Mad Hedge Biotech and Healthcare Letter

July 6, 2023

Fiat Lux

Featured Trade:

(BETWEEN HEADWINDS AND HORIZONS)

(AMGN), (HZNP), (NTLA), (RYTM)

Mad Hedge Biotech and Healthcare Letter

July 6, 2023

Fiat Lux

Featured Trade:

(BETWEEN HEADWINDS AND HORIZONS)

(AMGN), (HZNP), (NTLA), (RYTM)

In the pursuit of safe, sustainable, and substantial dividend yields, my quest often leads me to the realm of dividend aristocrats.

A particular entity that has caught my interest is the biotech behemoth Amgen Inc. (AMGN).

Although the company has been treading on a rocky path, with its shares plunging below their previous highs and year-to-date performance, it continues to pique my curiosity. After all, this downward trend does present a silver lining.

It unlocks an investment opportunity in the form of a record 3.9% dividend yield that AMGN currently offers, with its strong business performance and anticipated robust free cash flow countering any valuation concerns.

Still, investing in biotech is more than just a mere bet on a company's innovative prowess. It's also a gamble on the company’s skill to maneuver through the labyrinth of policy interventions.

Recent headlines talk about AMGN's ongoing battles, with a plethora of challenges leading investors to remain on the sidelines.

The IRS' quest for billions in back taxes from the company, the Federal Trade Commission's move to halt its massive acquisition of Horizon Therapeutics (HZNP), and a Supreme Court ruling against Amgen in a crucial patent case are just some of the headwinds the company faces.

Amidst these, the impending patent cliff hangs like a Damocles sword, with several of its blockbuster drugs, such as Enbrel and Otezla, likely to witness revenue shrinkage owing to patent expirations and intensifying competition.

Yet, despite the grim scenario, there are silver linings.

AMGN's proposed acquisition of Horizon Therapeutics was driven by the latter's key drug, Tepezza. However, declining sales have put the future of this acquisition into question.

Despite the swirling questions, AMGN remains confident about the eventual success of the Horizon deal. Its leadership foresees no anti-competitive barriers obstructing this merger and anticipates a positive outcome from the FTC hearing later this year.

In relation to Tepezza, the company underscores the synergistic benefits post-merger that can enhance the drug's value. Notably, the larger scale and international presence of AMGN, coupled with its manufacturing expertise, will give a significant boost to Tepezza's sales.

The company has other acquisition options if the Horizon deal hits a roadblock.

Potential targets could be Intellia Therapeutics (NTLA) and Rhythm Pharmaceuticals (RYTM), both of which offer great value at the current price point. The addition of these companies could enhance AMGN's portfolio with promising therapies for rare genetic disorders while providing a potentially novel gene-editing technology.

Furthermore, AMGN is upping the ante in its biosimilar initiatives, viewing its protein manufacturing and clinical development capabilities as its unique strengths. An excellent example is the successful launch of its recent biosimilar, AMJEVITA. Moreover, the company’s plans for more candidates attest to this optimism.

Meanwhile, AMGN's efforts are showing results. Despite a dip in the first quarter of 2023’s net income due to higher expenses, there was a robust volume growth powered by several tailwinds, including the fading impact of COVID. This, along with record sales of key drugs, lends the company confidence for the rest of the year and beyond.

The company also sees growth in international markets, especially in aging populations like Japan and China, and remains optimistic about its growth potential despite price erosion and competition.

On the dividends front, AMGN scores highly with its current yield of 3.9%, backed by a modest 46% payout ratio. Its impressive dividend growth record, coupled with anticipated free cash flow, makes it a promising candidate for dividend growth investors.

Overall, the company’s current stock price offers an attractive opportunity despite the challenges ahead. Given its current trajectory, it’s apparent that AMGN's track record of outperforming the market could very well repeat in the future, promising potentially lucrative returns for those who dare to navigate through the headwinds.

Mad Hedge Biotech and Healthcare Letter

June 22, 2023

Fiat Lux

Featured Trade:

(A ROLLERCOASTER RIDE ON THE BIOTECH HIGHWAY)

(AMGN), (HZNP), (AMZN), (MSFT)

What gets my heart racing about Wall Street's wild rodeo is its capricious personality. This unpredictable creature weaves a tapestry of inflated possibilities, stretching across a vibrant spectrum of asset classes. It's like being at an all-you-can-eat financial buffet; every day, there's a fresh plate of opportunities to dig into.

Just last year, for instance, we saw a grand opportunity to pack our portfolios with tech titans like Amazon (AMZN) and Microsoft (MSFT) when the market was frolicking after cash-flush pharmaceutical stocks, allured by their pricing power and inflation defense.

But oh, how the pendulum swings. Today, we find the market donning its risk-taking garb again, pursuing high-growth stocks and leaving value stocks eating its dust.

This brings us to Amgen (AMGN).

Amgen, a trailblazer in the biotech industry since its inception in 1980, has earned its stripes, boasting membership in the esteemed Dow Jones Industrial Index and Nasdaq 100. Over the past year, AMGN churned out an impressive $26 billion in total revenue.

The company proudly displays a well-rounded product portfolio experiencing a strong global thirst. This is echoed by the hearty 14% YoY volume growth in the first quarter.

Notably, much of this surge was fueled outside U.S. borders, with the Asia Pacific region flexing a muscular 47% volume growth. Credit this partly to the rapidly aging populations in Japan and China, where medicines like Amgen’s Repatha and Prolia are enjoying a burgeoning demand.

However, we're not getting the complete picture from these favorable metrics.

Amgen is embarking on a journey into a period filled with question marks, marked by stiff competition from biosimilars for its aging blockbusters, pushback from the Federal Trade Commission over its proposed acquisition of Horizon Therapeutics (HZNP), and valid doubts surrounding the rationale behind this hefty $28 billion buyout.

The firm has had a tough time finding a true growth engine in recent years, despite launching several new drugs for high-value indications such as lung cancer, cardiovascular disease, and migraine headaches. Can Amgen sail past these patent headwinds?

While most in the industry are betting on Amgen to win its legal battle to acquire Horizon, this move carries its own set of hitches.

The spotlight is on Horizon's primary growth engine, Tepezza, which is dealing with recent commercial setbacks.

In Q1 2023, Tepezza sales took an 18% sequential dip from Q4 2022 and were down 19% YoY.

Horizon blamed seasonality for this significant sales dip, which is disheartening for a drug slated to hit $4 billion in annual sales.

If Tepezza is the mainstay behind the proposed merger with Amgen, the biotech could set itself up for a rocky journey.

And remember, Amgen's previous attempts at value creation via business development haven't always been home runs.

Take the 2013 acquisition of Onyx's cancer drug Kyprolis. Despite initial excitement, Kyprolis has underperformed expectations, illustrating that Amgen's $28 billion bid for Horizon may not be a guaranteed solution to its patent woes.

Furthermore, Amgen's clinical pipeline isn't bursting with potential stars.

Its metabolic disorder candidate AMG 133 has been flagged as a potential blockbuster by some analysts, but the obesity treatment market is heating up. The same applies to Amgen's various candidates in hematology and immunology. Therefore, its current pipeline might not be the panacea to its legacy medicine challenges.

So, what's the play for investors?

The silver lining here is that Amgen isn't predicted to suffer a sharp drop in annual sales anytime soon, irrespective of the Horizon deal or its internal pipeline.

The main concern lies with the drugmaker's potential to resurrect robust top-line growth in the latter part of the decade. Given its low trailing-12-month payout ratio of 54%, the dividend appears to be on solid ground, which is a tick-in-the-box for its prospects as an income stock.

Overall, this stock could be a top pick for income investors considering its ample yield coverage, substantial margins, and double-digit average dividend growth.

Although the top line may seem a little shaky, buybacks should help keep EPS growth on track. Given its resilience, the stock presents an attractive opportunity for income investors. Just don't hold your breath waiting for a sudden surge.

In fact, if you're on a DRIP (Dividend Reinvestment Plan), you'd rather want the shares to slump for a bit.

After all, Amgen has the makings of a SWAN (Sleep Well At Night) stock. So, keep those midnight snacks handy.

Global Market Comments

June 20, 2023

Fiat Lux

Featured Trades:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or TIME TO CHANGE STRATEGY),

(SPY), (TLT), (UNG), (FCX), (TSLA), (AMGN)

CLICK HERE to download today's position sheet.

All good things must come to an end.

Mad Hedge has made fortunes for thousands of followers over the last 15 years with its aggressive options spread strategy, which profits mightily from falling market volatility ($VIX). That is what is happening in the market 95% of the time.

However, it doesn’t make sense when the ($VIX) drops below $20, and that may now continue to be the case for a prolonged period of time.

However, just as one window closes, another opens.

While low volatility makes options spreads no longer attractive, it makes two-year LEAPS the bargain of the century. With volatility this low, you essentially get the second year for free. That is more than adequate time to go into any recession that may or may not happen and then come back out the other side at max profit.

If the underlying stock suddenly rockets, which is often the case with my recommendations, you can collect 90% of the maximum potential profit in a two-year LEAPS within months, if not weeks.

Better yet, while we used to make 15%-20% on front month options spreads, which benefited from accelerated time decay, the profit on two-year LEAPS can run from 100% to 500%. One client bagged a 5,000%, or 50X profit on an NVIDIA (NVDA) LEAPS he strapped on last October.

He doesn’t work anymore.

The timing for this strategy adjustment is perfect. We have just entered a new bull market for stocks that could run for another decade. With the exception of the “Magnificent Seven,” most US stocks are now just above their bear market bottoms. What better time to increase your leverage tenfold.

I won’t be adding LEAPS to my daily position sheet or P&L. They will remain a front-month trading tool. So the millions you are about to make will just have to remain our little secret. Concierge members will get access to a dedicated website that will keep a running total of all Mad Hedge LEAPS issued.

All good strategies must come to an end. Market conditions change or the copycats and wannabees squeeze the life out of them. I have seen too many good traders go out of business clinging to strategies that worked yesterday, but not today. They were hauled away in straight jackets, kicking and screaming because they lost all their money.

The stock market is like working in a hurricane. If you don’t learn how to bend with the wind, you snap and end up in a pile of debris.

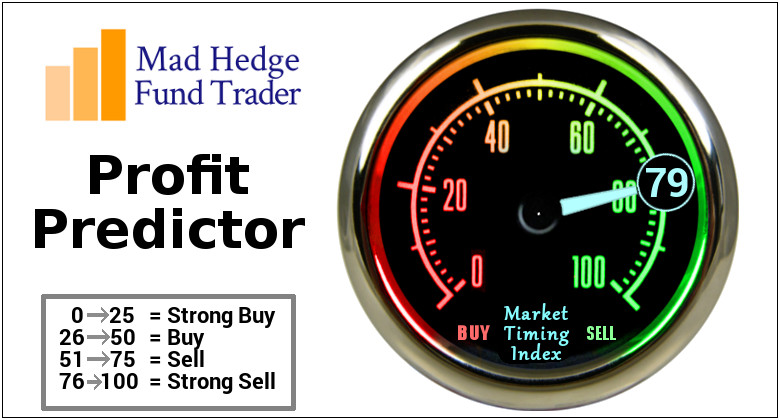

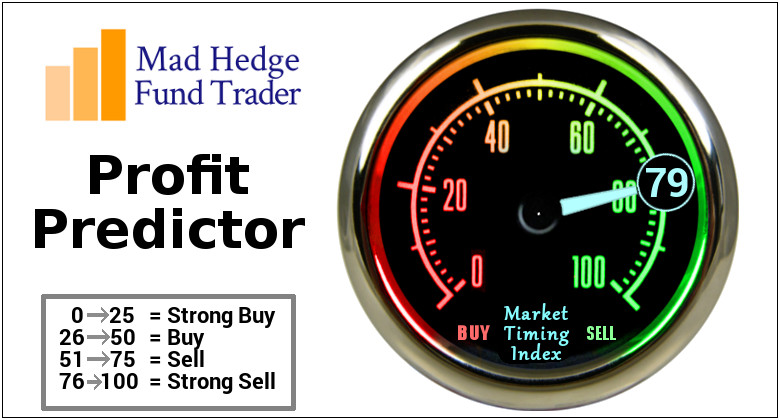

When the ($VIX) gets back above $20, or better yet $30, and the Mad Hedge Market Timing Index plunges down to the $20’s, I’ll be back fully loaded with front month options spreads by the dozens.

Good luck.

So far in June, we are up +0.47%. My 2023 year-to-date performance is still at an eye-popping +62.52%. The S&P 500 (SPY) is up only a miniscule +12.63% so far in 2023. My trailing one-year return reached +101.75% versus +24.19% for the S&P 500.

That brings my 15-year total return to +659.71%. My average annualized return has blasted up to +48.86%, another new high, some 2.54 times the S&P 500 over the same period.

Some 42 of my 46 trades this year have been profitable. Only 23 of my last 24 consecutive trade alerts have been profitable.

I executed no trades last week. Concierge members received a LEAPS trade alert on Crown Castle International (CCI), which regular subscribers should receive shortly. My longs in Tesla (TSLA) and Freeport McMoRan (FCX) expired at max profit, which I easily ran into the June 16 option expiration this week. I now have a very rare 100% cash position due to the lack of high-return, low-risk short-term trades.

A Mad Hedge Market Timing Index at 82 is not exactly encouraging me to bet the ranch. Don’t rush to buy the top.

On another matter, I am proud to say that every Mad Hedge service saw positions expire at their maximum profit at the June 16 quadruple witching options expiration.

Global Trading Dispatch rang the cash register with Tesla (TSLA) and Freeport McMoRan (FCX). The Mad Hedge Technology Letter coined it with Apple (AAPL). The Mad Hedge Biotech & Health Care Letter printed money with Amgen (AMGN). Jacquie’s Post pleased followers with a profit in the (TLT). Finally, Mad Hedge AI, launched only on Monday, saw the shares for its initial trade alert for (UNG) jump a breathtaking 15% in four days.

I must be doing something right.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper-accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

Tesla Model Y Became World’s Top Selling Car in Q1, the first EV to do so. Some 267,200 Y’s were shifted, edging out Toyota’s Corolla by 10,800 units, which led the field for decades. Elon Musk’s price-cutting volume play is working to the competition’s chagrin. The Model Y is on track to top one million sales this year. Buy (TSLA) on dips

Tesla Drops Model 3 Price to $33,000, net of $7,500 federal EV tax credit. That helped it become the world’s top-selling car. Late to the market EV makers are getting killed, hemorrhaging cash. That took the shares up to a new 2023 high of $231. Keep buying (TSLA) on dips.

Apple Launches $3,497 Vision Pro Headset, in a run at Meta (META) in the virtual headset world. It’s the company’s first new product launch since the Apple Watch in 2014 coining yet another new revenue stream. Apple shares hit a new all-time high on the news. Buy (AAPL) on dips.

Weekly Jobless Claims Jump to 261,000, an increase of 28,000, as the deflationary effects of high-interest rates take hold.

Europe Enters a Recession, with a -0.1% GDP print in Q1. Sharp rises in Euro interest rates get the blame.

General Motors Adopts Tesla’s Charging System, essentially giving a near monopoly to Elon Musk. (GM) is joining Ford’s (F) capitulation from two weeks ago. This should grow into a $20 billion a year profit item for Tesla. All of my outrageous forecasts are coming true. Buy (TSLA) on dips.

US to Send Another $2 Billion Worth of Advanced Missiles to Ukraine. The package includes advanced Raytheon (RTX) Himars and Lockheed (LMT) Patriot 3 missiles. Buy both (RTX) and (LMT) on dips as both missiles now have order backlogs extending for years.

Coinbase Gets Crushed after the SEC throws the book at them. The government agency is intent on destroying the entire crypto infrastructure. Get your money out if you can. Avoid (COIN) on pain of death.

Volatility Index ($VIX) Hits 3 ½ Year Low, at $14.26. Complacency with the S&P 500 is running rampant, which always ends in tears. The level implies a maximum up-and-down range of only 8.2% for 30 days.

Airline Profits to Double in 2023, as service sharply deteriorates with revenge travel accelerating. Looks for this summer to be a perfect travel storm.

On Monday, June 19 is the first-ever Juneteenth National Holiday celebrating the freedom of the slaves in Texas, the last state to do so. Markets are closed.

On Tuesday, June 20 at 8:30 PM EST, US Building Permits for May are announced.

On Wednesday, June 21 at 10:00 AM, Fed Chairman Powell testifies in front of Congress.

On Thursday, June 22 at 8:30 AM, the Weekly Jobless Claims are announced.

On Friday, June 23 at 9:45 AM the S&P Global Flash PMI is printed.

At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, with the shocking re-emergence of Nazis on America's political scene, memories are flooding back to me of some of the most amazing experiences in my life. I thought we were done with these guys I have been warning my long-term readers for years now that this story was coming. The right time is now here to write it.

I know the Nazis well.

During the civil rights movement of the 1960s, I frequently hitchhiked through the Deep South to learn what was actually happening.

It was not usual for me to catch a nighttime ride with a neo-Nazi on his way to a cross burning at a nearby Ku Klux Klan meeting, always with an uneducated blue-collar worker who needed a haircut.

In fact, being a card-carrying white kid, I was often invited to come along.

I had a stock answer: "No thanks, I'm going to another Klan meeting further down the road."

That opened my driver up to expound at length on his movement's bizarre philosophy.

What I heard was chilling. Suffice it to say, I learned to talk the talk.

During 1968 and 1969, I worked in West Berlin at the Sarotti Chocolate factory in order to perfect my German. On the first day at work, they let you eat all you want for free.

After that, you got so sick that you never wanted to touch the stuff again. Some 50 years later and I still can’t eat their chocolate with sweetened alcohol on the inside.

My co-worker there was named Jendro, who had been captured by the Russians at Stalingrad and was one of the 5% of prisoners who made it home alive in 1955. His stories were incredible and my problems pale in comparison.

Answering an ad on a local bulletin board, I found myself living with a Nazi family near the company's Tempelhof factory.

There was one thing about Nazis you needed to know during the 1960s: They absolutely loved Americans.

After all, it was we who saved them from certain annihilation by the teeming Bolshevik hoards from the east.

The American postwar occupation, while unpopular, was gentle by comparison. It turned out that everyone loved Hershey bars. Americans became very good at looking the other way when Germain families were trying to buy food on the black market. That’s why Reichsmarks wasn’t devalued until 1948.

As a result, I got free room and board for two summers at the expense of having to listen to some very politically incorrect theories about race. I remember the hot homemade apple strudel like it was yesterday.

Let me tell you another thing about Nazis. Once a Nazi, always a Nazi. Just because they lost the war didn't mean they dropped their extreme beliefs.

Fast-forward 30 years, and I was a wealthy hedge fund manager with money to burn, looking for adventure with a history bent during the 1990s.

I was mountain climbing in the Bavarian Alps with a friend, not far from Garmisch-Partenkirchen, when I learned that Leni Riefenstahl lived nearby, then in her 90s.

Attending the USC film school decades earlier, I knew that Riefenstahl was a legend in the filmmaking community.

She produced such icons as Olympia, about the 1932 Berlin Olympics, and The Triumph of the Will, about the Nuremburg Nazi rallies. It is said that Donald Trump borrowed many of these techniques during his successful 2016 presidential run.

It was rumored that Riefenstahl was also the one-time girlfriend of Adolph Hitler.

I needed a ruse to meet her since surviving members of the Third Reich tend to be very private people, so I tracked down one of her black and white photos of Nubian warriors, which she took during her rehabilitation period in the 1960s.

It was my plan to get her to sign it.

Some well-placed intermediaries managed to pull off a meeting with the notoriously reclusive Riefenstahl, and I managed to score a half-hour tea.

I presented the African photograph, and she seemed grateful that I was interested in her work. She signed it quickly with a flourish.

I then gently grilled her on what it was like to live in Germany in the 1930s. What I learned was fascinating.

But when I asked about her relationship with The Fuhrer, she flashed, "That is nothing but Zionist propaganda."

Spoken like a true Nazi.

The interview ended abruptly.

I took my signed photograph home, framed it, and hung it on my office wall for a few years. Then I donated it to a silent auction at my kids' high school.

Nobody bid on it.

The photo ended up in storage at my home, and when it was time to make space, it went to Goodwill.

I obtained a nice high appraisal for the work of art and then took a generous tax deduction for the donation, of course.

It is now more than a half-century since my first contact with the Nazis, and all of the WWII veterans are gone. Talking about it to kids today, you might as well be discussing the Revolutionary War.

By the way, the torchlight parade we saw in Charlottesville, VA in 2017 was obviously lifted from The Triumph of the Will, except that they didn't use tiki poolside torches in Germany in the 1930s.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Leni Riefenstahl

Olympia

Mad Hedge Biotech and Healthcare Letter

May 23, 2023

Fiat Lux

Featured Trade:

(HUNTING FOR OPPORTUNITIES IN HEALTHCARE STOCKS)

(LLY), (NVO), (VTRS), (OGN), (MRK), (TEVA), (GI), (CNC), (PFE), (GILD), (AMGN)

I've been riveted by the healthcare sector's most extravagant stocks lately.

Just look at Eli Lilly (LLY), with its jaw-dropping market value of $412 billion, making it the richest pure-play biopharma company ever. And right on its heels is Novo Nordisk (NVO), boasting a market value of $377 billion. It's enough to make your head spin.

But if you're on the hunt for value, these sky-high prices might leave you feeling a bit queasy. That's why I embarked on a mission to uncover some hidden gems in the healthcare sector.

Now, don't get me wrong. These stocks may be cheap for a reason, and it's crucial to exercise caution. When it comes to investment opportunities, it's essential to separate the diamonds in the rough from the fool's gold.

Enter Viatris (VTRS), a rising star in the generic drug manufacturing arena that has caught the attention of savvy investors seeking long-term holdings. But is it the real deal, or just another flash in the pan?

Viatris shows potential with solid revenue from branded generics like Lipitor, Viagra, and EpiPens. These household-name medicines have a lasting market demand. Plus, its generous 5.2% dividend yield surpasses the market average.

But here's the catch: Viatris is currently undervalued and has yet to prove its growth potential. Its stock price took a hit, and sales in the core generic and branded segments dipped. However, there's hope in the pipeline.

With a range of injectable generic medicines awaiting approval, Viatris could be at the forefront of the market.

By 2027, these programs could yield over $1 billion in annual revenue. While not a game-changer for the company's overall revenue, it sets the stage for future earnings growth.

At this stage, I don’t see Viatris as a slam-dunk investment. However, monitoring their strategic plan to reduce debt, improve efficiency, and drive growth is prudent. It's a work-in-progress worth monitoring for future opportunities.

Another company that caught my attention is Organon (OGN), a recent spinout from Merck (MRK) that focuses on women's health and biosimilars. This hidden gem trades at an attractive valuation of just 4.8 times earnings.

Organon & Co. is a pioneering developer and provider of prescription therapies and medical devices catering to contraception and fertility needs.

The female contraceptive market is projected to experience robust growth, with a compound annual growth rate (CAGR) of 8.5% from 2022 to 2027. Notably, Organon is among the top 5 major corporations addressing the demands in this market segment.

But that's not all.

Organon boasts a diverse portfolio that extends beyond women's health. They also offer biosimilar immunology products, two oncology treatments, hypertension therapies, respiratory solutions, dermatology products, non-opioid pain management pills, and cures for male pattern hair loss.

On its first day of official existence, June 3, 2021, Organon's management proudly announced a lineup of over 60 drug products to enhance female health, along with Merck's (MRK) former biosimilars portfolio.

The biosimilars market is projected to soar to $44.7 billion by 2026, showing an impressive CAGR of 23.5%.

As expected, the biosimilars arena has become a bustling hub with both established and emerging companies eagerly entering the space. For instance, Teva Pharmaceutical Industries Limited (TEVA) has high hopes for its biosimilar drug targeting arthritis treatment, expecting it to boost Teva's revenue significantly.

Organon has already witnessed promising revenue growth from its biosimilar drugs, with a remarkable 17% increase amounting to $116 million.

Several drug sales have experienced a surge of over 30% in the United States, Canada, and Brazil. Moreover, Organon's brands have shown strong performance in China and the Asia Pacific/Japan region.

Investing in women's health is not only a wise choice; it's a strategic move that can yield significant rewards for individual investors and portfolios. With Organon's innovative solutions, broad product portfolio, and forward-thinking approach, it stands out as a compelling opportunity in the market.

Now, let's take a look at some intriguing names that have found their way onto the list.

We have health insurance behemoth Cigna Group (GI), trading at a mere 9.9 times earnings, alongside the health insurer Centene (CNC) at 10.3 times earnings. Not to mention the presence of renowned drugmakers Pfizer (PFE), Gilead Sciences (GILD), and Amgen (AMGN) gracing this list of bargain stocks.

These seemingly cheap healthcare stocks warrant close attention for the savvy investor seeking hidden gems. Sure, the term "cheap" can sometimes be misleading, but within these underappreciated names lies the potential for hidden value waiting to be discovered.

Mad Hedge Biotech and Healthcare Letter

May 9, 2023

Fiat Lux

Featured Trade:

(WEIGHT LOSS DRUGS: THE NEXT BIG THING OR JUST HYPE?)

(LLY), (NVO), (PFE), (JNJ), (AMGN), (ALT)

Selling hot products and crushing the competition is where the real money's at. However, the challenge is to avoid falling for the hype. You need to assess a company's growth to know if it's worth investing in for the long haul.

If you have heard of tirzepatide, then you know that this drug has taken the pharma world by storm, making Eli Lilly (LLY) the talk of the town. In fact, this popular treatment helps patients drop more than 20% of their weight. No wonder it's got everyone hyped up.

But it's not just Eli Lilly that's causing a stir. Novo Nordisk (NVO) has a similar drug that's making waves, too.

In the world of pharmaceuticals, few drugs have generated as much buzz as Lilly's tirzepatide and Novo's semaglutide. These medications are projected to be among the top sellers of the decade.

These game-changing treatments have joined the ranks of iconic meds like the birth control pill, Prozac, and Pfizer’s (PFE) Viagra.

As expected, the share prices of both Eli Lilly and Novo Nordish have gone through the roof. They're already valued at around $400 billion each, placing them right behind industry leader Johnson & Johnson (JNJ).

Still, drug development is unpredictable.

A recent reminder of this was the biotech company Altimmune's (ALT) disclosure in March that a significant number of patients in a closely watched trial of its new weight-loss drug dropped out due to gastrointestinal issues.

That’s why it's essential to distinguish between opportunity and hype. More importantly, it’s critical to determine what exactly makes Lilly's tirzepatide and Novo's semaglutide so game-changing.

First, it's crucial to know that these two drugs come in various forms and are marketed for different conditions.

Novo's semaglutide is sold under the names Ozempic and Wegovy for Type 2 diabetes and obesity treatment, respectively, as well as Rybelsus, a pill for Type 2 diabetes. Lilly's tirzepatide, on the other hand, is currently only available as Mounjaro, an injection for Type 2 diabetes, but may soon have a new name added to the roster.

The real revolutionary aspect of these drugs is their effectiveness in lowering blood sugar and promoting weight loss. They mimic natural hormones that stimulate insulin production and slow digestion, making people feel fuller for longer.

Weight loss has long been a tricky area for drug development, with previous attempts being either ineffective or dangerous, resulting in many weight loss drugs being removed from the market.

But these drugs from Novo and Lilly are proving to be safe, albeit with significant side effects, and their efficacy is impressive.

In one trial, patients using Lilly's tirzepatide lost an average of 22.5% of their body weight, while patients on Novo's semaglutide lost 14.9% of their body weight in a separate trial. By comparison, a previous Novo drug called Saxenda only cut patients' body weights by 7.4%.

Another pressing question is about the availability of these drugs.

Mounjaro and Novo's Ozempic, Wegovy, and Rybelsus are already available on the market but have been in high demand and short supply.

To address this issue, both companies have announced plans to increase production. In April, Novo revealed that it had secured a new contract manufacturer, while Lilly has stated that it plans to double its production capacity for Mounjaro and similar drugs by the end of 2023.

Considering the market size and potential for these treatments, it comes as no surprise that competitors are already emerging.

Pfizer is currently developing a similar pill to tirzepatide and semaglutide, while Amgen (AMGN) is testing a weight-loss drug that uses a different mechanism.

Lilly has other weight-loss drugs in its pipeline, including a pill called orforglipron, which could launch in 2027. This is projected to generate $9.9 billion in sales in 2030.

Despite the emergence of competition, the weight-loss market is substantial enough to accommodate several drugs. Sales of obesity drugs are estimated to reach $30 billion by 2030, not including the Type 2 diabetes indication.

It's no secret that obesity and Type 2 diabetes are among the most prevalent health issues affecting millions worldwide. But did you know that the combined market for drugs targeting these conditions is expected to skyrocket to $90 billion globally by 2030?

Given the alarming statistics provided by the Centers for Disease Control and Prevention, such a staggering figure is not hard to fathom.

Almost 42% of American adults are obese, and about one in ten have diabetes. No wonder drug companies are racing to develop effective treatments to cater to this massive patient pool.

But what's interesting is that these drugs, which are not curative, could be a cash cow for pharmaceutical companies, as patients will likely need to take them for a long time.

This is why it’s easy to be bullish on the earnings potential of drugs like Mounjaro, with estimates for peak sales ranging from a heady $100 billion a year to a still impressive $40 billion.

In the pharmaceutical industry, buzz-worthy drugs are a dime a dozen, but game-changing medications that can revolutionize an entire market are few and far between.

Lilly's tirzepatide and Novo's semaglutide are just that.

These drugs have demonstrated significant weight loss in patients and are projected to be top sellers for the next decade. Despite the risks, Lilly and Novo's drugs are impressive, as they mimic natural hormones in the body, stimulate insulin production, and slow digestion to promote weight loss.

With the weight-loss market projected to reach staggering amounts by 2030, the potential is significant, but drug development is unpredictable, and competitors will inevitably emerge. Needless to say, investors must determine if these drugs' sky-high expectations are already factored into current share prices or if there's still room for growth.

While the weight-loss drug race is far from over, it’s clear that Lilly and Novo are off to a good start.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.