There was probably no more broken promise in the investment world over the last several years than that energy master limited partnerships (MLPs) would hold up even if the price of oil fell.

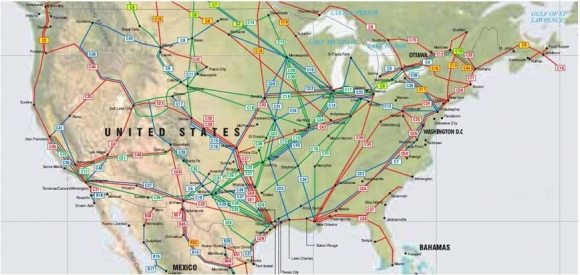

These guys were toll takers, it was said, and profited from the volume of crude pumped through their pipelines. The price of oil was somebody else’s problem.

In any case, double-digit yields would provide more than ample support in any kind of sell-off.

It didn’t quite work out like that.

Once the price of Texas tea (USO) began its plunge in 2014 from $107 to negative $37 at the pandemic low, any investment tarred with an oil connection got slaughtered.

It was the classic flash fire in the movie theater.

Bids for MLP’s vaporized.

Making matters worse is that many retail investors bought highly leveraged MLPs on margin, turning 10% yields into 20% ones. When the sushi hit the fan, it didn’t take long for those positions to go to zero.

Most of the leveraged plays went bankrupt or were unwound in a variety of creative ways with enormous losses.

I always find it a useful exercise to sift through the wreckage of past investment disasters. Not only are there valuable lessons to be learned, but sometimes great trades emerge.

I have been doing that lately in the energy sector, a hedge fund favorite these days, and guess what?

MLPs are back. And no, I’m not talking about the Maui Land and Pineapple Company (MLP) (yes, there is such a thing!).

But these are not your father’s MLPs.

Let me start with my investment thesis.

It is always better to invest in an asset class that has its crash behind it (energy) than ahead of it (the US dollar).

And let’s face it, the final bottom for oil this year at $68 is in.

We may bounce around a bottom for a while as recession fears prevail. But eventually, I expect a global synchronized economic recovery to take it sustainably higher, $100 a barrel or better.

And while I have never been a fan of OPEC, they are showing rare discipline in honoring the production quotas negotiated in November.

That eliminates much of the downside from MLPs and makes it one of the more attractive risk/reward trades out there.

Except that this time it’s different.

Thanks to hyper-accelerating technology (yes, there’s that term again), new wells employ a fraction of the labor of the old ones and are therefore more profitable.

That means they can function, and even prosper, with a much lower oil price.

The surviving MLPs are now a much better quality investment.

Balance sheet quality has improved as a result of deleveraging in the last 14-18 months, and the worst of the rating downgrade cycle is likely behind us.

Importantly, some $50 billion‒$60 billion of growth opportunities for MLPs are expected during FY2024-2025.

That makes the industry one of the great secular growth stories out there today.

As an old fracker myself, I can tell you that the potential of the revolutionary new technology has barely been scratched.

Thanks to technology that is improving by the day, Saudi Arabia’s worth of energy reserves remains to be exploited, potentially turning the US into an energy-exporting powerhouse as the world’s largest producer at 13 million barrels a day.

Industry experts expect MLP distributions to grow by 3%‒5% annually over the coming years. Few other industries can beat this.

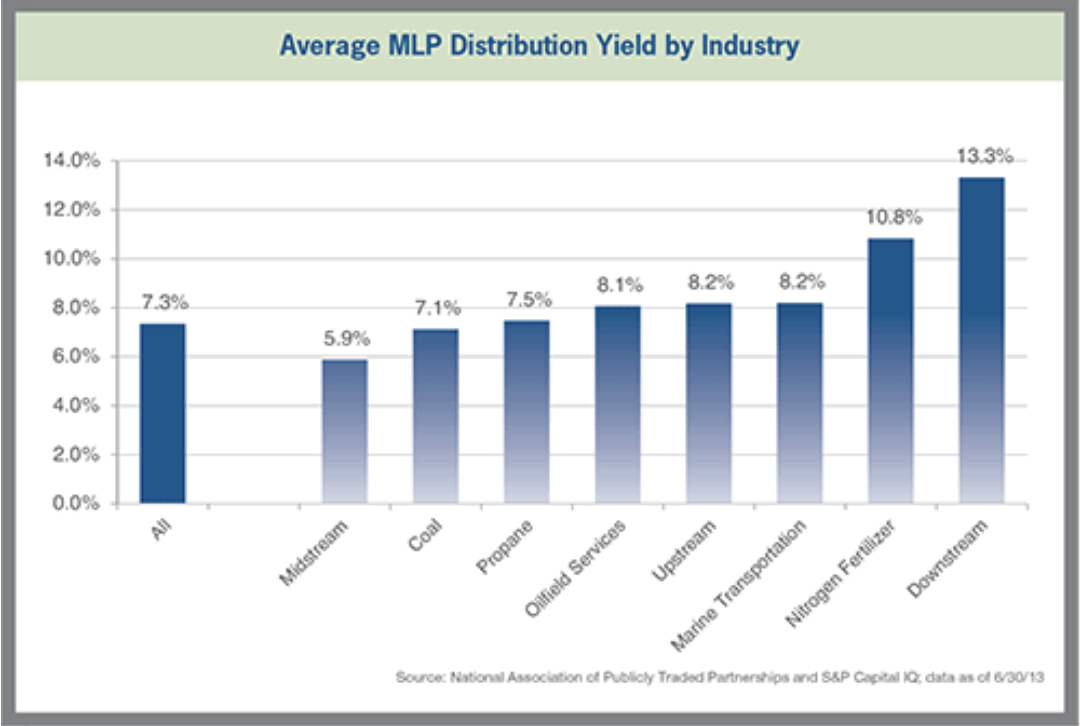

That means avoiding upstream Exploration and Production companies; where there is still a ton of risk, and placing your bets on midstream companies that operate pipelines.

And by midstream, I don’t just mean pipelines but also processing facilities for natural gas liquids and storage and terminal facilities.

You especially want to look at companies with high barriers to entry and attractive assets in high-growth and low-cost production regions. I’m all about big moats (see (NVDA)).

Companies with a sustainable cost advantage, operated by experienced management with proven geological are further pluses.

MLPs also stack up nicely as a diversifier for your overall portfolio.

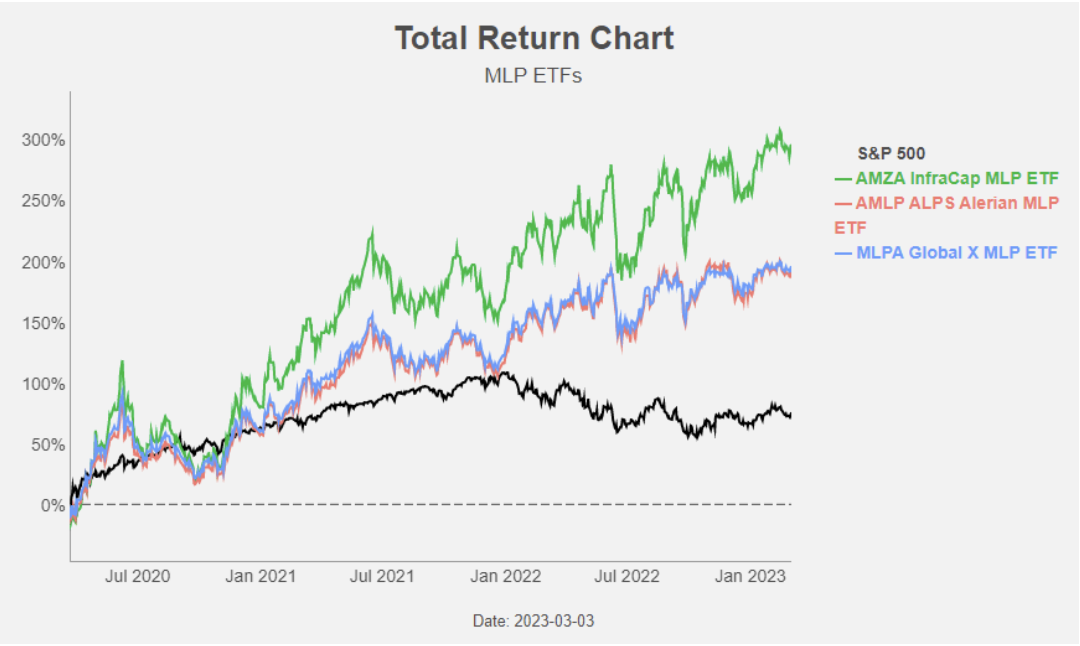

Over longer time periods, MLPs have generated similar returns to equities, with similar to slightly higher levels of volatility.

Historically they have traded at lower yields than high-yield bonds, but currently, they are yielding 150 basis points more.

And now for the warning labels.

This is not a new story.

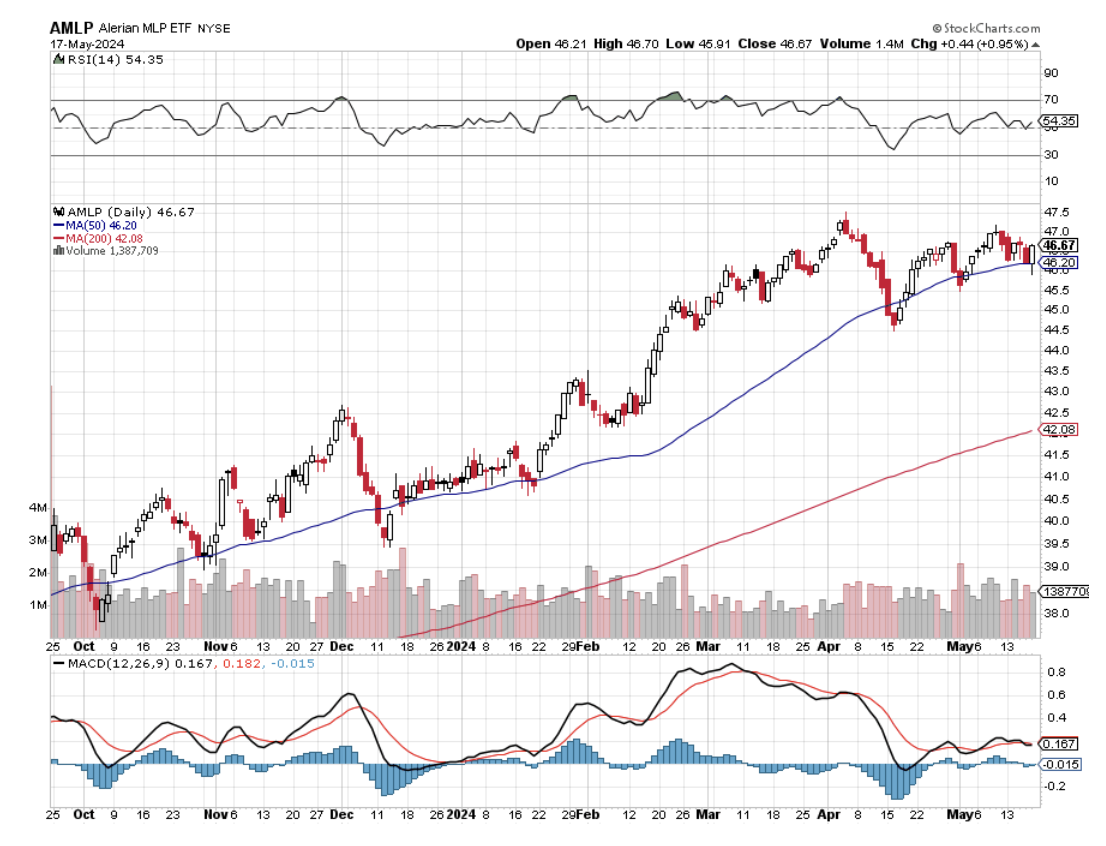

As you can see from the charts below, MLPs have been rallying hard since oil bottomed at the pandemic low in April 2020.

And if my oil forecast is wrong and we plumb new generational lows once again, investment in this sector will suffer.

Still, with yields in the 7%-10% range, a certain amount of pain is worth it.

Still interested?

Take a look at the Alerian MLP ETF (AMLP) (7.36%) and the Global X MLP Energy Infrastructure ETF (MLPX) (4.91%), Western Midstream Partners (WES) (9.20%), and Energy Transfer LP (ET) (7.96%).