Global Market Comments

December 4, 2025

Fiat Lux

Featured Trade:

(WILL SPACE X BE YOUR NEXT TEN BAGGER?)

(EBAY), (TSLA), (SCTY), (BA), (LMT)

Global Market Comments

December 4, 2025

Fiat Lux

Featured Trade:

(WILL SPACE X BE YOUR NEXT TEN BAGGER?)

(EBAY), (TSLA), (SCTY), (BA), (LMT)

Global Market Comments

October 10, 2023

Fiat Lux

Featured Trade:

(FRIDAY, OCTOBER 13 KIEV, UKRAINE GLOBAL STRATEGY LUNCHEON)

(WILL SPACEX BE YOUR NEXT TEN BAGGER?)

(EBAY), (TSLA), (SCTY), (BA), (LMT)

I am constantly on the lookout for ten baggers, stocks that have the potential to rise tenfold over the long term.

Look at the great long-term track records compiled by the most outstanding money managers, and they always have a handful of these that account for the bulk of their outperformance, or alpha, as it is known in the industry.

I’ve found another live one for you.

News came out last week that Elon Musk’s SpaceX has just landed a $70 million contract with the Department of Defense for the creation of its military Star Shield satellite network.

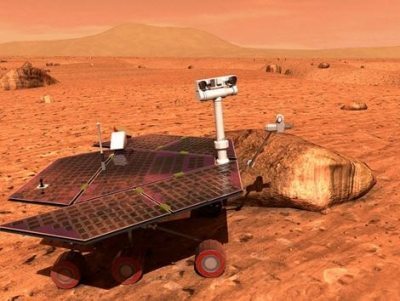

Elon Musk’s SpaceX is so forcefully pushing forward rocket technology that he is setting up one of the great investment opportunities of the century.

In the past decade, his start-up has accomplished more breakthroughs in advanced rocket technology than seen in the last 60 years, since the golden age of the Apollo space program.

As a result, we are now on the threshold of another great leap forward into space. Musk’s ultimate goal is to make mankind an “interplanetary species.”

There is only one catch.

SpaceX is not yet a public company, being owned by a handful of fortunate insiders and venture capital firms. But you should get a shot at the brass ring someday.

The rocket launch and satellite industry is the biggest business you have never heard of, accounting for $200 billion a year in sales globally. This is probably because there are no pure stock market plays.

Only two major companies are public, Boeing (BA) and Lockheed Martin (LMT), and their rocket businesses are overwhelmed by other aerospace lines.

The high value-added product here is satellite design and construction, with rocket launches completing the job.

Once dominated by the US, the market for launches has long since been ceded to foreign competitors. The business is now captured by Europe (the Arianne 5), and China (the Long March 5). Space business for Russia and its Angara A5 rocket abruptly ended with its invasion of Ukraine.

Until recently, American rocket makers were unable to compete because decades of generous government contracts enabled costs to spiral wildly out of control.

Whenever I move from the private to the governmental sphere, I am always horrified by the gross indifference to costs. This is the world of the $10,000 coffee maker and the $20,000 toilet seat.

Until 2010, there was only a single US company building rockets, the United Launch Alliance (ULA), a joint venture of Boeing and Lockheed Martin. ULA builds the aging Delta IV and Atlas V rockets.

The vehicles are launched from Cape Canaveral, Florida and Vandenberg Air Force Base in California, both of which I had the privilege to witness. They look like huge Roman candles that just keep on going until they disappear into the blackness of space.

Enter SpaceX.

Extreme entrepreneur Elon Musk has shown a keen interest in space travel throughout his life. The sale of his interest in PayPal, his invention, to eBay (EBAY) in 2002 for $165 million, gave him the means to do something about it.

He then discovered Tom Mueller, a childhood rocket genius from remote Idaho who built the largest ever amateur liquid-fueled vehicle, with 13,000 pounds of thrust. Musk teamed up with Mueller to found SpaceX in 2002.

Two decades of grinding hard work, bold experimentation, and heart-rending testing ensued, made vastly more difficult by the 2008 Great Recession.

SpaceX’s Falcon 9 first flew in June 2010 and successfully orbited Earth. In December 2010, it launched the Dragon space capsule and recovered it at sea. It was the first private company ever to accomplish this feat.

Dragon successfully docked with the International Space Station (ISS) in May 2012. NASA has since provided $440 million to SpaceX for further Dragon development.

The result was the launch of the Dragon V2 (no doubt another historical reference) in May 2014, large enough to carry seven astronauts.

The largest SpaceX rocket now in testing has Mars capability, the 27-engine, 394-foot-high Starship, the largest rocket ever built.

Commit all these names to memory. You are going to hear a lot about them.

Musk’s spectacular success with SpaceX can be traced to several different innovations.

He has taken the Silicon Valley hyper-competitive ethos and financial model and applied it to the aerospace industry, the home of the bloated bureaucracy, the no-bid contract, and the agonizingly long time frame.

For example, his initial avionics budget for the early Falcon 1 rocket was $10,000 and was spent on off-the-shelf consumer electronics. It turns out that their quality had improved so much in recent years they met military standards.

But no one ever bothered to test them. $10,000 wouldn’t have covered the food at the design meetings at Boeing or Lockheed Martin, which would have stretched over the years.

Similarly, Musk sent out the specs for a third-party valve actuator no more complicated than a garage door opener, and a $120,000, one-year bid came back. He ended up building it in-house for $3,000. Musk now tries to build as many parts in-house as possible, giving it additional design and competitive advantages.

This tightwad, full speed ahead and damn the torpedoes philosophy overrides every part that goes into SpaceX rockets.

Amazingly, the company is using 3D printers to make rocket parts, instead of having each one custom-made.

Machines guided by computers carve rocket engines out of a single block of Inconel nickel-chromium super alloy, foregoing the need for conventional welding, a frequent cause of engine failures.

SpaceX is using every launch to simultaneously test dozens of new parts on every flight, a huge cost saver that involves extra risks that NASA would never take. It also uses parts that are interchangeable for all its rocket types, another substantial cost saver.

SpaceX has effectively combined three nine-engine Falcon 9 rockets to create the 27-engine Falcon Heavy, the world’s largest operational rocket. It has a load capacity of a staggering 53 metric tons, the same as a fully loaded Boeing 737 can carry. It has half the thrust of the gargantuan Saturn V moon rocket that last flew in 1973.

Musk is able to capture synergies among his three companies not available to any competitor. SpaceX gets the manufacturing efficiencies of a mass-production carmaker.

Tesla Motors has access to the futuristic space-age technology of a rocket maker. Solar City (SCTY) provides cheap solar energy to all of the above.

And herein lies the play.

As a result of all these efforts, SpaceX today can deliver what ULA does for 73% less money with vastly superior technology and capability. Specifically, its Falcon Heavy can deliver a 116,600-pound payload into low earth orbit for only $90 million, compared to the $380 million price tag for a ULA Delta IV 57, 156-pound launch.

In other words, SpaceX can deliver cargo to space for $772 a pound, compared to the $7,515 a pound UAL charges the US government. That’s a hell of a price advantage.

You would wonder when the free enterprise system is going to kick in and why SpaceX doesn’t already own this market.

But selling rockets is not the same as shifting iPhones, laptops, watches, or cars. There is a large overlap with the national defense of every country involved.

Many of the satellite launches are military in nature and top secret. As the cargoes are so valuable, costing tens of millions of dollars each, reliability and long track records are big issues.

Enter the wonderful world of Washington DC politics. UAL constructs its Delta IV rocket in Decatur, Alabama, the home state of Senator Richard Shelby, the powerful head of the Banking, Finance, and Urban Affairs Committee.

The first Delta rocket was launched in 1960, and much of its original ancient designs persist in the modern variants. It is a major job creator in the state.

ULA has no rocket engine of its own. So it bought engines from Russia, complete with blueprints, hardly a reliable supplier. Magically, the engines have so far been exempted from the economic and trade sanctions enforced by the US against Russia for its invasion of Ukraine.

ULA has since signed a contract with Amazon’s Jeff Bezos-owned Blue Origin, which is also attempting to develop a private rocket business but is miles behind SpaceX.

Musk testified in front of Congress in 2014 about the viability of SpaceX rockets as a financially attractive, cost-saving option. His goal is to break the ULA monopoly and get the US government to buy American. You wouldn’t think this is such a tough job, but it is.

Elon became a US citizen in 2002 primarily to qualify for bidding on government rocket contracts, addressing national security concerns.

NASA did hold open bidding to build a space capsule to ferry astronauts to the International Space Station. Boeing won a $4.2 billion contract, while SpaceX received only $2.6 billion, despite superior technology and a lower price.

It is all part of a 50-year plan that Musk confidently outlined to me 25 years ago. So far, everything has played out as predicted.

The Holy Grail for the space industry has long been the building of reusable rockets, thought by many industry veterans to be impossible.

Imagine what the economics of the airline business would be if you threw away the airplane after every flight. It would cost $1 million for one person to fly from San Francisco to Los Angeles.

This is how the launch business has been conducted since the inception of the industry in the 1950s.

SpaceX is on the verge of accomplishing exactly that. It will do so by using its Super Draco engines and thrusters to land rockets at a platform at sea. Then you just reload the propellant and relaunch.

What's coming down the line? A SpaceX cargo business where you can ship high value products like semiconductors from Silicon Value to Australia in 30 minutes, or to Europe in 20 minutes.

Talk about disruptive innovation with a turbocharger!

The company has built its own spaceport in Brownsville, Texas that will be able to launch multiple rockets a day.

The Hawthorne, CA factory (where I charge my own Tesla S-1 when in LA) now has the capacity to build 160 rockets a year. This will eventually be ramped up to hundreds.

SpaceX is the only organization that offers a launch price list on its website (click here for that link), as much as Amazon sells its books. The Falcon 9 will carry 28,930 pounds of cargo into low earth orbit for only $60.2 million. Sounds like a bargain to me.

This no doubt includes an assortment of tax breaks, which Musk has proven adept at harvesting. Elon has been a quick learner of the ways of Washington.

Customers have included the Thai telecommunications firm, Rupert Murdock’s Sky News Japan, an Israeli telecommunications group, and the US Air Force.

So when do we mere mortals get to buy the stock? Analysts now estimate that SpaceX is worth up to $200 billion.

The current exponential growth in broadband and SpaceX’s Starlink will lead to a similar growth in satellite orders, and therefore rocket launches. So the commercial future of the company looks especially bright.

However, Musk is in no rush to go public. A permanent, viable, and sustainable colony on Mars has always been a fundamental goal of SpaceX. It would be a huge distraction for a publicly managed company. That makes it a tough sell to investors in the public markets.

You can well imagine that the next recession would bring cries from shareholders for cost-cutting that would put the Mars program at the top of any list of projects to go on the chopping block. So Musk prefers to wait until the Mars project is well established before entertaining an IPO.

Musk expects to launch a trip to Mars by 2027 and establish a colony that will eventually grow to 80,000. Tickets will be sold for $500,000. Click here for the details.

There are other considerations. Many employees and early venture capital investors wish to realize their gains and move on. Public ownership would also give the company extra ammunition for cutting through Washington red tape. These factors point to an IPO that is earlier than later.

On the other hand, Musk may not care. The last net worth estimate I saw for his net worth was $300 billion. If his many companies increase in value by ten times over the next decade, as I expect, that would increase his wealth to $3 trillion, making him the richest person in the world by miles.

If an IPO does come, investors should jump in with both boots. While the value of the firm may have already increased tenfold by then, there may be another tenfold gain to come. Get on the Elon Musk train before it leaves the station.

To describe Elon as a larger-than-life figure would be something of an understatement. Musk is the person on which the fictional playboy/industrialist/technology genius, Tony Stark in the Iron Man movies, has been based.

Musk has said he wishes to die on Mars, but not on impact. Perhaps it would be the ideal retirement for him, say around 2045 when he will be 75.

To visit the SpaceX website, please click here. It offers very cool videos of rocket launches and a discussion with Elon Musk on the need for a Mars mission.

Mad Hedge Technology Letter

September 24, 2021

Fiat Lux

Featured Trade:

(NOT THE SEXIEST TECH STOCK — BUT HIGHLY RELIABLE)

(EBAY)

Readers of this tech letter know that I have been wildly bullish on ecommerce company eBay (EBAY) precisely when vulture hedge fund Elliot Management acquired it in January 2019.

Alongside fellow activist fund Starboard Value LP, Elliott pressured eBay to revamp its operations. At their urging, the company pledged to sell off its Stubhub ticketing and its internationally-focused classifieds businesses, and replace its CEO.

My recommendation was spot on, and shares are up 220% since Elliot forced massive changes to first, the crappy management, and second, to the business model.

Luckily, those changes have staying power as Elliot exited their investment at the end of last year at then — all-time highs.

Elliot’s legacy will inherently be one of turning around eBay into what it is now, and I write to you today to say that eBay is coming into its own even after Elliot’s exit.

It’s not only about discontinued legacy tactics that led to low value, infrequent or one-and-done buyers.

Such an unsustainable strategy makes you want to tear your hair out.

But now, a fledgling buyer base is starting to evolve based on a re-optimized strategy.

These high-volume buyers are growing compared to a year ago and their spend on eBay is growing even faster.

This higher-quality mix of buyers increases value for sellers and will lead to improved health of eBay’s ecosystem over the long term.

Payments and Advertising initiatives continue to deliver a simpler product experience and meaningful benefits for sellers, buyers, and shareholders.

Managed Payments is now live in every market globally, and the transition is progressing faster than expected.

eBay management is now driven via a multiyear journey to become the best global marketplace for sellers and buyers, through a tech-led reimagination.

Their priorities are to grow the core, become the platform of choice for sellers, and cultivate life-long trusted relationships with buyers, by turning them into enthusiasts.

They finally completed the transition of eBay's Classified business, which was initiated by Elliot, to Adevinta.

This deal was originally valued at approximately $9.2 billion, but a closing in June had appreciated to $13.3 billion.

In June, eBay announced the sale of over 80% of their Korean business to Emart for approximately $3 billion, bringing together two leading e-commerce and retail companies that can unlock significant potential in Korea.

Revenue grew 11% driven by the acceleration in the Payments migration and advertising growth.

Luxury watches are also sustaining double-digit growth. Improved buyer trust is leading to strong cross-category shopping behavior similar to what eBay has experienced in sneakers. The next luxury category eBay is focused on is handbags.

They also expanded the My Garage feature to Canada, Italy, France, and Spain, which allows buyers to store their vehicle data, leading to a more tailored shopping experience. eBay plans to launch more technology-driven innovations in this category later this year to further build on their success.

To sum it up, eBay delivered strong short-term results, ahead of expectations, while transforming the company for the longer term.

Obviously, the moves they are making at the top level to create over $20 billion of shareholder value give the company capital to intensely focus on growing the core.

Now the focus is laser-like to grow that central engine of ecommerce and the Covid bump forced a realization to the executive level here that it’s a no-brainer to double down at the core when the revenue runway is there.

To migrate into something else while the green, lush vegetation is right there for them to harvest would be nothing more than lunacy.

Management even felt confident enough to spin the cash from the Korean, Classified, and StubHub deals into an increased 2021 share buyback program to $5 billion for an initial $2 billion.

Granted that eBay isn’t a YOLO growth company to throw money at and its implied Q2 guidance between $2.58 billion and $2.63 billion of revenue growing 8% to 10% isn’t going to make you do cartwheels in the street, nor is the 11% Q2 revenue expansion, but this is a solid tech bet whose stock will grind up.

Management is also on a run of profitable deals that are meaningfully segueing into higher share buybacks.

Sometimes readers don’t need to focus on the sexiest tech stock, and just go with old reliable.

Mad Hedge Biotech & Healthcare Letter

July 13, 2021

Fiat Lux

FEATURED TRADE:

(SPINOFF STOCKS POISED FOR LONG-TERM GROWTH)

(VTRS), (OGN), (PFE), (MRK), (JNJ), (LLY), (ABBV),

(AZN), (GSK), (BMY), (GILD), (REGN), (PYPL), (EBAY), (CARR), (UTC)

Spinoffs have historically been known to deliver healthy returns for their investors.

A good example is PayPal (PYPL), which grew sevenfold since 2015 following its spinoff from eBay (EBAY).

A more recent example is Carrier Global (CARR), which tripled its shares amid the pandemic after its spinoff from United Technologies (UTC) last year.

Basically, spinoffs allow smaller segments of companies to thrive on their own or push high-growth divisions to expand faster.

Over the past months, the cheapest stocks found in the S&P 500 have recently spun off pharmaceutical companies: Viatris (VTRS) and Organon (OGN).

Viatris is a spinoff of Pfizer (PFE), which merged with Mylan, while Merck (MRK) jettisoned Organon (OGN) just last month.

Both are brand new and still under the radar, particularly among investors who don’t follow healthcare updates.

While these two have yet to impress the market, both exhibit potential that could make them promising long-term prospects.

Viatris holds an extensive portfolio of drugs courtesy of Pfizer’s Upjohn unit and Mylan’s pipeline.

The list includes the previously top-selling Lipitor, Viagra, Lyrica, and even Norvasc from Pfizer. It also has Mylan’s income-generating EpiPen along with the company’s HIV/AIDS therapies and 7,500 marketed products across the globe.

To date, Viatris has fallen roughly 30% from its average price target. It’s not for the subpar performance of its products though. This is mostly attributed to the lack of attention from investors and possibly a bit of skepticism from some analysts.

However, Viatris has a really good value proposition.

The main goal of the biggest names in the biopharmaceutical sector, such as Johnson & Johnson (JNJ), Eli Lilly (LLY), AbbVie (ABBV), AstraZeneca (AZN), GlaxoSmithKline (GSK), Bristol-Myers Squibb (BMY), and Gilead Sciences (GILD), is to develop and launch the best-in-class treatments to market.

To achieve that, these industry giants are granted a set period to exclusively sell and market each new drug that gains approval.

This would allow them to command a premium price, which in turn would give them the money to fund the next round of research and development needed to come with the next generation of newer and improved versions of the treatment.

However, not everyone can afford those premium prices.

So when the periods of exclusivity end, there are companies like Mylan—now Viatris—that are allowed to manufacture generic versions of those branded drugs and sell them at lower prices.

The list of drugs with soon-to-expire patents for which Viatris has been working on creating biosimilars or generic versions include Humira from AbbVie, which recorded peak sales at $20 billion; Eylea from Regeneron (REGN), which peaked at $7.5 billion; and even Allergan’s Botox, which peaked at $5 billion.

Viatris is also working on biosimilars for Roche’s (RHHBY) cancer treatments Avastin, which had peak sales of $7 billion, and Perjeta, which peaked at $5 billion.

Obviously, Viatris will not reach the same height of success as the companies that created those branded drugs.

But, if it manages to achieve even only 10% of those numbers, then it can generate roughly $4 to $5 billion in sales—and that’s just the tip of the iceberg.

So far, Viatris owns at least 1,400 approved molecules applicable in roughly 10 therapeutic segments.

It has roughly 350 products in its pipeline at the moment, with each item estimated to generate approximately $100 million to $500 million in sales.

With its current performance and access to 165 countries and territories, Viatris is expected to generate roughly $224 billion in global sales annually.

With all these in mind, Viatris’ value proposition looks impressively strong to me.

More importantly, this Pfizer spinoff has the capacity to become the world’s first dominant generic and biosimilar drug manufacturer, with its revenues potentially becoming comparable to major pharmaceutical companies at some point.

The same value proposition could be behind Organon, as this newly spun-off company markets Merck’s off-patent drugs.

While the move to separate from its parent company has yet to show tangible results, Organon is projected to rake $6.1 billion to $6.4 billion in revenue for 2021, with annual sales expected to rise in mid-single digits and dividends anticipated to be about 3%.

The biosimilars market is still relatively young, with only 60 biosimilars approved in the EU and 29 in the US thus far. In total, those represent a market worth approximately $17 billion.

Conservative estimates project that the global biosimilars market will be worth $692 billion by 2027, considerably outpacing the mainstream pharmaceutical sector.

Given their potential and prospect for future gains, the low prices for companies like Viatris and Organon present rare opportunities to grab long-term investments.

Mad Hedge Technology Letter

June 4, 2021

Fiat Lux

Featured Trade:

(RIDING THE COATTAILS OF ELLIOT MANAGEMENT)

(DBX), (TWTR), (EBAY), (CRM), (BOX)

Renowned Vulture Fund Elliott Management is at it again, looking to feast on the frail like the predator fund it is.

It was recently announced they own a large stake in cloud provider Dropbox (DBX) and has been holding private discussions with the file-sharing service provider for some time.

The hedge fund owns a stake of more than 10% which is valued at more than $800 million, the source said, declining to reveal the exact size of the investment.

Dropbox currently has a market cap of around $11 billion.

This is a cloud company that allows users to store documents, videos, and photos online, listed its shares in March 2018 at $21 a share.

Elliott has previously gotten their way at other tech companies like Twitter (TWTR) and eBay (EBAY).

Now Elliott Management is assumed to own the second biggest holding in Dropbox after CEO Drew Houston.

Elliot’s previous 13-F filing form has shown they are scooping up shares of Dropbox.

Dropbox shares also gained in March on news of a potential takeover that never came to fruition, and it smells a lot like that was Elliot.

I have heard other analysts mention Dropbox as a short-listed acquisition candidate for a handful of big players.

An acquisition looked close especially after Salesforce (CRM) announced the purchase of Slack Technologies and it’s logical that Dropbox could have been a retaliation purchase for a bigger tech company looking to keep pace with Salesforce's acquisitive thirst.

Elliot Management overtook Vanguard Group Inc. as the largest shareholder outside of Houston. Vanguard had a stake just below 10% as of March 31, according to Bloomberg.

The hedge fund has not made it clear whether it is seeking board seats on Dropbox’s board or other changes at the company.

But I will tell you there is a standard playbook that Elliot loves to roll out each time they buy into a tech company.

These changes almost always revolve around switching management and squeezing out more efficiencies in operations.

They even threatened Founder and CEO of Twitter Jack Dorsey to become more attuned to revenue acceleration so he could keep his job.

There are those who want to play the moral compass card out there, but I can say that almost any tech company Elliot Management has bought into experience a significant boost in asset appreciation 3-6 months after the acquisition.

Elliot is hyper-targeted in what they do, and they usually seek out management who has become too comfortable in their routine.

I believe they do not go after tech companies if they feel they cannot boost the underlying stock shares by 30% within a year.

They have a brilliant track record and any tech investor who doesn’t want to overcomplicate tech investing buys the same tech companies Elliot acquires.

Why?

Because changes are in the pipeline and every management or board seat change is usually met with a 5-7% surge in share price.

What’s not to like about that?

Then there are many up days on the operational front from cutting costs, and forcing through other changes that are first and foremost beneficial for the stakeholders of the company.

Other vulture fund specialists do this too like Starboard Value when they launched a proxy fight earlier this year at Box (BOX), where it has nominated four directors for the three seats that are coming available this year.

To play it simple, buy into Dropbox on the next dip and hold onto shares for the first part of the turnaround.

Once the pace of changes starts to plateau, by then, you should already have a decent-sized profit and can dump the shares.

Mad Hedge Technology Letter

November 30, 2020

Fiat Lux

Featured Trade:

(THE GREEN LIGHT FOR E-COMMERCE)

(AMZN), (W), (OSTK), (WMT), (TGT), (MELI), (EBAY), (CRM), (ADBE)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.