Mad Hedge Technology Letter

July 1, 2022

Fiat Lux

Featured Trade:

(WHO’S BEING HONEST?)

(META), ($COMPQ)

Mad Hedge Technology Letter

July 1, 2022

Fiat Lux

Featured Trade:

(WHO’S BEING HONEST?)

(META), ($COMPQ)

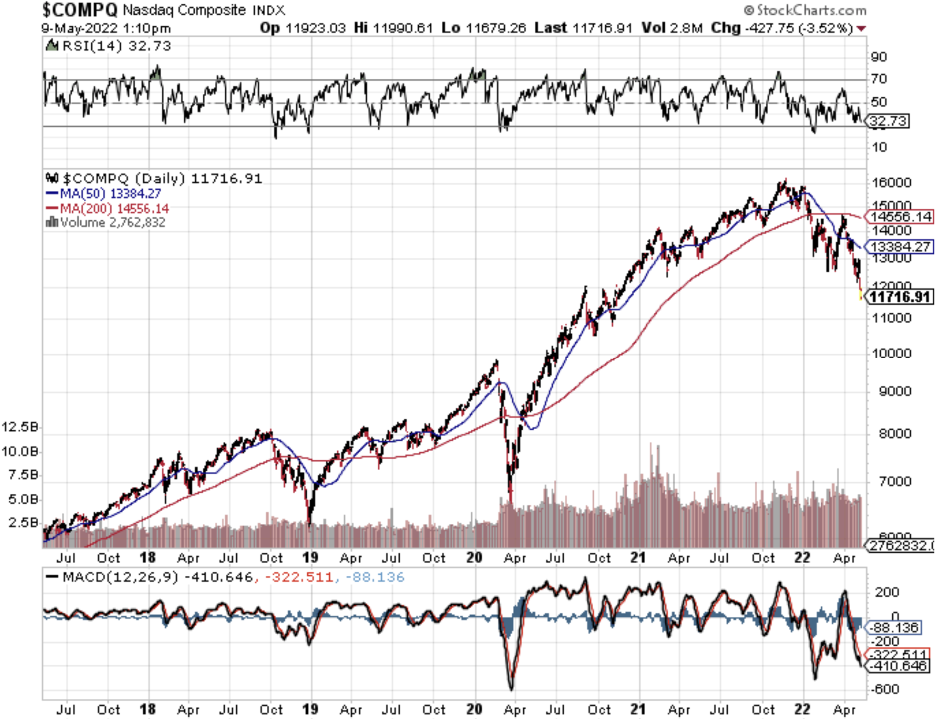

It’s fair to take a look at the Nasdaq index and predict there’s a substantially strong chance for the Nasdaq ($COMPQ) to hit 9,310 which is around 12% from here.

The people in charge have been sounding out how great the US economy is with Federal Reserve Chair Jerome Powell saying the US economy is in “strong shape” and the central bank can reduce inflation to 2% while maintaining a solid labor market.

I believe Powell is overplaying his hand and the economy isn’t as strong as he says it is.

Energy stocks were up 29% in the first half of 2022 and their outperformance contributed to pushing other sectors down like technology.

The re-rating of the economy to worse than first thought will translate into worse than expected earnings projections and take us down closer to 9,310 on the technology-heavy Nasdaq index.

That’s only about 12% from today.

The US central bank is still fighting an uphill battle to contain inflation.

Let’s do some simple math.

The Fed Fund’s rate is currently sitting at 1.75%.

Considering that inflation is at 8.65%, the Fed would need to raise rates another 6.85% for real inflation to be zero.

The Fed said they hope to get to 4% by the end of 2023 which would still represent relative inflation of 4.65%.

That’s also 17 months away and worse unintended consequences could manifest along the way which is why raising it all at one time would probably be better than not at this point.

Powell’s comments came at a panel discussion at the European Central Bank’s annual policy forum in Sintra, Portugal.

Ironically, peel back a layer and the environment is starting to unravel in Silicon Valley.

One bellwether to take note of is Meta (META) or Facebook which announced they will cut plans to hire engineers by at least 30% this year, CEO Mark Zuckerberg told employees on Thursday, as he warned them to brace for a deep economic downturn.

“If I had to bet, I'd say that this might be one of the worst downturns that we've seen in recent history,” Zuckerberg told workers in a weekly employee Q&A session.

Zuckerberg confirmed that layoffs are also coming saying the company was “turning up the heat” on performance management to filter out staffers unable to meet more aggressive goals.

“Realistically, there are probably a bunch of people at the company who shouldn't be here,” Zuckerberg said.

Chief Product Officer Chris Cox said that the company must “prioritize more ruthlessly” and that the economy is in “serious times here and the headwinds are fierce.”

Powell’s comments are diametrically opposed to what Zuckerberg and Cox are revealing to their staff and these Facebook executives have access to much more detailed data on the state of the consumer than Powell.

Who should we believe?

Powell just got re-elected to another 4-year term which in fact was a reason why he said he was late to raise rates.

Zuckerberg and Cox can’t afford to wait to get “re-elected” because in the game of public businesses there are only the ones who are left behind and the ones who do the leaving behind.

Powell can slow play the rate situation and pedal out false narratives because he is guaranteed a 4-year term which will most likely be his last before retiring to a nice benefits package and pension.

Zuckerberg is presiding over a failing Facebook business where Meta is sucking up lots of capital expenditure to develop an uncertain metaverse.

My bet is that we will see many tech companies reinforce what Zuckerberg and Cox laid out.

Companies will need to tighten up shops and shave off the fat.

The incremental eyeball is much harder to secure and monetize in July 2022 than it was during the great bull market of 2018 and 2019.

Tesla CEO Elon Musk has also reiterated similar talking points and the odd man out appears to be Powell.

9,310 could be here sooner than we think.

Mad Hedge Technology Letter

June 6, 2022

Fiat Lux

Featured Trade:

(A KEY CLUE TO THE FUTURE OF META)

(FB), (COMPQ)

Chief Operating Officer (COO) of Facebook (FB) Sheryl Sandberg quitting from her post caught many off guard.

It seemed like she was in it to the end, until she wasn’t.

Most thought she wouldn’t stop until the company she worked for completely destroyed democracy, or ruined other countries’ free elections, or until she had more money than most sovereign countries.

Apparently, that wasn’t the finish line!

Did she get tired of all the mass killings that Facebook streamed live to its multi-billion-person audience?

Probably not.

My read into this is that Facebook is heading directly for a cataclysmic revenue iceberg and Sandberg is definitely not on board with the new direction of the company, i.e. the Metaverse.

The Metaverse has already lost 10s of billions of dollars and will continue to do so for the next couple of years for a very untested and unproven technology.

She clearly gives the Metaverse a big thumbs down and we might look back on this to a vital signal or even a missed sign.

Sandberg would most likely stay on board if there was another billion it in for her.

Remember, it was Sandberg who brought the concept of a digital ad model from Google to Facebook which catapulted Facebook into a wildly successful cash cow for its shareholders.

After that, I am not sure what else she did, but most executives never get that far in the first place.

Another takeaway from her resignation is that her digital ad model which essentially stole personal data from the user to sell to digital advertisers is on a downward and irreversible trajectory.

The underlying data supports this notion as Facebook, minus Instagram, bleeds users.

So instead of being in Menlo Park to take the blame for the downfall, might as well rebrand herself as the most powerful female Venture Capitalist in technology and move on to reignite her corporate feminism.

Even though she did pocket well over a billion dollars from her 14-years in mostly vested stock selling, she will be more known for selling out the Facebook user.

Rather than sacrifice a smidgeon of profitability to protect users, she decided to build a colossal army to construct a communications and government affairs squad to deny and deflect criticism of Facebook.

Those teams have been supremely effective at stymieing any momentum to go after Facebook itself.

That’s why the company is never in trouble and executives aren’t in jail.

They run a playbook of delaying tactics that stretch each story beyond the attention span of journalists and policymakers and even paying others to write bad press.

Sandberg was the engineer of that strategy and of the teams that implemented it. This was a deliberate choice. So was the Facebook decision to hire a consultancy to do opposition research about George Soros after the billionaire criticized Facebook in a speech at the World Economic Forum in early 2018.

She is a master of the dark arts and her quitting at Facebook does help cleanse the stench of the tech industry that has built a rotten reputation recently.

The biggest corporate sellout of Silicon Valley quitting epitomizes the deep trenches tech and Facebook find themselves in right now.

The fall from grace in 2022 has forced many hedge funds to liquidate.

Negative wealth effects are something no industry wants to be a part of.

However, it appears there is light at the end of the tunnel.

The 30% correction in the Nasdaq index has been followed by a 6% bear market rally.

The good news is that it's highly likely the Nasdaq index will not experience another 30% correction in the second half of 2022.

However, a recession not yet being priced into Nasdaq shares and a bad earnings setup put a spanner into the works, which is why the bear market rally is legitimately capped to the upside.

This means that it's the year of the short-term trader while long-term ETF holders won’t and haven’t found much success this year.

Sell the big rallies and buy the big dips, then take profits.

At least now is the time we are starting to discover dip buyers after they took the first 6 months off in 2022.

Mad Hedge Technology Letter

May 20, 2022

Fiat Lux

Featured Trade:

(STUDENTS POISED TO DUMP ON TECH STOCKS)

($COMPQ)

The straw that breaks the camel's back for not only the broader market, but tech stocks, could be the $2 trillion in student debt loans that could be canceled by U.S. President Joe Biden’s current administration.

About $1.6 trillion of the $2 trillion in loans that's owed to the U.S. federal government, as opposed to private loans, went into forbearance at the beginning of the pandemic.

The U.S. government already owes over $30 trillion in debt with another handout of $40 billion going to Ukraine yesterday and today another $100 million planned in weapons earmarked for Ukraine.

If we do a basic calculation, $2 trillion of possible forgiven student debt represents around 7% of total federal debt; and this will add additional pressure to the federal government, as they will absorb the debt and gaudy interest payments that will make their debt repayments even more arduous.

To be more precise, the federal government is about to give up $25 billion per year in interest payments from these loans, and that is $25 billion they won’t have to pay back of their own interest-based debt repayments.

These current pro-inflation policies are on borrowed time for not only the people on the ground dealing with them, but some of these politicians.

Senator Mitt Romney and four Republican senators introduced the Student Loan Accountability Act, which would: prohibit the Biden administration from enacting wide-scale student loan cancellation to forgive all, or some, student loans for borrowers; and include exemptions for existing targeted federal student loan forgiveness, student loan cancellation, or student loan repayment programs, such as public service loan forgiveness and teacher loan forgiveness.

Desperate times make for desperate measures.

What does this mean for technology stocks?

In general, it means lower price per share.

Another explosion of high inflation would force the Fed to become even more hawkish about raising interest rates.

Although I don’t want to beat a dead horse, the macro elements have completely consumed everything and anything going on in risk markets.

It’s almost not about the tech stocks anymore, even though they are guiding weakly.

Much of the fallout stems from the extremity of the exogenous events as the world barrels towards a food shortage in 2023 because many countries have banned food exports and Ukrainian ports shut down.

Much like the price of Bitcoin, technology stocks don’t perform well in a hyperinflationary environment.

Money is allocated to other needs, which is why we saw BlackRock's $10 billion momentum ETF dumping technology for energy starting next week.

Energy stocks are not in a bubble compared to non-profit tech companies in a high inflation environment. You have to ask yourself: what companies benefit more from higher inflation prices? Definitely the energy sector.

Russia’s current account surplus more than tripled in the first four months of the year to $95.8 billion.

Last week, the International Energy Agency said Russian oil export revenue is up 50% since the start of 2022 with the Kremlin generating close to $20 billion per month in sales.

Additional incremental capital allocation pouring into energy sets the stage once the student debt gets canceled, this money will be used to pay for even higher energy prices which in turn be used to return to shareholders via buybacks and dividends.

Energy prices will certainly be higher since the current administration enacted price controls by The U.S. House passing a bill on Thursday that allows the U.S. president to issue an energy emergency declaration, making it unlawful for companies to excessively increase gasoline and home fuel prices.

This will destroy more supply as smaller gas companies shudder in fear of being prosecuted, leaving only the big players and decreased capacity.

The money saved on not paying student loans will not go into technology stocks in the short-term, especially since the rising rates put a cap on price appreciation.

We are in the midst of extreme shareholder capitalism in the United States, anyone who can double or triple prices can and will.

This means that every industry needs to package itself the shiniest to get a sliver of the incremental capital.

Technology stocks are failing at this, and it was only just recently they were considered the darlings of the economy.

The shelter-at-home economy is long gone and same for the revenue that was pulled forward with it.

Revenue is now being pushed further back and the tech industry is panicking under the new rules of the global economy.

Mad Hedge Technology Letter

May 18, 2022

Fiat Lux

Featured Trade:

(REDEMPTION WATERFALL)

($COMPQ)

What’s around the pipeline for all these super leveraged tech hedge funds?

I’ll tell you what will happen, and it’s not pretty.

This has direct consequences for your fragile portfolio, so be sure to listen up.

Top quartile tech hedge fund managers wind up becoming liquidity providers due to bottom quartile managers agreeing to redemptions.

Yep, I just said it, we are about to enter a period of extreme redemptions brought on by the massive underperformance of tech stocks by tech growth hedge fund managers.

Apply the same logic to top-performing stocks vs. bottom-performing stocks and people’s penchants for selling winners and keeping losers.

These capital redemptions are about to hit us and don’t think that hedge fund managers have trillions lying around just to return.

Most of their liquidity is already tied up in the market or better saying already lost in the market!

Many of these funds have been laser-like focused on tech growth stocks, just do the research, there are no gold-based hedge funds because they don’t sell well.

Tech has been outperforming the market for this entire bull market cycle and the way that manifests itself inside the hedge fund ecosystem is with more copy-paste tech growth funds.

When the Nasdaq drops 30% nominally like it did in the past 6 months and a fund is laden with the garden variety of growth stocks, these funds are in the queue for returns, and some possibly even shut down completely.

That’s exactly what’s been going on as we come back to reality.

These funds are proving that they aren’t living up to the hype of being nimble and flowing in and out of trades.

Their behavior suggests they are the opposite and just another ETF copycat, repackaged with the hedge fund marketing lingo.

So what’s the deal now?

Buy and hold in the face of accelerating rate rise expectations is hardly ideal, but that’s what these Harvard MBA-supported private hedge funds are doing.

I can’t make this stuff up.

Then even in this case, they overperform relative to a 30% drop in the Nasdaq of let’s say -10%.

Do we believe the incremental capital allocator will jump at a chance to lose 10% because it’s not losing 30%?

Maybe in U.S. President Joe Biden’s world, but not in the world of real people investing where they fight tooth and nail to preserve capital.

Take for instance some of these infamous guys like Tiger Capital which specializes in tech growth.

Back-of-the-envelope calculations based on the reported $35 billion size of Tiger’s overall public equities booked at the end of last year indicate that it has probably suffered a nominal loss of at least $15 billion in 2022.

To put that into perspective, Citadel lost 55% for an estimated $8 billion loss in the 2008 financial crisis.

Given that there were 82 trading days in January-April, this works out to be a loss of roughly $183 million every day that markets were open this year. Or $28.1 million every hour that US markets were open.

That’s what you’re overpaying for - these smart guys to lose your money.

Billionaire investor Steve Cohen’s Point72 Asset Management also removed the $750 million it invested in Melvin Capital Management.

Melvin Capital, the hedge fund at the center of the GameStop trading frenzy, lost 49% on its investments during the first three months of 2021.

Hedge fund managers Cohen and Kenneth Griffin had stepped in to aid Melvin Capital in January last year with Griffin’s Citadel and Cohen’s Point72 adding $2.75 billion to the firm.

What’s the fallout here?

The best employees, if they do exist, leave these cratering tech funds to either get another job at another tech hedge fund or start new tech funds themselves by raising new money.

Soon these funds, if they still exist, must fold because of the brain drain encouraging 100% redemptions; and as I talk to many friends today, this trend is accelerating.

To get redeemed out of existence looks bad on the resume.

Required liquidity due to losses in other funds is where we are now in this economic cycle.

Ironically, this could lead to several Bernie Madoff type Ponzi’s in the worst case, but the best case is after this bear market rally, there will be a sharp sell-off that will take us a leg lower in the Nasdaq.

This could be sped up by the US Central Bank talking up inflation even more frequently, and the market will need to fight through this to keep its levels.

Mad Hedge Technology Letter

May 9, 2022

Fiat Lux

Featured Trade:

(BUYER STRIKE HAS LEGS)

($COMPQ), (AMZN), (FB)

The buyer strike roars ahead as the 10-year U.S. treasure accelerates its rate of decline touching 3.2%.

We are dealing with a major deleveraging of the tech sector as a massive rotation flood into commodity-linked assets, the US dollar, and shorting bonds.

Sadly, we got another kick up the rear side when US Central Bank governor Jerome Powell committed yet another policy mistake by attempting to save the stock market.

Things could get ugly from here.

Many investors believed the Fed would self-correct after the “transitory” inflation nonsense.

It’s not so much the actual 3.2% rate today, but the velocity of the move which is creating many air pockets that are not being filled.

Why?

Investors are betting that Powell will most likely make a third policy mistake which could create another suicidal spiral downwards.

Investors have no incentive to buy stocks when the Fed has not only lost credibility but appears to not understand what is going on with real inflation tearing apart economic health.

This looks a lot like the 1970s just before former US Fed Chair Paul Volcker was brought in to slam the economy and raise interest rates to 18%.

Powell doesn’t seem like he has the guts to do that which is why the prolonging of this failed interest rate policy will mean a longer and more painful economic recession in the future.

I see many pundits going on record saying that the “risk reward has improved.”

Besides stating the obvious, this analysis doesn’t take into consideration that yields could go higher which would cause tech stocks to plummet further.

So yes, the risk reward has improved, but it can improve even more from here.

That doesn’t tell us much about anything.

All signs are now pointing to a souring paradigm shift among tech firms and dramatic changes under the hood.

Facebook (FB) is pausing hiring, a previously unthinkable prospect.

The company blamed macroeconomic challenges and Apple’s privacy changes for its slowest revenue growth in 10 years last quarter.

Almost 12 months after Apple launched App Tracking Transparency, a new analysis predicts its second year will still see big losses to advertisers on FB and YouTube and more collectively losing around $16 billion.

In total, FB will sink $10 billion into its new business with no revenue in 2022.

In February, Amazon (AMZN) announced it would raise its base pay cap from a maximum of $160,000 for most roles to $350,000.

The news comes after employees listed insufficient base pay as the second-most common reason they're looking to leave Amazon in an internal survey conducted last year.

I don’t have an issue with raising salaries, but AMZN had to boost it by far more than double showing readers the intense pressures on current expenses.

Even more problematic now is that new recruits won’t want to accept restricted stock options because of the tech selloff making their stock options less valuable.

Nobody wants to catch a falling knife, me included.

This will put more cash flow pressure on tech companies as new employees will reject stock options and demand a higher net cash salary.

The incremental micro negatives are causing tech companies to miss earnings and guide lower adding yet another negative layer to the grim outlook.

I would argue that even with earnings beats and positive guidance, the tech sector losses would be less.

However, we are experiencing a perfect storm of poor macro events and bad operational data.

Even though the risk reward has improved, it could improve more as the Fed will be forced to ratchet up rates more than expected to compensate for the latest policy mistake.

The market has sniffed this out and is unwilling to buy the dip until the Fed does what is necessary to seriously fight inflation.

The nonsense needs to stop.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

OKLearn moreWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

If you do not want that we track your visist to our site you can disable tracking in your browser here:

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Vimeo and Youtube video embeds: