Mad Hedge Technology Letter

April 18, 2018

Fiat Lux

Featured Trade:

(WHY YOU SHOULD STILL BE BUYING FACEBOOK ON THIS DIP),

(FB), (GOOGL), (AMZN), (NFLX)

Tag Archive for: (AMZN)

He did just enough.

He did 5% enough, but it should have been 10%.

That was the performance of the highly controversial data company Facebook (FB) in the wake of Mark Zuckerberg's (the aforementioned "he") testimony in front of politicians who failed to correctly pronounce his name let alone understand his business model.

But Zuckerberg did well.

Well enough that investors approved in droves.

Facebook shares tanked after the Cambridge Analytica scandal was disclosed, and the stock traded 16% below its February high.

The FANG stocks lost more than $200 billion in market value at one point when the headlines went viral.

Amazon (AMZN) and Netflix (NFLX) accounted for more than 30% of the S&P 500's 2018 gains in February, and their contribution has dipped to about 24% as of early April.

The leadership burden for large-cap tech is a resilient pillar propping up the equity market.

Let's get this straight - there has been no regulation as of yet but this moves forward any regulation that eventually was going to happen.

However, it could be a highly diluted version of any worst-case scenarios of which one could think.

The big question: Will earnings and guidance be sideswiped because of higher data costs?

And how many of the 2.2 billion MAU (Monthly Active Users) permanently deleted their Facebook accounts?

Facebook profile removals surged to 4,000 to 5,000 the first few days after the news hit and decreased to 2,000 per day in late March. The numbers further subsided to 1,000 at the start of April.

Deletions around the political testimony were clocking in between 1,000 to 2,000 per day.

To put this into perspective, the extirpation of accounts was only about 30% of the Snapchat rebellion where users quit in hoards because of a sub-optimal design refresh.

The media has done its best to sensationalize events and avoid the fact that hyper-targeting ad models has been around for years and has been used by various companies.

Facebook is not the only one.

Bottom line, there has been no material damage to user volume, and the testimony will empower tech because of Washington's botched question session.

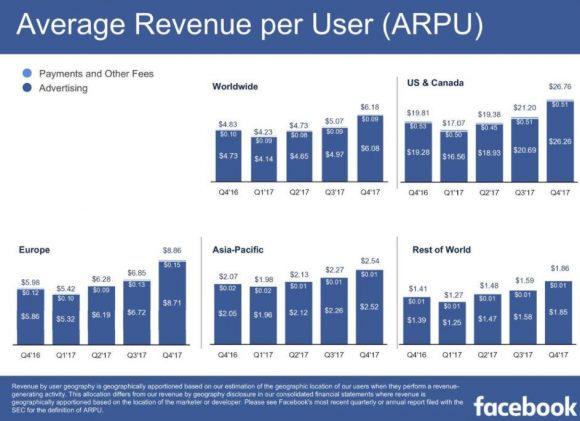

Most of Facebook's profits come from less than 10% of user accounts.

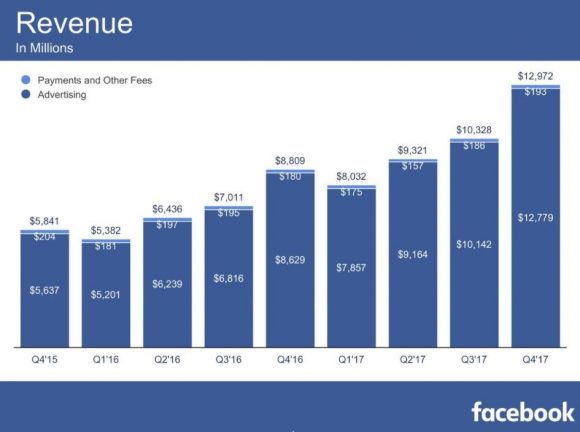

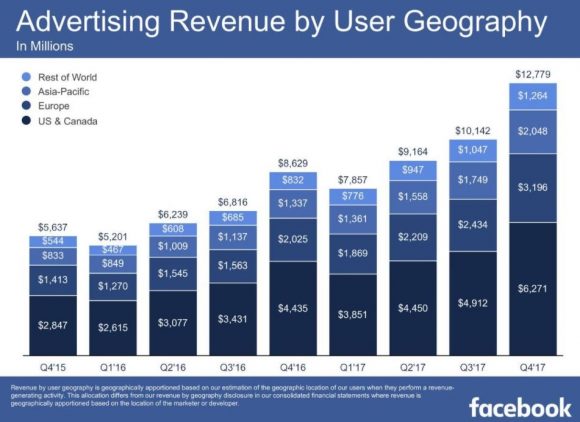

Facebook is a one-trick pony with 98% of profits coming from ad revenue.

To add granularity, the bulk of revenue derives from developed nations mainly from North America, which make up more than 50%, and Europe at about 30% of total revenue.

Falling user engagement from the developed English speaking world would be a canary in the coal mine.

I am not talking about a few thousand profile deletions. However, a mass removal of 50,000 profiles or 100,000 profiles per day would throw Mark Zuckerberg into a tizzy.

If Facebook can convince users to stick around then Mark Zuckerberg is the ultimate winner.

With all the fearmongering, some facts get swept under the carpet. And it could be the case that many users are fine with Facebook possessing large swaths of their personal data.

In reality, users might prefer Facebook to Washington when it comes to possessing their personal information.

The performance of politicians lined up to interrogate Mark Zuckerberg was an unmitigated disaster for the political elite.

It is clear there is a competency issue with politicians. The generation bias has given us a fleet of politicians who have almost zero grasp of technology and its pervasive use in America's economy.

Many politicians showed a weak grasp of Facebook's profit engine.

Some politicians were more focused on Facebook's diversity policy than the real issue at hand.

Let's not forget Zuckerberg also controls 60% of voting rights through his accumulation of Facebook Class B shares and has an iron grip on any direction where the company traverses.

Any meaningful regulation costs will be passed onto the advertisers as a cost of doing business.

This is the key lever investors don't fully understand.

Facebook currently uses an auction-based system for ad pricing but could easily slip in stand-alone regulatory fees to compensate the extra costs.

The industries move from CPC (cost per click) to CPM (cost per impression) including duopoly playmate Alphabet (GOOGL) is a great strategy to pad profits.

The only real incurred cost to Facebook is the in-house DevOps team responsible for platform enhancement.

Facebook tried to experiment in 2016 by charging Facebook-owned smartphone messaging service WhatsApp users a $1 per year fee to use the messaging service.

It has done the groundwork to roll out a mass paid service.

Facebook later decided against this move as many users of WhatsApp are from undeveloped countries with no access to credit card payment services.

Zuckerberg is awkward. However, he has come a long way since his hoody days, even using smoke and mirrors to wriggle out of probing questions.

Half the "grilling" he received in Washington was met with the same vanilla answer saying that his team will get back to them.

The peak of evasiveness was Zuckerberg's response to a question about the willingness to change the business model in the interest of protecting individual privacy.

Zuckerberg stated he was "not sure what that means."

The hammering in Facebook shares was overdone.

It is obvious Washington is no match for large cap tech.

Facebook's upside trajectory has been sacrificed in the short term, but one could argue regulation was on the way - regardless of this data breach.

Regulation is a natural progression for an industry with almost no meaningful regulation.

Therefore, a little regulation for tech does not mean the end of tech.

Facebook is not going out of business. Not anytime soon.

Facebook earned revenue of $27.64 billion in 2016, on the back of $40.65 billion in 2017.

Facebook does not need to be "fixed" - it just needs a few bandages in place before it goes back onto the field.

These bandages will damage operating margins that are currently at 57% in Q4 2017, but their long-term fundamentals are still intact.

The wall of worry is unfounded and ad engagement is still solid.

Facebook is in store for record bottom- and top-line numbers when earnings come out. Ad revenue numbers and the guidance will be the key metric to digest.

Investors might want Zuckerberg to kitchen sink the quarter because most of the bad news is already priced into the stock and might as well dig out all the skeletons in the closet.

Regulation is positive for Facebook because Facebook and the rest of the FANGs are in the best position to confront the regulations. The worst case scenario is finding a backdoor way to navigate through the new rules just as the backdoor way of profiting through ad distribution.

The headline hysteria makes it seem like Facebook is about to go under and file Chapter 11.

The bar has been set so low for upcoming earnings that any reasonable guidance will be seen as a victory.

Advertisers have no choice but to pay for Facebook ads if they want to grow business - that has not changed.

Facebook is growing so fast that the CEO could not name the competition when he was asked at the hearing.

There is a huge short squeeze setting up for the next earnings report due out on April 25, 2018.

Lastly, WhatsApp recently surpassed 1.5 billion MAU with users sending more than 60 billion messages every day.

Remember that Mark Zuckerberg purchased WhatsApp when it had around 500 million MAU back in February 2014.

This service hasn't even started to monetize yet and was a genius piece of business for $19.3 billion in 2014.

The valuation is at least double to triple the price of purchase now but seemed ludicrously expensive when Facebook snapped it up at the time.

Facebook has bottomed out, and the added bonus is it is quite insulated from all the tariff chaos whipsawing the equity markets.

__________________________________________________________________________________________________

Quote of the Day

"I'm on the Facebook board now. Little did they know that I thought Facebook was really stupid when I first heard about it back in 2005."- said founder and CEO of Netflix Reed Hastings

Mad Hedge Technology Letter

April 17, 2018

Fiat Lux

Featured Trade:

(WHY THE CLOUD IS WHERE TRADING DREAMS COME TRUE),

(ZS), (ZUO), (SPOT), (DBX), (AMZN), (CSCO), (CRM)

Dreams don't often come true - but they do frequently these days.

Highly disruptive transformative companies on the verge of redefining the status quo give investors a golden chance to get in before the stock goes parabolic.

Traditional business models are all ripe for reinvention.

The first phase of reformulation in big data was inventing the cloud as a business.

Amazon (AMZN) and its Amazon Web Services (AWS) division pioneered this foundational model, and its share price is the obvious ballistic winner.

The second phase of cloud ingenuity is trickling in as we speak in the form of companies that focus on functionality, performance, and maintenance on the cloud platform.

This is a big break away from the pure accumulation side of stashing raw data in servers.

However, derivations of this type of application are limitless.

Swiftly identifying these applied cloud companies is crucial for investors to stay ahead of the game and participate in the next gap up of tech growth.

The markets' reaction to Spotify's (SPOT) and Dropbox's (DBX) hugely successful IPOs was head-turning.

Both companies finished the first day of trading firmly well above their respective, original opening prices -- or for Spotify, the opening reference price.

The pent-up momentum for anything "Cloud" has its merits, and these two shining stars will give other ambitious cloud firms the impetus to go public.

If Spotify and Dropbox laid an egg, momentum would have screeched to a juddering halt, and companies such as Pivotal Software would reanalyze the idea of soon going public.

Now it's a no-brainer proposition.

There are more than 40 more public cloud companies that are valued at more than a $1 billion, and more are in the pipeline.

To understand the full magnitude of the situation, evaluating recent IPO performance is a useful barometer of health in the tech industry.

The first company Zscaler (ZS) is an enterprise company focused on cloud security that closed 106% above its opening price when it went public this past March 16.

It opened up at $16 a share and finished the day at $33.

Zscaler CEO, Jay Chaudhry, audaciously rebuffed two offers leading up to the March 16 IPO. Both offers were more than $2 billion, and both were looking to acquire Zscaler at a discount.

The decision to forego these offers was a prudent move considering (ZS)s current market cap is around $3.3 billion and rising.

One of the companies vying for (ZS) was Cisco Systems (CSCO), which is also in the cloud security business. Cisco is looking to add another appendage to its offerings with the cash hoard it just repatriated from abroad.

Cisco has been willing to dip into its cash hoard by buying San Francisco-based AppDynamics for $3.7 billion in 2017, which specializes in managing the performance of apps across the cloud platform and inside the data center.

Cloud security is critical for outside companies to feel comfortable implementing universal cloud technology.

Storing sensitive data online in a storage server is also a risk and difficult to migrate back once on the cloud.

Without solid security to protect data, data-heavy companies will hesitate to vault up their data in a public place and could remain old-school with external data locations storing all of a firm's secrets.

However, this traditional approach is not sustainable. There is just too much generated data in 2018.

Cybersecurity has expeditiously evolved because hackers have become greatly sophisticated. Plus, they are getting a lot of free PR.

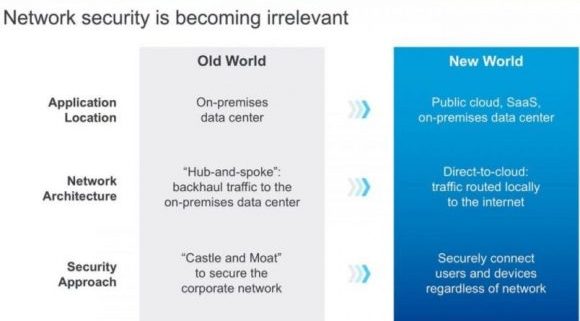

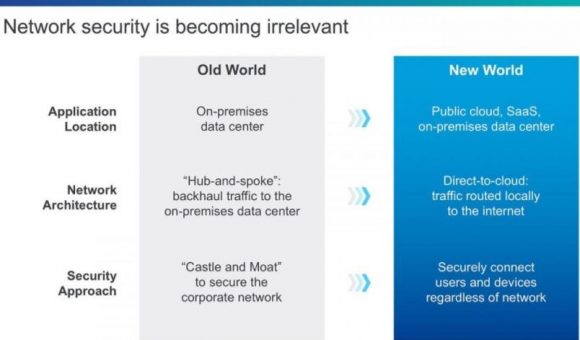

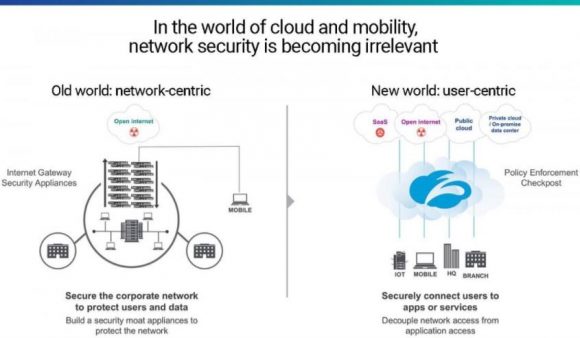

Data center and in-house applications secured operations by managing access and using an industrial strength firewall.

This was the old security model.

Security became ineffective as companies started using cloud platforms, meaning many users accessed applications outside of corporate networks and on various devices.

The archaic "moat" method to security has died a quick death, as organizations have toiled to ziplock end points that offer hackers premium entry points into the system.

Zscaler combats the danger with a new breed of security. The platform works to control network traffic without crashing or stalling applications.

As cloud migration accelerates, the demand for cloud security will be robust.

Another point of cloud monetization falls within payments.

Tech billing has evolved past the linear models that credit and debit in simplistic fashion.

SaaS (Software as a Service), the hot payment model, has gone ballistic in every segment of the cloud and even has been adopted by legacy companies for legacy products.

Instead of billing once for full ownership, companies offer an annual subscription fee to annually lease the product.

However, reoccurring payments blew up the analog accounting models that couldn't adjust and cannot record this type of revenue stream 10 to 20 years out.

Zuora (ZUO) CEO Tien Tzuo understood the obstacles years ago when he worked for Marc Benioff, CEO of Salesforce (CRM), during the early stages in the 90s.

Cherry-picked after graduating from Stanford's MBA program, he made a great impression at Salesforce and parlayed it into CMO (Chief Marketing Officer) where he built the product management and marketing organization from scratch.

More importantly, Tzuo built Salesforce's original billing system and pioneered the underlying system for SaaS.

It was in his nine years at Salesforce that Tzuo diagnosed what Salesforce and the general industry were lacking in the billing system.

His response was creating a company to seal up these technical deficits.

Other second derivative cloud plays are popping up, focusing on just one smidgeon of the business such as analytics or Red Hat's container management cloud service.

SaaS payment model has become the standard, and legacy accounting programs are too far behind to capture the benefits.

Zuora allows tech companies to seamlessly integrate and automate SaaS billing into their businesses.

Tzuo's last official job at Salesforce was Chief Strategy Officer before handing in his two-week notice. Benioff, his former boss, was impressed by Tzuo's vision, and is one of the seed investors for Zuora.

These smaller niche cloud plays are mouthwateringly attractive to the bigger firms that desire additional optionality and functionality such as MuleSoft, integration software connecting applications, data and devices.

MuleSoft was bought by Salesforce for $6.5 billion to fill a gap in the business. Cloud security is another area in which it is looking to acquire more talent and products.

If you believe SaaS is a payment model here to stay, which it is, then Zuora is a must-buy stock, even after the 42% melt up on the first day of trading.

The stock opened at $14 and finished at $20.

One of the next cloud IPOs of 2018 is DocuSign, a company that provides electronic signature technology on the cloud and is used by 90% of Fortune 500 companies.

The company was worth more than $3 billion in a round of 2015 funding and is worth substantially more today.

These smaller cloud plays valued around $2 billion to $3 billion are a great entry point into the cloud story because of the growth trajectory. They will be worth double or triple their valuation in years to come.

It's a safe bet that Microsoft and Amazon will continue to push the envelope as the No. 1 and No. 2 leaders of the industry. However, these big cloud platforms always are improving by diverting large sums of money for reinvestment.

The easiest way to improve is by buying companies such as Zuora and Zscaler.

In short, cloud companies are in demand although there is a shortage of quality cloud companies.

__________________________________________________________________________________________________

Quote of the Day

"The great thing about fact-based decisions is that they overrule the hierarchy." - said Amazon founder and CEO, Jeff Bezos

Global Market Comments

April 13, 2018

Fiat Lux

Featured Trade:

(ANNOUNCING THE MAD HEDGE LAKE TAHOE, NEVADA, CONFERENCE, OCTOBER 26-27, 2018),

(APRIL 11 GLOBAL STRATEGY WEBINAR Q&A),

(TLT), (TBT), (GOOGL), (MU), (LRCX), (NVDA) (IBM),

(GLD), (AMZN), (MSFT), (XOM), (SPY), (QQQ)

Below please find subscribers' Q&A for the Mad Hedge Fund Trader April Global Strategy Webinar with my guest co-host Bill Davis of the Mad Day Trader.

As usual, every asset class long and short was covered. You are certainly an inquisitive lot, and keep those questions coming!

Q: Many of your April positions are now profitable. Is there any reason to close out before expiration?

A: No one ever got fired for taking a profit. If you feel like you have enough in hand - like 50% of the maximum potential profit in the position, which we do have in more than half of our current positions - go ahead and take it.

I'll probably run all of our April expirations into expiration day because they are very deep in the money. Also, because of the higher volatility and because of higher implied volatility on individual stock options, you're being paid a lot more to run these into expiration than you ever have been before, so that is another benefit.

Of course, one good reason to take profits now is to roll into another position, and when we find them, that may be exactly what we do.

Q: What do you think will be the impact of the US hitting Syria with missiles?

A: Initially, probably a 3-, 4-, or 500-point drop, and then a very rapid recovery. While the Russians have threatened to shoot down our missiles, in actual fact they can't hit the broad side of a barn. When Russians fired their cruise missiles at Syrian targets, half of them landed in Iran.

At the end of the day, it doesn't really impact the US economy, but you will see a big move in gold, which we're already starting to see, and which is why we're long in gold - as a hedge against all our other positions against this kind of geopolitical event.

Q: Will 2018 be a bull market or a bear market?

A: We are still in a bull market, but we may see only half the returns of last year - in other words we'll get a 10% profit in stocks this year instead of a 20% profit, which means it has to rise 12% from here to hit that 10% up by year-end.

Q: What is your take on the ProShares Ultra Short 20+ Year Treasury Bond Fund (TBT)?

A: I am a big buyer here. I think that interest rates (TLT) are going to move down sharply for the rest of the year. The (TBT) here, in the mid $30s, is a great entry point - I would be buying it right now.

Q: How do you expect Google (GOOGL) to trade when the spread is so wide?

A: It will go up. Google is probably the best-quality technology company in the market, after Facebook (FB). We'll get some money moving out of Facebook into Google for exactly that reason; Google is Facebook without the political risk, the regulatory risk, and the security risks.

Q: Are any positions still a buy now?

A: All of them are buys now. But, do not chase the market on any conditions whatsoever. The market has an endless supply of sudden shocks coming out of Washington, which will give you that down-400-points-day. That is the day you jump in and buy. When you're buying on a 400-down-day, the risk reward is much better than buying on a 400-point up day.

Q: What is "sell in May and go away?"

A: It means take profits in all your positions in May when markets start to face historical headwinds for six months and either A) Wait for another major crash in the market (at the very least we'll get another test of the bottom of the recent range), or B) Just stay away completely; go spend all the money you made in the first half of 2018.

Q: Paul Ryan (the Republican Speaker of the House) resigned today; is he setting up for a presidential run against Trump in 2020?

A: I would say yes. Paul Ryan has been on the short list of presidential candidates for a long time. And Ryan may also be looking to leave Washington before the new Robert Mueller situation gets really unpleasant.

Q: What reaction do you expect if Trump resigns or is impeached?

A: I have Watergate to look back to; the stock market sold off 45% going into the Nixon resignation. It's a different world now, and there were a lot more things going wrong with the US economy in 1975 than there are now, like oil shocks, Vietnam, race riots, and recessions.

I would expect to get a decline, much less than that - maybe only a couple 1,000 points (or 10% or so), and then a strong Snapback Rally after that. We, in effect, have been discounting a Trump impeachment ever since he got in office. Thus far, the market has ignored it; now it's ignoring it a lot less.

Q: Thoughts on Micron Technology (MU), Lam Research (LRCX), and Nvidia (NVDA)?

A: It's all the same story: a UBS analyst who had never covered the chip sector before initiated coverage and issued a negative report on Micron Technology, which triggered a 10% sell-off in Micron, and 5% drops in every other chip company.

He took down maybe 20 different stocks based on the argument that the historically volatile chip cycle is ending now, and prices will fall through the end of the year. I think UBS is completely wrong, that the chip cycle has another 6 to 12 months to go before prices weaken.

All the research we've done through the Mad Hedge Technology Letter shows that UBS is entirely off base and that prices still remain quite strong. The chip shortage still lives! That makes the entire chip sector a buy here.

Q: Can Trump bring an antitrust action against Amazon?

A: No, no chance whatsoever. It is all political bluff. If you look at any definition of antitrust, is the consumer being harmed by Amazon (AMZN)?

Absolutely not - if they're getting the lowest prices and they're getting products delivered to their door for free, the consumer is not being harmed by lower prices.

Second is market share; normally, antitrust cases are brought when market shares get up to 70 or 80%. That's what we had with Microsoft (MSFT) in the 1990s and IBM (IBM) in the 1980s. The largest share Amazon has in any single market is 4%, so no there is basis whatsoever.

By the way, no president has ever attacked a private company on a daily basis for personal reasons like this one. Thank the president for giving us a great entry point for a stock that has basically gone up every day for two years. It's a rare opportunity.

Q: How will the trade war end?

A: I think the model for the China trade war is the US steel tariffs, where we announced tariffs against the entire world, and then exempted 75% of the world, declaring victory. That's exactly what's going to happen with China: We'll announce massive tariffs, do nothing for a while, and then negotiate modest token tariffs within a few areas. The US will declare victory, and the stock market rallies 2,000 points. That's why I have been adding risk almost every day for the last two weeks.

Q: Would you be buying ExonMobil (XOM) here, hoping for an oil breakout?

A: No, I think it's much more likely that oil is peaking out here, especially given the slowing economic data and a huge onslaught in supply from US fracking. We're getting big increases now in fracking numbers - that is very bad for prices a couple of months out. The only reason oil is this high is because Iran-sponsored Houthi rebels have been firing missiles at Saudi Arabia, which are completely harmless. In the old days, this would have caused oil to spike $50.

Q: Would you be selling stock into the rally (SPY), (QQQ)?

A: Not yet. I think the market has more to go on the upside, but you can still expect a lot of inter-day volatility depending on what comes out of Washington.

Q: Do you ever use stops on your option spreads?

A: I use mental stops. They don't take stop losses on call spreads and put spreads, and if they did they would absolutely take you to the cleaners. These are positions you never want to execute on market orders, which is what stop losses do. You always want to be working the middle of the spread. So, I use my mental stop. And when we do send out stop loss trade alerts, that's exactly where they're coming from.

Q: Will the Middle East uncertainty raise the price of oil?

A: Yes, if the Cold War with Iran turns hot, you could expect oil to go up $10 or $20 dollars higher, fairly quickly, regardless of what the fundamentals are. It's tough to be blowing up oil supplies as a great push on oil prices. But that's a big "if."

Hello from the Italian Riviera!

Mad Hedge Technology Letter

April 11, 2018

Fiat Lux

Featured Trade:

(WHY YOU SHOULD BE BETTING THE RANCH ON TECHNOLOGY),

(AMZN), (NFLX), (FB), (Samsung), (Tencent)

Global IT spending is forecasted to surpass $3.7 trillion in 2018, a boost of 6.2% YOY, according to a report released by leading technology research firm Gartner, Inc. (IT).

This year is the best growth rate forecasted since 2007, and is a precursor to a period of flourishing IT growth.

IT budgetary resilience is oddly occurring in the face of a tech backlash engulfing Mark Zuckerberg as collateral damage during higher than normal volatility due to an unstable geo-political environment and nonstop chaos in the White House.

Zuckerberg's reputation has been torn to shreds by the media and politicians alike.

Tech has had better weeks and months, for instance as this past January when tech stocks went up every day. Facebook (FB) still had a great business model in January as well.

The biggest takeaway from the report was the outsized capital investments going into enterprise software, which spurs on exponential business formation.

Enterprise software will successfully record its highest spend rate increasing by 11.1% YOY to $391 billion. This is far and away an abnormally fast pace of increase, but is completely justified based on every brick and mortar migrating toward data harnessing.

The software industry will benefit immensely by the universal digitization of all facets of life as software acts as the tool that businessmen use to propel companies to stardom.

Application software spending will healthily rise into 2019, and infrastructure software also will continue to grow, boosted by the revamping of laggard architecture.

Data center systems are predicted to grow 3.7% in 2018, down from 6.3 percent growth in 2017. The longer-term outlook continues to have challenges, particularly for the storage segment.

The lower relative rate of spend is exacerbated by the chip shortage for memory components, and prices have shot up faster than previously expected.

The new Samsung Galaxy 9 cost an additional $45 in semiconductor chip costs because of the importunate costs that sabotage cost structures.

Exorbitant pricing was set to subside in the early part of 2018, but the dire shortage of chips is here to stay until the end of 2018.

Even though the supply side has ramped up 30%, demand is far outpacing supply, spoiling any chance for tech devices to be made on the cheap.

Global spend for digital devices will grow in 2018, reaching $706 billion, an increase of 6.6 percent from 2017. Not only will we see the standard characters such as phones and tablets, but new creative ways to produce devices in the micro-variety will soon populate our shores.

Amazon Alexa and Apple's HomePod are just the beginning and will spawn micro-devices that would fit nicely into a flashy James Bond film.

The demand for ultra-mobile premium smartphones will slow in 2018 as more consumers delay their upgrade and feel comfortable using older devices -- kind of like a smashed-up Volvo station wagon handed down from sibling to sibling.

In times of uncertainty, corporations hold back spending until the near-term variables can be flushed out, and unforeseen costs causing operational turbulence can be anticipated.

However, the industry has brushed aside the turmoil that has attempted to infiltrate the core growth story.

Investors cannot overlook that total tech spending growth for 2018 is the highest in the past 15 years.

Next quarter's earnings are now on tap, and investors will turn to fundamentals as a cheat sheet for what's in store.

It's undeniable that currently tech stocks aren't cheap anymore. They are also more expensive than they were at the beginning of the year barring Facebook and a few other stragglers.

The momentum has intensified with the five biggest tech firms accounting for more than 14% of the S&P 500 index's weighting.

Tech's relative performance has fended off the bears with PE multiples down a paltry 4.9% this year compared to the cratering of 11.4% in the general market.

And tech is still trading at a tiny fraction of the crisis of the dot-com era.

The outsized reinvestments back into business models don't tell the tale of an industry brought down to its knees begging for salvation.

Look no further than across the Pacific Ocean. Samsung Electronics Co. represents almost 25% in South Korea's Kospi index. At the same time, Asia's most valuable company, Tencent Holdings, makes up almost a 10% weighting in Hong Kong's Hang Seng Index.

Back stateside, about 90% of US tech firms beat revenue estimates in the last quarter of 2017, marking the best success rate for any industry.

The positive sentiment has continued into this year with wildly bullish expectations led by the FANG stocks.

The broader volatility is a gift to investors who hesitated and missed the monster rally that has graced tech the past few years.

Tech is vital to emerging markets. And this is the first year since 2004 that tech constitutes the biggest sector in the MSCI Emerging Markets Index blowing past financials.

Tech had a 28% weighting at the end of 2017, the weighting more than doubling from six years ago.

As it stands today, tech enjoys light regulation and by a long mile. Tech is actually the least regulated industry in America and has used this period of light regulation to stack up profits to the sky.

Banks are nine times more regulated than tech companies, and manufacturing companies are five times more regulated.

Legislation such as Dodd-Frank has done a lot to taper the excesses of the sub-prime frenzy that almost took down Wall Street.

The lean regulation has helped tech companies such as Facebook and Google build a gilt-edged competitive advantage that has been exploited to full effect.

After the Fed closed the curtains on its QE program, tech and its earnings are the sturdiest pillar of the nine-year bull market.

The Street is reliant on the big players to earn its crust of bread and show investors that tech isn't just a flash in the pan.

The two numbers acting as the de-facto indicators of the health of the overall economy are Netflix's subscriber growth numbers and Amazon's AWS Cloud revenue.

These two companies do not focus on profits and are the prototypical tech growth companies.

If they beat on these metrics, the rest of tech should follow suit.

The market is entirely dependent on big tech to drag investors through the time of transition. My bet is that tech will over-deliver booking stellar earnings.

__________________________________________________________________________________________________

Quote of the Day

"By giving the people the power to share, we're making the world more transparent." - said Facebook CEO Mark Zuckerberg

Mad Hedge Technology Letter

April 10, 2018

Fiat Lux

Featured Trade:

(WHY I'M PASSING ON ORACLE),

(ORCL), (MSFT), (AMZN), (CRM)

To say 2018 is the Year of the Cloud is an understatement.

Oracle (ORCL) felt the tremors of investors' fickle preference for quality cloud growth when the stock sold off hard after earnings that were relatively solid but unspectacular.

Oracle is a Silicon Valley legacy firm established in 1977 under the name of Software Development Laboratories. The company was co-founded by Larry Ellison, Bob Miner, and Ed Oates and the name later was changed to Oracle.

The company made its name through database software and still relies on it for the bulk of its $37 billion in annual revenue.

Legacy companies are put through the meat grinder by investors, and analysts are micro-sensitive to just a few narrow-defined metrics.

Not all cloud companies are treated equally.

It has become consensus that the only way to move forward is through advancing the cloud model, and neglecting this segment is a death knell for any quasi-cloud stock.

Oracle skirted any sort of calamitous earnings performance but left a lot to be desired.

Cloud SaaS (software-as-a-service) revenue for the quarter was $1.2 billion, up 21% YOY, and growth rates were in line with many that are part of the winners' bracket.

Oracle's overall cloud business is still a diminutive piece of its overall business constituting just 16%, which is incredibly worrisome.

This number accentuates the lack of brisk execution and its late entrance into this industry.

Gross cloud margin only increased 2% to 67%, up from 65% QOQ, providing minimum incremental growth.

Total cloud revenue guidance was substantially weak, which includes SaaS, PaaS (platform-as-a-service) and IaaS (infrastructure-as-a-service) expected to grow 19% to 23% in 2018, much less than the forecasted guidance of 27%.

Oracle should be growing its cloud segment faster, especially since its cloud business is many times smaller than competition, and growing pains habitually occur later in the growth cycle.

The outsized challenge is attempting to leverage its foundational database business to convince existing corporate clients to adopt Oracle's in-house cloud services instead of diverting capital toward cloud offerings from Microsoft (MSFT), Salesforce (CRM), or Amazon (AMZN).

It could be doing a better job.

Weak guidance of 1%-3% for annual total revenue topped off a generally underwhelming cloud forecast.

The lack of over-performance is highly disappointing for a company that has been touting its pivot to cloud.

The message from Oracle is the transformation is nowhere close to finished. That was investors' queue to stampede for the exits.

Investors only need to look a few miles up the coast at the competition.

Salesforce is putting up solid numbers, and many cloud companies are judged solely on a relative basis to the industry leaders.

The turnaround companies are getting crushed by these growth magnates. Salesforce is sequentially increasing total revenue over 20% each quarter and expects total revenue to rise more than 20% in 2019. It has set ambitious revenue targets for 2020, 2030, and 2040.

Microsoft Azure grew cloud revenue 98% QOQ, and Microsoft Windows, its legacy business, only makes up 42% of Microsoft's total revenue and is shrinking by the day.

Microsoft has earned its positon as the King of the Legacy Businesses offering proof by way of its position as the industry's second-best cloud company, engineering cloud quarterly revenue of $7.8 billion and gaining on Amazon Web Services (AWS).

Microsoft was in the same situation as Oracle a few years ago, stuck with a powerful business in a declining industry. It then turned to the cloud and never looked back.

Instead of leveraging databases, Microsoft leveraged its operating system and proprietary software to persuade new clients to adopt its cloud platform - and the numbers speak for themselves.

Oracle still has the chance to pivot toward the cloud because its database product is a brilliant entrance point for potential cloud converts.

In the meantime, Amazon has its sights set on Oracle's database product and plans to go after market share.

Oracle believes its database product is the best in the business - more affordable, quicker, and dependable. However, technology is evolving at such a rapid pace that these nimble companies can flip the script on their opponents in no time.

It's a dangerous proposition to compete with Amazon because of the nature of competing means dumping products, and unlimited cash burn battering opponents into submission by crushing profitability.

Oracle's margins would get hammered in this circumstance at a time when Oracle's gross margins have been a larger sore spot than first diagnosed.

Legacy companies are unwilling to enter price wars with Amazon because they still have dividends to defend and profit margins to nurture skyward.

Concurrently, Salesforce and Microsoft Dynamics CRM are attacking Oracle's CRM products (Customer Relationship Management), which could further impair margins.

The breadth of competition showed up to the detriment of margins with PaaS and IaaS gross margins eroding from 46% YOY, down to 35% YOY.

Microsoft's cloud revenue eked out a better than 60% gross margin even with its gargantuan size.

Investors punished Oracle for whispers of its cloud business plateauing with a size that is just a fraction of Microsoft Azure.

The leveling out is hard to take after Larry Ellison claimed cloud margins would soon breach 80% in upcoming quarters.

Conversely, Microsoft has claimed margins could start to erode as the company reallocates capital into expanding its cloud infrastructure, but it is understandable for maturing companies that must battle with the law of large numbers.

At the end of the day, Oracle's cloud business is failing to grow enough.

Oracle's competitors are speeding down the autobahn while Oracle has been dismissed to the frontage road.

Growth impediments with the small size of Oracle's cloud business is a red flag.

Avoid this legacy turnaround story that hasn't turned around yet.

Oracle looks like a value play at this point and could rise if it gets its cloud act together or the mere anticipation of a resurgence.

But with margins and competition pressuring its attempts at transformation, I would take a wait-and-see approach.

It's clear that Oracle is in the third inning of its turnaround, and teething problems are expected.

If you get the urge to suddenly buy cloud stocks, better look at any dip from Microsoft, Salesforce, and Amazon, which all directly compete with Oracle but are performing at a much higher level.

__________________________________________________________________________________________________

Quote of the Day

"A company is like a shark, it either has to move forward or it dies." - said Oracle co-founder Larry Ellison.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.