Below please find subscribers’ Q&A for the May 29 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Incline Village, NV.

Q: Since Elon Musk is raising tons of money for his AI startup called xAI, will this impact Tesla’s (TSLA) stock price?

A: Yes, it's a very positive move for Tesla because anytime Elon Musk raises money anywhere in his network, it takes the need off of him to sell Tesla shares for cash. And I think his xAI will be the next trillion-dollar company, and SpaceX is in front of it as another trillion-dollar company. Those stocks, he can sell any time and raise a lot of money, but the other two are still private companies. We can't buy them yet unless we buy some of the public vehicles offered by venture capitalists like Ron Baron who has heavy positions in both Tesla and SpaceX. So, no direct plays yet on these companies, but no doubt when they become incredibly valuable, he'll take them all public and become the richest man in the world two or three times over. So yes, that is a positive.

Q: Where do you think (TLT) will be in the next few months?

A: In a narrow trading range. I think we're basically in a $86 to $91 trading range, and we'll go nowhere until we get clarification on Fed interest rate cuts. At the rate the economy is slowing, we may get one in September, and even if the Fed doesn't cut, the rest of the world will, including Japan, Europe, Great Britain, and so on. So we may get our interest rates dragged down here by foreign countries that all have much weaker economies than the US.

Q: Should I keep buying big tech stocks after Nvidia's (NVDA) blowout earnings?

A: Well, if you recall back in the ancient times of April, Nvidia had a 20% sell-off, and most of the tech stocks were down at least 10%. So, I would wait for the next 20% sell-off of Nvidia not only to buy Nvidia but all other big tech stocks as well, because it basically is a big tech story and will continue for the rest of the year like that. So we're really looking to buy dips among the big tech winners, and those would include Amazon (AMZN), Meta (META), Microsoft (MSFT), and so on.

Q: How long can the US economy go without a recession?

A: Five years. The way our economic cycle works is after a long period of growth, companies get overconfident, over-invest, create excessive capacity in the markets for everything, and that leads to a crash and a recession, deflation, and lower interest rates. So even if we don't get major moves in the (TLT) upside now, you always will over the long term get interest rates going back to 2 or 3% for the 10-year so it’s a great long-term hold. That is the economic cycle—that's what creates bear markets and it’s known as “Boom and Bust”. Long may it live because that’s where we traders earn our crust of bread. But this time may be different. We may go longer than 5 years because AI is still in its infancy, still rolling out, and the number of companies making actual profits in AI will go from 3 to 300 over the next five years.

Q: I'm looking to buy gold in an investment account (GLD). Would you do that now, if so, what would you recommend?

A: I would recommend GLD (SPDR Gold Trust) because the metals are still outperforming the miners, miners being held back by the inflation rates unique to the mining industry, which are much higher than the 3.3% for the general economy. And if you want to add a little more spice to your portfolio, buy some silver (SLV) because it is rising at three times the rate of gold thanks to Chinese speculation. You might buy some copper while you're at it too—it's moving almost as fast as gold is.

Q: Which big tech firm is next to issue a dividend?

A: That's an easy answer, it's Netflix (NFLX). But there's a more important question out here— Which is the next tech stock to issue a stock split? And guess what the answer is? Netflix again, which needs to declare both a dividend and a stock split. It's at an all-time high, has a very high share price, and over time, stocks that split deliver double the performance of the S&P 500. So, the mere announcement will suck in a lot of new retail investors as we just saw with Nvidia (NVDA), where we got a $250 move on the split announcement. So, watch your splits, and in fact, I'm going to be devoting a major piece of next Monday's newsletter to splits and how to play them.

Q: Why has the stock market been so strong this year when interest rates are high?

A: The answer to that is AI. We are still in the very early days of AI, and as I mentioned earlier, only three companies are making money from AI right now. That's Nvidia (NVDA), Microsoft (MSFT), and Google (GOOG). That number will increase as AI moves down the food chain and everybody starts using it, including you and me. I view the AI development as similar to 1995 when all of a sudden we got Netscape, a navigator that made the Internet available to the public, Dell Computers (DELL), and Microsoft (MSFT) software all at once hitting the market and creating the online economy essentially from scratch. Something of that magnitude is what the stock market is discounting now. Think of it in terms of the revolutionary new technologies of 1995, which means we have another 5 or 6 years to go, and that's why the stock market is so strong.

Q: Should I invest in Berkshire Hathaway (BRK/B), or do you think their magic will run out soon?

A: I don't think their magic will ever run out. Of course, the day that Warren Buffett dies it'll be down 10%, but then you'll want to buy it with both hands because Warren has already replaced himself with a first-class management team who is carrying on his strategy. Any selloffs in Berkshire you get this summer, go in there and buy the calls, the call spreads, the stock, the LEAPS, and the kitchen sink. Still a great long-term BUY, and I see $500 either late this year or next year in (BRK/B).

Q: I'm a member of IM Academy.

A: Oh my gosh. I would let your membership expire, except you're probably on auto-renewal, and the only way to stop your subscription is to call your credit card company and ask them to block the billings. That is the problem with these predatory financial newsletters, they're impossible to get out of, even when they promise refunds anytime.

Q: Are there any Chinese stocks you like now?

A: No, but the highest quality stock in China is Alibaba (BABA). It's basically a combination of Amazon and PayPal in China, but you still have a very high political risk investing in anything in China. The currency is very weak, so better fish to fry is my opinion. And I tend to avoid countries suffering from demographic implosions.

Q: Should we buy (TLT) now or wait?

A: I would wait until we get some upside momentum going and we complete a few more downside tests.

Q: What's the best place to put cash in the summer?

A: The answer is always good old 90-day US Treasury bills. They are still paying 5.25%.

Q: What are your thoughts on PayPal (PYPL)?

A: I'm avoiding that sector because of over-competition crushing profit margins; that has been a problem for a couple of years now. Don't confuse “gone down a lot” with cheap.

Q: Which oil companies are the best to invest in right now?

A: You can buy Exxon Mobil (XOM) for the high dividend and the sheer size of the company. My second is Occidental Petroleum (OXY), because Warren Buffett owns 25% of the company, has shrunk the float, and that has a result in magnifying any moves up in the stock. Also, I somewhat admire Warren Buffett's stock-picking ability. And of course, I’ve been following the California company OXY since 1970, back when it was run by Armand Hammer, a friend of Vladimir Lenin, so my connections with the company go back a very long time.

Q: Do you like DuPont (DD) for the three-way split?

A: I do, but DuPont has a major problem looming with lawsuits over the PFAS chemicals—those are the forever chemicals which are all over the country, all over the food supply, and cause cancer. So that could be sort of like a Johnson & Johnson-type liability problem with the talcum powder. So again…why look for trouble? Buying a stock facing that kind of liability could be another tobacco situation.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, select your subscription (GLOBAL TRADING DISPATCH, TECHNOLOGY LETTER, or Jacquie's Post), then click on WEBINARS, and all the webinars from the last 12 years are there in all their glory

Good Luck and Stay Healthy,

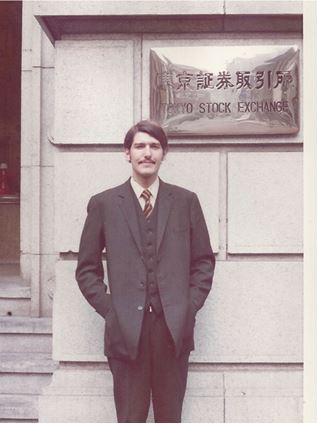

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader