Global Market Comments

October 27, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE YEAREND RALLY HAS STARTED),

(NFLX), (SPY), (TLT), ($VIX), (GM), (TSLA),

(USO), (PHM), (GLD), (AAPL), (SLV), (FXI)

Global Market Comments

October 27, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE YEAREND RALLY HAS STARTED),

(NFLX), (SPY), (TLT), ($VIX), (GM), (TSLA),

(USO), (PHM), (GLD), (AAPL), (SLV), (FXI)

Global Market Comments

August 29, 2025

Fiat Lux

Featured Trade:

(AUGUST 27 BIWEEKLY STRATEGY WEBINAR Q&A),

(BA), (FXI), (SPY), (QQQ), (CCJ), (VSTR), (LEN), (PHM), (KBH), (RKT), (JPM), (BAC), (GS), (MS), (CCI), (DHI), (GLD), (MSTR), (TLT)

Global Market Comments

August 1, 2025

Fiat Lux

Featured Trade:

(JULY 30 BIWEEKLY STRATEGY WEBINAR Q&A),

(NVDA), (AAPL), (STBX), (SPY), (FCX), (FXI), ($COPPER)

Global Market Comments

May 6, 2025

Fiat Lux

Featured Trade:

(THEY’RE NOT MAKING AMERICANS ANYMORE)

(SPY), (EWJ), (EWL), (EWU), (EWG), (EWY), (FXI), (EIRL), (GREK), (EWP), (IDX), (EPOL), (TUR), (EWZ), (PIN), (EIS)

If demographics are destiny, then America’s future looks bleak. You see, they’re just not making Americans anymore.

At least that is the sobering conclusion of the latest Economist magazine survey of the global demographic picture.

I have long been a fan of demographic investing, which creates opportunities for traders to execute on what I call “intergenerational arbitrage”. When the number of middle-aged big spenders is falling, risk markets plunge.

Front run this data by two decades, and you have a great predictor of stock market tops and bottoms that outperforms most investment industry strategists.

You can distill this even further by calculating the percentage of the population that is in the 45-49 age bracket.

The reasons for this are quite simple. The last five years of child rearing are the most expensive. Think of all that pricey sports equipment, tutoring, braces, SAT coaching, first cars, first car wrecks, and the higher insurance rates that go with it.

Older kids need more running room, which demands larger houses with more amenities. No wonder it seems that dad is writing a check or whipping out a credit card every five seconds. I know, because I have five kids of my own. As long as dad is in spending mode, stock and real estate prices rise handsomely, as do most other asset classes. Dad, you’re basically one generous ATM.

As soon as kids flee the nest, this spending grinds to a juddering halt. Adults entering their fifties cut back spending dramatically and become prolific savers. Empty nesters also start downsizing their housing requirements, unwilling to pay for those empty bedrooms, which in effect, become expensive storage facilities.

This is highly deflationary and causes a substantial slowdown in GDP growth. That is why the stock and real estate markets began their slide in 2007, while it was off to the races for the Treasury bond market.

The data for the US is not looking so hot right now. Americans aged 45-49 peaked in 2009 at 23% of the population. According to US census data, this group then began a 13-year decline to only 19% by 2022.

You can take this strategy and apply it globally with terrific results. Not only do these spending patterns apply globally, but they also backtest with a high degree of accuracy. Simply determine when the 45-49 age bracket is peaking for every country, and you can develop a highly reliable timetable for when and where to invest.

Instead of poring through gigabytes of government census data to cherry-pick investment opportunities, my friends at HSBC Global Research, strategists Daniel Grosvenor and Gary Evans, have already done the work for you. They have developed a table ranking investable countries based on when the 34-54 age group peaks—a far larger set of parameters that captures generational changes.

The numbers explain a lot of what is going on in the world today. I have reproduced it below. From it, I have drawn the following conclusions:

* The US (SPY) peaked in 2001 when our first “lost decade” began.

*Japan (EWJ) peaked in 1990, heralding 32 years of falling asset prices, giving you a nice back test.

*Much of developed Europe, including Switzerland (EWL), the UK (EWU), and Germany (EWG), followed in the late 2,000’s, and the current sovereign debt debacle started shortly thereafter.

*South Korea (EWY), an important G-20 “emerged” market with the world’s lowest birth rate, peaked in 2010.

*China (FXI) topped in 2011, explaining why we have seen three years of dreadful stock market performance despite torrid economic growth. It has been our consumers driving their GDP, not theirs.

*The “PIIGS” countries of Portugal, Ireland (EIRL), Greece (GREK), and Spain (EWP) don’t peak until the end of this decade. That means you could see some ballistic stock market performances if the debt debacle is dealt with in the near future.

*The outlook for other emerging markets, like Indonesia (IDX), Poland (EPOL), Turkey (TUR), Brazil (EWZ), and India (PIN) is quite good, with spending by the middle-aged not peaking for 15-33 years.

*Which country will have the biggest demographic push for the next 38 years? Israel (EIS), which will not see consumer spending max out until 2050. Better start stocking up on things Israelis buy.

Like all models, this one is not perfect, as its predictions can get derailed by a number of extraneous factors. Rapidly lengthening life spans could redefine “middle age”. Personally, I’m hoping 72 is the new 42.

Emigration could starve some countries of young workers (like Japan), while adding them to others (like Australia). Foreign capital flows in a globalized world can accelerate or slow down demographic trends. The new “RISK ON/RISK OFF” cycle can also have a clouding effect.

So why am I so bullish now? Because demographics is just one tool in the cabinet. Dozens of other economic, social, and political factors drive the financial markets.

What is the most important demographic conclusion right now? That the US demographic headwind veered to a tailwind in 2022, setting the stage for the return of the “Roaring Twenties.” With the (SPY) up 27% since October, it appears the markets heartily agree.

While the growth rate of the American population is dramatically shrinking, the rate of migration is accelerating, with huge economic consequences. The 80-year-old trend of population moving from North to South to save on energy bills is picking up speed, and the Midwest is getting hollowed out at an astounding rate as its people flee to the coasts, all three of them.

As a result, California, Texas, Florida, Washington, and Oregon are gaining population, while Missouri, Iowa, Nebraska, Kansas, and Wyoming are losing it (see map below). During my lifetime, the population of California has rocketed from 10 million to 40 million. People come in poor and leave as billionaires, as Elon Musk did.

In the meantime, I’m going to be checking out the shares of the matzo manufacturer down the street.

Global Market Comments

May 2, 2025

Fiat Lux

Featured Trade:

(APRIL 30 BIWEEKLY STRATEGY WEBINAR Q&A),

(FXI), (AGQ), (NVDA), (SH), (UNG), (USO),

(TSLA), (SPX), (CCJ), (USO), (GLD), (SLV)

Below, please find subscribers’ Q&A for the April 30 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Incline Village, NV.

Q: Why is the Australian dollar not moving against the US dollar as much as the other currencies?

A: Australia is too closely tied to the Chinese economy (FXI), which is now weak. When the Chinese economy slows, Australia slows. Australia is basically a call option on the Chinese economy. So they're not getting the ballistic moves that we've seen in, say, the Euro and the British pound, which are up about 20%. Live by the sword, die by the sword. If you rely on China as your largest customer for your export commodities, you have to take the good and the bad.

Q: I see we had a terrible GDP print on the economy this morning, down 0.3%. When are we officially in a recession?

A: Well, the classical definition of a recession is two back-to-back quarters of negative GDP growth. We now have one in the bank. One to go. And this quarter is almost certain to be much worse than the last quarter, because the tariffs basically brought all international trade to a complete halt. On top of that, you have all of the damage to the economy done by the DOGE cuts in government spending. Approximately 80% of the US states, mostly in the Midwest and South, are very highly dependent on Washington spending for a healthy economy, and they are going to really get hit hard. So the question now is not “do we get a recession?”, but “how long and how deep will it be?” Two quarters, three quarters, four quarters? We have no idea. Even if trade deals do get negotiated, those usually take years to complete and even longer to implement. It just leaves a giant question mark over the economy in the meantime.

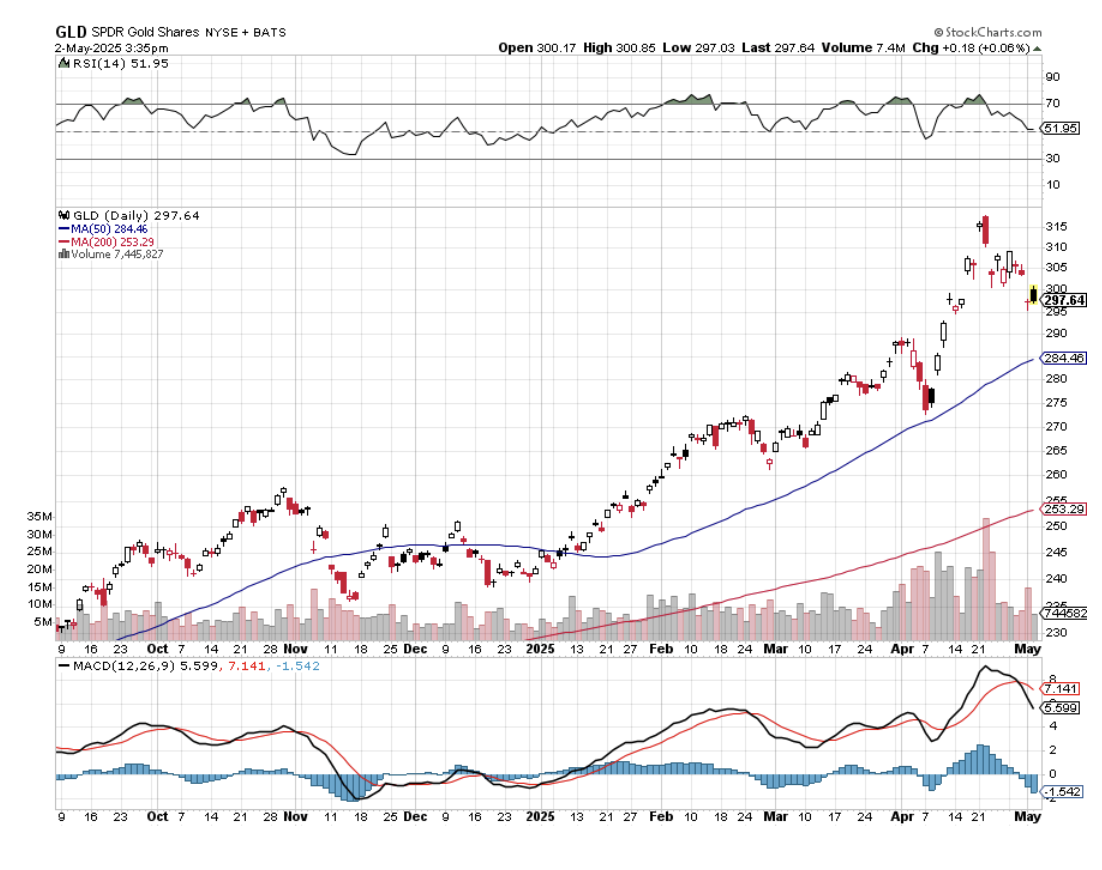

Q: Is SPDR Gold Trust (GLD) the best way to play gold, or is physical better?

A: I always go for the (GLD) because you get 24-hour settlement and free custody. With physical gold, you have to take delivery, shipping is expensive, and insurance is more expensive. Plus, then you have to put it in a vault. Private vaults have a bad habit of going bankrupt and disappearing with your gold. You keep it in the house, and then if the house burns down, all your gold is gone there. Plus, it can get stolen. There's also a very wide dealing spread between bid and offer on physical gold coins or bars; usually it's at least 10%, often more. So I often prefer the ease of trading with the GLD, which owns futures on physical gold, which is held in London, England. So that is my call on that.

Q: Is ProShares Ultra Silver (AGQ) the leveraged silver play?

A: It absolutely is, but beware: (AGQ) is only good for short, sharp rises because the contango and the storage operating costs of any 2x are very, very high—like 10% a year. So, good if you're doing a day trade, not good for a one-year hold. Then you're just better off buying silver (SLV).

Q: What is more important with the Fed's mandate—unemployment or fear of inflation?

A: That's an easy one. Historically, the number one priority at the Fed has been inflation. That is their job to maintain the full faith and credit of the U.S. Dollar, and inflation erodes the value, or at least the purchasing power of the US dollar, so that has always historically been the priority. Until we see inflation figures fall, I think the chance of them cutting interest rates is zero, and we may not see actual falls until the end of the year, because the next influence on prices is up because of the trade war. The trade war is raising prices everywhere, all at the same time. So that will at least add 1 or 2% to inflation first before it starts to fall. You can imagine how if we get a 6% inflation rate, there's no way in the world the Fed can cut rates, at least for a year, until we get a new Fed governor. So that has always historically been the priority.

Q: Do you think the 10-year yield is going down to 5%?

A: You know, we're really in a no-man's-land here. Recession fears will drive rates down as they did yesterday. I haven't even had a chance to see where the bond market is this morning because. So, rates are rising on a recessionary GDP, which is the worst possible outcome. Rates should be falling on a recessionary GDP print. Of course, Washington’s efforts to undermine the U.S. dollar aren't helping. Threatening to withhold taxes on interest payments to foreign owners is what caused the 10% down move in bonds in one week—the worst move in the bond market in 25 years. So, the mere fact that they're even thinking about doing something like that scares foreign investors, not only from the bond market, but all US investments period. And certainly, we've seen some absolutely massive stock selling from them.

Q: Why won't the market go down to 4,000 in the S&P 500?

A: Absolutely, it could; that is definitely within range. That would put us down 30% from the February highs, it just depends on how long the recession lasts. If you just get a two-quarter shallow recession, we could bounce off 4800 for the (SPX) until we come out. If the recession continues for several quarters, and it's looking like it will, then 4,000 is definitely within range. So, it's all about the economy. And remember, stocks are expensive. They don't get cheap until we get a PE multiple of 16, and even then, that alone, just a multiple shrinkage would take us down to 4,000.

Q: Would it be a good idea to buy the S&P 500 (SPY) as it falls?

A: I'm getting emails from readers asking if it's time to buy Nvidia (NVDA) or time to buy Tesla (TSLA). What I've noticed is that investors are constantly fighting the last battle. They're always looking for what worked last time, and that does not succeed as an investment strategy. As long as I'm selling rallies, I'm not even thinking about what to buy on the bottom. The world could look completely different on the other side. The MAG-7 may not be the leadership in the future, especially with the Trump administration trying to dismantle four out of seven companies through antitrust, and the rest are tied up in the trade wars. So, tech is still expensive relative to the main market, and we're going to need to look for new leaders. My picks are going to be mining shares, gold, and banking. Those are the ones I'm looking to buy on dips, but right now, cash is king unless you want to play on the short side. Being paid 4.3% to stay away sounds pretty good to me, especially when your neighbors have 30% losses. You know, I've heard of people having all of their retirement funds in just two stocks: Nvidia and Tesla, and they're getting wiped out. So, you don't want to become one of them.

Q: After a tremendous run in Gold, is Silver a better risk-reward right now?

A: I would say yes, it is. Silver has been lagging gold all year because central banks, the most consistent buyers for the past decade, buy gold—they don't buy silver. But what we may be in store for here now is a prolonged sideways move in gold while the technicals catch up with it. And in the meantime, the money goes elsewhere into silver and Bitcoin. That's my bet.

Q: Is Apple (APPL) a no-touch now?

A: I’d say yes. The trade war is changing by the day, and Apple probably does more international trade than any other company in the world. Also, Apple gets hit with recessions like everybody else. There was a big front run to buy Apple products ahead of tariffs—my company bought all its computer and telephone needs for the whole year ahead of the tariffs. We're not buying anything else this year. And I would imagine millions more are planning to do the same, so you could get some really big hits in Apple earnings going forward.

Q: Should I sell my August Proshares Short S&P 500 (SH) LEAPS?

A: No, I would keep them. If the (SPX) IS trading between 5,000 to 5,800, your $4-$42 SH LEAPS should expire at max profit in August, so I'm hanging on to mine. Next time we take a run at 5,000, you should be able to get out of your SH LEAPS at 80% to 90% of the max profit.

Q: What car company stock will do the best in a high-tariff global economy?

A: Tesla (TSLA), because 100% of their cars are made in the US with 90% US parts (the screens come from Panasonic in Japan). Their foreign components are only about 10%, so they can eat that. For General Motors (GM), it's more like 30% of all components are made abroad, and they can't eat that; their profit margins are too low. (GM) expects to lose $5 billion because of tariffs. By the way, the profit margins on Tesla have fallen dramatically from 30% down to 10% in two years, so it's not like they're in great shape either. Also, Tesla hasn’t had a CEO for ten months, which is why the board is looking for a replacement.

Q: Is it a good time to buy the dip in oil (USO)?

A: Absolutely not. Oil is the most sensitive sector to recessions, because if you can't sell oil, you have to store it, very expensively. It costs 30 to 40% a year to store oil—that's the contango; and once all the storage is full, then you have to cap wells, which then damages the long-term production of the wells. I think at some point you will expect an announcement from Washington to refill the Strategic Petroleum Reserve, which was basically sold by Biden at $100 a barrel. You can now get it back for $60. That may not be a bad idea if you're going to have a strategic petroleum reserve. What's better is just to quit using oil completely, which we were on trend to do.

Q: Will interest rates drop by year-end?

A: They may drop by year-end once unemployment runs up to 5% or 6% —which is likely to happen in a recession—and inflation starts to decline, even if it declines from a higher level. Even if they don't cut by year end, they'll still cut in a year when the president can appoint a new Fed governor. What the Trump really needs to do is appoint Janet Yellen as the Fed governor. She kept interest rates near zero for practically all of her term. We need another Yellen monetary policy.

Q: The job market here seems to be slowing quite fast. Is there any way this will rebound and stave off recession?

A: No, there is not. Companies are going to be looking to cut costs as fast as they can to offset the shrinkage in sales, but also to help cope with tariffs. So no, the job market is actually surprisingly strong now. That means future data releases are probably going to get a lot worse. In April, we saw job gains in Health care, adding 51,000 jobs. Other sectors posting gains included transportation and warehousing (29,000), financial activities (14,000), and social assistance. I highly doubt any of these sectors will show gains next month.

Q: What about nuclear energy plays?

A: I like them, partly because people are buying stocks like Cameco Corp (CCJ) as a flight to safety commodity play, like they're buying gold, silver, and copper. But also, this administration is supposed to be deregulation-friendly, and the only thing holding back nuclear (at least new modular reactors) is regulation. That and the fact that no one wants to live next door to a nuclear power plant, for some strange reason.

Q: What do I think about natural gas (UNG)?

A: Don't touch. Don't buy the dip. All energy plays look terrible right here, going into recession.

Q: What are your thoughts on manufacturing returning to the U.S? And how will that affect the stock market?

A: I think there's zero chance that any manufacturing returns to the U.S. Companies would rather just shut down than operate money-losing businesses. You know, if your labor cost goes from $5 to $75 an hour, there's no chance anyone can make money doing that, and no shareholders are going to want to touch that stock. That is the basic flaw in having a government where no one is actually running a manufacturing business anywhere in the government. They don't know how things are actually made. They're all real estate or financial people.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

April 9, 2025

Fiat Lux

Featured Trade:

(TECH SHARES RECOVER ON MACRO NEWS)

(FXI), ($COMPQ)

Expect this type of showmanship to be the new normal as the U.S. government goes pedal to the medal hoping to extract better trade terms.

In the short term, expect wild swings in the prices of US tech stocks.

U.S. President Trump unilaterally raised the US tariff rate on China (FXI) to 125% and instituted a 90-day pause on steep 'reciprocal' tariffs.

The Nasdaq shot up by an intraday 10% - an unprecedented type of market reaction stemming from short-covering.

The entire tech index was heavily weighted for lower Nasdaq ($COMPQ) share prices and this one announcement torpedoed the short-term momentum to the downside.

2025 is presenting itself to be one of the hardest environments to trade in the last two decades plus as tech shares are the trajectory of them are reliant on the whims of an aggressive new federal government.

People are scared – scared more about the uncertainty this presents.

Uncertainty creates an environment to sell stock resulting in meaningful lower-tech shares.

Additionally, it is very obvious the federal government will target China and the way it does business to reign them in. They are the big fish.

Remember that China has a massive youth unemployment rate problem inching towards 30% and the Chinese Communist Party (CCP) knows they are playing with fire if Trump’s tariffs result in millions of new job layoffs.

Trump on Tuesday claimed that China, as well as other countries, are keen to negotiate. Those talks have reportedly begun with Japan and South Korea. But he has remained defiant as members of his own party and Wall Street billionaires start to push back.

On the negotiations front, both markets and trading partners still seem to be searching for what exactly Trump is seeking.

The president’s approach has prompted retaliation from China and caused other countries to draw up their own plans to hit American exports. As a result, economists have raised their expectations for a recession in the United States, and many now consider the odds to be a coin flip.

During the trade fight with China in Mr. Trump’s first term, U.S. agricultural exports plummeted after China imposed high retaliatory duties on soybean, corn, wheat, and other American imports, and the United States spent about $23 billion to support American farmers.

The Retail Industry Leaders Association, which represents major companies like Walmart, Target, and Best Buy, said this could drive up prices for the American consumer.

In the short term, this should first alleviate the pressure on the U.S. dollar and the price hikes for tech products.

I would stay away from companies that have exposure to China like Tesla and Micron.

Gradually, we will see countries come to the table and if this gets through, even in diluted form, it would be considered a victory for US tech stocks.

Sure, the Federal Government could again jump back on its horse and go insane with the tariffs, but I do believe this pause highlights the fact that they aren’t willing to nuke the economy and tech sector just yet.

I also believe there is a roadmap to claim victory in all of this.

It starts with East Asian countries like Japan and South Korea which will take a “bad deal” in exchange for stability.

We have seen this a few times with Japan and I don’t believe they will reject America’s approach when Japan’s economy, society, and direction are even worse than Europe and America combined.

Once we get a little bit more settled and predictable, it should be a great buy-the-dip opportunity in tech shares.

Global Market Comments

March 3, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or ARMAGEDDON)

(JPM), (IBKR), (TSLA), (NVDA), (TLT), (GS), (BRK/B), (PRIV), (GLD), (FXI)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.