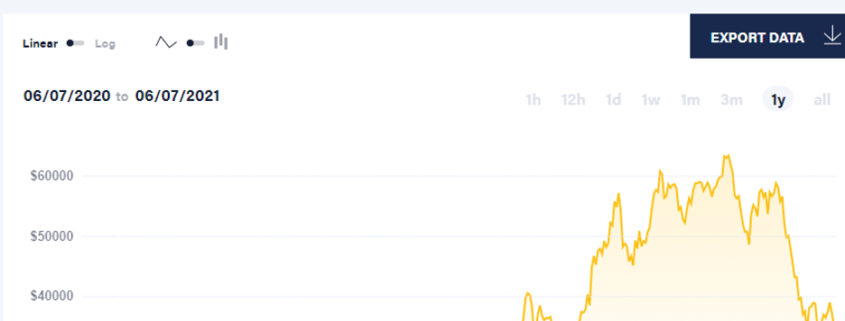

I first got involved with bitcoin in 2011, when a subscriber wanting to thank me for a spectacular investment performance GAVE me ten Bitcoin. They were then worth $1 each.

Then, I forgot about them. When they appreciated to $100 in 2013, I decided to sell them and take the family out to dinner at The French Laundry, the best restaurant in California’s Napa Valley. I thought I was a genius.

Back then, early in the life of Bitcoin, theft was rampant, and exchange regularly went bankrupt. So cashing in on my windfall wasn’t such an unreasonable thing to do.

That turned out to be the most expensive dinner of my life. If I had kept the ten Bitcoin, they would be worth today over $600,000. Maybe I’m not such a genius after all.

Unless you have been living in a cave for the past five years, you have probably heard of Bitcoin.

By now, you have decided that it is the greatest money-making opportunity of all time or the greatest scam since Carlo Ponzi amassed a fortune selling international postal coupons in 1922.

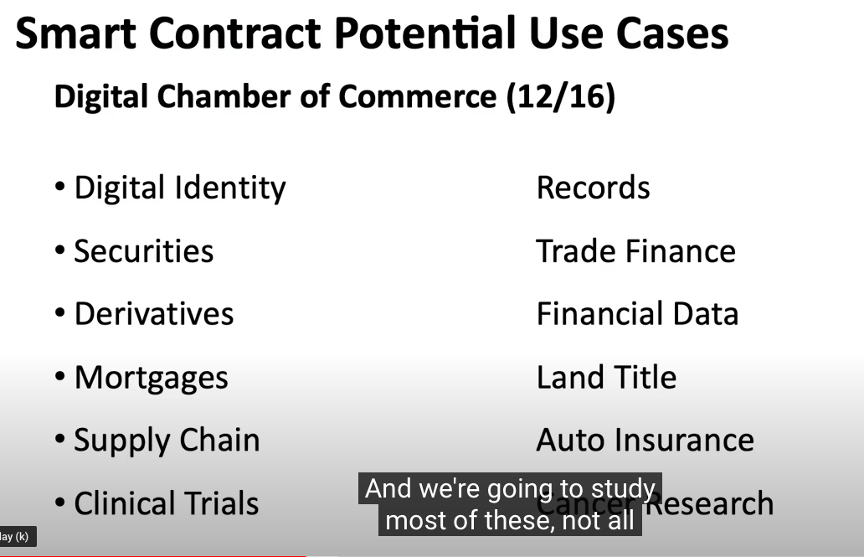

Some things are certain. Bitcoin will change the financial system beyond all recognition. It will revolutionize banking and investment. And it will vastly accelerate the digitization of the global economy to everyone’s benefit.

After reading this book, you may or may not want to invest in Bitcoin. However, a working knowledge of what it is and how it works will become essential for everyone as the 21st century unfolds.

For s start, Bitcoin, other cryptos, and future cryptos yet to be invented will save $1 trillion a year in transaction costs in the global economy. Who will be the beneficiary of this bounty? You, me, and all the companies we invest in.

It is certain that some form of current or future crypto will be a stepping stone to a global digital currency, not just for emerging nations like El Salvador, but all nations.

And here is the most interesting thing. The eventual impact of crypto on our lives hasn’t even been imagined yet.

Going back to my Defense Department days, I was one of a handful who was present at the birth of the Internet and the similarities are legion. A few clever people were aware of bits and corners of the Internet back in 1989, but nobody had a big picture.

Long term predictions might as well have been science fiction. Insiders were buying up domain names for a dollar each, such as Mcdonalds.com, whitehouse.com, and sex.com. The MacDonald’s site was later sold to the fast-food company for $10 million.

When the Internet began mass adoption in 1995, no one imagined that every taxi company in the world would be out of business in 15 years. New York City taxi medallions once worth $1 million became worthless, prompting many suicides.

Nor did prime downtown apartment owners all over the world expect they could rent their homes for astronomical daily rates through Airbnb (ABNB). They didn’t even expect that a small startup named Netflix (NFLX) would stream videos online, wiping out Blockbuster Video.

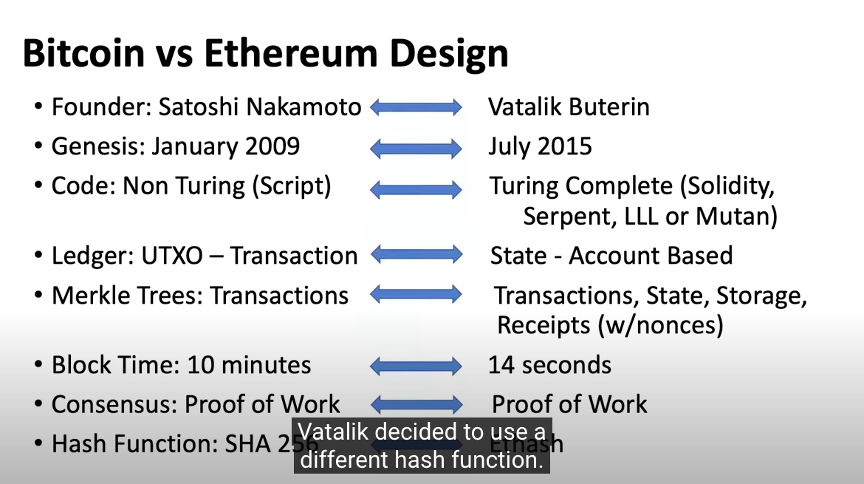

Bitcoin was created by Satoshi Nakamoto, a pseudonymous person or team who outlined the technology in a 2008 white paper. Nobody knows for sure. It might even be a US government agency that invented Bitcoin. It’s an appealingly simple concept: bitcoin is digital money that allows for secure, trustless, peer-to-peer transactions on the internet.

Unlike other payment services, like PayPal’s Venmo (PYPL), which rely on the traditional financial system for permission to transfer money and on existing debit/credit accounts, bitcoin is decentralized: any two people, anywhere in the world, can send bitcoin to each other without the involvement of a bank, government, or other institution.

Every transaction involving Bitcoin is tracked on the blockchain, which is like a bank’s ledger, or log of customers’ funds going in and out of the bank. In simple terms, it’s a record of every transaction ever made using bitcoin. Think of blockchain as a chain of blocks of code, each one of which contains millions of lines of code.

Unlike a bank’s ledger, the Bitcoin blockchain is distributed across the entire network. No company, country, or third party is in control of it; and anyone can become part of that network. The Mad Hedge Fund Trader is part of that network, otherwise known as a “node.”

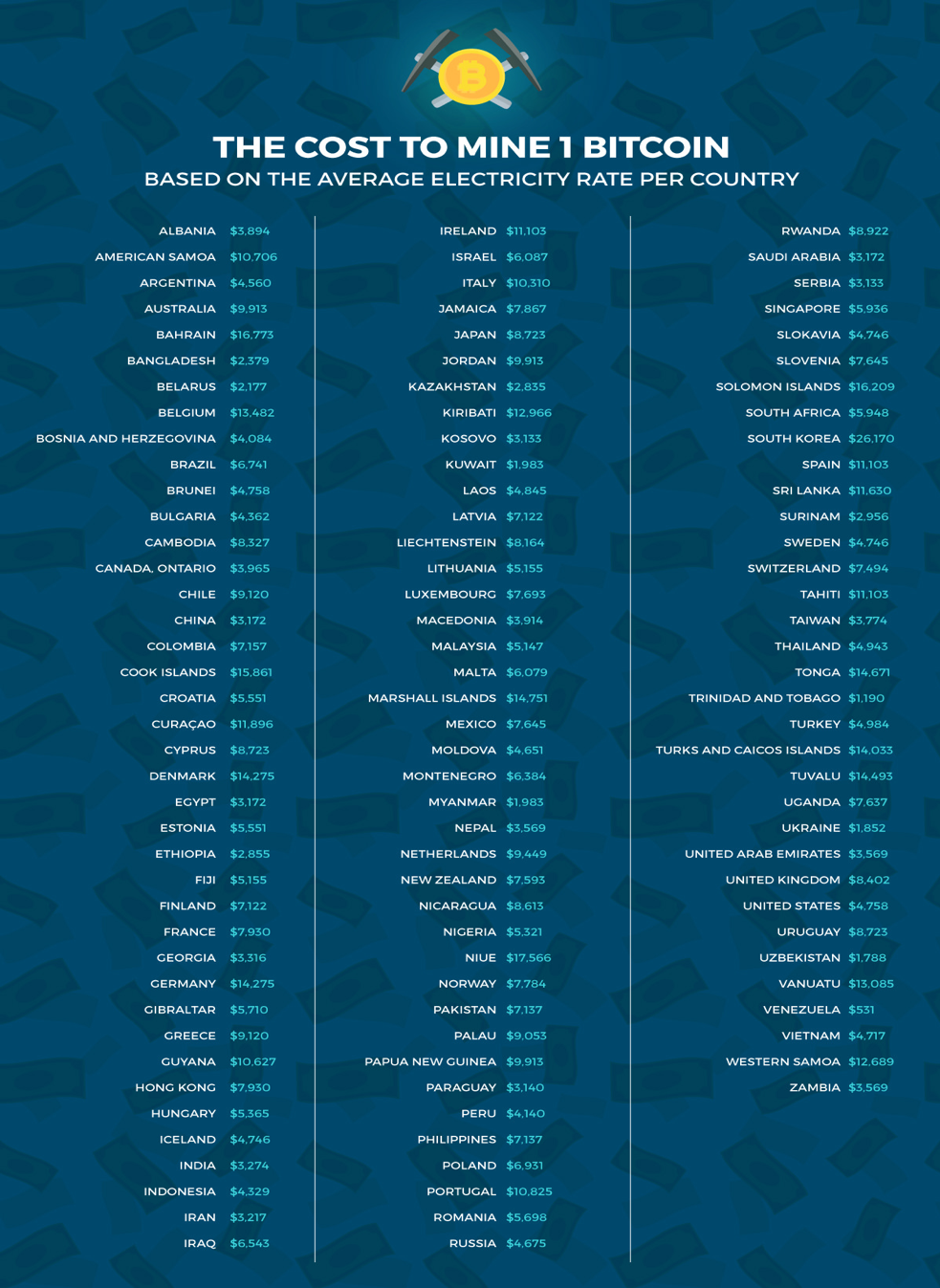

There will only ever be 21 million Bitcoins. This is digital money that cannot be inflated or manipulated in any way.

It isn’t necessary to buy an entire bitcoin: you can buy just a fraction of one if that’s all you want or need. To open my own crypto wallet, I started with an initial buy of one ten thousand of a Bitcoin, or $10. Now, I’m trading in the millions.

Whatever the outcome of Bitcoin is, one thing is certain. None of our lives will be the same.