Mad Hedge Biotech and Healthcare Letter

May 1, 2025

Fiat Lux

Featured Trade:

(TELEHEALTH'S NEW WEIGHT CLASS)

(HIMS), (NVO)

Mad Hedge Biotech and Healthcare Letter

May 1, 2025

Fiat Lux

Featured Trade:

(TELEHEALTH'S NEW WEIGHT CLASS)

(HIMS), (NVO)

Mad Hedge Biotech and Healthcare Letter

April 29, 2025

Fiat Lux

Featured Trade:

(BIOTECH’S AWKWARD MIDDLE CHILD)

(GILD), (VRTX), (AMGN), (BMY)

Well, folks, I've been trading biotech stocks since before most of today's analysts had their first internships.

After countless dinners with pharma execs and more investor conferences than I care to remember, there's one thing I've learned about this sector – these stocks are a lot like the experimental drugs themselves: sometimes miraculous, sometimes disappointing, and always requiring patience.

That brings us to Gilead Sciences (GILD), which has recently pulled off the financial equivalent of finding a $100 bill in an old jacket: a 90% gain since May 2024.

If you're an income-focused investor eyeing GILD's promising yield like a prospector spotting gold, I'd suggest taking a breath before you stake your claim.

After diving into this company's financial innards with the ruthless precision of a veteran hedge fund manager, I've uncovered some fascinating contradictions.

First off, GILD has undergone a remarkable transformation, shedding its growth-focused biotech skin to become what I call a "mature dividend machine" – offering 9 consecutive years of dividend increases since 2015.

Its current annual dividend of $3.16 per share yields 2.99%, significantly outpacing the biotechnology sector average of 1.92%. Not too bad for a company that cut its teeth on groundbreaking HIV and COVID treatments.

But here's where things get interesting. Despite GILD's revenue looking as seasonal as a summer blockbuster (with predictably lower earnings in the first half of each year), the company's fundamentals show troubling signs beneath the surface.

While Q1 2025 revenue was expected to land around $6.77 billion, the company's economic profitability has fallen off a cliff since 2024. Blame it on negative net income in early 2024 and a Cash Tax Rate that jumped from 25.4% to 30.6% faster than a trader fleeing a market crash.

The historical performance tells an even more sobering tale. From IPO to 2015, GILD delivered average annual returns of 32.25% in 79% of years – performance that would make even the most jaded investor whistle.

But since 2015? The stock managed profits in only 50% of years with an anemic average return of 0.99%, which translates to a 2.17% loss when adjusted for inflation. Ouch.

You might say that the entire sector's going through a rough patch these days, and I would have agreed with you except there are several biotechs still performing well.

Take Vertex Pharmaceuticals (VRTX). Those guys are up 36.7% over the past 52 weeks.

Or consider Amgen (AMGN), whose dividend is growing at a mouth-watering 8.94% annually over five years – nearly triple what GILD is serving up to its shareholders.

Even BioMarin (BMRN), a company most retail investors couldn't pick out of a lineup, has been quietly crushing it with 27.3% revenue growth while GILD's top line moves sideways like a crab with performance anxiety.

And don't get me started on Bristol Myers Squibb (BMY). Despite facing their own patent cliff dramas, they're maintaining a forward P/E of just 7.2 – practically giving away shares – while offering a dividend yield of 4.7%.

So, let me tell you something the glossy investor presentations won't: GILD's forward P/E ratio of 13.35x looks attractively cheap compared to the healthcare sector's 20.13x and the S&P 500's 18.60x.

After having had drinks with several institutional investment managers last week, though, I can assure you that discount exists for a reason.

The smart money has correctly identified that this company is no longer growing profitably, and certain whispers about their pipeline aren't inspiring confidence.

For dividend investors hoping to beat inflation while preserving capital, GILD presents a mixed bag. The dividend growth continues but remains stubbornly below inflation, creating a slow leak in real returns.

And, look, I know the Trump White House isn't exactly making life easy for companies like Gilead. Over whiskey last month with a former FDA bigwig (who shall remain nameless), I heard some concerning murmurs about potential cuts to HIV prevention programs.

Bad news when you're sitting on 40% of the U.S. PrEP market like GILD is.

Bottom line? I'm sticking with "hold" for now. The smart money moves when the smart money knows, and my Rolodex isn't flashing buy signals yet.

I've watched enough biotech darlings flame out to know that patience outperforms panic every time.

When GILD shows signs of recapturing that pre-2014 magic, you'll hear it from me before the CNBC talking heads catch wind of it.

Mad Hedge Biotech and Healthcare Letter

April 24, 2025

Fiat Lux

Featured Trade:

(DIVIDEND HUNTING IN BEAR COUNTRY)

(BMY)

Mad Hedge Biotech and Healthcare Letter

March 27, 2025

Fiat Lux

Featured Trade:

(NO SHERPA REQUIRED)

(MRK), (BMY)

Perched high above the timberline on Colorado's Mt. Elbert last weekend, I found myself short on oxygen and long on questions—namely, which pharmaceutical heavyweight deserves a spot in my portfolio: Merck (MRK) or Bristol-Myers Squibb (BMY)?

At 14,438 feet, the air thins out fast, but the thinking gets clearer. Clarity tends to arrive when your brain’s running at 60% capacity.

I’d stuffed my pack with company reports, earnings transcripts, and a few too many granola bars—one of which was being stalked by a very persistent marmot as I paused to catch my breath. I must’ve looked like an underprepared Everest hopeful, hunched over charts and trying to find altitude-adjusted alpha.

On paper, both firms dominate the oncology space and have made a career out of telling cancer where to shove it. But markets don’t care about reputations—they care about margins, pipelines, and who's going to make it through the next patent cliff without blowing out their kneecaps.

Let’s start with the money.

Merck posted Q4 2024 revenue of $17.76 billion, up 6.77% year-on-year. Its price-to-sales ratio sits at 3.74x—above the sector median, but still 14.7% cheaper than its own five-year average. It’s also beaten revenue expectations for 12 straight quarters. That’s not a hot streak. That’s clinical precision.

Bristol-Myers pulled in $12.34 billion last quarter with 7.5% YoY growth, but it trades at a much lower 2.51x P/S. That’s a discount—16.5% under the sector median. Ten out of twelve quarters beating the Street is nothing to sneeze at either. You get the sense both firms have their accounting departments on creatine.

Debt? Merck sits on $24.6 billion in net debt, but with a net debt/EBITDA ratio of 0.84x, it's practically sipping debt through a paper straw. Bristol-Myers, on the other hand, carries $40.1 billion with a 2.07x ratio. Still manageable, but not the kind of leverage that makes you sleep like a baby—unless you're the baby in question.

Dividends? Bristol-Myers pays more—4.14% vs. Merck’s 3.42%. That might earn it a second glance from income hawks, but when you zoom out, Merck still wears the financial crown.

Now here’s where things get messier.

Merck has a bit of a single-product addiction problem. Keytruda brought in $7.83 billion last quarter, making up a jaw-dropping 50.2% of total revenue. It's a blockbuster, yes, but when one drug makes up half your business, you start looking like a biotech version of Jenga. Merck’s top five products represent 75.7% of sales.

Bristol-Myers shows better balance. Eliquis is its biggest hitter, pulling in 25.9%, while its top five products account for 71.6% overall. Not exactly ironclad diversification, but a more even spread than Merck’s lineup.

Still, Keytruda is a monster. It outsold Bristol’s Opdivo by a whopping $5.4 billion in Q4 alone. That’s not a competition—that’s a beatdown. But both companies are running out the clock on their oncology flagships. Keytruda loses U.S. patent protection in 2028. Merck’s answer is a subcutaneous version—MK-3475A—patent-protected until 2039. Bristol’s already fired back with Opdivo Qvantig, a smart preemptive strike that could buy them time and market share.

Pipelines? Merck leads here too. BMY has 74 active R&D projects, 11 in Phase 3. Merck? Over 90 clinical-stage assets, 31 of them in Phase 3, and five are already under regulatory review. They’re not just defending Keytruda—they’re building the next dynasty.

Meanwhile, Bristol-Myers’ stock is flashing overbought signals like a Christmas tree. Merck, by contrast, trades below its VWAP, and Wall Street sees an 18.3% upside from here. Bristol-Myers? A yawn-worthy 1.36%. That's a rounding error, not an investment thesis.

Fast forward to 2029. I expect Merck to print a non-GAAP EPS of $11, led by Keytruda, Welireg, and a few wild cards currently in late-stage trials. Bristol-Myers might reach $6.80 EPS on $44 billion in revenue. Not bad, just... not Merck.

After sorting through this on the summit—between water breaks, altitude headaches, and one increasingly assertive marmot—the picture came into focus. Merck is the better long-term pick. They’ve got the product, the pipeline, the margin, and the momentum.

As I packed up and started the long descent, I dropped my guard for half a second and the marmot made his move—snatched my energy bar right off my pack. Bold little bastard. But honestly, he earned it.

Sometimes, the one who climbs higher sees further and waits patiently gets the prize. Merck just did all three.

After all, in investing—as in mountain climbing—peaks and profits favour those who don’t lose their breath or their nerve.

Global Market Comments

March 24, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD or THE SPECIAL NO CONFIDENCE ISSUE)

(GM), (SH), (TSLA), (NVDA), (GLD), (TLT), (LMT), (BA), (NVDA), (GOOGL), (AAPL), (META), (AMZN), (PANW), (ZS), (CYBR), (FTNT), (COST)

(AMGN), (ABBV), (BMY), (TSLA), GM), (GLD), (BYDDF)

It’s official: Absolutely no one is confident in their long-term economic forecasts right now. I heard it from none other than the chairman of the Federal Reserve himself. The investment rule book has been run through the shredder.

It has in fact been deleted.

That explains a lot about how markets have been trading this year. It looks like it is going to be a reversion to the mean year. Forecasters, strategists, and gurus alike are rapidly paring down their stock performance targets for 2025 to zero.

When someone calls the fire department, it’s safe to assume that there is a fire out there somewhere. That’s what Fed governor Jay Powell did last week. It raises the question of what Jay Powell really knows that we don’t. Given the opportunity, markets will always assume the worst, that there’s not only a fire, but a major conflagration about to engulf us all. Jay Powell’s judicious comments last week certainly had the flavor of a president breathing down the back of his neck.

It's interesting that a government that ran on deficit reduction pressured the Fed to end quantitative tightening. That’s easing the money supply through the back door.

For those unfamiliar with the ins and outs of monetary policy, let me explain to you how this works.

Since the 2008 financial crisis, the Fed bought $9.1 trillion worth of debt securities from the US Treasury, a policy known as “quantitative easing”. This lowers interest rates and helps stimulate the economy when it needs it the most. “Quantitative easing” continued for 15 years through the 2020 pandemic, reaching a peak of $9.1 trillion by 2022. For beginners who want to know more about “quantitative easing” in simple terms, please watch this very funny video.

The problem is that an astronomically high Fed balance sheet like the one we have now is bad for the economy in the long term. They create bubbles in financial assets, inflation, and malinvestment in risky things like cryptocurrencies. That’s why the Fed has been trying to whittle down its enormous balance sheet since 2022.

By letting ten-year Treasury bonds it holds expire instead of rolling them over with new issues, the Fed is effectively shrinking the money supply. This is how the Fed has managed to reduce its balance sheet from $9.1 trillion three years ago to $6.7 trillion today and to near zero eventually. This is known as “quantitative tightening.” At its peak a year ago, the Fed was executing $120 billion a month quantitative tightening.

By cutting quantitative tightening, from $25 billion a month to only $5 billion a month, or effectively zero, the Fed has suddenly started supporting asset prices like stocks and increasing inflation. At least that is how the markets took it to mean by rallying last week.

Why did the Fed do this?

To head off a coming recession. Oops, there’s that politically incorrect “R” word again! This isn’t me smoking California’s largest export. Powell later provided the forecasts that back up this analysis. The Fed expects GDP growth to drop from 2.8% to 1.7% and inflation to rise from 2.5% to 2.8% by the end of this year. That’s called deflation. Private sector forecasts are much worse.

Just to be ultra clear here, the Fed is currently engaging in neither “quantitative easing nor “quantitative tightening,” it is only giving press conferences.

Bottom line: Keep selling stock rallies and buying bonds and gold on dips.

Another discussion you will hear a lot about is the debate over hard data versus soft data.

I’ll skip all the jokes about senior citizens and cut to the chase. Soft data are opinion polls, which are notoriously unreliable, fickle, and can flip back and forth between positive and negative. A good example is the University of Michigan Consumer Confidence, which last week posted its sharpest drop in its history. Consumers are panicking. The problem is that this is the first data series we get and is the only thing we forecasters can hang our hats on.

Hard data are actual reported numbers after the fact, like GDP growth, Unemployment Rates, and Consumer Price Indexes. The problem with hard data is that they can lag one to three months, and sometimes a whole year. This is why by the time a recession is confirmed by the hard data, it is usually over. Hard data often follows soft data, but not always, which is why both investors and politicians in Washington DC are freaking out now.

Bottom line: Keep selling stock rallies and buying bonds and gold (GLD) on dips.

A question I am getting a lot these days is what to buy at the next market bottom, whether that takes place in 2025 or 2026. It’s very simple. You dance with the guy who brought you to the dance. Those are:

Best Quality Big Tech: (NVDA), (GOOGL), (AAPL), (META), (AMZN)

Big tech is justified by Nvidia CEO Jensen Huang’s comment last week that there will be $1 trillion in Artificial Intelligence capital spending by the end of 2028. While we argue over trade wars, AI technology and earnings are accelerating.

Cybersecurity: (PANW), (ZS), (CYBR), (FTNT)

Never goes out of style, never sees customers cut spending, and is growing as fast as AI.

Best Retailer: (COST)

Costco is a permanent earnings compounder. You should have at least one of those.

Best Big Pharma: (AMGN), (ABBV), (BMY)

Big pharma acts as a safety play, is cheap, and acts as a hedge for the three sectors above.

March is now up +2.92% so far. That takes us to a year-to-date profit of +12.29% in 2025. That means Mad Hedge has been operating as a perfect -1X short S&P 500 ETF since the February top. My trailing one-year return stands at a spectacular +82.50%. That takes my average annualized return to +51.12% and my performance since inception to +764.28%.

It has been another busy week for trading. I had four March positions expire at their maximum profit points on the Friday options expiration, shorts in (GM), and longs in (GLD), (SH), and (NVDA). I added new longs in (TSLA) and (NVDA). This is in addition to my existing longs in the (TLT) and shorts in (TSLA), (NVDA), and (GM).

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 74 of 94 trades have been profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

UCLA Andersen School of Business announced a “Recession Watch,” the first ever issued. UCLA, which has been issuing forecasts since 1952, said the administration’s tariff and immigration policies and plans to reduce the federal workforce could combine to cause the economy to contract. Recessions occur when multiple sectors of the economy contract at the same time.

Retail Sales Fade, with consumers battening down the hatches for the approaching economic storm. Retail sales rose by less than forecast in February and the prior month was revised down to mark the biggest drop since July 2021.

This Has Been One of the Most Rapid Corrections in History, leaving no time to readjust portfolios and put on short positions.

The rapid descent in the S&P 500 is unusual, given that it was accomplished in just 22 calendar days, far shorter than the average of 80 days in 38 other examples of declines of 10% or more going back to World War II.

Home Builder Sentiment Craters to a seven-month low in March as tariffs on imported materials raised construction costs, a survey showed on Monday. The National Association of Home Builders/Wells Fargo Housing Market Index dropped three points to 39 this month, the lowest level since August 2024. Economists polled by Reuters had forecast the index at 42, well below the boom/bust level of 50.

BYD Motors (BYDDF) Shares Rocket, up 72% this year, on news of technology that it claims can charge electric vehicles almost as quickly as it takes to fill a gasoline car. BYD on Monday unveiled a new “Super e-Platform” technology, which it says will be capable of peak charging speeds of 1,000 kilowatts/hr. The EV giant and Tesla rival say this will allow cars that use the technology to achieve 400 kilometers (roughly 249 miles) of range with just 5 minutes of charging. Buy BYD on dips. It’s going up faster than Tesla is going down.

Weekly Jobless Claims Rise 2,000, to 223,000. The number of Americans filing new applications for unemployment benefits increased slightly last week, suggesting the labor market remained stable in March, though the outlook is darkening amid rising trade tensions and deep cuts in government spending.

Copper Hits New All-Time High, at $5.02 a pound. The red metal has outperformed gold by 25% to 15% YTD. It’s now a global economic recovery that is doing this, but flight to safety. Chinese savers are stockpiling copper ingots and storing them at home distrusting their own banks, currency, and government. I have been a long-term copper bull for years as you well know. New copper tariffs are also pushing prices up. Buy (FCX) on dips, the world’s largest producer of element 29 on the Periodic Table.

Boeing (BA) Beats Lockheed for Next Gen Fighter Contract for the F-47, beating out rival Lockheed Martin (LMT) for the multibillion-dollar program. Unusually, Trump announced the decision Friday morning at the White House alongside Defense Secretary Pete Hegseth. Boeing shares rose 5.7% while Lockheed erased earlier gains to fall 6.8%. The deal raises more questions than answers, in the wake of (BA) stranding astronauts in space, their 737 MAX crashes, and a new Air Force One that is years late. Was politics involved? You have to ask this question about every deal from now on.

Carnival Cruise Lines (CCL) Raises Forecasts, on burgeoning demand from vacationers, including me. The company’s published cruises are now 80% booked. Cruise lines continue to hammer away at the value travel proposition they are offering. However, the threat of heavy port taxes from the administration looms over the sector.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties is now looking at multiple gale-force headwinds. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. My Dow 240,000 target has been pushed back to 2035.

On Monday, March 24, at 8:30 AM EST, the S&P Global Flash PMI is announced.

On Tuesday, March 25, at 8:30 AM, the S&P Case Shiller National Home Price Index is released.

On Wednesday, March 26, at 1:00 PM, the Durable Goods are published.

On Thursday, March 27, at 8:30 AM, the Weekly Jobless Claims are disclosed. We also get the final report for Q1 GDP.

On Friday, March 28, the Core PCE is released, and important inflation indicator. At 2:00 PM, the Baker Hughes Rig Count is printed.

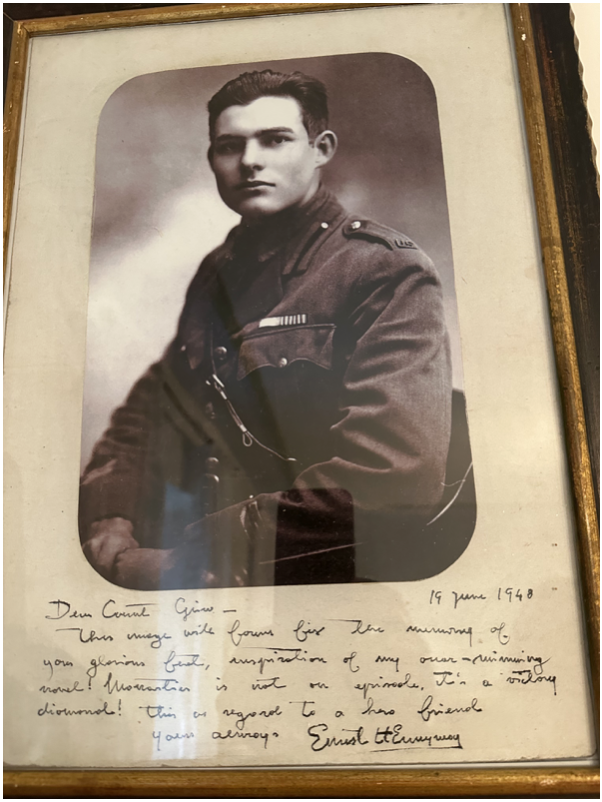

As for me, I received calls from six readers last week saying I remind them of Ernest Hemingway. This, no doubt, was the result of Ken Burns’ excellent documentary about the Nobel Prize-winning writer on PBS last week.

It is no accident.

My grandfather drove for the Italian Red Cross on the Alpine front during WWI, where Hemingway got his start, so we had a connection right there.

Since I read Hemingway’s books in my mid-teens I decided I wanted to be him and became a war correspondent. In those days, you traveled by ship a lot, leaving ample time to finish off his complete work.

I visited his homes in Key West, Cuba, and Ketchum Idaho.

I used to stay in the Hemingway Suite at the Ritz Hotel on Place Vendome in Paris where he lived during WWII. I had drinks at the Hemingway Bar downstairs where war correspondent Ernest shot a German colonel in the face at point-blank range. I still have the ashtrays.

Harry’s Bar in Venice, a Hemingway favorite, was a regular stopping-off point for me. I have those ashtrays too.

I even dated his granddaughter from his first wife, Hadley, the movie star Mariel Hemingway, before she got married, and when she was also being pursued by Robert de Niro and Woody Allen. Some genes skip generations and she was a dead ringer for her grandfather. She was the only Playboy centerfold I ever went out with. We still keep in touch.

So, I’ll spend the weekend watching Farewell to Arms….again, after I finish my writing.

Oh, and if you visit the Ritz Hotel today, you’ll find the ashtrays are now glued to the tables.

As for last summer, I stayed in the Hemingway Suite at the Hotel Post in Cortina d’Ampezzo Italy where he stayed in the late 1940’s to finish a book. Maybe some inspiration will run off on me.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Biotech and Healthcare Letter

February 20, 2025

Fiat Lux

Featured Trade:

(PORTFOLIO MANAGEMENT DURING PAIN MANAGEMENT)

(VRTX), (DSNKY), (AZN), (GILD), (SNY), (GSK), (JNJ), (BMY), (LLY)

Mad Hedge Biotech and Healthcare Letter

January 21, 2025

Fiat Lux

Featured Trade:

(THE ONLY TIME FIGHTING YOURSELF MAKES MONEY)

(ABBV), (AMGN), (SDZNY), (CHRS), (PFE), (JNJ), (ALVO), (TEVA), (SNY), (BMY)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.