Mad Hedge Technology Letter

March 4, 2020

Fiat Lux

Featured Trade:

(THE BEST TECH STOCKS TO BUY AT THE BOTTOM)

(NFLX), (ZM), (PTON), (AMZN), (OKTA), (WORK), (ATVI), (EA), (TTWO)

Mad Hedge Technology Letter

March 4, 2020

Fiat Lux

Featured Trade:

(THE BEST TECH STOCKS TO BUY AT THE BOTTOM)

(NFLX), (ZM), (PTON), (AMZN), (OKTA), (WORK), (ATVI), (EA), (TTWO)

Tech stocks that are begging to be picked up on the back of the coronavirus pandemic are Netflix (NFLX), Zoom Video Communications (ZM), workplace collaboration service Slack Technologies (WORK), and Peloton Interactive (PTON), the spin bike company.

Their short-term outperformance indicates that these stocks work well during mass pandemics shelving most outdoor activity and commerce.

The basket of 3 stocks has easily beat the S&P 500 since the coronavirus emerged as a threat in mid-January.

Home sitting doesn’t generate a net output of business activity unless that job is digital.

The majority of workers still commute in a physical car only to sit in an office, restaurant, or some other type of self-contained space.

That is the underlying problem that has no solution, and any rate cut by the Fed cannot ultimately solve consumers holed up in their house.

If the companies that could opt to go pure digital do take up the option, the number of remote workers would rise and digital products would be the ultimate beneficiary of this trend.

Companies that promote remote working such as Slack (WORK) and Google Hangouts are in pole position to reap the rewards.

These services include video conferencing software, logistical services, administrative services, network security services, ecommerce and any service that aids in generating digital content like Adobe and its umbrella of assets.

The trend was already transforming American culture, but the virus vigorously pulls forward a trend that was already in overdrive.

Enabling information workers to produce outside the traditional office environment is one of the lynchpins of the Silicon Valley model.

Companies will ultimately realize that spending big bucks on business travel to meet face to face for 30 minutes is probably not an optimal allocation of resources.

Business travel is getting cut with a cleaver such as Amazon.com (AMZN) who are forcing employees to avoid all nonessential travel for now, including within the U.S. Much of that travel could be replaced by video calls.

Other companies will get in on the action by directing their employees to work from home in the coming weeks.

Coronavirus mania has reached the U.S. shores with consumers stocking up on all the essentials at the local Costco.

If this gets worse, there is no solution unless a viable medical solution starts improving the health crisis.

There are still only 7 known fatalities from the coronavirus, all in the state of Washington, and limiting that number is critical to the health of the tech market.

Another company is Okta (OKTA), a leader in authentication security cloud software.

The company’s offering allows employees to use corporate applications on-site and remotely and protecting their access to their digital services is just as important as the work itself.

As consumer spurn movie theaters, concerts, and gyms, the entertainment space will give way to digital entertainment that includes Netflix (NFLX) and Roku (ROKU).

Roku is a great place to hide out in the world where Covid-19 meets daily consumers in the U.S. in a more meaningful way during 2020.

Netflix is a company that has defied gravity this year by bull-rushing its way through the competition and proving there is space for everyone.

The increase in incremental demand for digital content will only help Netflix claim a bigger part of the pie.

We can also lump the videogame industry into this cohort such as Activision Blizzard (ATVI), Electronic Arts (EA), and Take-Two Interactive Software (TTWO).

They have faced serious headwinds from gaming phenomenon Fortnite, but prolonged home sitting will even boost their shares.

The spine of digital services will receive a boost as well from the usual cast of characters such as Microsoft (MSFT), Apple (AAPL), Alphabet (GOOGL), and Facebook (FB).

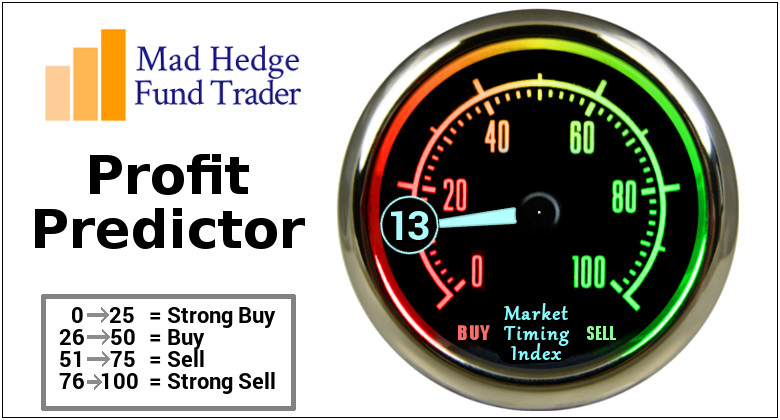

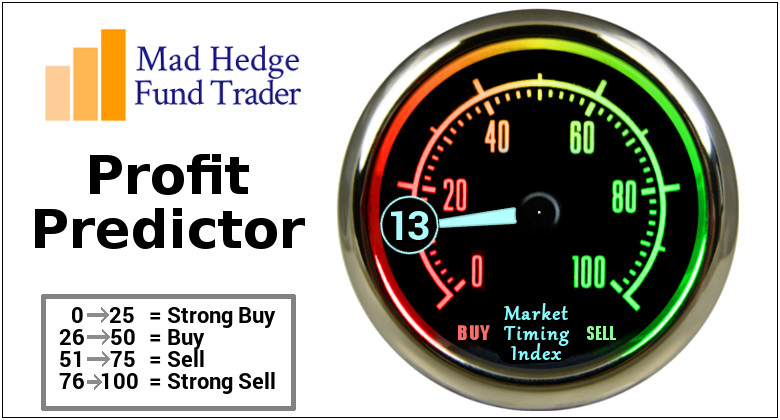

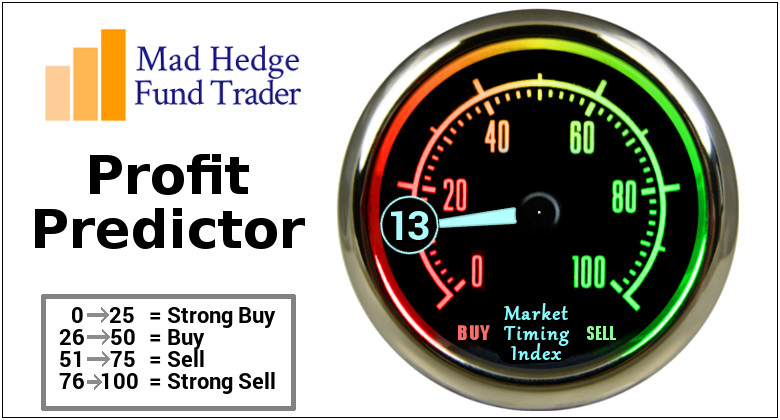

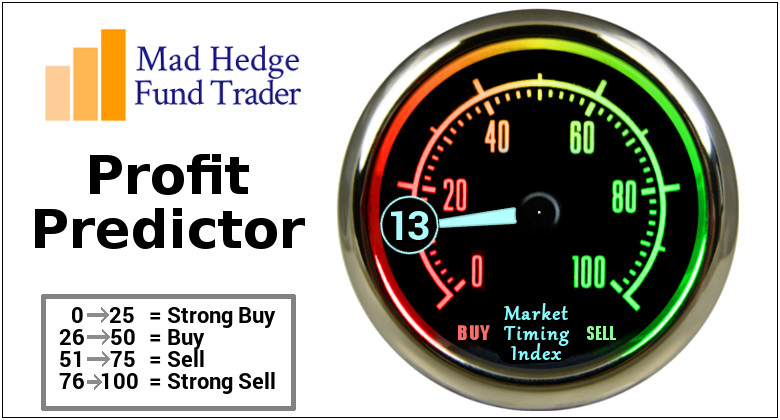

As investors wait for the climax of the coronavirus and the Central Bank has indicated that they are open to more accommodative policy, we could be ripe for more volatility.

Chinese coronavirus cases have started to taper off and if the rest of the world trends in a similar fashion, this virus scare could be in the history books in 2-3 months.

However, the trajectory of the virus is still a massive unknown in the U.S. and winning the health battle is the only panacea to this dilemma.

Global Market Comments

March 4, 2020

Fiat Lux

Featured Trade:

(TEN LONG TERM LEAPS TO BUY AT THE BOTTOM)

(MSFT), (AAPL), (GOOGL), (QCOM), (AMZN),

(V), (AXP), (NVDA), (DIS), (TGT)

Global Market Comments

March 3, 2020

Fiat Lux

Featured Trade:

(TEN STOCKS TO BUY BEFORE YOU DIE)

(MSFT), (AAPL), (GOOGL), (QCOM), (AMZN),

(V), (AXP), (NVDA), (DIS), (TGT)

A better headline for this piece might have been “Ten stocks to Buy at the Bottom”.

At long last, we have a once-a-decade entry point for the ten best stock in America at bargain basement prices.

Coming in here and betting the ranch is now a no-lose trade. If I’m right, the pandemic ends in three months, stocks will soar. If I’m wrong and the global epidemic explodes from here, you’ll be dead anyway and won’t care that the stock market crashed further.

Needless to say, I have a heavy tech orientation with this list, far and away the source of the bulk of earnings growth for the US economy for the foreseeable future. If anything, the coronavirus will accelerate the move away from shopping malls and towards online commerce as consumers seek to avoid direct contact with the virus.

What would I be avoiding here? Directly corona-related stocks like those in airlines, hotels, casinos, and cruise lines. Avoid human contact at all cost!

Microsoft (MSFT) – still has a near-monopoly on operating systems for personal computers and a huge cash balance. Their inroads with the Azure cloud services have been impressive. (MSFT) just reported an impressive $8.9 billion in Q4 earnings. It’s now yielding a respectable 1.26%.

Apple (AAPL) – Even with the Coronavirus, Apple still has a cash balance of $225 billion. Its 5G iPhone launches in the fall, unleashing enormous pent-up demand. Apple’s rapid move away from a dependence on hardware to services continues. It’s now yielding a respectable 1.13%.

Alphabet (GOOGL) – Has a massive 92% market share in search and remains the dominant advertising company on the planet. (GOOGL) just announced an incredible $8.9 billion in Q4 earnings.

QUALCOMM (QCOM) – Has a near-monopoly in chips needed for 5G phones. It also recently won a lawsuit against Apple over proprietary chip design.

Amazon (AMZN) – The world’s preeminent retailer is growing by leaps and bounds. Dragged down by its association with the world’s worst industry, (AMZN) is a bargain relative to other FANGs.

Visa (V) – The world’s largest credit company is a free call on the growth of the internet. We still need credit cards to buy things. And guess what? Coronavirus will accelerate the move of commerce out of malls, where you can get sick, to online.

American Express (AXP) – Ditto above, except it charges high fees, its stock has lagged Visa and Master Card in recent years and pays a 1.58% dividend.

NVIDIA (NVDA) – The leading graphics card maker that is essential for artificial intelligence, gaming, and bitcoin mining.

Advanced Micro Devices (AMD) – Stands to benefit enormously from the coming chip shortage created by the coming 5G.

Target (TGT) – The one retailer that has figured it out, both in their stores and online. It can’t be ALL tech.

Good Luck and Good Trading

John Thomas

Global Market Comments

March 2, 2020

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or TRADING THE CORONA MARKET),

(SPX), (INDU), (AAPL), (VIX), (VXX), (AAPL), (MSFT), (AMZN)

It’s time to stockpile food, load up on ammo, and get ready to isolate yourself from the coming Corona Armageddon. If you rely on prescriptions to keep breathing, better lay in a three-month supply. Six months might be better.

At least, that’s what the stock market thinks. That was some week!

Thank goodness it wasn’t as bad as the 1987 crash, when we cratered 20% in a single day, thanks to an obscure risk control strategy called “portfolio insurance” that maximized selling at market bottoms.

In fact, we may have already hit bottom on Friday at Dow 24,681 and S&P 500 (SPX) 2,865.

There are a whole bunch of interesting numbers that converge at the 24,000 Dow Average handle. That is the level where we started the second week of 2019, so we have virtually given up that entire year. If you missed 2019, you get a second chance at the brass ring.

As for the (SPX), as the week’s lows have pulled back exactly to the peaks of twin failed rallies of 2018, right where you would expect major technical support on the long term charts.

And here is something else that is really interesting. If you use the (SPX) price earnings multiple of 16X that prevailed when Trump became president and then add in the 38.62% earnings growth that has occurred since then, you come up with a Dow average of 24,000.

Yes, the market has plunged from a 20X multiple to 16X in a week.

Want more?

If you drop every stock in the market to its 200-day moving average, you get close to a Dow Average of 24,000. I’m talking Apple (AAPL) down to $240, Microsoft (MSFT) cratering to $145. Amazon (AMZN) hit the 200-day on Friday at $1,849.

This means we are well overdue for a countertrend short-covering rally of one-third to two-thirds of the recent loss, or 1,500 to 3,000. That could take the (VIX) back to $20 in a heartbeat. I’ll take any bounce I can get, even the dead cat variety.

What the market has done in a week is backed out the entire multiple expansion that has occurred over the last three years caused by artificially low interest rates and the presidential browbeating of the Federal Reserve.

The fluff is gone.

I have been warning for months that torrid stock market growth against falling corporate earnings growth could only end in tears. And so it did.

Whether the bottom is at 24,000, 23,000, or 22,000, you are now being offered a chance to get off your rear end and pick up at bargain prices the cream of the crop of corporate America, many of which have seen shares drop 20-30% in six trading days.

Stock prices here are discounting a recession that probably won’t happen. That’s what it always does at market bottoms. It’s not a bad time to dollar cost average. Put in a third of your excess cash now, a third in a week, and the last bit in two weeks.

You also want to be selling short the Volatility Index (VIX) big time. With a rare (VIX) level of $50, you can consider this a “free money” trade. Over the last decade, (VIX) has spent only a couple of days close to this level.

Even during the darkest days of the 2008 crash, (VIX) spent only quarter trading between $20 and $50, and one day at $90. That makes one-year short positions incredibly attractive. Get the (VXX) back to last week’s levels and you are looking at 100% to 200% gains on put options very quickly. That’s why I went to a rare double position on Friday.

And then there is the Coronavirus, which I believe is presenting a threat that is wildly exaggerated. If you assume that the Chinese are understating the number of deaths, the true figure is not 3,000 but 30,000. In a population of 1.2 billion that works out to 0.0025%.

Apply that percentage to the US and the potential number of deaths here is a mere 7,500, compared to 50,000 flu deaths a year. And most of those are old and infirm with existing major diseases, like cancer, pneumonia, or extreme obesity.

Thank goodness I’m not old.

Fear, on the other hand, is another issue. Virtually all conferences have been cancelled. A school is closed in Oregon. Most large corporations banned non-essential travel on Friday. Major entertainment areas in San Francisco have become ghost towns. If this continues, we really could scare ourselves into an actual recession, which is what the stock market seemed to be screaming at us last week.

You can forget about the vaccine. It would take a year to find one and another year to mass produce it. They may never find a Corona vaccine. They have been looking for an AIDS vaccine for 40 years without success. So, we are left with no choice but to let nature run its course, which should be 2-3 months. The stock market may fully discount this by the end of this week.

What's disgraceful is the failure of the US government to prepare for a pandemic we knew was coming. I just returned from a two-week trip around Asia and Australia and at every stop my temperature was taken, I was asked to fill out an extensive health questionnaire and was screened for quarantine. When I got back to the US there was nothing. I just glided through the eerily empty immigration.

Most American communities have no Corona tests and have to mail samples to the CDC in Atlanta to get a result. We probably already have thousands of cases here already but don’t know it because there has been no testing. When the stock market learns this, expect more down 1,000-point days.

Where is the bottom? That is the question being asked today by individuals, institutions, and hedge funds around the world. That’s because there are hundreds of billions of dollars waiting on the sidelines left behind by the 2019 melt-up in financial assets. It’s been the worst week since 2008. All eyes are on (SPX) 2,850, the October low and the launching pad for the Fed’s QE4, which ignited stocks on their prolific 16% run. Suddenly, we

have gone from a market you can’t get into to a market you can’t get out of.

How long is this correction? The post-WWII average is four months, but we have covered so much ground so fast that this one may be quicker. We haven’t seen one since Q4 2018, which was one of the worst.

Corona does have a silver lining. Air pollution in China is the lowest in decades, with coal consumption down 42% from peak levels. It’s already starting to return as Chinese workers go back on the job. Call it the “Looking out the Window” Index.

Consumer Confidence was weak in February, coming in at 130.7, less than expected. Corona is starting to sneak into the numbers. Yes, imminent death never inspired much confidence in me.

International Trade is down 0.4% year on year for the first time since the financial crisis. It’s the bitter fruit of the trade war. The coasts were worst hit where trade happens. Trade is clearly in free fall now, thanks to the virus.

The helicopters are revving their engines, with global central banks launching unprecedented levels of QE to head off a Corona recession. Futures market is now pricing in three more interest rate cuts this year, up from zero two weeks ago. Hong Kong is giving every individual $1,256 to spend to stimulate the local economy. The plunge protection team is here! At the very least, markets are due for a dead cat bounce.

Bob Iger Retired from Walt Disney as CEO and will restrict himself to the fun stuff. The stock is a screaming “BUY” down here, with theme parks closing down from the Corona epidemic. Oops, they’re also in the cruise business!

Will the virus delay the next iPhone, and 5G as well? Like everything else these delays, it depends. Missing market could become the big problem. Missing customers too. I still want to buy (AAPL) down here in the dumps down $90 from its high.

The IEA says the energy outlook is the worst in a decade. Structural oversupply and the largest marginal customers mean that we will be drowning in oil basically forever. Avoid all energy plays like the plague. Don’t get sucked in by high yielding master limited partnerships. Don’t confuse “gone down a lot” with “cheap”.

Why is the market is really going down? It’s not the Coronavirus. It’s the Fed ending of its repo program in April, announced in the Fed minutes on February 19. No QE, no bull market. The virus is just the turbocharger. The Fed just dumped the punch bowl and no one noticed. This may all reverse when we get the next update on the Coronavirus.

A surprise Fed rate cut may be imminent, with a 25-basis point easing coming as early as tomorrow. There is no doubt that the virus is demolishing the global economy.

Investment Spending is Falling off a Cliff, with the Q4 GDP Report showing a 2.3% decline. Consumer spending, the main driver for the US economy, is also weakening as if economic data made any difference right now.

I could see the meltdown coming the previous weekend and was poised to hit the market with short sales and hedges. But when the index opened down 1,000, it was pointless. The best thing I could do was to liquidate my portfolio for modest losses. Two days later, that was looking a stroke of genius. This was the first 1,000 dip in my lifetime that I didn’t buy.

I then piled on what will almost certainly be my most aggressive position of 2020, a double weighting in selling short the Volatility Index at $50. Within 30 minutes of adding my second leg, the (VIX) had plunged to $40, earning back nearly half my losses from the week.

The British SAS motto comes to mind: “Who Dares Wins”.

My Global Trading Dispatch performance pulled back by -6.19% in February, taking my 2020 YTD return down to -3.11%. My trailing one-year return is stable at 40.95%. My ten-year average annualized profit ground back up to +34.34%.

With many traders going broke last week or running huge double-digit losses, I’ll take that all day long in the wake of a horrific 4,500 point crash in the Dow Average.

All eyes will be focused on the Coronavirus still, with deaths over 3,000. The weekly economic data are virtually irrelevant now. However, some important housing numbers will be released.

On Monday, March 2 at 10:00 AM, the US Manufacturing PMI for February is out.

On Tuesday, March 3 at 4:00 PM, US Auto Sales for February are released.

On Wednesday, March 4, at 8:15 PM, the ADP Report for private sector employment is announced.

On Thursday, March 5 at 8:30 AM, Weekly Jobless Claims are published.

On Friday, March 6 at 8:30 AM, the February Nonfarm Payroll Report is printed. The Baker Hughes Rig Count follows at 2:00 PM.

As for me, we have just suffered the driest February on record here in California, so I’ll be reorganizing my spring travel plans. Out goes the skiing, in come the beach trips.

Such is life in a warming world.

That’s it after I stop at Costco and load the car with canned food.

John Thomas

CEO & Publisher

Mad Hedge Technology Letter

February 28, 2020

Fiat Lux

Featured Trade:

(THE TRUE COST OF THE CORONAVIRUS)

(COMPQ), (PYPL), (MSFT), (AMZN), (GOOGL)

Global Market Comments

February 28, 2020

Fiat Lux

Featured Trade:

(FEBRUARY 26 BIWEEKLY STRATEGY WEBINAR Q&A),

(VIX), (VXX), (SPY), (TLT), (UAL), (DIS), (AAPL), (AMZN), (USO), (XLE), (KOL), (NVDA), (MU), (AMD), (QQQ), (MSFT), (INDU)

Tech shares are hoping to stage a rebound after the coronavirus-fueled rout that saw the Nasdaq’s 2-day drop by 6.38%, which is its worst since June 2016.

Readers can now pencil in a fresh readjustment to growth expectations of zero to low single digits in tech shares for fiscal year of 2020.

That is why Thursday morning was greeted by another 3% drop at the open - proceed with caution to not get trapped in the proverbial dead cat bounce vortex in the short-term.

A major tech consolidation could take place because let’s get real, the unpredictability is having a major impact on technology companies and uncertainty is a substantial input in heightened risk.

What are the realistic scenarios that are still left on the table?

Firms trading on the Nasdaq will slash price targets and profit estimates that could uncoil another leg down in the Nasdaq index.

In fact, it has already happened as PayPal (PYPL), Microsoft (MSFT), and Apple (AAPL) issued revenue warnings saying they do not expect to meet their revenue goals because of the coronavirus.

On an operational level, softness is what I see when delving into the semantics of Amazon (AMZN) whose ranking algorithm demotes product sellers who go out of stock.

The coronavirus has crippled supply chains, and to avoid a lack of stock, sellers are raising prices to slow sales, while planning to move production to other countries.

This is on top of the backbreaking supply problems that companies face because of the ill-effects of the trade war.

If the Amazon algorithm punishes the seller, once stock is replenished, they must overspend on advertising to climb back to the top of product searches.

The surveys I have taken out with Amazon sellers in the last few days show a precarious situation where sellers are stretched to the limit relying on numerous uncertain variables that are completely out of their control,

Even if the local government allows Chinese factories to restart, it will be understaffed while workers from other provinces self-quarantine.

The third-party marketplace accounts for more than half of Amazon’s retail sales with a robust base of manufacturers and sellers in China.

Google (GOOGL) and Microsoft are accelerating efforts to shift hardware production to Southeast Asia amid the worsening coronavirus outbreak, opening factories in Vietnam and Thailand as well.

Google is set to begin production of the Pixel 4A smartphone and also plans to manufacture its next-generation flagship smartphone called the Pixel 5 in Vietnam.

Google is also on the verge of building factories in Thailand for "smart home" related products, including voice-activated smart speakers like the Nest Mini.

Google and Microsoft’s plans are a giant shift away from their prior generation-long China manufacturing strategy and the coronavirus has only supported a strategy to remove China as a core manufacturing hub.

It is getting so bad in China that they are evaluating the feasibility and cost implications to uninstall some production equipment and ship it from China to Vietnam, literally packing up and taking their show on the road.

The have already initiated the process by asking a key sourcing contact to convert an old Nokia factory in the northern Vietnamese province of Bac Ninh to handle the production of Pixel phones.

Data center server production was also rerouted to Taiwan last year.

The coronavirus threat is only speeding up the move into South East Asia and Google and Microsoft hope to avoid the geopolitical risk in the region.

Remember that all of this rejigging of production will add costs and only the biggest can absorb mega hits to the balance sheets.

As for the coronavirus, business is becoming more complicated as the ban on Chinese nationals and flights from China could build barriers to business, and now South Korea has joined the list.

Korea’s Samsung Electronics, the world's largest smartphone maker, has operated a smartphone supply chain in northern Vietnam for years but still relies on some components made in China.

While there are many moving parts, the average investor needs to wait on optimal entry points.

Japan announced school shutdowns for a month and tech shares have only priced in the coronavirus eventually entering the U.S., but if there are mass shutdowns of American cities and schools, then tech shares will see another stinging sell-off.

The contagion could eventually lead to the Olympics in Tokyo being canceled, high-profile corporate management getting infected, and the Chinese economy being sidelined for most of 2020.

All of these events are highly negative to the global economy which is why potential risks have exploded through the roof in such a short time.

Slinging mud at the wall will not work in times like this, but this does have the makings of a once-in-a-year entry point into tech shares.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.