Who knew the devil could lurk in an Excel spreadsheet? More specifically, in a hidden tab that, until recently, was minding its own business like a shy teenager at a school dance.

That is, until some eagle-eyed analyst at Cantor Fitzgerald decided to right-click their way into a $12 billion nightmare for Amgen.

(If you're wondering how to find these hidden tabs yourself, just right-click on any visible tab in Excel. Though after this debacle, pharmaceutical companies might start password-protecting their spreadsheets like they're nuclear launch codes.)

The data in question concerns MariTide, Amgen's hopeful contestant in the "help-America-lose-weight" sweepstakes.

The hidden tabs revealed what the published paper in Nature Metabolism conspicuously didn't mention: bone density scans that would make an osteoporologist reach for their stress ball.

Patients receiving the 420-milligram dose saw their bone density drop by about 4% over 12 weeks - the kind of number that sends stock traders reaching for their sell buttons faster than you can say "osteoporosis."

Speaking of selling, this discovery sent Amgen's stock tumbling 7%, which in the biotech world is like watching $12 billion vanish faster than free cookies at a Weight Watchers meeting.

Amgen, doing what pharmaceutical companies do best when faced with uncomfortable data, assured everyone that their Phase 1 study doesn't suggest any bone safety concerns. (One imagines their PR team working overtime, possibly sustained by the same stress-eating habits their drug aims to curb.)

Now, let's talk about the increasingly crowded room of companies trying to help elephants become gazelles.

Novo Nordisk (NVO), the current crown prince of weight-loss drugs, is sitting pretty with Wegovy raking in 17.3 billion Danish kroner (about $2.5 billion) in just one quarter.

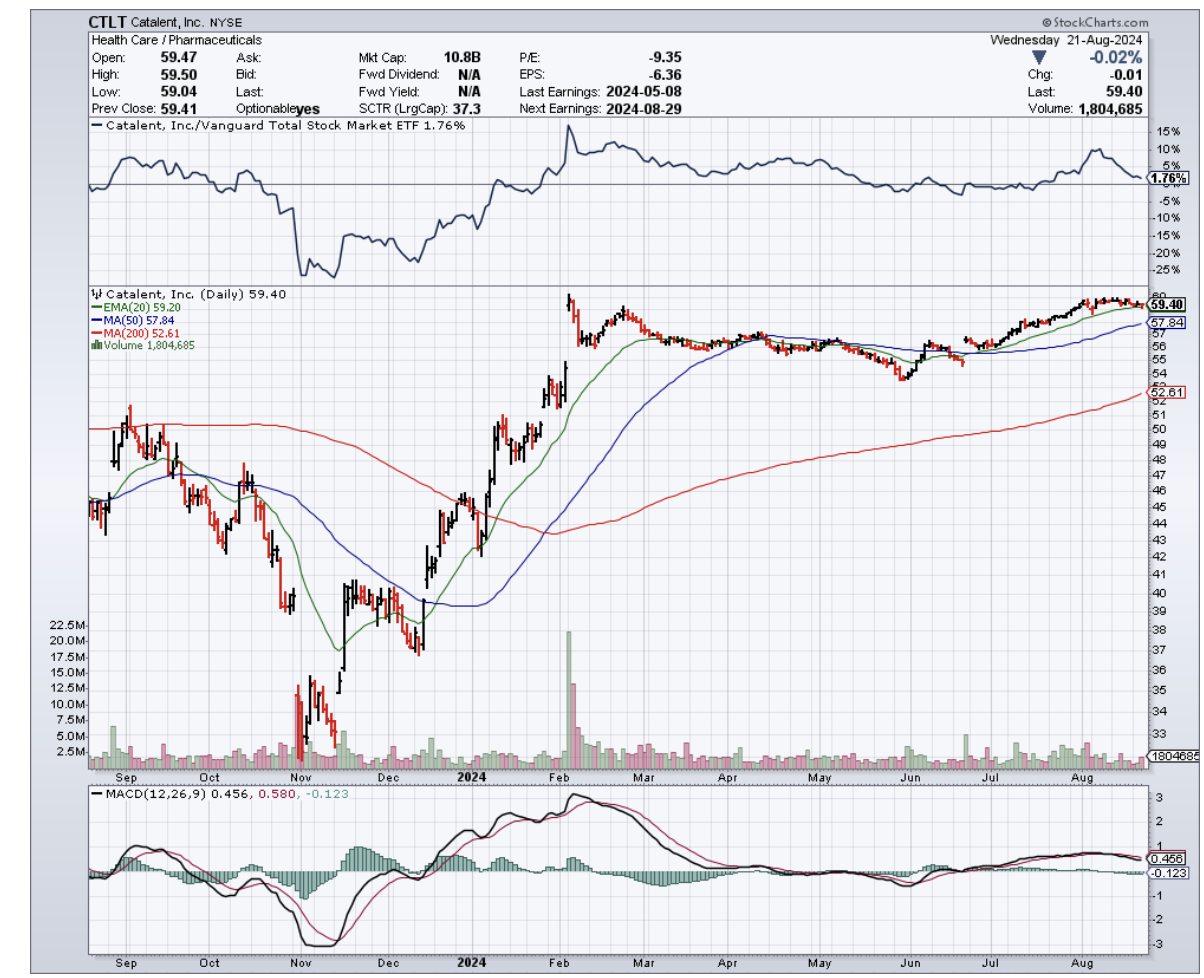

They're so confident they're throwing $11 billion at Catalent faster than you can say "production scale-up." That's enough kroner to buy every Danish pastry in Copenhagen, though that might defeat the purpose.

Not to be outdone, Eli Lilly's (LLY) Zepbound is showing off with weight loss results that would make Jenny Craig jealous - we're talking 21% body weight reduction.

Together with Novo Nordisk, they're expected to dominate 80% of the market, leaving other companies to fight over the crumbs like desperate dieters at a birthday party.

Still, the supporting cast is equally fascinating.

Pfizer's (PFE) danuglipron and Structure Therapeutics' (GPCR) GSBR-1290 are trying to turn these injectable drugs into pills, because apparently not everyone enjoys playing pin cushion.

Viking Therapeutics (VKTX) is getting creative with VK2735, a dual GLP-1 and glucagon receptor agonist, which is pharmaceutical speak for "two mechanisms of action are better than one."

Meanwhile, AstraZeneca's (AZN) AZD5004 is trying to join the party, though their early Phase I results are about as impressive as a rice cake at a dessert buffet.

Now, let’s take a look at the numbers. The global anti-obesity drugs market is expected to balloon from $6.15 billion in 2024 to an eye-watering $37.94 billion by 2032.

But, that seems to be just the conservative estimate. Some analysts are betting this market could hit $150 billion by the early 2030s.

So, what’s the smart move here?

For those watching this space (while probably patting their own midsections thoughtfully), the message is clear: This market is hotter than a freshman chemistry experiment gone wrong.

But as Amgen's Excel adventure shows, sometimes the devil really is in the details - or in this case, in Tab 9, hidden away like a chocolate bar in a dieter's sock drawer.

And like my old friend Deng Xiaoping used to say, sometimes you have to cross the river by feeling the stones.

Today, those stones are telling me this: hold off on buying Amgen - that bone density data isn't just a minor setback, it's a potential deal-breaker.

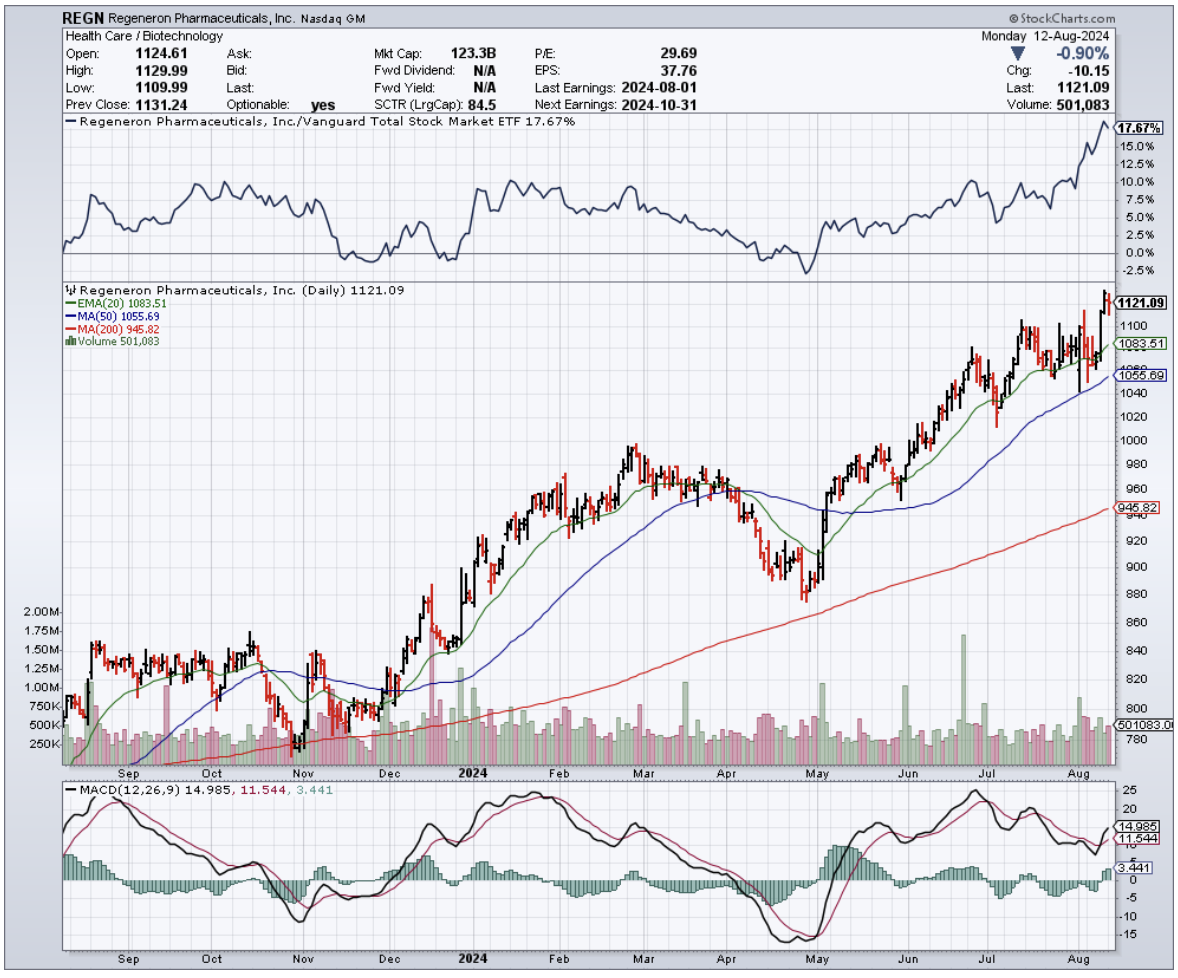

If you really want to take part in the action, opt for Novo Nordisk and Eli Lilly for their proven ability to execute and dominate.

And for those of you who, like me, enjoy a bit of calculated risk-taking, consider a speculative position in Structure Therapeutics and Viking Therapeutics.

Before you get too excited, though, I'd suggest limiting these speculative plays to no more than 5% of your portfolio each - promising early-stage biotechs can deliver spectacular returns, but they can also crash faster than a poorly maintained MIG-25.