Chief Operating Officer (COO) of Facebook (FB) Sheryl Sandberg quitting from her post caught many off guard.

It seemed like she was in it to the end, until she wasn’t.

Most thought she wouldn’t stop until the company she worked for completely destroyed democracy, or ruined other countries’ free elections, or until she had more money than most sovereign countries.

Apparently, that wasn’t the finish line!

Did she get tired of all the mass killings that Facebook streamed live to its multi-billion-person audience?

Probably not.

My read into this is that Facebook is heading directly for a cataclysmic revenue iceberg and Sandberg is definitely not on board with the new direction of the company, i.e. the Metaverse.

The Metaverse has already lost 10s of billions of dollars and will continue to do so for the next couple of years for a very untested and unproven technology.

She clearly gives the Metaverse a big thumbs down and we might look back on this to a vital signal or even a missed sign.

Sandberg would most likely stay on board if there was another billion it in for her.

Remember, it was Sandberg who brought the concept of a digital ad model from Google to Facebook which catapulted Facebook into a wildly successful cash cow for its shareholders.

After that, I am not sure what else she did, but most executives never get that far in the first place.

Another takeaway from her resignation is that her digital ad model which essentially stole personal data from the user to sell to digital advertisers is on a downward and irreversible trajectory.

The underlying data supports this notion as Facebook, minus Instagram, bleeds users.

So instead of being in Menlo Park to take the blame for the downfall, might as well rebrand herself as the most powerful female Venture Capitalist in technology and move on to reignite her corporate feminism.

Even though she did pocket well over a billion dollars from her 14-years in mostly vested stock selling, she will be more known for selling out the Facebook user.

Rather than sacrifice a smidgeon of profitability to protect users, she decided to build a colossal army to construct a communications and government affairs squad to deny and deflect criticism of Facebook.

Those teams have been supremely effective at stymieing any momentum to go after Facebook itself.

That’s why the company is never in trouble and executives aren’t in jail.

They run a playbook of delaying tactics that stretch each story beyond the attention span of journalists and policymakers and even paying others to write bad press.

Sandberg was the engineer of that strategy and of the teams that implemented it. This was a deliberate choice. So was the Facebook decision to hire a consultancy to do opposition research about George Soros after the billionaire criticized Facebook in a speech at the World Economic Forum in early 2018.

She is a master of the dark arts and her quitting at Facebook does help cleanse the stench of the tech industry that has built a rotten reputation recently.

The biggest corporate sellout of Silicon Valley quitting epitomizes the deep trenches tech and Facebook find themselves in right now.

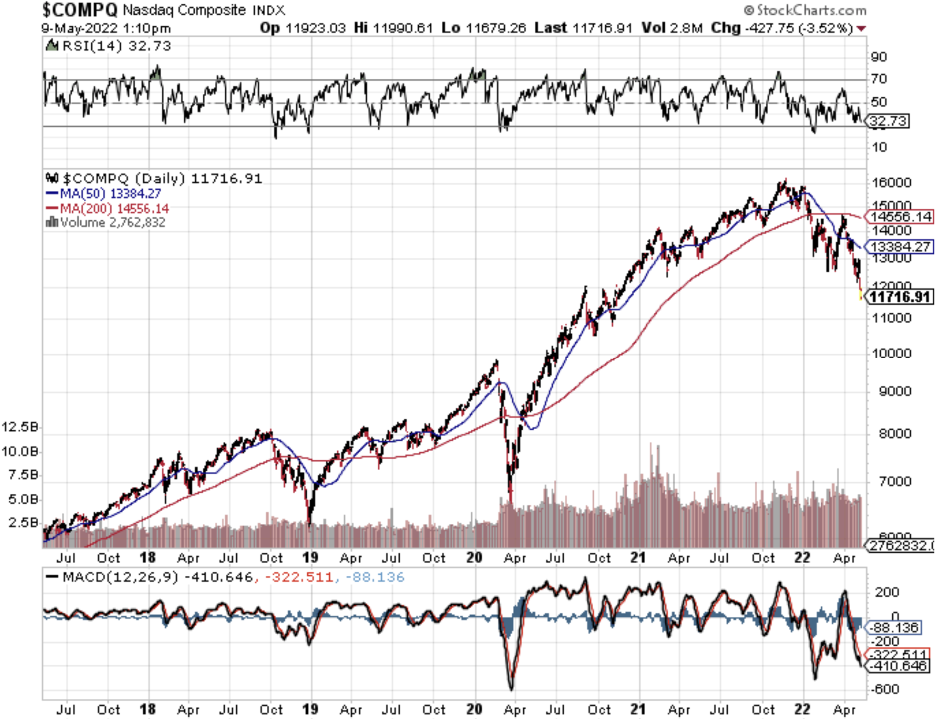

The fall from grace in 2022 has forced many hedge funds to liquidate.

Negative wealth effects are something no industry wants to be a part of.

However, it appears there is light at the end of the tunnel.

The 30% correction in the Nasdaq index has been followed by a 6% bear market rally.

The good news is that it's highly likely the Nasdaq index will not experience another 30% correction in the second half of 2022.

However, a recession not yet being priced into Nasdaq shares and a bad earnings setup put a spanner into the works, which is why the bear market rally is legitimately capped to the upside.

This means that it's the year of the short-term trader while long-term ETF holders won’t and haven’t found much success this year.

Sell the big rallies and buy the big dips, then take profits.

At least now is the time we are starting to discover dip buyers after they took the first 6 months off in 2022.