Mad Hedge Technology Letter

March 22, 2023

Fiat Lux

Featured Trade:

(IF BITCOIN THEN GROWTH TECH TOO)

(COIN), (MSTR), (BTC), (DOCU), (TDOC)

Mad Hedge Technology Letter

March 22, 2023

Fiat Lux

Featured Trade:

(IF BITCOIN THEN GROWTH TECH TOO)

(COIN), (MSTR), (BTC), (DOCU), (TDOC)

We are closing in on $27,000 and that’s quite the performance for the digital gold Bitcoin (BTC).

It just was last year when Bitcoin was down in the dumps.

I am not here flogging crypto but tech investors should take heed of what is happening in the riskier parts of the asset markets.

Yes, tech growth is quite volatile, but bitcoin even more so.

The price of Bitcoin is already up 72% this year and that will beat most tech growth stocks including the Teledocs and DocuSigns of the world.

This last strong surge is correlated with global banking contagion with even very liberal-based CNBC stating that Switzerland has become a financial “banana republic.”

Bitcoin is often advertised as the alternative asset class to fiat banking precisely because fiat banking has a history of going to zero.

The blowups at Silicon Valley Bank, First Republic, and Credit Suisse offer credible evidence that the strength of the fiat money banking system is trending down rather than up.

Hence the monster rally and this will just make banking more expensive for the unbanked and give the big banks more power and more “too big to fail” status.

Narratives are more powerful in crypto in generating real price movements than any other asset class and no matter what your thoughts on how powerful that narrative is, people actually believe this.

Cryptocurrency initially attracted interest from a niche group of investors following bank failures and government rescues.

While its popularity has grown among speculative investors in the roughly decade-and-a-half since, it has retained a status among some as being an asset more removed from the banking system than stocks and government bonds.

If the Fed decides to slow down the pace of interest rate hikes this is highly bullish for the crypto and tech growth sector.

Crypto investors have been particularly sensitive to regulatory and interest-rate developments.

They tend to pull money from long-bitcoin funds while adding to short-bitcoin products after the Federal Reserve announces interest-rate increases and regulators take action against crypto companies.

Since regulators started to crack down on some of the biggest crypto players, investors have pulled about $424 million from global exchange-traded products.

It’s been a terrible year to short bitcoin as that trade was last year’s rich uncle.

An important part of investing is to avoid searching for that boat that has left the dock.

Investors betting against crypto exchange, Coinbase (COIN), and bitcoin-buying software intelligence firm, MicroStrategy (MSTR), were down 76% and 62%, respectively, this year.

Some investors remain cautiously optimistic about the trajectory of bitcoin’s price, especially as it has surged against the backdrop of a banking crisis.

Although there could be a vicious pullback from the epic surge so far this year, Bitcoin will likely do well along with tech growth stocks in a paused or lower rate interest environment.

Throw in the bank contagion as a supercharger and 2023 is shaping up to be a great year to buy bitcoin and growth tech on the dips.

Global Market Comments

February 6, 2023

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or WELCOME TO THE WHIPSAW)

(SPY), (TLT), (TSLA), (QQQ), (DOCU), (META), (AMZN)

CLICK HERE to download today's position sheet.

Note: We are moving webinar platforms to Zoom for the February 8, 12:00 EST Mad Hedge Biweekly Strategy

Webinar. To join, please click here.

Well, that was some week!

The next time there is a Fed interest rate announcement, earnings from all the big tech companies, and a Nonfarm Payroll Report all within five days, I am going to call in sick, volunteer at the Oakland Food Bank, or explore some remote Pacific island!

For good measure, a top-secret Chinese spy balloon passed overhead before it was shot down, which I was able to read all about in USA Today.

Still, when you live life in the front trenches and on the cutting edge and use the kind of leverage that I do, you are going to take hits. It’s all a cost of doing business. If you can’t stand the heat, get out of the kitchen.

The last month in the markets have seen one of the greatest whipsaws of all time. Many leading stocks are up 40%-100%, while the Volatility Index ($VIX) plunged to a two-year low. Stocks have gone from zero bid to zero offered. The bulls are back in charge, for now.

Go figure.

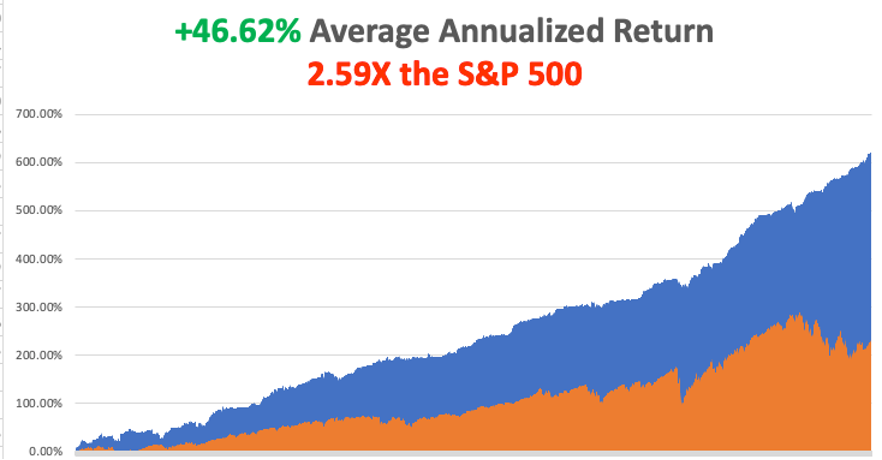

This year has proved full of flocks of black swans so far, with February setting me back -5.70%. My 2023 year-to-date performance is still at the top at +16.65%. The S&P 500 (SPY) is up +9.92% so far in 2023. My trailing one-year return maintains a sky-high +84.10%.

That brings my 15-year total return to +613.84%, some 2.59 times the S&P 500 (SPX) over the same period. My average annualized return has retreated to +46.62%, still the highest in the industry.

Last week, I got stopped out of my short position in the (QQQ), in what will hopefully be my biggest loss of the year, but not the last. Once or twice a year, you get a major gap opening that takes you through one, and sometimes two full strike prices, taking you to the cleaners, and this was one of those times. It takes three more winning trades to make up for these.

I also took small profits on my remaining long in Apple (AAPL). That leaves me 80% in cash, with a double short in Tesla (TSLA). Markets are wildly overextended here with my own Mad Hedge Market Timing Index well into “SELL” territory at 76. Tread at your own peril. Cash is king right here.

Growth stocks are on fire and small caps have been prospering, all classic bull market indicators. This has triggered panic short covering by hedge funds which have seen their worst start to a New Year in decades. The old pros are getting carried out on stretchers.

Maybe this is a good time to hire some kid to do your trading, like one who has never seen markets go down before, one who started his career only on January 1? Or maybe one who retired on December 31 2021, and took a year off?

So, what are markets trying to tell us? That in an hour, the view of the economy has flipped from a mild recession to a soft landing? That interest rates don’t matter anymore? That big chunks of the economy can operate without outside money? That big tech will always make money, it will just rotate from large profits to small ones and back to outrageous ones again?

Those who instead bet on a severe recession are currently filling out their applications as Uber drivers. Warning: it’s harder than it used to be, no more fake IDs or salvage title cars. Next, they’ll want your DNA sample.

If it is any consolation, Fed governor Jay Powell hasn’t a clue about what’s happening either, and that’s with 100 PhD's in economics on his staff. He was just as flummoxed as we over a January Nonfarm Payroll Report that came in 2.5 X expectations on top of 4.5% in interest rate hikes.

Clearly, a new economy has emerged from the wreckage of the pandemic, and no one, not anyone, has quite figured out what it is yet.

Some ten years’ worth of economic evolution has been pulled forward. Everything is digitizing at an astonishing rate. What do I do after slaving away in front of a computer all day? Go back to my computer to have fun. Lots of “zeros” and “ones” there.

It looks like we get a new stock market too.

All of this frenetic market action does fit one theory that I spelled out for you in great detail last week. It is that technology stocks are about to spin off such immense profits that it is about to replace the Fed as a new immense supply of free money.

META up 20% in a day? That’s what it says to me. Notice that Mark Zuckerberg mentioned “AI” 16 times in his earnings call.

Is it possible that I nailed this one….again?

On another related topic, the last three months have just given us a wonderful illustration of how well the Mad Hedge Market Timing Index works (see chart below). We got a strong BUY at an Index reading of 30 on December 22, when the (SPY) began a robust 12% move up. We are now at the top end of an upward trend with my Index at 76. You’d be Mad to add a long position here, at least for the short term.

Someone asked me the other day if the algorithm has gotten smarter in the seven years I have been using it. The answer is absolutely “yes,” and you can see it in my performance. During this time, my average annualized return has jumped from 31% to 46%. That’s because the algorithm gets smarter with the hundreds of new data points that are added every day. Believe it or not, this is how much of the economy is run now.

But there is another factor. I get smarter every year. Believe it or not, when you go from year 54 to 55, you actually learn quite a lot about the markets. Of course, markets are evolving all the time and the rate of change is accelerating. When I saw the market moving towards algorithms, I wrote an algorithm. The challenge is to solve each new problem the market throws at you every year, which I love doing.

Nonfarm Payroll Report at 513,000 Blows Away Estimates, more than double expectations. The Headline Unemployment Rate fell to a new 53-year low at 3.4%. Leisure & Hospitality gained an incredible 128,000, Professional & Business Services 82,000, and Government 74,000. You can kiss that interest rate cut goodbye. Bonds believe it, down 3 points, but stocks are still in Lalaland, reversing a 300-point reversal in the (QQQ)s.

Fed Raises Rates 25 basis points, but Powell talks hawkish, smashing stocks for an hour. He needs more evidence that inflation is finally headed down. He might as well have said he’ll burn the place down. One or two more rate rises to go before the pivot.

Weekly Jobless Claims Hit New 9 Month Low, at 183,000, down 3,000, and is close to a multi-generational low. A recession is rapidly moving off the table as today’s move in tech stocks indicates.

JOLTS Surges Past 11 Million Job Openings in December to a five-month high. The Fed’s assault on labor clearly isn’t working. The million who died from Covid certainly aren’t coming back to work, nor are the 500,000 long Covid cases. That’s 1% of the US workforce.

Ukraine War is Accelerating Move to Green Energy, or so thinks British Petroleum, cutting its ten-year energy demand forecast. Russian energy has proven unreliable at best, and the key pipelines have been blown up anyway. Massive subsidies have been unleashed in Europe and the US for solar, wind, EVs, hydro, and even nuclear. The war gave coal a respite from oblivion, but only a temporary one.

S&P Case Shiller Drops to an 8.6% Annual Gain, the National Home Price Index falling for five consecutive months. No green shoots here. The deeply lagging indicator may not turn positive until yearend. Miami, Tampa, and Atlanta showed the biggest gains, with San Francisco the biggest loser.

Office Occupancy Recovers to 50%, according to a private research firm. New York, San Jose, and San Francisco are still lagging. With the work-from-home trend and high interest rates, commercial properties have entered a perfect storm. Austin, TX was the highest at 68%.

Europe Delivers Surprising Q4 Growth, despite WWIII playing out on its doorstep. GDP increased by 0.1% when a decline was expected. European stocks should outperform American ones in 2023.

IMF Upgrades Global Growth Forecast for 2023 to 2.9% and sees a modest recovery in 2024. The figures are an improvement from the last report, thanks to falling inflation and energy prices. China ending lockdowns is another plus.

General Motors to Invest $650 Million in Lithium Americas, pouring money into a Nevada mine at Thacker Pass, the largest such US investment so far. (GM) says it will raise EV production to 400,000 this year versus 120,000 for all of 2022. Good luck because local environmental opposition to the new mine has been enormous. Goodbye China.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. Dow 240,000 here we come!

On Monday, February 6, no data of note is announced.

On Tuesday, February 7 January 31 at 5:30 AM EST, the Balance of Trade is out.

On Wednesday, February 8 at 7:30 AM, the Crude Oil Stocks are published.

On Thursday, February 9 at 8:30 AM, the Weekly Jobless Claims are announced.

On Friday, February 10 at 8:30 AM, the University of Michigan Consumer Sentiment is printed. At 2:00 the Baker Hughes Oil Rig Count is out.

As for me, the telephone call went out amongst the family with lightning speed, and this was back in 1962 when long-distance calls cost a fortune. President Dwight D. Eisenhower was going to visit my grandfather’s cactus garden in Indio the next day, said to be the largest in the country, and family members were invited.

I spent much of my childhood in the 1950s and 1960s helping grandpa look for rare cactus in California’s lower Colorado Desert, where General Patton trained before invading Africa. That involved a lot of digging out a GM pickup truck from deep sand in the remorseless heat. SUVs hadn’t been invented yet, and a Willys Jeep (click here) was the only four-wheel drive then available in the US.

I have met nine of the last 13 presidents, but Eisenhower was my favorite. He certainly made an impression on me as a ten-year-old boy, who I remember as a kindly old man.

I walked with Eisenhower and my grandfather plant by plant, me giving him the Latin name for its genus and species, and citing unique characteristics and uses by the Indians. The former president showed great interest and in two hours we covered the entire garden. I still make my kids learn the Latin names of plants.

Eisenhower lived on a remote farm at the famous Gettysburg, PA battlefield given to him by a grateful nation. But the winters there were harsh so he often visited the Palm Springs mansion of TV Guide publisher Walter Annenberg, a major campaign donor.

Eisenhower was one of the kind of brilliant men that America always comes up with when it needs them the most. He learned the ropes serving as Douglas MacArthur’s Chief of Staff during the 1930s. Franklin Roosevelt picked him out of 100 possible generals to head the allied invasion of Europe, even though he had no combat experience.

After the war, both the Democratic and Republican parties recruited him as a candidate for the 1952 election. The latter prevailed, and “Ike” served two terms, defeating the governor of Illinois Adlai Stevenson twice. During his time, he ended the Korean War, started the battle over civil rights at Little Rock, began the Interstate Highway System, and admitted Hawaii as the 50th state.

As my dad was very senior in the Republican Party in Southern California during the 1950s, I got to meet many of the bigwigs of the day. New York prosecutor Thomas Dewy ran for president twice, against Roosevelt and Truman, and was a cold fish and aloof. Barry Goldwater was friends with everyone and a decorated bomber pilot during the war.

Richard Nixon would do anything to get ahead, and it was said that even his friends despised him. He let the Vietnam War drag out five years too long when it was clear we were leaving. Some 21 guys I went to high school with died in Vietnam during this time. I missed Kennedy and Johnson. Wrong party and they died too soon. Ford was a decent man and I even went to church with him once, but the Nixon pardon ended his political future.

Peanut farmer Carter was characterized as an idealistic wimp. But the last time I checked, the Navy didn’t hire wimps as nuclear submarine commanders. He did offer to appoint me Deputy Assistant Secretary of the Treasury for International Affairs, but I turned him down because I thought the $15,000 salary was too low. There were not a lot of Japanese-speaking experts on the Japanese steel industry around in those days. Biggest mistake I ever made.

Ronald Reagan’s economic policies drove me nuts and led to today’s giant deficits, which was a big deal if you worked for The Economist. But he always had a clever dirty joke at hand which he delivered to great effect….always off camera. The tough guy Reagan you saw on TV was all acting. His big accomplishment was to not drop the ball when it was handed to him to end the Cold War.

I saw quite a lot of George Bush, Sr. who I met with my Medal of Honor Uncle Mitch Paige at WWII anniversaries, who was a gentleman and fellow pilot. Clinton was definitely a “good old boy” from Arkansas, a glad-hander, and an incredible campaigner, but was also a Rhodes Scholar. His networking skills were incredible. George Bush, Jr. I missed as he never came to California. And 22 years later we are still fighting in the Middle East.

Obama was a very smart man and his wife Michelle even smarter. Stocks went up 400% on his watch and Mad Hedge Fund Trader prospered mightily. But I thought a black president of the United States was 50 years early. How wrong was I. Trump I already knew too much about from when I was a New York banker.

As for Biden, I have no opinion. I never met the man. He lives on the other side of the country. When I covered the Senate for The Economist, he was a junior member.

Still, it’s pretty amazing that I met 9 out of the last 13 presidents. That’s 20% of all the presidents since George Washington. I bet only a handful of people have done that and the rest all live in Washington DC. And I’m a nobody, just an ordinary guy. It just makes you think about the possibilities.

Really.

It’s Been a Long Road

Mad Hedge Technology Letter

February 3, 2023

Fiat Lux

Featured Trade:

(HIGH BETA IS SUDDENLY HOT)

(DOCU), (META), (LYFT), (AMZN), (NFLX)

The Federal Reserve swung its big stick again.

They are and will continue to be the largest influencer in tech share price action in the short-term and the last 2 days has proved it.

Whatever you think or say about the equity market, we can’t hide from the truth that liquidity will either wreak havoc on short-term price action or shoot it to the moon like we saw post-Fed announcement about the latest rate hike.

Tech shares lifted off like an Elon Musk spaceship to Mars and the Mad Hedge Technology Letter was tactical enough to take profits on a DocuSign (DOCU) put spread and stomp out in Meta (META) before the earnings report.

I was able to add some additional long tech as Friday is proving to benefit from the spillover effect.

No matter how we view it, volatility isn’t going anywhere any time soon.

Why?

Since January 2020, the US has printed nearly 80% of all US dollars in existence.

Lots of fiat paper sloshing around in the system has many unintended consequences.

When pushed into certain asset classes, the hot money polarizes price action. That’s how we got all the meme stock craziness.

This phenomenon won’t be going away anytime soon and the Fed slowly reducing their asset sheet pales in comparison to the liquidity hanging around on the sidelines.

The Fed hike means short-term rates now stand at between 4.5%-4.75%, the highest since October 2007.

The move marked the eighth increase in a process that began in March 2022. By itself, the fund's rate sets what banks charge each other for overnight borrowing, but it also spills through to many consumer debt products.

Tech shares took off because Chairman Powell acknowledged that “the disinflationary process” had started.

In a blink of an eye, the Nasdaq was up 2% and growth stocks were up 5%.

Powell intentionally didn’t pour cold water on the rally when he had a chance to smash it down with more hawkish rhetoric or a 50 basis point hike.

It appears highly likely that Powell isn’t interested in tech stocks or any equities for that matter experiencing another bloodbath like 2022.

There might be pitchforks out for him if there is a 30% loss in major indexes this year and perhaps he is scared that Washington would bring the heat. He likes his cushy job and the benefits that come with it.

I do believe this is only the first of a series of Powell Houdini acts where he is willing to disappear behind any sort of opportunity to smash down the markets and let them run wild.

Tech stocks will be a natural buy-the-dip opportunity during this deflation narrative.

We have a clear runway from 6.5% inflation to around 4% and during this 2.5% deflation drop, I can easily see the Nasdaq lurching higher.

I used Friday to add a bullish position in Lyft (LYFT) and Amazon (AMZN) after their terrible earnings while I took almost maximum profit in our Netflix (NFLX) call spread.

It was almost as if Powell announced a new round of QE or, well, sort of.

When the sushi hits the fan – the sushi really does hit the fan.

We are at the beginning of a massive tech reckoning, and many will shed a tear because of the new changes.

The lavish era of artificially rock-bottom-priced interest rates that fueled an unconscionable tech bubble has now reached an end.

There wasn’t even a main street parade for the closing.

Many fortunes were christened over the past 13 years, mostly by the "Who’s Who" of Silicon Valley as founders and CEOs.

This meant that wild speculation was the flavor of the day which was a force that delivered the equity markets astronomically high tech valuations that we have never seen before.

Those likely won’t be back any time soon.

Many investors haven’t adjusted to the new normal yet.

Similar to 2009, the founders & executives that run VC-backed companies have been quick to figure it out.

They understand that the cost of capital is now exorbitantly high and that high cash burn rates are now impossible.

These artisanal tech companies with zero killer technology like Uber, Lyft, and Peloton are more or less screwed in this new environment.

Even though the executives and founders get what is going on, the same can’t be said on the field of play.

Tech employees who may have enjoyed higher than average success aren’t prepared to enter this new era where accountability and costs matter.

When I talk about employees, I am referring to the ones working in technology in the Bay Area.

Up until now, tech employees have been used to pretty much naming their benefits and compensation package and companies fighting over them.

A rude awakening meets them as tech companies who once showered stock options on new employees now wait in horror as that same method of payment is demonstrably less attractive to future employees with low stock prices.

Most employees have only experienced this amusement park-like setting in the Bay Area, which is what led to many employees dictating the work-from-home situation.

Unfortunately, they might now have to come into the office or get fired.

In many ways, this is not their fault. Excess capital led to excessive showering of employee benefits and heightened expectations.

Unfortunately, you can't ignore the fact that if your company isn't cash flow positive & capital is now expensive, you are living on borrowed time.

During the arbitrary societal lockdown, many companies experimented with remote workers, most from outside of the Bay Area.

Based on anecdotal conversations, this trend is likely to continue post-pandemic. This means the Bay Area employee is now competing with a broader set of alternatives.

In today's world, positive cash-flow matters & surviving requires outmaneuvering competitors.

You need teammates that are ready to grit it out and not whine like an adolescent teenager.

Sadly, we may have conditioned a contingent of employees in a way that is incongruent with this mindset.

As we enter the cusp of layoffs, the guy at the bottom is clearly hurt the most or the last one in is usually the first out.

There is nobody to blame for this situation.

The low rates encouraged that type of poor behavior because they could get away with it.

When everybody is making money, most companies don’t clamp down and top employees can’t get away with a lot.

Tech firms like Teledoc (TDOC) and DocuSign (DOCU) are in real trouble if the capital markets only offer them 10% cost of capital for the next few years.

As the greater economy looks to reset, the goalposts have narrowed in the technology sector and the firms considered “successful” from here on out will have a checkmark next to profitability.

Growth at all costs has now been substituted with survive at all costs in Silicon Valley, so get used to it.

Global Market Comments

April 22, 2022

Fiat Lux

Featured Trade:

(APRIL 20 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPX), (TSLA), (TBT), (TLT), (BAC), (JPM), (MS),

(BABA), (TWTR), (PYPL), (SHOP), (DOCU),

(ZM), (PTON), (NFLX), (BRKB), (FCX), (CPER)

Below please find subscribers’ Q&A for the April 20 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley.

Q: Should I take profits on the ProShares UltraShort 20+ Year Treasury ETF (TBT), or will it go lower?

A: Well, you’ve just made a 45% profit in 4 months; no one ever gets fired for taking a profit. And yes, it will go lower, but I think we’re due for a 5 -10% rally in the (TBT) and we’re seeing some of that today.

Q: Do you think the bottom is in now for the S&P 500 Index (SPX)?

A: No, I think the 50 basis point rate hikes will put the fear of God into the market and prompt another round of profit-taking in stocks. So will another ramp up or expansion in the Ukraine War, and so could another spike in Covid cases. And interest rates are getting high enough, with a ten-year US Treasury (TLT) at 2.95% and junk at 6.00% that they will start to bleed off money from stocks.

So there are plenty of risks in this market that I don’t need to chase thousand point rallies that fail the following week.

Q: What would cause a rally in the iShares 20 Plus Year Treasury Bond ETF (TLT)?

A: Everyone in the world is short, for a start. And secondly, we’ve had a $36 point drop in the market in 4 ½ months—that is absolutely screaming for a short-covering rally. It would be typical of the market to get everybody in the world short one thing, and then ramp it right back up. You can bet hedge funds are just gunning for that trade. So those are two big reasons. Another big reason is getting a slowdown in the economy. Fear of interest rate rises and yield curve inversions are certainly going to scare people into thinking that.

Q: Where to buy Tesla (TSLA)?

A: We had a $1,200 all-time high at the end of last year, then sold off to $700—that was your ideal entry point, on that one day when the market was down $1,000 and they were throwing out Tesla stock like there was no tomorrow. We have since rallied back to the 1100s, so I'd say at this point, anything you could get under just above the $200-day moving average at $900 would be a gift because the sales are happening and they’re making tons of money. They’re so far ahead of the rest of the world on EV technology that no one will ever be able to catch up. A lot of the biggest companies like Ford (F) and (GM) are still unable to mass produce electric cars, even though they’re all talking about these wonderful models they're bringing out in 2024 and 2025. So, I think Tesla is just so far ahead in the market that no one will catch them. And the stock will have to reflect that by trading at a higher premium.

Q: I Bought the ProShares UltraShort 20+ Year Treasury ETF (TBT) at your advice at $14, it’s now at 425. Time to take the money and run?

A: Yes, so that you’re in position to rebuy the (TBT) at $22, or even $20.

Q: I bought some bank LEAPS such as Bank of America (BAC), JP Morgan (JPM), and Morgan Stanley (MS) just before earnings; they’re doing well so far.

A: That will definitely be one of my target sectors on any recovery; because the only reason the stock market recovers is because recession fears have been put away, and the only reason the banks have been going down is because of recession fears. Certainly, the yield curve inversion has been helping them lot, as are absolute higher interest rates. So yes, zero in on the banks, I’m holding back waiting for better entry points, but for those who are aggressive, there’s no problem with scaling in here.

Q: If Putin uses a tactical nuclear weapon in the Ukraine, what would be the outcome?

A: Well, I don't think he will, because you don’t want to use nukes on your neighbors because the wind tends to blow the radiation back into your own country. It also depends on when he does this; if Ukraine joins NATO, joins the EC, and NATO troops enter Ukraine, and then they use tactical nukes, France and England also have their own nuclear weapons. So, attacking a nuclear foe and risking bringing in the US, who could wipe out the whole country in minutes, would not be a good idea.

Q: Would you get into Chinese stocks here?

A: Not really; China seems to have changed its business model permanently by abandoning capitalism. The Mad Hedge Technology Letter is currently running a short position in Alibaba (BABA) which has proved highly successful. Although these things are stupidly cheap, they could get cheaper before they turn around. Also, there’s the threat of delisting on the stock exchanges facing them in a year or two, and the trade tensions which continue with China. China doesn’t seem friendly anymore or is interested in capitalism. You don't want to own stocks anywhere in that situation. And by the way, Russia has also banned all foreign stock listings. China could do the same—not good if you’re an owner of those stocks.

Q: How would you play Twitter (TWTR) now?

A: I think it’s a screaming short, myself. If the board doesn’t accept Elon’s offer, which seems to be the case with their poison pill adoption, there are no other buyers of Twitter; and Elon has already said he’s not going to pay up. So you take Elon Musk’s shareholding out of the picture, and you’re looking at about a 30% drop.

Q: Many of the biggest Covid beneficiaries are near or below their March 2020 lows, such as PayPal (PYPL), Shopify (SHOP), DocuSign (DOCU), Zoom (ZM), Peloton (PTON), Netflix (NFLX), etc. Are these buys soon or are there other new names joining them?

A: I think this will continue to be a laggard sector. I think any recovery will be led by big tech, and once big tech peaks out after a 6-month run, then you may get the smaller ones catching up—especially if they're still down 80% or 90%. So that’s a no-touch for me; too many better fish to fry.

Q: Do you think inflation is transitory or are we headed toward double digits over the long term?

A: The transitory argument got thrown out the window the day Russia invaded Ukraine; they are one of the world’s largest producers of both energy and wheat. So that definitely set those markets on fire and really could end up adding an extra 5% in our inflation numbers before we peak out. I think we will see the highs sometime this year, could be as low as 4% by the end of this year. But we may have a double-digit print before we top out, and that could be next month. So, if you’re looking for another reason for stocks to sell out, that would be a good one.

Q: If the EU could limit oil purchases from Russia, then the war would be over in a month since Russia has no borrowing power or reserves.

A: The problem is whether they actually could limit oil purchases, which they can’t do immediately. If you could limit them in a year or cut them down by like 80%, we could come up with the other 20%, that is possible. Then, the war would end and Russia would starve; but Russia may starve anyway. Even with all the rubles in the world, they can’t buy anything overseas. Basically, Russia makes nothing, they only sell commodities and use those proceeds to buy consumer goods from abroad, which have all been completely cut off. They’re in for an economic disaster no matter what happens, and they have no way of avoiding it.

Q: What are your thoughts on supply chain problems?

A: I actually think they’re getting better; I watch the number of ships at anchor in San Francisco Bay, and it’s actually down by about half over the last 3 months. People are slowly starting to get things that they ordered nine months ago, used car prices are starting to roll over…so yes, it’s going to be a very slow process. It took one week to shut down the global economy, it’ll take three years to get it fully reopened. And of course, that’s extended by the Ukraine War. Plus, as long as there are supply chain problems and huge prices being paid for parts and labor, you’re not going to have a recession, it’s impossible.

Q: What’s your outlook on tech stocks?

A: I see them bottoming in the current quarter, and then going on to new all-time highs in the second half.

Q: What about covered calls?

A: It’s a really good idea, allowing you to get long a stock here, and reduce your average cost every month by writing calls against your position until they eventually get called away. Not too long ago, I wrote a piece on covered calls, so I could rerun that again to get people familiar with the concept.

Q: If Warren Buffet retires, what happens to Berkshire Hathaway (BRKB) stock?

A: It drops about 5% one day, then goes on to new highs. The concept of a 90-year-old passing away in his sleep one night is not exactly revolutionary or new. Replacements for Buffet have been lined up for so long that now the replacements are retiring. I think that’s pretty much baked in the price.

Q: Any plans to update the long-term portfolio?

A: Yes it’s on my list.

Q: Too late to buy Freeport McMoRan (FCX)?

A: Yes I’m afraid so. We’ve had a near double since September when it started moving. However, I would hold it if you already own it and add on any substantial selloff. Freeport McMoRan announced fabulous earnings today, and the stock promptly sold off 9%. It was a classic “buy the rumor, sell the news” type move. This is despite the fact that the United States Copper Fund ETF (CPER), in which (FCX) is a major holding, is up on the day. Please remember that I told you earlier that each Tesla needs 200 pounds of copper, that Tesla sales could double to 2 million this year, and that they could sell 4 million if they could make them. It sounds like a bullish argument of me, of which (FCX) is the world’s largest producer.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

February 22, 2022

Fiat Lux

Featured Trades:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or BUYING AT THE SOUND OF THE CANON),

(SPY), (TLT), (TBT), (BRKB), (MSFT), (GOOGL),

(NFLX), (ZM), (DOCU), (ROKU), (VMEO)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.