The summer is winding down and I view it as a huge success.

I ended up using all 20 of my vintage Hawaiian shirts, which I often get compliments on. I don’t tell people I bought them when they were new. My dry cleaner thought she died and went to Heaven.

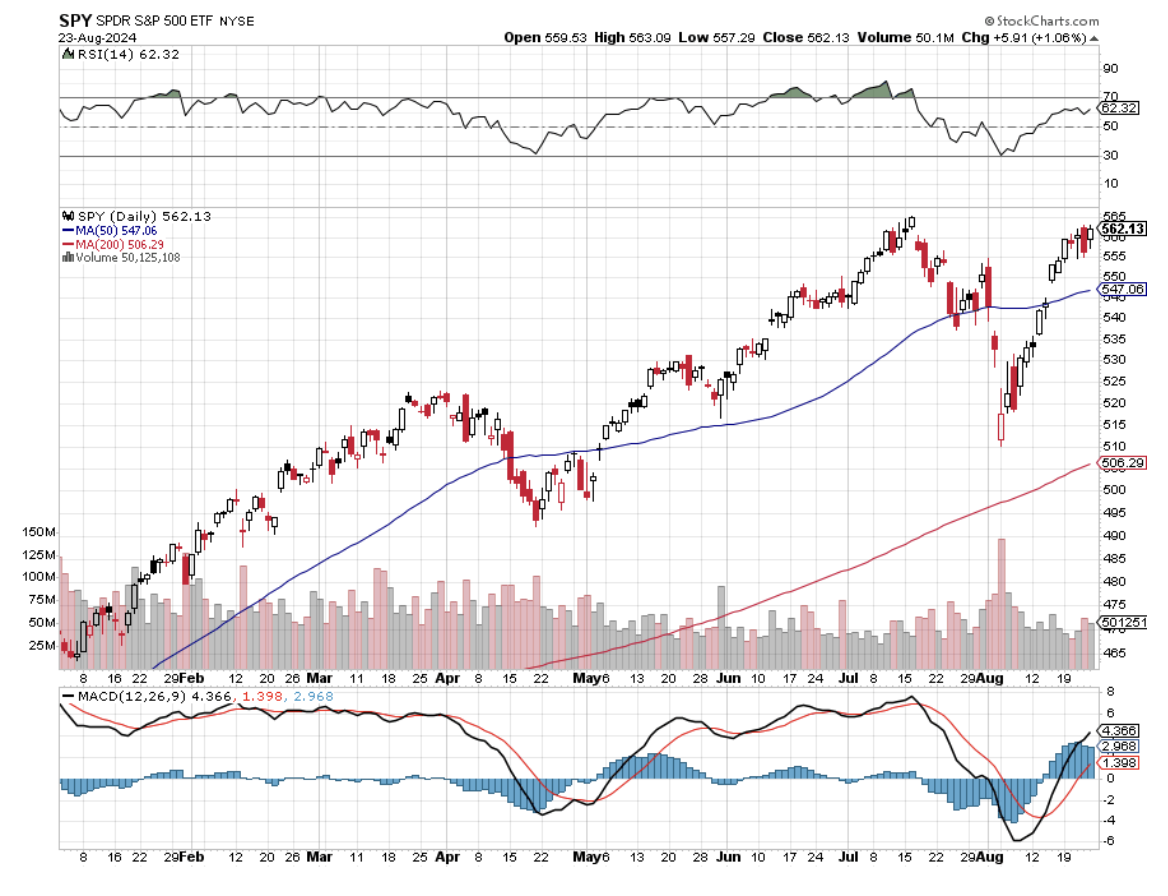

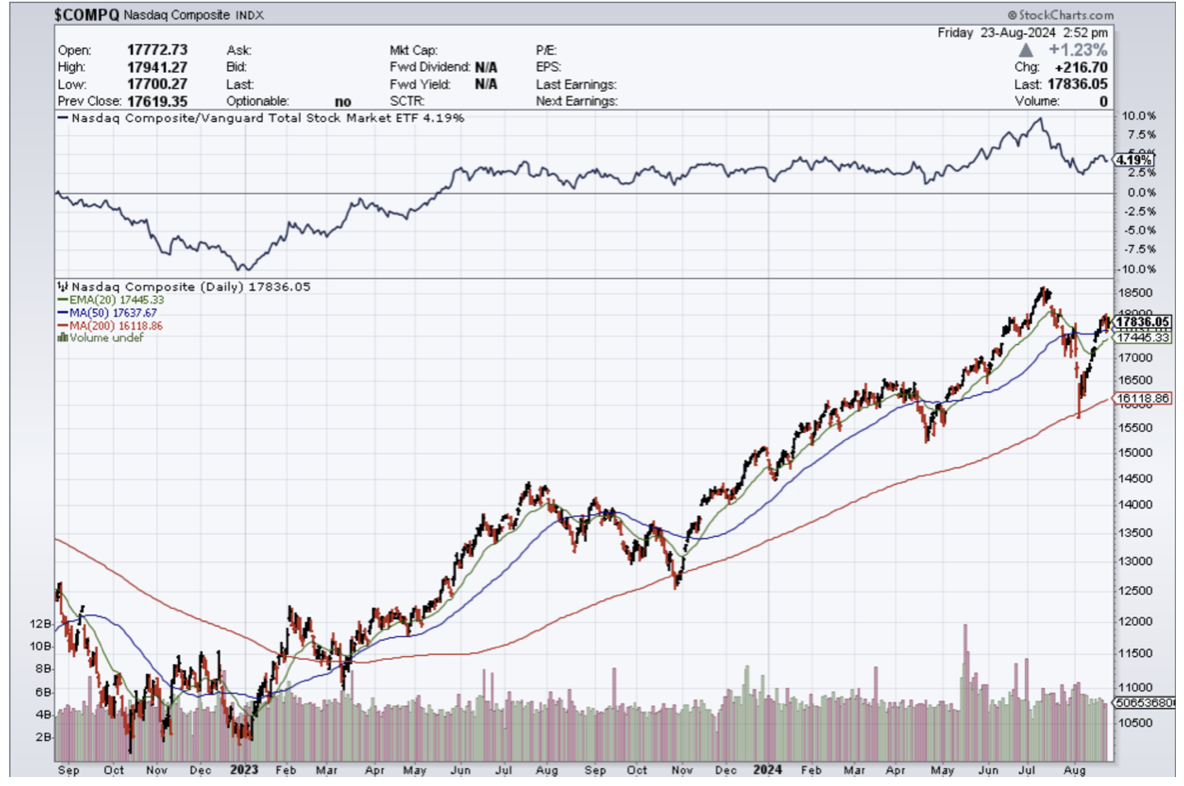

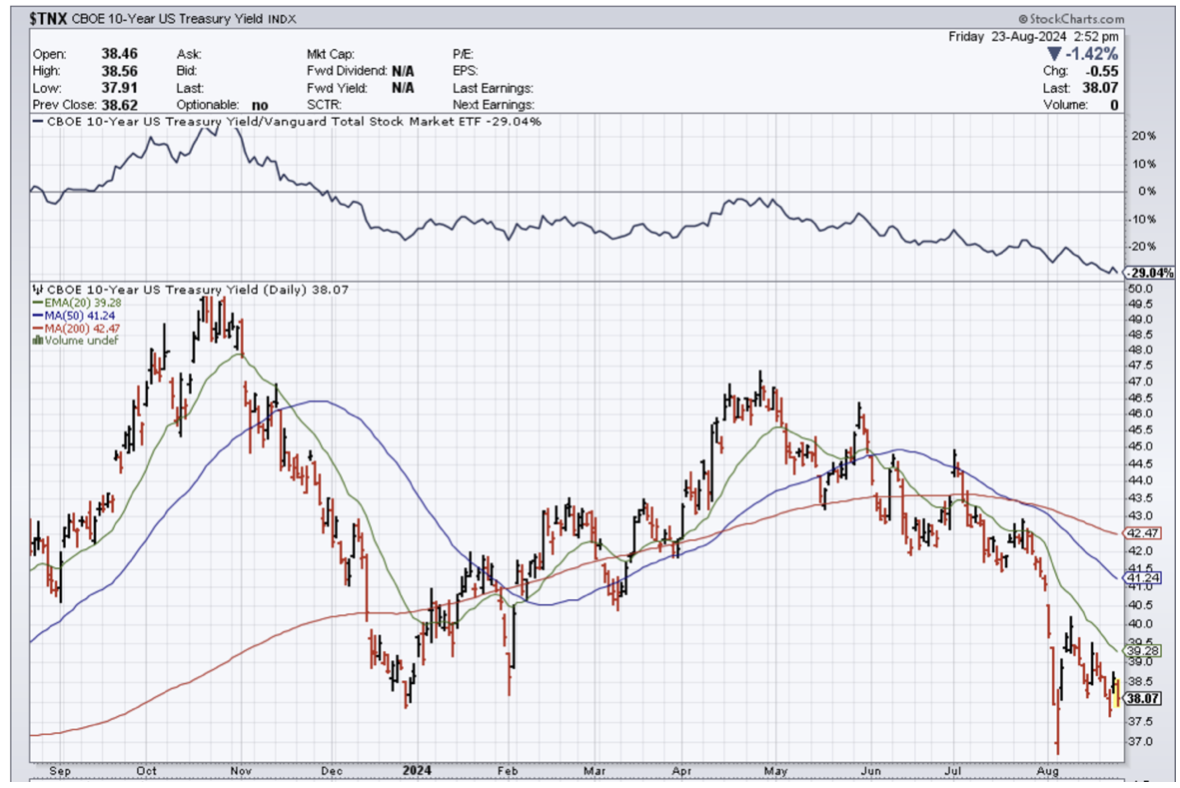

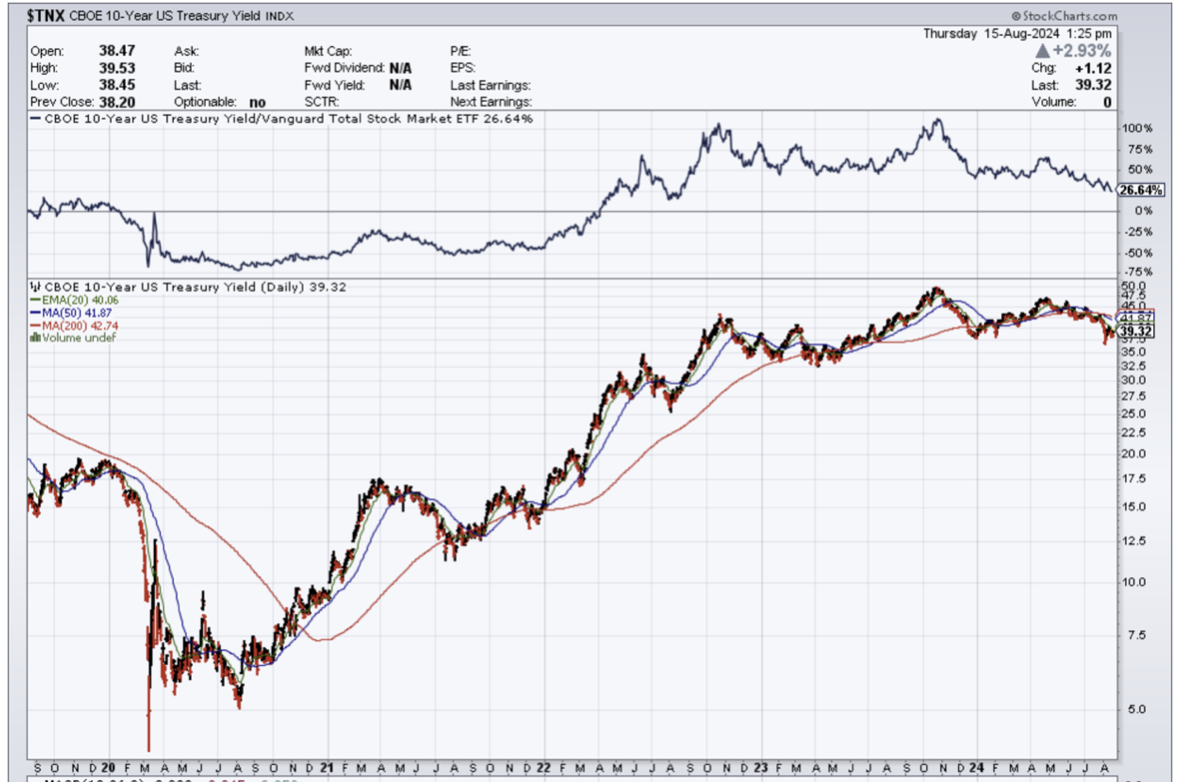

Now that an interest rate cut is a sure thing, what happens next? This is the first bull market in history not preceded by an interest rate cut. It might pay us to review how much markets have really gone up in such a short amount of time.

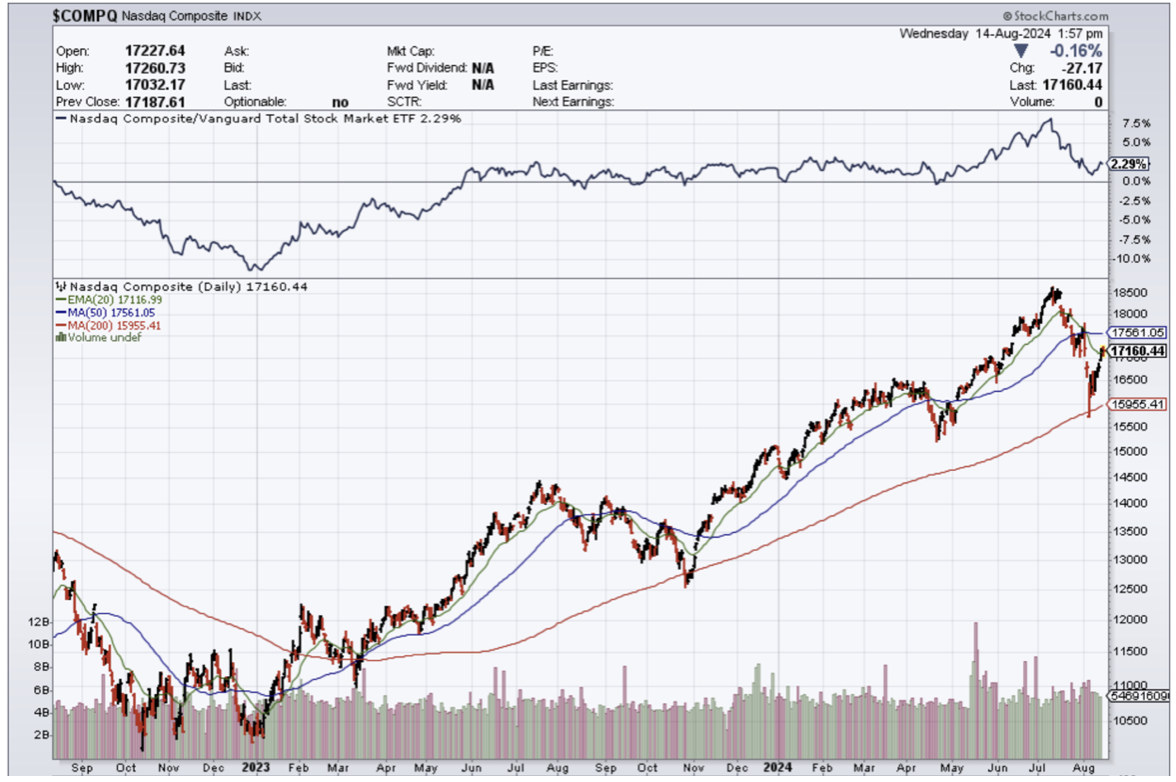

Since the pandemic low, the Dow Average ($INDU) is up 116%, the S&P 500 (SPY) 181%, and the NASDAQ a positively ballistic 262%. Just since the October 26 low, the Dow Average ($INDU) is up 44%, the S&P 500 (SPY) 60%, and the NASDAQ a positively ballistic 86%.

And you want more?

So, what happens now when we get the first interest rate cut in five years? Another new bull market?

Maybe.

Dow 240,000 here we come.

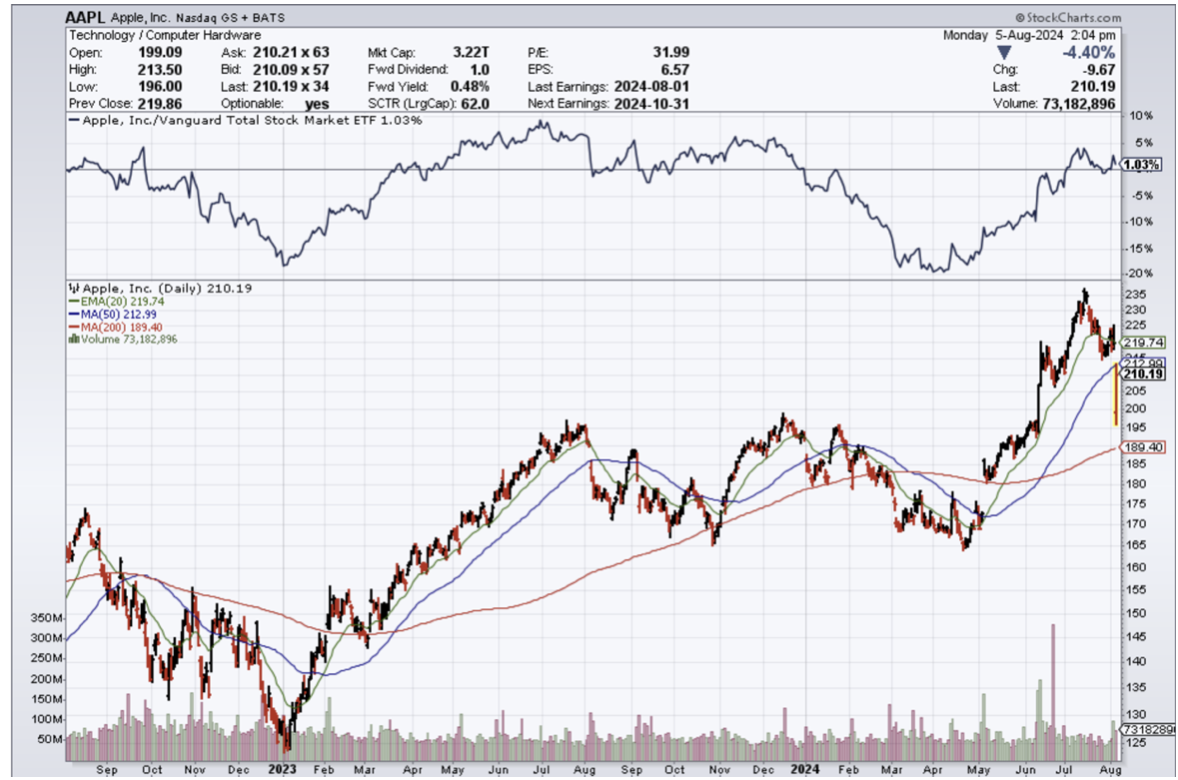

Mad Hedge Fund Trader enjoyed a meteoric performance run so far in 2024, even dodging a bullet from the August 5 Nonfarm Payroll black swan. Whenever that happens, I start to get nervous. So I thought I’d make a list of potential black swans on our horizon that could upset the apple cart.

1) NVIDIA (NVDA) reports, earnings disappoint, and revises down its spectacular forward guidance citing that the AI boom has become overheated. I give this maybe a 5% probability, but even a good report could mark a market top.

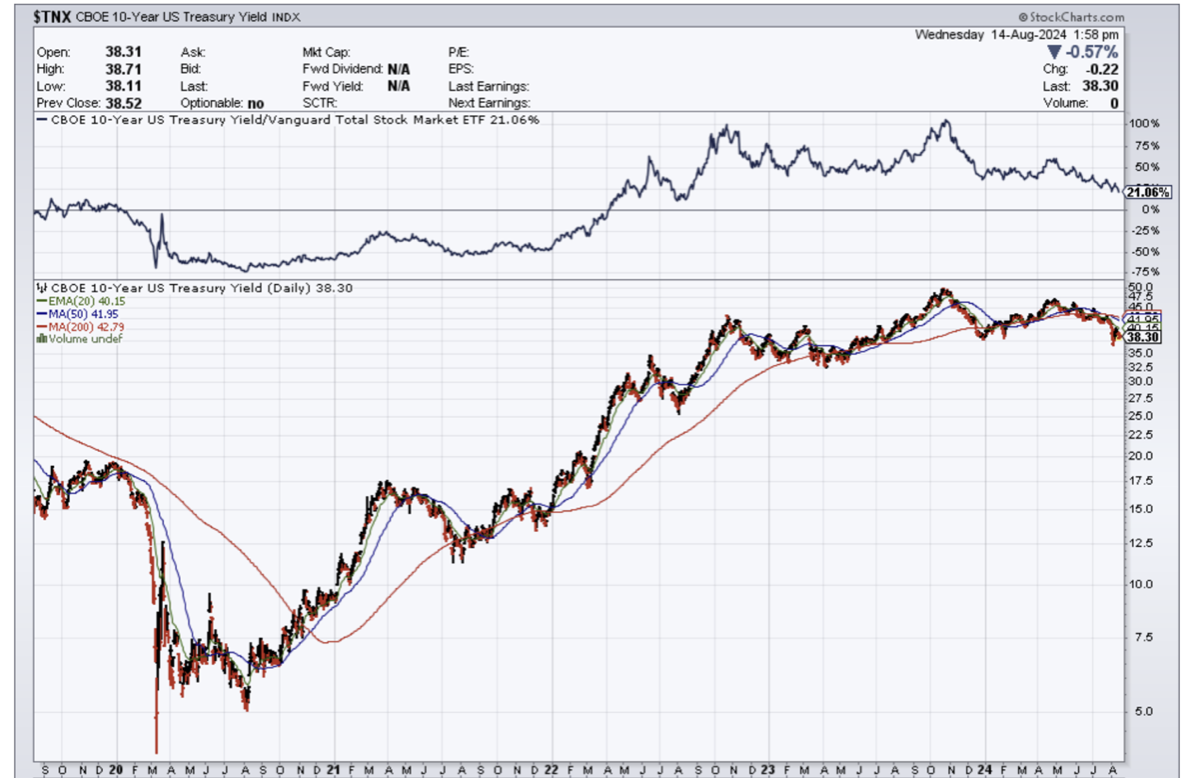

2) The September 6 Nonfarm Payroll Report comes in too hot, and Jay Powell does NOT cut interest rates on September 18. This would be worth a very quick 10% correction and a retest of the (SPY) $510 August low. I give this maybe a 30% probability. The market now considers a rate cut a 100% certainty, which is always dangerous.

3) Jay Powell cuts interest rates on September 18, but only by 25 basis points. If he does this in the wake of an awful September 6 Nonfarm Payroll Report and a jump in the headline Unemployment Rate, we would similarly get a 10% correction and a retest of the (SPY) $510 August low.

4) The calendar alone could give us a correction. The biggest selloffs of both 2022 and 2023 both ended in mid-October. Is history about to repeat itself? Or at least rhyme?

5) The war in the Middle East expands when Iran attacks Israel again. For most American traders the map of the world ends on the US coasts. So even if this happens it’s not worth more than a 4% correction.

Of course, it’s the black swans you don’t see coming that really hurt. That’s why they’re called black swans. Who saw the 9/11 terrorist attacks coming? The 2014 flash crash? The pandemic?

I landed in London on the eve of the big event of the year. No, it was not the King Charles III coronation.

It was the Taylor Swift Eras concert. Thousands of ecstatic Americans crossed the pond to catch the show. I actually thought about going to Wembley Arena to watch her. The last time I had been there was in 1985 for the Live Aid concert. Before that, it was the Beach Boys and Rod Stewart in 1977, which I recently reminded Mike Love about.

But at $1,000 a ticket to get crushed by a crowd of 100,000 I decided to give it a pass. Better to give these old bones a break and catch her on iTunes for free.

But I did get a chance to grill a card-carrying Swifty about the mysterious attraction while waiting at the Virgin Atlantic first-class lounge on the way back to San Francisco.

First of all, she loved the music. But it’s more than just music. More importantly, she admired an independent woman who wrote her own songs and became a billionaire purely through her efforts.

Maybe there will be more strong, independent women in our future.

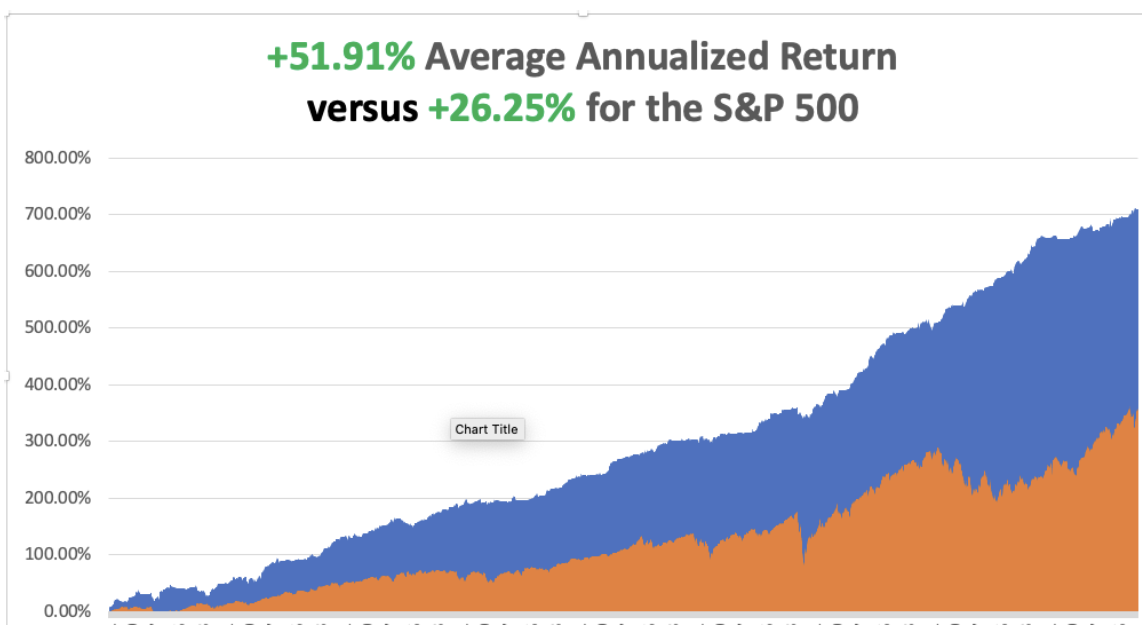

So far in August, we are up by +2.67%. My 2024 year-to-date performance is at +33.61%. The S&P 500 (SPY) is up +18.23% so far in 2024. My trailing one-year return reached +52.25. That brings my 16-year total return to +710.24. My average annualized return has recovered to +51.91%.

I executed no trades last week and am maintaining a 100% cash position. I’ll text you next time I see a bargain in any market. Now there are none.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 49 of 66 trades have been profitable so far in 2024, and several of those losses were break-even. That is a success rate of +74.24%.

Try beating that anywhere.

Jay Powell Says the Time to Adjust Policy is Here, and that much progress has been made toward the 2% inflation target and a sustainable path to get there is in place. Stocks had already front-run the move, but bonds liked it. The path is now clear for a September rate cut, but how much?

Where did the 818,000 Jobs Go? 50 states compiling data in 50 different ways on differing time frames is going to generate some big errors like this one. That means monthly job gains fell from 250,000 to 175,000. Is the message that the Fed waited too long to cut rates?

Weekly Jobless Claims Fall to 233,000, down a whopping 17,000, but how real is it in the wake of this week’s 12-month revision? The report comes with Wall Street on edge amid signs that job growth is slowing and even signaling a potential recession on the horizon. Jobless claims have been trending higher for much of the year, though still remain relatively tame

$6 billion Poured into US Equity Funds Last Week, bolstered by bets of a Federal Reserve rate cut in September and easing worries about a potential downturn in economic growth. That is the largest weekly net purchase since July 17. A benign inflation report last week and the Fed meeting minutes on Wednesday, indicating a potential rate cut in September, boosted investor appetite for risk assets.

Mortgage Rates Hit New 2024 Low. The average for a 30-year, fixed loan was 6.46%, down from 6.49% last week. Borrowing costs are down significantly after topping 7.48% earlier this year, giving house hunters more purchasing power and coaxing some would-be buyers off the fence. Sales of previously owned US homes in July or the first time in five months.

Waymo Picks Up the Pace, Alphabet's (GOOG) Waymo said it had doubled Robotaxi paid rides to 100,000 per week in just over three months. If robotaxis take over the world, imagine the amount of job losses to taxi drivers.

GM (GM) Cuts Staff, GM is laying off more than 1,000 salaried employees globally in its software and services division following a review to streamline the unit’s operations. This follows many other firms that are trying to keep expenses low as the economy starts to slow.

Copper (COPX) Flips from Shortage to Surplus, as the Chinese economic recovery drags on. Copper surpluses of 265,000 metric tons are now expected this year, 305,000 tons in 2025, and 436,000 in 2026. Prices may recover in the fourth quarter if exchange stocks are drawn down. ME copper hit 4-1/2 month lows of $8,714 a ton in early August as U.S. recession fears and concern the Federal Reserve has kept interest rates too high exacerbated negative sentiment from soaring inventories and lackluster demand.

China (FXI) consumes more than half of global refined copper supplies, estimated at around 26 million tons this year. But much of the copper used in China is for wiring in household goods which are then exported. A housing market slump and China's stagnant manufacturing sector highlight the headwinds copper demand faces. Hold off on (FCX).

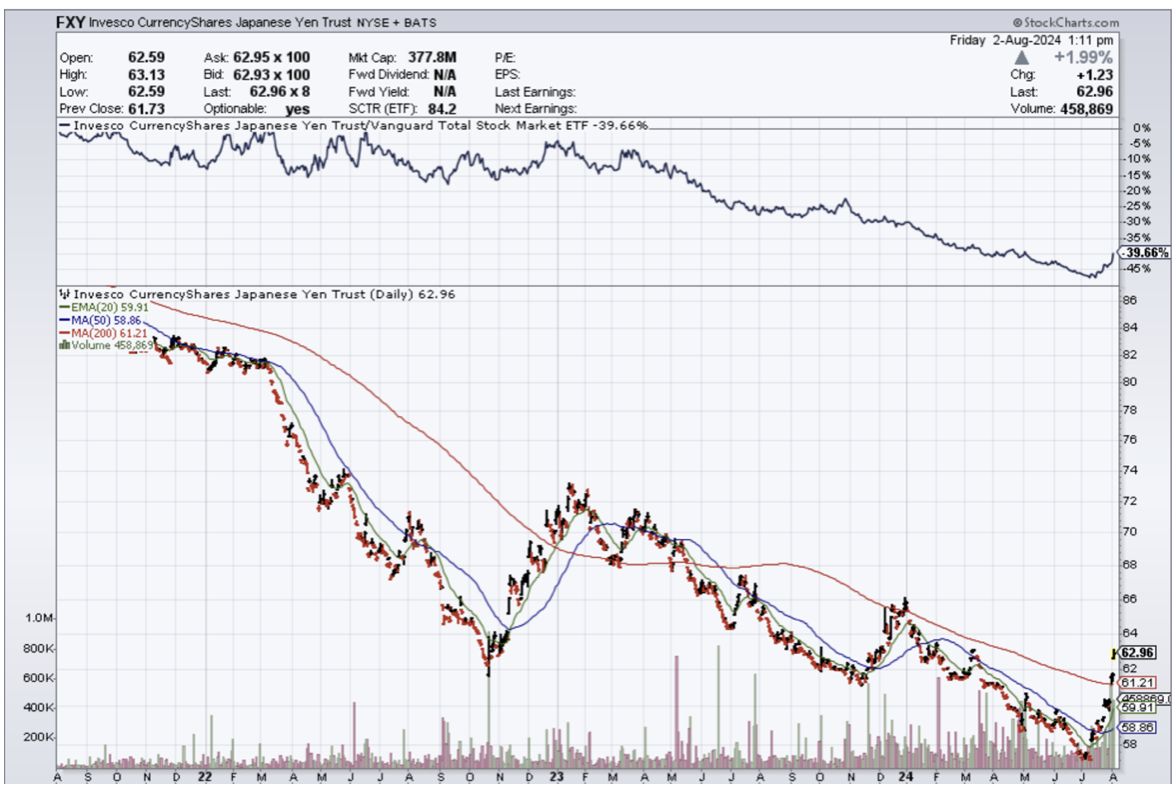

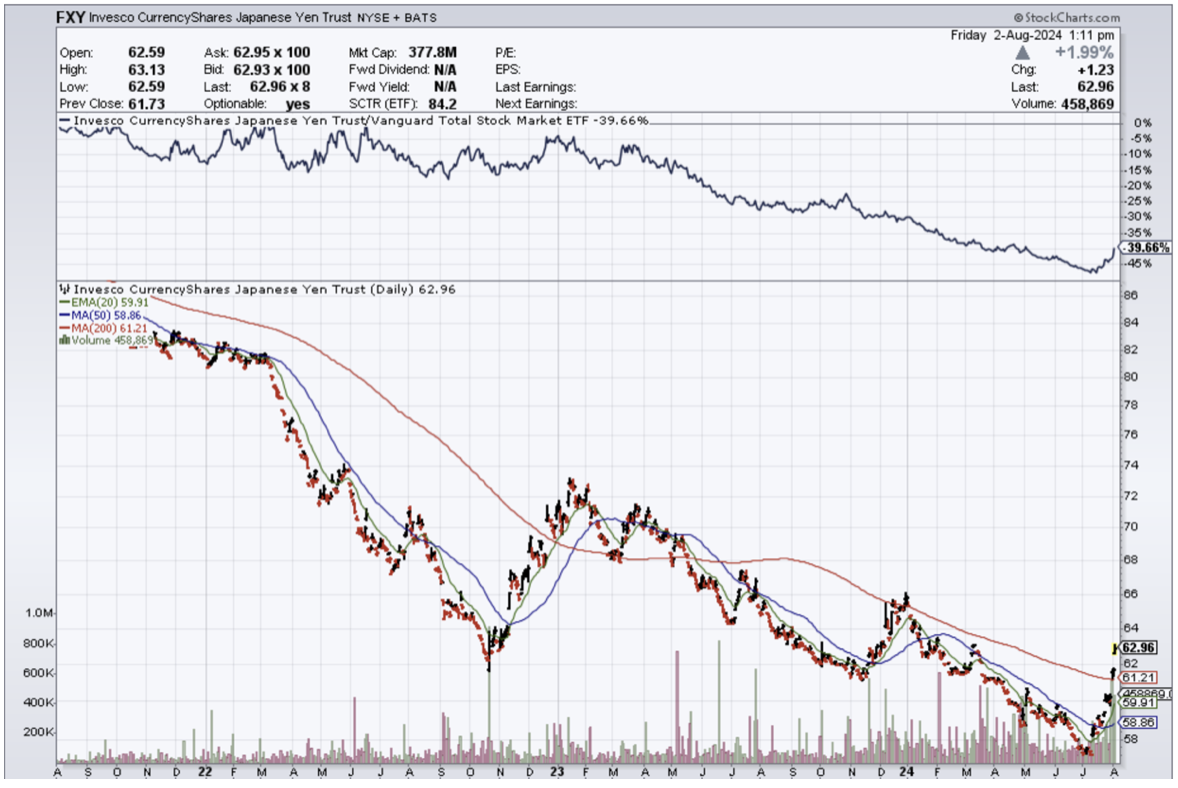

Dollar (UUP) Hits Seven Month Low, as US interest rate cuts loom. It could be a decade-long move. Buy (FXE), (FXB), (FXC), and (FXA).

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, August 26 at 8:30 AM EST, the US Durable Goods orders are out.

On Tuesday, August 27 at 6:00 AM, the S&P Case Shiller National Home Price Index is released.

On Wednesday, August 28 at 7:30 PM, EIA Crude Stocks are printed.

On Thursday, August 29 at 8:30 AM, the Weekly Jobless Claims are announced. We also get Q2 US GDP.

On Friday, August 30 at 8:30 AM EST, the US Core PCE Index is disclosed. Also, New Home Sales are disclosed. At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, you know you’re headed into a war zone the moment you board the train in Krakow, Poland. There are only women and children headed for Kiev, plus a few old men like me. Men of military age have been barred from leaving the country. That leaves about 8 million to travel to Ukraine from Western Europe the visit spouses and loved ones.

After a 15-hour train ride, I arrived at Kiev’s Art Deco station. I was met by my translator and guide, Alicia, who escorted me to the city’s finest hotel, the Premier Palace on T. Shevchenka Blvd. The hotel, built in 1909, is an important historic site as it was where the Czarist general surrendered Kiev to the Bolsheviks in 1919. No one in the hotel could tell me what happened to the general afterward.

Staying in the best hotel in a city run by Oligarchs does have its distractions. That’s to the war occupancy was about 10%. That didn’t keep away four heavily armed bodyguards from the lobby 24/7. Breakfast was well populated by foreign arms merchants. And for some reason there we always a lot of beautiful women hanging around.

The population is getting war-weary. Nightly air raids across the country and constant bombings take their emotional toll. Kiev’s Metro system is the world’s deepest and at two cents a ride the cheapest. It where the government set up during the early days of the war. They perform a dual function as bomb shelters when the missiles become particularly heavy.

My Look Out Ukraine ap duly announced every incoming Russian missile and its targeted neighborhood. The buzzing app kept me awake at night so I turned it off. The missiles themselves were nowhere near as noisy.

The sound of the attacks was unmistakable. The anti-aircraft drones started with a pop, pop, pop until they hit a big 1,000-pound incoming Russian cruise missile, then you heard a big kaboom! Disarmed missiles that were duds are placed all over the city and are amply decorated with colorful comments about Putin.

The extent of the Russian scourge has been breathtaking with an an epic resource grab. The most important resource is people to make up for a Russian population growth that has been plunging for decades. The Russians depopulated their occupied territory, sending adults to Siberia and children to orphanages to turn them into Russians. If this all sounds medieval, it is. Some 19,000 Ukrainian children have gone missing since the war started.

Everyone has their own atrocity story, almost too gruesome to repeat here. Suffice it to say that every Ukrainian knows these stories and will fight to the death to avoid the unthinkable happening to them.

It will be a long war.

Touring the children’s hospital in Kiev is one of the toughest jobs I ever undertook. Kids are there shredded by shrapnel, crushed by falling walls, and newly orphaned. I did what I could to deliver advanced technology, but their medical system is so backward, maybe 30 years behind our own, that it couldn’t be employed. Still, the few smiles I was able to inspire made the trip worth it.

The hospital is also taking the overflow of patients from the military hospitals. One foreign volunteer from Sweden was severely banged up, a mortar shell landing yards behind him. He had enough shrapnel in him to light up an ultrasound and had already been undergoing operations for months.

To get to the heavy fighting I had to take another train ride a further 15 hours east. You really get a sense of how far Hitler overreached in Russia in WWII. After traveling by train for 30 hours to get to Kherson, Stalingrad, where the German tide was turned, is another 700 miles east!

I shared a cabin with Oleg, a man of about 50 who ran a car rental business in Kiev with 200 vehicles. When the invasion started, he abandoned the business and fled the country with his family because they had three military-aged sons. He now works a minimum-wage job in Norway and never expects to do better.

What the West doesn’t understand is that Ukraine is not only fighting the Russians but a Great Depression as well. Some tens of thousands of businesses have gone under because people save during war and also because 20% of their customer base has fled.

I visited several villages where the inhabitants had been completely wiped out. Only their pet dogs remained alive, which roved in feral starving packs. For this reason, my major issued me my own AK47. Seeing me heavily armed also gave the peasants a greater sense of security.

It’s been a long time since I’ve held an AK, which is a marvelous weapon. But it’s like riding a bicycle. Once you learn you never forget.

I’ve covered a lot of wars in my lifetime, but this is the first fought by Millennials. They post their kills on their Facebook pages. Every army unit has a GoFundMe account where doners can buy them drones, mine sweepers, and other equipment.

Everyone is on their smartphones all day long killing time and units receive orders this way. But go too close to the front and the Russians will track your signal and call in an artillery strike. The army had to ban new Facebook postings from the front for exactly this reason.

Ukraine has been rightly criticized for rampant corruption which dates back to the Soviet era. Several ministers were rightly fired for skimming off government arms contracts to deal with this. When I tried to give $3,000 to the Children’s Hospital, they refused to take it. They insisted I send a wire transfer to a dedicated account to create a paper trail and avoid sticky fingers.

I will recall more memories from my war in Ukraine in future letters, but only if I have the heart to do so.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader