Global Market Comments

May 6, 2025

Fiat Lux

Featured Trade:

(THEY’RE NOT MAKING AMERICANS ANYMORE)

(SPY), (EWJ), (EWL), (EWU), (EWG), (EWY), (FXI), (EIRL), (GREK), (EWP), (IDX), (EPOL), (TUR), (EWZ), (PIN), (EIS)

Global Market Comments

May 6, 2025

Fiat Lux

Featured Trade:

(THEY’RE NOT MAKING AMERICANS ANYMORE)

(SPY), (EWJ), (EWL), (EWU), (EWG), (EWY), (FXI), (EIRL), (GREK), (EWP), (IDX), (EPOL), (TUR), (EWZ), (PIN), (EIS)

If demographics are destiny, then America’s future looks bleak. You see, they’re just not making Americans anymore.

At least that is the sobering conclusion of the latest Economist magazine survey of the global demographic picture.

I have long been a fan of demographic investing, which creates opportunities for traders to execute on what I call “intergenerational arbitrage”. When the number of middle-aged big spenders is falling, risk markets plunge.

Front run this data by two decades, and you have a great predictor of stock market tops and bottoms that outperforms most investment industry strategists.

You can distill this even further by calculating the percentage of the population that is in the 45-49 age bracket.

The reasons for this are quite simple. The last five years of child rearing are the most expensive. Think of all that pricey sports equipment, tutoring, braces, SAT coaching, first cars, first car wrecks, and the higher insurance rates that go with it.

Older kids need more running room, which demands larger houses with more amenities. No wonder it seems that dad is writing a check or whipping out a credit card every five seconds. I know, because I have five kids of my own. As long as dad is in spending mode, stock and real estate prices rise handsomely, as do most other asset classes. Dad, you’re basically one generous ATM.

As soon as kids flee the nest, this spending grinds to a juddering halt. Adults entering their fifties cut back spending dramatically and become prolific savers. Empty nesters also start downsizing their housing requirements, unwilling to pay for those empty bedrooms, which in effect, become expensive storage facilities.

This is highly deflationary and causes a substantial slowdown in GDP growth. That is why the stock and real estate markets began their slide in 2007, while it was off to the races for the Treasury bond market.

The data for the US is not looking so hot right now. Americans aged 45-49 peaked in 2009 at 23% of the population. According to US census data, this group then began a 13-year decline to only 19% by 2022.

You can take this strategy and apply it globally with terrific results. Not only do these spending patterns apply globally, but they also backtest with a high degree of accuracy. Simply determine when the 45-49 age bracket is peaking for every country, and you can develop a highly reliable timetable for when and where to invest.

Instead of poring through gigabytes of government census data to cherry-pick investment opportunities, my friends at HSBC Global Research, strategists Daniel Grosvenor and Gary Evans, have already done the work for you. They have developed a table ranking investable countries based on when the 34-54 age group peaks—a far larger set of parameters that captures generational changes.

The numbers explain a lot of what is going on in the world today. I have reproduced it below. From it, I have drawn the following conclusions:

* The US (SPY) peaked in 2001 when our first “lost decade” began.

*Japan (EWJ) peaked in 1990, heralding 32 years of falling asset prices, giving you a nice back test.

*Much of developed Europe, including Switzerland (EWL), the UK (EWU), and Germany (EWG), followed in the late 2,000’s, and the current sovereign debt debacle started shortly thereafter.

*South Korea (EWY), an important G-20 “emerged” market with the world’s lowest birth rate, peaked in 2010.

*China (FXI) topped in 2011, explaining why we have seen three years of dreadful stock market performance despite torrid economic growth. It has been our consumers driving their GDP, not theirs.

*The “PIIGS” countries of Portugal, Ireland (EIRL), Greece (GREK), and Spain (EWP) don’t peak until the end of this decade. That means you could see some ballistic stock market performances if the debt debacle is dealt with in the near future.

*The outlook for other emerging markets, like Indonesia (IDX), Poland (EPOL), Turkey (TUR), Brazil (EWZ), and India (PIN) is quite good, with spending by the middle-aged not peaking for 15-33 years.

*Which country will have the biggest demographic push for the next 38 years? Israel (EIS), which will not see consumer spending max out until 2050. Better start stocking up on things Israelis buy.

Like all models, this one is not perfect, as its predictions can get derailed by a number of extraneous factors. Rapidly lengthening life spans could redefine “middle age”. Personally, I’m hoping 72 is the new 42.

Emigration could starve some countries of young workers (like Japan), while adding them to others (like Australia). Foreign capital flows in a globalized world can accelerate or slow down demographic trends. The new “RISK ON/RISK OFF” cycle can also have a clouding effect.

So why am I so bullish now? Because demographics is just one tool in the cabinet. Dozens of other economic, social, and political factors drive the financial markets.

What is the most important demographic conclusion right now? That the US demographic headwind veered to a tailwind in 2022, setting the stage for the return of the “Roaring Twenties.” With the (SPY) up 27% since October, it appears the markets heartily agree.

While the growth rate of the American population is dramatically shrinking, the rate of migration is accelerating, with huge economic consequences. The 80-year-old trend of population moving from North to South to save on energy bills is picking up speed, and the Midwest is getting hollowed out at an astounding rate as its people flee to the coasts, all three of them.

As a result, California, Texas, Florida, Washington, and Oregon are gaining population, while Missouri, Iowa, Nebraska, Kansas, and Wyoming are losing it (see map below). During my lifetime, the population of California has rocketed from 10 million to 40 million. People come in poor and leave as billionaires, as Elon Musk did.

In the meantime, I’m going to be checking out the shares of the matzo manufacturer down the street.

Global Market Comments

February 10, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD or BACK TO BOOT CAMP)

(SPY), (EWG), (EWU), (TSLA), (NVDA), (VST)

I have a new outlook for the US stock markets.

The current government's economic policy reminds me a lot about the Marine Corps boot camp. Through harsh treatment and rigorous training, the Marines seek to destroy incoming recruits. They then spend 13 weeks rebuilding a new soldier from scratch who is obedient, respectful, follows orders, and is in much better physical condition. He is also a pretty good shot.

Since Trump inherited an almost perfect economy, with 3% real GDP growth, 2.8% inflation, and 4% unemployment, he has to break it first. Then he can spend the next four years rebuilding it and take credit for the recovery.

It looks like we are going to get more on the destruction front this week, with the US announcing European tariffs, which tanked stocks on Friday. We could remain in the destruction phase for the rest of the year. It sets up nicely at least a 20% correction sometime in 2025. Oh, and never buy on a Friday. All of the “shock and awe” announcements are occurring on the weekends. Wait for the Monday morning opening and buy the collapse.

It’s pretty clear that markets hate all things tariff-related. Can we please talk more about deregulation, which markets love? The reality is that markets don’t know how to price in Trump, swinging back and forth between euphoria one moment to Armageddon another. Best case, markets flat line. Worst case, they crash.

Here are some additional causes for concern. Big Tech was the only stock market sector that saw net inflows in 2024. It was also the only down sector in January. It just so happens to be the most overweight sector among almost all individuals and institutions, including yours. Big Tech now accounts for 35% of stock market capitalization. It is a concentration on steroids. So when we finally DO get a correction, it will be a big one, easily more than 10%.

Looking at stock market performance around the world since the 2008-09 financial crisis, it’s easy to see where the idea of American exceptionalism comes from. Since 2010, the German stock market (EWG) is up by 142% and the UK (EWU) by 112%. During the same 15-year period, the S&P 500 (SPY) soared by 1,112%, an outperformance of an eye-popping 8:1.

Since the beginning of 2025, the German stock market (EWG) is up by 12.7% and the UK (EWU) by 9%. In the meantime, the S&P 500 has managed a mere 3.5% gain. What has happened? Has something changed? Is American exceptionalism a thing of the past? If so, it would be terrible news for stocks.

In the rest of the world, 26% of corporate cash flow is reinvested in the company. In the US, it’s 42%, and for the Magnificent Seven, it’s 57%. This is American Exceptionalism distilled by a single driver. If this continues, that’s great. If rampant uncertainty drives US companies into hiding, it won’t. 90-day US Treasury bills yielding a risk-free 4.2% look pretty good in this new chaotic world, especially if you are still sitting on the gigantic profits of the past two years.

This is why Foreigners have been pouring money into the US as fast as possible and has been a major factor in our price appreciation until now. Foreign investors now own $23 trillion worth of American debt, equities, and real estate today versus only $8 trillion in 2017.

As I mentioned last week, when I suggest a European investment idea to a European, they tell me I am out of my mind and beg for more US investment ideas. I know this because about one-third of the Mad Hedge subscribers are aboard in 134 countries.

And this is why markets are so jittery. Some 23% of all the completed cars sold in the US are actually made in Mexico and Canada. For auto parts, the figure is more than 50%. The US sold 3.7 million vehicles made in Mexico and Canada. The new 25% tariff will increase prices by $6,300 per vehicle. Average car prices are now at $50,000 and are already at all-time highs. That works out to a $22.7 billion tax on the buyers of new cars who are mostly middle class.

My bet? That the prices of used cars soar, which aren’t subject to any such taxes.

Turn off the TV. Ignore the noise. Buy the down days and sell the up days. It’s no more complicated than that. If you want to play headline ping pong with the president, be my guest. But you’ll lose your shirt.

February has started with a breakeven +0.57% return so far.

That takes us to a year-to-date profit of +6.25% so far in 2025. My trailing one-year return stands at +83.45% as a bad trade a year ago fell off the one-year record. That takes my average annualized return to +5.23% and my performance since inception to +757.12%.

I used the weakness in Tesla to double up my long there. That tops up our portfolio to a long in (TSLA), a short in (TSLA), and longs in (NVDA) and (VST).

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 74 of 94 trades have been profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

Try beating that anywhere.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties, is now looking at multiple gale force headwinds. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

My Dow 240,000 target has been pushed back to 2035.

On Monday, February 10, nothing of note takes place.

On Tuesday, February 11, at 8:30 AM EST, the NFIB Business Optimism Index is released.

On Wednesday, February 12 at 8:30 AM, the Core Inflation Rate is printed.

On Thursday, February 13 at 8:30 AM, the Weekly Jobless Claims are disclosed.

On Friday, February 14 at 8:30 AM, the Producer Price Index is announced. At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, it was with a heavy heart that I boarded a plane for Los Angeles to attend a funeral for Bob, the former scoutmaster of Boy Scout Troop 108.

The event brought a convocation of ex-scouts from up and down the West coast and said much about our age.

Bob, 85, called me two weeks ago to tell me his CAT scan had just revealed advanced metastatic lung cancer. I said, “Congratulations Bob, you just made your life span.”

It was our last conversation.

He spent only a week in bed and then was gone. As a samurai warrior might have said, it was a good death. Some thought it was the smoking he quit 20 years ago.

Others speculated that it was his close work with uranium during WWII. I chalked it up to a half-century of breathing the air in Los Angeles.

Bob originally hailed from Bloomfield, New Jersey. After WWII, every East Coast college was jammed with returning vets on the GI bill. So he enrolled in a small, well-regarded engineering school in New Mexico in a remote place called Alamogordo.

His first job after graduation was testing V2 rockets newly captured from the Germans at the White Sands Missile Test Range. He graduated to design ignition systems for atomic bombs. A boom in defense spending during the fifties swept him up to the Greater Los Angeles area.

Scouts I last saw at age 13 or 14 were now 60, while the surviving dads were well into their 80s. Everyone was in great shape, those endless miles lugging heavy packs over High Sierra passes obviously yielding lifetime benefits.

Hybrid cars lined both sides of the street. A tag-along guest called out for a cigarette, and a hush came over a crowd numbering over 100.

Apparently, some things stuck. It was a real cycle of life weekend. While the elders spoke about blood pressure and golf handicaps, the next generation of scouts played in the backyard or picked lemons off a ripening tree.

Bob was the guy who taught me how to ski, cast rainbow trout in mountain lakes, transmit Morse code, and survive in the wilderness. He used to scrawl schematic diagrams for simple radios and binary computers on a piece of paper, usually built around a single tube or transistor.

I would run off to Radio Shack to buy WWII surplus parts for pennies on the pound and spend long nights attempting to decode impossibly fast Navy ship-to-ship transmissions. He was also the man who pinned an Eagle Scout badge on my uniform in front of beaming parents when I turned 15.

While in the neighborhood, I thought I would drive by the house in which I grew up, once a modest 1,800 square foot ranch-style home to a happy family of nine. I was horrified to find that it had been torn down, and the majestic maple tree that I planted 40 years ago had been removed.

In its place was a giant, 6,000-square-foot marble and granite monstrosity under construction for a wealthy family from China.

Profits from the enormous China-America trade have been pouring into my hometown from the Middle Kingdom for the last decade, and mine was one of the last houses to go.

When I was class president of the high school here, there were 3,000 white kids and one Chinese. Today, those numbers are reversed. Such is the price of globalization.

I guess you really can’t go home again.

At the request of the family, I assisted in the liquidation of his investment portfolio. Bob had been an avid reader of the Diary of a Mad Hedge Fund Trader since its inception, and he had attended my Los Angeles lunches.

It seems he listened well. There was Apple (AAPL) in all its glory at a cost of $21. I laughed to myself. The master had become the student, and the student had become the master.

Like I said, it was a real circle of life weekend.

Scoutmaster Bob

1965 Scout John Thomas

The Mad Hedge Fund Trader at Age 11 in 1963

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

April 24, 2024

Fiat Lux

Featured Trade:

(THEY’RE NOT MAKING AMERICANS ANYMORE)

(SPY), (EWJ), (EWL), (EWU), (EWG), (EWY), (FXI), (EIRL), (GREK), (EWP), (IDX), (EPOL), (TUR), (EWZ), (PIN), (EIS)

If demographics is destiny, then America’s future looks bleak. You see, they’re not making Americans anymore.

At least that is the sobering conclusion of the latest Economist magazine survey of the global demographic picture.

I have long been a fan of demographic investing, which creates opportunities for traders to execute on what I call “intergenerational arbitrage”. When the numbers of the middle-aged big spenders are falling, risk markets plunge. Front run this data by two decades, and you have a great predictor of stock market tops and bottoms that outperforms most investment industry strategists.

You can distill this even further by calculating the percentage of the population that is in the 45-49 age bracket.

The reasons for this are quite simple. The last five years of child rearing are the most expensive. Think of all that pricey sports equipment, tutoring, braces, SAT coaching, first cars, first car wrecks, and the higher insurance rates that go with it.

Older kids need more running room, which demands larger houses with more amenities. No wonder it seems that dad is writing a check or whipping out a credit card every five seconds. I know, because I have five kids of my own. As long as dad is in spending mode, stock and real estate prices rise handsomely, as do most other asset classes. Dad, you’re basically one generous ATM.

As soon as kids flee the nest, this spending grinds to a juddering halt. Adults entering their fifties cut back spending dramatically and become prolific savers. Empty nesters also start downsizing their housing requirements, unwilling to pay for those empty bedrooms, which in effect, become expensive storage facilities.

This is highly deflationary and causes a substantial slowdown in GDP growth. That is why the stock and real estate markets began their slide in 2007, while it was off to the races for the Treasury bond market.

The data for the US is not looking so hot right now. Americans aged 45-49 peaked in 2009 at 23% of the population. According to US census data, this group then began a 13-year decline to only 19% by 2022.

You can take this strategy and apply it globally with terrific results. Not only do these spending patterns apply globally, they also back-test with a high degree of accuracy. Simply determine when the 45-49 age bracket is peaking for every country and you can develop a highly reliable timetable for when and where to invest.

Instead of pouring through gigabytes of government census data to cherry-pick investment opportunities, my friends at HSBC Global Research, strategists Daniel Grosvenor and Gary Evans, have already done the work for you. They have developed a table ranking investable countries based on when the 34-54 age group peaks—a far larger set of parameters that captures generational changes.

The numbers explain a lot of what is going on in the world today. I have reproduced it below. From it, I have drawn the following conclusions:

* The US (SPY) peaked in 2001 when our first “lost decade” began.

*Japan (EWJ) peaked in 1990, heralding 32 years of falling asset prices, giving you a nice backtest.

*Much of developed Europe, including Switzerland (EWL), the UK (EWU), and Germany (EWG), followed in the late 2000s and the current sovereign debt debacle started shortly thereafter.

*South Korea (EWY), an important G-20 “emerged” market with the world’s lowest birth rate peaked in 2010.

*China (FXI) topped in 2011, explaining why we have seen three years of dreadful stock market performance despite torrid economic growth. It has been our consumers driving their GDP, not theirs.

*The “PIIGS” countries of Portugal, Ireland (EIRL), Greece (GREK), and Spain (EWP) don’t peak until the end of this decade. That means you could see some ballistic stock market performances if the debt debacle is dealt with in the near future.

*The outlook for other emerging markets, like Indonesia (IDX), Poland (EPOL), Turkey (TUR), Brazil (EWZ), and India (PIN) is quite good, with spending by the middle age not peaking for 15-33 years.

*Which country will have the biggest demographic push for the next 38 years? Israel (EIS), which will not see consumer spending max out until 2050. Better start stocking up on things Israelis buy.

Like all models, this one is not perfect, as its predictions can get derailed by a number of extraneous factors. Rapidly lengthening life spans could redefine “middle age”. Personally, I’m hoping 72 is the new 42.

Emigration could starve some countries of young workers (like Japan) while adding them to others (like Australia). Foreign capital flows in a globalized world can accelerate or slow down demographic trends. The new “RISK ON/RISK OFF” cycle can also have a clouding effect.

So why am I so bullish now? Because demographics is just one tool in the cabinet. Dozens of other economic, social, and political factors drive the financial markets.

What is the most important demographic conclusion right now? That the US demographic headwind veered to a tailwind in 2022, setting the stage for the return of the “Roaring Twenties.” With the (SPY) up 27% since October, it appears the markets heartily agree.

While the growth rate of the American population is dramatically shrinking, the rate of migration is accelerating, with huge economic consequences. The 80-year-old trend of population moving from North to South to save on energy bills picking up speed, the Midwest is getting hollowed out at an astounding rate as its people flee to the coasts, all three of them.

As a result, California, Texas, Florida, Washington, and Oregon are gaining population, while Missouri, Iowa, Nebraska, Kansas, and Wyoming are losing it (see map below). During my lifetime, the population of California has rocketed from 10 million to 40 million. People come in poor and leave as billionaires, as Elon Musk did.

In the meantime, I’m going to be checking out the shares of the matzo manufacturer down the street.

Global Market Comments

April 5, 2019

Fiat Lux

Featured Trade:

(APRIL 3 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (VIX), (TSLA), (BA), (FXB), (AMZN), (IWM), (EWU)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader April 3 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: I’ve gotten a lot of newsletters but not many trades. Why is that?

A: Perfect trades do not happen every day of the year. They happen a few times a year and they tend to bunch up. Most time in the market is spent waiting for an entry point and then piling on 5 or 10 trades rapidly. We’re letting our profits run and waiting for new trades to open up, so just be patient and we’ll get you more trades than you can chew on.

If you have to ask this question, you are probably overtrading. The goal is to make yourself rich, not your broker. The other newsletters that offer a trade alert every day don’t publish their performance as I do and lose money for their followers hand over fist.

Q: Are we on track for a market peak in May?

A: Yes; if we keep climbing up, eventually hitting new highs this month, then we are setting up perfectly for a pretty sharp pullback around May 10th. That would be a good time to get rid of all your longs and put on some short positions, certainly deep in the money put spreads—we’ll be knocking quite a few of those out in the end of April/beginning of May.

Q: Are you worried about the Russell 2000 (IWM) climb?

A: I’m not. If you look at the chart, every up move has been weak, and every down move has been strong. Looking at the chart, it’s still in a clear downtrend dragging all the other markets, and this is because small-cap stocks do poorly in recessions or market pullbacks.

Q: How severe and how long do you see the coming bear market being?

A: If history repeats itself, then it’s going to be rather shallow. The last move down was only three months long and that stunned a lot of people who were expecting a more extreme pullback. I don’t see conditions in place that indicate a radically deep pullback—25% at most and 6-12 months in duration, which won’t be enough to liquidate your portfolio and justify the costs of getting out now and trying to get back in later. They key thing is that there are no systemic threats to the market other than the exploding levels of government borrowing.

Q: If you had the Tesla (TSLA) April $310-$330 vertical bear put spread, would you keep it?

A: Probably, yes, because you have a $15 cushion against a good news surprise and a lot less at risk. I got out of my Tesla (TSLA) April $300-$320 vertical bear put spread because my safety cushion shrank to only $5 and the risk/reward turned sharply against me.

Q: Should we be buying the Volatility Index (VIX) here for protection?

A: Not yet; we still have enough momentum in the stock market to hit all-time highs. After that, you really want to start looking at the VIX hard, especially if we get down to the $12 level. So good thinking, just not quite yet—as we know in the market, timing is everything.

Q: Are you getting nervous about the short Disney (DIS) calls?

A: I’m always nervous, every day of the year about every position, and yes, I’m watching them. You are paying me to be nervous so you can go play golf. We may take a small hit on the calls if the stock keeps rising, but that will be offset by a bigger gain on the call spread we’re long against.

Q: When is the quarterly option expiration?

A: It was on March 15 and the next one is June 21. This is an off-month expiration coming up on April 18th, and that’s only 12 trading days away.

Q: If you get a hard Brexit (FXB) in the next few weeks, what will happen to the pound?

A: It’s risen about 10% in the last few weeks on hopes of a Brexit outright failure. If that doesn't happen, the pound will get absolutely slaughtered.

Q: If China (FXI) is stimulating their economy, will that eventually help the U.S.?

A: Stimulus anywhere in the world always gets back to the U.S. because we’re the world’s largest market. So, yes, it will be positive.

Q: Would you consider trading UK stocks under Brexit fail?

A: Yes, and there is a UK stock ETF, the iShares MSCI United Kingdom ETF(EWU) and you’re looking at a 20%-25% rise in the British stock market if they completely give up on Brexit or just have another election.

Q: What are your thoughts on the China trade war?

A: The Chinese are in no rush to settle; that’s why we keep missing deadline after deadline and all the positive rumors are coming from the U.S. side. It’s looking more like a photo op trade deal than an actual one.

Q: If we get a top in stocks in May, how far do you expect (SPY) to go?

A: Not far; maybe 5% or 10%, you just have to allow all the recent players who got in to get out again, and if the economy slows to, say, a 1% rate in Q1, that’s not a panicky type market. That’s a 10% correction market and what we’ll probably get. If the economy then improves in Q2 and Q3, then we may go back up again to new highs. We seem to have a three quarter a year stock market and therefore, a three quarter a year stock market. Q1 is always a write off for the economy.

Q: Do you still like Amazon (AMZN)?

A: Absolutely, yes—it’s going to new highs. And it’s also starting to make a move on the food market, cutting prices at Whole Foods, which it owns, for the 3rd time this year. So, it’s moving on several fronts now, including healthcare. There’s at least a double in the company long term from these levels, and a triple if they break the company up.

Q: If you bought the stock in Boeing (BA) instead of the option spread, would you stay long?

A: I would, yes. It’s a great company and there's an easy 10% move in that stock once they get the 737 MAX back off the ground again which they should do within the month.

Q: What do you think about food stocks with big name brands like Hershey (HSY)?

A: I’ve never really liked the food industry. It’s really a low margin industry. You’re looking at 2% a year earnings growth against the big food companies vs 20% a year growth in tech which is why I stick with tech. My advice is always to focus on the few sectors that are the best 5% of the market and leave the dross for the index funds.

Q: With the current bullish wave in the market (SPY), what sector/stocks do you think have the most momentum to break out another 10% to 15% gain in the next one to three months?

A: The next 10% to 15% in the market will only happen after we drop 5-10% first. I believe this is the last 5% move of the China trade deal rally and after that, markets will fall or go to sleep for six months.

Q: Do you expect 2019 to be more like 2018 or 2017? We know you are predicting the (SPX) will hit an all-time high of 3000 in 2019. Do you think it zooms up to a blow-off top in Q2/Q3 and then pulls back in Q4, like 2018? Or, do you expect a steadier ascent with minor pullbacks along the way (like 2017), closing at or near the year's highs on Dec 31? This guidance will really help.

A: I think we have made most of the gains for 2019. Only the tag ends are lifted. We have already hit the upside targets for most strategists, and mine is only 7% higher. After that, there is a whole lot of boring ahead of us for 2019 and the (VIX) should drop to $9. After complaining about horrendous market volatility in December, traders will beg for volatility.

Good Luck and Good Trading

John Thomas

CEO & Publisher

Diary of a Mad Hedge Fund Trader

Regular readers of this letter are well aware of my fascination with demographics as a market driver.

They go a long way towards explaining if asset prices are facing a long-term structural headwind or tailwind.

The great thing about the data is that you can get precise, high quality numbers 20, or even 50 years in advance. No matter how hard governments may try, you can?t change the number of people born 20 years ago.

Ignore them at your peril. Those who failed to anticipate the coming retirement of the baby boomer generation in 2006 all found themselves horribly long and wrong in the market crash that followed shortly.

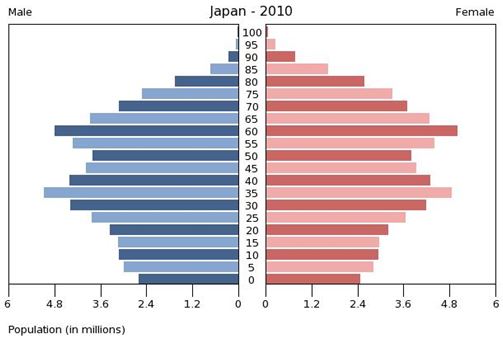

The Moody?s rating agency (MCO) has published a report predicting that the number of ?super aged? countries, those with more than 7% of their population over the age of 65, will increase from three to 13 by 2020, and 34 in 2030.

Currently, only Japan (26.4%) (EWJ), Italy (21.7%) (EWI), and Germany (EWG) are so burdened with that number of old age pensioners. France (EWQ) (18.7%), Switzerland (EWL) (18.2%), and the UK (EWU) (18.1%) are about to join the club.

The implication is that the global demographic dividend the world has enjoyed over the last 40 years is about to turn into a tax, a big one. The consequence will be lower long-term growth, possibly by 0.5%-1.0% less than we are seeing today.

This is what the bond market may already be telling us with its unimaginably subterranean rates for its long term bonds (Japan at -0.13%! Germany at 0.14%! The US at 1.75%!).

Traveling around Europe last summer, I was struck by the number of retirees I ran into. It certainly has taken the bloom off those topless beaches (I once saw one great grandmother with a walker on the beach in Barcelona).

For the list of new entrants to the super aged club, see the table below.

This is all a big deal for long-term investors.

Countries with inverted population pyramids have lots of seniors saving money, spending very little, and drawing hugely on social services.

For example, in China, the number of working age adults per senior plunges from 6 in 2020, to 4.2 in 2030, to only 2.6 by 2050!

Financial assets do very poorly in such a hostile environment. Your money doesn?t want to be anywhere near a country where diaper sales to seniors exceed those to newborns.

You want to bet your money on countries with positive demographic pyramids. They have lots of young people who are eager to work and to spend on growing families, drawing on social services little, if at all.

Fewer seniors to support keeps tax and savings rates low. This is all great for business, and therefore, risk assets.

Be careful not to rely solely on demographics when making your investment decisions. If you did that, you would have sold all your American stocks in 2006, had two great years, but then missed the tripling in markets that followed.

According to my friend, noted demographer Harry S. Dent, Jr., the US will not see a demographic tailwind until 2022.

When building a secure retirement home for yourself, you need to use all the tools in your toolbox, and not rely just on one.

A demographic headwind does not permanently doom a country to investment perdition.

The US is a prime example, where a large number of women joining the labor force, high levels of immigration, later retirement ages, and lower social service payouts all help mitigate a demographic drag.

A hyper accelerating rate of technological innovation also provides a huge cushion.

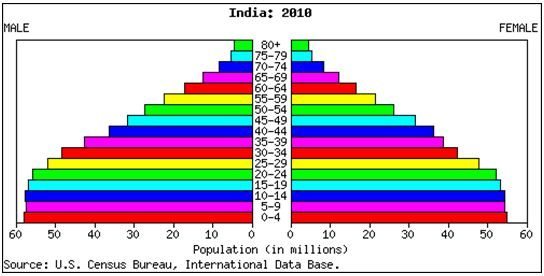

You Want to Invest in This Pyramid?

You Want to Invest in This Pyramid?

...Not This One

...Not This One

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.