Mad Hedge Biotech and Healthcare Letter

February 23, 2023

Fiat Lux

Featured Trade:

(BATTLE FOR GENE THERAPY SUPREMACY)

(CRSP), (NVS), (BIIB), (BLUE), (VYGR), (GBIO), (SIOX), (NTLA), (EDIT), (VRTX), (PRIME), (BEAM)

Mad Hedge Biotech and Healthcare Letter

February 23, 2023

Fiat Lux

Featured Trade:

(BATTLE FOR GENE THERAPY SUPREMACY)

(CRSP), (NVS), (BIIB), (BLUE), (VYGR), (GBIO), (SIOX), (NTLA), (EDIT), (VRTX), (PRIME), (BEAM)

Gene therapy is arguably one of the most fascinating and revolutionary fields in the healthcare and biotechnology industry.

A significant reason for the excitement behind gene therapy is that it provides the possibility of “functional cures,” such as “one-and-done treatments,” for patients. It’s also why these therapies are some of the most costly on the market.

For example, Zolgensma from Novartis (NVS), which focuses on treating spinal muscular atrophy in infants, has a whopping $2 million-plus price tag. Despite that, it’s considered the best option.

For context, its counterpart, Spinraza from Biogen (BIIB), costs roughly $750,000 in the first year of treatment. Unlike Zolgensma, Spinraza needs to be administered four times each year. After the first treatment, patients would need to pay $350,000 per annum. By the fifth year, Spinraza has surpassed the treatment cost of Zolgensma.

Despite its incredible potential, gene therapy is one of the riskiest bets.

Take Bluebird Bio (BLUE) into consideration. This biotech has won not only one but two regulatory approvals for its innovative gene therapies. One is for Skysona, which targets a rare cerebral condition called adrenoleukodystrophy; the other, Zynteglo, is for the blood disorder beta-thalassemia. Unfortunately, this biotech’s price has slid by more than 90% in the past five years.

Working on gene therapies is filled with complicated and challenging obstacles. Most companies in this segment ended up burning through their cash without successfully launching a marketable product. Some examples of these are Voyager Therapeutics (VYGR), Generation Bio (GBIO), and Sio Gene Therapies (SIOX).

However, there is a field in the gene therapy world that has substantially rewarded investors: CRISPR gene editing.

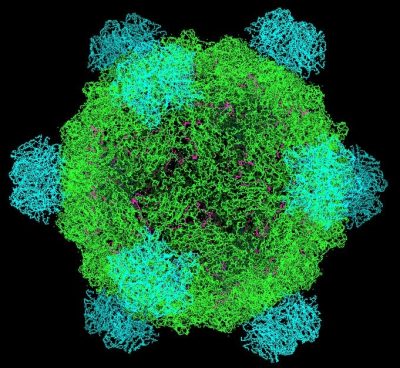

CRISPR means Clustered, Regularly Interspaced Short Palindromic Repeats, which was discovered by Jenifer Doudna and Emannualle Charpentier. Their discovery won the Nobel Prize for Chemistry in 2020.

Basically, CRISPR is utilized by bacteria to recognize genetic sequences that belong to dangerous or harmful viruses and cleave them via specialized enzymes like CAS-9. Eventually, Doudna and Charpentier discovered that the system could be modified to target and remove, destroy, or even edit damaging genetic sequences in human beings.

This discovery gave birth to many biotech companies. Intellia Therapeutics (NTLA) was the brainchild of Doudna, while Charpentier co-founded CRISPR Therapeutics (CRSP).

Over the past five years, NTLA's share price has risen by 146% while CRISPR skyrocketed by 210%. In comparison, the S&P 500 recorded a 53% gain within the same timeframe.

Given the volatility of the field and market volatility, other CRISPR-centered companies failed to replicate this success.

The share price of Editas Medicine (EDIT) fell by 55% over the past five years. Caribou Biosciences (CRBU) also failed to ride the momentum and slid by 44%.

Still, there are positive updates amid the struggles of the sector.

The latest news is from CRISPR Therapeutics, which expects several catalysts in 2023 thanks to its promising pipeline of candidates and clinical trials. So far, one of the most anticipated catalysts is its biologics license application for its sickle cell disease candidate, which the company aims to file by March 2023.

CRISPR Therapeutics developed this candidate, called exa-cel, alongside Vertex Pharmaceuticals (VRTX). It would be the first-ever Crispr-based therapy to edit or rewrite faulty genes if approved. Based on the company’s data, patients who underwent this one-time treatment have continued to be free of sickle cell disease symptoms.

Every year, 100,000 patients in the US are reported to suffer from sickle cell disease. Many companies have offered treatments for this condition for years but no cure. Hence, CRISPR and Vertex’s one-and-done therapy has received a fast-tracked designation. Consequently, this would give the developers sought-after market exclusivity.

As anticipated, CRISPR Therapeutics’ competitors are hot on its heels with sickle cell disease treatments of their own. To date, Prime Medicine (PRME), Beam Therapeutics (BEAM), Editas, and Intellia have candidates queued for clinical trials.

Overall, the gene editing sector continues to be an exciting and interesting field. Investors looking to take part of the action in this segment should consider buying and holding CRISPR Therapeutics stock for at least five years because the company has a reasonable chance of becoming the most dominant name in the business soon.

Global Market Comments

January 20, 2023

Fiat Lux

Featured Trade:

(WILL SYNBIO SAVE OR DESTROY THE WORLD?),

(XLV), (XPH), (XBI), (IMB), (GOOG), (AAPL), (CSCO), (BIIB)

CLICK HERE to download today's position sheet.

Some 50 years ago, when I was a biotechnology student at UCLA, a handful of graduate students speculated about how dangerous our work really was.

It only took us an hour to figure out how to synthesize a microbe that had a 99% fatality rate, was immune to antibiotics and was so simple it could be produced in your home kitchen.

Basically, a bunch of bored students discovered a way to destroy the world.

We voiced our concerns to our professors, who immediately convened a national conference of leaders in the field. Science had outpaced regulation, as it always does. They adopted standards and implemented safeguards to keep this genie from getting out of the bottle.

Four decades later scientists have been successful at preventing a “doomsday” bug from accidentally escaping a lab and wiping out the world’s population.

That is, until now.

In 2010, Dr. Craig Venter created the first completely synthetic life form able to reproduce on its own. Named “Phi X174,” the simple virus was produced from a string of DNA composed entirely on a computer. Thus was invented the field of synthetic biology, better known as “Synbio.”

Venter’s homemade creature was your basic entry-level organism. Its DNA was composed of only 1 million base pairs of nucleic acids (adenine, thymine, cytosine, guanine, and uracil), compared to the 3 billion pairs in a human genome. Shortly thereafter, Venter one-upped himself by manufacturing the world’s first synthetic bacteria.

The work was hailed as the beginning of a brave new world that will enable biology to make the same dramatic advances in technology that computer science did in the 20th century. Dr. Drew Endy of Stanford University says that Synbio already accounts for 2% of US GDP and is growing at a breakneck 12% a year. He predicts that Synbio will eventually do more for the economy than the Internet and social media combined.

You may recall Craig Venter as the man who first decoded the human genome in 2003. The effort demanded the labor of thousands of scientists and cost $3 billion. We later learned that the DNA that was decoded was Craig’s own. Some five years later, the late Steve Jobs spent $1 million to decode his own genes in a vain attempt to find a cure for pancreatic cancer.

Today, you can get the job done for $1,000 in less than 24 hours. That’s what movie star Angelina Jolie did, who endured a voluntary double mastectomy when she learned her genes guaranteed a future case of terminal breast cancer.

The decoding industry is now moving to low-cost China, where giant warehouses have been built to decode the DNA of a substantial part of humanity. That should soon drop the price to $100. It’s all about full automation and economies of scale.

This technology is already spreading far faster than most realize. In 2004, MIT started the International Genetically Engineered Machine Contest where college students competed to construct new life forms. Recently, a high school division was opened, attracting 194 entries from kids in 34 countries. Gee, when I went to wood shop in high school, it was a big deal when I finished my table lamp.

This will make possible “big data” approaches to medical research that will lead to cures of every major human disease, such as cancer, heart disease, diabetes, and more within our lifetimes. This is why the healthcare (XLV), biotechnology (XBI), and pharmaceutical (XPH) sectors have been top performers in the stock market for the past two years. It’s not just about Obamacare.

The implications spread far beyond healthcare. IBM (IBM) is experimenting with using DNA-based computer code to replace the present simple but hugely inefficient binary system of 0’s and 1’s. “DNA-based computation” is prompting computer scientists to become biochemists and biochemists to evolve into computer scientists to create “living circuit boards.” Google (GOOG), Apple (AAPL), and Cisco (CSCO) have all taken notice.

We are probably only a couple of years away from enterprising hobbyists downloading DNA sequences from the Internet and building new bugs at home with a 3D printer. Simple organisms, like viruses, would need a file size no larger than one needed for a high-definition photo taken with your iPhone. They can then download other genes from the net, creating their own customized microbes at will.

This is all great news for investors of every stripe, and will no doubt accelerate America’s economic growth. But it is also causing governments and scientists around the world to wring their hands, seeing the opening of a potential Pandora’s box. What if other scientists lack Venter’s ethics, who went straight to President Obama for security clearance before he made his findings public?

If we can’t trust our kids to drink, drive, or vote, then how responsibly will they behave when they get their hands on potential bioterror weapons? How many are familiar with Bio Safety Level 4 (BSL) standards? None, I hope.

In fact, the race is already on to weaponize synbio. In 2002, scientists at SUNY Stonybrook synthesized a poliovirus for the first time. In 2005, another group managed to recreate the notorious H1N1 virus that caused the 1918 Spanish Flu epidemic. Some 50-100 million died in that pandemic within 2 years.

Then in 2011, Ron Fouchier of the Erasmus Medical Center in Holland announced that he had found a way to convert the H5N1 bird flu virus, which in nature is only transmitted from birds to people, into a human to human virus. Of the 565 who have come down with bird flu so far, which originates in China, 59% have died.

It didn’t take long for the Chinese to get involved. They have taken Fouchier’s work several steps further, creating over 127 H5N1 flu varieties, five of which can be transmitted through the air, such as from a sneeze. The attributes of one of these just showed up in the latest natural strain of bird flu, the H7N9.

The World Health Organization (WHO) and the Center for Disease Control (CDC) in Atlanta, Georgia are charged with protecting us from outbreaks like this. But getting the WHO, a giant global bureaucracy, to agree on anything is almost impossible unless there is already a major outbreak underway. The CDC has seen its budget cut by 25% since 2010 and has lost another 5% due to the US government sequester.

The problem is that the international organizations charged with monitoring all of this are still stuck in the Stone Age. Current regulations revolve around known pathogens, like smallpox and the Ebola virus, that date back to the 1960s when the concern was about moving lethal pathogens across borders via test tubes.

That is, oh so 20th century. Thanks to the Internet, controlling information flow is impossible. Just ask Muammar Gaddafi and Bashar Al Assad. Al Qaida has used messages embedded in online porn to send orders to terrorists.

Getting international cooperation isn’t that easy. Only 35 countries are currently complying with the safety, surveillance, and research standards laid out by the WHO. Indonesia refused to part with H5N1 virus samples spreading there because it did want to make rich the western pharmaceutical companies that would develop a vaccine. African countries say they are too poor to participate, even they are the most likely victims of future epidemics.

Scientists have proposed a number of safeguards to keep these new superbugs under control. One would be a dedicated sequence of nucleic acid base pairs inserted into the genes that would identify its origin, much like a bar code at the supermarket. This is already being used by Monsanto (MON) with its genetically modified seeds. Another would be a “suicide sequence” that would cause the germ to self-destruct if it ever got out of a lab.

One can expect the National Security Agency to get involved, if they haven’t done so already. If they can screen our phone calls for metadata, why not high-risk DNA sequences sent by email?

But this assumes that the creators want to be found. The bioweapon labs of some countries are thought to be creating new pathogens so they can stockpile vaccines and antigens in advance of any future conflict.

There are also the real terrorists to consider. When the Mubarak regime in Egypt was overthrown in 2011, demonstrators sacked the country’s public health labs that had been storing H5N1 virus. Egypt has one of the world’s worst bird flu problems, due to the population’s widespread contact with chickens.

It is hoped that the looters were only in search of valuable electronics they could resell, and tossed the problem test tubes. But that is only just a hope.

I have done a lot of research on this area over the decades. I even chased down the infamous Unit 731 of the Japanese Imperial Army that parachuted plagued infected rats into China during WWII, after first experimenting on American POWs.

The answer to the probability of biowarfare always comes back the same. Countries never use this last resort for fear of it coming back on their own population. It really is an Armageddon weapon. Only a nut case would want to try it.

Back in 1976, I was one of the fortunate few to see in person the last living cases of smallpox. As I walked through a 15th century village high in the Himalayas in Nepal, two dozen smiling children leaned out of second-story windows to wave at me. The face of everyone was covered with bleeding sores. And these were the survivors. Believe me, you don’t want to catch it yourself.

Sure, I know this doesn’t directly relate to what the stock market is going to do today. But if a virus escaped from a rogue lab and killed everyone on the planet, it would be bad for prices, wouldn’t it?

I really hope one of the kids competing in the MIT contest doesn’t suffer from the same sort of mental problems as the boy in Newton, Connecticut did.

Mad Hedge Biotech and Healthcare Letter

December 1, 2022

Fiat Lux

Featured Trade:

(A RECESSION-PROOF STOCK)

(LLY), (ESALY), (BIIB), (JNJ)

Whispers of a recession in 2023 plague virtually every corner of the world. Nowadays, fund managers and Wall Street leaders are developing strategies to brace themselves for what’s to come next.

Inflation continues to be a cause of alarm, and a more unstable growth backdrop not only in the United States but also across the globe could drag down earnings in almost all industries. That means tactics to play defense are all the rage these days.

With the market meltdown this year, several names in the biotechnology and healthcare industry managed to buck the trend and even rise significantly. One of them is Eli Lilly (LLY).

Eli Lilly has surged by 33% in 2022 and continues to outperform the market amid the economic turmoils and financial crises; let’s check out what’s under its hood and see if it’s a good stock to add to a recession-proof portfolio.

Although it wasn’t the major player in the recent updates on Alzheimer’s disease treatments, Eli Lilly shares rose following the announcement from Eisai (ESALY) and Biogen (BIIB) earlier this week.

The full results of their Phase 3 trials showed promising data, which strengthened the underlying theory that Alzheimer’s symptoms are linked to the beta-amyloid plaques that build up in the patient’s brain.

While this theory has been floating around for roughly 30 years, Biogen’s study marks the first time it received any confirmation. The results convincingly illustrated the link between eliminating the amyloid and the slowdown in cognitive decline among Alzheimer’s patients.

Biogen and Eisai may be the first to prove this, but their work provided Eli Lilly’s Alzheimer’s program the much-needed boost since the latter’s candidates are also based on the same theory.

In terms of revenue, Eli Lilly and Biogen could compete for a market opportunity worth more than $20 billion.

Outside this Alzheimer’s program, Eli Lilly offers investors a top-notch and diverse portfolio.

Founded way back in 1876, the company has grown into the second-biggest pharmaceutical business across the globe. It has a market capitalization of $343 billion, which is next only to Johnson & Johnson, with $459 billion.

The leading candidate in Eli Lilly’s portfolio is its Type 2 diabetes drug, Trulicity, which rakes in over $5 billion in sales annually. On top of that, it has 6 more blockbusters contributing more than $1 billion in annual revenue. These include the cancer drug Verzenio, insulin treatments Humalog and Humulin, and heart failure medication Jardiance.

These products, along with 9 other drugs in Eli Lilly’s portfolio, all contributed to boosting its revenue by 2.5% year-over-year to reach $6.9 billion in the third quarter of 2022. It also helps that the company has an expansive presence worldwide, with its treatments and products available in 120 countries.

There are also approximately 70 more projects queued for clinical development, while others are awaiting regulatory review.

Meanwhile, the most significant catalyst for Eli Lilly this year has been its Type 2 diabetes drug Mounjaro, which was approved last May.

The recently concluded third quarter marked the first complete quarter since the drug was launched in the US. Raking in an impressive $97.3 million in revenue for this period alone, Mounjaro is definitely off to a promising start.

The figures are projected to climb as Eli Lilly receives regulatory approvals from Japan and the European Union.

Actually, Mounjaro is anticipated to become a mega-blockbuster drug for Eli Lilly. It’s estimated to reach annual peak sales of $25 billion. For context, this amount is almost as much as the total revenue of the company in 2022, which is $28.6 billion.

Overall, they have consistently proved as one of the best-managed biopharmaceutical companies in the world. Its innovative strategies and initiatives have been top-notch. Eli Lilly is a stock worthy of a spot in a recession-proof portfolio. Make sure to buy the dip.

Mad Hedge Biotech and Healthcare Letter

November 29, 2022

Fiat Lux

Featured Trade:

(DO OR DIE FOR THIS BIOTECH)

(BIIB), (ESALY)

Investors are about to discover whether Biogen’s (BIIB) latest Alzheimer’s drug, which it developed in collaboration with Eisai (ESALY), is truly as effective as they claim.

A few months ago, the partners disclosed that the drug, called Lecanemab, exceeded their expectations in the Phase 3 study. Results should be out anytime this week.

Reports show that the drug offered a statistically significant decrease in the cognitive decline of the 1,800 participants included in the trial. Biogen anticipates a FED decision for its application for accelerated approval by January 6, 2023.

Meanwhile, traditional regulatory approval in the United States, Japan, and Europe is expected by March 2023.

Basically, Biogen and Eisai believe that Alzheimer’s symptoms are linked to particular plaques that accumulate in a patient’s brain.

Despite the expectations over the results for Lecanemab’s Phase 3 trial results, the enthusiasm for the scientific hypothesis on which the treatment is based had dwindled after years of underwhelming results.

Apart from that, Biogen’s previous failure remains fresh in the minds of investors. Back in June 2021, shares of both Biogen and Eisai climbed exponentially when the Food and Drug Administration suddenly gave the green light for their previous Alzheimer’s drug, Aduhelm.

Unfortunately, this momentum wasn’t sustained because Aduhelm’s commercial promise failed to be realized. This is because there are so many factors that could quickly derail the success of a product.

Equally crucial to receiving approval from the FDA is whether the drugmakers can persuade the Centers for Medicare and Medicaid Services, which is behind the widely used Medicare program, to cover the expenses of patients needing the drug.

At that time, the CMS decided to refuse reimbursements for Aduhelm. This move effectively sunk any chances of Biogen and Eisai to salvage that Alzheimer’s candidate.

Considering the budget allocated for Aduhelm from the time of its inception to commercialization, Biogen shares practically went on a free fall when the drug was eventually scrapped and development was shut down. Needless to say, this makes Lecanemab a do-or-die candidate for Biogen’s Alzheimer’s program.

Although the broader market is focused on its Alzheimer’s candidates, Biogen has an extensively diverse pipeline. The biotech is aggressively pursuing treatments for some of the most challenging to crack older-age conditions, with substantial sales and income potential.

This covers segments including depression, amyotrophic lateral sclerosis (ALS) or Lou Gehrig’s disease, Parkinson’s, lupus, cancer, and even multiple sclerosis. To date, it has 12 solid programs expected to go through Phase 3 trials or queued for regulatory approvals in the following months.

The promise that the success of Lecanemab holds is what keeps Biogen on the radar of many investors. These days, the stock is trading somewhere between $280 and $290.

If the biotech’s latest candidate for Alzheimer’s disease actually manages to meet (or exceed) expectations and hit the market, then the price could reach $370 or more.

Meanwhile, peak sales for Lecanemab are projected to be $14 billion—a figure substantially higher than Biogen’s recent revenue base.

However, there are risks to this investment.

Obviously, any investor buying Biogen stock must deal with the risk of a repeat of the Aduhelm drug debacle. That means the biotech, which regularly trades somewhere in the $200s, could face a minimum of $80 dip or roughly 30% loss.

Overall, Biogen can be considered cheap if we base it on the potential approval of Lecanemab. But, this biotech faces a binary situation where any disappointing result or a failure to gain regulatory approval could send the stock spiraling to new lows.

Meanwhile, an outlier scenario for investors to consider is that Biogen remains an immensely attractive target for a takeover by a bigger and more successful biopharmaceutical company. It offers a one-of-a-kind and solid growth pipeline with a reasonably sound valuation on trailing results that are rare in this economic condition.

Mad Hedge Biotech and Healthcare Letter

October 4, 2022

Fiat Lux

Featured Trade:

(A POWERHOUSE BIOTECH GOING HIGHER)

(VRTX), (BIIB), (CRSP)

There is no single recipe for building wealth over the years. There are several ways to achieve this goal. However, a particularly effective one is recognizing solid businesses that deliver revenue and profit over time.

You can easily find many excellent candidates in the biotechnology and healthcare world. Actually, a lot of biotech stocks have managed to outperform the struggling market this 2022.

One name that emerged virtually unscathed from the onslaught of economic, political, and financial crises is Vertex Pharmaceuticals (VRTX).

Admittedly, the market downturn has yet to end. That means the company could still experience the effects of macro headwinds and tensions in the near future.

With that said, Vertex is one of the few companies equipped with the right tools to deliver excellent returns in the long run.

One of the reasons Vertex is at the top of the list in the biotech world is its history. The company has been generating solid returns for investors for quite a while now.

In fact, it has impressively surpassed the S&P 500 Index in the past 10 years.

Apart from that, Vertex continues to boost its revenue and profits courtesy of its monopoly in the market for treatments that target the underlying reasons or causes behind cystic fibrosis (CF).

Vertex is the market leader in the CF space worldwide. The company sells four therapies targeting this condition.

The company’s latest approval in this segment was for Trikafta, which received the green light in 2019. By 2021, Trikafta was already able to rake in over $5.6 billion in revenue.

Trikafta can be used as a treatment for up to 90% of CF patients. This number goes beyond any of those delivered by other Vertex products. More importantly, Trikafta will keep its patent exclusivity until the late 2030s.

That provides Vertex with plenty of time to make headway and expand the application of the product to cover previously untapped markets—a strategy that the company has been perfecting over the years.

Vertex has been busy winning approvals in new age groups and more reimbursements in several countries to ensure longer-lasting dominance in this segment.

Recently, the biotech has launched its Phase 3 trials for a candidate that may be an even better product than Trikafta.

While details have been kept under wraps, Vertex shared that the product would be a one-time curative treatment. Needless to say, this would translate to a massive payday for Vertex.

If everything goes according to plan, this new candidate might be launched by the first quarter of 2023.

At the same time, the biotech has been working on promising candidates for much-needed treatment areas, projected to generate billions of dollars in revenue.

This move is aligned with the strategy Vertex has been using over the years: target diseases with only a handful (if any) of safe and effective therapy options.

Among Vertex’s promising but ambitious programs is VX-880, a potential treatment for Type 1 diabetes.

While this could be a long shot, Vertex’s decision to buy ViaCyte for $320 million speaks volumes of the biotech’s seriousness about the endeavor. For context, ViaCyte is a private company focused on developing a functional cure for Type 1 diabetes.

This acquisition enables Vertex to add researchers who have been working on the same goal for years to contribute their expertise to the pipeline. Plus, ViaCyte can bolster Vertex’s manufacturing expertise for cell-based therapies targeting Type 1 diabetes.

Of course, there’s the work with CRISPR Therapeutics (CRSP) to develop gene therapies. Combining this collaboration with ViaCyte’s pipeline, which includes gene-edited cells created to evade the immune system, means Vertex could design a program eliminating the necessity for immunosuppressive therapy.

Meanwhile, there are other solid candidates in the biotech pipeline.

So far, Vertex has been having discussions with the FDA. The company has recently provided proof of concept data for its candidate for Exa-cel in sickle cell disease and transfusion-dependent thalassemia. Given the progress, the product should be slated for release by early 2023.

Another is VX-147, which is a kidney disease candidate that’s currently in crucial development. To date, the product is on track for accelerated approval and could start generating sales by late 2024.

On top of these, Vertex has been working on alternatives for opioids to avoid overdoses. Amid the growing concerns and data on the addictiveness of opioids, these continue to be prescribed as treatments.

This epidemic shows no signs of slowing down, with the CDC’s recent estimate increasing to 75,000 Americans dying from an overdose. According to the CDC, over 2 million Americans are addicted to opioids.

One explanation for this issue is that there is no effective alternative. While Vertex’s initial candidates failed to show an optimal profile, its latest candidate may very well be the answer.

The new candidate, VX-548, was created based on observations and research on families in Pakistan with the rare ability not to feel or experience any pain.

Due to this particular genetic abnormality, members of these families are able to walk on hot coals, get stabbed with knives, and jump from heights, and experience absolutely no pain at all.

The genetic mutation stops the peripheral nervous system from sending pain signals to the brain.

Vertex and other developers like Biogen (BIIB) are attempting to develop drugs that mimic the pain-blocking ability resulting from this genetic mutation.

If successful, VX-548’s greatest asset is its non-addictive potential, thereby making premium pricing more likely justified.

The current market for acute pain treatments annually is $4 billion, and that number is for generic pricing.

Considering that the pricing of a branded treatment would probably be at least double, then the commercial potential is massive.

Over the next 10 years, Vertex is expected to launch new biotech treatments which, combined with its current CF franchise, will propel its earnings, profit, and share price to even higher heights.

It’s currently facing the bear market without so much as breaking a sweat, with stock prices climbing by roughly 28% so far this 2022 compared to the market’s 19% decline. I suggest you don’t wait too long to buy into Vertex, as this is a top-tier biotech.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.