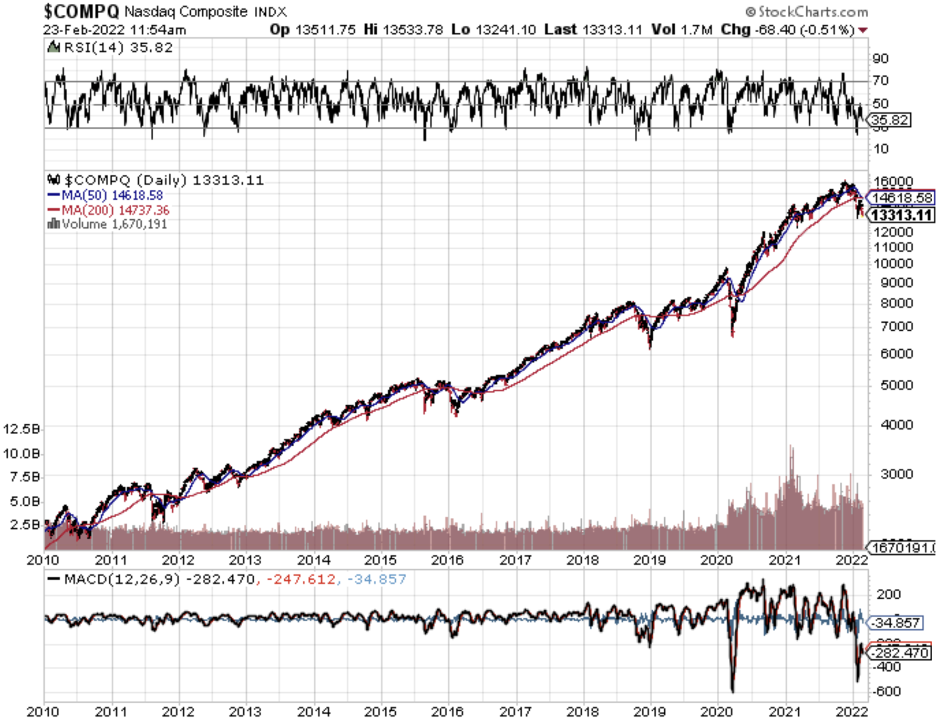

The Nasdaq technology index has been on a bull run for the ages.

You didn’t think it was going to last forever, did you?

In the past 10 years, we’ve only had three little blips, one in 2019 from the temper tantrum, then the 2020 pandemic selloff, and now the 2022 inflation problem.

It’s more or less been strong performance aside from those quick corrections where the Nasdaq bounced back even stronger.

The truth is that meaningful corrections don’t happen that often and every time one has occurred, it’s been a great buying opportunity.

I know it sounds scary in the face of red drowning out your screen, but the silver lining is that this will give readers a chance to grab high quality stocks that are rarely, if at all, on sale.

Here are a few tips on how to navigate a tech market correction.

- Put Market Corrections in Context

Since 1928, a correction of at least 10% has happened about once every 19 months – not that often. Of the 27 corrections since World War II, the index has experienced an average decline of 13.7%.

This highlights the simple truth that investing is not a contest of who can dump stocks as fast as possible.

If you’re convinced a sell-off is on the horizon, consider making the following changes.

- Take Profits

Sell stocks in your portfolio that you think have peaked.

Alternatively, you may want to establish a selling strategy that dictates when you sell stocks and remove any emotion from the decision.

This type of strategy is a method of managing stress and you will avoid misusing that fat finger to get rid of your best assets.

- Focus on Asset Allocation

Preside over a healthy mix of different types of investments that will hold their value until you can jump back into tech stocks.

Don’t put all your money into Facebook (FB) and feel wounded after it drops 25% after their business model collapses (which is essentially what just happened.)

Rarely will everything go down all at once.

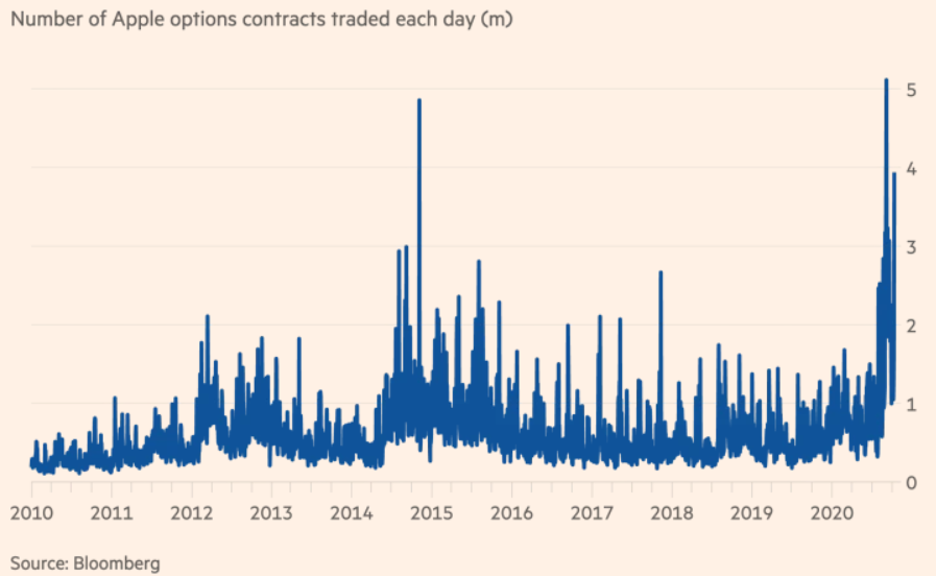

The tech sector usually experiences more downside in a correction than others due to their high growth nature.

This is when dividend-paying stocks start to outperform and a huge rotation rapidly takes place.

- Smarten Up by Placing Limit Orders

It is essential to always place limit orders and not market orders. With a limit order, you specify the price you want to buy or sell at, and the trade is only executed at that price or better.

Meanwhile, opting for a market order means your trade is at the whim of the market. The final filled order could be a few percentage points of where you expected it.

This nasty surprise is easy to avoid.

- Don’t Lose Sight of Your Ultimate Goal

Even if you’re a buy-and-hold investor, you’ll eventually want to sell some of your investments.

Minimizing risks is the name of the game and most investors have a number in mind at the end of the day.

This number is complemented by a timeline; don’t lose sight of the path towards that, and the process needed to achieve that final number.

Markets almost never sell off by 20% and many of these market corrections are great chances to get into the best of tech.

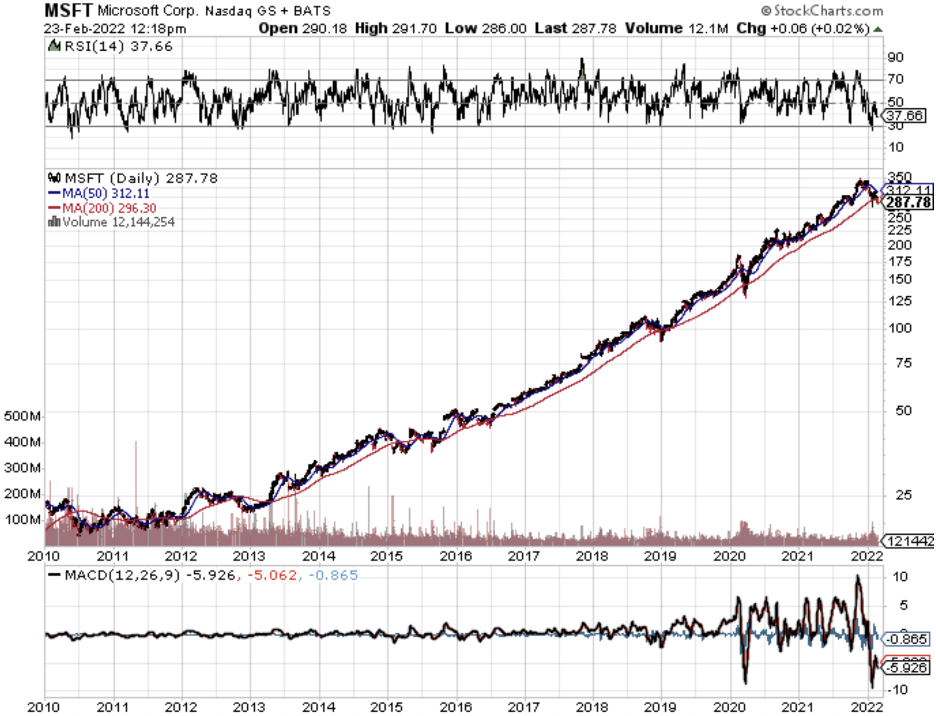

Let’s be honest, tech has been very expensive the last few years and to get a great company like Google, Apple, or Microsoft on discount is something that people pray for.

The tech market has always recovered from its short- and longer-term market dips and this correction won’t be any different.