In prior iterations of the CPI report, a set of data reflecting the current inflation trends in the US, a positive report would have sent the tech index, known as the Nasdaq (COMPQ), soaring.

Today, we got none of that.

Volatility has taken a nap for the time being – even to the downside.

Why is that?

This time around the tech market is already looking around the corner to earnings that are assumed to be terrible.

Most of the profit margin gains were accrued last year and in the first quarter of this year. The rest of the year, tech companies won’t be able to raise the price of services.

Last year, Apple pushed that extra level pricing of iPhone, and Airbnb charged that extra level for that vacation rental. Now – no more.

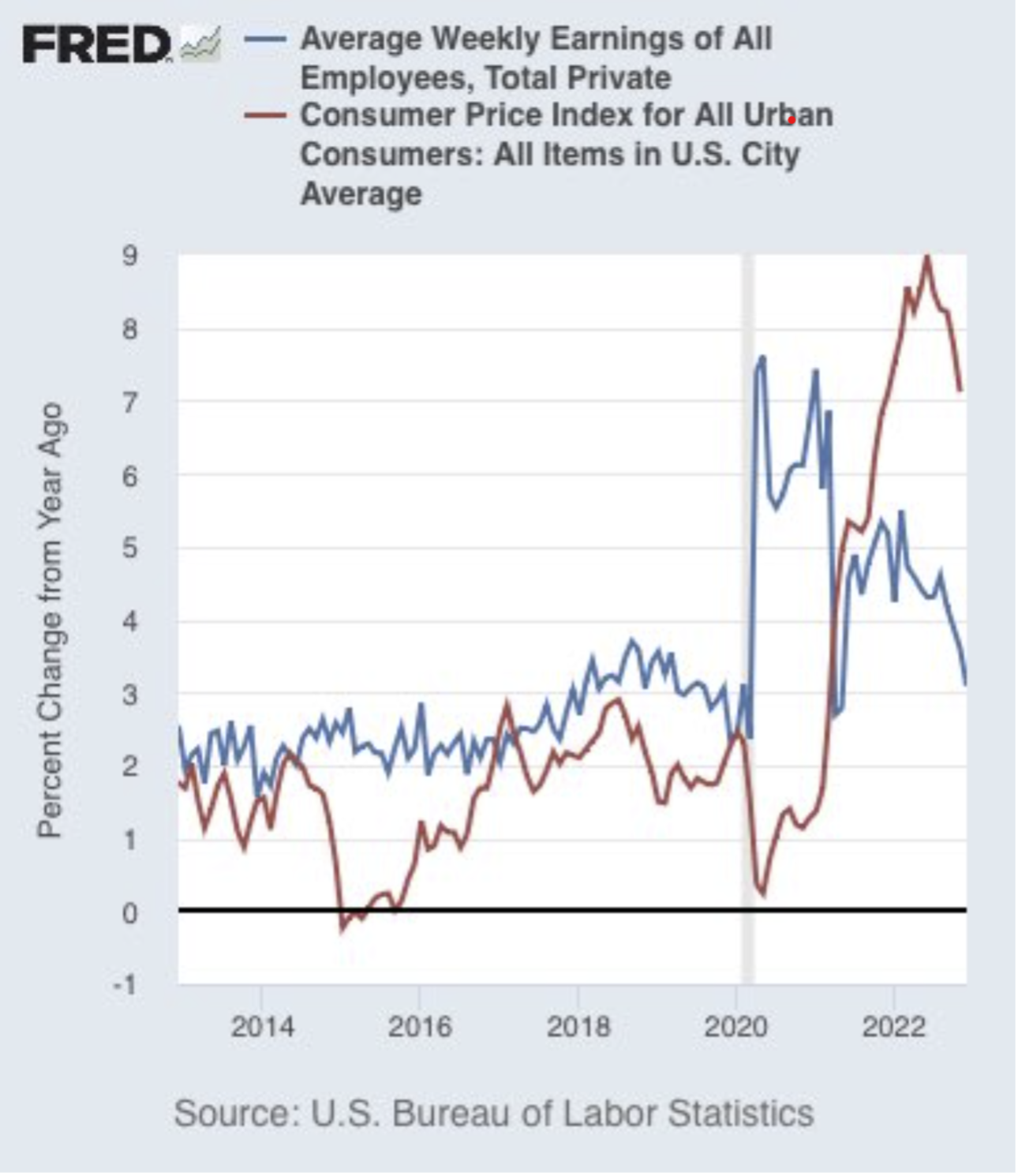

Tech consumers are at the extreme upper limit of what they can afford and in fact, have been going deeper into debt to pay for software, hardware, and streaming.

The credit card debt levels have been soaring, showing that consumers are paying more for each item but getting less for every tech product.

What does this mean?

Management will offer bleak tech forecasts.

Silicon Valley might use this underwhelming period as a great platform to throw out the kitchen sink with the bath water.

That’s what today’s price action is telling us.

The easy gains in tech share appreciation were secured in January and March.

Conditions for the same melt up have soured quickly, and not bouncing hard off a great inflation report is an ominous sign in the short term for tech shares.

Now is a time when the easiest path of movement is south in shares as many investors could be taking profits heading into the earnings season.

There are no catalysts for a short-term bounce.

One bright note is that the US dollar has continued its awful performance this year which is highly positive for global growth which tech companies more than participate in.

Hollowing out the tech consumers isn’t the greatest strategy, but until now, it has worked. However, at what point will they stop taking on debt to fund their latest purchase? We could be coming to an inflection point, and that is not good for tech stocks.

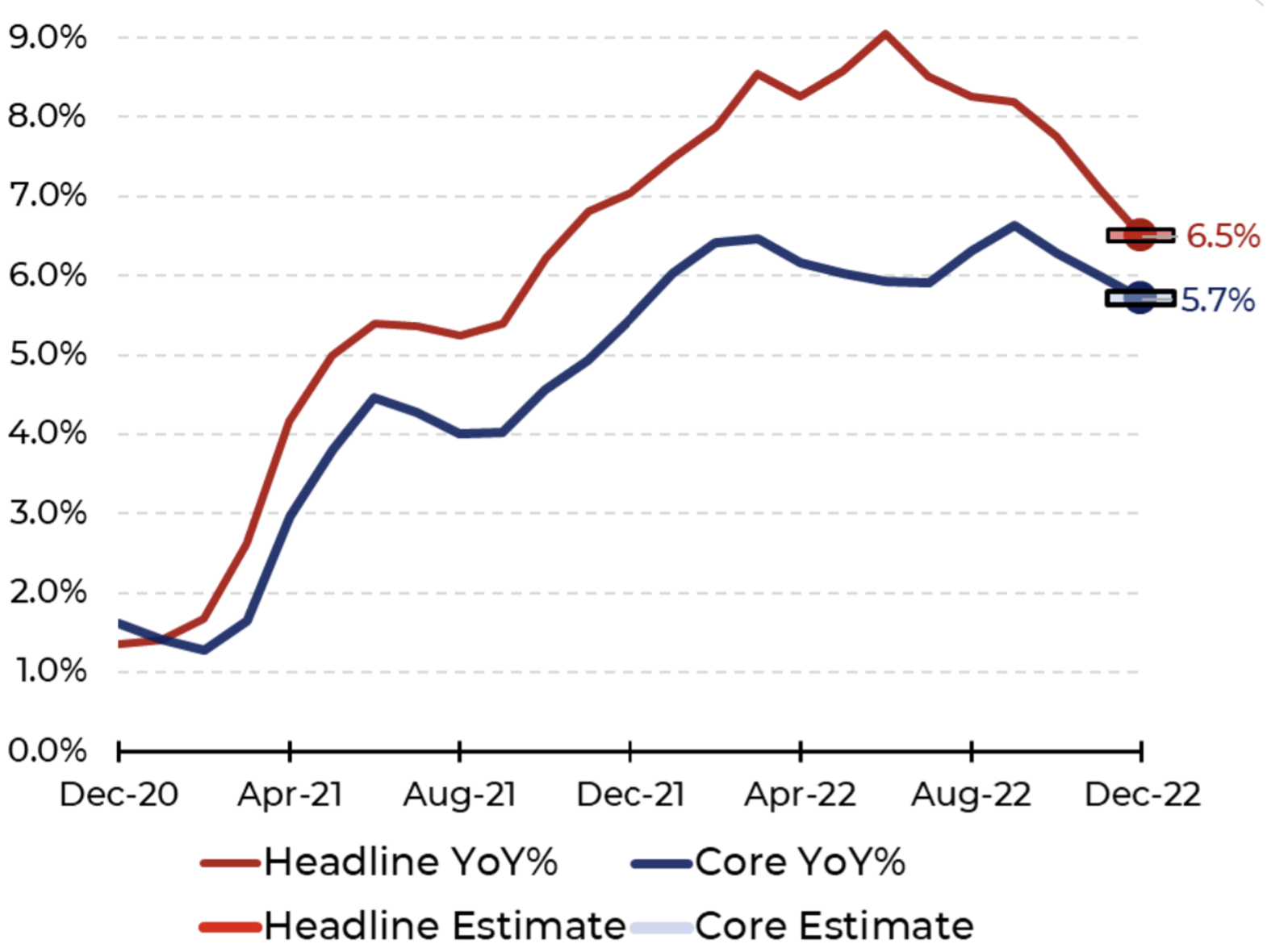

As it stands, U.S. inflation is at its lowest level in nearly two years, but underlying price pressures will be sticky for a while.

Inflation rose 5% last month from a year earlier, down from February’s 6% increase and the smallest gain since May 2021, the Labor Department said Wednesday.

The labor market cooled some in March, with hiring gains moderating and wage growth easing. Weekly jobless claims, a proxy for layoffs, are up from historic lows. Also, job openings have dropped—a signal that demand for workers is softening.

Even if the job market has cooled, it hasn’t cooled enough for inflation to crash.

Yes, many tech jobs have been cut, and I see that as a much needed solution to the excesses of Silicon Valley, but today is more of a story of the number one risk to the market shifting from inflation to bad individual performance.

Get ready for many tech companies to tell us why they won’t be doing great later this year.

Remember the market always looks forward, and at the end of last month I predicted a slow April; that forecast has been nothing short of perfect so far.