Below please find subscribers’ Q&A for the October 9 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Lake Tahoe, Nevada.

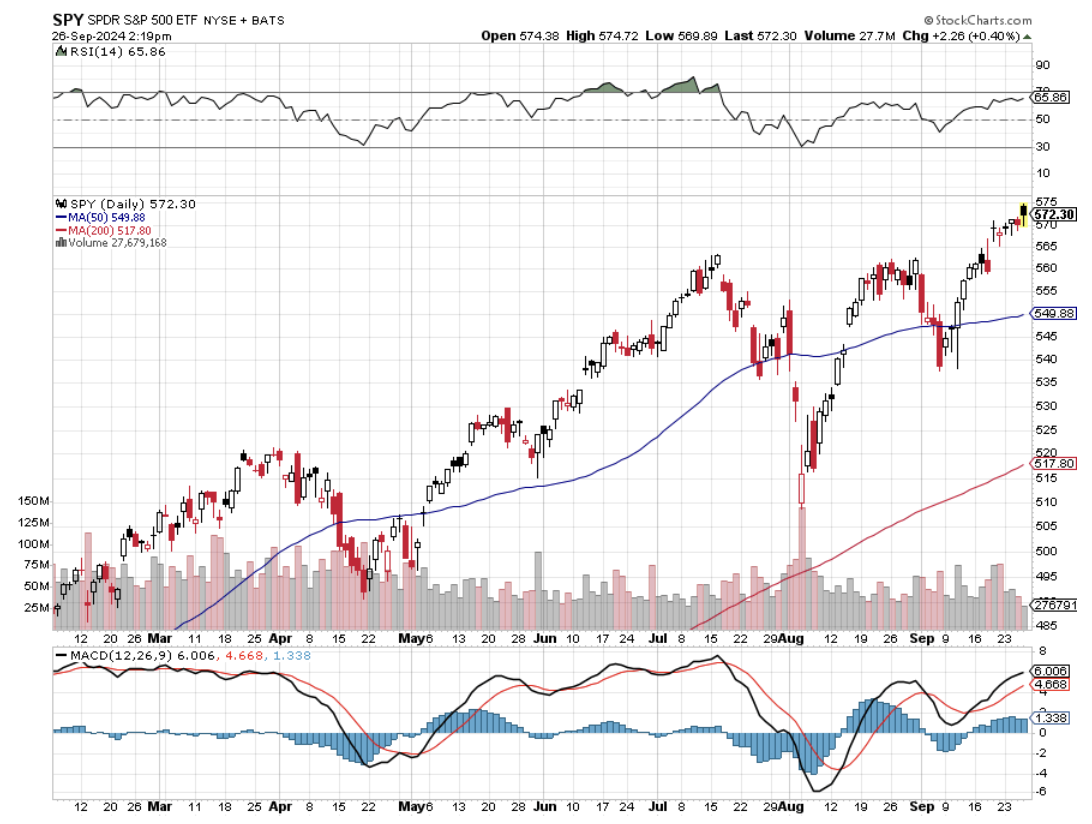

Q: Is the iShares 20+ Year Treasury Bond ETF (TLT) a buy here?

A: I think we are testing the 200-day moving average, which is at 92.75. Let’s see if that holds, and if it does, we want to do at-the-money LEAPS one year out because the Fed has basically said it’s going to keep lowering interest rates until June, and bonds can’t lose on that. That would also be a nine-point pullback from the recent high.

Q: I found a YouTube video about your Uncle Mitchell Paige, who won the first Medal of Honor in WWII.

A: Yes, there’s a ton of stuff on the internet about Uncle Mitch, even though he passed away 22 years ago. There’s even a Mattel G.I Joe version of Uncle Mitch that you can buy, which he gave me. I also inherited his samurai swords.

Q: When will small caps turn around?

A: That’s the iShares Russell 2000 (IWM). Small caps are joined at the hips with interest rates, so when interest rates go up, and bond prices go down, small caps also go down. That is because small caps are much more dependent on borrowed money than any other section of the market, 60% lose money, 40% are regional banks, and they have much weaker credit ratings. They are a leverage play on everything going great—when interest rates are rising, they aren’t great. I would hold off on the (IWM). Even when interest rates start going back down again, which I expect they will do going into the next Fed meeting, (IWM) will be about number ten on the list of interesting things to do.

Q: The hiring numbers were great with the nonfarm payroll on Friday, so will the recession be pushed back to 2026?

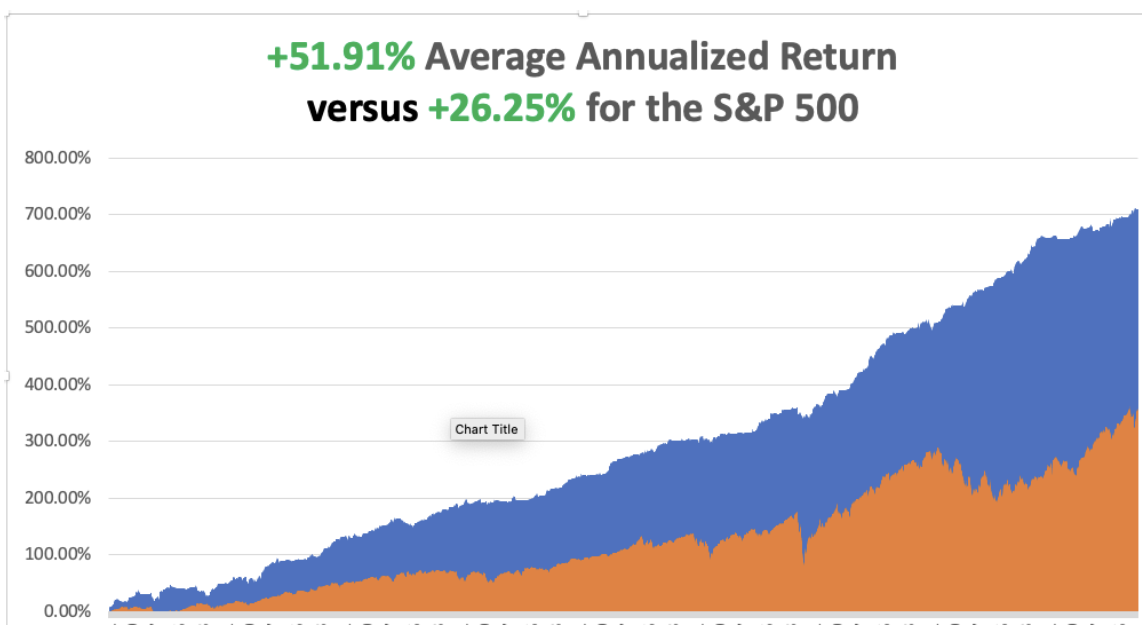

A: I don’t think we’re going to have a recession. I think we have a growth scare, a growth slowdown, and then we reaccelerate again as more companies start booking AI profits to their bottom lines. Also, the recovery of China would be nice, recovery of Europe would be nice—so there are many other factors at play here. The fact is the United States has the world’s strongest economy, and we are going from strength to strength. That’s why everybody in the world is sending their money over here.

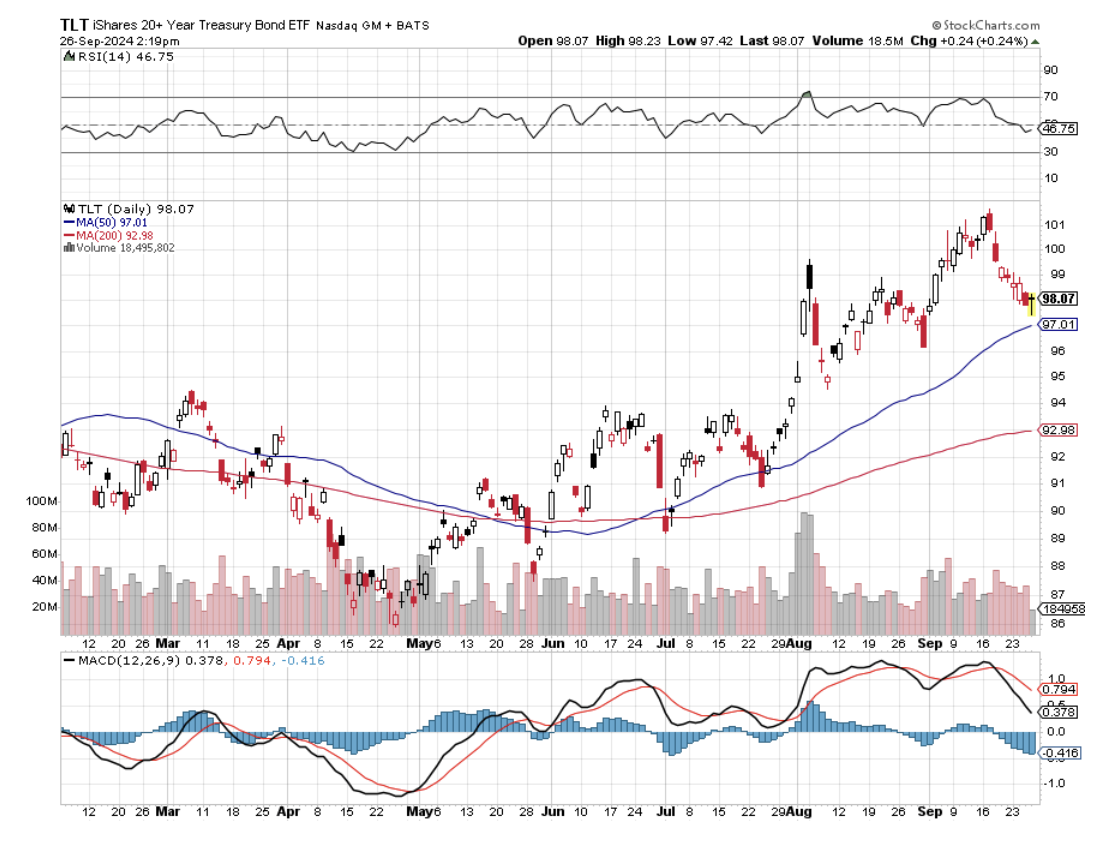

Q: Do you expect heightened volatility going into the year-end?

A: I expect heightened volatility going into the election; after that, it may collapse. Right now, the Volatility Index ($VIX) is in the low $20s, which is the high end of the recent range. I expect that to fall, and then we get a ballistic market after the election once all the uncertainty is gone.

Q: Should I buy utilities and industrials now?

A: Yes, these are two of the most interest-sensitive sectors in the market—especially utilities, which are very heavy borrowers. They’ve already had tremendous runs—things like Duke Energy (DUK) and NextEra (NEE). However, I think I’m going up more if we’re going to get interest rates down to 3%. Even if we get them down to 3.5 or 4%, the rallies in all the interest-sensitive sectors will continue.

Q: If the global economy recovers, would that lead to increased inflation and an increase in interest rates?

A: In an old-fashioned economy—one driven by, for instance, the car industry—yes, that would be happening. Back then, wage settlements with the United Auto Workers had the biggest impact on your portfolio. In the modern economy, technology is dropping prices so fast that even during periods of high growth, prices are still falling. The example I give is: the cheapest PC you could get in 1990 cost $5,000, which was a Compact. Now you could get the same computer for $300. You can bet going forward that eliminating all port workers will also be highly disinflationary; we won’t have to pay those $200,000 salaries for port workers, so that goes to zero. You can cite literally hundreds of examples in the economy where technology is collapsing prices.

Q: Should I go with a safe strategy now or increase my risk?

A: I think if we don’t sell off in the next two weeks, you have to buy the hell out of the market because we have had every excuse to sell off, and the market just won’t do it. Middle Eastern war, uncertainty in the election, gigantic hurricanes which will definitely shrink economic growth this year, the port strike and the Boeing strike, which will take a month out of GDP growth on the coast—and it still won’t go down. So, if you throw bad news on a market and it still won’t go down, you buy the heck out of it. The last chance for this to go down is literally this month. After that, the seasonals turn strongly positive. What’s the opposite of “sell in May, and go away”? It’s “buy in October and ring the cash register.”

Q: Will gold (GLD) go to 3,000/oz soon?

A: Yes. That’ll happen on the next Fed interest rate cuts as we go into the end of the year. We'll probably get two more cuts of 25 basis point cuts. Gold loves that. And guess what? Chinese have nowhere else to save their money except gold. So, yes, I'm looking for $3,000 and then $4,500 after that. You definitely want to own gold.

Q: Should I dump Chinese (FXI) stocks after this short-term spike?

A: Yes, for the short term, but not for the long term. Some kind of recovery will come, because if this Chinese stimulus package fails, they'll bring another one, and you'll get another one of those monster rallies. So, if you're a long-term holder, then I would stay in. The blue-chip stocks are incredibly cheap. But I still believe the best China plays are in the US, in oil (USO), copper (FCX), iron ore (BHP), and gold (GLD).

Q: Is oil headed down after the Israel and Lebanon war?

A: That really isn’t the main factor in the oil market. These people have been fighting for a century, literally, and any geopolitical influence has not had any sustainable impact on the price of oil. Really, the sole driver for oil prices now is China. You get China back in the game, oil goes back to $95 a barrel. If China remains in recession, then oil stays low and goes back to the $60s. It’s purely a China play. The US economy will continue to grow, but most of our oil consumption is domestic now—we are the world’s largest oil producer at 13.5 million barrels a day. We do not need any Middle Eastern oil anymore, really, we’re just running out our existing contracts.

Q: Do you think cryptocurrencies will have a bull market with the stock market?

A: No, I don’t. Cryptocurrencies did well when we had a liquidity surplus and an asset shortage. Now, we have the opposite; we have a liquidity shortage and an asset surplus, and the theft problem is still rampant with the cryptocurrencies keeping most institutional and individual investors out of that market.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, select your subscription (GLOBAL TRADING DISPATCH, TECHNOLOGY LETTER, or Jacquie's Post), then click on WEBINARS, and all the webinars from the last 12 years are there in all their glory

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader