Welcome to the first day of November, when the seasonals swing from negative to positive. The hard six months are over. The next six should be like shooting fish in a barrel.

At least that’s what happened in the past. The period from November 1 to May 31 has delivered the highest stock returns for the past 75 years.

So how do we play a hand that we have already been dealt full of aces and kings?

Load the boat with financials, like (MS), (GS), (BLK), (JPM), and (BAC). Notice that when we had the sharpest rise in interest rates in a year, financials barely moved when they should have crashed? That means they will soon start going up again.

You might have also observed that technology stock has been flat-lining when rising rates should have floored them. That means their torrid 20% earnings growth will keep floating their boats.

It gets better. We just learned that the GDP growth rate plunged in Q3 from a rip-roaring 6% rate to only 2%. What happens next? That 4% wasn’t lost, just deferred into 2022. The rip-roaring 6% growth rate returns. That’s why stocks are pushing up to new all-time highs right now.

So, buy the dips. We may have seen our last 5% correction of 2021. The only unknown is how markets will react to a Fed taper, which could come as early as Wednesday. But on the heels of that, we will get a $1.75 billion rescue package, the biggest in 50 years. One will cancel out the other, and then some.

Take a look at the ProShares Ultra Technology Fund (ROM), the 2X long ETF. I just analyzed its 30 largest holdings. Half are tech stocks that have been trash and are down 30% or more. The other half are at all-times highs, like Microsoft (MSFT) and Alphabet (GOOGL).

What happens next when the seasonals are a tailwind? The tech stocks that are down will rally because they are cheap, while the high stocks keep going because they are best of breed. I think (ROM) has $150 written all over it by March.

You’ve got to love Elon Musk, whose net worth is approaching $300 billion. When the pandemic broke, every automaker cancelled their chip orders for the rest of the year while Tesla took them all. Today, Detroit has millions of cars built but in storage because they are all missing chips. In the meantime, Tesla is snagging orders for 100,000 cars at a time.

Like I say, you gotta love Musk. Hey, Elon, call me! Why don’t you just buy the entire US coal industry and shut it down. It would only cost $5 billion, as market caps are so low. That would have more impact on the environment than another million Teslas. Worst affected would be China, where 70% of US coal now goes.

A continued major driver of the bull case for stocks is profit margins of historic proportions.

Q1 saw a 13% margin, Q2 13.5% and Q3 12.3%, and Q3 had to carry the dead weight of a delta impaired GDP growth rate of only 2.0%. Imagine what companies can do in Q4 when the growth rate is returning to a torrid 6% rate.

This has been one of my basic assumptions for the entire year and it seems it was I was alone in having it. This is where the 90% year-to-date performance comes from.

Inflation is Here to Stay, says top investing heavyweights, at least 4% through 2022. That means high inflation, higher financial shares, and higher Bitcoin prices. It’s going to take two years to unwind the mess at the ports that is driving prices.

Covid is Getting Knocked Out by a One-Two Punch, via a new round of booster shots and imminent childhood vaccinations. It could take new cases to zero in a year and give us a booming economy.

S&P Case Shiller is Still Rocketing, the National Home Price Index up 19.8% YOY in August. Phoenix (33.3%), San Diego (26.2%), and Tampa (25.9%) were the hot cities. This will continue for a decade but as a slower rate.

New Home Sales Pop, to 800,000. Annual median prices jump at an annual 18.7% to $408,000. The share of homes selling over $1 million increased from 5% to 9% in a year. It cost $500,000 to get a starter home in an Oakland slum these days. Homebuilders Sentiment Soars to 80. Buy (KBH), (PUL), and (LEN) on dips.

Bonds Melt Up, creating one of the best trade entry points of the year. A successful 30-year auction this week that took yields from 1.71% down to 1.52% in a heartbeat. It makes no sense. Buying bonds here is like buying oil in the full knowledge that someday it will go to zero. I am doubling my short position here. Look at the (TLT) December 2022 $150-$155 vertical bear put spread LEAPS which is offering a 14-month return of 54%. This is the month when the Fed has promised to begin the first of six interest rate hikes. Just buy it and forget about it.

Proof that the Roaring Twenties is Here. It’s demand that is spiking, the greatest ever seen, not supplies that are drying up in the supply chain issue. It should continue for a decade and the bull market in stocks that follows it. You heard it here first. Dow 240,000 here we come.

Apple Blows it in Q3, with millions of its phones lost at sea and no idea when unloads are possible, costing it $6 billion in sales. Revenues were up a ballistic 29% YOY. Buy (AAPL) on dips. I see $200 a year next year.

Amazon Craters, with both shrinking revenues and profits. Supply chain problems about with several billion of inventory trapped at sea off the coast of Long Beach. It plans to hire 275,000 to handle the Christmas rush. The stock hit a one year low. There is a time to buy (AMZN) on the dip, but not quite yet.

My Ten Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

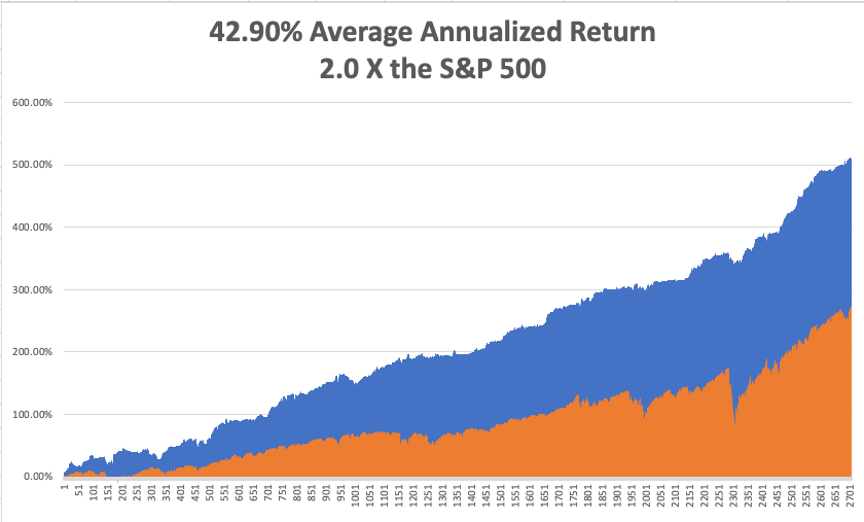

My Mad Hedge Global Trading Dispatch saw a massive +8.95% gain in =October. My 2021 year-to-date performance maintained 88.55%. The Dow Average is up 17.06% so far in 2021.

After the recent ballistic move in the market, I am continuing to run my longs in Those include (MS), (GS), (BAC), and a short in the (TLT). All are approaching their maximum profit point and we have nothing left but time decay to capture. So, I am going to run these into the November 19 expiration in 14 trading days. It’s like have a rich uncle write you a check one a day.

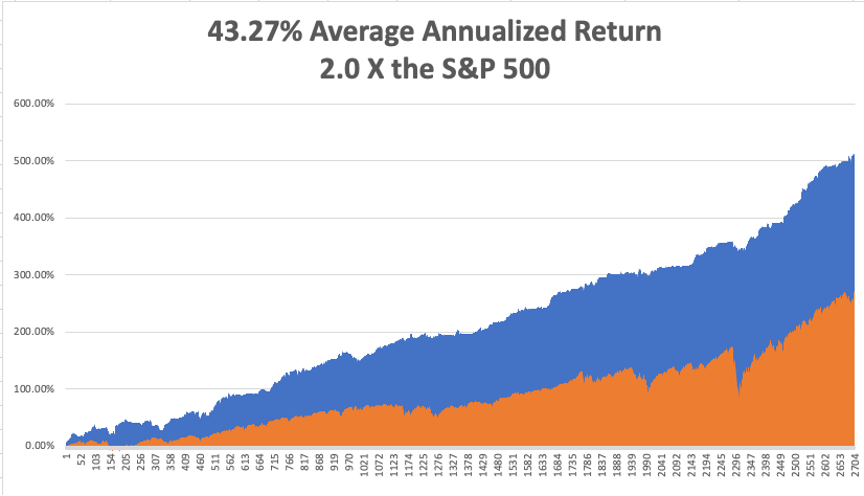

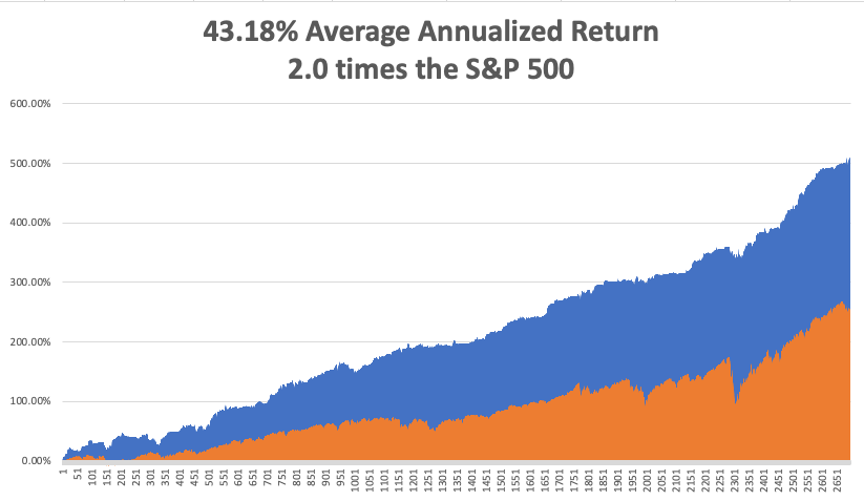

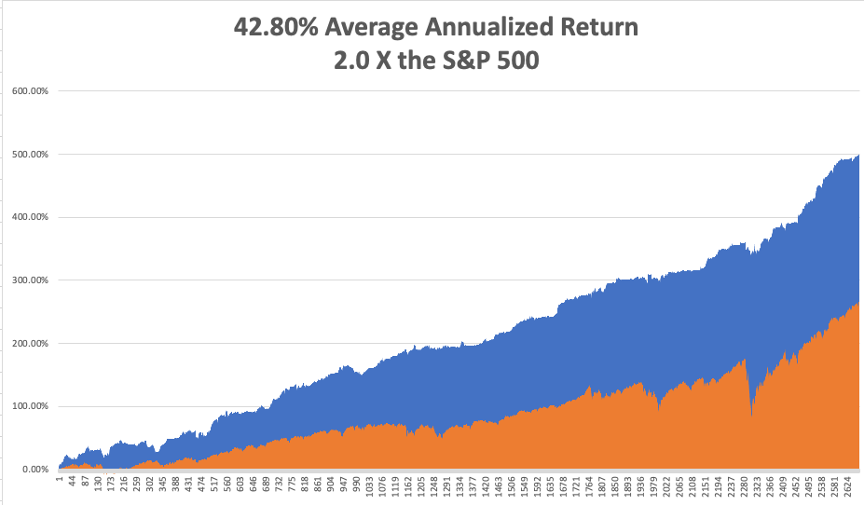

That brings my 12-year total return to 511.10%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return now stands at an unbelievable 42.90%, easily the highest in the industry.

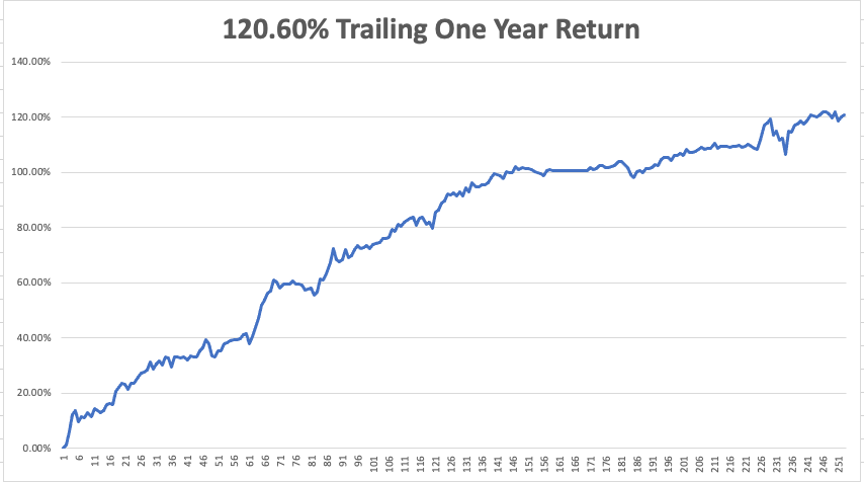

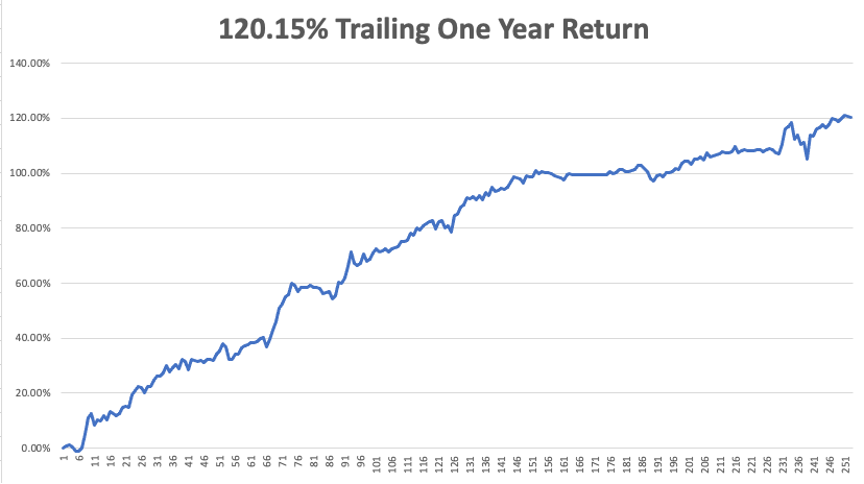

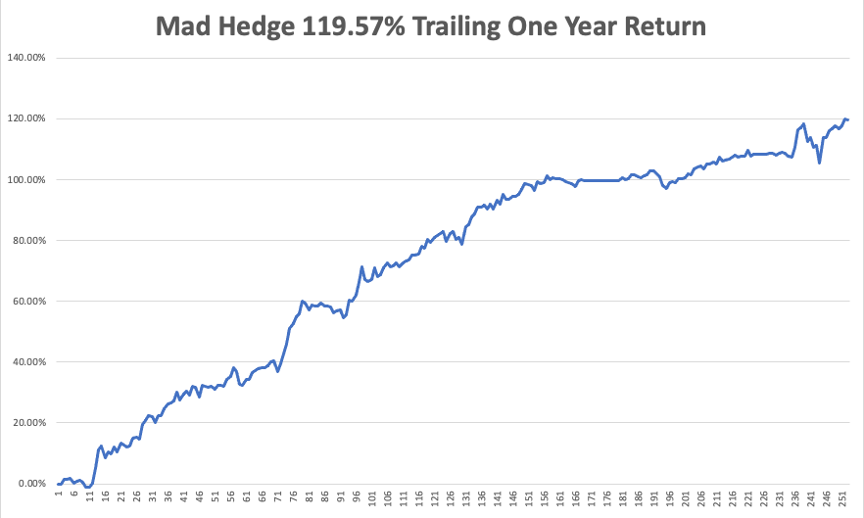

My trailing one-year return popped back to positively eye-popping 120.60%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 46 million and rising quickly and deaths topping 746,000, which you can find here.

The coming week will be slow on the data front.

On Monday, November 1 at 7:00 AM, the ISM Manufacturing PMI for October is out. Avis (CAR) Reports.

On Tuesday, November 2 at 1:30 PM, the API Crude Oil Stocks are released. Pfizer (PFE) reports.

On Wednesday, November 3 at 7:30 AM, the Private Sector Payroll Report is published. Etsy (ETSY) reports. At 11:00 AM, the Federal Reserve interest rate decision is announced, followed by a press conference.

On Thursday, November 4 at 8:30 AM, Weekly Jobless Claims are announced. Airbnb reports (ABNB).

On Friday, November 5 at 8:30 AM, The October Nonfarm Payroll Report is released. DraftKings (DKNG) reports. At 2:00 PM, the Baker Hughes Oil Rig Count are disclosed.

As for me, I have been known to occasionally overreach myself, and a trip to the bottom of the Grand Canyon a few years ago was a classic example.

I have done this trip many times before. Hike down the Kaibab Trail, follow the Colorado River for two miles, and then climb 5,000 feet back up the Bright Angle Trail for a total day trip of 27 miles.

I started early, carrying 36 pounds of water for myself and a companion. Near the bottom, there was a National Park sign stating that “Being Tired is Not a Reason to Call 911.” But I wasn’t worried.

The scenery was magnificent, the colors were brilliant, and each 1,000 foot descent revealed a new geologic age. I began the long slog back to the south rim.

As the sun set, it was clear that we weren’t going to make to the top. I was passed by a couple who RAN the entire route who told me “better hurry up.” I realized that I had erred in calculating the sunset, it'staking place an hour earlier in Arizona than in California.

By 8:00 PM it was pitch dark, the trail had completely iced up, and it was 500 feet straight down over the side. I only had 500 feet to go but the batteries on my flashlight died. I resigned myself to spending the night on the cliff face in freezing temperatures.

Then I saw three flashlights in the distance. Some 30 minutes later, I was approached by three Austrian Boy Scouts in full dress uniform. I mentioned I was a Scoutmaster and they offered to help us up.

I grabbed the belt of the last one, my companion grabbed my belt, and they hauled us up in the darkness. We made it to the top and I said, “thank you”, giving them the international scout secret handshake.

It turned out that I wasn’t in great shape as I thought I was. In fact, I hadn’t done the hike since I was a scout myself 30 years earlier. I couldn’t walk for three days.

Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Happy Halloween!