Global Market Comments

June 4, 2024

Fiat Lux

Featured Trade:

(The Mad June traders & Investors Summit is ON!)

(THE BIGGEST “TELL” IN THE MARKET RIGHT NOW),

(GOOGL), (FRC), (PINS), (WORK), (UBER),

(ADSK), (WDAY), (SNE), (NVDA), (MSFT)

Global Market Comments

June 4, 2024

Fiat Lux

Featured Trade:

(The Mad June traders & Investors Summit is ON!)

(THE BIGGEST “TELL” IN THE MARKET RIGHT NOW),

(GOOGL), (FRC), (PINS), (WORK), (UBER),

(ADSK), (WDAY), (SNE), (NVDA), (MSFT)

I am constantly looking for “tells” in the market, little nuggets of information that no one else notices, but give me a huge trading advantage.

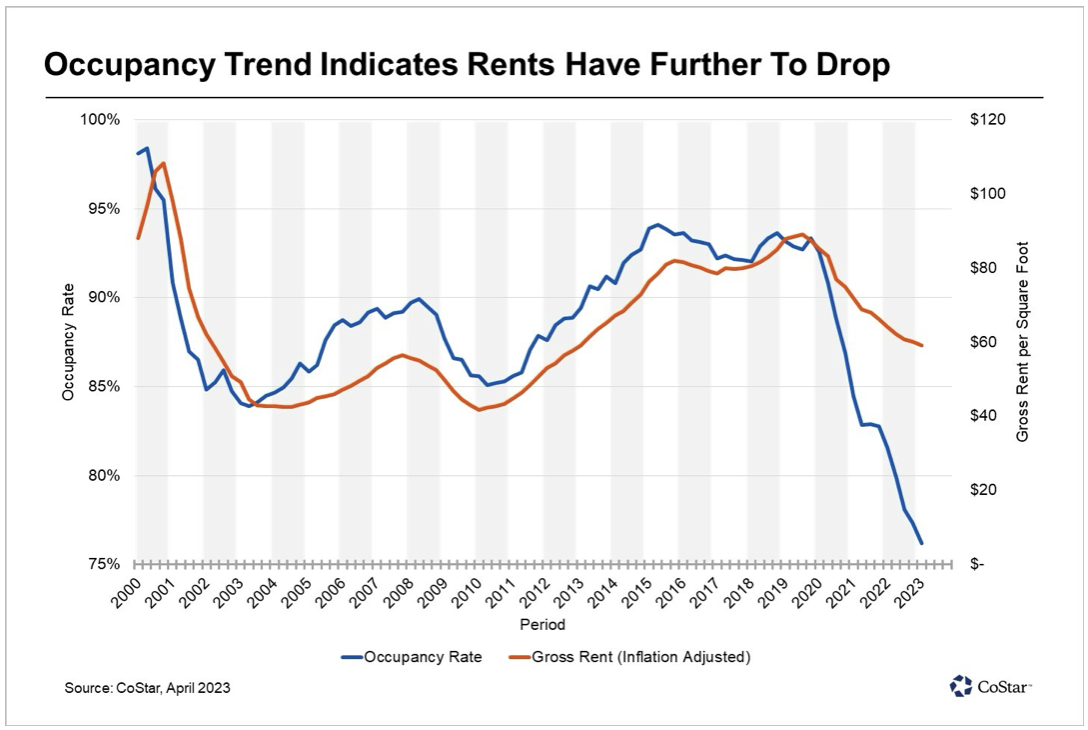

Well, there is a big one out there right now. The bottom feeders are pouring into San Francisco commercial real estate, taking advantage of valuations that sometimes reach negative numbers. Owners are walking away from buildings, mailing in the keys, and going into default rather than keeping up mortgage payments. What’s worse is refinancing at today’s lofty rates. That’s what you would expect with a 36% vacancy rate.

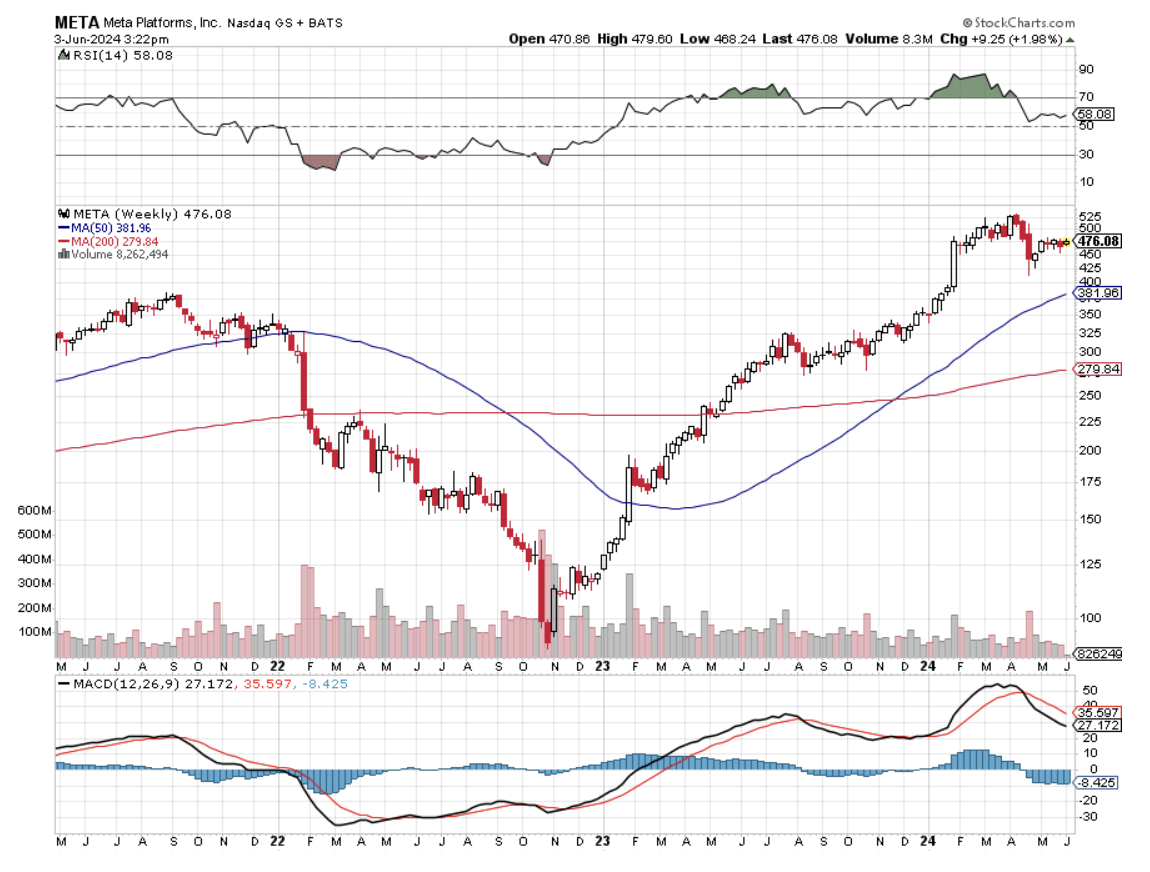

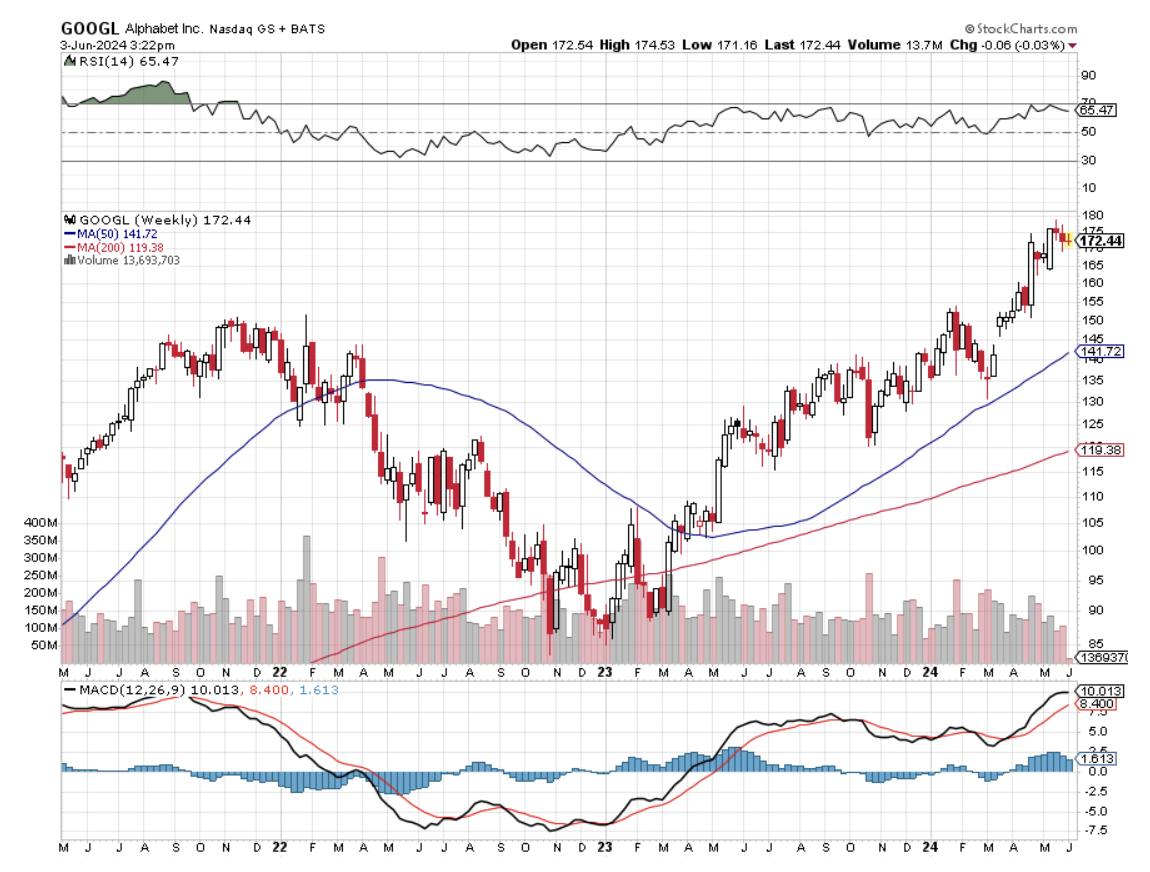

The message for you traders is loud and clear. You should be picking up the highest quality technology growth stocks on every substantial dip, such as Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL), Meta (META), and NVIDIA (NVDA). For they all know some things that you don’t. Their businesses are about to triple, if not quadruple over the coming decade thanks to AI. For every abandoned building out there are 200 new AI start-ups taking advantage of today’s bargain basement rates, and ALL of them use the services of the five companies above.

Technology stocks, which now account for an eye-popping 30% of stock market capitalization, will make up more than half of the market within ten years, much of that through stock price appreciation. And they are all racing to lock up the office space with which to do that….now.

San Francisco office rents reached a record pre-pandemic as the continued growth of tech — now turbocharged by nearly $100 billion in new capital raised in a series of initial public offerings — met a severe space crunch.

Asking rents rose to a staggering $84.16 per square foot annually for the newest and highest quality offices in the central business district, and citywide asking rents for such spaces, known as Class A, were up over 9% from the prior year. The citywide office vacancy rate was 5.5% in June, down from 7.4% a year ago.

In addition, local Bay Area home prices could get a turbocharger by the fall, when interest rates are expected to start falling.

San Francisco companies that have gone public continue to grow by leaps and bounds. Pinterest (PINS), Slack (WORK), and Uber (UBER) also signed office leases this year, with room for thousands of new employees.

Tech companies Autodesk (ADSK) and Glassdoor also signed deals at 50 Beale St. in the spring. In a sign of the city’s rapidly changing economy, old-line construction firm Bechtel and Blue Shield, the legacy health insurer, are both moving out of 50 Beale St. Sensor maker Samsara, software firm Workday (WDAY), and Sony’s (SNE) PlayStation video game division also expanded.

Globally, San Francisco has the seventh-highest rents in prime buildings. It’s still behind financial powerhouses Hong Kong, London, New York, Beijing, Tokyo, and New Delhi (San Francisco’s average office rents beat out New York.)

Only a handful of new office projects are being built, and future supply is further constrained by San Francisco’s Proposition M, which limits the amount of office space that can be approved each year. That is creating a steadily worsening structural shortage. Only two large office projects are under construction without tenant commitments.

Suddenly, it’s Not Crowded in San Francisco

Mad Hedge Technology Letter

December 6, 2019

Fiat Lux

Featured Trade:

(AUGMENTED REALITY IS HEATING UP),

(AAPL), (LITE), (QCOM), (NVDA), (ADSK), (FB), (MSFT), (SNAP)

First, what is augmented reality for all the newbies?

Augmented reality is an interactive experience of a real-world environment where the objects that reside in the real world are enhanced by computer-generated perceptual information, sometimes across multiple sensory modalities.

Augmented reality (AR) went rival in 2016 when the Pokemon Go mania captivated everyone from children to adults.

No sooner than 2021, the AR addressable market is poised to mushroom to $83 billion - a sizeable increase from the $350 million in 2018.

Much like machine learning, corporations are learning to marry up this technology with their existing products supercharging the performance.

Ulta Beauty, for example, has acquired AR and artificial intelligence start-ups to help customers digitally test the final appearance of makeup before users purchase the product.

That is just one micro example of what can and will be achieved.

Looking deeper into the guts, Qualcomm (QCOM) is hellbent on making their chips a critical part of the puzzle.

The company is better known for a telecom and a semiconductor play, not often lumped in with a list of AR stocks.

Qualcomm is strategically positioned to capitalize on the integration of augmented reality in mainstream corporate business embedding their chips into the devices.

Maximizing Qualcomm’s future role in the industry, the company announced in 2018 that it would be developing a chipset specifically for AR and VR applications.

This broad-based solution will make it easier for other developers to bring new glasses to the marketplace.

Autodesk (ADSK) is one of my favorite software stocks and a best of breed of industry design.

They sell 3D rendering software to designers and creators by offering a platform in which they can transform 2D designs into digital models that are both interactive and immersive, creating compelling experiences for end-users.

Autodesk has an array of powerful software suites to augment virtually any application, such as 3ds Max, a 3D modeling program; Maya LT game development software; its automotive modeling program VRED; and Forge, a development platform for cloud-based design.

Facebook (FB) has been piling capital into AR for years.

CEO Mark Zuckerberg wants to create an alternative profit-driver and is desperate to wean his brainchild from the digital ad circus.

One example is Facebook’s Portal TV and its Spark AR which is the platform responsible for mobile augmented reality experiences on Facebook, Messenger, and Instagram.

It supplies the virtual effects for consumers to play around with, but it is yet to be seen if consumers gravitate towards this product.

Lumentum (LITE) is the leader in 3D-sensing markets developing cloud and 5G wireless network deployments.

They manufacture 3D sensor lasers that can be used with smartphones to turn handsets into a sort of radar. Sensors are clearly a huge input in how AR functions along with the chips.

CEO of Apple (AAPL) Tim Cook put it best when he earlier said, “I do think that a significant portion of the population of developed countries, and eventually all countries, will have AR experiences every day, almost like eating three meals a day, it will become that much a part of you.”

He said that in 2016 and AR has yet to mushroom into the game-changing sector initially thought partly because the roll-out of 5G is taking longer than first expected.

Apple consumers will need to then adopt a 5G device or phone to really get the AR party started and that won’t happen until the backend of next year.

My initial channel checks hint that the Cupertino firm is planning a 5.4-inch model, two 6.1-inch devices, and one 6.7-inch phone, all of which will support 5G connectivity.

I surmise that Apple’s two premium devices will feature “world-facing” 3D sensing, a technology that could help Apple boost its augmented-reality capabilities and support other feature improvements on its priciest devices.

Apple has had a big hand in Lumentum's growth and will continue to buy their sensors, but other key component suppliers will get contracts such as Finisar, a manufacturer of optical communication components and subsystems.

Apple planned to debut AR glasses by 2020, but the rollout is now delayed until 2022.

They are clearly on the back foot with Microsoft (MSFT) further along in the process.

Microsoft already has a second iteration of its AR headset, HoloLens, and is compatible with several apps and has integration with Azure as well.

The head start of 2 years could really make a meaningful impact and might be hard for Apple to recover.

Facebook isn’t the only social media company going full steam into AR, Snap (SNAP) recently unveiled its newest spectacles, which feature AR elements.

Another application of AR is autonomous driving with Nvidia working on improving the driving experience by fusing AR with artificial intelligence.

Nvidia (NVDA) is already thinking about the next generation of AR technologies with varifocal displays, which improve the clarity of an object for a user.

It will take time to transform our relationship with AR, the infrastructure is still getting built out and many people just don’t have a device that will allow us to tap into the technology.

Investors must know that AR-related stocks will start to appreciate from the anticipation of full sale adoption and there could be a killer app that forces the mainstream user to take notice.

Until then, companies jockey for position and hope to be the ones that take the lion’s share of the revenue once the technology goes into overdrive.

Global Market Comments

July 16, 2019

Fiat Lux

Featured Trade:

(THE BIGGEST TELL IN THE MARKET RIGHT NOW),

(GOOGL), (FRC), (PINS), (WORK), (UBER),

(ADSK), (WDAY), (SNE), (NVDA), (MSFT),

(POPULATION BOMB ECHOES),

(CORN), (WEAT), (SOYB), (DBA), (MOS)

Mad Hedge Technology Letter

April 4, 2019

Fiat Lux

Featured Trade:

(A LEGACY TECH COMPANY YOU HAVE TO BUY)

(ADSK)

You cannot accuse Autodesk (ADSK) of ignoring the prodigious migration to digital and full-blown automation.

The company gives credence to the tech theory of taking a pretty darn good software product, repackage it as a subscription, then watch revenues and marginal profitability go through the roof.

Autodesk is one of the original pioneers of AutoCAD, a commercial computer-aided design (CAD) and drafting software application.

Before AutoCAD was introduced, most commercial CAD programs ran on mainframe computers or minicomputers, with each CAD operator working at separate graphics terminal.

Autodesk’s AutoCAD and Revit software are mainly applied by architects, engineers, and structural designers to design, draft, and model buildings.

Being one of the flagbearers of the industry has its perks with Autodesk’s AutoCAD software being involved in world-renowned projects from the One World Trade Center to Tesla electric cars.

Once I roll through their 2018 achievements, it will be impossible not to define this company as part of the cloud aristocracy.

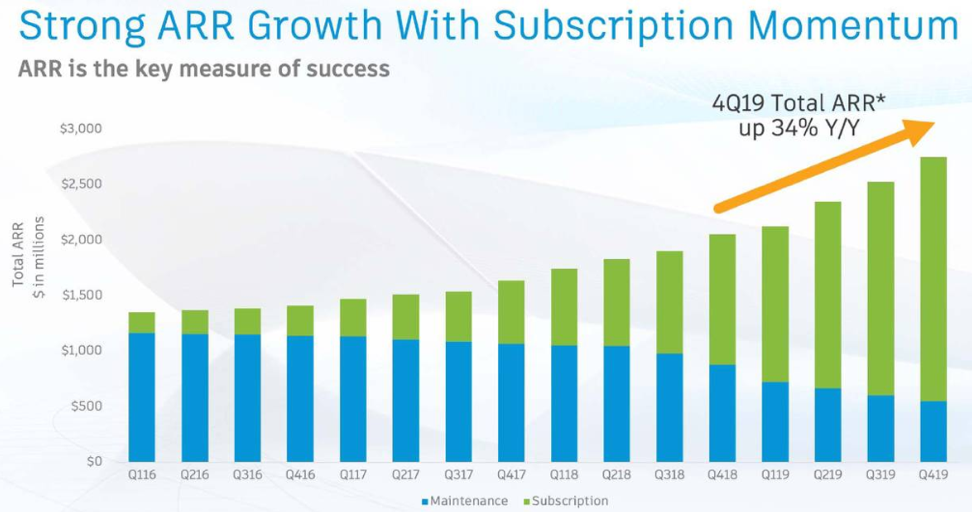

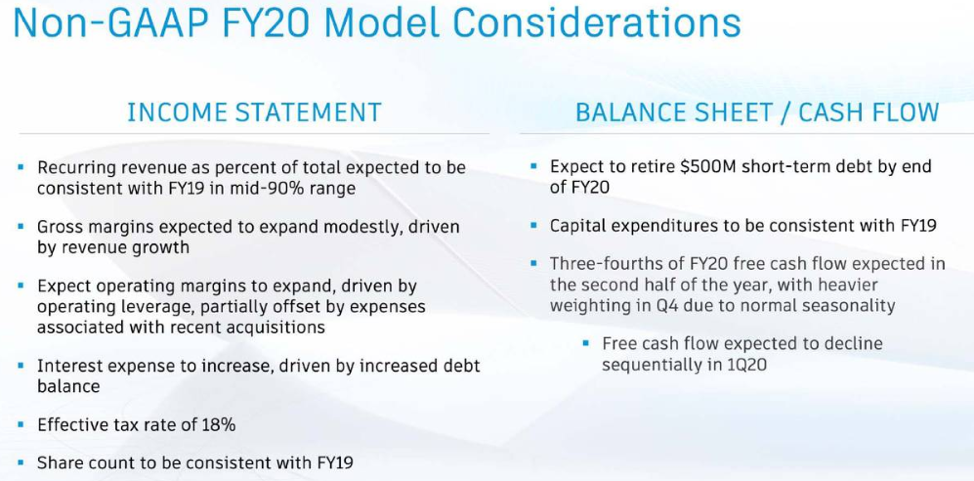

Scrolling through the numbers, my eyeballs pinpoint at the all-important Annual Recurring Revenue (ARR) as the starting point for clues to its success.

(ARR) is a crucial metric used by software-as-a-subscription (SaaS) businesses who define the contract length and the (ARR)’s specific dollar value contracted in return for proprietary software.

You’d be chuffed to bits to discover that Autodesk’s (ARR) delivers 95% of total annual revenue which amounted to almost $2.6 billion in fiscal 2018, a record for this company headquartered in San Rafael, California.

On an annualized basis, (ARR) growth amounted to 34% and billings cruised past the $1 billion mark for the first time last quarter.

Autodesk would be lying if they said subscriber growth isn’t the lynchpin to growing revenue, it certainly is, and they are doing their best to take advantage of this opportunity.

When talking about the strengths, we must look at Autodesk’s AutoCAD software which featured among the top 10 fastest growing skills in technology job searches.

According to Upwork’s latest quarterly index, Revit expertise is highlighted among the top 15 hardest skills for freelancers in the U.S. job market.

Building information modeling (BIM) is a process involving the generation, production, and management of digital representations of physical and functional characteristics of places.

Clayco, an ambitious construction design firm based in Chicago, has been an Autodesk customer for years.

They use BIM 360, Assemble, PlanGrid and Building connective as they are single-mindedly focused on fully embracing the digitization of construction.

BIM adoption remains one of the underlying reasons of investments in the infrastructure space.

An industry-wide cry for adopting BIM drove another seven figured enterprise agreement with a large European infrastructure provider last quarter.

Autodesk doubled the contract with the customer as the company hopes the adoption of BIM for building and managing will enhance the quality of infrastructure projects.

Autodesk’s unique portfolio design tools are allowing them to expand from products like AutoCAD and Inventor into Revit the world’s leading BIM design tool.

On the manufacturing side, generative design and investments in Fusion continue to attract global manufacturing leaders to collaborate with Autodesk.

A vivid example is the cloud agreement signed with Korean automobile maker Hyundai Motor Group who plan to leverage Autodesk’s software to generate innovative car designs.

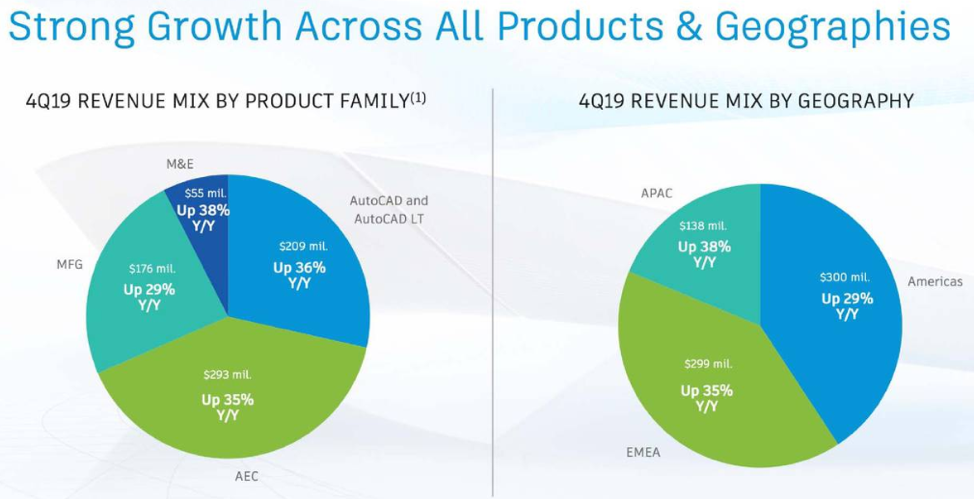

Taking a microscope to the financials, the average revenue per user (ARPS) increased 17% because of the 13% boost in the number of subscriptions.

The subscription plan subs grew by 291,000 organically.

Continued adoption of BIM 360 solutions gave a 51,000 boost to cloud subs.

Autodesk is finishing up migrating the maintenance customers to subscription packages.

In Q4, 110,000 customers moved from maintenance to product subscriptions, meaning Autodesk has switched over nearly 800,000 maintenance customers to subscriptions since the inception of the program.

The maintenance plan was abandoned in the fall of 2016 as a way of driving revenue momentum. Before, Autodesk offered software upgrades and the latest product releases for free.

Dramatically shifting to a subscription model has laid the pathway to monetize their software through a monthly recurring payment system.

The company also offers a discounted three-year subscription that 3rd parties can lock in if they are serious about a long-term relationship with Autodesk.

At the end of this month, Autodesk plans to increase the cost of certain subscription plans by between 2.5% and 10% allowing the company to deliver more value to the engineers that religiously rely on Autodesk.

Even though maintenance plan packages are slowly winding down, after this small group’s special discount expires, they will be recommended to join the new subscription program.

As it stands, less than 20% of revenues is generated from the maintenance agreements as the subscription revenue model has furthered Autodesk’s financial interests, effectively executing Autodesk’s growth strategy.

The shift to a cloud-based subscription setup is one of the crucial ways Autodesk has maximized free cash flow and has been a massive catalyst of a profitability surge.

The company is smack in the middle of growth sweet spot benefitting the top line and combined with gross margin expansion, I trust Autodesk shares to be an outsized winner of the cloud aristocracy.

Buy Autodesk on the dip.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

OKLearn moreWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

If you do not want that we track your visist to our site you can disable tracking in your browser here:

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Vimeo and Youtube video embeds: