In 1976, I joined the American Bicentennial expedition to climb Mount Everest led by my friend and mentor, Jim Whitaker. Since I was a late addition, there was no oxygen budget for me which, in those days, was very heavy and expensive.

Still, I was encouraged to climb as far as I could without it, which turned out to be up to Base Camp II at 21,600 feet. At that altitude, you couldn’t light a cigarette as the matches went out too quickly. There just wasn’t enough oxygen.

Out of 700 men on the team, including 600 barefoot Nepalese porters, only two made it to the top. By the time I made it back to Katmandu 150 miles away, I had lost 50 pounds, taking my weight down to a scarecrow 125.

You can see the metaphor coming already.

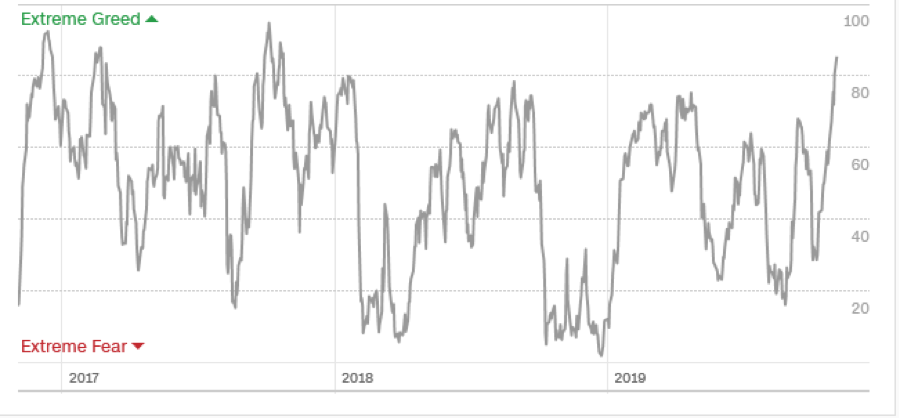

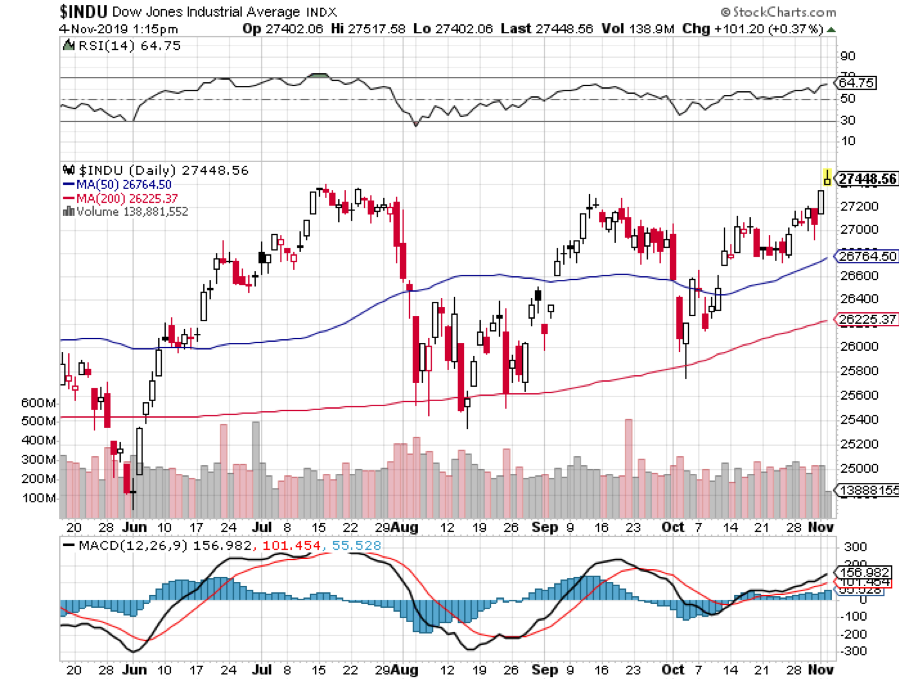

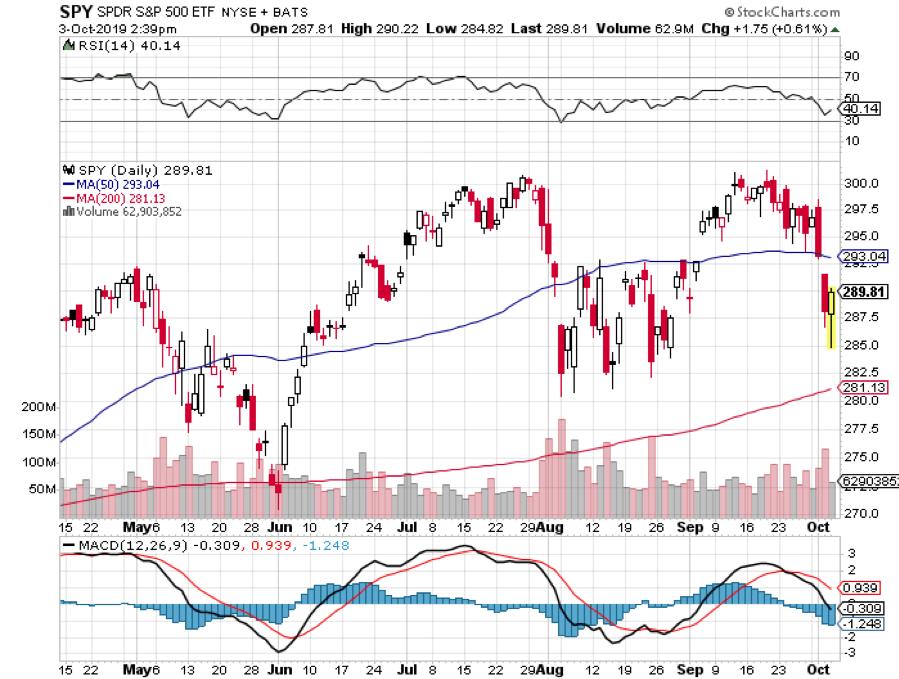

Here I am at my screen looking at 27,500 in the Dow Average and not only am I gasping for oxygen, I am ready to pass out. My Mad Hedge Market Timing Index hit a new high for 2019 at an acrophobic 85. All of this is happening in the face of slowly eroding fundamentals and a global economic slowdown.

Could the market go higher? You betcha! At least a couple percent more by yearend. Market bottoms are easy to identify when valuations hit decade lows. Market tops are impossible to gauge because greed is unquantifiable and knows no bounds.

I’ll give you a perfect example. The US and Japan signed the Plaza Accord in 1985 calling a doubling of the value of the yen against the dollar and the eventual transportation of half of Japan’s auto production capacity to the US. We all knew this would eventually destroy the Japanese economy. Yet the Nikkei Average rose for five more years until it finally crashed.

Of course, the impetus for all of this are artificially low-interest rates, which dropped 25 basis points again last week for the third time this year.

There were with two dissents, while the December rate cut futures fall to 20%. If we get Japanese levels of interest rates, we might get a Japanese type 30-year stagnant economy.

US Q3 GDP came in at 1.9% in its most recent report, better than expected, but we are still in a serious downtrend. The economy is most likely running at a lowly 1.5% rate now. Weakness is a sure thing, now the government has run out of money for special projects. Don’t count on more with a Democratic house. It’s not the bed of roses I was promised.

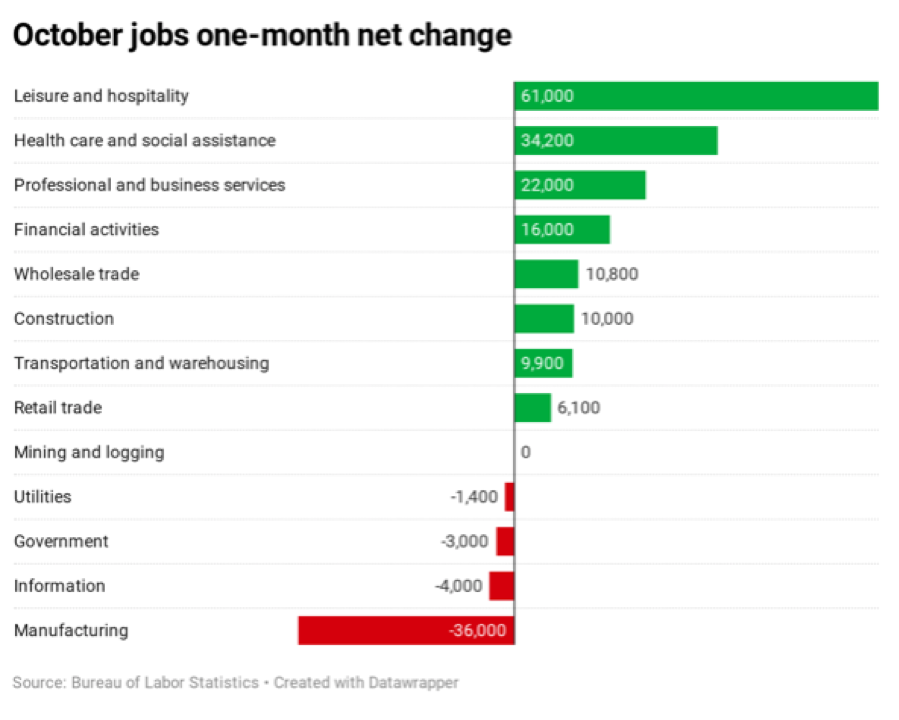

However, if there is trouble, you won’t see it in the employment data. The October Nonfarm Payroll Report surprised to the upside, at 128,000. Many expected much worse in the aftermath of the GM (GM) strike and Boeing (BA) grounding.

The headline Unemployment Rate ticked up 0.1% to 3.6%. The big gains were in Hospitality and Leisure, up a stunning 61,000, Health Care & Social Assistance, up 31,000, and Professional and Business Services, up 22,000. Manufacturing lost 36,000 jobs, a ten-year high. 20,000 temporary jobs were lost from the 2020 census wind down.

August and September were revised up by an unbelievable 95,000. The market loves these numbers.

Tesla shocked, bringing in a profit for only the third time in company history, and causing the stock to soar $55. The 100,000-unit production target within yearend looks within reach. Most importantly they opened up a new supercharger station in Incline Village, Nevada!

Tesla is now America’s most valuable car maker, beating (GM). The ideological Exxon-financed shorts have been destroyed once and for all. Buy (TSLA) on dips. There’s still a ten bagger in this one.

Amazon put out a gloomy Christmas forecast on the back of a disappointing earnings report, crushing the shares by 7%. Looks like the trade war might cause a recession next year. Q3 revenues were great, up 24% to an eye-popping $70 billion.

Good thing I took profits on the last option expiration. Poor Jeff Bezos, the abandoned son of an alcoholic circus clown, dropped $7 billion in net worth on Thursday. Buy (AMZN) on the dips.

The safest stock in the market, Microsoft (MSFT), says it’s all about the cloud. Azure revenues grew a stunning 59% in Q3. (MSFT) is now up 37% on the year. Keep buying every dip, if we ever get another one.

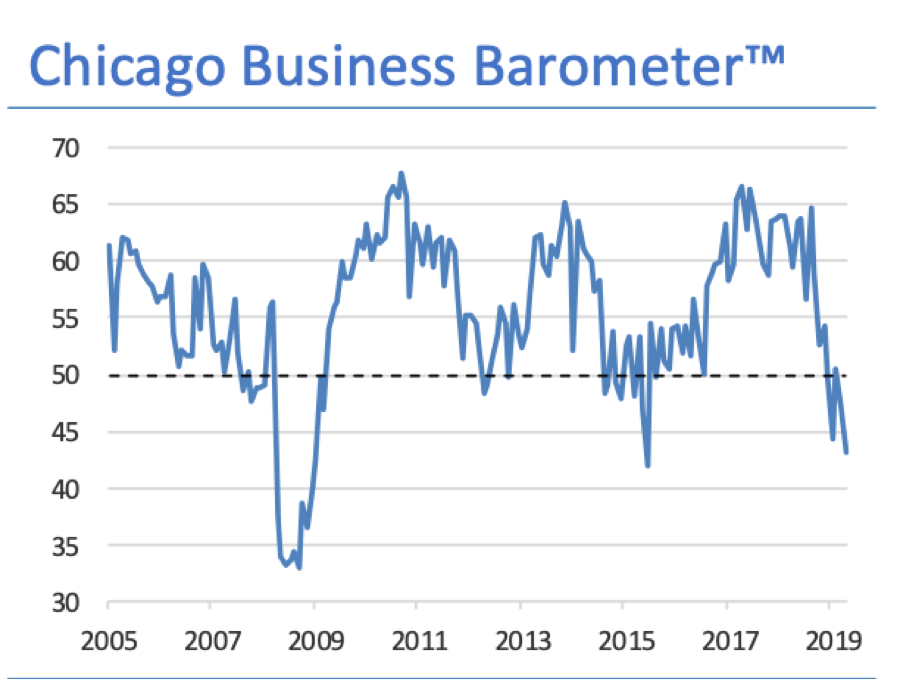

The Chicago PMI crashed, plunging from to 43.2, a four-year low. This horrific number was last seen during the recession scare of 2015. New orders have virtually disappeared, or order backlogs have vaporized. Inventories are soaring. This is the worst economic report this year and will cause a lot of economists’ hair to catch on fire.

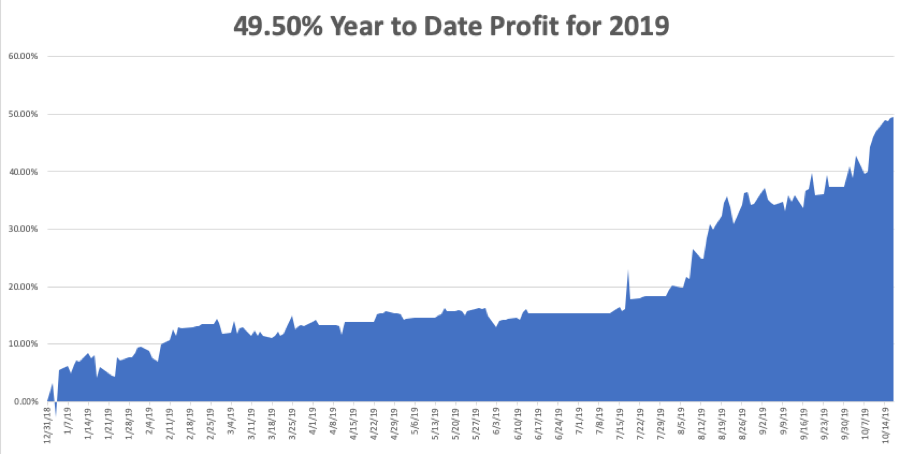

This was a week for the Mad Hedge Trader Alert Service to stay level at an all-time high. With only two positions left, in Boeing (BA) and Tesla (TSLA), not much else was going to happen.

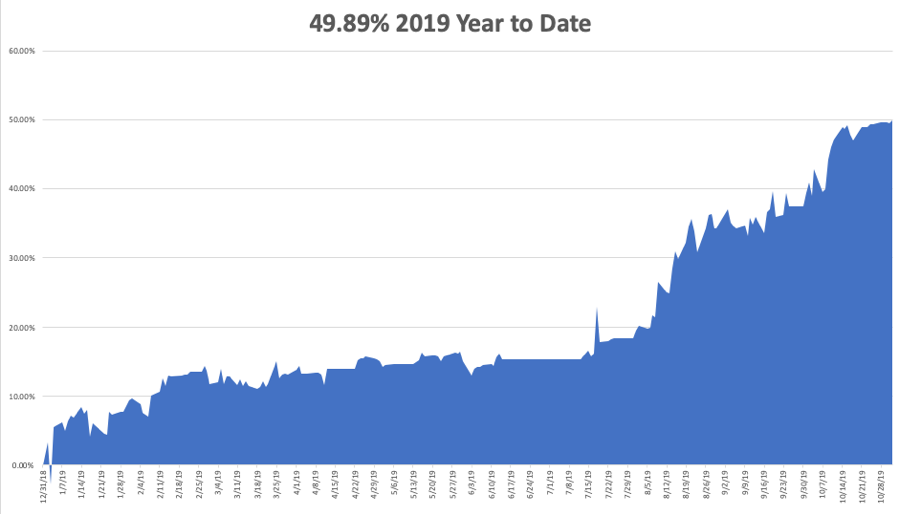

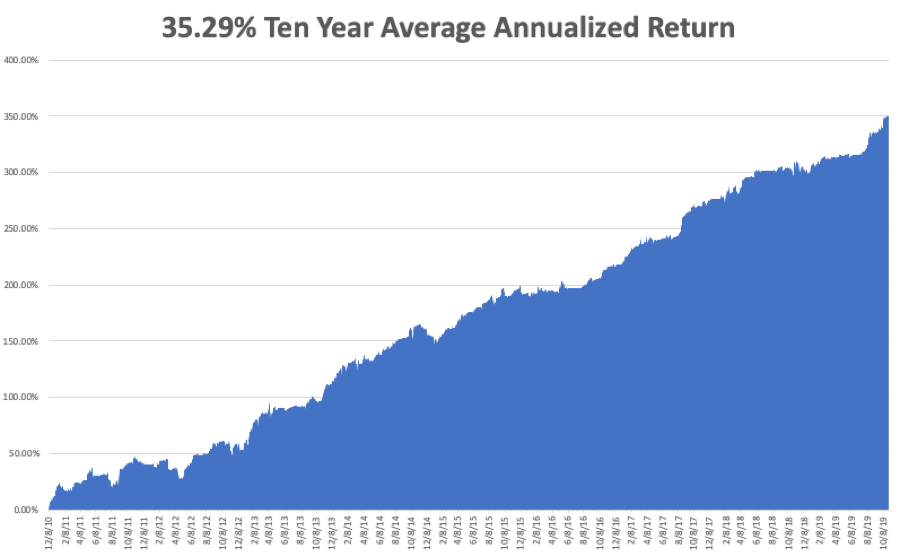

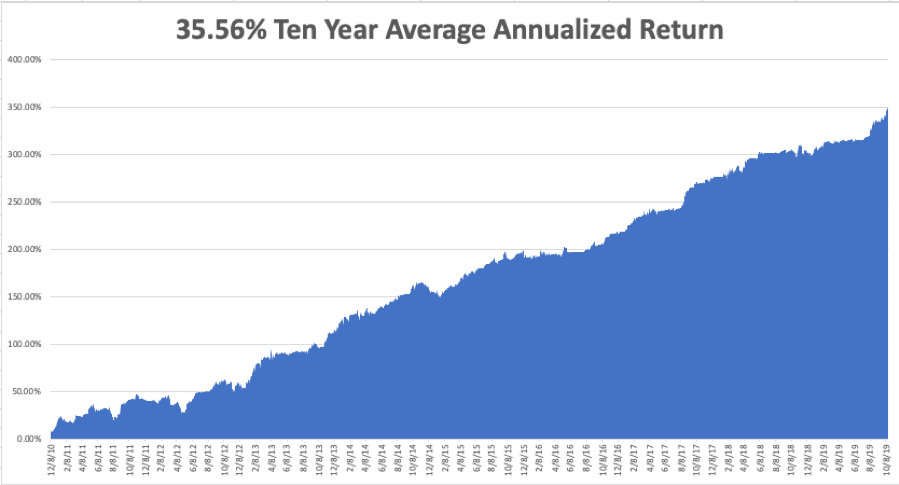

My Global Trading Dispatch reached new pinnacle of +350.03% for the past ten years and my 2019 year-to-date accelerated to +49.89%. The notoriously volatile month of October finished at +12.23%. My ten-year average annualized profit held steady at +35.29%.

The coming week is pretty non eventful of the data front after last week’s fireworks. Maybe the stock market will be non-eventful as well.

On Monday, November 4 at 8:00 AM, US Factory Orders for September are out. Uber (UBER) and Under Armor (UAA) report.

On Tuesday, November 5 at 8:00 AM, the October ISM Nonmanufacturing Index is published. US API Crude Oil Stocks are released at 2:30 PM EST. Peloton (PTON) reports.

On Wednesday, November 6, we get a raft of Fed speakers unrestrained by any impending meetings. QUALCOM (QCOM) and Humana (HUM) report.

On Thursday, November 7, there are a heavy duty series of bond auctions. Walt Disney (DIS) and Zoetis (ZTS) Report.

On Friday, November 8 at 8:00 AM, the University of Michigan Consumer Sentiment Indicator is learned.

The Baker Hughes Rig Count follows at 2:00 PM.

As for me, I am heading for Santa Cruz, California for the weekend to get out of the smoke and do some serious backpacking. I might even try to squeeze in a surfing lesson there. I’ll never give up.

By the way, several guests at the Tahoe conference remarked on the prominent scar on the side of my nose. That was caused by an ice ax that plunged straight through it in a fall while climbing Mount Rainer in 1967. Who patched it up and got me back down to the bottom? My friend Jim Whitaker.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader