There is no doubt that the data released out on Friday were a complete disaster for stock investors. The Dow Average futures posted a 1,000-point swing, from up 200 in the overnight markets to down 800 intraday.

Specifically, the Consumer Price Index came in at a hot 0.4%, which is 4.8% annualized. Five-year Inflation Expectations, which the Fed follows most closely, rocketed to 6.0%. Worse yet, Consumer Confidence rose only 0.1% for the second month in a row, the worst performance in 12 years. Friday was the day that the hard data met the soft data and concluded that the recession was on.

That screeching noise you hear is the economy grinding to a halt.

Stock markets absolutely hate stagflation. The last time we had stagflation was during the Ford and Carter administrations during the 1970s, when it took eight years for the Dow to rise a measly 1,000 points. Back then, Wall Street shrank to a fraction of its former self.

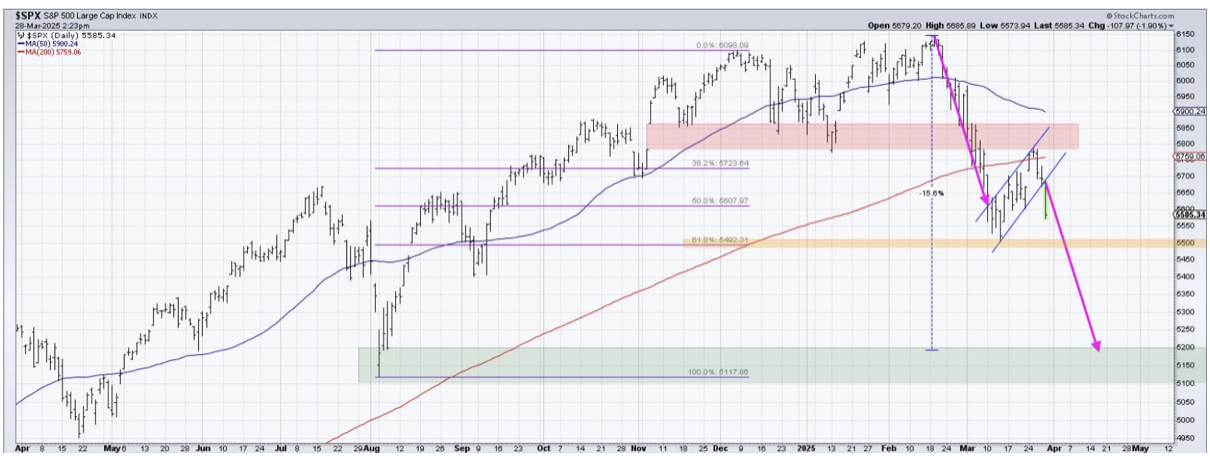

This all richly justifies my downside target of 5,000 for the S&P 500, off 20% from the February top, which is increasingly becoming a mainstream prediction. If I am wrong, it will plunge to 4,500, or down 30%.

We were promised animal spirits that would set markets on fire. Instead, the animals are sent back into hibernation and the markets are being snuffed out. I watch every single data release that comes out on a daily basis, and it is amazing how fast they are almost all rolling over at once.

The combination of rising inflation and a weakening economy is described by one infamous word: Stagflation. What’s worse, we are only one month into a stagflationary trend that could run for many months or years.

As a result, we have seen the worst start to a year since Q1 2020, the last time Trump was president. March was the worst month in 3 ½ years. It seems the stock market heartily agrees with my view.

It gets worse.

All earnings estimates for this year are based on record corporate profit margins. If those margins fail to hold when earnings are announced in the coming weeks, it may trigger the second 10% leg down in the major averages. More concerning is the forward guidance companies may provide.

It turns out that companies watch the daily data releases too. Companies sitting on their hands, not investing or hiring, can itself alone cause recessions. Right now, nobody knows what the heck to do.

The final shoe to fall will be a sharp spike up in the headline Unemployment Rate. We get the next read on this on Friday, April 4. It’s just a question of how soon this shows up in the data. Right now, hundreds of thousands of workers have been fired but are still receiving paychecks while their status is being challenged in the courts. So they aren’t being counted as unemployed….yet.

Some 42% of all the hiring in the US over the past three years has been in just two sectors, healthcare and education. That is where the biggest cuts are being made now. It’s all about getting ahead of the curve.

Let me tell you how bad things can get.

On Wednesday, the president announced 25% import duties for completed cars. General Motors (GM) makes about 30% of its cars in Mexico and Canada. As a result, (GM) may have to raise some car prices by 10%-25%. But the president has ordered (GM) not to raise prices at all.

It costs $20 billion and takes four years to build a new car factory in the US from scratch. This all turns (GM) into the perfect money-destruction machine. (GM) may not survive. And you wonder why I have been short (GM) stock two months in a row. Trump must really hate Detroit.

Believe it or not, there is a silver lining to all this.

If you missed the great bull market of the last five years, when the major indexes more than doubled, you are eventually going to get a second bite at the apple. Share prices are dropping so fast that we may get to a final capitulation selloff rather quickly. Then we will be spoiled for choice with stocks that have easy doubles and triples in them.

Let me tell you a trader’s trick.

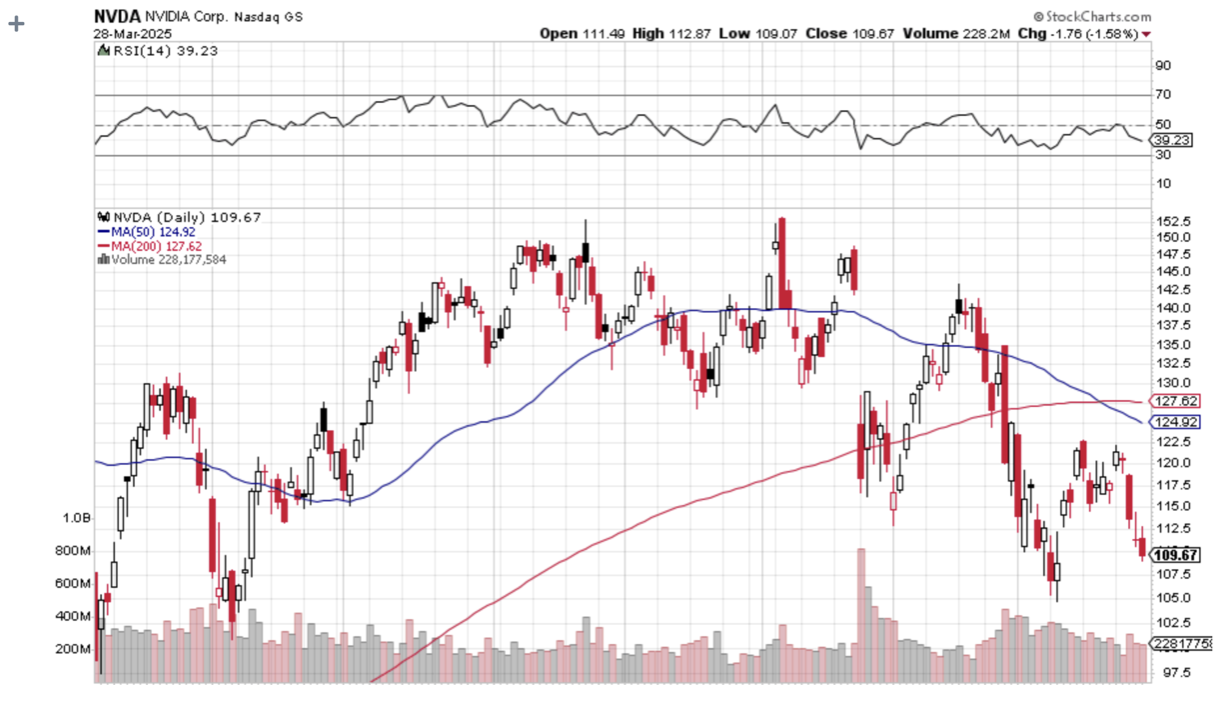

Watch the shares of companies that have the sharpest rises on the rare up days. These are the ones that institutions are willing to jump into and hold on to forever, the permanent earnings compounders. If you take a look at the longs in the Mad Hedge Model Trading Portfolio, they all meet these criteria. They include (COST), (BRK/B), (GS), (MS), (NVDA), and (AMZN).

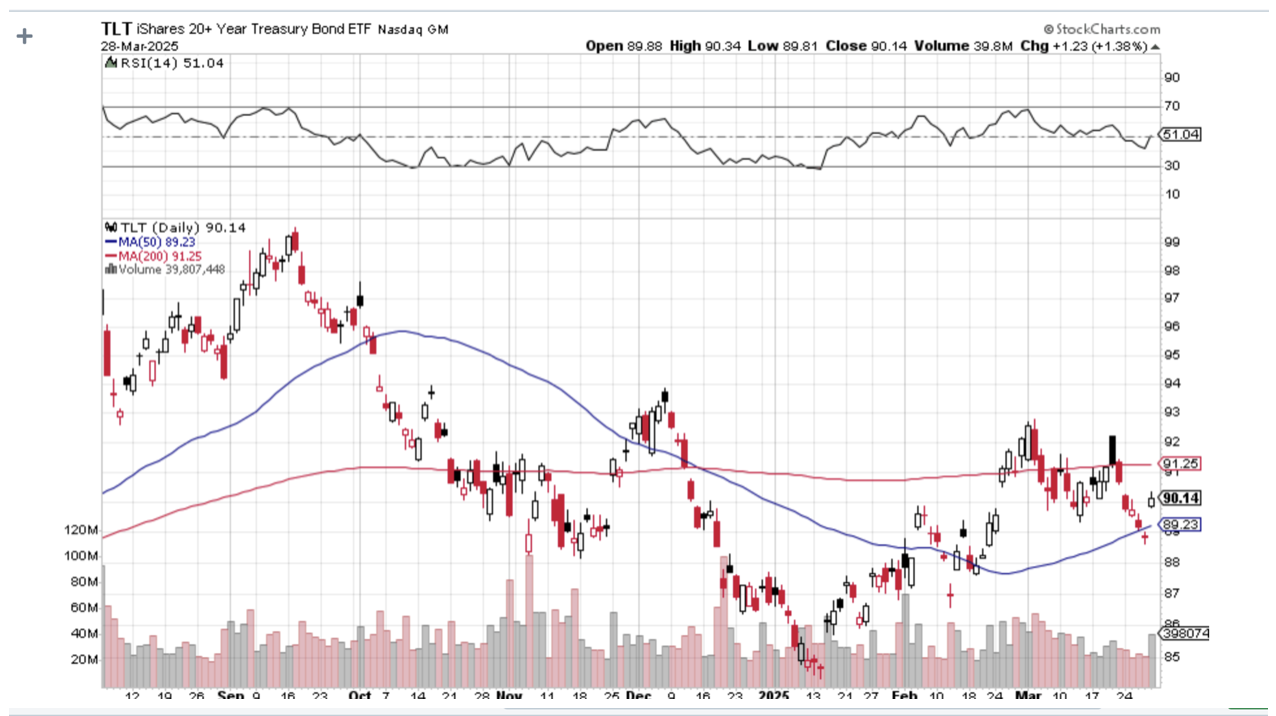

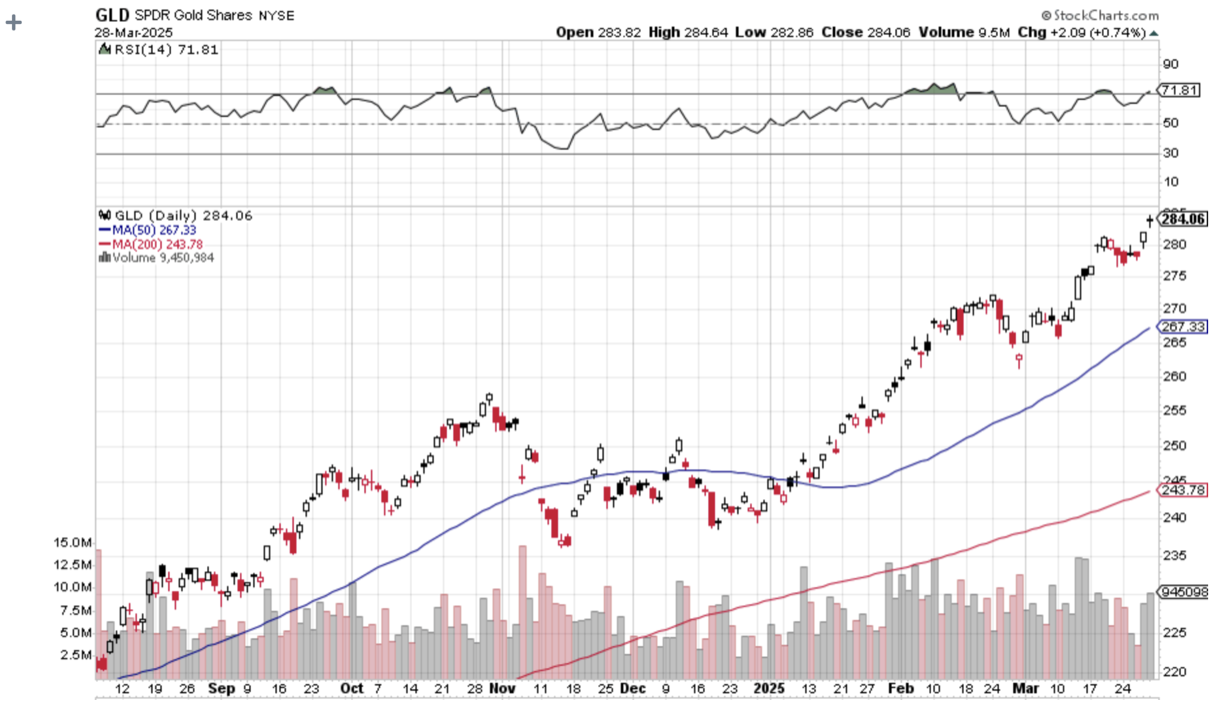

Buying bonds (TLT) and gold (GLD) going into a recession may not be a bad idea either. And for those who don’t want to play when the going gets rough, there are always 90-day US Treasury bills yielding 4.20%. They are government-guaranteed.

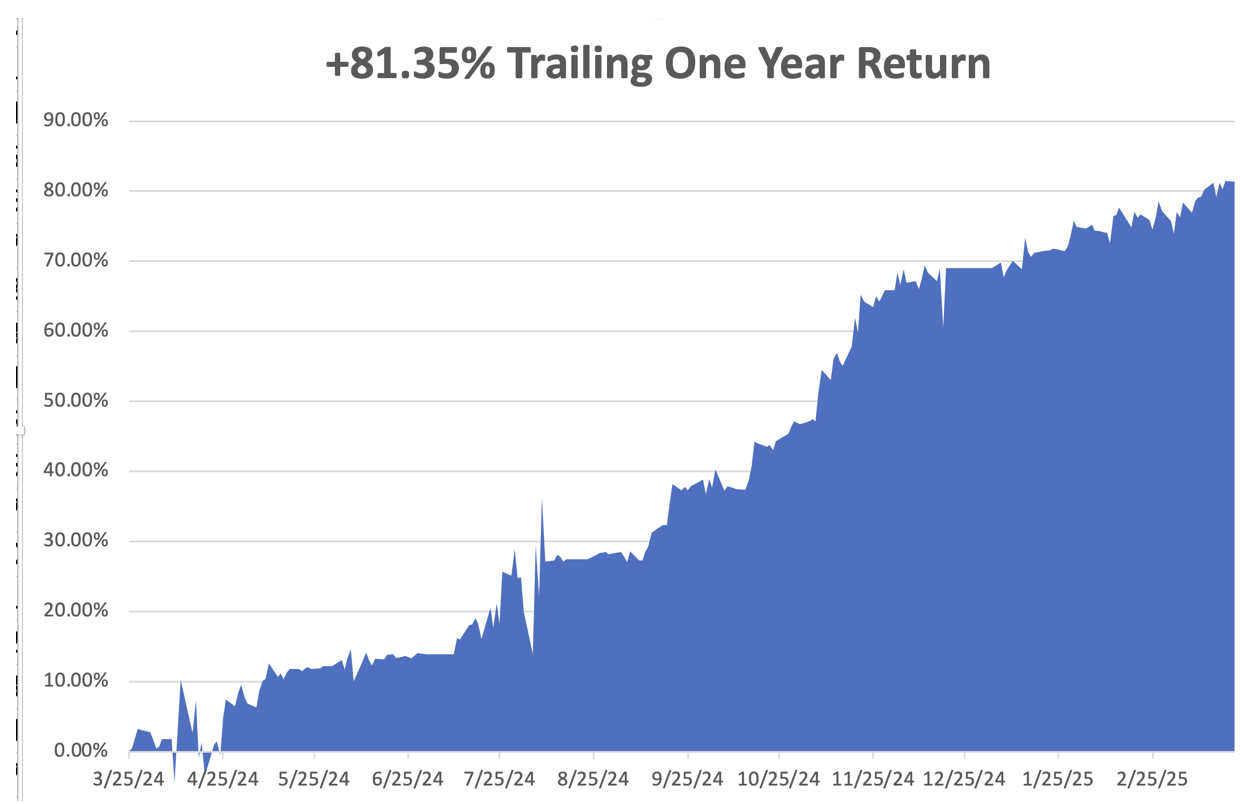

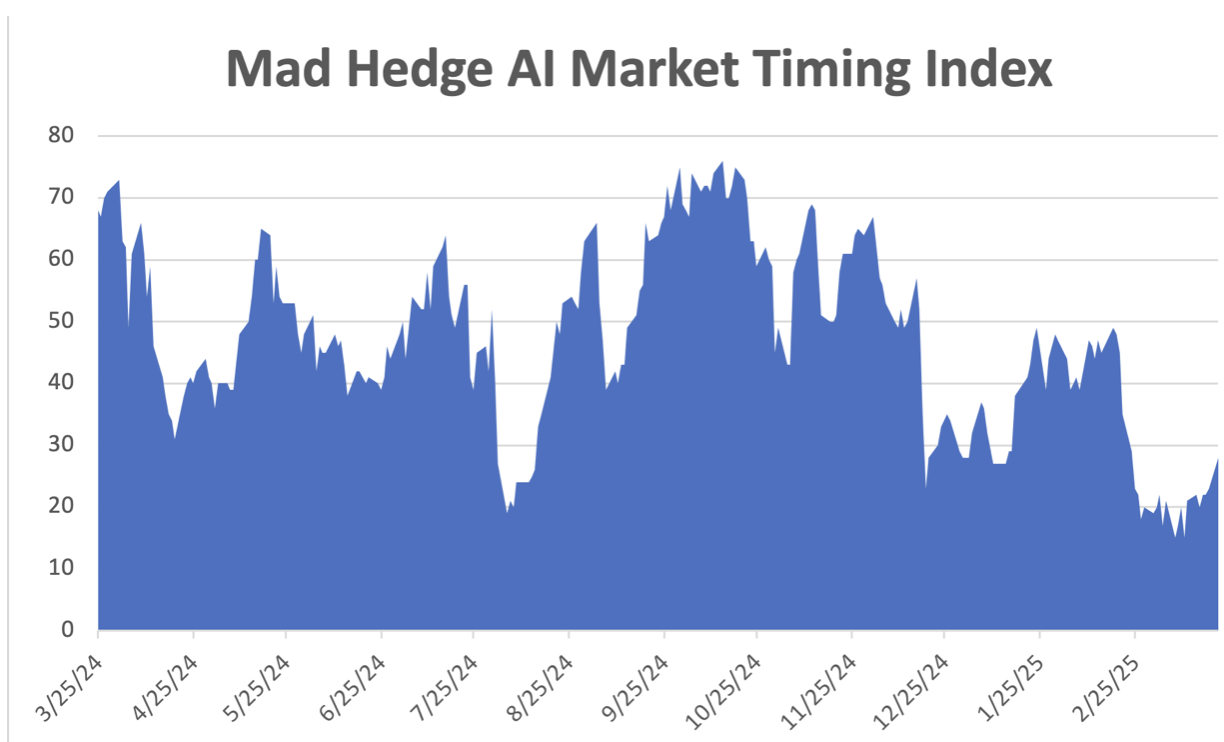

March is now up +3.17% so far. That takes us to a year-to-date profit of +12.64% so far in 2025. That means Mad Hedge has been operating as a perfect -1X short S&P 500 ETF since the February top. My trailing one-year return stands at a spectacular +81.35%. That takes my average annualized return to +49.82% and my performance since inception to +764.63%.

It has been another busy week for trading. I took profits on the short in (NVDA), which collapsed in the latest tech-driven leg down. I added a new long in (COST), a position I have been trying to get into for years, and it immediately started to make money.

I also stopped out of my two auto shorts in (GM) and (TSLA) at cost. Then Trump moved up his auto tariff announcements by a week, and both positions shot up to max profits. Welcome to trading in the Trump administration. In this period of extreme uncertainty, I have tightened up my stop-loss strategy to avoid big losses.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 74 of 94 trades have been profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

Try beating that anywhere.

Stagflation Accelerates, with a hot 0.4% increase in the Consumer Price Index and a tepid 0.1% increase in Consumer Spending, the worst since the Pandemic. One-year inflation expectations have shot up to 5.0%. Today is the day the hard data met the soft data and jointly agreed that we are in a recession. S&P 500 5,000 here we come!

25% Auto Import Tariffs Become Official on April 2. The auto industry, once the largest in the US, says it will trigger a recession. Car prices will rise an average of $5,000 per vehicle. Expect the economies of Michigan, Indiana, Wisconsin, and Illinois to get demolished as they feed a lot of the parts into Detroit. Steel will also be affected. Some 30% of autos made by US companies are assembled in Canada and Mexico. Which US car makers have the highest share of American content? Tesla.

US GDP Grows 2.4%, during the October-December quarter. These may be the last positive numbers we see for a while as the country heads into recession.

Bonds Rocket, with inflation now running at a 5% annual rate, and the tariffs should add another 1%. That means the next Fed move is likely to be an interest rate RISE, while the unemployment rate is rising. That’s a worst-case scenario for the economy and the stock market.

Moody’s Warns of a Downgrade of the United States, saying Trump’s trade tariffs could hamper the country’s ability to cope with a growing debt pile and higher interest rates. Recession risks are rising.

Canada Freezes Rebates for Tesla Purchasers. Canada has frozen C$43 million ($30.11 million) of rebate payments for Tesla. Buyers had been eligible for a $5,000 rebate on vehicles costing less than $65,000. Tesla’s Q1 sales out next week is expected to be terrible. Avoid (TSLA).

S&P Case Shiller National Home Price Index Rises 4.7% YOY. Home price growth held steady at 0.5% M/M, on a seasonally adjusted basis, in January, according to the S&P CoreLogic Case-Shiller Home Price Index composite for 20 cities. On an unadjusted basis, the Case-Shiller HPI for 20 cities inched up 0.1% from a month earlier, decelerating from the +0.2% consensus and accelerating from the previous month's -0.1%. On a Y/Y basis, the gauge climbed 4.7%, vs. +4.6% expected and +4.5% prior.

Consumer Confidence Plunges, by the most in five years, according to the conference. The Conference Board’s gauge of confidence decreased 7.2 points to 92.9, data released Tuesday showed. The median estimate in a Bloomberg survey of economists called for a reading of 94. The soft data for the economy continues to look horrific.

FedEx Gets Crushed, another early recession indicator. Fewer things are shipped in shrinking economies. Fears about a U.S. recession and President Donald Trump’s new reciprocal tariff rates starting April 2 could threaten FedEx’s earnings, Paterson said in a Friday note to clients. Memphis-based FedEx is generally regarded as a barometer of the global economy, as its business touches a wide variety of global industries.

Next-Gen Chips are Power Hogs. Big tech companies, which are all betting heavily on AI, will undoubtedly buy those chips, even if the price skyrockets. But there’s growing evidence that there won’t be enough electricity to power all of their AI dreams. Some new AI apps use 150 times more power than the old ones.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties is now looking at multiple gale-force headwinds. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. My Dow 240,000 target has been pushed back to 2035.

On Monday, March 31, at 8:30 AM EST, the Chicago PMI is announced.

On Tuesday, April 1, at 8:30 AM, the JOLTS Job Openings Report is released.

On Wednesday, April 2, at 1:00 PM, the ADP Employment Change is published.

On Thursday, April 3, at 8:30 AM, the Weekly Jobless Claims are disclosed. We also get the final report for Q1 GDP.

On Friday, April 4, at 8:30 AM, the Nonfarm Payroll Report for March is printed. At 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, back in 2002, I flew to Iceland to do some research on the country’s national DNA sequencing program called Decode, which analyzed the genetic material of everyone in that tiny nation of 250,000. It was the boldest project yet in the field and had already led to several breakthrough discoveries.

Let me start by telling you the downside of visiting Iceland. In the country that has produced three Miss Universes over the last 50 years, suddenly you are the ugliest guy in the country. Because guess what? The men are beautiful as well, the descendants of Vikings who became stranded there after they cut down all the forests on the island for firewood, leaving nothing with which to build long boats.

I said they were beautiful, not smart.

Still, just looking is free and highly rewarding.

While I was there, I thought it would be fun to trek across Iceland from North to South in the spirit of Shackleton, Scott, and Amundsen. I went alone because, after all, how many people do you know who want to trek across Iceland? Besides, it was only 150 miles, or ten days to cross. A piece of cake really.

Near the trailhead, the scenery could have been a scene from Lord of the Rings, with undulating green hills, craggy rock formations, and miniature Icelandic ponies galloping in herds. It was nature in its most raw and pristine form. It was all breathtaking.

Most of the central part of Iceland is covered by a gigantic glacier over which a rough trail is marked by stakes planted in the snow every hundred meters. The problem arises when fog or blizzards set in, obscuring the next stake and making it too easy to get lost. Then you risk walking into a fumarole, a vent from the volcano under the ice, always covered by boiling water. About ten people a year die this way.

My strategy for avoiding this cruel fate was very simple. Walk 50 meters. If I could see the next stake, I would proceed. If I couldn’t, I pitched my tent and waited until the storm passed.

It worked.

Every 10 kilometers stood a stone rescue hut with a propane stove for adventurers caught out in storms. I thought they were for wimps but always camped nearby for the company.

One of the challenges in trekking near the North Pole is getting to sleep. That’s because the sun never sets and it's daylight all night long. The problem was easily solved with the blindfold that came with my Icelandic Air first-class seat.

I was 100 miles into my trek, approached my hut for the night, and opened the door to say hello to my new friends.

What I saw horrified me.

Inside was an entire German Girl Scout Troop spread out in their sleeping bags all with a particularly virulent case of the flu. In the middle was a girl lying on the floor, soaking wet and shivering, who had fallen into a glacier-fed river. She was clearly dying of hypothermia.

I was pissed and instantly went into Marine Corps Captain mode, barking out orders left and right. Fortunately, my German was still pretty good then, so I instructed every girl to get out of their sleeping bags and pile them on top of the freezing scout. I then told them to strip the girl of her wet clothes and reclothe her with dry replacements. They could have their bags back when she got warm. The great thing about Germans is that they are really good at following orders.

Next, I turned the stove burners up high to generate some heat. Then I rifled through backpacks and cooked up what food I could find, force-fed it into the scouts, and emptied my bottle of aspirin. For the adult leader, a woman in her thirties who was practically unconscious, I parted with my emergency supply of Jack Daniels.

By the next morning, the frozen girl was warm, the rest were recovering, and the leader was conscious. They thanked me profusely. I told them I was an American “Adler Scout” (Eagle Scout) and was just doing my job.

One of the girls cautiously moved forward and presented me with a small doll dressed in a traditional German Dirndl, which she said was her good luck charm. Since I was her good luck, I should have it. It was the girl who was freezing to death the day before.

Some 20 years later, I look back fondly on that trip and would love to do it again.

Anyone want to go to Iceland?

Iceland 2002

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader