Mad Hedge Technology Letter

July 22, 2022

Fiat Lux

Featured Trade:

AUTOMATION AND BANKING)

(SQ), (PYPL), (APPL), (AMZN)

Mad Hedge Technology Letter

July 22, 2022

Fiat Lux

Featured Trade:

AUTOMATION AND BANKING)

(SQ), (PYPL), (APPL), (AMZN)

Automation is taking place at warp speed, displacing employees from all walks of life.

According to a recent report, the U.S. financial industry will depose of 200,000 workers in the next decade because of automating efficiencies.

Yes, humans are going the way of the dodo bird and banking will effectively become algorithms working for a handful of executives and engineers.

The x-factor in this equation is the $150 billion annually that banks spend on technological development in-house which is higher than any other industry.

Welcome to the world of lower cost, shedding wage bills, and boosting performance rates.

We forget to realize that employee compensation eats up 50% of bank expenses.

The 200,000 job trimmings would result in 10% of the U.S. banking sector getting axed.

The hyped-up “golden age of banking” should deliver extraordinary savings and premium services to the customer at no extra cost.

This iteration of mobile and online banking has delivered functionality that no generation of customers has ever seen.

The most gutted part of banking jobs will naturally occur in the call centers because they are the low-hanging fruit for automated chatbots.

A few years ago, chatbots were suboptimal, even spewing out arbitrary profanity, but they have slowly crawled up in performance metrics to the point where some customers are unaware that they are communicating with an artificially engineered algorithm.

The wholesale integration of automating the back-office staff isn’t the end of it, the front office will experience a 30% drop in numbers sullying the predated ideology that front office staff are irreplaceable heavy hitters.

The front-office staff has already felt the brunt of downsizing with purges carried out from 2022 representing a twelfth year of continuous decline.

Front-office traders and brokers are being replaced by software engineers as banks follow the wider trend of every company transitioning into a tech company.

The infusion of artificial intelligence will lower mortgage processing costs by 30% and the accumulation of hordes of data will advance the marketing effort into a smart, multi-pronged, hybrid cloud-based, and hyper-targeted strategy.

The last two human bank hiring waves are a distant memory.

The most recent spike came in the 7 years after the dot com crash of 2001 until the sub-prime crisis of 2008 adding around half a million jobs on top of the 1.5 million that existed then.

After the subsidies wear off from the pandemic, I do believe that the banking sector will quietly put in the call to trim even more.

The longest and most dramatic rise in human bankers was from 1935 to 1985, a 50-year boom that delivered over 1.2 million bankers to the U.S. workforce.

This type of human hiring will likely never be seen again in the U.S. financial industry.

Recomposing banks through automation is crucial to surviving as fintech companies like PayPal (PYPL) and Square (SQ) are chomping at the bit and even tech companies like Amazon (AMZN) and Apple (AAPL) have started tinkering with new financial products.

And if you thought that this phenomenon was limited to the U.S., think again, Europe is by far the biggest culprit by already laying off 63,036 employees in 2019, more than 10x higher than the number of U.S. financial job losses and that has continued in 2021 and 2022.

In a sign of the times, the European outlook has turned demonstrably negative with Deutsche Bank announcing layoffs of 40,000 employees through 2023 as it scales down its investment banking business.

Don’t tell your kid to get into banking, because they will most likely be feeding on scraps at that point.

THE LAST STAGE OF HUMAN-FACING BANK SERVICES IS NOW!

Mad Hedge Technology Letter

July 18, 2022

Fiat Lux

Featured Trade:

(GO STRAIGHT TO THE TOP WITH THE CLOUD)

(AMZN), (ZS), (CRM), (GOOGL)

Dealing with the Cloud works, and for every relevant tech company, this division serves as the pipeline to the CEO position.

If this isn’t the case for a tech company, then there’s something egregiously wrong with them!

Take Andy Jassy, the mastermind behind Amazon’s (AMZN) lucrative cloud computing division and the man who succeeded company founder Jeff Bezos.

He was rewarded this important position based on his performance in the cloud and faced the daunting proposition of following Bezos as CEO.

Bezos incorporated Amazon almost 30 years ago.

Jassy developed a highly profitable and market-leading business, Amazon Web Services, that runs data centers serving a wide range of corporate computing needs.

Cloud 101

If you've been living under a rock the past few years, the cloud phenomenon hasn't passed you by and you still have time to cash in.

You want to hitch your wagon to cloud-based investments in any way, shape, or form.

Amazon leads the cloud industry it created.

It still maintains more than 30% of the cloud market. Microsoft would need to gain a lot of ground to even come close to this jewel of a business.

Amazon relies on AWS to underpin the rest of its businesses and that is why AWS contributes most of Amazon's total operating income.

Total revenue for just the AWS division would operate as a healthy stand-alone tech company if need be.

The future is about the cloud.

These days, the average investor probably hears about the cloud a dozen times a day.

If you work in Silicon Valley, you can quadruple that figure.

So, before we get deep into the weeds with this letter on cloud services, cloud fundamentals, cloud plays, and cloud Trade Alerts, let's get into the basics of what the cloud actually is.

Think of this as a cloud primer.

It's important to understand the cloud, both its strengths and limitations.

Giant companies that have it figured out, such as Salesforce (CRM) and Zscaler (ZS), are some of the fastest-growing companies in the world.

Understand the cloud and you will readily identify its bottlenecks and bulges that can lead to extreme investment opportunities. And that is where I come in.

Cloud storage refers to the online space where you can store data. It resides across multiple remote servers housed inside massive data centers all over the country, some as large as football fields, often in rural areas where land, labor, and electricity are cheap.

They are built using virtualization technology, which means that storage space spans many different servers and multiple locations. If this sounds crazy, remember that the original Department of Defense packet-switching design was intended to make the system atomic bomb-proof.

As a user, you can access any single server at any one time anywhere in the world. These servers are owned, maintained, and operated by giant third-party companies such as Amazon, Microsoft, and Alphabet (GOOGL), which may or may not charge a fee for using them.

The most important features of cloud storage are:

1) It is a service provided by an external provider.

2) All data is stored outside your computer residing inside an in-house network.

3) A simple Internet connection will allow you to access your data at any time from anywhere.

4) Because of all these features, sharing data with others is vastly easier, and you can even work with multiple people online at the same time, making it the perfect, collaborative vehicle for our globalized world.

Once you start using the cloud to store a company's data, the benefits are many.

No Maintenance

Many companies, regardless of their size, prefer to store data inside in-house servers and data centers.

However, these require constant 24-hour-a-day maintenance, so the company has to employ a large in-house IT staff to manage them - a costly proposition.

Thanks to cloud storage, businesses can save costs on maintenance since their servers are now the headache of third-party providers.

Instead, they can focus resources on the core aspects of their business where they can add the most value, without worrying about managing IT staff of prima donnas.

Greater Flexibility

Today's employees want to have a better work/life balance and this goal can be best achieved by letting them work remotely which effectively happened because of the public health situation. Increasingly, workers are bending their jobs to fit their lifestyles, and that is certainly the case here at Mad Hedge Fund Trader.

How else can I send off a Trade Alert while hanging from the face of a Swiss Alp?

Cloud storage services, such as Google Drive, offer exactly this kind of flexibility for employees.

With data stored online, it's easy for employees to log into a cloud portal, work on the data they need to, and then log off when they're done. This way a single project can be worked on by a global team, the work handed off from time zone to time zone until it's done.

It also makes them work more efficiently, saving money for penny-pinching entrepreneurs.

Better Collaboration and Communication

In today's business environment, it's common practice for employees to collaborate and communicate with co-workers located around the world.

For example, they may have to work on the same client proposal together or provide feedback on training documents. Cloud-based tools from DocuSign, Dropbox, and Google Drive make collaboration and document management a piece of cake.

These products, which all offer free entry-level versions, allow users to access the latest versions of any document so they can stay on top of real-time changes which can help businesses to better manage workflow, regardless of geographical location.

Data Protection

Another important reason to move to the cloud is for better protection of your data, especially in the event of a natural disaster. Hurricane Sandy wreaked havoc on local data centers in New York City, forcing many websites to shut down their operations for days.

And we haven’t talked about the ransomware attacks by Eastern Europeans on energy company Colonial Pipeline and meat producer JBS Foods.

The cloud simply routes traffic around problem areas as if, yes, they have just been destroyed by a nuclear attack.

It's best to move data to the cloud, to avoid such disruptions because there your data will be stored in multiple locations.

This redundancy makes it so that even if one area is affected, your operations don't have to capitulate, and data remains accessible no matter what happens. It's a system called deduplication.

Lower Overhead

The cloud can save businesses a lot of money.

By outsourcing data storage to cloud providers, businesses save on capital and maintenance costs, money that in turn can be used to expand the business. Setting up an in-house data center requires tens of thousands of dollars in investment, and that's not to mention the maintenance costs it carries.

Plus, considering the security, reduced lag, up-time and controlled environments that providers such as Amazon's AWS have, creating an in-house data center seems about as contemporary as a buggy whip, a corset, or a Model T.

The cloud is where you want to be.

Mad Hedge Technology Letter

July 13, 2022

Fiat Lux

Featured Trade:

(HOT INFLATION NUMBER BODES POORLY FOR TECH STOCKS)

(LYFT), (UBER), (AMZN), (SHOP), (GOOGL), (SNAP), (META), (TWTR), (MELI), (EXPE), (TRIP)

Fed swaps now fully price in 150 basis points of hikes over the next two meetings after awful inflation numbers came in showing inflation heading in the wrong direction.

The 9.1% inflation print was an acceleration of the 8.6% which was what we got last time.

I don’t want to beat a dead horse, but inflation accelerating and beating the expectations of 8.8%, is paramount to the trajectory of tech shares.

The awful number also underscores the magnitude of policy mistakes that the U.S. Fed Central Bank has overseen.

This is the only thing that matters because macro liquidity drives the trajectory of equities in the short term.

These clowns aren’t serious about tackling inflation, as I said a few times already and this proves it!

Itty bitty rate rises won’t stamp out 9.1% inflation and in fact, encourages it.

The Fed would need to raise the Fed Funds rate by 7.35% to 9.1% immediately from the current 1.75% for the real inflation rate to be non-inflationary.

According to the official Fed website, the Fed targets 2% inflation because they call this level “healthy.”

By their own measure, to achieve this 2% inflation, they would still need to raise rates by 5.35% immediately, but they absolutely won’t because Powell simply has no interest in doing his job, period.

These core expenses skyrocketing is why I keep and kept mentioning that Americans have less money to splurge on tech gadgets and software and again, this inflation report validates my thesis.

Think about pitiful tech stocks that didn’t work in bull markets like ride chauffeurs Lyft (LYFT) and Uber (UBER), I fully expect these companies to perform terribly over the next 6 months amid a rising rate backdrop.

Not only are they growth tech, but their business is directly tied to energy prices.

They are the poster boys for the pain tech companies will feel from hyperinflation.

The outlook is quite poor for technology in the short term, and we are still waiting to form a bottom. It will come back but we need a capitulation.

The accelerated rate of inflation means that we push back the big recovery in tech stocks.

Ecommerce stocks will suffer like Amazon (AMZN), Shopify (SHOP), and MercadoLibre (MELI) because of the decline in discretional spending for the consumer.

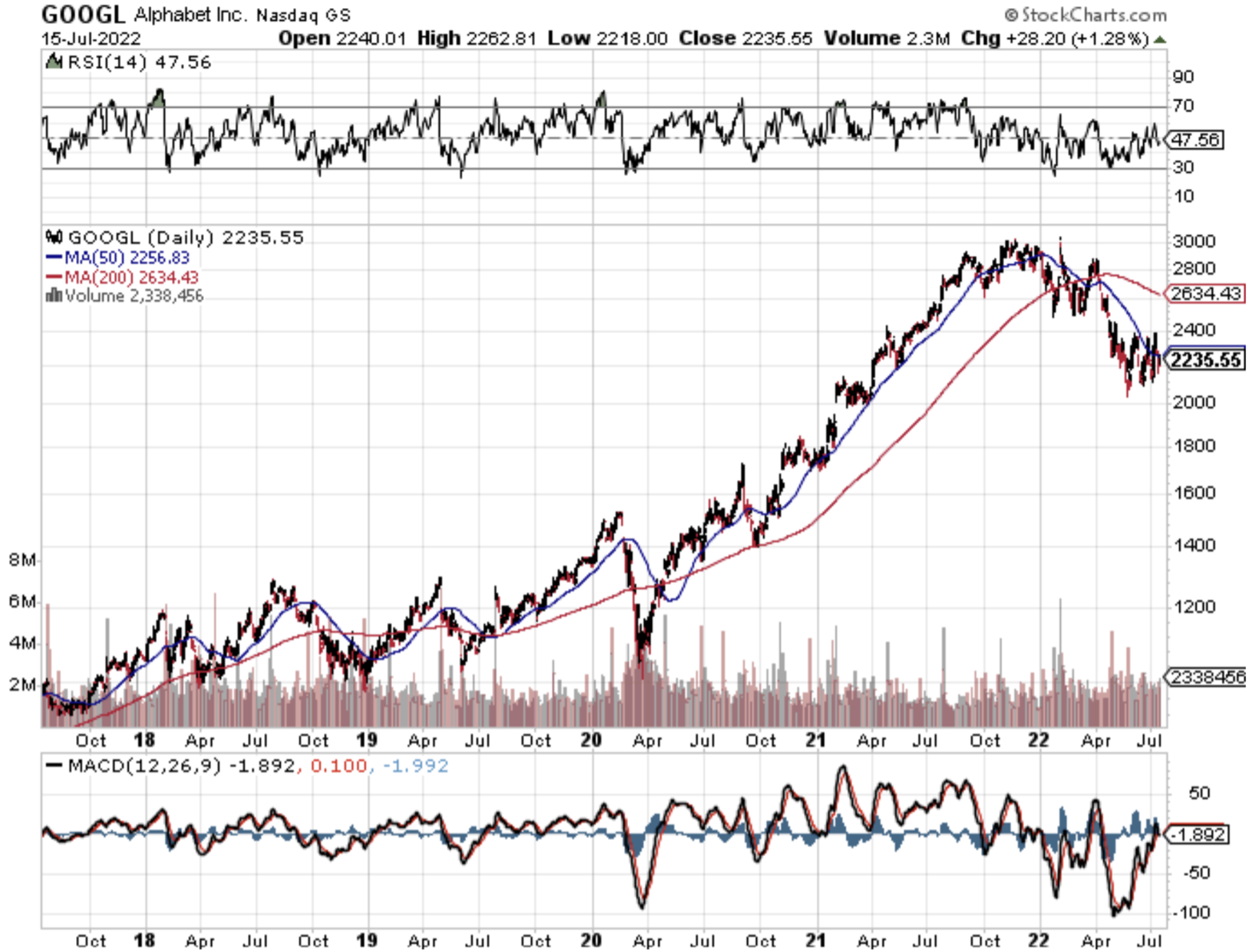

Digital ad giants like Google (GOOGL), Snap (SNAP), Meta (META), and Twitter (TWTR) will need to reckon with smaller ad budgets from 3rd party ad purchasers as companies cut back on marketing spend.

Don’t need to increase marketing spend when people have no money to spend on products.

Travel tech stocks like Expedia (EXPE) and Tripadvisor (TRIP) can expect summer to mark peak travel as Americans get more concerned about food and oil budgets after the summer of travel revenge from the arbitrary lockdowns.

It also means there will be a meaningful next leg down for tech stocks as many CFOs are now furiously crunching the new revenue and margin downgrades to reflect this heightened risk.

The new re-rating isn’t reflected yet in tech shares.

It’s already been a few months on the trot where many analysts say this is the top, they have been inaccurate every time.

Even if it is the top, inflation will stay higher for longer and stagflation is the consensus for 2023.

The clowns at the Fed not doing their job means that economic cycles will be shorter and a great deal more volatile because the smoothing effect of moderated inflation is now stripped out of calculations. This effectively means a contracted boom-bust trajectory for tech stocks which is unequivocally what we are seeing in market behavior.

Mad Hedge Biotech and Healthcare Letter

July 5, 2022

Fiat Lux

Featured Trade:

(AN AAA-RATED STOCK POISED TO DELIVER MARKET-BEATING RETURNS)

(JNJ), (AAPL), (GOOGL), (AMZN), (MSFT), (TSLA), (META), (BRK.A)

More than six months after what appeared to be a never-ending assault on the biotechnology and healthcare industries, the sector seems to be slowly reviving.

While it is still too early to declare the pullback over, there are a few companies that provide a ray of hope for investors.

In the US, only four stocks have recorded a market capitalization of $1 trillion or higher: Apple (APPL), Alphabet (GOOGL), Amazon (AMZN), and Microsoft (MSFT). This year's market crash saw Tesla (TSLA) and Meta Platforms (META) departure from this elite group.

The market-wide selloff also made it more difficult for stocks to reach the $1 trillion mark. However, this does not necessarily preclude them from achieving this goal in the future.

Companies are rapidly expanding and equipped with the right tools and strategies to capitalize on growth opportunities, making them prime candidates to make the $1 trillion cut in a couple of years.

One of them is Johnson & Johnson (JNJ).

Almost everyone is familiar with JNJ's century-old brands, such as Band-Aids and Listerine. What many people probably do not realize is that the company's med-tech and pharmaceutical segments account for the vast majority of its total revenue.

In 2021, its pharmaceuticals segment alone comprised 55% of JNJ sales, while its medical devices unit contributed 29% to the company’s top line.

So far, the most promising drug in JNJ’s pharmaceutical segment is Tremfya. First-quarter sales for this psoriasis treatment jumped to a whopping 41% year over year to record an annualized $2.4 billion.

Meanwhile, JNJ's med-tech segment is poised for massive growth as a result of the strong demand for its electrophysiology products. These devices, used to keep hearts beating normally, have been identified as lucrative revenue streams and growth drivers in the long run.

The company has been working on spinning off its consumer segment into a separate publicly traded entity in the following months. This means that investors with JNJ stock will eventually end up owning shares of two different companies by 2023.

The decision to spin off its consumer health segment is part of the company's effort to shed a cyclical segment and become a health pure play focused on pharmaceuticals and medical devices.

Hence, now is an excellent time to buy JNJ shares.

While JNJ isn’t known as a high-growth stock, the company’s strategies have the potential to spur exponential growth and send shares soaring.

The next decade will be crucial for the company's success as it transforms. If the company executes its plans successfully, its current market capitalization of $467 billion could slowly but steadily increase to approximately $1 trillion.

J&J will be able to invest and concentrate its resources on segments with high sales and margins, which should increase the company's income and cash flows at a faster rate than at present.

Furthermore, JNJ's plan is expected to increase shareholder returns through higher dividends and share repurchases because of its growing cash flow. With these factors combined, JNJ's stock price will undoubtedly rise, as will its market cap.

On top of these, JNJ offers a 2.6% dividend yield. Admittedly, this isn’t remarkably high. However, investors can rely on its steady rise. Moreover, JNJ is a Dividend King. In fact, it recently raised its payout for the 60th year in a row.

If these aren’t enough to cement the company’s reputation as a solid investment, consider the fact that JNJ is one of the largest holdings in Warren Buffett’s (BRK.A) portfolio.

It’s also one of the only two publicly traded companies with the coveted AAA credit rating from S&P. For context, the US government only has an AA rating. Needless to say, this makes JNJ one of the safest—if not the safest—income stock to date.

Overall, JNJ has been diligent in getting all of its ducks in a row and is poised to provide market-beating returns to patient investors.

Mad Hedge Technology Letter

May 27, 2022

Fiat Lux

Featured Trade:

(ECOMMERCE PLATEAUS)

(AMZN)

Amazon’s decision to look for subletters of 10 million square feet of warehouse space means they don’t believe ecommerce growth will migrate into the extra space they planned for.

This is a big deal because it takes a long time to acquire the extra footage to expand capacity.

It doesn’t happen in one day.

It’s almost a surrender of sorts that this short-term pandemic ecommerce bump had no legs.

It’s over like it almost never existed, sort of like the health crisis.

So why is this a problem?

Amazon’s ecommerce investors' main reason for investing in Amazon is to earn money through appreciating shares.

This only comes about if their businesses are growing and behind their cloud division called Amazon Web Services (AWS), ecommerce is the second most important.

This is why Amazon has seen such as epic selloff in the first half of the year.

I do believe the negativity has somewhat overshot which is why I executed a deep-in-the money bull call option spread on this stock.

It’s not the death of Amazon, hardly so, but it’s been really painful for shareholders.

It was just in 2020 when Amazon added warehouse space faster than it ultimately needed in response to the challenges of the pandemic, outpacing consumer sales and resulting in an extra $2 billion in costs in the first quarter.

However, given the extraordinary demand and uncertainty Amazon was seeing at the time, there’s not much else the company could have done.

This is not what management describes as “right sizing capacity” and in fact is an error in capacity expectations.

Companies don’t spend an extra $2 billion in capacity when they don’t need to.

It would cripple many small ecommerce companies.

Amazon’s online sales fell 3% for the quarter to $51 billion, as shoppers relied less on the company for critical purchases.

Amazon’s recent announcement of a “Buy with Prime” program, serving ecommerce sites other than Amazon.com, takes the company further down the path of using its fulfillment and delivery network to offer shipping as a service, generating additional revenue and potentially competing with UPS and FedEx.

It’s similar to what Amazon did with Amazon Web Services, using its online expertise and cloud infrastructure as a starting point for a business that generated $18.4 billion in revenue in the first quarter.

The company has spent the past few years creating its own last-mile delivery network, known as “AMZL,” leveraging a network of dedicated Amazon Delivery Service Partners and reducing its dependence on third-party delivery companies such as UPS and the U.S. Postal Service.

The 45% selloff in Amazon has been quite overdone bringing the PE ratio all the way down to around 50.

If energy prices and inflation can moderate somewhat in the back half of the year, AMZN would be the first candidate to extend this dead cat bounce into a real bounce back to $3,000 per share.

AMZN is one of the beneficiaries of lower inflation because of its high reliance on fuel to deliver products the last mile.

That cannot be substituted at all so the stock market is reflecting the short-term pain.

The energy having such a stronghold over the tech market is quite unprecedented and don’t expect AMZN to start their oil refiner business.

However, I do expect choppy trading as rising rates and lower purchasing power for Americans do a dirty job on the AMZN bottom line.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.