There has been one tech company that has tied its fortunes directly to the price of Bitcoin ($BTC) and that is MicroStrategy (MSTR).

Gutsy is a word that would describe this direction, and some would even say it’s full out irresponsible.

The daring company has had to deal with fallout when bitcoin crashes and it was brutal in the PR world.

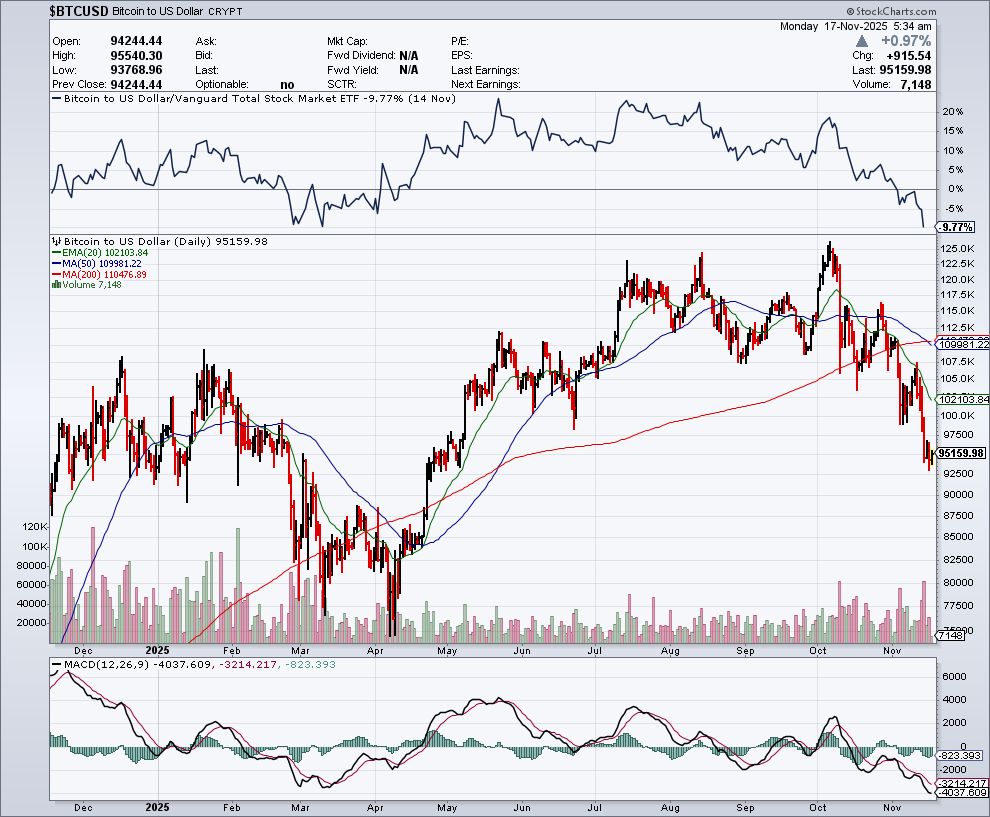

Yet as Bitcoin soars in price today, the co-founder of MSTR Michael Saylor should take a victory lap.

Saylor was on the receiving end of a great deal of scorn and criticism as Bitcoin tanked to $15,000 per coin.

Now the company is levering up some more to go bigger.

MSTR bought another 12,000 Bitcoin for $821.7 million, the second-largest purchase by the enterprise software maker since it began acquiring the cryptocurrency almost four years ago.

The fresh hoard raised MicroStrategy’s total Bitcoin holdings to around 205,000 tokens, or to more than $14 billion.

Saylor started buying Bitcoin in 2020 as an inflation hedge and alternative to holding cash. MicroStrategy has already spent more than $1 billion in Bitcoin in the first three months of 2024, more than half of last year’s total buying. The cryptocurrency is up around 675% since Saylor began buying.

The shift into Bitcoin has led to a revival in the share price of MicroStrategy, which has surged more than 1,000% since Saylor’s pivot.

The company’s market capitalization has increased to around $25.7 billion, topping the level that it previously peaked at in March 2000. MicroStrategy reached a settlement in December 2000 with the SEC over accounting fraud allegations.

The average price for the total holding is $33,706, according to the filing. Bitcoin reached a record high of more than $72,000.

The company also presides over a real software business and they believe that the combination of an operating structure including a bitcoin strategy will succeed.

MSTR’s focus on technology innovation provides a unique opportunity for value creation.

Being an operating company, MSTR’s software business remains a core revenue and cash flow generator.

In addition, it also enables them to acquire bitcoin through the use of excess cash or proceeds from equity capital raises or corporate debt capital raises and to pursue software innovations that leverage the bitcoin blockchain.

They’ve deployed these levers to increase bitcoin holdings in a manner that has created shareholder value.

Bitcoin development includes its Bitcoin acquisition strategy and Bitcoin advocacy initiatives.

MSTR’s software development includes BI, AI, Cloud, or Bitcoin and Lightning-related software development.

In 2024, they are hell-bent to shift focus to grow in AI plus BI, while accelerating a sharp transition to a cloud-centric operating model.

Key strategic goals are to grow cloud, innovate with AI, and increase profitability.

In December, they successfully deployed Google Cloud platform integration, furthering multi-cloud capabilities, and providing greater optionality to their customers.

I won’t say that MSTR’s software and cloud business will compete with the Silicon Valley Magnificent 7, but its existence is to support a risky Bitcoin strategy which is actually working effectively as we speak.

Sometimes risky bets pay off well.

Shares in this company will either skyrocket or go to zero depending on what Bitcoin does.