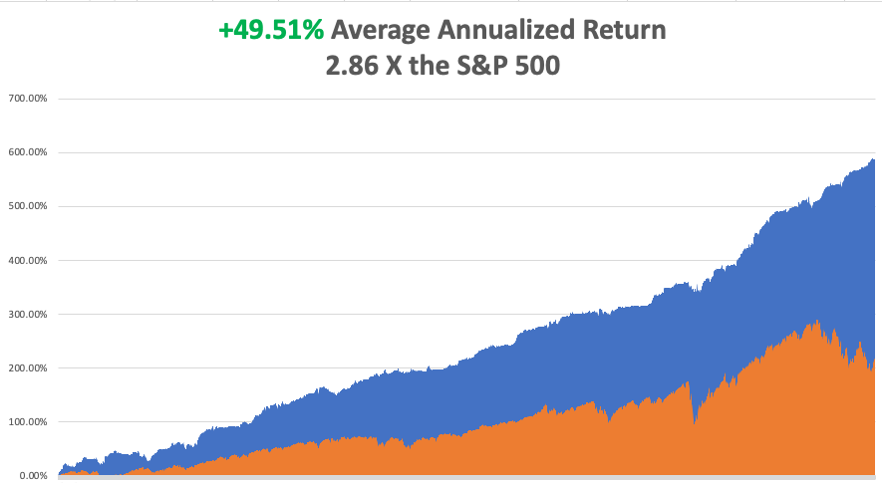

Below please find subscribers’ Q&A for the December 14 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley in California.

Q: Is it time to short the S&P 500 (SPY), or go into cash?

A: I vote for cash. Number 1. We’ve just had a tremendous run in the market. The 200-day moving average at $405 is proving to be massive resistance, and you could get a bunch of profit-taking in January on all the positions people bought up in October. They’ve made a ton of money on that, and they may be deferring to profit-taking, hoping for the Santa Clause rally to continue and to take advantage of all that time decay over the holidays—so, high risk. Risk-reward right now is terrible, so I don’t want to do anything. I’m 100% cash, and I’ll stay that way until the New Year unless something exceptional happens in the markets—you never know what might happen. And I watch markets 24/7, vacation or not because it's in my blood.

Q: What about Financials?

A: Wait until the next dip and then go for call spreads which deliver max profits in sideways markets. JP Morgan (JPM), Bank of America (BAC), Citigroup (C) and you might take a look at Wells Fargo (WFC) next time around, but they always seem to be getting into trouble.

Q: What do we do about interest rates here?

A: Look for the 10-year Treasury bond (TLT) yield to drop to about 2.50% in 2023, about the first half of 2023—maybe by June or so. We did just have a round of profit-taking, but we’re adding on dips.

Q: What do you think about the US sending patriot batteries to Ukraine?

A: The problem is the MIM-104 Patriot SAM system is kind of old—about 41 years old—and it’s been outrun by the new technologies developed by the Ukraine war. Also, 1,000 drones at $1,000 each would be cheaper than 1 patriot missile for $4 million. Sending swarms of hundreds of super cheap drone bombs to attack targets has only been developed over the past six months and you only need one to get through to destroy the target for which the patriot would be useless. Patriot is really designed to shoot down incoming Russian intercontinental ballistic missiles with nuclear warheads with one hour of notice and highly predictable trajectories. We used them a lot in the Gulf War in 1991, and we gave many to Israel which used them to great effect when defending big cities. But they were only firing against slow WWII German-style V2 rockets which Saddam Hussein literally copied off of Wikipedia. If you want to see how effective the new drone strategy is, watch competitive drone racing (https://www.youtube.com/watch?v=HNRiMgNnuVE ), or robot wars (http://www.robotwars.tv ), or any of these other online programs where you have drones controlled by humans doing exactly what I’m talking about. Also, 1,000 drones at $1,000 each would be cheaper than 1 patriot missile for $ million.

Q: What’s your Rivian (RIVN) target by the January options expiration?

A: I have no idea, but Elon Musk has had the impact of destroying not only Tesla but the entire EV sector, so Rivian is a great company clearly being dragged down by Tesla. But also, a joint venture to make trucks in Europe was also put on hold with Mercedes. And of course, nobody wants to spend money ahead of a recession. Buy (RIVN) two-year LEAPS.

Q: Why is the US buying Natural Gas (UNG) in Massachusetts from Russia when we have so much already in this country?

A: The US does not have a national natural gas pipeline system, so you can have excesses in Texas where it’s produced meet shortages in Massachusetts where it’s consumed. Somebody found a loophole to get Russian gas into the US using offshore shell companies which I’m sure will be closed instantly once that delivery is made. Suffice it to say that the sanctions on Russia are tightening, are having a deeper effect and forcing them to pull out of Ukraine sooner than we expect. That may be the pivotal black swan of 2023—that Russia gives up on Ukraine, which would be a huge positive for all markets.

Q: When will we be using nuclear fusion?

A: I have been following nuclear fusion for 50 years, ever since I worked at the Nuclear Test Site in Nevada—it’s long been the holy grail for alternative energy. I talked to the teams every once in a while, since they live next door. The positive developments we saw in England last week are a big breakthrough, but you’re looking for at least 30 years until we get functional economic nuclear fusion power plants. So, we only have to stay alive for 30 more years (and keep climate change from killing us all off in the meantime) before we get carbon-free energy in an unlimited supply. Having said that, from the time they developed a functional commercial nuclear powerplant using Uranium in 1957 from the initial use of the atomic bomb in 1945, was only 12 years and that had to be equally as daunting. So, I may be wrong, and there may be other breakthroughs coming our way, but you don’t control 150 million degrees easily—that's what’s necessary with fusion. The amounts of power input required are also staggering, like all the power that San Francisco uses in a day, just to produce marginal bits of electricity. And the deuterium fuel needed (H2, or heavy hydrogen) in large quantities would not exactly be cheap either. But in 30 years every city should get its own min sun to provide unlimited electricity. So there’s your science lecture of the day, from a long-term fusion follower. For a more detailed explanation please click here at https://www.energy.gov/science/doe-explainsnuclear-fusion-reactions

Q: Is Tesla (TSLA) a buy here?

A: Absolutely, for the long term, but I would not be amazed to see $110 print first. Number one, there’s a major short play going on here too building huge amounts of buying power, and Number two, we’re flushing out a lot of long-term profit takers for tax loss selling as we go with the year-end to offset 2022 losses in other stocks. Buying Tesla at 27X earnings multiple, and next year’s 19X multiple when it was at 100X just a year ago is kind of unbelievable. An onslaught of new Tesla positives will hit the market in 2023. The new Cybertruck comes out and there is a two-year waiting list out the gate and deposits in hand for 100,000 vehicles. The company is generating such enormous cash flows that it is like to carry out $10 billion in share buybacks, especially with the price this low. There are no real competitors on the horizon, except for a handful with minimal production at big losses outside of China.

Q: Is the demise of FTX the end of crypto?

A: I would say yes, which is why we stopped producing our Bitcoin newsletter. It could take 30 years for this thing to recover. It’s another Japanese stock market type situation, where it literally takes three decades to recover, and by then new technologies will far surpass it. The confidence in anything crypto has been totally destroyed by the FTX scandal—it’s the final nail in the coffin. And there are better things to do—I’d rather be buying NVIDIA (NVDA) or Tesla (TSLA) than crypto. There are too many great trades after a bear market.

Q: Is Blackrock (BLK) in trouble?

A: Not in a million years, and I’d be buying it on any dip. They’re an incredibly well-run company, buy on dips. They have one gated REIT which thei disclosed well in advance that is drawing all the adverse publicity. In bear markets, traders always believe the worst.

Q: Why would you not sell Nvidia (NVDA)?

A: Well, we dumped all our tech stocks in January, so we did sell there. But I try not to go against long-term trends, and the long-term trends for Nvidia is a double or triple from here since they are the 8-pound gorilla in the high-end chip business.

Q: Why is cybersecurity (PANW), (CRWD) so unloved in this environment?

A: They are over-owned. When everybody owns something, you can have the greatest story in the world and it doesn’t go up because you need new buyers for things to go up, and the Cybersecurity story is pretty well known. That’s why it won’t go down either, people are not selling because they believe in the long-term story of cyber security—and quite correctly so, and I might add at the bottom of the ranges.

Q: Isn’t Warren Buffet’s age a worry regarding Berkshire Hathaway (BRKB)?

A: No, the replacement management team that has been there for 20 years, is generating great results. Warren is basically just the front-end mouthpiece for Berkshire Hathaway, just like I’m the front-end mouthpiece for the Mad Hedge Fund Trader and isn't really involved in day-to-day decisions. That’s how Berkshire was able to step up its technology exposure during the teens. When he goes, the stock might drop 5% from algorithm and uninformed sales, but no more.

Q: What do you think of the iShares 20 Plus Year Treasury Bond ETF (TLT) versus the ProShares UltraShort 20+ Year Treasury (TBT)?

A: Avoid the (TBT) because it’s a 2x—you have extra management fees, and extra dealing costs—it’s better just to buy (TLT) on a 2x margin than it is shorting the (TBT) which is already a 2x. I’m looking for $120-$130 in the (TLT) by mid-2023, which is also a great LEAPS candidate.

Q: Is the market rethinking technology multiples here which are IBIDTA based?

A: It has already rethought the technology multiples because they have collapsed. They have dropped, in Tesla’s case 100X to 19X, which looks like a pretty serious piece of rethinking to me, so yes absolutely. Where is the final level? My theory always has been that when tech falls to a market multiple, which for the S&P 500 right now is 18.5X, that is your final bottom in tech multiples which means they may have more to go down. And what might really happen is you may have a situation where the market multiples start to rise again and get back up to the 20’s, tech falls, and they meet somewhere in the low 20s. That’s your final bottom for tech, and then you buy it to own for the next 10 years.

Q: When do you think the Fed will start lowering rates?

A: It will be a second-half affair. First of all, they have to raise rates by 50 basis points on Wednesday, then raise them again in February by 50 and again in March by 25, and then leave them alone for 3 months. Then we will have a recession, or dramatically lower inflation by then, or both. And then they’ll have room to start cutting, which sets a calendar of about June where they start several 75 basis point CUTS. Remember, markets discount things 6-9 months in advance, which is why we had that $20 rally in the (TLT) that started in February. There’s your calendar. So far, it’s working.

Q: Will you give a buy signal on Tesla (TSLA)?

A: More like a Hail Mary on Tesla, hoping that it’s the bottom. When you get these capitulation selloffs, which is what we’re getting on Tesla, there is absolutely no way of predicting where the final number is, because you’re dealing with human emotions here, which are totally unpredictable and are panicking. I’d rather wait, give the first 10% of the move to the next guy, and then play the new trend from there. But I think Tesla could be one of the top performers of 2023. Especially if you get down to like $110 or so, something unbelievable—you know, get Tesla to market multiple, that means it’s got to drop another $30 essentially, and in this environment, it could do that. It could keep going down every day for the rest of this year because a lot of these big reversals tend to happen at year ends. When you get the last Tesla bull out of there, that’s when it goes up. After that, it’s all short covering.

Q: Do you think it will be 50 or 75 basis points?

A: It’s a coin toss for whether it’s 50 or 75. Knowing Jay Powell as I do, I’d go for 50, but with harsh talk. I think he wants to shock us, wants to kill off this stock market rally, wants to kill off any hope you can get one more price rise through the system before we hit a recession. A 50 basis points would be a real shocker and, by the way, would also give us easily a 1000-point selloff, which we could then use to buy into for the new year.

Q: Could Tesla reach $600?

A: Yes, I think it could. Remember, the fundamental story for Tesla is still on track. They are still growing at a 40% rate, while the rest of Detroit is going nowhere. All of their leads are overwhelming, and the really telling aspect for the future of Tesla is that Apple gave up on its autonomous driving program. Every other car company in the world is going to come to the same decision, except for maybe Google. So yes, the bull case is absolutely there, you just have to wait for the current capitulation to flush out, and then it becomes a buy for years.

Q: Does the adoption of a digital currency impact the economy?

A: No, I think anything digital money is on hold for the foreseeable future as the FTX disaster unfolds.

Q: Do you like Salesforce (CRM)?

A: Yes, long-term. It’s also in a capitulation “catch a falling knife” stage. Wait for that to finish—better to buy it on the way up than on the way down is all I can say.

Q: Will there be any restrictions on copper mining (FCX)?

A: Not that I can think of—we’re looking at an enormous shortage of copper going forward and a future copper shock. Most of this is produced in emerging markets that have no environmental restrictions, which is why it happens there, like Chile. So yes, looking for new copper sources will be one of the big plays of this decade.

Q: Do you think the market will bottom in 2023?

A: Yes, if it hasn’t already.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Peleliu in 1978 with a Japanese 8 Inch Gun