Global Market Comments

February 3, 2026

Fiat Lux

Featured Trade:

(REVISITING THE FIRST SILVER BUBBLE),

(SLV), (SLW), (AGQ)

Global Market Comments

February 3, 2026

Fiat Lux

Featured Trade:

(REVISITING THE FIRST SILVER BUBBLE),

(SLV), (SLW), (AGQ)

Global Market Comments

October 10, 2025

Fiat Lux

Featured Trade:

(PROSHARES ULTRA SILVER ETF LEAPS),

(AGQ)

Global Market Comments

July 18, 2025

Fiat Lux

Featured Trade:

(JULY 16 BIWEEKLY STRATEGY WEBINAR Q&A),

(GLD), (SLV), (DHI), (LEN), (CCI), (KRE), (META), (NFLX), (AMZN), (SLB), (PPL), (XOM), (OXY), (AGQ), (WFC), (DXJ), (FXE)

Global Market Comments

June 9, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE BLIND MAN’S MARKET)

(GOOGL), (MSFT), (NVDA), (JPM), (V), (AAPL), (GLD), (MSTR), (SPY), (AAPL), (QQQ), (TLT), (WPM), (SLV), (SIL), (AGQ)

Global Market Comments

May 2, 2025

Fiat Lux

Featured Trade:

(APRIL 30 BIWEEKLY STRATEGY WEBINAR Q&A),

(FXI), (AGQ), (NVDA), (SH), (UNG), (USO),

(TSLA), (SPX), (CCJ), (USO), (GLD), (SLV)

Below, please find subscribers’ Q&A for the April 30 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Incline Village, NV.

Q: Why is the Australian dollar not moving against the US dollar as much as the other currencies?

A: Australia is too closely tied to the Chinese economy (FXI), which is now weak. When the Chinese economy slows, Australia slows. Australia is basically a call option on the Chinese economy. So they're not getting the ballistic moves that we've seen in, say, the Euro and the British pound, which are up about 20%. Live by the sword, die by the sword. If you rely on China as your largest customer for your export commodities, you have to take the good and the bad.

Q: I see we had a terrible GDP print on the economy this morning, down 0.3%. When are we officially in a recession?

A: Well, the classical definition of a recession is two back-to-back quarters of negative GDP growth. We now have one in the bank. One to go. And this quarter is almost certain to be much worse than the last quarter, because the tariffs basically brought all international trade to a complete halt. On top of that, you have all of the damage to the economy done by the DOGE cuts in government spending. Approximately 80% of the US states, mostly in the Midwest and South, are very highly dependent on Washington spending for a healthy economy, and they are going to really get hit hard. So the question now is not “do we get a recession?”, but “how long and how deep will it be?” Two quarters, three quarters, four quarters? We have no idea. Even if trade deals do get negotiated, those usually take years to complete and even longer to implement. It just leaves a giant question mark over the economy in the meantime.

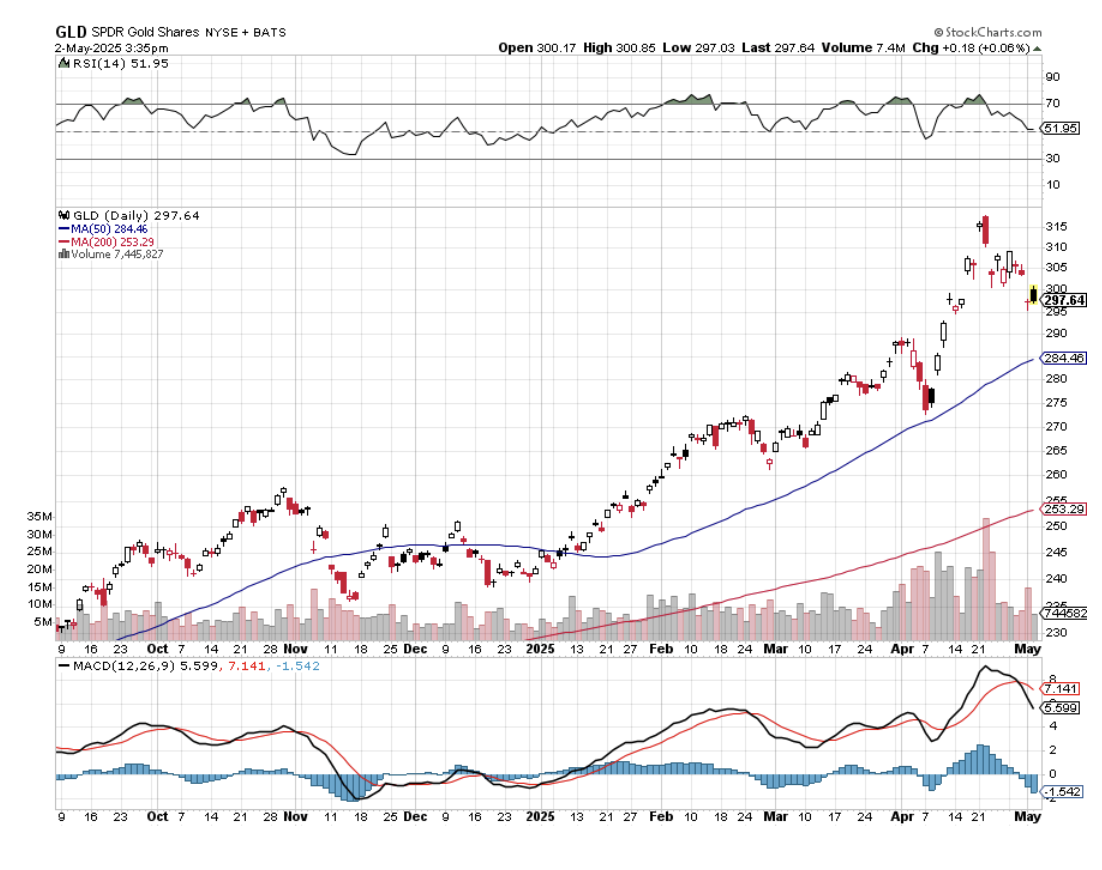

Q: Is SPDR Gold Trust (GLD) the best way to play gold, or is physical better?

A: I always go for the (GLD) because you get 24-hour settlement and free custody. With physical gold, you have to take delivery, shipping is expensive, and insurance is more expensive. Plus, then you have to put it in a vault. Private vaults have a bad habit of going bankrupt and disappearing with your gold. You keep it in the house, and then if the house burns down, all your gold is gone there. Plus, it can get stolen. There's also a very wide dealing spread between bid and offer on physical gold coins or bars; usually it's at least 10%, often more. So I often prefer the ease of trading with the GLD, which owns futures on physical gold, which is held in London, England. So that is my call on that.

Q: Is ProShares Ultra Silver (AGQ) the leveraged silver play?

A: It absolutely is, but beware: (AGQ) is only good for short, sharp rises because the contango and the storage operating costs of any 2x are very, very high—like 10% a year. So, good if you're doing a day trade, not good for a one-year hold. Then you're just better off buying silver (SLV).

Q: What is more important with the Fed's mandate—unemployment or fear of inflation?

A: That's an easy one. Historically, the number one priority at the Fed has been inflation. That is their job to maintain the full faith and credit of the U.S. Dollar, and inflation erodes the value, or at least the purchasing power of the US dollar, so that has always historically been the priority. Until we see inflation figures fall, I think the chance of them cutting interest rates is zero, and we may not see actual falls until the end of the year, because the next influence on prices is up because of the trade war. The trade war is raising prices everywhere, all at the same time. So that will at least add 1 or 2% to inflation first before it starts to fall. You can imagine how if we get a 6% inflation rate, there's no way in the world the Fed can cut rates, at least for a year, until we get a new Fed governor. So that has always historically been the priority.

Q: Do you think the 10-year yield is going down to 5%?

A: You know, we're really in a no-man's-land here. Recession fears will drive rates down as they did yesterday. I haven't even had a chance to see where the bond market is this morning because. So, rates are rising on a recessionary GDP, which is the worst possible outcome. Rates should be falling on a recessionary GDP print. Of course, Washington’s efforts to undermine the U.S. dollar aren't helping. Threatening to withhold taxes on interest payments to foreign owners is what caused the 10% down move in bonds in one week—the worst move in the bond market in 25 years. So, the mere fact that they're even thinking about doing something like that scares foreign investors, not only from the bond market, but all US investments period. And certainly, we've seen some absolutely massive stock selling from them.

Q: Why won't the market go down to 4,000 in the S&P 500?

A: Absolutely, it could; that is definitely within range. That would put us down 30% from the February highs, it just depends on how long the recession lasts. If you just get a two-quarter shallow recession, we could bounce off 4800 for the (SPX) until we come out. If the recession continues for several quarters, and it's looking like it will, then 4,000 is definitely within range. So, it's all about the economy. And remember, stocks are expensive. They don't get cheap until we get a PE multiple of 16, and even then, that alone, just a multiple shrinkage would take us down to 4,000.

Q: Would it be a good idea to buy the S&P 500 (SPY) as it falls?

A: I'm getting emails from readers asking if it's time to buy Nvidia (NVDA) or time to buy Tesla (TSLA). What I've noticed is that investors are constantly fighting the last battle. They're always looking for what worked last time, and that does not succeed as an investment strategy. As long as I'm selling rallies, I'm not even thinking about what to buy on the bottom. The world could look completely different on the other side. The MAG-7 may not be the leadership in the future, especially with the Trump administration trying to dismantle four out of seven companies through antitrust, and the rest are tied up in the trade wars. So, tech is still expensive relative to the main market, and we're going to need to look for new leaders. My picks are going to be mining shares, gold, and banking. Those are the ones I'm looking to buy on dips, but right now, cash is king unless you want to play on the short side. Being paid 4.3% to stay away sounds pretty good to me, especially when your neighbors have 30% losses. You know, I've heard of people having all of their retirement funds in just two stocks: Nvidia and Tesla, and they're getting wiped out. So, you don't want to become one of them.

Q: After a tremendous run in Gold, is Silver a better risk-reward right now?

A: I would say yes, it is. Silver has been lagging gold all year because central banks, the most consistent buyers for the past decade, buy gold—they don't buy silver. But what we may be in store for here now is a prolonged sideways move in gold while the technicals catch up with it. And in the meantime, the money goes elsewhere into silver and Bitcoin. That's my bet.

Q: Is Apple (APPL) a no-touch now?

A: I’d say yes. The trade war is changing by the day, and Apple probably does more international trade than any other company in the world. Also, Apple gets hit with recessions like everybody else. There was a big front run to buy Apple products ahead of tariffs—my company bought all its computer and telephone needs for the whole year ahead of the tariffs. We're not buying anything else this year. And I would imagine millions more are planning to do the same, so you could get some really big hits in Apple earnings going forward.

Q: Should I sell my August Proshares Short S&P 500 (SH) LEAPS?

A: No, I would keep them. If the (SPX) IS trading between 5,000 to 5,800, your $4-$42 SH LEAPS should expire at max profit in August, so I'm hanging on to mine. Next time we take a run at 5,000, you should be able to get out of your SH LEAPS at 80% to 90% of the max profit.

Q: What car company stock will do the best in a high-tariff global economy?

A: Tesla (TSLA), because 100% of their cars are made in the US with 90% US parts (the screens come from Panasonic in Japan). Their foreign components are only about 10%, so they can eat that. For General Motors (GM), it's more like 30% of all components are made abroad, and they can't eat that; their profit margins are too low. (GM) expects to lose $5 billion because of tariffs. By the way, the profit margins on Tesla have fallen dramatically from 30% down to 10% in two years, so it's not like they're in great shape either. Also, Tesla hasn’t had a CEO for ten months, which is why the board is looking for a replacement.

Q: Is it a good time to buy the dip in oil (USO)?

A: Absolutely not. Oil is the most sensitive sector to recessions, because if you can't sell oil, you have to store it, very expensively. It costs 30 to 40% a year to store oil—that's the contango; and once all the storage is full, then you have to cap wells, which then damages the long-term production of the wells. I think at some point you will expect an announcement from Washington to refill the Strategic Petroleum Reserve, which was basically sold by Biden at $100 a barrel. You can now get it back for $60. That may not be a bad idea if you're going to have a strategic petroleum reserve. What's better is just to quit using oil completely, which we were on trend to do.

Q: Will interest rates drop by year-end?

A: They may drop by year-end once unemployment runs up to 5% or 6% —which is likely to happen in a recession—and inflation starts to decline, even if it declines from a higher level. Even if they don't cut by year end, they'll still cut in a year when the president can appoint a new Fed governor. What the Trump really needs to do is appoint Janet Yellen as the Fed governor. She kept interest rates near zero for practically all of her term. We need another Yellen monetary policy.

Q: The job market here seems to be slowing quite fast. Is there any way this will rebound and stave off recession?

A: No, there is not. Companies are going to be looking to cut costs as fast as they can to offset the shrinkage in sales, but also to help cope with tariffs. So no, the job market is actually surprisingly strong now. That means future data releases are probably going to get a lot worse. In April, we saw job gains in Health care, adding 51,000 jobs. Other sectors posting gains included transportation and warehousing (29,000), financial activities (14,000), and social assistance. I highly doubt any of these sectors will show gains next month.

Q: What about nuclear energy plays?

A: I like them, partly because people are buying stocks like Cameco Corp (CCJ) as a flight to safety commodity play, like they're buying gold, silver, and copper. But also, this administration is supposed to be deregulation-friendly, and the only thing holding back nuclear (at least new modular reactors) is regulation. That and the fact that no one wants to live next door to a nuclear power plant, for some strange reason.

Q: What do I think about natural gas (UNG)?

A: Don't touch. Don't buy the dip. All energy plays look terrible right here, going into recession.

Q: What are your thoughts on manufacturing returning to the U.S? And how will that affect the stock market?

A: I think there's zero chance that any manufacturing returns to the U.S. Companies would rather just shut down than operate money-losing businesses. You know, if your labor cost goes from $5 to $75 an hour, there's no chance anyone can make money doing that, and no shareholders are going to want to touch that stock. That is the basic flaw in having a government where no one is actually running a manufacturing business anywhere in the government. They don't know how things are actually made. They're all real estate or financial people.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

April 17, 2025

Fiat Lux

Featured Trade:

(THE MAD HEDGE TRADERS & INVESTORS SUMMIT REPLAYS ARE UP)

(APRIL 16 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (SH), (SDS), (TLT), (MSTR), (GLD),

(GOLD), (SLV), (AGQ), (NEM)

Below, please find subscribers’ Q&A for the April 16 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Incline Village, NV.

Q: Is it time to get out of the (SH), which is the short S&P 500 LEAPS?

A: I would say no. We're still very deep in the money for the LEAPS I put out two months ago. I doubt we're going to new highs by August when that LEAPS expires, so I would hang on to it, especially if you have other longs on the stock market. But if you're nervous, you probably have at least a 50% profit in that anyway, so take the money and run.

Q: Could the S&P 500 trade down to 4,500?

A: Absolutely, yes. China is kind of in a good position. They can wait. They can wait a very long time until they get what they want. We can't. Trump needs China to fold immediately, or the trade with China will cause a never-ending recession in the US. Remember, we have elections here—in China, they don't. That puts them in a very strong negotiating position. That's why you're seeing basically all economic data roll over and point to a recession. Even if some settlement is negotiated, there still will be some tariffs left. They just won't be at 145%. You know, it’s not a great investment environment to bet your retirement savings on, and certainly not an environment to engage in very rapid short-term trading unless you have 50 years of experience like I do. That's why I'm up this month, and the rest of the world is getting absolutely crushed.

Q: Are you going to send more LEAPS?

A: LEAPS are something we do at market bottoms, not tops, because we have such enormous leverage in the LEAPS trade—they’re usually 10 - 1 to 100 - 1 leverage. At some point, there'll be a lot of fantastic LEAPS in technology stocks, but I don't think we've hit bottom yet. In fact, at best, they've mounted weak bounces over the last few days. So, the charts still look terrible—not a good time for LEAPS.

Q: When do you see the bottom?

A: I have no idea, nobody has any idea. It's like economic policy is changing hour by the hour. Best thing to do is nothing in that situation—and that's what most of the economy is doing. That's why the economy is shutting down. Nobody knows what the final picture will look like—the uncertainty is the greatest since the uncertainty of the pandemic, or 9/11 before that.

Q: Should I hide in a money market fund?

A: No, with the money market fund, you run credit risk with the issuer of that fund. With 90-day US Treasury bills, there's no risk, so you have a government guarantee to get all your money back on the maturity date. If your custodian goes bankrupt, you can always get the T-bills back. It may take you three years in custodian bankruptcy proceedings to get your money market fund back. That’s what we saw with MF Global in 2011.

Q: What is the end game of the China-US trade dispute? How does it affect the stock market?

A: Well, we can't see an end game. Basically, you have two counterparties who are stubborn as heck, and we could be stuck in no man's land for a very long time. You'd have to think eventually a settlement of some type comes. Is that worth a recession for the U.S? For most people, I doubt it. And what if China just wants to wait out Trump and wait for the tariffs to go away in four years? That is a possible outcome. Stock markets always discount the worst-case scenario first before they discount anything else. I think that's what we saw last week, when we broke 5,000 in the S&P 500.

Q: Are you optimistic about bank stocks now?

A: No. They will lead the downturn along with technology stocks. But when this all ends, they will also lead the upturn, and that's why you're seeing bank stocks have such hard bounces off their bottom. It's another one of two sectors that people will be first to rush into—banks and technology stocks. And while tech is expensive, banks are cheap.

Q: How can interest rates fall when government policies, interest rate policies, are causing them to spike?

A: Well, it's very simple: when foreign investors lose faith in the U.S. Government, they have, they pull their money out. They don't need to be here. It's a situation of, “Well, if you don't need us, we don't need you.” And foreigners own about 25% of all of the $36 trillion in national debt out there, or about $9 trillion. And in stocks they own here and the number goes up to $12 trillion. It doesn't take much selling to cause a panic in the bond market. That is what we have been seeing. Whether that continues, I have no idea—it depends on the next tweet coming out of Washington.

Q: What about Bank of America (BAC)?

A: Yeah, it will also bounce the hardest off the bottom—great buy, and these things are all cheap relative to technology stocks. You know, banks still have PE multiples in the low teens. Tech stocks are all the way down to the low 20s from the 30s and 40s, so they're roughly trading at double the multiples of bank stocks. That's one reason people are rushing back into these.

Q: What's the basis of your prediction on a falling US dollar?

A: Again, it's foreign selling. I don't think I've ever seen a falling dollar and rising interest rates in 60 years of watching. It goes against all economic fundamentals in the currency markets. But when there's a panic, there's a panic. People want out of everything at any price, and that's what's happening now. As long as foreigners are dumping our assets, the dollar will keep going down—dumping our assets means dollar selling after 80 years of dollar buying.

Q: Is gold the only safe haven?

A: Yes. We'll get into this in the gold section, but even gold went down for three days, and then wiser heads prevailed and it actually triggered a panic melt-up in gold assets. The miners were up 25% in days. That is another great weak-dollar play.

Q: How do you protect the US from a dollar fall?

A: Change our economic policies; end the trade war.

Q: Is it a good time to buy a house?

A: No, it is not, unless you can wait out the current downturn. High interest rate mortgage rates shot up from 6.5% to 7.1% in a week, and that basically kills off the housing market for the foreseeable future. And of course, when people are worried about their futures, their savings, and their assets, the last thing they do is go out and buy a house.

Q: Is there enough negative sentiment around now for us to go back into the bond market?

A: No. There is no precedent for the type of market action that's going on now. Will the U.S. government suddenly become reasonable? I doubt it. You can expect tweet bombs to happen at any time. So, people are just hoarding cash and avoiding risk at all costs. It used to be that bonds were the safe place to go. No longer. Not with 10% moves down in a week like we saw last week. Sorry—T-Bills are the only actual safe play out there, and their yield is the same as Treasury bonds without the risk.

Q: Will crypto keep going down?

A: If we continue with a risk-off market, I think you can expect crypto to keep falling. Crypto fell 30% from its top—at least Bitcoin did. It's basically matching the downside with tech stocks one for one, so no protection in crypto, no diversification. The protection aspect that was promised by crypto promoters lever shows. No flight to safety is happening there whatsoever. And that's why I'm looking to add to my short in MicroStrategy Inc. (MSTR)—they're a leveraged long Bitcoin play.

Q: Is the U.S. economy set for a hard landing?

A: I think absolutely, yes, the hard landing is in progress. That's what all of the economic data says. It's hard to find any positive news coming out of the economy—people are running for their lives, essentially.

Q: Do you expect inflation to return and take stocks lower?

A: Absolutely, yes. The highest tariffs in history start hitting retail prices in the next month or two, and the price increases should be dramatic, especially on anything from China. So yeah, we should see that come out in the data in the next few months.

Q: Do you expect silver to follow gold?

A: Yes, I do, but it hasn't been performing as well because there is a recession drag on silver, which you don't have for gold. Silver (SLV), (AGQ) are used in a lot of electronics and solar panels.

Q: When do you get back into gold (GLD)?

A: Whenever we get a dip. So far, any dips have been very brief and short-term. It's kind of reminiscent of the 1970s when gold moved from $32 an ounce to $900. That’s when you found me in a line in Johannesburg, South Africa, waiting to sell all my Krugerrands.

Q: Which countries will benefit from manufacturing moving out of China?

A: The answer is really no countries. As soon as manufacturing moves from China to another one like Vietnam, the US then puts punitive tariffs on that second country. So, there's no place to hide. It's really a war against the world. That's the message that the administration is putting out: if you don't want to build a factory here, we don't want to do business with you. We don't want your products. And most companies will do nothing. They'll wait this out, wait for a future president to eliminate all tariffs. Until then, international trade grinds to a halt. No trade makes sense at 145% tariff. Just to give you some idea on how much that is, if you buy a top end MacBook Pro for $8,000, and you pay the full 145% tariff, that is an $11,600 tariff if you have to pay it, which brings the total cost of a MacBook Pro to nearly $19,600. How many are you going to buy at that price?

Q: Do you think the Fed will cut interest rates?

A: No, we haven't seen the inflation data yet. They are backward-looking, and only after we see a sharp rise in prices will they raise rates. Chances of them cutting now are zero with all the risks in inflation to the upside right now and unemployment still under control. So, no interest rate cuts this year.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

October 25, 2024

Fiat Lux

Featured Trade:

(OCTOBER 23 BIWEEKLY STRATEGY WEBINAR Q&A),

(TLT), (JNK), (CCJ), (VST), (BRK/B), (AGQ), (FCX), (TM), (BLK), (NVDA), (TSLA), (T), (SLV), (GLD), (MO), (PM)

Below, please find subscribers’ Q&A for the October 23 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Lake Tahoe, Nevada.

Q: What the heck is happening with the iShares 20+ Year Treasury Bond ETF (TLT)? It keeps dropping even though interest rates are dropping. It seems to be an anomaly.

A: It is. What’s happening is that bonds are discounting a Trump win, and Trump has promised economic policies that will increase the national debt by anywhere from $10 to $15 trillion. Bonds don’t like that—you borrow more money through bonds, and the price goes up. Interest rates could go as high as 10% if we run deficits that high (at least the bond market may go that low.) On the other hand, stocks are discounting a Harris win. Stocks went up 60% over the last four years. I did roughly double that. And a Harris win would mean basically four more years of the same. So stocks have been trading at new all-time highs almost every day until this week when the election got so close that the cautious money is running to the sidelines. So what happens if there's a Harris win? Bonds make back the entire 10 points they lost since the Fed cut interest rates. And what happens if Trump wins? Bonds lose another 10 points on top of the 10 points they've already lost. Someone with a proven history of default doesn't exactly inspire confidence in the bond market. So that is what's going on in the bond market.

Q: Will the US dollar continue its run into year-end?

A: No, I have a feeling it’s going to completely reverse in two weeks and, give up all of its gains, and resume a decade-long trend to new lows. So, I think everything reverses after election day. Stocks, bonds, commodities, precious metals—the only thing that doesn't is energy, and that keeps going down because of global oversupply that even a Middle Eastern war can’t support.

Q: Are you expecting a major correction in 2025?

A: I am, actually. We basically postponed all corrections into 2025 and pulled forward all performance in 2024. So, I think we could get at least a 10% correction sometime next year, and that is normal. Usually, we get a couple of them. This year, we only got the one in July/August. So, back to normal next year, which means smaller returns from the stock market. In fact, smaller returns from everything except maybe gold and silver. This is why they're going up so much now.

Q: Are you discounting a huge increase in the deficit under Biden-Harris?

A: No, the huge increase in the deficit is behind us because we had all the pandemic programs to pay for, and if anything, technology inflation should go down because of accelerating technology. We're already seeing that in many industries now, so I don't think there'll be any policy changes under Harris, except for little tweaks here and there. All the big policies will remain the same.

Q: What is a dip?

A: A dip is different for every stock and every asset class. It depends on the recent volatility of the underlying instrument. You know, a dip in something like McDonald's (MCD) or Berkshire Hathaway (BRK/B) might be 5%, and a dip in Nvidia (NVDA) might be 15 or 20%. So, it really depends on the volatility of the underlying stock, and no two volatilities are alike.

Q: What are your top picks on nuclear?

A: Well, we've been in Cameco (CCJ), the Canadian uranium company, since the beginning of the year, and it has doubled. Vistra Corp (VST) is another one, and there are many more names after that.

Q: What are your thoughts on Toyota (TM)?

A: I love Toyota for the long term. The fact that they were late into EVs is now a positive since the EV business is losing money like crazy. They're the ones who really pioneered the hybrid business, and I’ve toured many of their factories in Japan over the years. Great company, but right now, they're being held back by the slow growth of the Japanese economy.

Q: Market timing index says get out. We're heading into the seasonally bullish time of the year. Should we be in or out over the next two months?

A: I would be in as long as you can handle some volatility around the stock market. When the market timing index is at 70, that means any new trades that you initiate have a 30% chance of making money. Now, they can sit at highs sometimes for months, and it actually did that earlier this year. Markets can get overbought and stay overbought for months, and that is a really difficult time to trade. If you're a long-term investor, you just ignore all of this and just stay in all the time.

Q: Silver has broken out; what's next?

A: Silver had had a massive run since the beginning of September—some 30%. We're up to about $31/oz. The obvious target for silver is the last all-time high, which I think we did 40 years ago, and that was at $50/oz. So there's another easy 60% of upside in silver. That's why I put out a LEAPS on the 2x long silver play (AGQ), and people are already making tons of money on that one. I think Silver will be your big performer going forward.

Q: Too late to invest in Chinese stocks?

A: No, it's selling off again. IT Could retest the lows, especially if the government sits on its hands for too long with more stimulus packages.

Q: Is big tech still a good bargain buy?

A: I would take “bargain” out of that. The rule on tech investing is you're always buying expensive stuff because the future always has a spectacular outlook. So, tech investing is all about buying something expensive that gets more expensive. This is exactly what tech stocks have been doing for the last 50 years, so it's not exactly a new concept. I know tons of people who never touched Nvidia (NVDA) or Tesla (TSLA) because it was too expensive. (NVDA) was too expensive when it was $2, and now it's even more expensive at $140 or, in Tesla's case, $260.

Q: Will Tesla (TSLA) go up or down tonight?

A: I have no idea. Anybody else who says they have an idea is lying. You go to timeframes that short, and you are subjecting yourself to random chance; even the weather could affect your position by tomorrow.

Q: How uncomfortable is the stem cell extraction?

A: Extremely uncomfortable. If they say it won't hurt a bit, don't believe them for a second. They take this giant needle hammer it into your backbone to get your spinal fluid (and I count the hammer blows.) Last time, I think I got up to 50 before I couldn't take the pain anymore, and they extracted the spinal fluid to get the stem cells. So, for those who don't tolerate pain very well, this is absolutely not for you.

Q: Why is Intel (INTC) stock doing so badly this year?

A: Low-end products, no new products, poor manager. Whenever a salesman takes over a technology company, you want to run a mile. That's what happened at Intel because they have no idea how the technology works.

Q: Should I sell my Philip Morris (PM) stock? It's just had a huge run-up.

A: No. For dividend holders, this is the dream come true. They pay a 4.1% dividend. This was a pure dividend play ever since the tobacco settlement was done 40 years ago. Then they bought a Swedish company that has these things called tobacco pouches, and that has been a runaway bestseller. So, all of a sudden, the earnings at Philip Morris are exploding. The dividend is safe. I think Philip could go a lot higher, so buy PM on dips. And I will dig into this story and try to get some more information out of it. I love high growth high dividend plays.

Q: What's the best play for silver?

A: I'm doing the ProShares Ultra Silver (AGQ), which is a 2x long silver and has gone from $30 to $50 since the beginning of September. If you want to sleep at night (of course, I don't need to), then you just buy the iShares Silver Trust (SLV), which is a 1x long silver play and that owns physical silver. I think it's held in a bank vault in London.

Q: Time to sell Copper (FCX)?

A: Short term, yes, as China weakens. Long-term, hang on because we are coming into a global copper shortage, and that'll take the price of copper up to $100 or (FCX) up to $100. So yes, love (FCX) for the long term. Short term, it has a China drag.

Q: Will inflation come back in 2025?

A: No, it won't. Technology is accelerating so fast, and AI is accelerating so fast it's going to cut costs at a tremendous rate. And that's why you're seeing these big tech companies laying off people hundreds at a time; it's because the low-end jobs have already been replaced by AI. There is a lot more of that to come. I'm not worried about inflation at all.

Q: Do you disagree with Tudor Jones on inflation?

A: Yes, I disagree with him heartily. Tudor Jones is talking his own book, which means he doesn't want to get a tax increase with a Harris administration. So he's doing everything he can to talk up Trump, and that isn't helping me with my investment strategy whatsoever. By the way, Tudor Jones is often wrong, you know; he made most of his money 30 years ago. And before that, it was when he was working for George Soros. So, yes, I agree with the man from Memphis. He’s in the asset protection business. You’re in the wealth creation business, a completely different kettle of fish.

Q: Do you hold the ProShares Ultra Silver (AGQ) overnight?

A: I've been holding my (AG for four months, and the cost of carry-on that is actually quite low because silver doesn't pay any dividend or interest. There really isn't much of a contango in the precious metals anyway—it's not like oil or natural gas. It’s a 3X plays that you really shouldn’t hold overnight.

Q: Where is biotech headed?

A: Up for the long term, sideways for the short term. That's because, after the election, risk on will go crazy. We could have a melt-up in stocks, and when that happens, people don't want to buy “flight to safety” sectors like Biotechs and healthcare; they want to buy more Nvidia. Basically, that's what happens. More Nvidia (NVDA), more Meta (META), and more Apple (APPL). They want to buy all the Mag7 winners. Well, let's call them the Mag7 survivors, which are still going up after a ballistic year.

Q: Any suggestions on where to park cash for five to six years?

A: 90-day T-Bills are yielding 4.75%. That would be a safe place to put it. And you might even peel off a little bit of that—maybe 10% — and put that into a junk fund, which is yielding 6%. You're still getting a lot of money for cash—but not for much longer. The golden age of the 90-day T-bill is about to end.

Q: BlackRock (BLK) keeps growing, trillions after trillions. Why is the stock so great at building value?

A: Because you get a hockey stick effect on the earnings. As the stock market goes up, which it always does over time, their fees go up. Plus, their own marketing brings in new money. So, you have multiple sources of income rising at a rapid pace. I'm kicking myself for not buying the stock earlier this year.

Q: How does any antitrust action by the government affect stock prices?

A: Short-term, it caps them. Long term, it doubles them because when you break up these big companies, the individual pieces are always worth a lot more than the whole. We saw that with AT&T (T), where you're able to sell the individual seven pieces for really high premiums. So, that's why I'm never worried about antitrust.

Q: Do dividend stocks provide little upward appreciation since they're paying investors already?

A: To some extent, that's true because low-growth companies like formerly Philip Morris (PM) and Altria (MO) had to pay high dividends to get people to buy their stock because the industries were not growing. AT&T is another classic example of that—high dividend, no growth. But that does set you up for when a no-growth company can become a high-growth company, and then the stocks double practically overnight. And that's what's happening with Philip Morris.

Q: Are you buying physical gold (GLD) and silver (SLV)?

A: I bought some in the 1970s when it was $34/oz for gold, and the US went off the gold standard, and I still have them. It's sitting in a safe deposit box in a bank I will not mention. The trouble with physical gold is high transaction costs—it costs you about 10% or more to buy and sell. It can be easily stolen—people who keep them hidden at home or have safes at home regularly get robbed. And what if the house burns down? You really can't insure gold holdings accept with very high premiums. So, I've always been happy buying the gold ETFs. The tracking error is very small unless you get into the two Xs and three Xs. Gold coins are good for giving kids as graduation presents—stuff like that. I still have my gold coins for my graduation a million years ago (and that was a really great investment! $34 up to, you know, $2,700.)

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

2015 in Italy

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.