Crypto insider Mike Novogratz has long maintained an upbeat tone, even as crypto remains one of the most frustrating asset classes of the last few years.

His words are mostly silver linings and an optimistic view of the future.

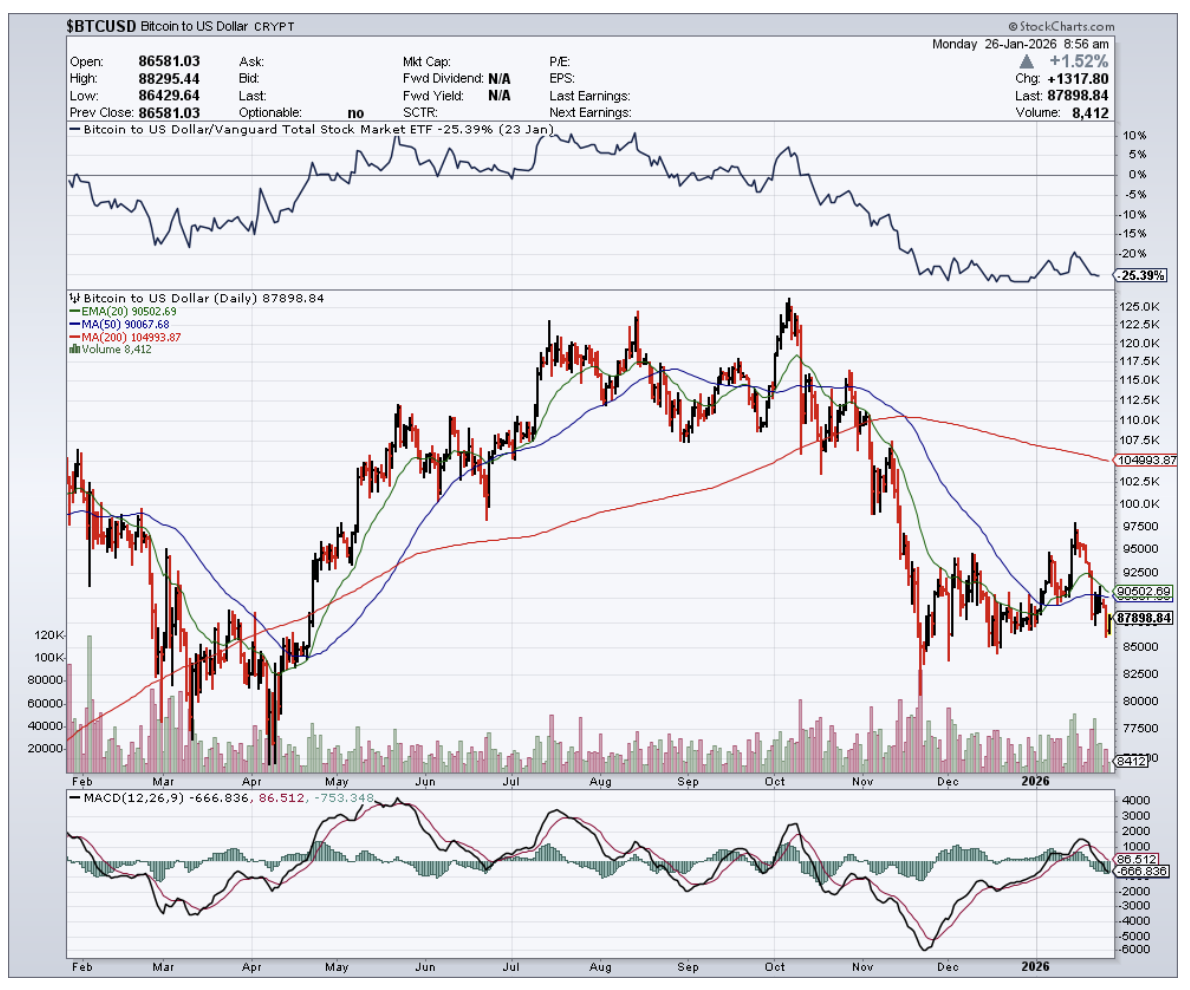

His argument for structural appreciation in Bitcoin centers on the premise that the next phase must differ from historical cryptocurrency rallies in terms of story and utility.

Compared to previous cycles, the thesis is that any future Bitcoin rally will be more focused on utility and less on the story.

An asset can only go so far based on the fear of missing out hype.

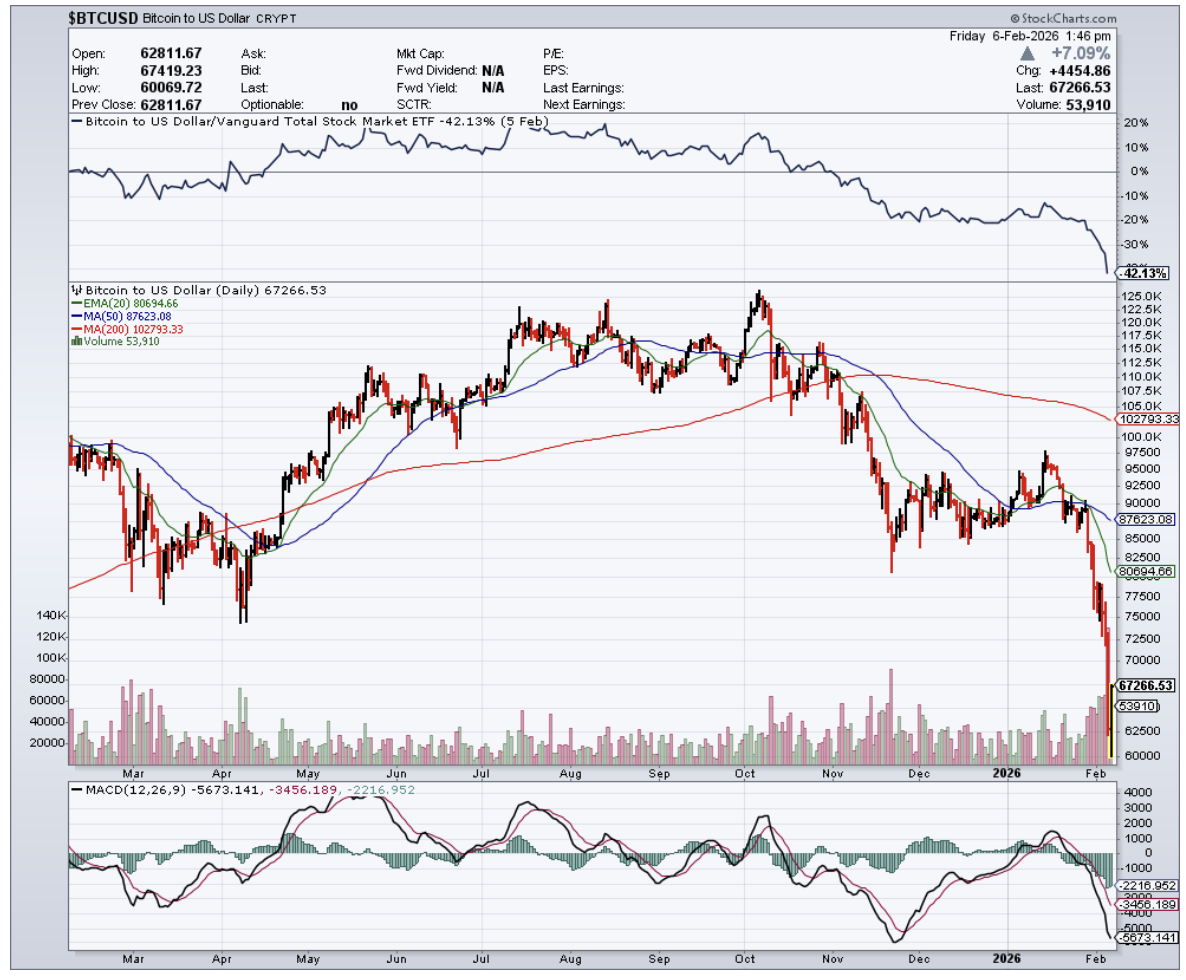

The structural issue remains the lack of buyers, and it is no surprise.

Every liquidity event serves as a great exit point for holders to dump more coins.

In my analysis over the years, I chronicle how structural shifts make it less attractive for incremental investors to bite at crypto.

The data backs me up as new buyers have largely exited this speculative industry and sought assets that pay an annuity-like premium.

According to Novogratz, the 2017 era was mostly about the story of people not trusting the government and wanting more privacy and decentralization.

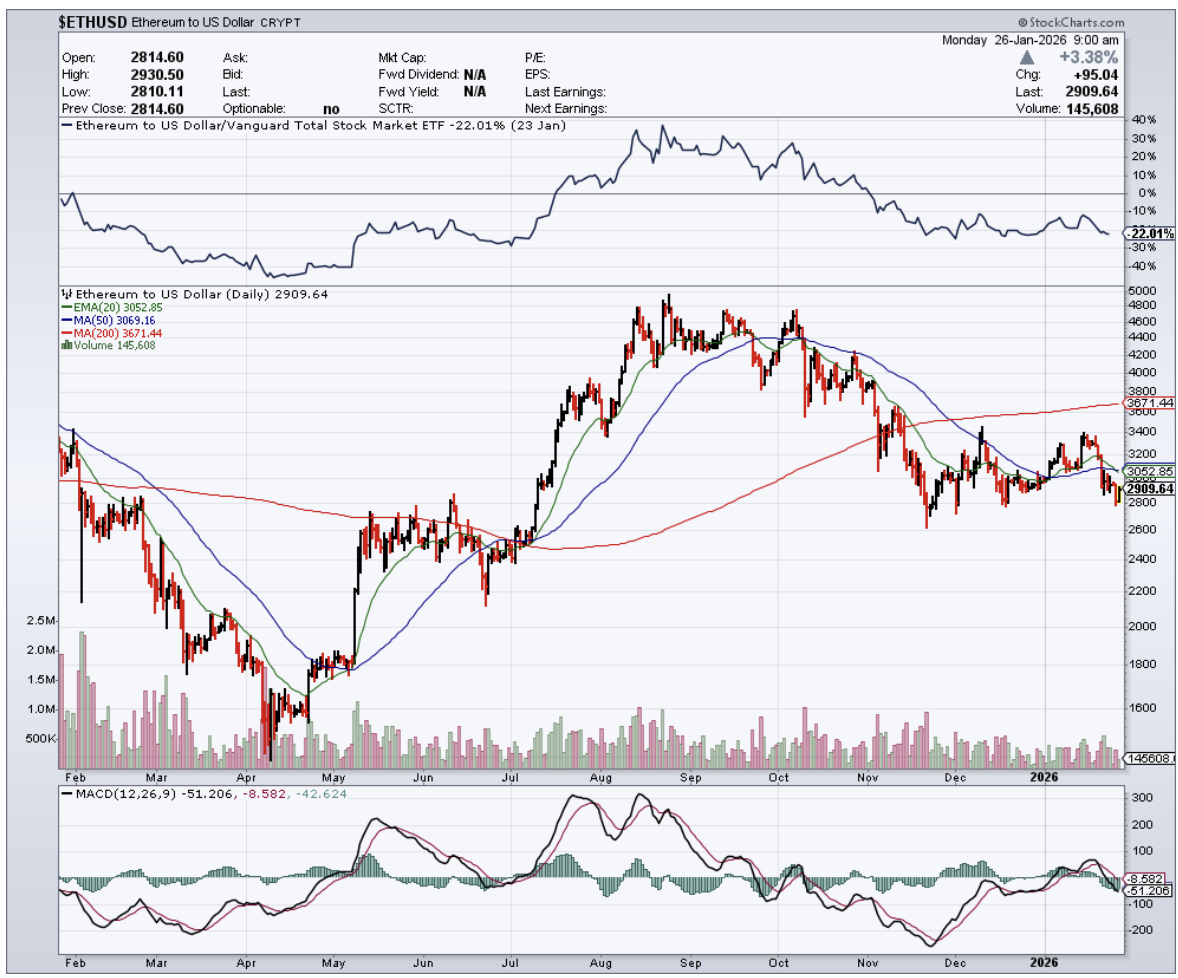

The blockchain narrative has stagnated, and few institutions have integrated the technology into daily tasks.

I do not see where the utility comes from.

The era when speculative investors bought digital real estate in the metaverse in hopes of accruing rental digital revenue defies belief.

I do not see the utility there either.

It is all good to use buzz words like scalable and user-friendly, yet I see no actual development.

I do not believe crypto is the inherent successor to fiat either, and I do believe that, at best, it acts as a nice compliment, and that is if miracle after miracle happens from here on out.

With governments regulating the sector heavily, its value proposition diminishes greatly.

Novogratz needs to stop pushing the inevitable theme like a real estate agent advising buyers to buy the most expensive mansion at the top of the market.

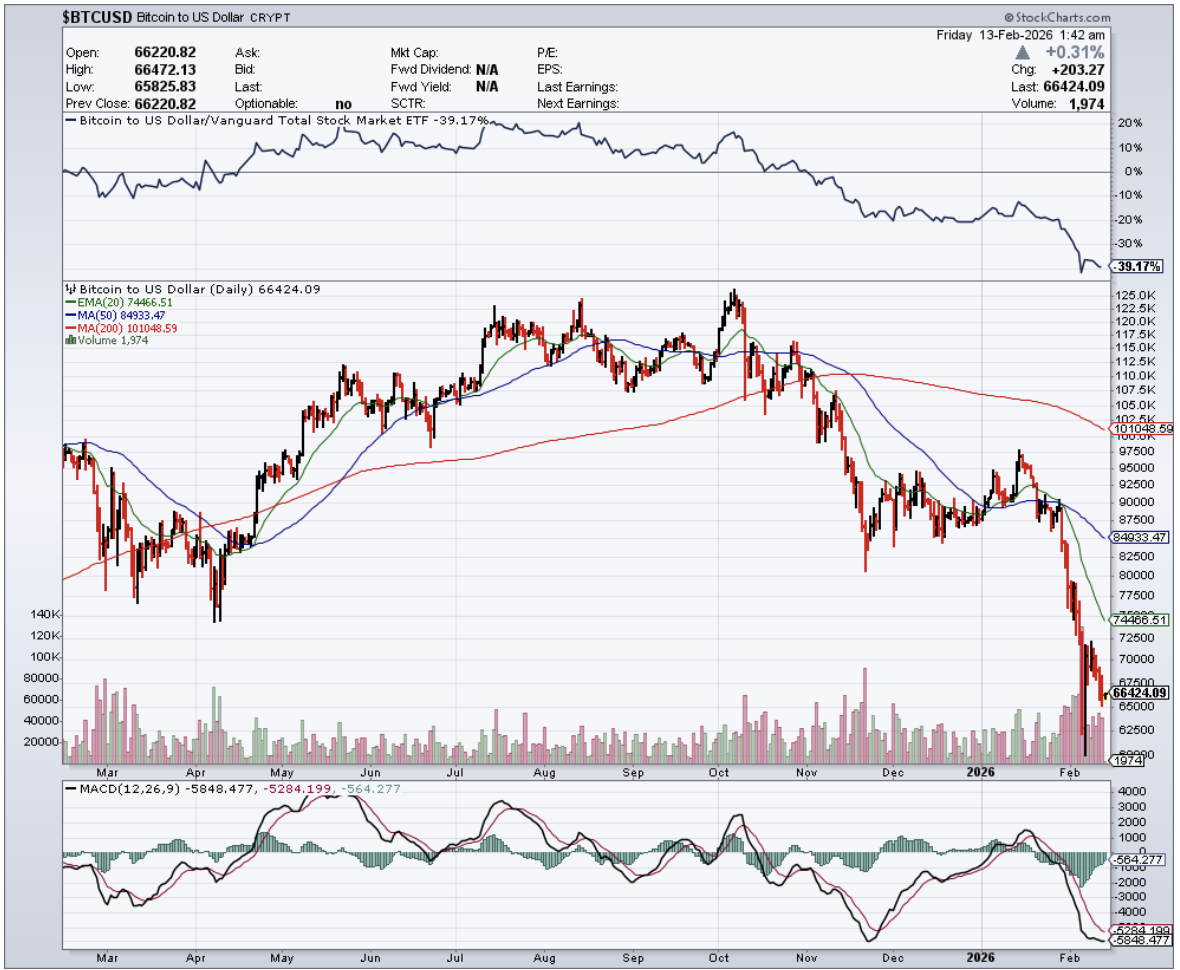

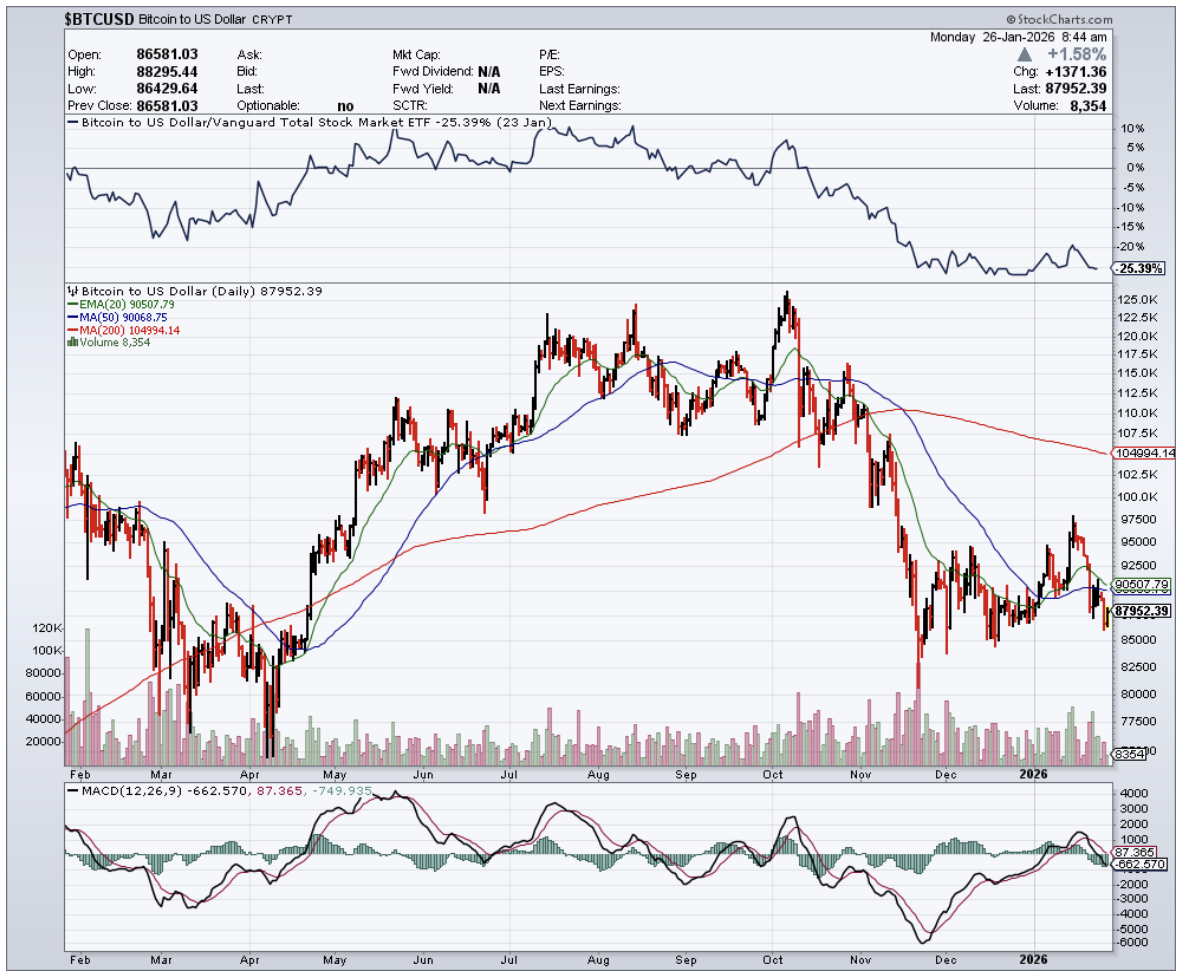

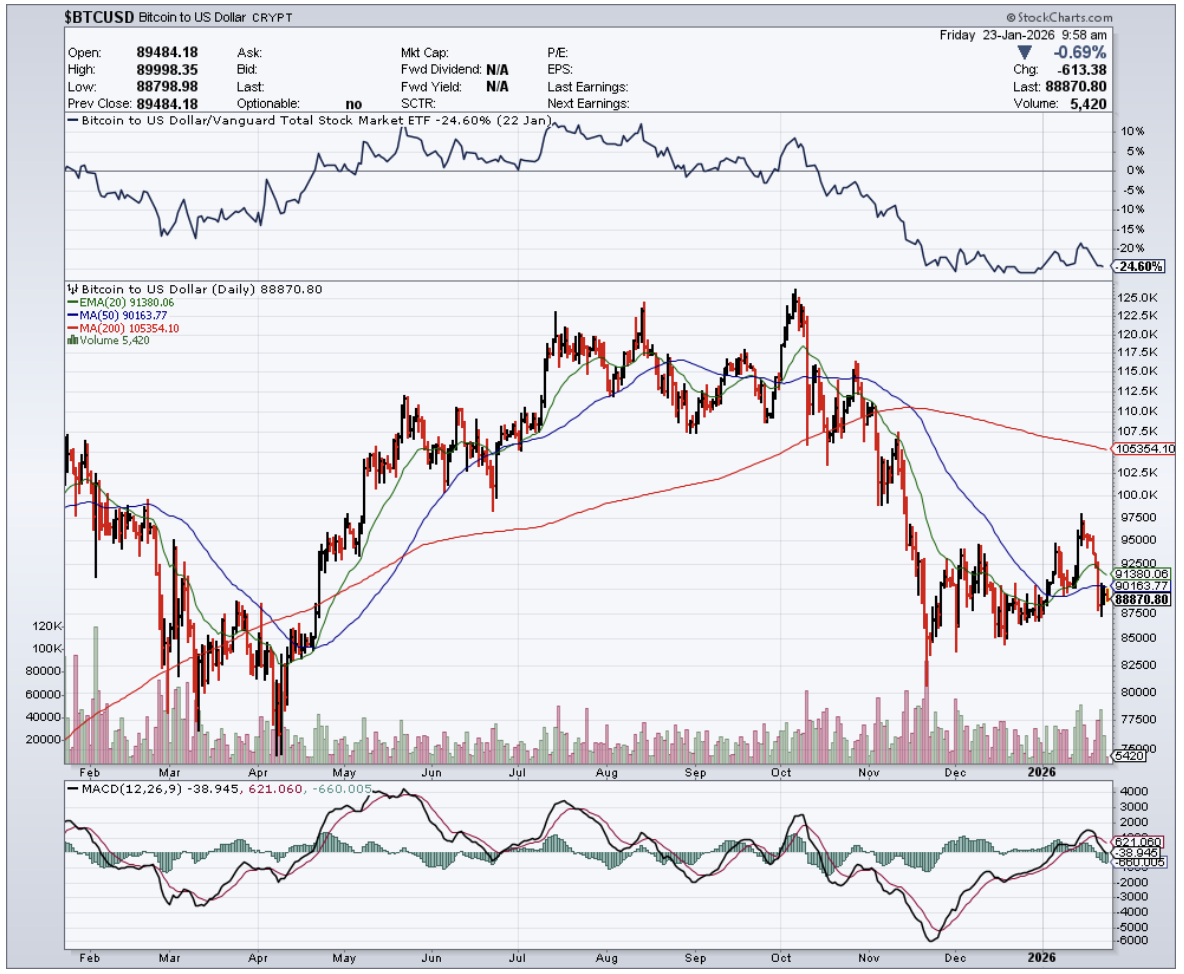

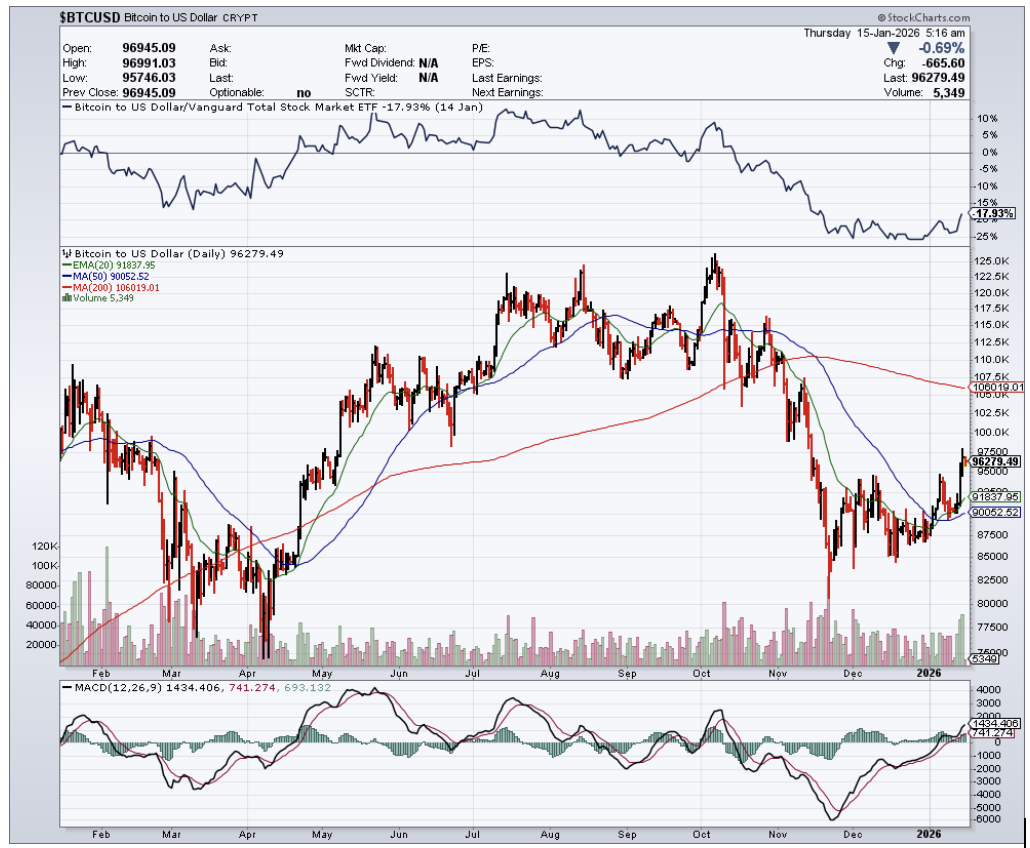

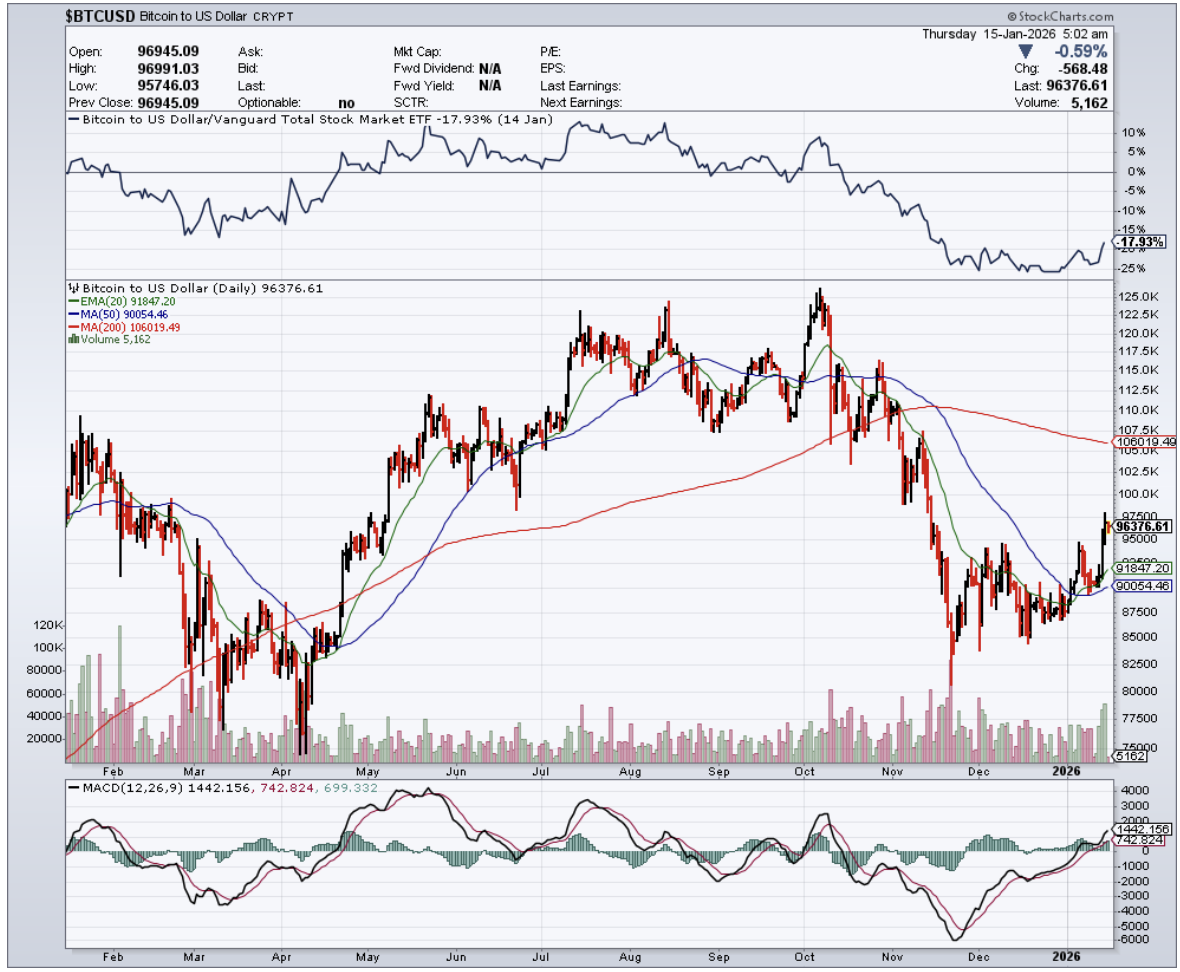

Hilariously enough, one of the knocks on crypto was the elevated volatility, which has dampened significantly.

Why?

The lack of volatility stems from the lack of new buyers and sellers. There are still owners who have not sold and are holding until infinity, so the price does not get pushed down further, but investors are so turned off by the charlatans and dangers in the industry that they would rather put their money in something more real.

Crypto executives need to stop pushing the Bitcoin to $1 million theme, as every headwind imaginable crushes the price of crypto.

Even worse, the industry is still metabolizing billions of dollars in regulatory actions, and I believe it is more responsible to talk about the persistent existential crisis that Bitcoin faces.

If Bitcoin fails, then crypto is finished, so it will be interesting to see what the last big holders do with their coin.

Do they sell out the rest and crash the market? Or wait for a bull run that may never come?

The likely outcome is that the price of Bitcoin remains rangebound for the foreseeable future.