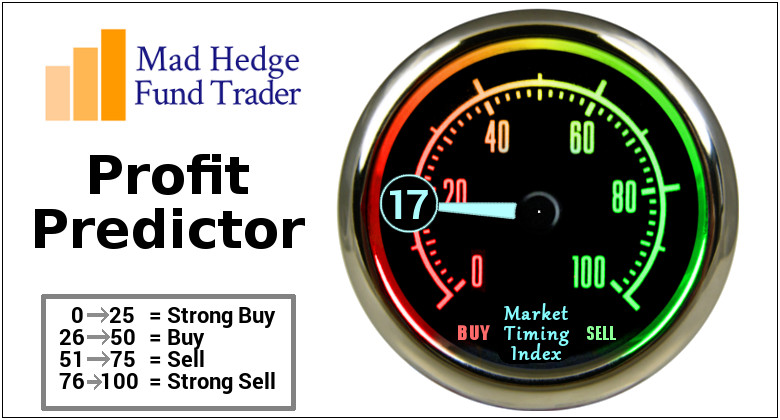

As I expected, the markets have continued their march to “cheap”, with the price-earnings multiple plunging in a week from 19X to 17X. This has occurred both through rising earnings and falling share prices.

“Cheap,” is now within range, a mere 10% drop in the (SPX) to $3,800 only 10% away, taking us to a 15X multiple. With the Volatility Index (VIX) at a sky-high $34, in another week we could be there.

The long-term smart money isn’t bothering to wait and has already started to scale into the best names. For now, they are overwhelmed by sellers panicking to sell the next market bottom, as they usually do. That won’t last.

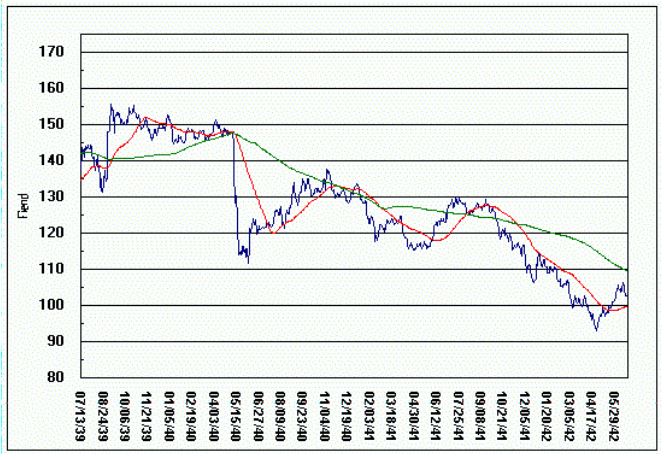

Stocks have seen their worst start to a year since 1942, right after the crushing Japanese attack on Pearl Harbor attack. They didn’t bottom until the US won the Battle of Midway in May, seven months later, even though the public didn’t learn about the strategic victory until months later.

That took the Dow Average down exactly 20%, from $115 to $92. Thereafter, the market began one of the greatest bull moves of all time, exploding from $92 to $240, up 161%.

That is how long and how much we may have to wait for a recovery this time as well with the same long-term outcome.

Those of you who have traditional 60/40 portfolios (60% stocks and 40% bonds), which are most of you, even though I advised against it, have suffered their worst start to a year since 1981, 40 years ago. Both bonds AND stocks have gone down huge.

NASDAQ, the red-headed stepchild of the day, delivered the worst monthly performance since October 2008. Playing from the short side has been like shooting fish in a barrel. The Mae Wests which have floated this market for years have been found to be full of holes.

Consumer discretionary stock delivered a horrific performance. The discretion of consumers right now is to flee stocks and own cash.

I prefer Oracle of Omaha Warren Buffet’s approach. For the first time in years, he is pouring money into stocks, some $51 billion in Q1. That includes $26 billion into California energy major Chevron (CVX), followed by a big bet on Occidental Petroleum (OXY) (click here for my piece at https://www.madhedgefundtrader.com/take-a-look-at-occidental-petroleum-oxy-4/ ).

These are clearly a bet that oil will remain high for at least five more years. That has whittled his cash position down from $147 billion to only $106 billion. Buffet likes to keep a spare $100 billion on hand so he can take over a big cap at any time.

Warren clearly eats his own cooking, buying $26 billion worth of his own stock in 2021. If you can’t afford the lofty $4,773 price for the “A” shares, try the “B” shares at $322.83, which also offer listed options on NASDAQ and in which Mad Hedge Fund Trader currently has a long position.

Rather than fleeing what you already own, because it’s too late, you’re better off building lists of what to buy at the bottom. And the farther the market falls, the more volatility I am looking for.

Investors are salivating at the demise of Cathy Wood’s Ark Innovation ETF (ARKK), which has collapsed by 72% in 14 months. In the meantime, the short Ark ETF (SARK) rose by 50% in April Alone.

You can scale into (ARKK) on the next Armageddon Day. Better yet, you can pick up their ten largest holdings. Those include:

Tesla (TSLA)

Zoom (ZM)

Roku (ROKU)

Coinbase (COIN)

Block (BLOK)

Exact Sciences (EXAS)

Unity Software (U)

Teladoc (TDOC)

Unity

UiPath (PATH)

Over five years, you can expect two of these to go bust, three to do nothing, two to get taken over at a 50% premium, one to double, one to go up ten times, and one to go up 50 times. If you do the math on this, it’s pretty attractive. Guess which one I think is going up ten times?

After listening to endless talking heads postulating about what Bitcoin is, I have finally come up with a definition. It is a small-cap non-earning stock. For that is the asset close showing the closest correlation in the current meltdown. That is not good because I expect small-cap non-earning stocks to go nowhere for the foreseeable future. Don’t hold your breath, but when they turn, you can expect a 2X-10X return on investment, as we did before.

My Ten Year View

When we come out the other side of the pandemic, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. With interest rates still historically cheap, oil peaking out soon, and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

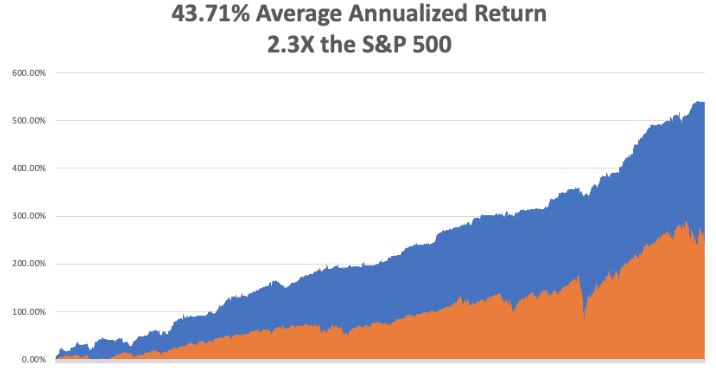

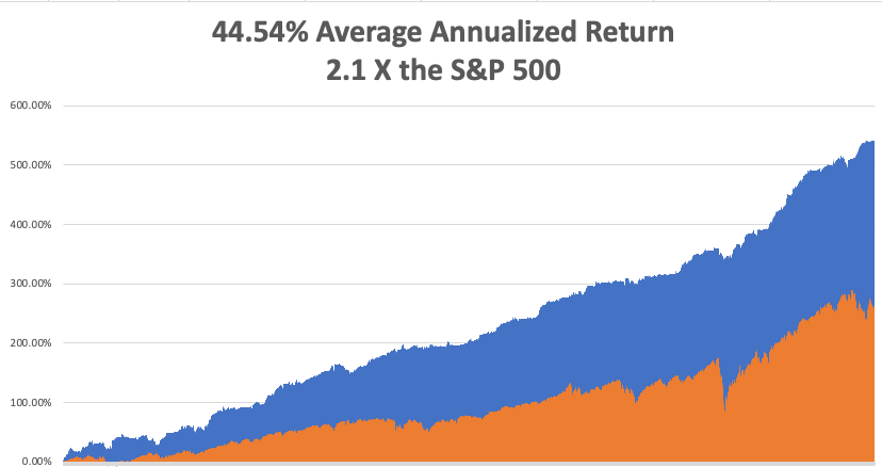

My April month-to-date performance added a decent 3.33%. My 2022 year-to-date performance ended at a chest-beating 30.18%. The Dow Average is down -13.5% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high 62.56%.

On the next capitulation selloff day, which might come with the April Q1 earnings reports, I’ll be adding long positions in technology, banks, and biotech. I am currently in a rare 100% cash position awaiting the next ideal entry point.

That brings my 13-year total return to 542.74%, some 2.10 times the S&P 500 (SPX) over the same period. My average annualized return has ratcheted up to 43.71%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 81.4 million, up only 300,000 in a week, and deaths topping 993,000 and have only increased by 5,000 in the past week. Wow, we only lost the equivalent of 12 Boeing 747 crashes in a week! Great news indeed. You can find the data here at https://coronavirus.jhu.edu.

The coming week is a big one for the jobs reports.

On Monday, May 2 at 7:00 AM EST, the ISM Manufacturing PMI is published. NXP Semiconductors (NXPI) reports.

On Tuesday, May 3 at 7:00 AM, the JOLTS Job Openings report is announced. Skyworks Solutions Reports (SWKS).

On Wednesday, May 4 at 8:30 AM, ADP Private Sector Employment Change is printed. At 11:00 AM the Federal Reserve announced its interest rate decision. Jay Powell’s press conference follows at 11:30. Moderna (MRNA) reports.

On Thursday, May 5 at 8:30 AM, Weekly Jobless Claims are disclosed. Conoco Phillips (COP) reports.

On Friday, May 6 at 8:30 AM, the Nonfarm Payroll Report for April is released.

At 2:00 PM, the Baker Hughes Oil Rig Count are out.

As for me, I spent a decade flying planes without a license in various remote war zones because nobody cared.

So, when I finally obtained my British Private Pilot’s License at the Elstree Aerodrome, home of the WWII Mosquito twin-engine bomber, in 1987, it was cause for celebration.

I decided to take on a great challenge to test my newly acquired skills. So, I looked at an aviation chart of Europe, researched the availability of 100LL aviation gasoline, and concluded that the farthest I could go was the island nation of Malta.

Caution: new pilots with only 50 hours of flying time are the most dangerous people in the world!

Malta looms large in the history of aviation. At the onset of the second world war, Malta was the only place that could interfere with the resupply of Rommel’s Africa Corps, situated halfway between Sicily and Tunisia. It was also crucial for the British defense of the Suez Canal.

So, Malta was mercilessly bombed, at first by Mussolini’s Regia Aeronautica, and later by the Luftwaffe. By April 1942, the port at Valletta became the single most bombed place on earth.

Initially, Malta had only three obsolete 1934 Gloster Gladiator biplanes to mount a defense, still in their original packing crates. Flown by volunteer pilots, they came to be known as “Faith, Hope, and Charity.”

The three planes held the Italians at bay, shooting down the slower bombers in droves. As my Italian grandmother constantly reminded me, “Italians are better lovers than fighters.” By the time the Germans showed up, the RAF had been able to resupply Malta with as many as 50 infinitely more powerful Spitfires a month, and the battle was won.

So Malta it was.

The flight school only had one plane they could lend me for ten days, a clapped-out, underpowered single-engine Grumman Tiger, which offered a cruising speed of only 160 miles per hour. I paid extra for an inflatable life raft.

Flying over the length of France in good weather at 500 feet was a piece of cake, taking in endless views of castles, vineyards, and bright yellow rapeseed fields. Italy was a little trickier because only four airports offered avgas, Milan, Rome, Naples, and Palermo. Since Italy had lost the war, they never experienced a postwar aviation boom as we did.

I figured that if I filled up in Naples, I could make it all the way to Malta nonstop, a distance of 450 miles, and still have a modest reserve.

Flying the entire length of Italy at 500 feet along the east coast was grand. Genoa, Cinque Terra, the Vatican, and Mount Vesuvius gently passed by. There was a 1,000-foot-high cable connecting Sicily with the mainland that could have been a problem, as it wasn’t marked on the charts. But my US Air Force charts were pretty old, printed just after WWII. But I spotted them in time and flew over.

When I passed Cape Passero, the southeast corner of Sicily, I should have been able to see Malta, but I didn’t. I flew on, figuring a heading of 190 degrees would eventually get me there.

It didn’t.

My fuel was showing only quarter tanks left and my concern was rising. There was now no avgas anywhere within range. I tried triangulating VORs (very high-frequency omnidirectional radar ranging).

No luck.

I tried dead reckoning. No luck there either.

Then I remembered my WWII history. I recalled that returning American bombers with their instruments shot out used to tune into the BBC AM frequency to find their way back to London. Picking up the Andrews Sisters was confirmation they had the right frequency.

It just so happened that buried in my pilot’s case was a handbook of all European broadcast frequencies. I look up Malta, and sure enough, there was a high-powered BBC repeater station broadcasting on AM.

I excitedly tuned in to my Automatic Direction Finder.

Nothing. And now my fuel was down to one-eighth tanks and it was getting dark!

In an act of desperation, I kept playing with the ADF dial and eventually picked up a faint signal.

As I got closer, the signal got louder, and I recognized that old familiar clipped English accent. It was the BBC (I did work there for ten years as their Tokyo correspondent).

But the only thing I could see were the shadows of clouds on the Mediterranean below. Eventually, I noticed that one of the shadows wasn’t moving.

It was Malta.

As I was flying at 10,000 feet to extend my range, I cut my engines to conserve fuel and coasted the rest of the way. I landed right as the sunset over Africa.

While on the island, I set myself up in the historic Excelsior Grand Hotel. Malta is bone dry and has almost no beaches. It is surrounded by 100-foot cliffs. I paid homage to Faith, the last of the three historic biplanes, in the National War Museum in Valetta.

The other thing I remember about Malta is that CIA agents were everywhere. Muammar Khadafy’s Libya was a major investor in Malta, recycling their oil riches, and by the late 1980’s owned practically everything. How do you spot a CIA agent? Crewcut and pressed creased blue jeans. It’s like a uniform. What they were doing in Malta I can only imagine.

Before heading back to London, I had to refuel the plane. A truck from air services drove up, dropped a 50-gallon drum of avgas on the tarmac along with a pump then they drove off. It took me an hour to hand pump the plane full.

My route home took me directly to Palermo, Sicily to visit my ancestral origins. On takeoff to Sardinia wind shear flipped my plane over, caused me to crash, and I lost a disk in my back.

But that is a story for another day.

Who says history doesn’t pay!

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“Faith”

The Andrews Sisters

Spitfire

Grumman Tiger