Global Market Comments

May 6, 2025

Fiat Lux

Featured Trade:

(THEY’RE NOT MAKING AMERICANS ANYMORE)

(SPY), (EWJ), (EWL), (EWU), (EWG), (EWY), (FXI), (EIRL), (GREK), (EWP), (IDX), (EPOL), (TUR), (EWZ), (PIN), (EIS)

Global Market Comments

May 6, 2025

Fiat Lux

Featured Trade:

(THEY’RE NOT MAKING AMERICANS ANYMORE)

(SPY), (EWJ), (EWL), (EWU), (EWG), (EWY), (FXI), (EIRL), (GREK), (EWP), (IDX), (EPOL), (TUR), (EWZ), (PIN), (EIS)

If demographics are destiny, then America’s future looks bleak. You see, they’re just not making Americans anymore.

At least that is the sobering conclusion of the latest Economist magazine survey of the global demographic picture.

I have long been a fan of demographic investing, which creates opportunities for traders to execute on what I call “intergenerational arbitrage”. When the number of middle-aged big spenders is falling, risk markets plunge.

Front run this data by two decades, and you have a great predictor of stock market tops and bottoms that outperforms most investment industry strategists.

You can distill this even further by calculating the percentage of the population that is in the 45-49 age bracket.

The reasons for this are quite simple. The last five years of child rearing are the most expensive. Think of all that pricey sports equipment, tutoring, braces, SAT coaching, first cars, first car wrecks, and the higher insurance rates that go with it.

Older kids need more running room, which demands larger houses with more amenities. No wonder it seems that dad is writing a check or whipping out a credit card every five seconds. I know, because I have five kids of my own. As long as dad is in spending mode, stock and real estate prices rise handsomely, as do most other asset classes. Dad, you’re basically one generous ATM.

As soon as kids flee the nest, this spending grinds to a juddering halt. Adults entering their fifties cut back spending dramatically and become prolific savers. Empty nesters also start downsizing their housing requirements, unwilling to pay for those empty bedrooms, which in effect, become expensive storage facilities.

This is highly deflationary and causes a substantial slowdown in GDP growth. That is why the stock and real estate markets began their slide in 2007, while it was off to the races for the Treasury bond market.

The data for the US is not looking so hot right now. Americans aged 45-49 peaked in 2009 at 23% of the population. According to US census data, this group then began a 13-year decline to only 19% by 2022.

You can take this strategy and apply it globally with terrific results. Not only do these spending patterns apply globally, but they also backtest with a high degree of accuracy. Simply determine when the 45-49 age bracket is peaking for every country, and you can develop a highly reliable timetable for when and where to invest.

Instead of poring through gigabytes of government census data to cherry-pick investment opportunities, my friends at HSBC Global Research, strategists Daniel Grosvenor and Gary Evans, have already done the work for you. They have developed a table ranking investable countries based on when the 34-54 age group peaks—a far larger set of parameters that captures generational changes.

The numbers explain a lot of what is going on in the world today. I have reproduced it below. From it, I have drawn the following conclusions:

* The US (SPY) peaked in 2001 when our first “lost decade” began.

*Japan (EWJ) peaked in 1990, heralding 32 years of falling asset prices, giving you a nice back test.

*Much of developed Europe, including Switzerland (EWL), the UK (EWU), and Germany (EWG), followed in the late 2,000’s, and the current sovereign debt debacle started shortly thereafter.

*South Korea (EWY), an important G-20 “emerged” market with the world’s lowest birth rate, peaked in 2010.

*China (FXI) topped in 2011, explaining why we have seen three years of dreadful stock market performance despite torrid economic growth. It has been our consumers driving their GDP, not theirs.

*The “PIIGS” countries of Portugal, Ireland (EIRL), Greece (GREK), and Spain (EWP) don’t peak until the end of this decade. That means you could see some ballistic stock market performances if the debt debacle is dealt with in the near future.

*The outlook for other emerging markets, like Indonesia (IDX), Poland (EPOL), Turkey (TUR), Brazil (EWZ), and India (PIN) is quite good, with spending by the middle-aged not peaking for 15-33 years.

*Which country will have the biggest demographic push for the next 38 years? Israel (EIS), which will not see consumer spending max out until 2050. Better start stocking up on things Israelis buy.

Like all models, this one is not perfect, as its predictions can get derailed by a number of extraneous factors. Rapidly lengthening life spans could redefine “middle age”. Personally, I’m hoping 72 is the new 42.

Emigration could starve some countries of young workers (like Japan), while adding them to others (like Australia). Foreign capital flows in a globalized world can accelerate or slow down demographic trends. The new “RISK ON/RISK OFF” cycle can also have a clouding effect.

So why am I so bullish now? Because demographics is just one tool in the cabinet. Dozens of other economic, social, and political factors drive the financial markets.

What is the most important demographic conclusion right now? That the US demographic headwind veered to a tailwind in 2022, setting the stage for the return of the “Roaring Twenties.” With the (SPY) up 27% since October, it appears the markets heartily agree.

While the growth rate of the American population is dramatically shrinking, the rate of migration is accelerating, with huge economic consequences. The 80-year-old trend of population moving from North to South to save on energy bills is picking up speed, and the Midwest is getting hollowed out at an astounding rate as its people flee to the coasts, all three of them.

As a result, California, Texas, Florida, Washington, and Oregon are gaining population, while Missouri, Iowa, Nebraska, Kansas, and Wyoming are losing it (see map below). During my lifetime, the population of California has rocketed from 10 million to 40 million. People come in poor and leave as billionaires, as Elon Musk did.

In the meantime, I’m going to be checking out the shares of the matzo manufacturer down the street.

Global Market Comments

April 24, 2024

Fiat Lux

Featured Trade:

(THEY’RE NOT MAKING AMERICANS ANYMORE)

(SPY), (EWJ), (EWL), (EWU), (EWG), (EWY), (FXI), (EIRL), (GREK), (EWP), (IDX), (EPOL), (TUR), (EWZ), (PIN), (EIS)

If demographics is destiny, then America’s future looks bleak. You see, they’re not making Americans anymore.

At least that is the sobering conclusion of the latest Economist magazine survey of the global demographic picture.

I have long been a fan of demographic investing, which creates opportunities for traders to execute on what I call “intergenerational arbitrage”. When the numbers of the middle-aged big spenders are falling, risk markets plunge. Front run this data by two decades, and you have a great predictor of stock market tops and bottoms that outperforms most investment industry strategists.

You can distill this even further by calculating the percentage of the population that is in the 45-49 age bracket.

The reasons for this are quite simple. The last five years of child rearing are the most expensive. Think of all that pricey sports equipment, tutoring, braces, SAT coaching, first cars, first car wrecks, and the higher insurance rates that go with it.

Older kids need more running room, which demands larger houses with more amenities. No wonder it seems that dad is writing a check or whipping out a credit card every five seconds. I know, because I have five kids of my own. As long as dad is in spending mode, stock and real estate prices rise handsomely, as do most other asset classes. Dad, you’re basically one generous ATM.

As soon as kids flee the nest, this spending grinds to a juddering halt. Adults entering their fifties cut back spending dramatically and become prolific savers. Empty nesters also start downsizing their housing requirements, unwilling to pay for those empty bedrooms, which in effect, become expensive storage facilities.

This is highly deflationary and causes a substantial slowdown in GDP growth. That is why the stock and real estate markets began their slide in 2007, while it was off to the races for the Treasury bond market.

The data for the US is not looking so hot right now. Americans aged 45-49 peaked in 2009 at 23% of the population. According to US census data, this group then began a 13-year decline to only 19% by 2022.

You can take this strategy and apply it globally with terrific results. Not only do these spending patterns apply globally, they also back-test with a high degree of accuracy. Simply determine when the 45-49 age bracket is peaking for every country and you can develop a highly reliable timetable for when and where to invest.

Instead of pouring through gigabytes of government census data to cherry-pick investment opportunities, my friends at HSBC Global Research, strategists Daniel Grosvenor and Gary Evans, have already done the work for you. They have developed a table ranking investable countries based on when the 34-54 age group peaks—a far larger set of parameters that captures generational changes.

The numbers explain a lot of what is going on in the world today. I have reproduced it below. From it, I have drawn the following conclusions:

* The US (SPY) peaked in 2001 when our first “lost decade” began.

*Japan (EWJ) peaked in 1990, heralding 32 years of falling asset prices, giving you a nice backtest.

*Much of developed Europe, including Switzerland (EWL), the UK (EWU), and Germany (EWG), followed in the late 2000s and the current sovereign debt debacle started shortly thereafter.

*South Korea (EWY), an important G-20 “emerged” market with the world’s lowest birth rate peaked in 2010.

*China (FXI) topped in 2011, explaining why we have seen three years of dreadful stock market performance despite torrid economic growth. It has been our consumers driving their GDP, not theirs.

*The “PIIGS” countries of Portugal, Ireland (EIRL), Greece (GREK), and Spain (EWP) don’t peak until the end of this decade. That means you could see some ballistic stock market performances if the debt debacle is dealt with in the near future.

*The outlook for other emerging markets, like Indonesia (IDX), Poland (EPOL), Turkey (TUR), Brazil (EWZ), and India (PIN) is quite good, with spending by the middle age not peaking for 15-33 years.

*Which country will have the biggest demographic push for the next 38 years? Israel (EIS), which will not see consumer spending max out until 2050. Better start stocking up on things Israelis buy.

Like all models, this one is not perfect, as its predictions can get derailed by a number of extraneous factors. Rapidly lengthening life spans could redefine “middle age”. Personally, I’m hoping 72 is the new 42.

Emigration could starve some countries of young workers (like Japan) while adding them to others (like Australia). Foreign capital flows in a globalized world can accelerate or slow down demographic trends. The new “RISK ON/RISK OFF” cycle can also have a clouding effect.

So why am I so bullish now? Because demographics is just one tool in the cabinet. Dozens of other economic, social, and political factors drive the financial markets.

What is the most important demographic conclusion right now? That the US demographic headwind veered to a tailwind in 2022, setting the stage for the return of the “Roaring Twenties.” With the (SPY) up 27% since October, it appears the markets heartily agree.

While the growth rate of the American population is dramatically shrinking, the rate of migration is accelerating, with huge economic consequences. The 80-year-old trend of population moving from North to South to save on energy bills picking up speed, the Midwest is getting hollowed out at an astounding rate as its people flee to the coasts, all three of them.

As a result, California, Texas, Florida, Washington, and Oregon are gaining population, while Missouri, Iowa, Nebraska, Kansas, and Wyoming are losing it (see map below). During my lifetime, the population of California has rocketed from 10 million to 40 million. People come in poor and leave as billionaires, as Elon Musk did.

In the meantime, I’m going to be checking out the shares of the matzo manufacturer down the street.

Regular readers of this letter are well aware of my fascination with demographics as a market driver.

They go a long way towards explaining if asset prices are facing a long-term structural headwind or tailwind.

The great thing about the data is that you can get precise, high quality numbers 20, or even 50 years in advance. No matter how hard governments may try, you can?t change the number of people born 20 years ago.

Ignore them at your peril. Those who failed to anticipate the coming retirement of the baby boomer generation in 2006 all found themselves horribly long and wrong in the market crash that followed shortly.

The Moody?s rating agency (MCO) has published a report predicting that the number of ?super aged? countries, those with more than 7% of their population over the age of 65, will increase from three to 13 by 2020, and 34 in 2030.

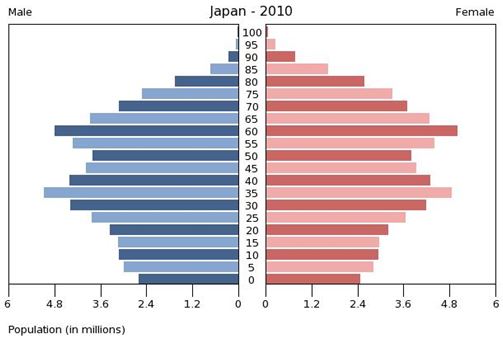

Currently, only Japan (26.4%) (EWJ), Italy (21.7%) (EWI), and Germany (EWG) are so burdened with that number of old age pensioners. France (EWQ) (18.7%), Switzerland (EWL) (18.2%), and the UK (EWU) (18.1%) are about to join the club.

The implication is that the global demographic dividend the world has enjoyed over the last 40 years is about to turn into a tax, a big one. The consequence will be lower long-term growth, possibly by 0.5%-1.0% less than we are seeing today.

This is what the bond market may already be telling us with its unimaginably subterranean rates for its long term bonds (Japan at -0.13%! Germany at 0.14%! The US at 1.75%!).

Traveling around Europe last summer, I was struck by the number of retirees I ran into. It certainly has taken the bloom off those topless beaches (I once saw one great grandmother with a walker on the beach in Barcelona).

For the list of new entrants to the super aged club, see the table below.

This is all a big deal for long-term investors.

Countries with inverted population pyramids have lots of seniors saving money, spending very little, and drawing hugely on social services.

For example, in China, the number of working age adults per senior plunges from 6 in 2020, to 4.2 in 2030, to only 2.6 by 2050!

Financial assets do very poorly in such a hostile environment. Your money doesn?t want to be anywhere near a country where diaper sales to seniors exceed those to newborns.

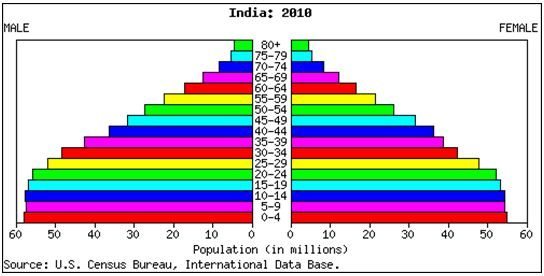

You want to bet your money on countries with positive demographic pyramids. They have lots of young people who are eager to work and to spend on growing families, drawing on social services little, if at all.

Fewer seniors to support keeps tax and savings rates low. This is all great for business, and therefore, risk assets.

Be careful not to rely solely on demographics when making your investment decisions. If you did that, you would have sold all your American stocks in 2006, had two great years, but then missed the tripling in markets that followed.

According to my friend, noted demographer Harry S. Dent, Jr., the US will not see a demographic tailwind until 2022.

When building a secure retirement home for yourself, you need to use all the tools in your toolbox, and not rely just on one.

A demographic headwind does not permanently doom a country to investment perdition.

The US is a prime example, where a large number of women joining the labor force, high levels of immigration, later retirement ages, and lower social service payouts all help mitigate a demographic drag.

A hyper accelerating rate of technological innovation also provides a huge cushion.

You Want to Invest in This Pyramid?

You Want to Invest in This Pyramid?

...Not This One

...Not This One

Markets are overbought now, especially given that the US economy is only growing at a subpar 2% annual rate. But the S&P 500 (SPY) will close higher by yearend. Despite the fact that 30-year Treasury prices (TLT) are near all time highs, there are still huge opportunities in the fixed income space. And both the Japanese yen (FXY) (YCS) and the Tokyo stock market (EWJ) (DXJ) have more to run.

These were a few choice investment nuggets I gleaned from my wide-ranging interview with my friend, Anthony Scaramucci. Anthony is the founder and managing partner of SkyBridge Capital, a leading fund of funds for alternative investments. To learn more about SkyBridge Capital, please go to their website at http://www.skybridgecapital.com/.

After getting a law degree from Harvard, he started his investment career at Goldman Sachs in 1989, where he spent 7 years in the wealth management division. He went on to start his own money management firm, which he sold to Neuberger Berman in 2001. When Lehman Brothers bought Neuberger Berman in 2003, Scaramucci spent a short stint there as managing director of its Investment Management Division.

Anthony is the author of two books: The Little Book of Hedge Funds: What You Need to Know About Hedge Funds but the Managers Won?t Tell You and Goodbye Gordon Gekko: How to Find Your Fortune Without Losing Your Soul.

Scaramucci is focusing his heaviest weighting in fixed income strategies that benefit from improving credit ratings in the US real estate market and low prepayment rates. This brilliant, reasonably well risk adjusted strategy is earning him 11%-13% annual returns, or 5-7 times the cash flow of ten-year Treasury bonds.

Anthony has been consistently negative on gold, which makes him look like a genius for the past two years. He has a small weighting in emerging markets, which offer higher risk and volatility, but potentially greater returns. His picks there include the Southeast Asian nations of Indonesia (IDX), Singapore (EWS), and Malaysia (EWM).

He thinks Apple (AAPL) is very cheap, but is facing an innovation headwind. Still, investors in Steve Jobs? creation should do well over the long term.

SkyBridge Capital uses 28 sub managers to generate outsized market returns. He came out ahead by 20% in 2012 and is up 9% so far this year. It has won awards for the best fund of funds with over $1 billion in assets for the last three years in a row. The firm now has over $7.7 billion in assets under management or advisement.

Anthony?s team of professionals does all the spadework in finding great managers, doing the due diligence, and cross hedging exposures. He charges 1.50% management fee, but last year earned back 77 basis points for his clients in manager discounts. So on a net basis the fees are really quite reasonable.

New investors can open an account for as little as $50,000. This is a big deal because some of the best managers have minimums as high as $10-$15 million. It is the only way the little guy can get access to the best of the best. Customers must be accredited investors with at least $200,000 in annual income and a net worth of over $1 million.

Anthony comes across as polished and erudite, yet cautious. He clearly spends a lot of time thinking about how to invest other people?s money.

As if Scaramucci didn?t have enough to do, he devotes much energy to organizing the SkyBridge Alternatives Conferences, the annual Woodstock for the high and the mighty of the hedge fund industry. The most recent event in Las Vegas presented heavyweight hedge fund legends Paulson & Co.?s John Paulson, Third Point?s Daniel Loeb, and Omega?s Leon Cooperman (click here for my coverage of this love fest).

I will be attending the next SkyBridge Alternatives Conference in Singapore during September 24-27, 2013 (click the link http://www.saltconference.com/saltasia2013/). Former Treasury secretary, Tim Geithner, and the last European Central Bank president, Jean-Claude Trichet, will be the keynote speakers.

To learn the precise details of the SkyBridge high return strategy, please follow the instructions for downloading the full interview below. There you can also get his list of the best US stocks to buy in the current environment.

Just go to the AUDIO menu tab and click on the pull down menu for RADIO SHOW (click here for the link at http://madhedgefundradio.com/radio-show/). Click on the green BUY NOW button and complete the order form. A blue link will appear telling you to ?click here to proceed?. Then click on the small blue box with the question mark inside to download. Hit the PLAY arrow to listen. You can pause, fast forward, or rewind at any time. Given the quality of the information you will obtain, the $4.95 price is a bargain.

To buy The Little Book of Hedge Funds at a discounted Amazon price, please click here. To buy Goodbye Gordon Gekko, please click here.

?Oh, how I despise the yen, let me count the ways.? I?m sure Shakespeare would have come up with a line of iambic pentameter similar to this if he were a foreign exchange trader. I firmly believe that a short position in the yen should be at the core of any hedged portfolio for the next decade, but so far every time I have dipped my toe in the water, it has been chopped off by a samurai sword.

I was heartened once again this week when Japan?s Ministry of Finance released data showing that the country suffered its first annual trade deficit since 1980. Specifically, the value of imports exceeded exports by $39 billion. Japan still ran healthy surpluses with the US and Europe. But it ran a gigantic deficit with the Middle East, its primary supplier of energy.

You can blame the March tsunami and the Fukushima nuclear meltdown that followed for much of this. Japan depended on nuclear power for 25% of its electric power generation, and since then the number of operating plants has been cut from 54 to just 5. Conventional plants powered by oil and LNG have had to make up the difference, causing a surge in imports. Crude?s leap from $75/barrel in the fall to $100 made matters worse.

It also hasn?t helped that Japan has offshored much of its low end manufacturing to China over the last 30 years, as America has done. Exacerbating the problem were the Thai floods, which caused immense supply chain problems, further eroding exports.

To remind you why you hate all investments Japanese, I?ll refresh your memory with this short list of the other problems bedeviling the country:

* With the world?s weakest major economy, Japan is certain to be the last country to raise interest rates.

* This is inciting big hedge funds to borrow yen and sell it to finance longs in every other corner of the financial markets.

* Japan has the world?s worst demographic outlook that assures its problems will only get worse. They?re not making Japanese any more.

* The sovereign debt crisis in Europe is prompting investors to scan the horizon for the next troubled country. With gross debt exceeding 200% of GDP, or 100% when you net out inter-agency crossholdings, Japan is at the top of the hit list.

* The Japanese long bond market, with a yield of 0.98%, is a disaster waiting to happen.

* You have two willing co-conspirators in this trade, the Ministry of Finance and the Bank of Japan, who will move Mount Fuji, if they must, to get the yen down and bail out the country?s beleaguered exporters.

When the big turn inevitably comes, we?re going to ?100, then ?120, then ?150. That could take the price of the leveraged short yen ETF (YCS), which last traded at $41.43, to over $100.? But it might take a few years to get there. The fact that the Japanese government has come on my side with this trade is not any great comfort. Many intervention attempts have so FAR been able to weaken the Japanese currency only for a few nanoseconds.

If you think this is extreme, let me remind you that when I first went to Japan in the early seventies, the yen was trading at ?305, and had just been revalued from the Peace Treaty Dodge line rate of ?360. To me the ?78 I see on my screen today is unbelievable.

Noted hedge fund manager Kyle Bass says he is already in this trade in size. All he needs for it to work is for Japan to run out of domestic savers essential to buy the government?s domestic yen bond issues, who have pitifully had sub 1% yields forced upon them for the past 17 years. Then the yen, the bond market, and the stock market all collapse like a house of cards. Kyle says that could happen as early as the spring.

It?s All Over For the Yen

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.