As I write this to you, I am flying at 30,000 feet over the red clay of Georgia. The azure blue of the Gulf of Mexico is on the left and the Golden State of California lies straight ahead.

I am returning from a five-day whirlwind tour of Florida, which saw me speak at three Strategy Luncheons and countless private meetings.

It was a blast!

Not only did I learn the local lay of the land, I often pick up some great trading ideas.

I first hitchhiked across the Sunshine State in 1967. Except for a few small towns on the coasts, there was nobody there. The entire inland of the state was covered with small cattle ranches and the odd tourist trap (mermaids, alligator wrestling, snake shows etc).

People thought the extensive freeway system was only built because the state was just 90 miles away from Cuba, then a Cold War flash point (it is officially called the “Dwight D. Eisenhower National System of Interstate and Defense”). Suddenly, somebody secretly started buying up land around Orlando. The locals thought General Motors (GM) was going to build a car plant there.

Then Walt Disney Corp (DIS) swept in and announced they were building a second Disneyland to cater to the east coast, creating an astonishing 70,000 jobs and the freeways started to fill up (click here for the video).

Today, driving around the state is a dystopian nightmare. The US population has doubled since the first Interstates were built in the 1950s, and the US GDP has increased by ten times, a byproduct of the Interstates. That means ten times more heavy truck traffic which has been mercilessly beating the life out of the roads. In Florida, the population has risen by more than fourfold as well, from 5 million to 22.2 million so you get the picture.

You lurch from one traffic jam to the next, even in the middle of the night. Whatever time Google Maps says it will take to get somewhere, triple it. The only consolation is that the traffic is worse in California.

I loved Key West where a very happy Concierge member made available an 1859 mansion close to the waterfront, restored and modernized down to the studs. By this time of the year, anyone with money has decamped for New England leaving only the retirees and beach bums.

I made the pilgrimage to Earnest Hemmingway’s home where he produced 70% of his published writings in only seven years. Another two boxes of manuscripts were discovered in the basement of his favorite bar last year.

It’s ironic that this state is now known for banning books that include sex and violence. Steinbeck’s work has already hit the dustbin, so old Earnest can’t be far behind.

What’s next? The Bible? It has lots of sex and violence.

As for me, Hemingway’s granddaughter, Mariel, stands out as the only Playboy cover girl I ever dated (April, 1982, I think). She is now happily married with three grown kids.

And yes, I did prove that it is possible to eat Key Lime Pie four days in a row.

As for the stock market last week, there really isn’t much to say. The concentration of wealth at the top continues unabated, as it is in the rest of the country. Stocks are still discounting a soft landing, while commodities, energy, and bonds expect a recession.

Go figure.

The top five stocks continues to suck all the money out of the rest of the market, (AAPL), (GOOGL), (AMZN), (MSFT), and (NVIDIA), the early beneficiaries of AI, accounting for 80% of this year’s market gains. Of the other 495 stocks, 250 are below their 200-day moving averages, meaning they are still in bear markets.

This is what has crushed volatility, taking the ($VIX) from $34 down to $15. The last time volatility was this low was just before the Long Term Capital Management fiasco where it languished around $9 (read Liar’s Poker by my friend Michael Lewis). When LTCB went bust, volatility rocketed to $40 overnight and stayed there for two years.

Options traders made fortunes.

Mad Hedge has nailed every trend this year. We bought tech and Tesla (TSLA) in January when we should have. We shorted ($VIX) every time it approached $30. Then we bought the banking bottom in March (JPM), (BAC), (C) and carried those positions into April.

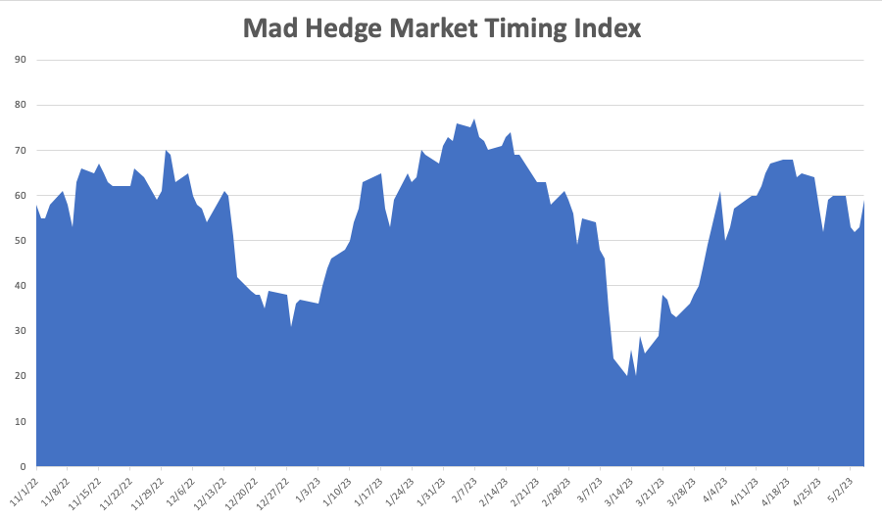

We’ve been shorting Tesla strangles every month. And now we are 80% in cash waiting for the world to end one more time in Washington DC so we can load the boat with LEAPS and replay the movie one more time.

By the way, Mad Hedge has issued 25 LEAPS over the past year and 24 made money with an average profit of about 300%. Our sole loser has been with Rivian (RIVN), but even it still has 18 months to run. Never own an EV stock during a price war.

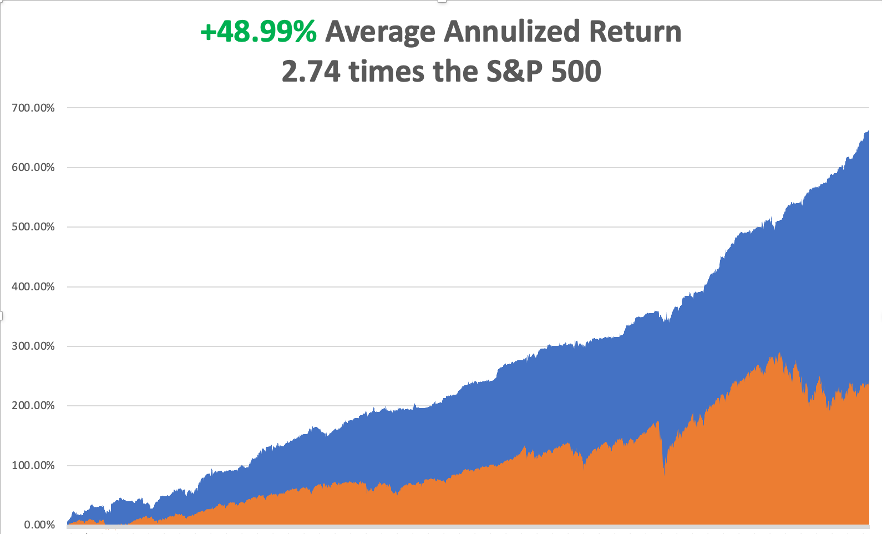

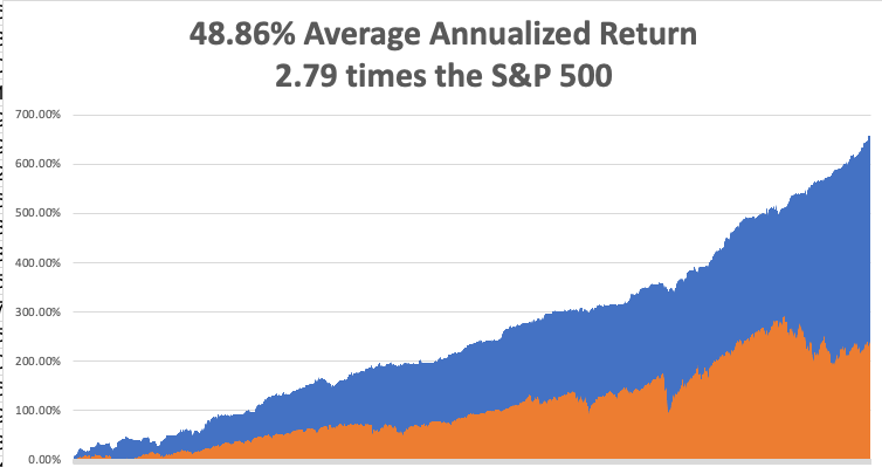

So far in May I have managed a modest 2.43% profit. My 2023 year-to-date performance is now at an eye-popping +64.18%. The S&P 500 (SPY) is up only a miniscule +9.00% so far in 2023. My trailing one-year return reached a 15-year high at +113.84% versus +10.87% for the S&P 500.

That brings my 15-year total return to +661.37%. My average annualized return has blasted up to +48.99%, another new high, some 2.74 times the S&P 500 over the same period.

Some 41 of my 44 trades this year have been profitable. My last 22 consecutive trade alerts have been profitable.

I closed out only one trade last week, a long in the (TLT) just short of max profit a day before expiration. That just leaves me with a long in Tesla and a short in Tesla, the “short strangle”. I now have a very rare 80% cash position due to the lack of high return, low risk trades.

There’s a 1,000 Point Drop in the Market Begging to Happen. That’s what happens when the market rallies on a Biden McCarthy debt ceiling deal, which McCarthy’s own party then votes down. After all, it took McCarthy 15 votes to get his job. Just watch volatility, it’s a coming.

Weekly Jobless Claims Fall to 242,000, down from 264,000. It’s a surprise slowdown. The rumor is that last week’s highpoint was the result of a surge in fraudulent online claims in Massachusetts.

NVIDIA Could Rise Fivefold in Ten years, say fund managers. I think that’s a low number. The Silicon Valley company makes the top performing GPU’s in the industry selling up to $60,000 each. (NVDA) is seeing a perfect storm of demand from the convergence of AI and Internet growth. The shares have already tripled off of the October low.

Tesla is Considering an India Factory, as part of its eventual build out to 10 plants worldwide. The country’s 100% import duty on cars has been a major roadblock. India is now pushing a “Made in India” initiative. Good luck getting anything done in India.

Homebuilder Sentiment Up for 10th Straight Month, as it will be for the next decade. There is no easy escape from a demographic wave. New homebuilders have figured out the new model.

India’s Tata to Build iPhones for Apple, in an accelerating diversification away from China. Apple has had too many of its eggs in one basket, especially given the recent political tensions between the US and the Middle Kingdom.

US Dollar Soars to Three Month High, as investors flee to safe haven short term investments. Rapidly worsening economic data is sparking recession fears. Ten consecutive months of falling inflation is another indicator of a slowdown.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper-accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, May 22 there is nothing of note to report.

On Tuesday, May 23 at 4:00 PM EST, the inaugural launch of Mad Hedge Jacquie’s Post takes place. Please click here to attend this strategy webinar. The Federal Reserve Open Market Committee minutes are out at 2:00 PM.

On Wednesday, May 24 at 2:00 PM, the Federal Reserve Open Market Committee minutes are out.

On Thursday, May 25 at 8:30 AM, the Weekly Jobless Claims are announced. The US GDP Q2 second estimate is also published.

On Friday, May 26 at 2:00 PM, the University of Personal Income & Spending and Durable Goods are released.

As for me, I am reminded of my own summer of 1967, back when I was 15, which may be the subject of a future book and movie.

My family summer vacation that year was on the slopes of Mount Rainier in Washington State. Since it was raining every day, the other kids wanted to go home early.

So my parents left me and my younger brother in the firm hands of Mount Everest veteran Jim Whitaker to summit the 14,411 peak (click here for this story ). The deal was for us to hitchhike back to Los Angeles as soon as we got off the mountain.

In those days, it wasn’t such an unreasonable plan. The Vietnam War was on, and a lot of soldiers were thumbing their way to report to duty. My parents figured that since I was an Eagle Scout, I could take care of myself anywhere.

When we got off the mountain, I looked at the map and saw there was this fascinating-sounding country called “Canada” just to the north. So, it was off to Vancouver. Once there I learned there was a world’s fair going on in Montreal some 2,843 away, so we hit the TransCanada Highway going east.

We ran out of money in Alberta, so we took jobs as ranch hands. There we learned the joys of running down lost cattle on horseback, working all day at a buzz saw, artificially inseminating cows, and eating steak three times a day.

I made friends with the cowboys by reading them their mail, which they were unable to do since they were all illiterate. There were lots of bills due, child support owed, and alimony demands.

In Saskatchewan, the roads ran out of cars, so we hopped a freight train in Manitoba, narrowly missing getting mugged in the rail yard. We camped out in a box car occupied by other rough sorts for three days. There’s nothing like opening the doors and watching the scenery go by with no billboards and the wind blowing through your hair!

When the engineer spotted us on a curve, he stopped the train and invited us to up the engine. There, we slept on the floor, and he even let us take turns driving! That’s how we made it to Ontario, the most mosquito-infested place on the face of the earth.

Our last ride into Montreal offered to let us stay in his boat house as long as we wanted so there we stayed. Thank you, WWII RAF Bomber Command pilot Group Captain John Chenier!

Broke again, we landed jobs at a hamburger stand at Expo 67 in front of the imposing Russian pavilion with the ski jump roof. The pay was $1 an hour and all we could eat.

At the end of the month, Madame Desjardin couldn’t balance her inventory, so she asked how many burgers I was eating a day. I answer 20, and my brother answered 21. “Well, there’s my inventory problem” she replied.

And then there was Suzanne Baribeau, the love of my life. I wonder whatever happened to her?

I had to allow two weeks to hitchhike home in time for school. When we crossed the border at Niagara Falls, we were arrested as draft dodgers as we were too young to have driver’s licenses. It took a long conversation between US Immigration and my dad to convince them we weren’t. It wasn’t the last time my dad had to talk me out of jail.

We developed a system where my parents could keep track of us across the continent. Long-distance calls were then enormously expensive. So, I called home collect and when my dad answered, he asked what city the call was coming from.

When the operator gave him the answer, he said he would NOT accept the call. I remember lots of surprised operators. But the calls were free, and Dad always knew where we were. At least he had a starting point to look for the bodies.

We had to divert around Detroit to avoid the race riots there. We got robbed in North Dakota, where we were in the only car for 50 miles. We made it as far as Seattle with only three days left until high school started.

Finally, my parents had a nervous breakdown. They bought us our first air tickets ever to get back to LA, then quite an investment.

I haven’t stopped traveling since, my tally now tops all 50 states and 135 countries.

And I learned an amazing thing about the United States. Almost everyone in the country is honest, kind, and generous. Virtually every night, our last ride of the day took us home and provided us with an extra bedroom, garage, barn or tool shed to sleep in. The next morning, they fed us a big breakfast and dropped us off at a good spot to catch the next ride.

It was the adventure of a lifetime and I profited enormously from it. As a result, I am a better man.

As for my brother Chris, he died of covid in early 2020 at the age of 65, right at the onset of the pandemic. Unfortunately, he lived very close to the initial Washington State hot spot.

People often ask me what makes me so different from others. I answer, “My parents taught me I could do anything with my life, and I proved them right.”

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Summit of Mt. Rainier 1967

McKinnon Ranch Bassano Alberta 1967

American Pavilion Expo 67

Hamburger Stand at Expo 67

Picking Cherries in Michigan 1967