During the heyday of my Morgan Stanley career in the 1980s, back when I had an unlimited expense account, a favorite place to take clients was Studio 54.

The place was full of rock stars, the music was piercing, and strange things were happening in dark corners. It was all the perfect adventure for the impressible visitor from the sedentary Midwest.

Studio 54 was notoriously difficult to get into. There were these hefty doormen dressed in black with big gold chains who did the vetting. If you were famous or a free-spending investment banker, the red ropes were cast aside, and you glided right in. $100 tips spoke volumes too. The hoi polloi could only watch with envy, even after spending hours in line.

The stock market has become a lot like Studio 54. It’s not letting you in. I had ten trade alerts lined up to get into the market on Friday and Monday. I only got off four. After a scant 3.2% decline, stocks turned around so fast it made your head spin. There are strange things happening in dark corners too.

Next week is the first time in a decade when the top five tech companies report earnings. If history is any guide, they will sell off sharply on the reports, form a base in August, then begin their yearend ramp up. This is why I have been hanging on to my short positions.

I continue to belie that the major miss by the markets is how much they are underestimating tech earnings. Maybe they have fully discounted 2021 earnings, but what about 2022-2030?

Let me give you the example of Apple alone. 5G wireless technology is rolling out now which is improving performance by ten times. What about 6G, 7G, and 8G? The cumulative performance gains of a decade of technological improvement is 10,000 times at zero cost!

Do you think Apple will buy more of its own stock in anticipation of this? Do you think everyone else will too?

You bet!

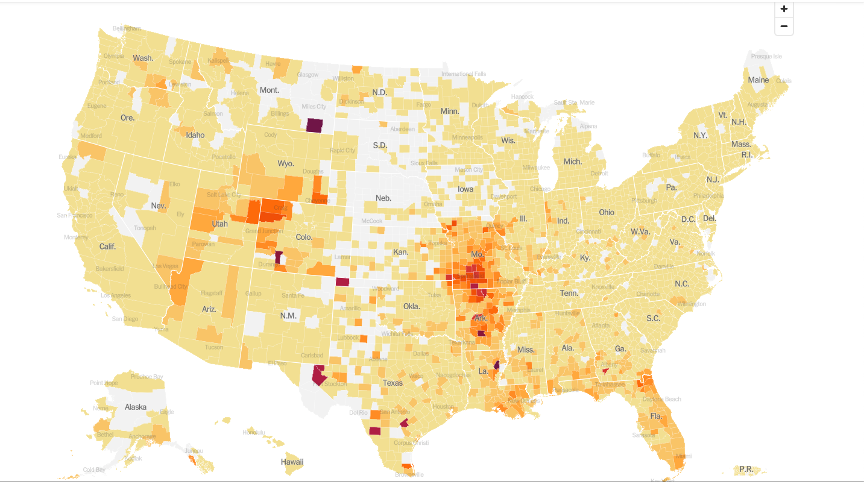

The “Delta” Correction lasted a day, with deaths in some states up 100% in a week. It is a pandemic of the unvaccinated and of children. The stock market was already ripe for a 5% correction. That’s what happens when you double in 16 months. The bond market at a 1.10% yield thinks the recovery is over and we’re going below 1.00% for the ten year.

Facebook is killing people, says Biden, through enabling the spread of vaccine information. Right-wing website says the vaccine causes sterility, alters your DNA, and enables the government to track your location. (FB) says members have the right to lie to each other. This isn’t going away. (FB) shares hit a new all-time high, taking its market cap into the trillion-dollar club.

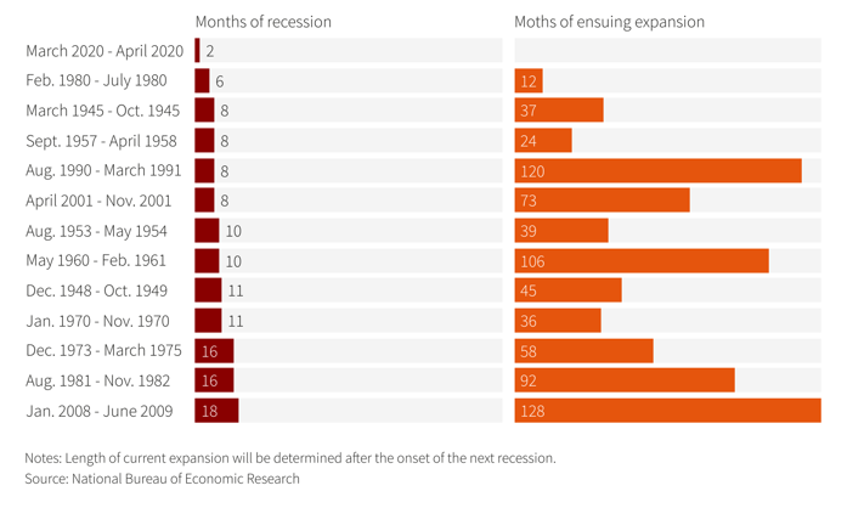

That was the shortest recession in history in 2020, lasting only two months. Straight down and then straight up, making it the shortest recession in history. But what two months it was, with an eye-popping 22 million jobs disappearing in March and April. We have since made more than half back.

The month-end selloff is back in play, with the 800-point bounce behind us. That’s when big tech reports. With trillions of dollars struggling to get into the market on any dip, a two-day, 3.2% correction is all we are going to get. I managed to strap on stock longs and bond shorts yesterday, but even I got left on the sidelines with my other trade alerts.

Bitcoin breaks $30,000, then bounces back up. It seems to be an inflation/rising interest rate play which does poorly when ten-year yields hit 1.12%. It’s almost trading 1:1 with Freeport McMoRan (FCX). That has to mean we’re soon entering “BUY” territory.

Rents are soaring, up 6.6% in May YOY, according to data collection firm Corelogic. It’s the biggest gain since 2005. Single-family homes, about half of the rental market, are leading the charge. Phoenix is delivering the biggest increases, up 14% YOY, followed by Dallas and Atlanta. What a great time to own!

Share buybacks are turbocharging this market, which could reach an eye-popping record $1 trillion in 2021 and another $550 billion in dividends. Q2 has already seen $350 billion in buybacks. Apple (AAPL) is leading the charge with a monster $250 billion in cash. Alphabet (GOOGL), Microsoft (MSFT), and Berkshire Hathaway (BRKB) follow. Even companies that have never bought the stock before may enter the fray, like Netflix (NFLX), which is a cash flow cow. My yearend target of an S&P 500 at 4,750, up 9.2% from here, is now looking totally attainable.

Existing Home Sales are up 1.4% in June to 5.86 million units, less than expected. Inventories are down 18.8% YOY to 1.25 million units to a 2.6-month supply. The Northeast was the leader, up 2.8%. Median home prices are still soaring to $363,000 and up an eye-popping 23.4% YOY. Sales of homes priced over $1 million are up 147%. No typo here. Some 14% of homes are now sold to investors, while 23% were to all-cash buyers.

GM recalls 69,000 bolts over recharging fire risk. The Ev's use will be severely restricted until fixed, citing “rare manufacturing defects.” Bolts use imported Korean batteries from LG. It’s what happens when you move into a new technology a decade late and rush to catch up. GM will never catch (TSLA). Avoid (GM) and buy (TSLA).

My Ten Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

My Mad Hedge Global Trading Dispatch profit suffered a -1.65% loss so far in July. My 2021 year-to-date performance appreciated to 66.95%. The Dow Average is up 14.57% so far in 2021.

Two of my positions, a long in (JPM) and a short in the (TLT) did great. But I really took it on the nose with my short positions in the (SPY) when the market melted up on Friday. That should turn out OK when all five big tech companies report this week, which historically marks a market top. That leaves me 60% in cash. I’m keeping positions small as long as we are at extreme overbought conditions.

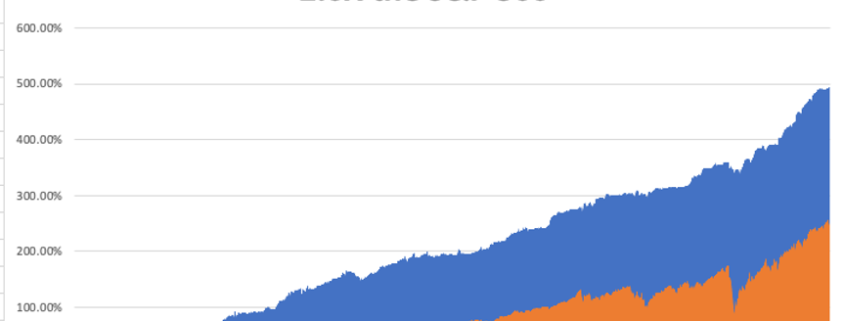

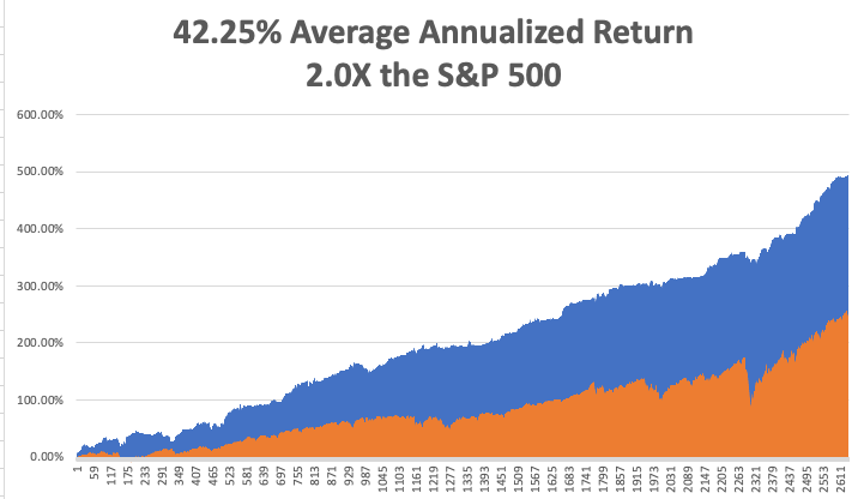

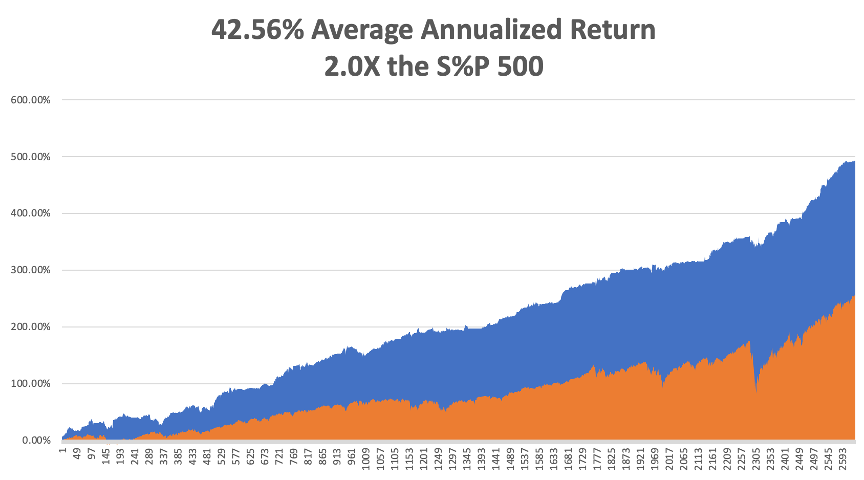

That brings my 11-year total return to 489.50%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return now stands at an unbelievable 42.25%, easily the highest in the industry.

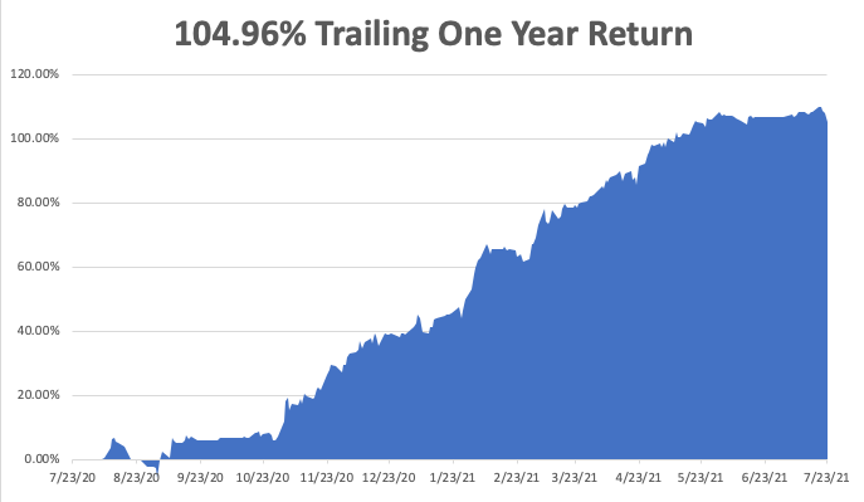

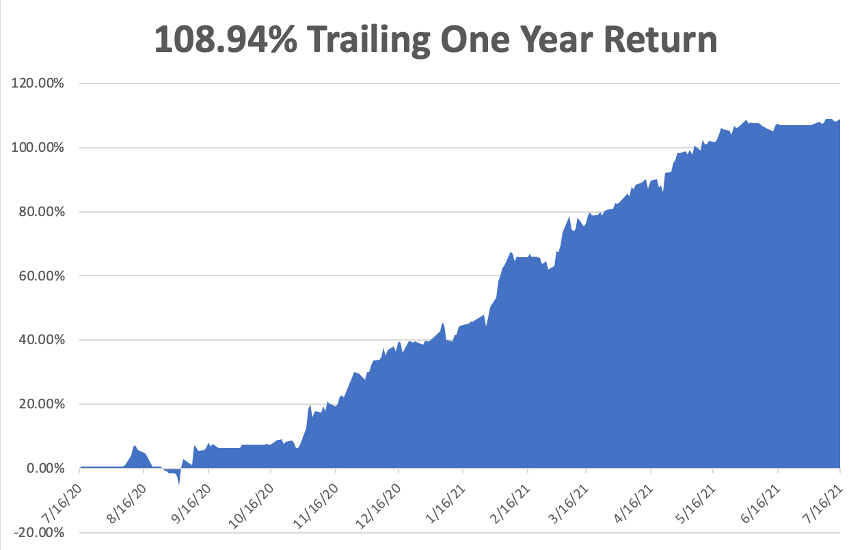

My trailing one-year return exploded to positively eye-popping 104.96%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 34.4 million and rising quickly and deaths topping 611,000, which you can find here. Some 34.1 million Americans have contracted Covid-19.

The coming week will be a weak one on the data front.

On Monday, July 26 at 11:00 AM, New Homes Sales for June are released. Alphabet (GOOGL), Tesla (TSLA), and Amazon (AMZN) report.

On Tuesday, July 27 at 10:00 AM, the S&P Case Shiller National Home Price Index for May is published. Apple (AAPL) reports.

On Wednesday, July 28 at 9:30 AM, the Wholesale Price Index for June is disclosed. Facebook (FB) and Microsoft (MSFT) report.

On Thursday, July 29 at 8:30 AM, we get Weekly Jobless Claims. We also learn the first look at Q2 US GDP, which should be a blockbuster.

On Friday, July 30 at 8:30 PM, we get Personal Income & Spending for June.

As for me, when I was shopping for a Norwegian Fiord cruise for next summer, each stop was familiar to me because a close friend had blown up bridges in every one of them.

During the 1970s at the height of the Cold War, my late wife Kyoko flew a monthly round trip from Moscow to Tokyo as a British Airways stewardess. As she was checking out of her Moscow hote, someone rushed at her and threw a bundled typed manuscript that hit her in the chest.

Seconds later, a half dozen KGB agents dog-piled on top of her. It turned out that a dissident was trying to get Kyoko to smuggle a banned book to the West and she was arrested as a co-conspirator and bundled away to Lubyanka Prison.

I learned of this when the senior KGB agent for Japan contacted me, who had attended my wedding the year before. He said he could get her released, but only if I turned over a top-secret CIA analysis of the Russian oil industry.

At a loss for what to do, I went to the US Embassy to meet with ambassador Mike Mansfield, who as The Economist correspondent in Tokyo I knew well. He said he couldn’t help me as Kyoko was a Japanese national, but he knew someone who could. Then in walked William Colby, head of the CIA.

Colby was a legend in intelligence circles. After leading the French resistance with the OSS, he was parachuted into Norway with orders to disable the railway system. Hiding in the mountains during the day, he led a team of Norwegian freedom fighters who laid waste to the entire rail system from Tromso all the way down to Oslo. He thus bottled up 300,000 German troops, preventing them from retreating home to defend themselves from an allied invasion.

During Vietnam, Colby became notorious for running the Phoenix assassination program.

I asked Colby what to do about the Soviet request. He replied, “give it to them.” Taken aback, I asked how. He replied, “I’ll give you a copy.” Mansfield was my witness so I could never be arrested for being a turncoat. Copy in hand, I turned it over to my KGB friend and Kyoko was released the next day and put on the next flight out of the country. She never took a Moscow flight again.

I learned that the report predicted that the Russian oil industry, its largest source of foreign exchange, was on the verge of collapse. Only massive investment in modern western drilling technology could save it. This prompted Russia to sign deals with American oil service companies worth hundreds of millions of dollars.

Ten years later, I ran into Colby at a Washington event and I reminded him of the incident. He confided in me, “You know that report was completely fake, don’t you?” I was stunned. The goal was to drive the Soviet Union to the bargaining table to dial down the Cold War. I was the unwitting middleman. It worked. That was Bill, always playing the long game.

After Colby retired, he campaigned for nuclear disarmament and gun control. He died in a canoe accident in the lake in from of his Maryland home in 1996.

Nobody believed it for a second.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader