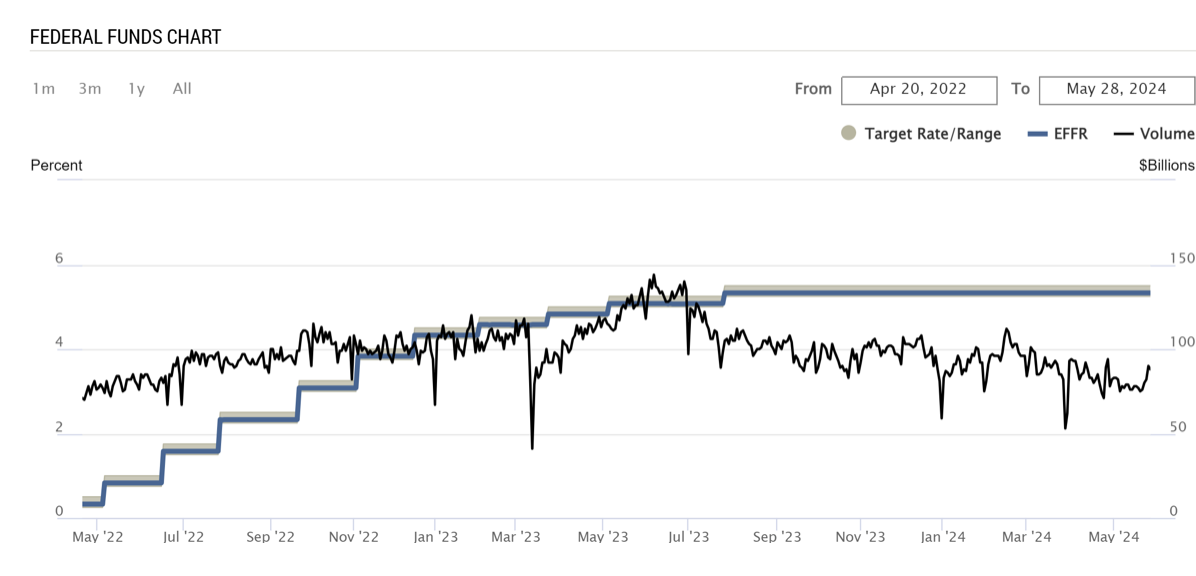

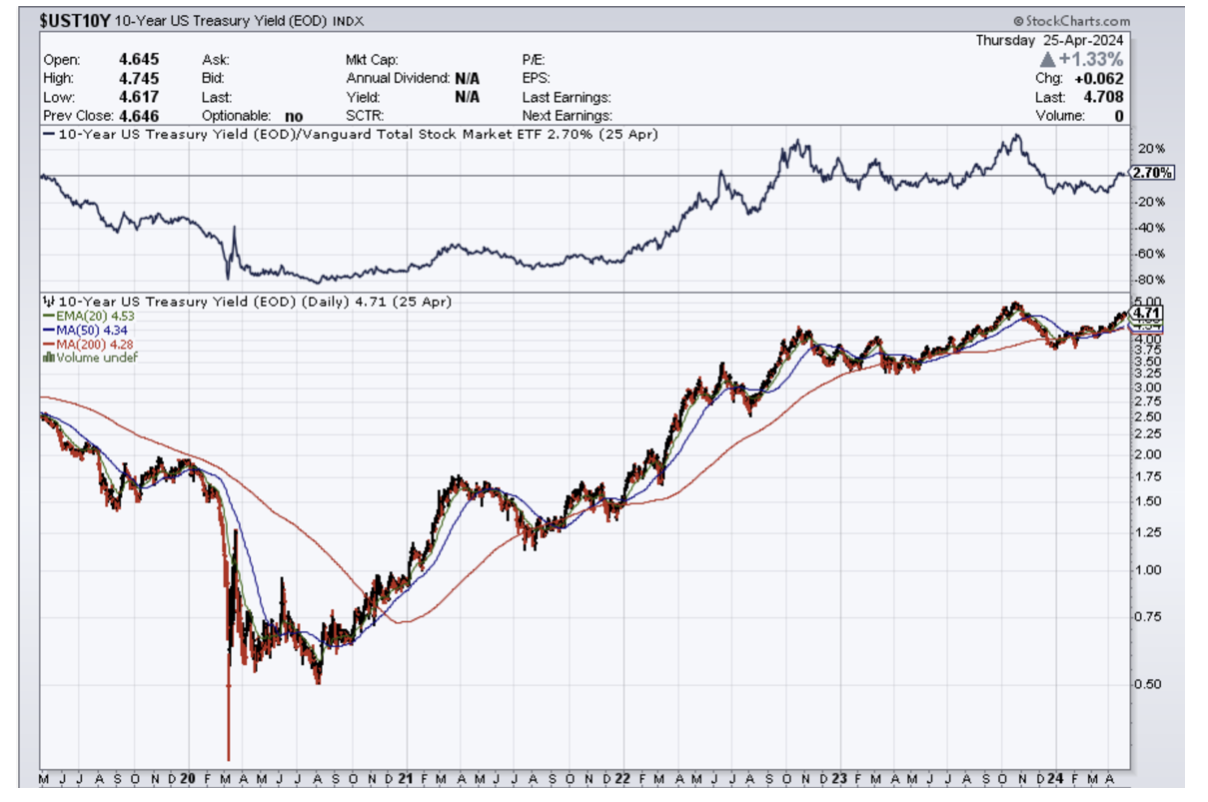

Rates will stay higher for longer and the higher income bracket will carry the US economy through any conflict with short-term inflation.

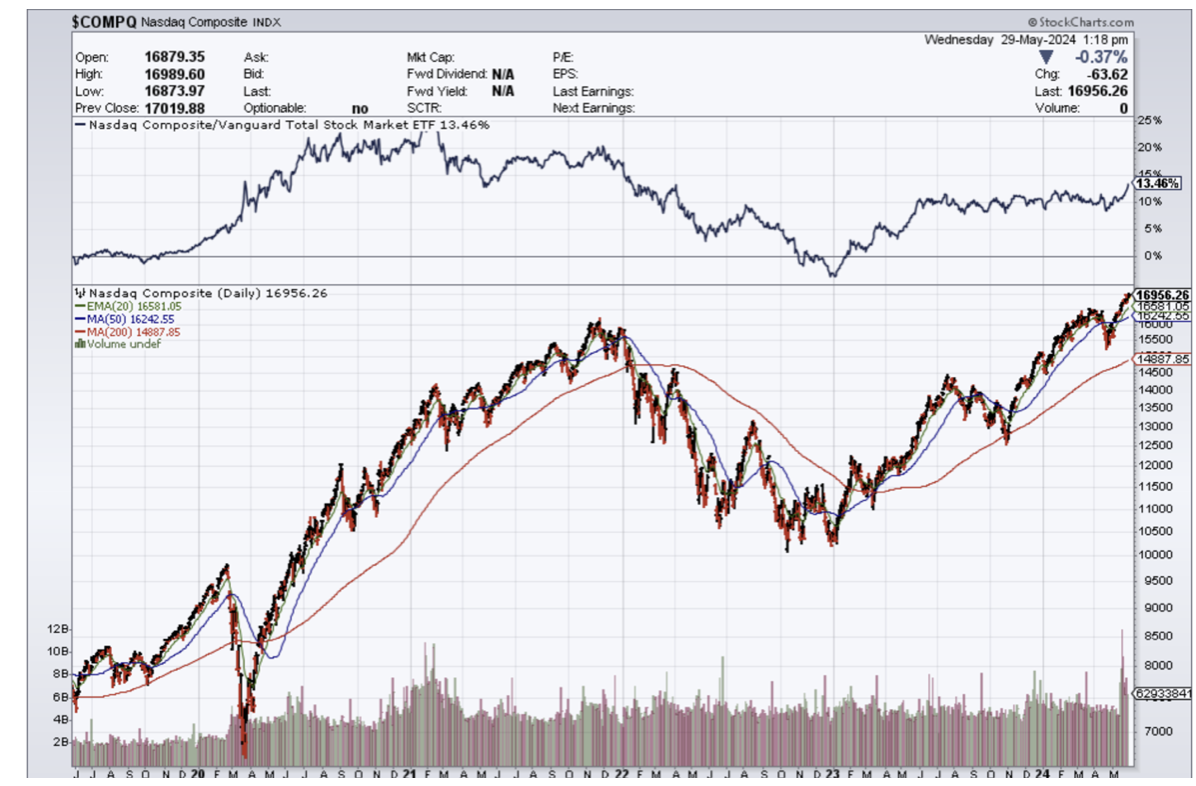

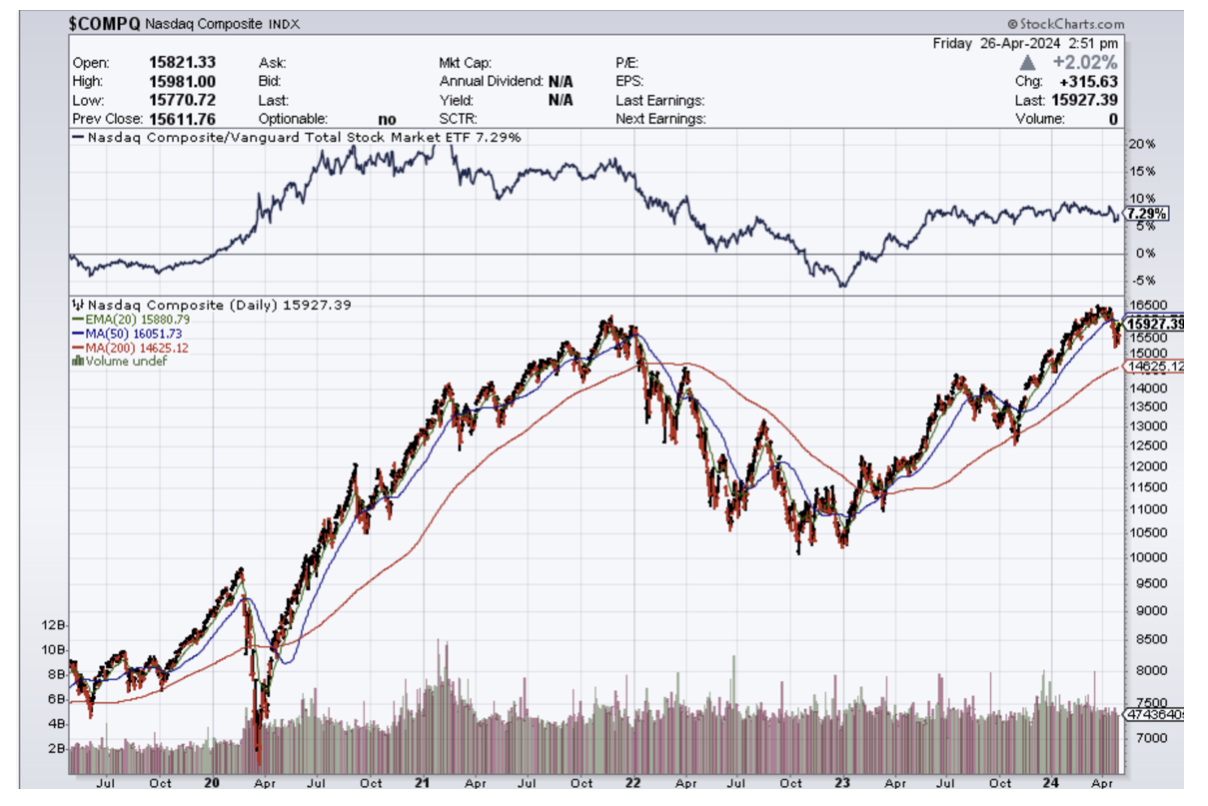

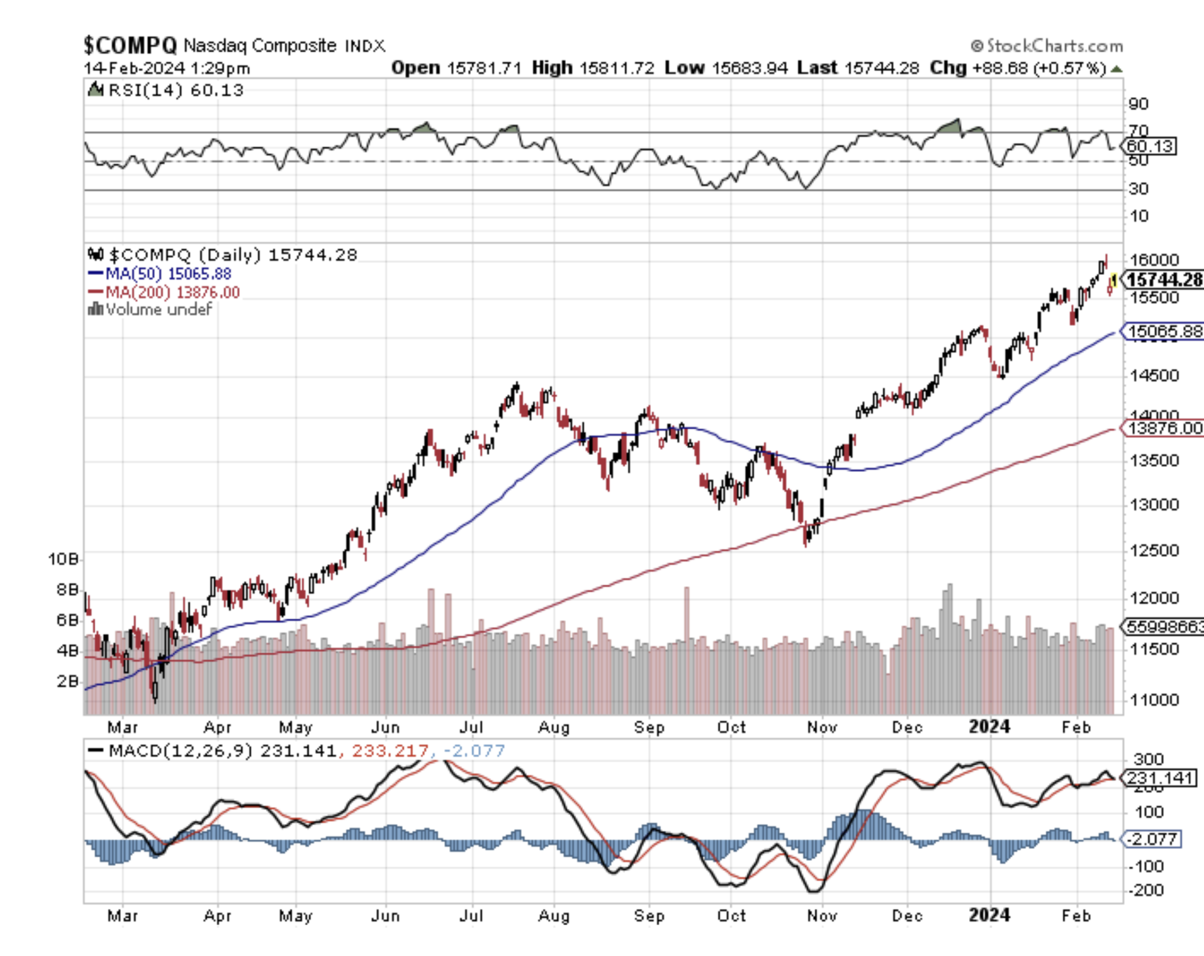

What does that mean for tech stocks?

It will trend higher for longer.

Sure, US rates will stay elevated, but tech stocks have proven they are tough to keep down with elevated inflation.

Most who buy tech stocks have done very well financially in the past 18 months.

There is a high likelihood that higher rates won’t affect their purchasing power to buy more tech stocks.

I do admit a big chunk of Americans are missing out on buying tech stocks at these current prices – I don’t diminish that.

The big spenders have utilized their 3% fixed mortgage to hunker down and continue to spend on devices, software, EVs, and other tech.

This clearly means that 5% isn’t the real neutral rate that the Fed is looking for and I view this rate as a relatively loose fiscal policy that is allowing high-income Americans to splurge on more tech products.

Don’t forget that these are the same stockholders that are reaping increasing tech dividends, higher-tech stocks, and generous shareholder returns.

Further evidence is that the $2 trillion in quantitative tightening along with a 5% Fed Funds rate has resulted in the S&P index rising 37%.

That’s not supposed to happen if rates are high above the neutral rate.

What the Fed gets wrong is that the neutral rate has moved significantly higher when we consider the trillions that were printed for the pandemic programs and stimulus checks.

The additional amount of fiat paper floating around chasing a limited amount of goods results in the neutral rate being somewhere closer to 8-10% and that development gets missed by the Fed.

Therefore, 5% Fed Funds rates are “high” and a lot higher than 0%, but the wealthy have now used this rate as a tailwind to progress their financial goals.

Wealthy households right now can earn upwards of 4.5% in a high-yield savings account, see their tech portfolios go up 20% in a year, and are watching the value of their real estate holdings surge higher.

Given the amount of wealth concentrated among a handful of US households and the skew on the income distribution in the US, just about any change in monetary policy will be regressive, advantaging those with more at the expense of those with less.

Tuesday's consumer confidence reading — while registering a three-month high — was far from a clear-cut judgment from Americans that things are looking up, economically speaking.

If the Fed holds at 5% and fails to erect rates closer to 8%, tech stocks will grind higher.

Rates would need to be at a nominal number that would give pain to higher-income buyers.

My personal view is that the Fed will stand pat at 5% interest rates and the Nasdaq should perform well in this scenario.

If we get talk of 6 or 7%, tech stocks will produce a minor pullback delivering another fabulous opportunity to buy.

The other piece here is Nvidia delivering stellar earnings and that should keep the shine on high-quality tech stocks when the market sets up to make the next move.

My bet is any dip will be bought ferociously and any “dip” could turn out to be more of a sideways time correction before we rip higher.

This is also why Nvidia is close to 81% above its 200-day moving average and boasts a current $2.7T valuation.