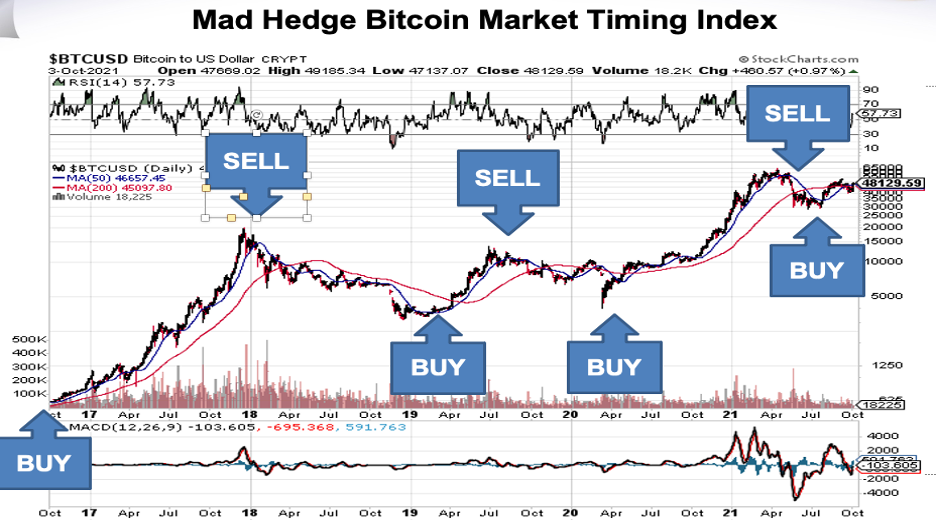

Periods of weakness in Bitcoin price action often reflect positioning and profit-taking rather than a breakdown in the asset’s underlying structure.

Bitcoin remains a volatile asset by design, and retracements have historically occurred even during sustained growth phases. Sharp pullbacks, while uncomfortable, have repeatedly functioned as resets rather than trend reversals.

From a structural perspective, Bitcoin’s price behavior continues to reflect cyclical volatility rather than instability.

Corrections are a feature, not a flaw.

Bitcoin does not move in a straight line, and expectations that it should do so tend to form near local extremes rather than durable inflection points.

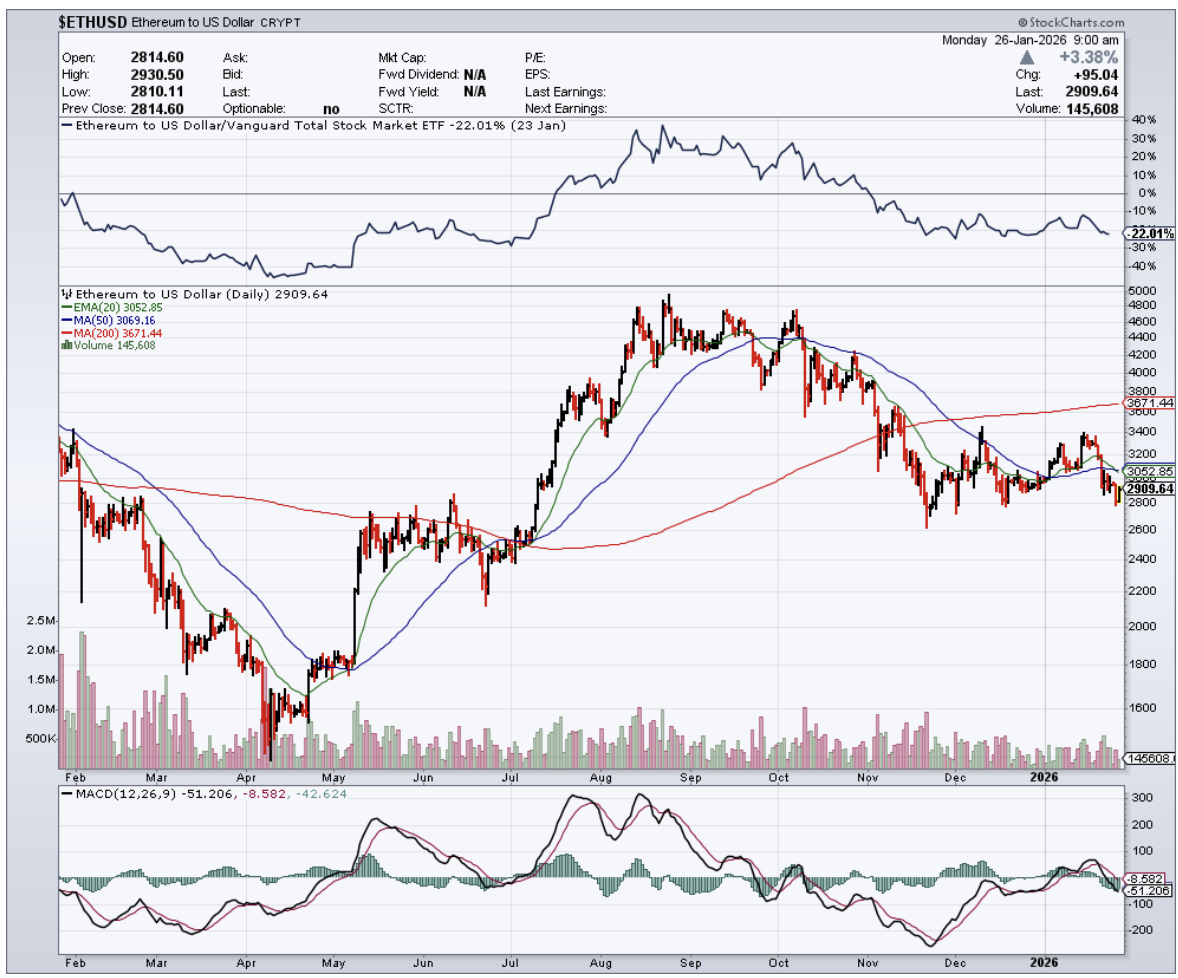

What has been more notable during periods of Bitcoin consolidation is the behavior of the broader digital asset market.

Even when Bitcoin has struggled to make near-term progress, capital rotation into alternative crypto assets has often remained active, signaling broader participation rather than capital flight.

Assets such as Ethereum, Solana, and Cardano have each experienced phases of outsized growth across multiple market cycles, alongside many smaller projects that have captured speculative and developmental interest.

This breadth reflects a market that has expanded beyond a single-asset thesis.

Bitcoin has begun to exhibit characteristics of a more mature asset, even while remaining volatile by traditional standards.

At the same time, much of the altcoin market remains earlier in its development curve, where experimentation, speculation, and rapid growth are more common.

As a result, capital that once flowed almost exclusively into Bitcoin increasingly disperses across a wider set of digital assets, particularly those perceived to offer higher upside at earlier stages.

A few years ago, broad-based participation across dozens of crypto assets would have seemed implausible.

The expansion of liquidity beyond Bitcoin reflects both increased risk tolerance and a growing belief that multiple blockchain networks can coexist with differentiated use cases.

That dispersion does not weaken Bitcoin’s role, but it does change how capital cycles through the ecosystem.

Macro conditions also continue to influence crypto markets.

Strength in the US dollar and shifts in global liquidity have periodically pressured risk assets, including digital currencies. While Bitcoin is often framed as an alternative monetary asset, it still competes for capital within the same global financial system.

During periods of dollar strength or tightening financial conditions, it is common for investors to reduce exposure, lock in gains, or rebalance toward perceived safety.

Currency volatility in emerging and developed markets alike has reinforced this dynamic, reminding investors that crypto does not exist in isolation from global macro forces.

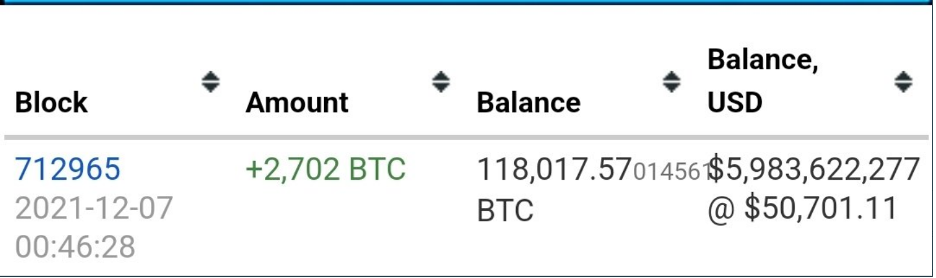

Another recurring source of market anxiety has been the distribution of long-dormant bitcoin holdings from early industry failures.

The long-running resolution of the Mt. Gox bankruptcy has periodically resurfaced as a sentiment overhang, driven by concerns that large distributions could temporarily pressure prices.

Historically, however, such events have tended to influence short-term behavior rather than long-term market structure.

Even when additional supply enters the market, it does not alter Bitcoin’s fixed issuance schedule or long-term scarcity.

If selling pressure emerges, it typically delays recovery rather than defining a new secular trend.

Despite these intermittent headwinds, the broader direction of crypto adoption has remained constructive.

Bitcoin continues to attract institutional interest, corporate balance-sheet allocation, and sovereign-level experimentation, while alternative networks push forward with development, scaling, and application design.

That combination has reinforced the idea that crypto markets are no longer driven by a single narrative or participant class.

Breadth across assets, use cases, and geographies has become one of the defining characteristics of the ecosystem.

Volatility remains, cycles persist, and corrections are unavoidable.

But the widening participation across digital assets suggests that crypto has moved beyond its earliest phase, even if it remains far from mature.

That breadth continues to be one of the strongest signals underpinning the asset class.