instant 20% revaluation of the Swiss franc (FXF).

In addition to wiping out a number of hedge funds and foreign exchange brokers around the world, they shattered confidence in the central bank. And if you can?t hide in the Swiss franc, where can you?

This all accounts for the $200 move we have just witnessed.

So now what?

From here, the picture gets a little murky.

Certainly, none of the traditional arguments in favor of gold ownership are anywhere to be seen. There is no inflation. In fact, deflation is accelerating.

The dollar seems destined to get stronger, not weaker. There is no capital flight from the US taking place. Rather, foreigners are throwing money at the US with both hands, escaping their own collapsing economies and currencies.

And once global bond markets top out, which has to be soon, the opportunity cost of gold ownership returns with a vengeance. You would think that with bond yields near zero we are close to the bottom, but I have been wrong on this so far.

All of which adds up to the likelihood that the present gold rally is getting long in the tooth, and probably only has another $50-$100 to go, from which it will return to the dustbin of history, and possibly new lows.

I am not a perma bear on gold. There is no need to dig up your remaining coins and dump them on the market, especially now that the IRS has a mandatory withholding tax on all gold sales. I do believe that when inflation returns in the 2020?s, the bull market for gold will return for real.

You can expect newly enriched emerging market central banks to raise their gold ownership to western levels, a goal that will require them to buy thousands of tons on the open market.

Gold still earns a permanent bid in countries with untradeable currencies, weak banks, and acquisitive governments, like China and India, still the world?s largest buyers.

Remember, too, that they are not making gold anymore, and that all of the world?s easily accessible deposits have already been mined. The breakeven cost of opening new mines is thought to be around $1,400 an ounce, so don?t expect any new sources of supply anytime soon.

These are the factors which I think will take gold to the $3,000 handle by the end of the 2020?s, which means there is quite an attractive annualized return to be had jumping in at these levels. Clearly, that?s what many of today?s institutional buyers are thinking.

Sure, you could hold back and try to buy the next bottom. Oh, really? How good were you at calling the last low, and the one before that?

Certainly, incrementally scaling in around this neighborhood makes imminent sense for those with a long-term horizon, deep pockets and a big backyard.

Oops!

Oops!

After one of the wildest rides in recent memory, the stock market has ground to a complete halt. So have virtually all other asset classes as well.

You can see this in the activity of my Trade Alert service as well. After sending out Alerts as fast as I could write them for the past three months, some three or four a day, the action has slowed to a snails pace. What gives?

I think that the sudden, universal optimism we saw break out all over in November and December ended up pulling performance out of 2014 back into 2013. Traders were picking up positions not only for the yearend rally, but the January one as well.

As a result, there is nothing for us to do in January. Our New Year asset reallocation rally happened last month. The net result has been one of the most boring starts to a new year in history, with trading confined to tortuous, frustrating low volume ranges.

What have been the best performing assets so far in 2014? Gold (GLD), gold miners (GDX), (ABX), and bonds (TLT), (TBT), the worst performing ones of 2013. Don?t get your hopes up. These are only dead cat bounces prompted by short covering with broader, longer term bear markets.

In the meantime, the stars of last year have become the dogs of this year, like consumer cyclicals and banks. Suddenly, it has become an upside-down world, with the good becoming bad, and the bad good. Don?t expect this to last. It never does.

It gets worse. What if we didn?t pull forward only in January and the end of last year, but February and March as well? We could be sitting back on our haunches for quite a long time. Sounds like a good time to catch up on those old back issues of Diary of a Mad Hedge Fund Trader that we didn?t have time to read because trading was too frenetic.

As for me, I am getting an early start on my tax returns this year so I can figure out how much my Obamacare is going to cost me. Thanks to my spectacular, once in a lifetime performance in 2013, Uncle Sam and I have quite a lot to talk about. What? You mean a $2,000 bottle of wine purchased in Portofino on the Italian Riviera (the seaside resort featured in The Wolf of Wall Street) is not deductible? If it is for Morgan Stanley, why not me?

Another reason for the sudden silence is that investors have suddenly become very cautious. We have just had a run for the ages. From my June 14 low I made a staggering 41.15% profit for my followers. My last 14 consecutive Trade Alerts have been profitable, as has every one so far in 2014. Those are serious numbers. While almost no one else matched these numbers, quite a few traders did well too.

Suddenly protecting performance has become far more important than catching that next marginal trade. When everyone else is in the same boat, markets go very quiet, until the boat tips over.

Things aren?t going to remain this dead forever. It reminds me of a witticism voiced by President Nixon?s chairman of the Council of Economic Advisors, Herbert Stein: ?If something cannot go on forever, it will stop.?

When the Trade Alert traffic dies down, I get barraged by daily complaints from readers that I?ve gotten lazy, I?ve gotten too rich to focus on this anymore, and that I ought to be doing more. Can you blame them? With an 85% success rate with my Alerts, who wouldn?t want more?

One of the reasons that my success rate is one of the highest in the industry is that I know when to quit trading. Some 45 years trading the markets has taught me one thing. If you chase a trade that?s not there it?s a perfect formula for losing money. There is no law stating that you always must have a position. That?s what brokers want you to do, a mug?s game at best.

My advice to you? Go out and spend some of the hard earned money you made last year from my Trade Alert Service. I understand there are great deals to be had on large screen HD TV?s at Best Buy. Unfortunately, my hometown San Francisco 49ers blew a playoff game in the last 22 seconds, depriving me from a trip to New York for Super Bowl XLVIII. But if you?re from Seattle or Denver, you definitely have something better to do for the week leading up to February 2.

Out With the Old?

And In With The New...

There Goes My Super Bowl Trip

There Goes My Super Bowl Trip

The ?Oracle of Omaha? expounded at length today on why he despises the barbarous relic. The sage doesn?t really care if the yellow metal hit an all-time high today of $1,440. He sees it primarily as a bet on fear. If investors are more afraid in a year than they are today, then you make money. If they aren?t, then you lose money. If you took all the gold in the world, it would form a cube 67 feet on a side, worth $7 trillion. For that same amount of money, you could own other assets with far greater productive power, including:

*All the farmland in the US, about 1 billion acres, which is worth $2.5 trillion.

*Seven Exxon Mobil?s (XOM), the largest capitalized company in the US.

*You would still have $1 trillion in walking around money left over.

Instead of producing any income or dividends, gold just sits there and shines, letting you feel like you are King Midas.

I don?t know. With the stock market peaking around here, and oil trading at $115/barrel in Europe, a bet on fear looks pretty good to me right now. I?m still sticking with my long term forecast of the old inflation adjusted high of $2,300.

Maybe Feeling Like King Midas is Not So Bad

Maybe Feeling Like King Midas is Not So Bad

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.