If I had a dollar for every time someone told me the biotech sector was overvalued, I'd have enough to fund my own drug development program.

Yet here we are, watching the global immunology market rocket from $55 billion to $166 billion in just a decade, with the sector projected to hit $192 billion by 2028.

If you're wondering why big pharma keeps pouring billions into autoimmune research - and believe me, this question came up in every meeting last week - the answer is simple: we've barely scratched the surface.

Despite thousands of PhDs burning midnight oil in labs from Boston to Basel, we still don't have effective treatments for systemic lupus erythematosus, scleroderma, or even something as visible as vitiligo.

Want to see where the smart money is going? Look no further than the biosimilar stampede into AbbVie's (ABBV) Humira territory.

Like bargain hunters at a Black Friday sale, everyone's getting in line: Amgen (AMGN) with Amjevita, Sandoz (SDZNY) with Hyrimoz, Coherus (CHRS) with Yusimry, and Pfizer (PFE) with Abrilada.

And just when you thought the party was over, here comes Amgen's Wezlana challenging Johnson & Johnson's (JNJ) Stelara, followed by Alvotech (ALVO) and Teva's (TEVA) Selarsdi.

But here's where it gets interesting. I've identified four companies that are trading at valuations that would make Benjamin Graham smile.

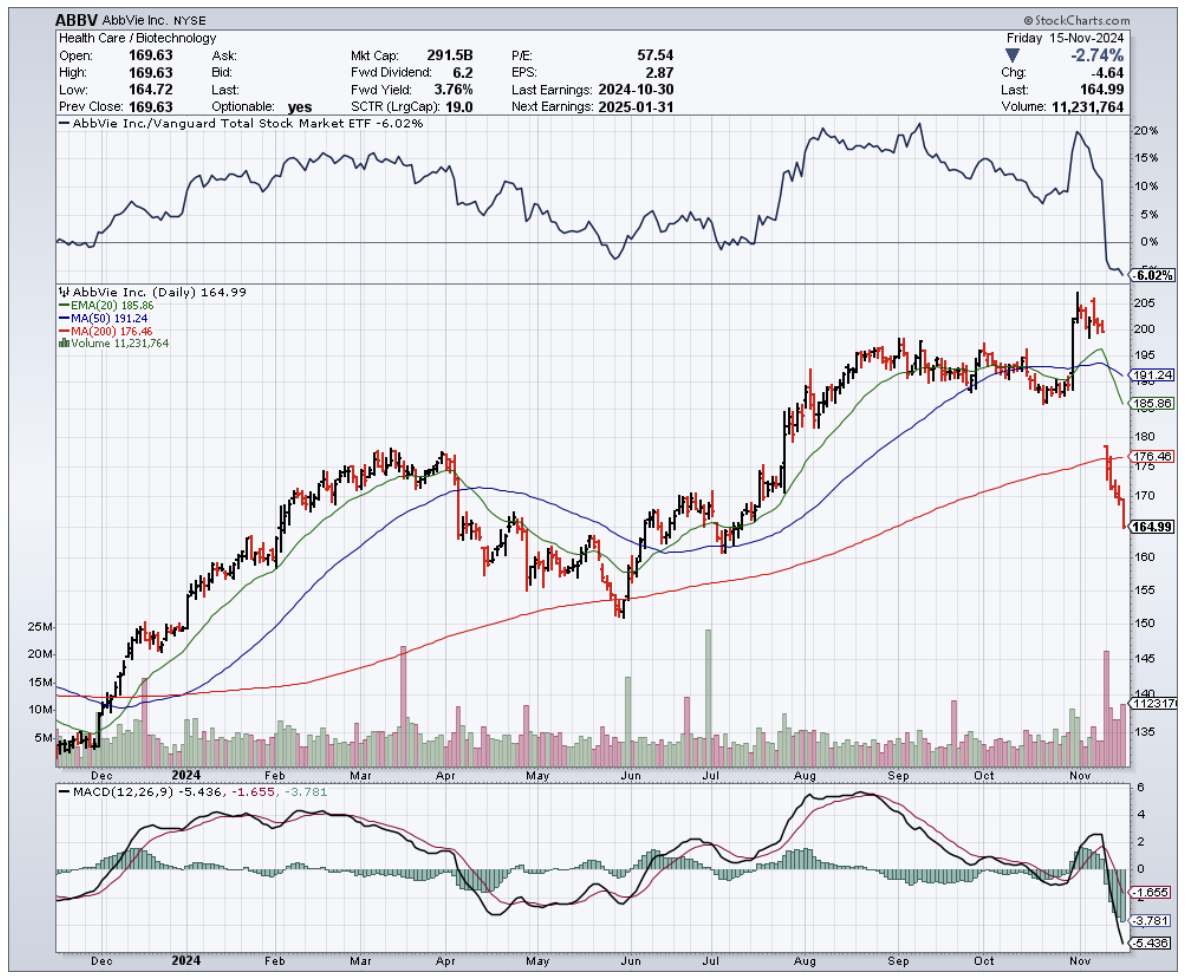

First up is AbbVie, trading at 15.96x earnings (11.9% below sector median), with projected EPS growth to $15.21 by 2027.

Their dynamic duo of Rinvoq and Skyrizi is performing like a biotech version of Batman and Robin.

Rinvoq sales hit $1.61 billion in Q3 2024, up 45.4% year-over-year, while Skyrizi broke $3 billion, thanks to its mid-2024 FDA approval for ulcerative colitis.

As for Sanofi (SNY)? Now we're talking value. At 11.7x earnings - 35.39% below sector median and 1.3% below its 5-year average - it's like finding a Ferrari priced like a Fiat.

Their star player Dupixent raked in 3.48 billion euros in Q3 2024, up 22.1% year-over-year and 5.2% quarter-over-quarter.

Then, there’s Teva Pharmaceuticals. Trading at a P/E ratio of 7.88x - that's 56.5% below the sector median - while projecting non-GAAP EPS growth to $3.6 by 2028.

But here's the kicker: their clinical trial data reads like a biotech investor's dream. Their new drug duvakitug achieved 47.8% clinical remission in ulcerative colitis patients versus 20.45% for placebo (p=0.003).

In Crohn's disease? Even better - 47.8% endoscopic response compared to 13% for placebo (p<0.001).

Finally, there's Bristol-Myers Squibb (BMY). Yes, it's trading at 47.5x earnings (162.1% above sector median), but here's where patience pays off - their P/E ratio is expected to drop to 8.82x by 2027.

Meanwhile, Zeposia sales jumped 19.5% year-over-year to $147 million in Q3 2024, while Sotyktu showed consecutive quarterly growth.

The cherry on top? These companies are paying you to wait. We're talking dividend yields from 3.8% to 4.41% - try getting that from your savings account.

Looking at these numbers reminds me of the tech sector in the late 1990s, but with one crucial difference - these companies are actually making money, lots of it.

They generate significant cash flow and have strong balance sheets, unlike many of the high-flying tech companies of the dot-com era that were burning through cash with no clear path to profitability.

While others are chasing the next meme stock or crypto moonshot, smart investors are quietly positioning themselves in companies that are literally changing the face of medicine.

Remember, buying umbrellas in the summer heat has always been my style.

Right now, the immunology sector is experiencing its own kind of summer, and these four stocks are your umbrellas.

The forecast? Growth storms ahead.