Armageddon is not a word I use lightly. But this weekend, every technical service I subscribed to warned that the recent damage to the market was immense. It’s time to raise cash, hedge your positions, or otherwise position for a bear market.

I have noticed over the past half-century that the best technicians spend a lot of time reading up on fundamentals, and the best fundamentalists spend a lot of time looking at charts. When both go to hell in a handbasket, as they are now, it’s time to head for the hills.

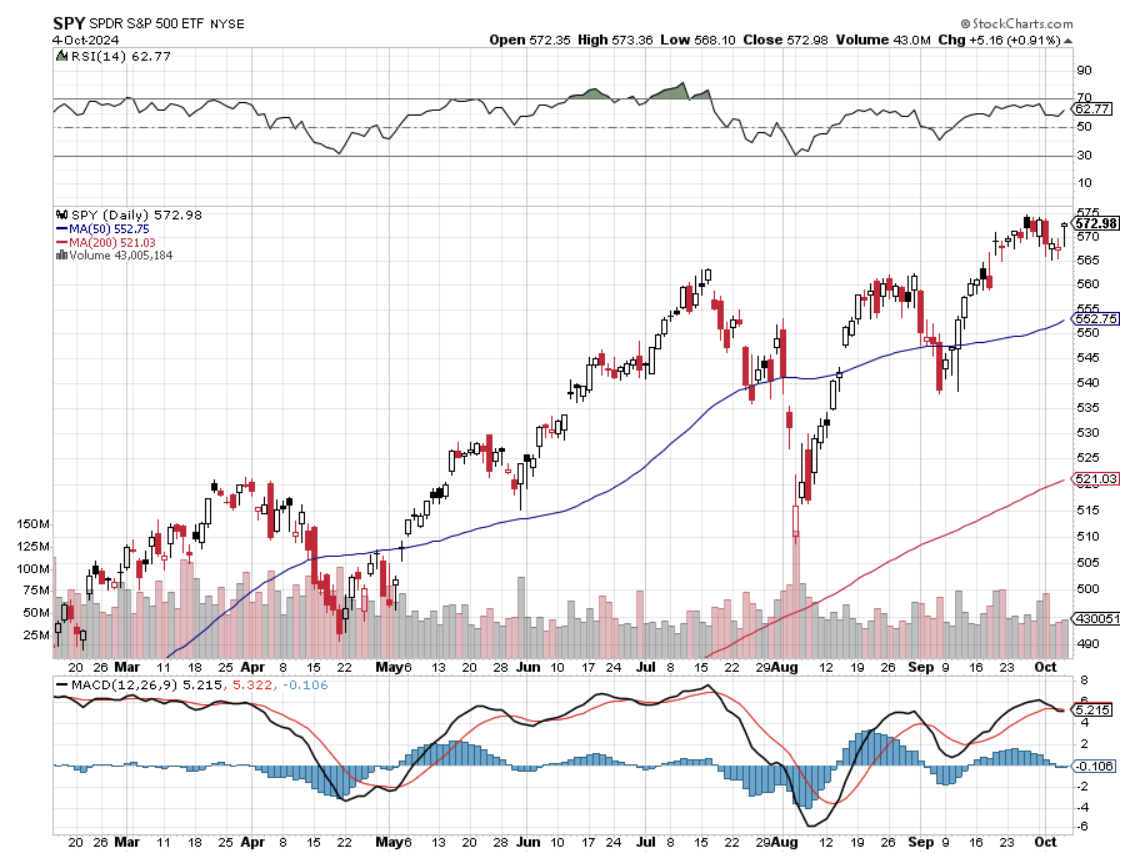

The only way Armageddon can be avoided, or at least postponed, is if the trade war, which is about to cut S&P 500 (SPY) earnings by half, suddenly ends. Only one person knows if that is going to happen, and he isn’t sharing any of his cards with me.

If the trade war continues or expands, the math here becomes very simple. The shares of companies that earn less money are worth less.

You learn in flight school that accidents aren’t usually the result of a single problem but several compounding ones. I know this too well because I have crashed three planes, in the Austrian Alps, in Sicily, and in Paris. First, the gyroscope blows up, then the radio goes out, and then you lose an engine when the weather turns bad. It doesn’t help when someone is shooting at you, either.

The problem for stock owners now is that there isn’t just one thing going wrong with the investment landscape right now; there are several compounding ones, like inflation, immigration, taxes, the deficit, the Ukraine War, and the end of American leadership of the West.

Loss of confidence in the top, which took a quantum leap downward in the wake of the dumpster fire at a White House Zelinski meeting, has consequences. At this point, every businessman in America is asking himself if he can survive the current regime.

With a scant one-seat majority in Congress, a budget can’t pass by March 14, when a government shutdown begins. It means that there will be no new tax cuts by year-end. Chaos ratchets up. Businessmen hate chaos.

It also means that the 2017 tax cuts extension isn’t going to happen, which adds $5 trillion in new taxes on the country just when the economy is slowing dramatically. Uncertainty runs rampant.

Here's the problem for investors with that. Confident markets trade at big premiums, as we saw for the last three years. Uncertain markets trade at big discounts. If I’m right, that discount will be 20%. If I’m wrong, it's 50%.

Ceding America’s leadership of the West comes at a heavy price. It started 80 years ago with the end of WWII. American stock markets have done pretty well during this time, rising by 435 times. Why anyone would want to give up such a system is beyond me.

For example, the US dollar would lose its reserve currency status. There is no way the national debt could have risen to $36 trillion, half of which was bought by foreigners, and all of which was used to stimulate the economy, without reserve currency status. Take that away, and economic growth goes elsewhere. So do higher stock prices, which we have already seen this year in China and Europe.

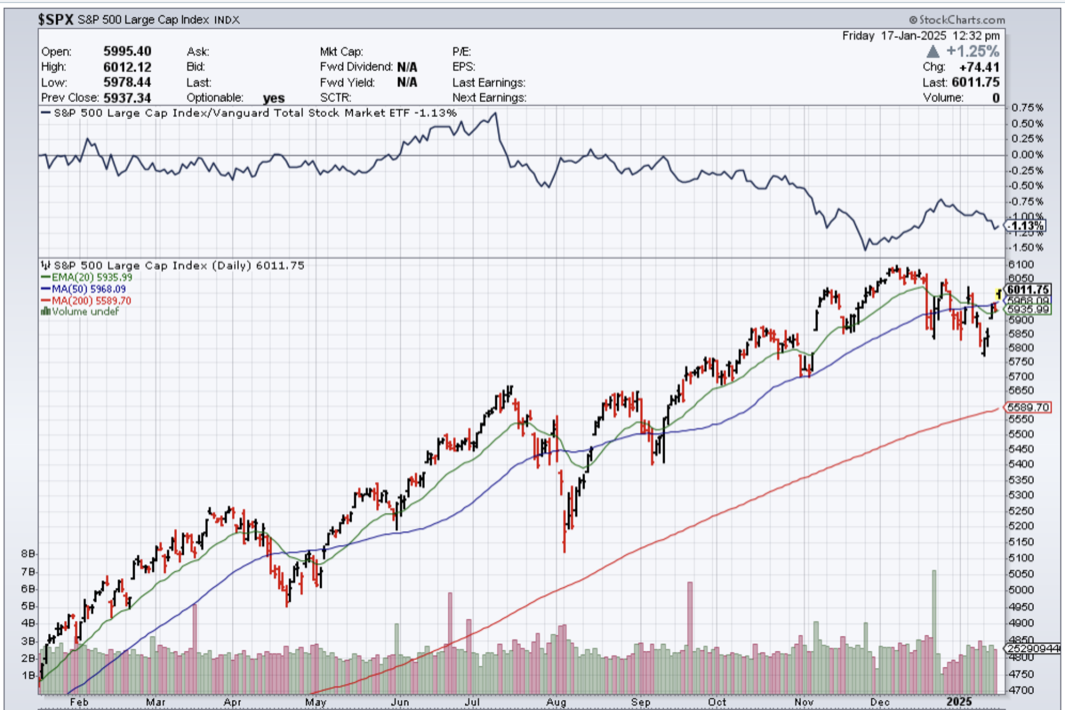

There is a fundamental repricing of the market taking place, and we are only just at the beginning.

About that economy thing. On Friday, the Atlanta Fed predicted that the US economy SHRANK by -1.5% in Q1. It would be easy to say, “There goes the Atlanta Fed again,” whose model is always prone to extreme predictions. But it is safe to say that the economy is either not growing or growing at a dramatically slowing rate.

The problem for investors? Reliable growing economies, which we have had since the Pandemic five years ago, support high stock multiples. Non-growing or shrinking economies can only support low earnings multiple. Remember back in 2009, the S&P 500 traded at a lowly multiple of only 9X, against today’s 25X.

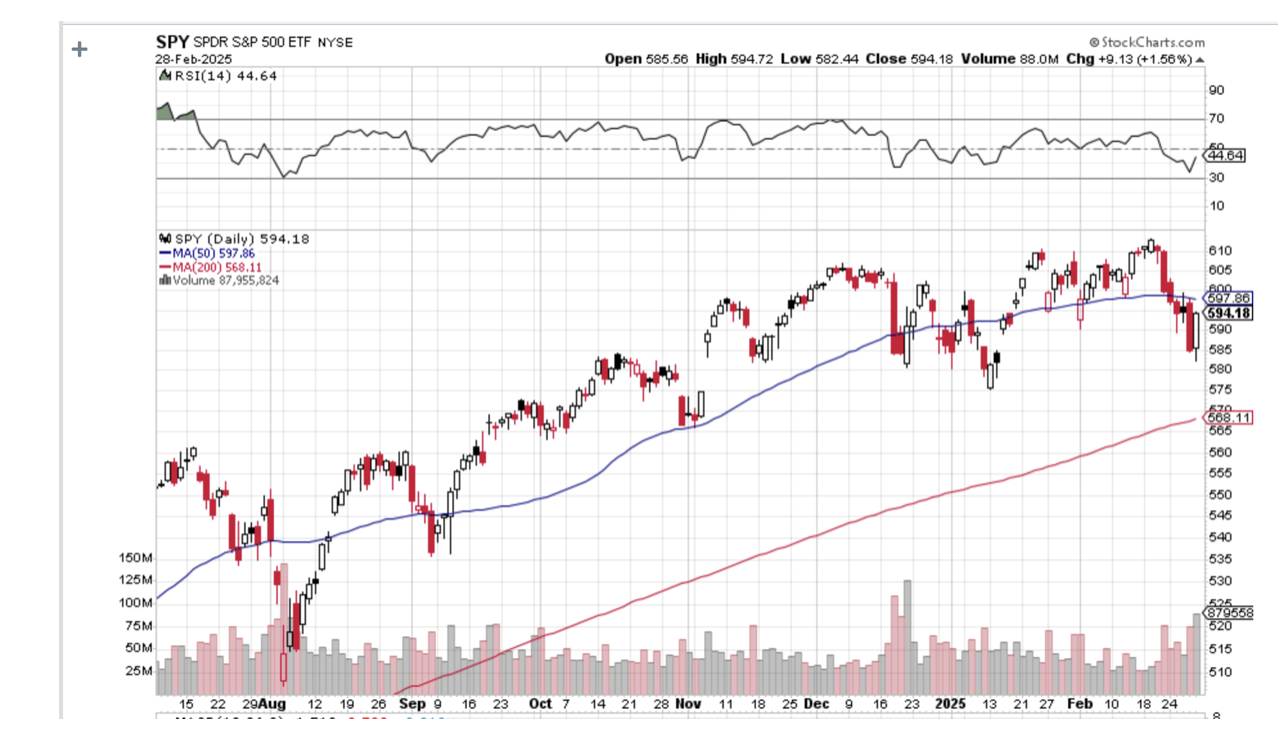

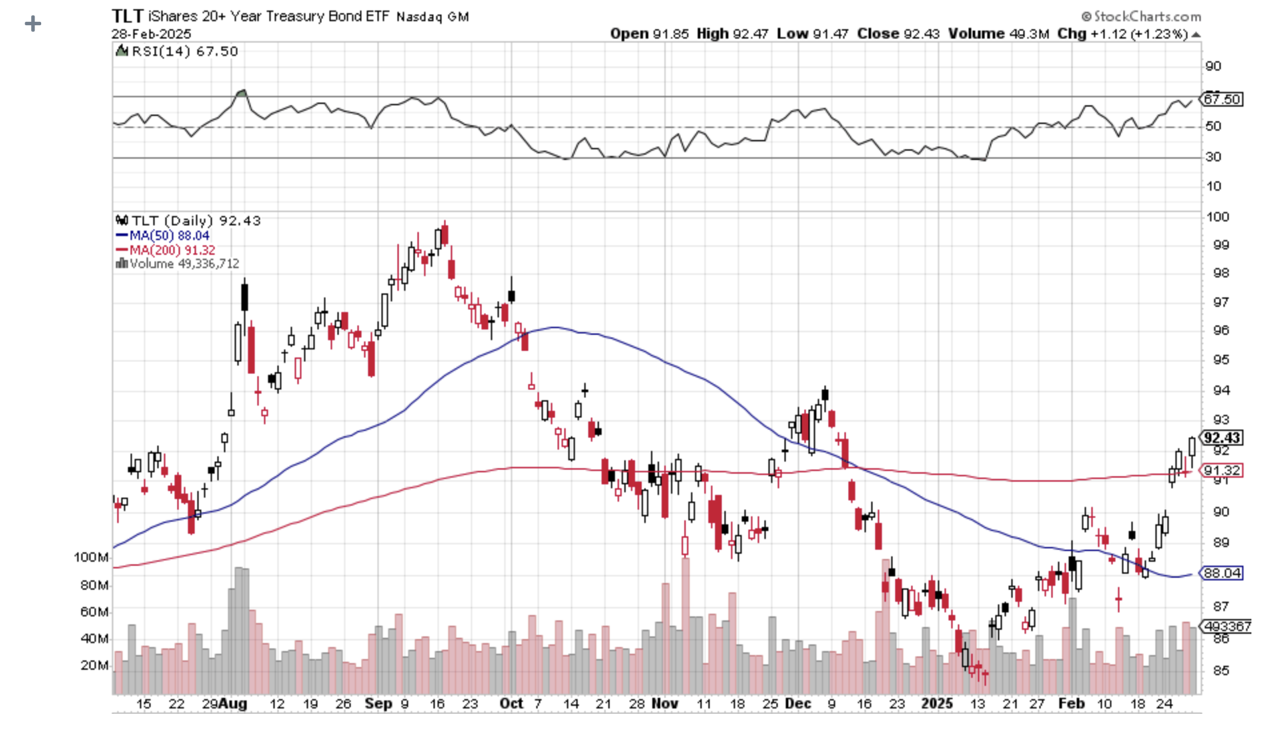

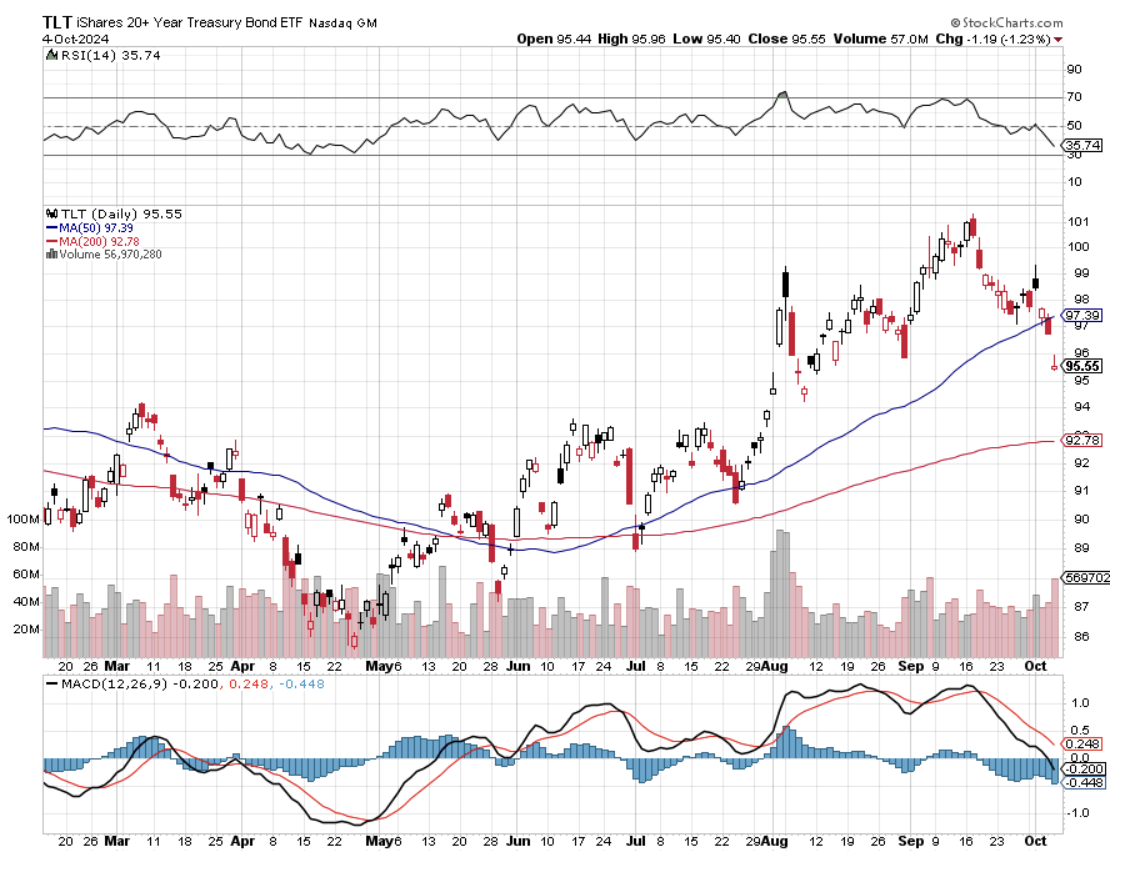

This isn’t just me howling at the moon. With a meteoric $10 rally this year, the bond market is starting to warn of a coming recession. Ten-year US Treasury bond yields have cratered from 4.80% to 4.20%. This is in the face of massive bond issuance in 2025, some $1.7 trillion worth, the product of the 2017 Trump tax cuts. Almost all new government policies are anti-economy and anti-growth.

The DOGE campaign is sucking massive amounts of money out of the economy. The yield curve has inverted, meaning that short-term interest rates are higher than long-term ones, indicating that the recession risk is real.

The dividend yield on the S&P 500 is at 1.2%. It was 2% only a couple of years ago. That is not much yield competition.

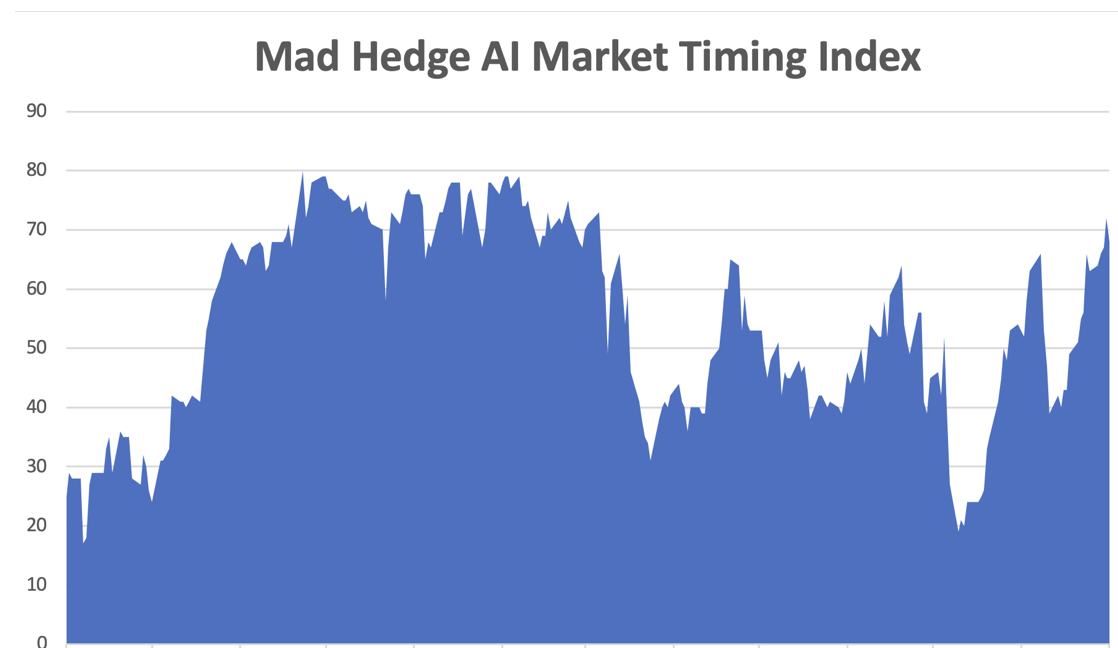

As I have been warning my Concierge members for weeks, get rid of all the stocks and asset classes you have been dating and only keep the ones you are married to. And what you keep should be hedged, such as through selling short call options against your longs, buying the (SDS), the 2X short S&P 500 ETF. And then there are 90-day US Treasury bills yield 4.2%, where nobody has ever lost money.

I learned something interesting the other day about your largest holding.

Some 70% of Nvidia is now held by indexes like the S&P 500. That’s because it has become an index proxy. It means that the shares have become an index hedge for hedge funds against which they can trade a myriad of options. This is why the (NVDA) options have implied volatilities four times those of the (SPY). It is a great arbitrage.

I watch closely the launch of new ETFs and write about the most interesting ones. I have been inundated by requests for private credit investments, which, by definition, are not available to the public.

Now, we will soon have the SPR SSGA Apollo IG Public & Privat Credit ETF (PRIV) out soon (https://www.ssga.com/us/en/intermediary/etfs/spdr-ssga-apollo-ig-public-private-credit-etf-priv ).

The fund will launch with an initial $50 million, and the minimum investment is $100,000. The fund essentially offers daily liquidity for illiquid long-duration loans. The yield should be in line with private illiquid debt, or about 10%-12%.

How they pull this off is anybody’s guess. Past funds that tried to do this closed their doors during times of economic distress, known as “gating, “so beware of gating when market conditions turn less than ideal. The fund promises to hold up to 35% of its funds in private credit and the rest in a mix of junk bonds. No word yet on the yield, but it will be much higher than the leading junk bond fund (JNK), which is offering 6.48%.

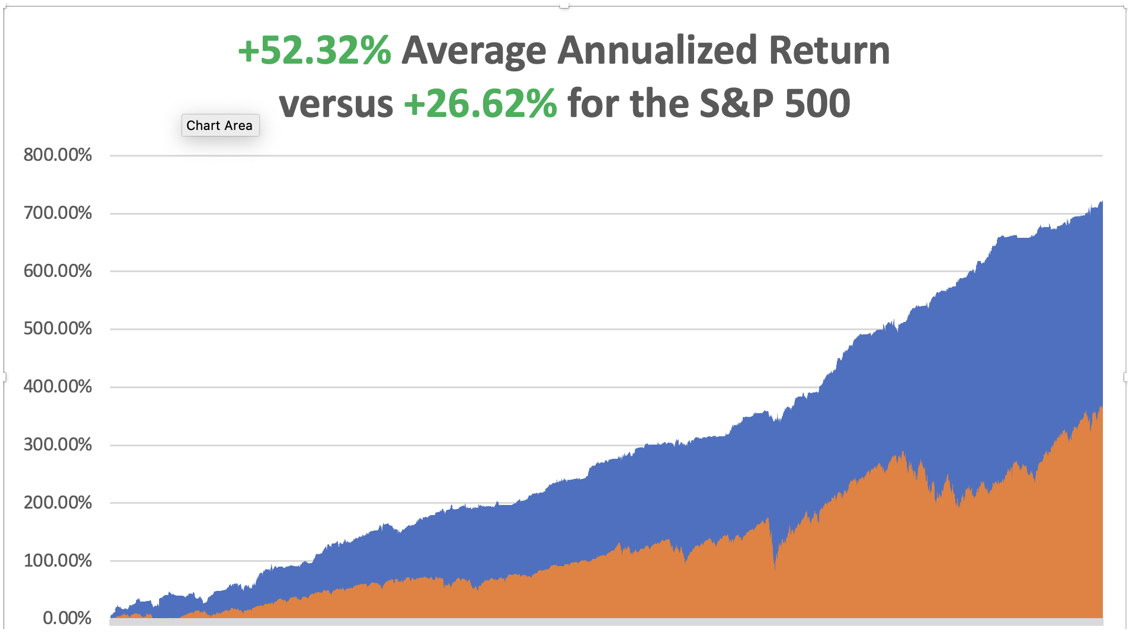

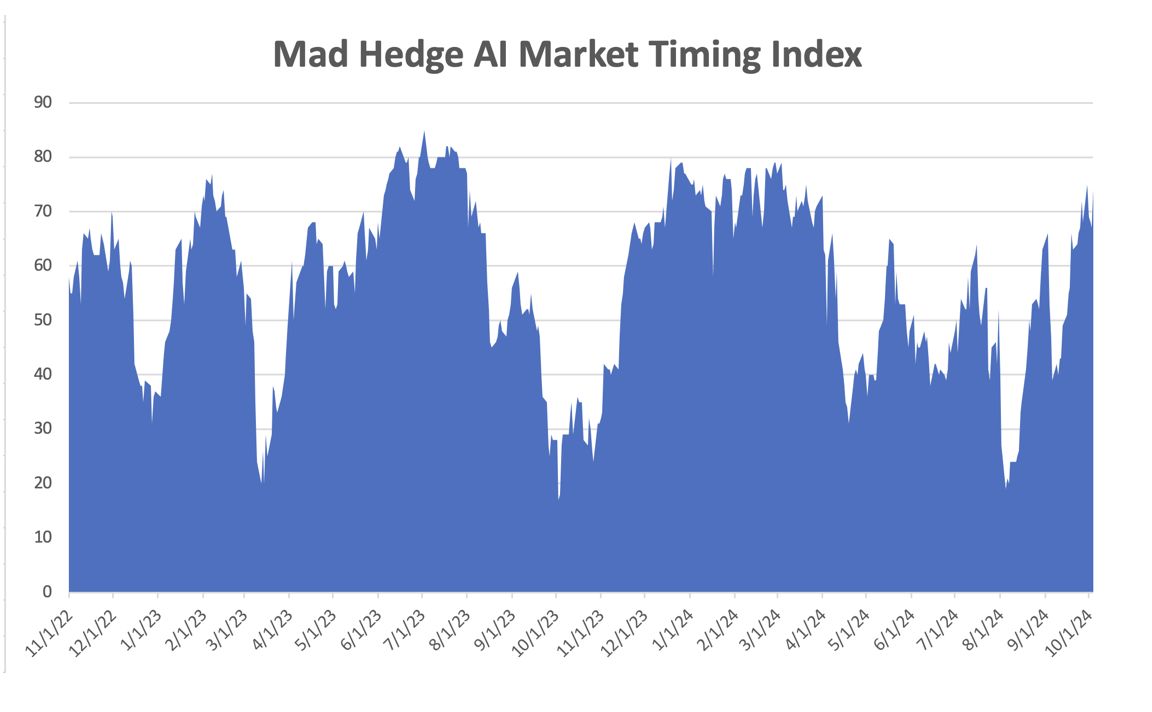

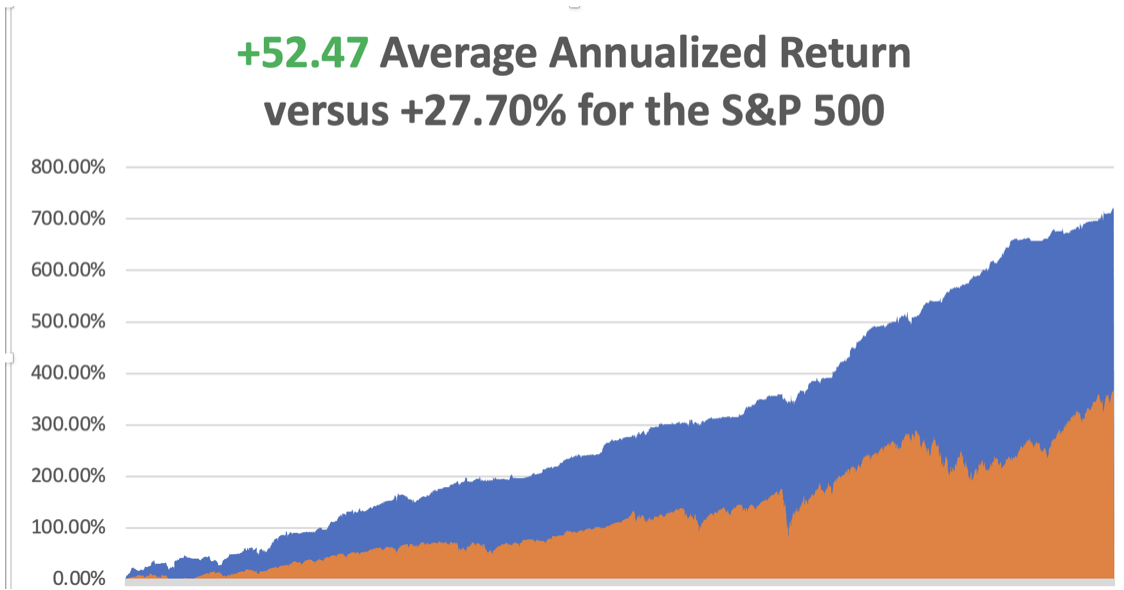

February has started with a respectable +2.25% return so far. That takes us to a year-to-date profit of +9.46% so far in 2025. My trailing one-year return stands at a spectacular +81.87% as a bad trade a year ago fell off the one-year record. That takes my average annualized return to +49.83% and my performance since inception to +761.36%.

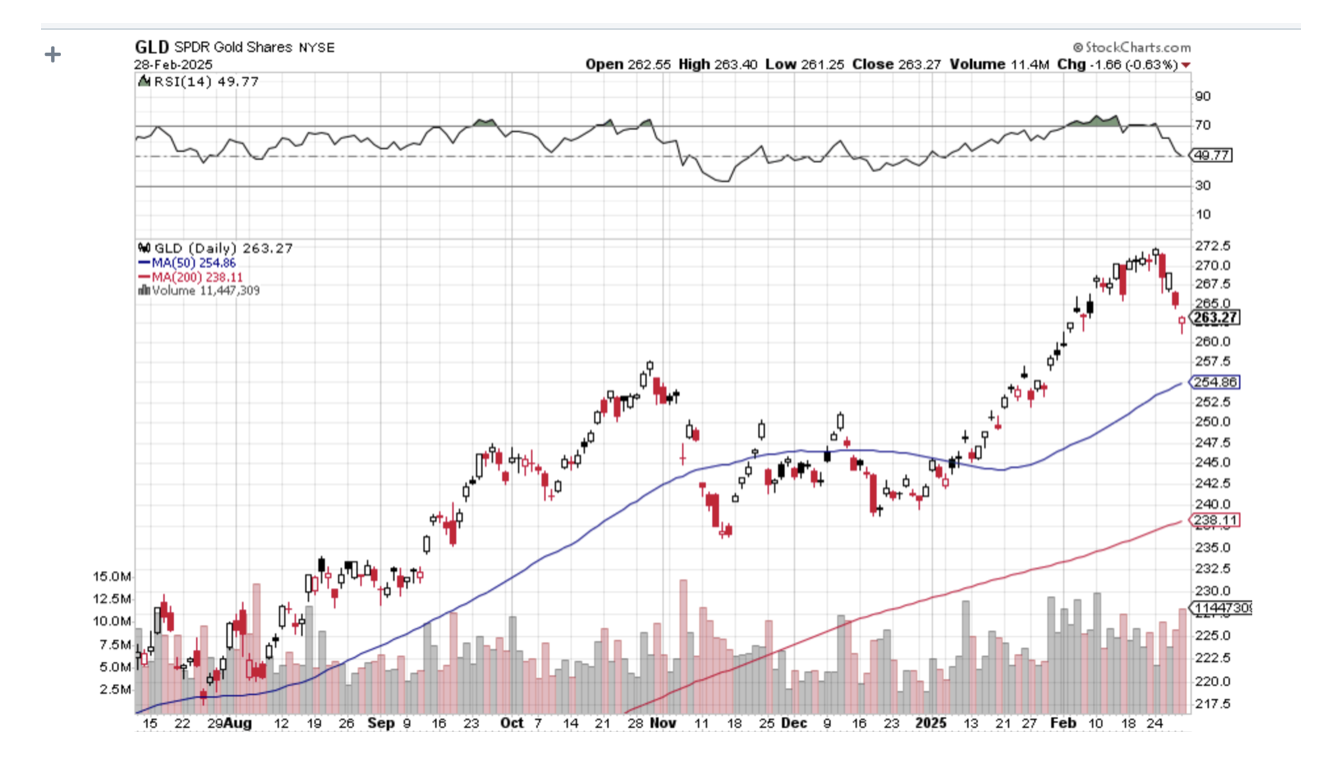

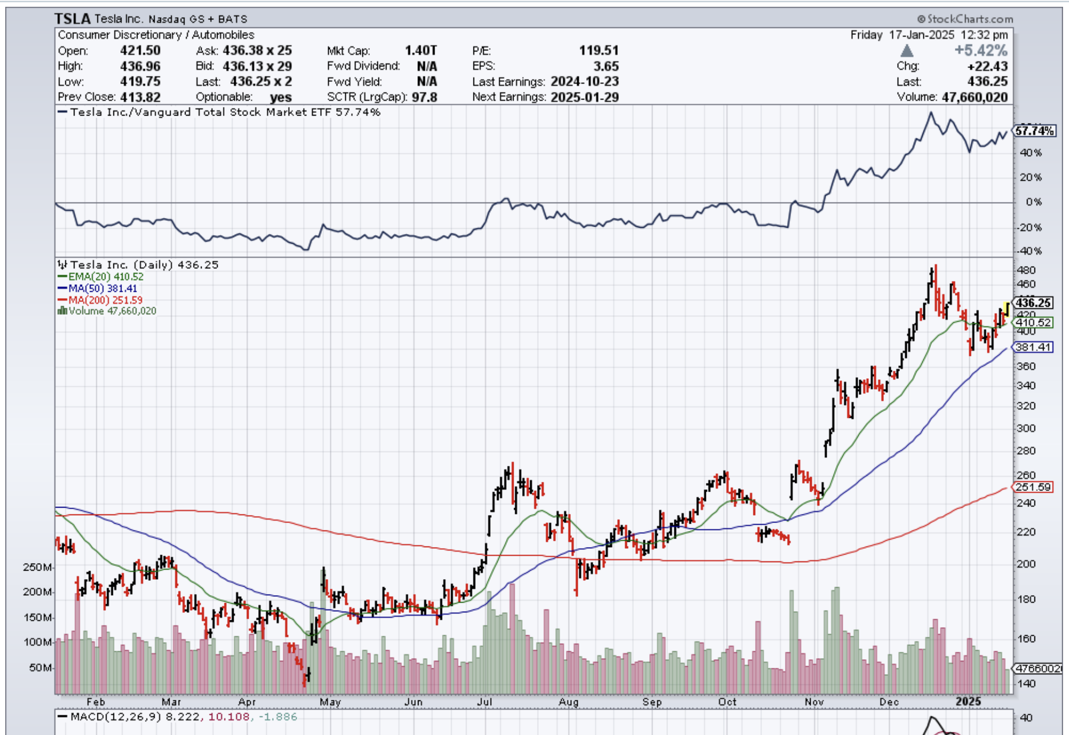

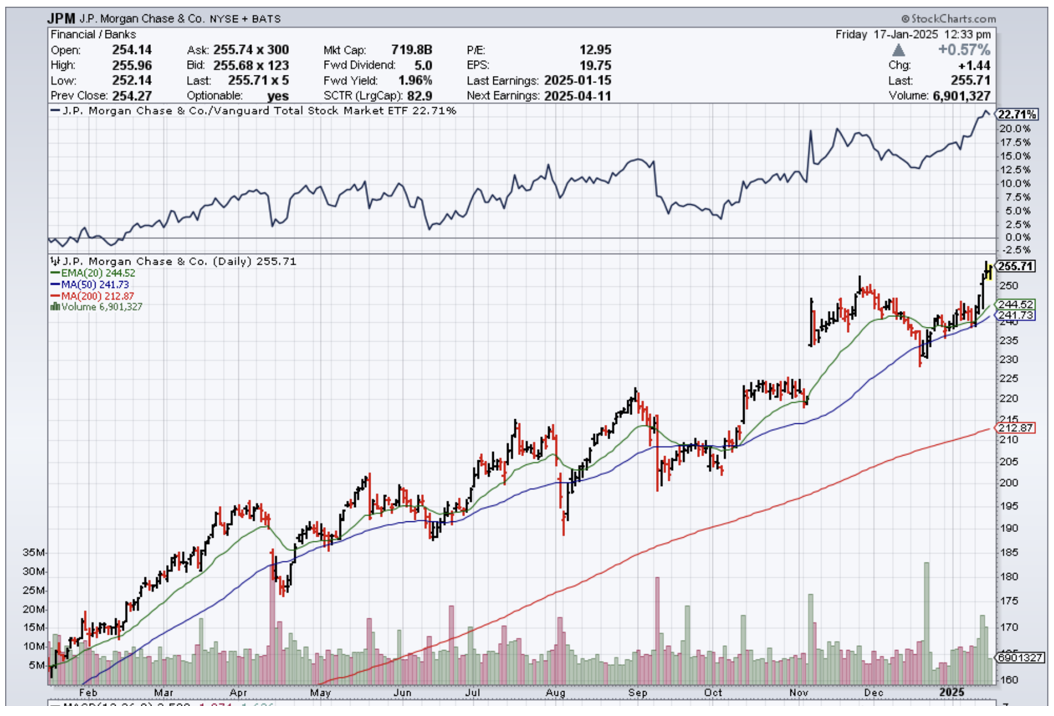

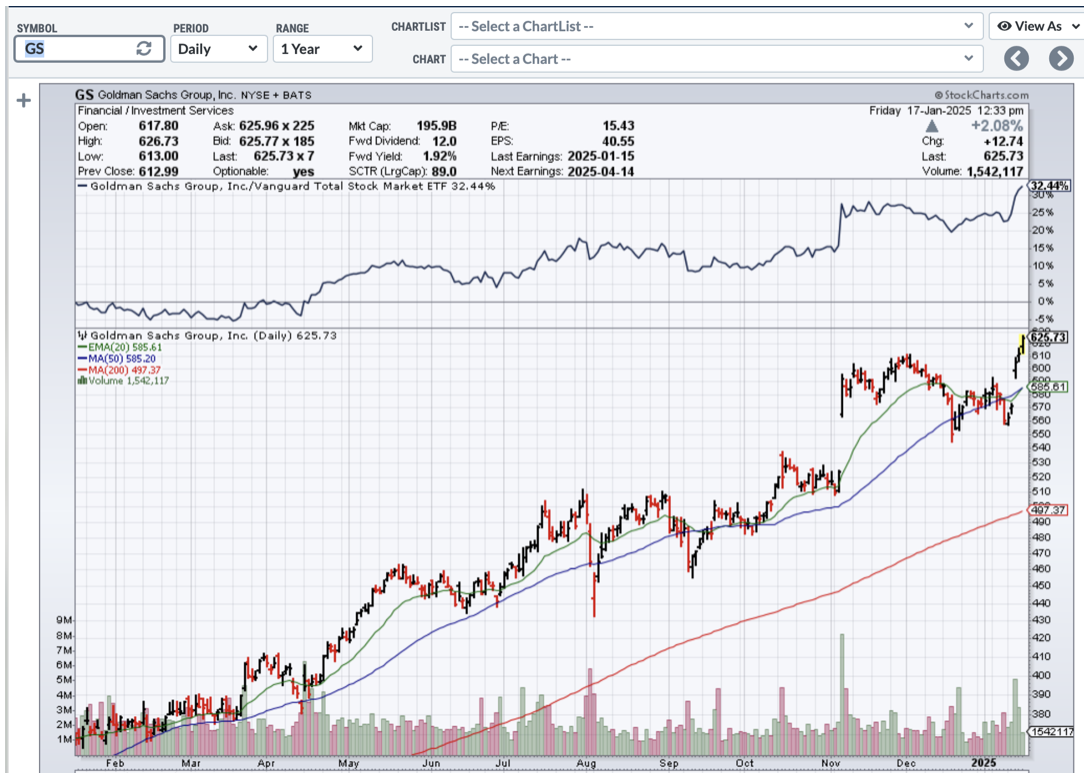

I saw the market breakdown coming a mile off and used my 90% cash to pile into new very short-term longs in JP Morgan (JPM), Interactive Brokers (IBKR), Tesla (TSLA), and Gold (GLD). I poured into new short positions with Tesla (TSLA), Nvidia (NVDA), and the United States US Treasury Bond Fund (TLT). This is in addition to an existing long in Goldman Sachs (GS). Last week, I leapt from 90% cash to 40% long, 40% short, and 20% cash.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 74 of 94 trades have been profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

Try beating that anywhere.

Core PCE Price Index Comes in Line. The personal consumption expenditures price index, the Federal Reserve’s preferred inflation measure, increased 0.3% for the month and showed a 2.5% annual rate. Excluding food and energy, core PCE also rose 0.3% for the month and was at 2.6% annually. Fed officials more closely follow the core measure as a better indicator of longer-term trends. Personal income posted rose 0.9% against expectations for a 0.4% increase. However, the higher incomes did not translate into spending, which decreased by 0.2%, versus the forecast for a 0.1% gain.

Retail Investors Market Sentiment Hit All-Time Bearish Highs. Options activity has also taken a big swing towards put buying. Dump all the stocks you were dating. Both Nvidia (NVDA) and Tesla (TSLA), the two most widely traded stocks in the market, broke their 200-day moving averages today. This is a very negative medium-term indicator. Only keep the ones you’re married to, not the ones you’re dating. This is not the rose garden we were promised.

US Margin Debt Hits All-Time High, at $937 billion as of January. That’s up 33% from $701 billion in January 2024. Over the same period, the S&P 500 gained 24.7%. Speculation on credit is running rampant. Margin trading, in which investors borrow funds from their brokerage firms in order to buy stocks, can amplify returns.

Weekly Jobless Claims Jump to 242,000, up 22,000, as the government firings kick in. In Washington, D.C., new claims totaled 2,047, an increase of 421, or 26%, the largest number for the city since March 25, 2023.

Nvidia Beats (NVDA) even the most optimistic expectations. The company forecasted higher first-quarter revenue, signaling continued strong demand for artificial intelligence chips, and said orders for its new Blackwell semiconductors were "amazing." The forecast helps allay doubts around a slowdown in spending on its hardware that emerged last month, following DeepSeek's claims that it had developed AI models rivaling Western counterparts at a fraction of their cost. Nvidia's outlook for gross margin in the current quarter was slightly lower than expected, though, as the company's Blackwell chip ramp-up weighs on Nvidia's profit. Nvidia forecast first-quarter gross margins will sink to 71%, below the 72.2% forecast by Wall Street, according to data compiled by LSEG.

Gold ETFs (GLD) Have Become a Hot Commodity, with $4.5 billion pouring into (GLD) — with around half of that inflow occurring during Friday’s stock market selloff. The flight to safety bid is on. Those moves come as gold prices are at all-time highs in early 2025, boosted by trade uncertainty and inflation concerns. Buy (GLD) on dips.

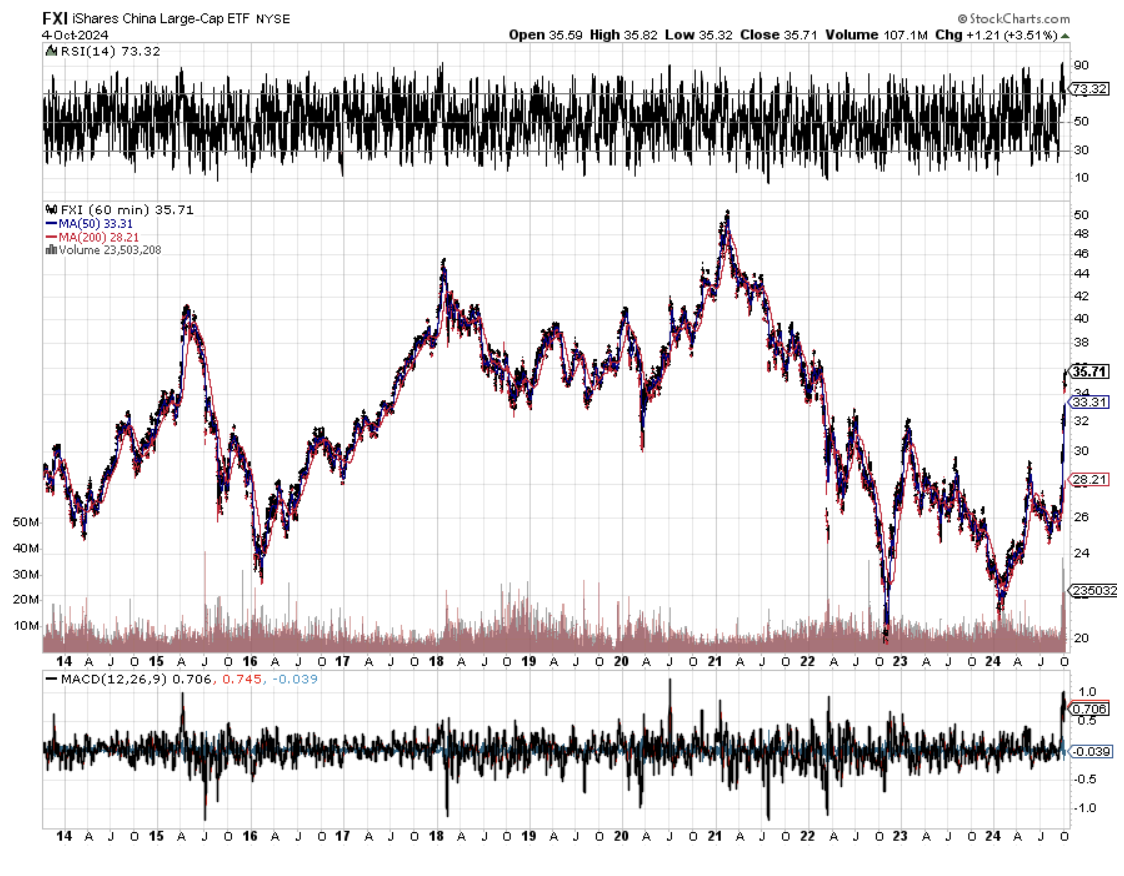

Chinese Inflation (FXI) Hits 20-Year Lows, as the economy continues in free fall. Beijing is also expected to release its plans for spending on defense and technological development in the year ahead, along with details on private sector support. Last year, the inflation rate came in at only 0.2%.

Pending Homes Sales Hit All-Time Low, in January down 4.6% MOM and 5.2% YOY. Inventories are rising, but affordability is at record lows. Exceptionally cold weather was a factor. Homebuilder Sentiment plummeted to 42, a two-year low, and tariff concerns. Our drywall comes from Mexico, and our lumber comes from Canada. Avoid all real estate plays like the plague.

Home Prices are Still Rising, according to the S&P Case Shiller National Home Price Index. House prices rose 0.4%. They increased 4.7% in the 12 months through December. The strong increase in prices was despite rising housing supply, which is being driven by ebbing demand amid higher mortgage rates. New York showed the biggest gain at 7.2% YOY, followed by Chicago at 6.6% and Boston at 6.35%. Washington, DC, was the only city showing a loss at -1.1%.

Consumer Confidence Collapses to a Four-Year Low, down 7 points from 105 to 98, as tariff-driven inflation fears ramp up. The Conference Board’s Consumer Confidence Index for February, released Tuesday morning, fell to 98.3, falling for the third-straight month and marking the largest monthly decline since August 2021. Technology stocks sold off hard. Bonds are starting to discount a recession.

Berkshire Hathaway (BRK/B) Builds Record Cash, at $334 billion, up $9 billion in December alone. The Oracle of Omaha has been selling huge chunks of Apple (AAPL) and Bank of America (BAC) and putting the money into US Treasury Bills. Warren earned an eye-popping $47 billion in 2024, up 27% YOY. A price earnings multiple at a record 25X for the S&P 500. If Warren Buffet is selling, should you be buying?

Jamie Dimon Sells 30% of JP Morgan Stock, yet another indicator of a market top. Jamie is famous for loading up on (JPM) at the absolute market bottom in 2009. Does he know something we don’t? Banks have been the lead sector in the market since the summer.

Existing Homes Sales Crater, on a closing contract basis, down 4.9% in January to 4.09 million units. Terrible weather was a factor. Inventories are up 17% YOY and 3.5% for the month. Al cash sales hit 29%. The average price of a home is at an all-time high at $396,800, up 4.5% YOY.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties, is now looking at multiple gale force headwinds. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

My Dow 240,000 target has been pushed back to 2035.

On Monday, March 3 at 8:30 AM EST, the ISM Manufacturing PMI is announced.

On Tuesday, March 4 at 8:30 AM, the API Crude Oil Stocks is released.

On Wednesday, March 5 at 8:30 AM, the ADP Employment Index is printed.

On Thursday, March 6 at 8:30 AM, the Weekly Jobless Claims are disclosed.

On Friday, March 7 at 8:30 AM, the Nonfarm Payroll Report for February is announced, as well as the headline Unemployment Rate. At 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, I’ll never forget when my friend Don Kagin, one of the world’s top dealers in rare coins, walked into my gym one day and announced that he had made $1 million that morning. I enquired. “How is that, pray tell?”

He told me that he was an investor and technical consultant to a venture hoping to discover the long-lost USS Central America, which sunk in a storm off the Atlantic Coast in 1857, heavily laden with gold from the California gold fields. He just received an excited call that the wreck had been found in deep water off the US east coast.

I learned the other day that Don had scored another bonanza in the rare coins business. He had sold his 1787 Brasher Doubloon for $7.4 million. The price was slightly short of the $7.6 million that a 1933 American $20 gold eagle sold for in 2002.

The Brasher $15 doubloon has long been considered the rarest coin in the United States. Ephraim Brasher, a New York City neighbor of George Washington, was hired to mint the first dollar-denominated coins issued by the new republic.

Treasury Secretary Alexander Hamilton was so impressed with his work that he appointed Brasher as the official American assayer. The coin is now so famous that it is featured in a Raymond Chandler novel where the tough private detective, Phillip Marlowe, attempts to recover the stolen coin. The book was made into a 1947 movie, “The Brasher Doubloon,” starring George Montgomery.

This is not the first time that Don has had a profitable experience with this numismatic treasure. He originally bought it in 1989 for under $1 million and has made several round trips since then. The real mystery is who bought it last. Don wouldn’t say, only hinting that it was a big New York hedge fund manager who adores the barbarous relic. He hopes the coin will eventually be placed in a public museum.

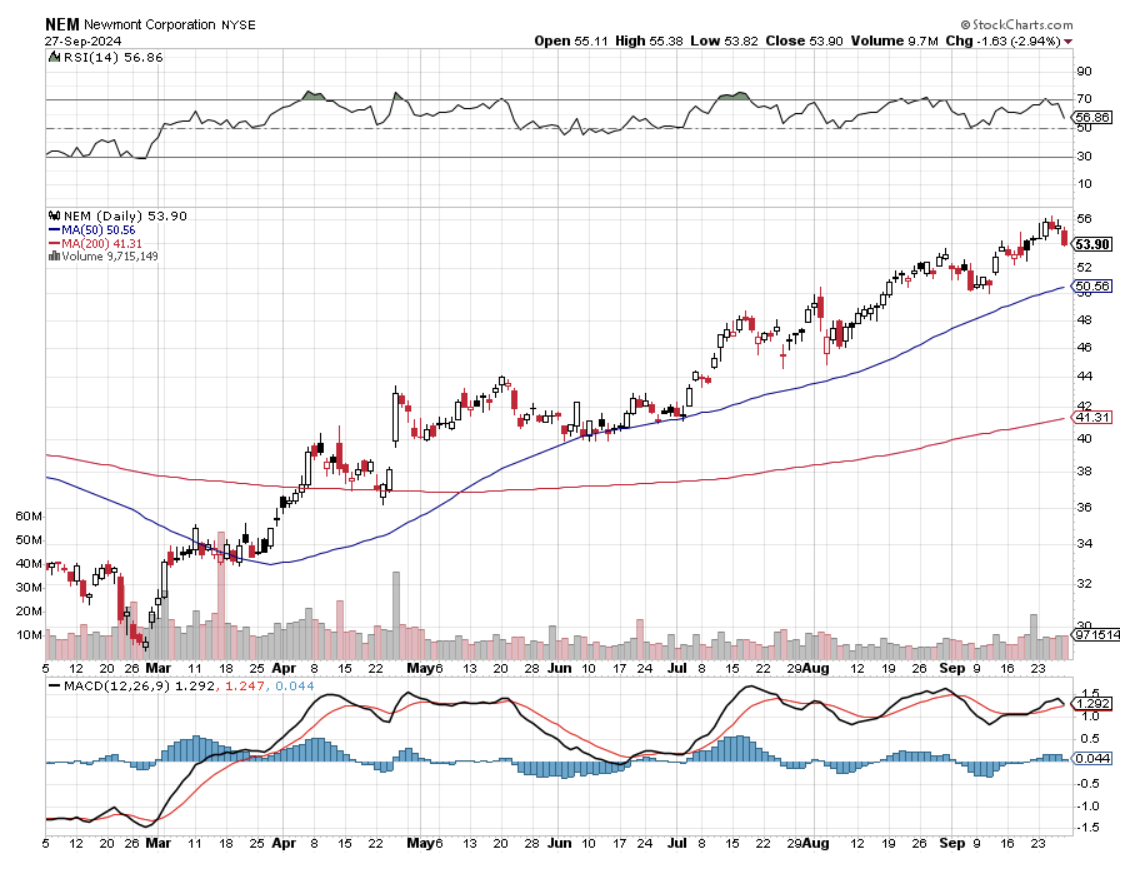

Mad Hedge followers should start paying more attention to gold, which I believe just entered another decade-long bull market, thanks to falling US interest rates. You can’t go wrong buying LEAPS in the top two miners, Barrack Gold (GOLD) and Newmont Mining (NEM).

Who says the rich aren’t getting richer?

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader