I usually write my Monday strategy letters in the middle of the night in my mind, from 2:00 AM to 3:00 AM, because my feet are too hot, too cold, or because my hip hurts. Then I go back to sleep. If I remember half of it the next morning, then I get a great letter.

I often like to refer to old proven market nostrums and show how true they really are. One of my favorites is the concept of the “good” market and the “bad” market.

The good market is the one for bonds. Vastly more research goes into bonds than stocks because that’s where the respectable, safe, widows and orphan money goes. Global bond markets are also far bigger, worth about $120 trillion. Bond traders usually began their journey at Harvard or Wharton, speak with clipped upper-class accents, and belong to exclusive private clubs that would never let you in for lunch, even with an invitation from a member.

Suffice it to say that the bond market is always right. Their relaxed lifestyle can be explained by the fact that they really only have two variables to look at, Fed policy and the actual supply and demand for money. Working in the bond market is almost like a sinecure, sending you a paycheck every month because you are entitled to it.

The stock market is the complete opposite.

While the bond market was polishing the teacher’s apple at the head of the class, the stock market was smoking cigarettes in the bathroom, endlessly catching detention. The stock market is also smaller, worth about $50 trillion. While bond traders are attending their Rotary meetings, stock traders binge drink and tear up the roads with their new Porsches and Ferraris.

Needless to say, stock traders are always wrong.

That’s because they face a hopeless dilemma. While bond traders have to contemplate only two variables, stock traders have to deal with millions. They have to cope with the hundreds of input variables per company that affect their earnings, and there are over 3,000 companies that trade in the US alone.

To illustrate the point, look at the recent market action.

Both markets have been driven by the same massive liquidity created by the government since 2009. The bond market peaked in August 2020 when it saw the free lunch of ultra-low interest rates soon ending. Stocks didn’t peak until January 2021, some 17 months later. It’s clear that stock traders suffer from a severe learning disorder.

And they’re doing it again.

After a 49% swan dive over two years plus, bonds bottomed on October 14. Stocks may not finally bottom until the spring, six months after bonds. Bonds are now betting that the recession has already begun, we just haven’t seen it in the data yet. Stocks are betting that the recession doesn’t start until 2023, if at all. That’s why it’s been going up.

As for me, I have traded both stocks AND bonds. That’s because before there were stocks, there were bonds as the only thing to trade. As you may recall, stocks were moribund in the 1970s. On top of that, you can add foreign exchange, precious metals, commodities, and volatility. There essentially isn’t anything I haven’t traded.

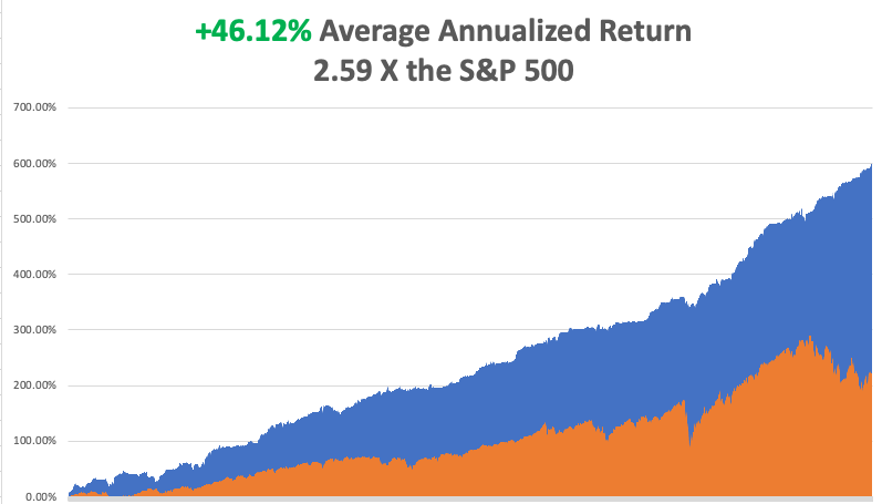

My performance in December has so far tacked on another robust +3.37%. My 2022 year-to-date performance ballooned to +87.05%, a spectacular new high. The S&P 500 (SPY) is down -13.61% so far in 2022.

It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high +104.88%.

That brings my 14-year total return to +599.61%, some 2.60 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to +46.12%, easily the highest in the industry.

I took profits in my triple weighting in bonds last week (TLT), booking some serious profits. All my remaining positions are profitable, shorts in (XOM), (OXY), (TSLA), (SPY), and one long in (TSLA), with 50% cash for a 30% net short position. We’ve just had a great run and the time to pay the piper is fast approaching.

With an +87.05% profit in hand this year, I don’t get a lot of complaints. However, I have been getting some lately because my trade alerts can be hard to get into.

Of course, it can be challenging to execute when 6,000 subscribers are trying to get into the same position at the same time. But when the entire world joins in, that raises the difficulty to a whole new level.

That is what happened with my trade alert to BUY the (TLT) on November 18. It was the trade alert around the world and the next day, bonds rocketed by $3.50. I laddered in with more positions with higher strike prices getting to a triple long in the bond market. When your trade alerts have a 95% success rate, that is what happens. It is the price of being right, which is better than the alternative.

When I first entered this trade, I thought the ten-year US Treasury yield would plunge from 4.46% to 2.50% by June 2023, taking the (TLT) from $91 to $120.

With the (TLT) at $108 on Friday and the ten-year yield at 3.50%, we are already halfway there. If I AM right and bond yields drop to 2.50%, the 30-year fixed mortgage rate will also drop below 4.00% and you can forget about any real estate crash. That's why the homebuilders (LEN), (KBH), and (PHM) are up 30%-40% since October.

With the ballistic moves in some Chinese stocks over the last two weeks (Alibaba (BABA) up 58%, Baidu ((BIDU) adding 47%, I have received a surge in inquiries about the prospects of the US going to war with the Middle Kingdom.

I have been asked this question continuously for the last 50 years, by several Presidents of the United States on down, and my answer is always the same.

There is not a chance.

The reason is very simple. The Chinese can’t feed themselves. They have not been able to do so for 100 years. With a population of 1.2 billion, the Chinese will never be able to feed themselves.

That means the Chinese are highly dependent on international trade to finance their food imports. When trade is vibrant, China prospers.

When it doesn’t, they start stacking up the bodies like cordwood for mass cremation, as happened when China suffered its last major famine. I know because I was there in the 1970s, and I’ll never forget that smell. As you quickly learn during a famine, there is no substitute for food.

So, what are the chances of China bombing their food supply? I’d say zero. A disruption of even a few months and people start to go hungry. Will they bluff, bluster, and obfuscate for domestic consumption? Every day of the year and that is what they are doing now.

As for buying Chinese stocks, I think I’ll pass for now. There are just too many great American ones on sale. The Chinese moves above are only taking place after horrific declines, 78% for (BABA), and 81% for (BIDU).

And before I go on to the data points, I want to recall a funny story.

One day in London 40 years ago, one of my junior traders at Morgan Stanley walked in with a big smile on his face. He had just gotten a great deal on a Ferrari Testarossa, which then retailed at $360,000, a lot of money for a 25-year-old East Ender in those days.

I thought to myself, “There are no great deals on Ferraris.”

A few months later, he totaled the Ferrari after a late night of binge drinking and racing on London’s damp streets, breaking the vehicle cleanly in half. The insurance company determined that his car was in fact two different Ferraris with two different VIN numbers that had been welded together. The car had split apart at the welds.

Some clever entrepreneur took the intact front end of a rear-ended car and the pristine back half of a car with destroyed hood and made one whole good Ferrari. Since my trader had only insured one car and not two, the insurance company refused to honor the claim.

All I can say is “Beware of friends bearing false Ferraris.”

Nonfarm Payroll Report Comes in Hot in November at 263,000, socking markets for 500 points. A December rate hike of 75 basis points has been firmly put back on the table. The Headline Unemployment Rate stays at a near-record high 3.7%. Average Hourly Earnings were up an inflationary 0.6%. Wages are up 5.1% YOY. The dollar soared on the prospect of higher rates for longer.

JOLTS Job Openings Report Comes in Weaker at 10.33 million in October, down 353,000 from September. High interest rates are finally taking their toll. There are still 1.7 job openings per applicant.

Key Inflation Read Drops, the Personal Consumption Expenditures Price Index falling 0.2% in October, excluding food and energy. It sets up a weak CPI on December 13, which would be very stock market positive.

Powell Turns Dovish, well, sort of, indicating that smaller interest rate hikes could start in December. The comments were made at a Brookings Institution meeting on Wednesday. Stocks rallied big on the news.

US to Ease Venezuela Sanctions, allowing Chevron to resume pumping there for six months after a three-year hiatus. It’s an out-of-the-blue big negative for oil prices. Venezuelan oil production has plunged from 2.1 million barrels a day to only 679, 000 thanks to gross mismanagement of the economy. But beggars can’t be choosers on the energy front. Good thing I’m running a double short in the sector. It’s the last think OPEC plus wanted to hear.

Don’t Expect a Housing Crash, as the financial system was vastly stronger than it was in 2008. A mild recession is already priced in, and bank balance sheets are rock solid. Buy the homebuilders on the next dips now coming off from horrific earnings, (KBH), (PHM), and (LEN).

Don’t Expect an iPhone 14 for Christmas, as pandemic-driven production shutdowns and Foxconn riots in China crimp supplies. It could be a longer wait if you want the new deep purple color. Avoid (AAPL) for now. I expect another big tech dive in 2023.

China Riots Tank Market, raising the specter of extended supply chain problems, especially for Apple (AAPL). Oil was especially hard hit as China is its largest buyer, hitting a two-year low and giving up all 2022 gains. China seems to be sacrificing its older generation, not giving them priority for vaccinations which don’t work anyway. This isn’t going away in a day. Transition to India will take a decade.

Case Shiller Plunges, the National Home Price Index Taking a 1.2% hit in September to 10.6%. Miami, Tampa, and Charlotte, NC showed the biggest YOY increases. You know the reasons why.

Home Rentals to Stay Sticky at Record Levels, with gains at 25-35% over the past 24 months. Homebuyers frozen out of the market by record-high interest rates are forced to rent at any price.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With the economy decarbonizing and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side will be far more efficient and profitable than the old. Dow 240,000 here we come!

On Monday, December 5 at 8:00 AM EST, the ISM Nonmanufacturing PMI for November is out.

On Tuesday, December 6 at 8:30 AM, the Mad Hedge Traders & Investors Summit begins. Click here to register.

On Wednesday, December 7 at 7:30 AM, the Crude Oil Stocks are announced. It’s pearly Harbor Day.

On Thursday, December 8 at 8:30 AM, the Weekly Jobless Claims are announced. We also get the Producer Price Index for November.

On Friday, December 9 at 8:30 AM, the Producer Price Index for November. At 2:00, the Baker Hughes Oil Rig Count is out.

As for me, I am sitting here in front of the fire at my place in the Berkeley Hills and it is freezing cold and pouring rain outside. Heaven knows we need it.

I’m going to San Francisco later today to do some Christmas shopping. It’s not the ideal time but in my hopelessly busy schedule, this was the only day this year allocated for this chore.

For some reason, last night I recalled my days as an Ivy League Princeton professor, which I hadn’t thought about for decades.

When Morgan Stanley was a private partnership, before it went public in 1987, the firm represented the cream of the US establishment. There wasn’t anyone in business, industry, or politics you couldn’t reach through one of the company’s endless contacts. We referred to it as the “golden Rolodex.”

One day in the early 1980s, a managing director asked me a favor. Since he had landed me my job there, I couldn’t exactly say no. He had committed to teaching a graduate night class in International Economics at his alma mater, Princeton University, but a scheduling conflict had prevented him from doing so.

Since I was then the only Asian expert in the firm, could I take it over for him? If I had extra time to kill, I could always spend it in the Faculty Club.

I said “sure.”

So, the following Wednesday found me at Penn Station boarding a train for the leafy suburb about an hour away. On the way down, I passed the locations of several Revolutionary War battles. When we pulled into Princeton, I realized why they called these places “piles”. The gray stone ivy-covered structures looked like they had been there a thousand years.

My students were whip-smart, spoke several Asian languages, and asked a ton of questions. Many came from the elite families who owned and ran Asia. I understood why my boss took the gig.

I turned out to be pretty popular at the faculty Club, with several profs angling for jobs at Morgan Stanley. Rumors of the vast fortunes being made there had leaked out.

Princeton was weak in my field, DNA research. But as the last home of Albert Einstein, it was famously strong in math and physics. Many of the older guys had worked with the famed Berkeley professor, Robert Oppenheimer, on the Manhattan Project.

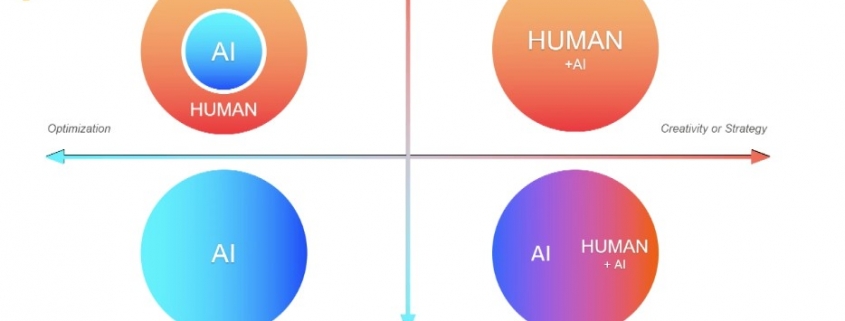

I was still a mathematician of some note those days, so someone asked me if I’d like to meet John Nash, the inventor of Game Theory, which won him a Nobel Prize in Economics in 1994. Nash’s work on partial differential equations became the basis for modern cryptography. I was then working on a model using Game Theory to predict the future of stock markets. It still works today and is the basis the Mad Hedge Market Timing Algorithm.

Weeks later found me driven to a remote converted farmhouse in the New Jersey countryside. On the way, I was warned that Nash was a bit “odd,” occasionally heard voices speaking to him, and rarely came to the university.

I later learned that his work in cryptography had driven him insane, given all the paranoia of the 1950s. Having worked in that area myself, that was easy to understand. His friends hoped that by arguing against his core theories, he would engage.

When I was introduced to him over a cup of tea, he just sat there passively. I realized that I was going to have to take the initiative so as a stock market participant, I immediately started attacking Game Theory. That woke him up and started the wheels spinning. It hadn’t occurred to him that game theory could be used to forecast stock prices.

His friends were thrilled.

I later went on to meet many Nobel Prize winners, as the Nobel Foundation was an early investor in my hedge fund. Whenever a member of the Swedish royal family comes to California, I get an invitation to lunch for the Golden State’s living Nobel laureates. It turns out that 20% of all the Nobel Prizes awarded since its inception live here. Last time, I sat next to Milton Friedman, and I argued against HIS theories.

The other thing I remembered about my Princeton days is my discovery of the “professor's dilemma.” Sometimes a drop-dead gorgeous grad student would offer to go home with me after class. I was happily married in those days with two kids on the way, so I respectfully declined, despite my low sales resistance.

No away games for me.

Stay healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

The Nobel Prize