Mad Hedge Technology Letter

October 30, 2018

Fiat Lux

Featured Trade:

(HOW ARTIFICIAL INTELLIGENCE WILL ENHANCE OR DESTROY YOUR PORTFOLIO)

(TSLA), (AMZN), (FB)

Mad Hedge Technology Letter

October 30, 2018

Fiat Lux

Featured Trade:

(HOW ARTIFICIAL INTELLIGENCE WILL ENHANCE OR DESTROY YOUR PORTFOLIO)

(TSLA), (AMZN), (FB)

Anti-AI physicist Professor Stephen Hawking was a staunch supporter of preserving human interests against the future existential threat from machines and artificial intelligence (AI).

He was diagnosed with motor neuron disease, more commonly known as Lou Gehrig's disease, in 1963 at the age of 21 and sadly passed away March 14, 2018, at the age of 76.

Famed for his work on black holes, Professor Hawking represented the human quest to maintain its superiority against quickly advancing artificial acculturation.

His passing is a huge loss for mankind as his voice was a deterrent to AI's relentless march to supremacy. He was one of the few who had the authority to opine on these issues. Gone is a voice of reason.

Critics have argued that living with AI poses a red alert threat to privacy, security, and society as a whole. Unfortunately, those most credible and knowledgeable about AI are tech firms. They have shown that policing themselves on this front is remarkably unproductive.

Mark Zuckerberg, CEO of Facebook (FB), has labeled naysayers as irresponsible and dismissed the threat. After failing to prevent Russian interference in the last election, he is exhibiting the same defensive posture translating into a de facto admission of guilt. His track record of shirking accountability is becoming a trend.

Share prices will materially nosedive if AI is stonewalled and development stunted. Many CEOs who stake careers on doubling or tripling down on AI cannot see it die out. There is too much money to lose.

The world will see major improvements in the quality of life in the next 10 years. But there is another side of the coin in which Zuckerberg and company refuse to delve into the dark side of technology.

Defective Amazon (AMZN) Alexa has been producing unexplained laughter because of a mistaken command to start laughing. Despite avoiding calamity, these small events show the magnitude of potential chaos capable of haywire AI functions. If one day, a user attempts to order a box of tissues and Alexa burns down the house, who is liable?

Tesla's (TSLA) CEO Elon Musk has shared his anxiety about robots flipping the script on humans. Elon acknowledges that AI and autonomous vehicles are important factors in the battle for new technology. The winner is yet to be determined as China has bet the ranch with unlimited resources from Chairman Xi.

Musk has hinted that robots and humans could merge into one species in the future. Is this the next point of competition among tech companies? The future is murky at best.

Bill Gates noted that robots should be taxed like humans. This reflects the bubble in which the ultra-elite reside. This comment implies that humans and robots are on the same level and shows a severe lack of empathy for the 40% of working Americans who will be replaced by machines over the next 10 years.

The West is comprised of a deeply hierarchical system of winners and losers. Hawking's premise that evolution has inbuilt greed can be found in the underpinnings of America's economic miracle.

Wall Street has bred a culture that is entirely self-serving regardless of the bigger system in which it finds itself.

Most of us are participating in this perpetual money game chase because our system treats it as a natural part of life. AI will help more people do well in this paper chase to the detriment of the majority.

Quarterly earnings performance is paramount for CEOs. Return value back to shareholders or face the sack in the morning. It's impossible to convince anyone that America's capitalist model is deteriorating in the greatest bull market of all time.

Wall Street has an insatiable hunger for cutting-edge technology from companies that sequentially beat earnings and raise guidance. Flourishing technology companies enrich the participants creating a Teflon-like resistance to downside market risk.

The issue with Professor Hawking's work is that his time frame is too far in the future. Professor Hawking was probably correct, but it will take 25 years to prove it.

The world is quickly changing as science fiction becomes reality. The year 2019 will signal the real beginning of AI in tangible form when autonomous fleets flood main streets.

People on Wall Street are a product of the system in place and earn a tremendous amount of money because they proficiently execute a specialized job. Traders are busy focusing on how to move ahead of the next guy.

Firms building autonomous cars are free to operate as is. Hyper-accelerating technology spurs on the development of AI, machine learning and enhanced algorithms. Record profits will topple and investors will funnel investments back into an even narrower grouping of technology stocks.

Professor Hawking said we need to explore our technological capabilities to the fullest in order to avoid extinction. In 2018, exploring these new capabilities still equals monetizing through the medium of products and services.

This is all bullish for equities as the leading companies associated with AI will not be subject to any imminent regulation, blowback or government intervention.

The only solution is keeping companies accountable by a function of law or creating a third-party task force to regulate AI.

In 2018, the thought of overseeing robots sounds crazy. However, by 2019, it might be as normal as uncontrollable laughter from your smart home.

Global Market Comments

October 29, 2018

Fiat Lux

Featured Trade:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or THE COMING 2018 REPLAY),

(TLT), (SPY), (VIX), (VXX), (AAPL),

(FB), (AMZN), (NFLX), (TESLA),

(A COW-BASED ECONOMICS LESSON)

If you missed 2018, you get to do it all over again. That’s what the major indexes are offering us after giving up all of this year’s gains, and then some.

We go into the coming week with markets giving their most oversold readings since the popping of the 2000 Dotcom bubble and the 1987 crash. Markets are shouting imminent recession loud and clear.

Except that markets have discounted 13 out of the last six recessions and it is currently discounting one of those non-recessions.

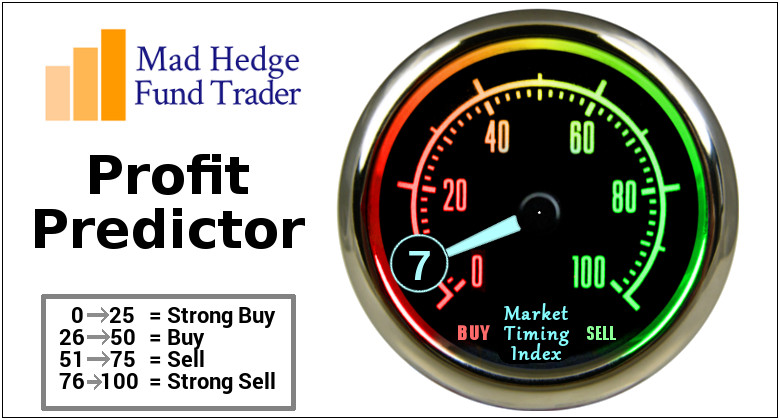

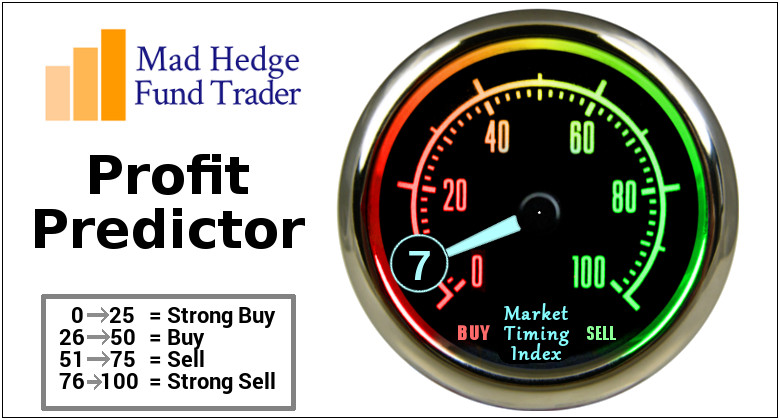

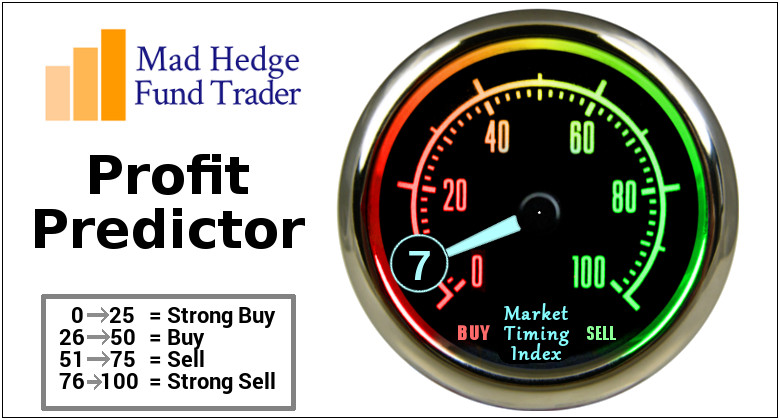

Here is my calendar of upcoming potential market bottoms. Please note that all are within the next seven trading days.

October 29-reversal day of the Friday selloff.

October 31-rebalancing of funds will require a large amount of equity buying for month end. Facebook (FB) reports.

November 1-the Apple (AAPL) earnings are out.

November 7-the midterm elections.

There is no way that we are going into a recession and a bear market now. That is 2019 business. Bear markets don’t begin with real interest rates at zero which they are at now (3.1% ten-year Treasury yield – 3.1% inflation rate = zero). And they may well still be at zero in a year (4% ten-year Treasury yield – 4% inflation rate= zero).

Earnings are still great in the technology area, 50% of the national total. The Dotcom market top was characterized by the collection of vast numbers of eyeballs, not actual cash.

This means that you want to buy the big dips. This is the best entry point for blue-chip technology stocks since 2015. With a price earnings multiple now at 14.9 times 2019 earnings, stocks have given up half the valuation gains since the 2009 market bottom IN A MONTH!

Global trade is collapsing. There is no doubt that businesses massively pulled forward orders to beat the administration’s punitive import duties, thus artificially boosting the Q3 GDP numbers.

The chickens will come to roost in Q1 2019 which is what the stock market may be screaming at us right now with its nightmarish price action.

The big print of the week was the Q3 GDP at 3.5%, down substantially from the 4.2% figure for Q2. That may be the last hot number we see for many years as the tax cuts and spending burst wear off. Next year we return to the long-term average of 2.5%...I hope. If I’m wrong we’ll see zero growth in 2019.

Tesla (TSLA) announced a profit for the first time since 2016, sending the shares soaring. The stock is back up to the level that prevailed before Elon Musk’s last nervous breakdown. Tesla 3’s are flooding the streets of California.

In the meantime, the economic data remains hot with Weekly Jobless Claims still hugging an all-time low at 215,000. But it is all backward-looking data.

Of course, the highlight of the week was the Mad Hedge Lake Tahoe Conference which couldn’t have taken place in more ideal conditions. The food was outstanding, the bottles of Caymus cabernet were fast-flowing, and we even had the option of crashing the wedding in the ballroom next door (I saw some incredibly hot distant cousins).

While I lectured away on the prospects for markets and interest rates, children built sandcastles outside on the balmy Tahoe beach 20 feet away. We had a lot of doctors attend this year and I have to admit it was the first time I was offered a colonoscopy in exchange for a newsletter subscription.

Good cheer was had by all and there was a lot of exchanging of trading tips, email addresses, and phone numbers. It is clear the readers are making fortunes with my service. Most have already committed to coming back next year.

My year-to-date performance has faded to a still market-beating 22.37%, and my trailing one-year return stands at 30.68%. October is down -6.02%, despite a gut-punching, nearly instant NASDAQ swoon of 13.7%. Most people will take that in these horrific conditions.

My single stock positions have been money makers, but my short volatility position (VXX), which I put on way too early, was a disaster eating up all of my profits. I bought puts with the (VXX) at $30. It hit an incredible $42 on Friday. That's why you only take on small 5% positions in outright volatility securities.

My nine-year return retreated to 298.84%. The average annualized return stands at 34.58%. Global Trading Dispatch is now only 44 basis points from an all-time high.

The Mad Hedge Technology Letter has done an outstanding job in October, giving back only -0.89% despite having an aggressively long portfolio. It still maintains an impressive annualized 20.31% profit. It almost completely missed the tech meltdown and then went aggressively long our favorite names right at the market bottom.

This coming week will be focused on the trifecta of jobs data and a few blockbuster technology earnings reports.

Monday, October 29 at 8:30 AM, the October Dallas Fed Manufacturing Survey is out.

On Tuesday, October 30 at 9:00 AM, the Corelogic S&P 500 Case-Shiller Home Price Index is released. Facebook (FB) and FireEye (FEYE) report. earnings.

On Wednesday, October 24 at 8:15 AM, the ADP Employment Report is published, a read on private hiring.

At 10:30 AM the Energy Information Administration announces oil inventory figures with its Petroleum Status Report.

Thursday, October 25 at 8:30, we get Weekly Jobless Claims. Apple (AAPL) reports.

On Friday, October 26, at 8:30 AM, the October Nonfarm Payroll Report is announced. The Baker-Hughes Rig Count follows at 1:00 PM.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Technology Letter

October 22, 2018

Fiat Lux

Featured Trade:

(FACEBOOK’S DARPA DALLIANCE),

(FB), (GOOGL), (AAPL)

How far will society and government allow tech companies to adventure before there is some blowback?

Honestly, it’s hard to say when to put the shackles on these companies that are getting too powerful for their own good.

Tech companies have been pedal to the medal pushing the limitations of what the human world can offer.

The hoard of profits showered on the tech giants is one thing, but should they be held accountable for the unintended consequences that there robot-like profit-making operations dump on society?

Each company has chosen different ways to deploy the capital. Apple decided to reward shareholders by executing a $100 billion share buyback program.

The stock has performed great this year.

Apple (AAPL) and CEO Tim Cook have been keen to show a trustful face among a growing phalanx of data misusers.

Facebook (FB) has used the surplus capital to build a secretive research center modeled after the Defense Advanced Research Projects Agency (DARPA) called Building 8.

DARPA is an agency of the United States Department of Defense responsible for the development of emerging technologies for military use.

The division of the government was launched in 1958 by United States President Dwight D. Eisenhower to counteract the Soviet launching of Sputnik 1 in 1957.

DARPA smartly partnered together with America’s business leaders, academia, and other talents dotted around the government and military branches to develop projects that would broaden the frontiers of technology and science far beyond immediate U.S. military current needs.

Building 8 met the real world for the first time when its first product Portal, a vertically-shaped display screen attached to a smart camera, debuted with befuddlement.

How does a company that just announced a breach of 50 million accounts, after a torrid string of mishaps which made a mockery of Facebook’s use of big data, launch a device that gives Facebook unfettered access into the confines of one’s personal home?

A Facebook spokesman said that Facebook will “use this information to inform the ads we show you across our platforms. Other general usage data, such as aggregate usage of apps, etc., may also feed into the information that we use to serve ads.”

Executives at Facebook know that this product would be a commercial write-off, but the sunk cost associated with this project forced them to throw it on the market with reckless abandon.

And at the end of the day, some data is better than no data at all and that is what the earth’s existence is boiling down to.

So, if you thought that Facebook might finally decide to stop being your effective cyber-stalker, you are wrong.

And this is all just the beginning, it gets a lot worse than this, let me explain.

In fact, Facebook’s Building 8 was led by the former Director of the Defense Advanced Research Projects Agency Regina Dugan.

The more I sniff around, the more I see her pawprints everywhere she went.

Dugan used her elite role at DARPA to score a job at Google’s (GOOGL) Advanced Technology and Projects (ATAP) group before she jumped ship to Facebook’s secretive research center Building 8.

Dugan’s tenure at DARPA from 1996 to 2012 meant she was privy to the LifeLog project which was developed for just one year and subsequently shut down.

This program was cancelled after heavy criticism from activists advocating privacy and rightly so.

But, was this program really shut down?

Lifelog was a program with the mission to effectively record all of an individual’s physical movements, conversations and everything they listened to, ate, read and bought.

Everything!

The premise of this program was to cultivate a permanent searchable record of one’s life.

The daredevil program was light years ahead of its time predating the iPhone, tablet, and the current wave of populism engulfing the free world.

Back then, the weaponizing of consumer technology was largely absent from the world, and the top brass of DARPA surely wasn’t naïve enough to believe that this technology could only be applied to create an epic cyber-diary of one’s life.

In any case, Dugan conveniently was employed by Google and Facebook and her knowledge of Lifelog was fluid, deep and comprehensive.

Unintended consequences are rife and, if I connect the dots, it appears that DARPA’s Lifelog found new spawning grounds in Silicon Valley’s richest companies, or at least two of them.

There is no way to know for sure, but monetizing Lifelog’s cyber-record technology to harness it as a tool to collect personal information for the use of digital ad targeting has rained profits down on these two companies.

Building 8 is serving up round two of its DARPA-esque mission by announcing that they have built a prototype producing an armband that will facilitate the understanding of oral language “through a person’s skin.”

It was in January 2017 when Dugan took the stage in San Jose at a conference to announce this project.

It was mostly dismissed as fantasy and something out of science fiction.

Well, it’s one more step closer to being rolled out in mass market form.

The way the language process works is that vibrations allow for the roots of words to be transformed into silent speech.

If scientists manage to do this, it would give deaf people a new lifeline giving them the capability to understand what people are saying without the need for lip reading.

However, on the other side of the coin, the technology could be modified to aid spies in eavesdropping if the range of the vibrations allows them to.

The second project announced by Dugan that same night in San Jose was Facebook’s bold attempt of a noninvasive brain sensor designed to turn thoughts into text.

This would require brain surgery to install a sensor, and the plan for this technology is for people to access devices from their brain without the need to physically or orally communicate with it.

I suspect that Facebook would collect the data from this brain sensor and the sensor would be in contact with the Facebook infrastructure sharing the performance and state of operations.

If the sushi hits the fan and a person dies from the sensor, Facebook would need to analyze the specific details in the malfunction.

What a scary thought.

Facebook adopting the DARPA blueprint from its halted project of Lifelog to respawn similar technology that painstakingly retrieves as much data about our lives as possible is the first step to something substantially bigger.

However, the digital ad business has made Facebook and Google insanely rich and they want an encore.

I am surprised that other Silicon Valley cash-rich companies avoid tapping up the offspring of other military-grade technology to join the profit parade.

Apparently, there has been zero backlash from it.

If Facebook somehow manages to roll-out a commercialized brain sensor giving Mark Zuckerberg access to our minds, I wonder what on earth could round three entail for Zuckerberg…

Nothing is impossible.

Global Market Comments

October 17, 2018

Fiat Lux

Featured Trade:

(WHO WAS THE GREATEST WEALTH CREATOR IN HISTORY?)

(FB), (AAPL), (GOOG), (AMZN),

(XOM), (BRKY), (T), (GM), (VZ), (CCA),

(WHY DOCTORS MAKE TERRIBLE TRADERS?)

Global Market Comments

October 11, 2018

Fiat Lux

Featured Trade:

(REACHING PEAK TECHNOLOGY STOCKS),

(GOOGL), (MSFT), (NFLX), (FB), (AAPL),

(LOCKHEED MARTIN’S SECRET FUSION BREAKTHROUGH),

(LMT), (NOC), (BA)

I drove into San Francisco for a client dinner last night and had to wait an hour at the Bay Bridge toll gate. When I finally got into town, the parking attendant demanded $50. Dinner for two at Morton’s steakhouse? How about $400.

Which all underlines the fact that we have reached “Peak” San Francisco. San Francisco just isn’t fun anymore.

The problem for you is that if the City by the Bay has peaked, have its much-loved big cap technology stocks, like Facebook (FB), Alphabet (GOOGL), and Netflix (NFLX) peaked as well?

To quote the late manager of the New York Yankees baseball team, Yogi Berra, “Nobody goes there anymore because it’s too crowded.”

What city was the number one creator of technology jobs in 2017?

If you picked San Francisco, you would have missed by a mile. Anyone would be nuts to start up a new business here as rents and labor are through the roof.

Competition against the tech giants for senior staff is fierce. What, no fussball table, free cafeteria, or on-call masseuses? You must be joking!

You would be much better off launching your new startup in Detroit, Michigan. Better yet, hyper-connected low-waged Estonia where the entire government has gone digital.

In fact, Toronto, Canada is the top job creator in tech now, creating an impressive 50,000 jobs last year. Miami, FL and Austin, TX followed. Silicon Valley was at the bottom of the heap.

It’s been a long time since peach orchards dominated the Valley.

Signs that the Bay Area economy is peaking are everywhere. Residential real estate is rolling over now that the harsh reality of no more local tax deductions on federal tax returns is sinking in.

To qualify for a home loan to buy the $1.2 million median home in San Francisco, you have to be a member of the 1%, earning $360,000 a year or better.

Two-bedroom one bath ramshackle turn of the century fixer uppers are going for $1 million in the rapidly gentrifying nearby city of Oakland, only one BART stop from Frisco.

Most school districts have frozen inter-district transfers because they are all chock-a-block with students. And good luck getting your kid into a private school like University or Branson. There are five applicants for every place at $40,000 a year each.

The freeways have become so crowded that no one goes out anymore. It’s rush hour from 6:00 AM to 8:00 PM every day.

When you do drive it’s dangerous. The packed roads have turned drivers into hyper-aggressive predators, constantly weaving in and out of traffic, attempting to cut seconds off their commutes. And there is no drivers ed in China.

I took my kids to the city the other day for a Halloween “Ghost Tour” of posh Pacific Heights. It was lovely spending the evening strolling the neighborhood’s imposing Victorian mansions.

The ornate gingerbread and stained-glass buildings are stacked right against each other to keep from falling down in earthquakes. It works. The former abodes of gold and silver barons are now occupied by hoody-wearing tech titans driving new Teslas.

We learned of the young girl forced into a loveless marriage with an older wealthy stock broker in 1888. She bolted at the wedding and was never seen again.

However, the ghost of a young woman wearing a white wedding address has been seen ever since around the corner of Bush Street and Octavia Avenue. Doors slam, windows shut themselves, and buildings make weird creaking noises.

Then I came to a realization walking around Fisherman’s Wharf as I was nearly poked in the eye by a selfie stick-wielding visitor. The tourist areas on weekdays are just as crowded as they were on summer weekends 30 years ago, except that now the number of languages spoken has risen tenfold, as has the cost.

It started out to be a great year for technology stocks. Amazon (AMZN) alone managed to double off its February mini crash bottom, while others like Apple (AAPL) rocketed by 56%. But traders may have visited the trough once too often

The truth is that technology stocks have not performed since June, right when the Mad Hedge Fund Trader dumped its entire portfolio. Only Microsoft (MSFT) and Amazon (AMZN) have managed to eke out new all-time highs since then, and only just.

The rest of tech has been moving either sideways in the most desultory way possible, or suffered cataclysmic declines like Facebook (FB) and Micron Technology (MU).

Of course, the trade wars haven’t helped. It’s amazing that big tech hasn’t already been hit harder given their intensely global business models.

Nor has rising interest rates. Big cap tech companies have such enormous cash balances that they are all net creditors to the financial system and actually benefit from higher interest rates. But dear money does slow the US economy and that DOES hurt their earnings prospects.

No, I’m not worried about tech for the long term. There is no analog company that can compete with a digital company anywhere in the world.

Accounting for 26% of the stock market capitalization and 50% of its profits, it’s only a question of when we get a major new up leg in share prices, not if.

The only unknown now is whether this next leg will take place before or after the next recession. Given the rate at which interest rates and oil prices are rising in the face of a slowing global economy, it’s looking like the recession may win the race.

As our tour ended, who did we see having dinner in the front window of one of the city’s leading restaurants? A young woman wearing a white wedding dress.

Yikes! Maybe the recession is sooner than I thought.

Mad Hedge Technology Letter

October 11, 2018

Fiat Lux

Featured Trade:

(WHY SNAPCHAT SNAPPED),

(SNAP), (FB), (AMZN), (NFLX)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.