Global Market Comments

August 24, 2018

Fiat Lux

Featured Trade:

(AUGUST 22 BIWEEKLY STRATEGY WEBINAR Q&A),

(BIDU), (BABA), (VIX), (EEM), (SPY), (GLD), (GDX), (BITCOIN),

(SQM), (HD), (TBT), (JWN), (AMZN), (USO), (NFLX), (PIN),

(TAKING A BITE OUT OF STEALTH INFLATION)

Tag Archive for: (GDX)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader August 22 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader.

As usual, every asset class long and short was covered. You are certainly an inquisitive lot, and keep those questions coming!

Q: How do you think the trade talks will resolve?

A: There will be no resolution this next round of trade talks. China has sent only their most hawkish negotiators who believe that China has done nothing wrong, so don’t expect results any time soon.

Also, because of the arrests in Washington, China is more inclined to just wait out Donald Trump, whether that’s 6 months or 6 1/2 years. They believe they have the upper hand now, sensing weakness in Washington, and in any case, many of the American requests are ridiculous.

Trade talks will likely overhang the market for the rest of this year and you don’t want to go running back into those China Tech plays, like Alibaba (BABA) and Baidu (BIDU) too soon. However, they are offering fantastic value at these levels.

Q: Will the Washington political storm bring down the market?

A: No, it won’t. Even in the case of impeachment, all that will happen is the market will stall and go sideways for a while until it’s over. The market went straight up during the Clinton impeachment, but that was during the tail end of the Dotcom Boom.

Q: Is Alibaba oversold here at 177?

A: Absolutely, it is a great buy. There is a double in this stock over the long term. But, be prepared for more volatility until the trade wars end, especially with China, which could be quite some time.

Q: What would you do with the Volatility Index (VIX) now?

A: Buy at 11 and buy more at 10. It’s a great hedge against your existing long portfolio. It’s at $12 right now.

Q: Are the emerging markets (EEM) a place to be again right now or do you see more carnage?

A: I see more carnage. As long as the dollar is strong, U.S. interest rates are rising, and we have trade wars, the worst victims of all of that are emerging markets as you can see in the charts. Anything emerging market, whether you’re looking at the stocks, bonds or currency, has been a disaster.

Q: Is it time to go short or neutral in the S&P 500 (SPY)?

A: Keep a minimal long just so you have some participation if the slow-motion melt-up continues, but that is it. I’m keeping risks to a minimum now. I only really have one position to prove that I’m not dead or retired. If it were up to me I’d be 100% cash right now.

Q: Would you buy Bitcoin here around $6,500?

A: No, I would not. There still is a 50/50 chance that Bitcoin goes to zero. It’s looking more and more like a Ponzi scheme every day. If we do break the $6,000 level again, look for $4,000 very quickly. Overall, there are too many better fish to fry.

Q: Is it time to buy gold (GLD) and gold miners (GDX)?

A: No, as long as the U.S. is raising interest rates, you don’t want to go anywhere near the precious metals. No yield plays do well in the current environment, and gold is part of that.

Q: What do you think about Lithium?

A: Lithium has been dragged down all year, just like the rest of the commodities. You would think that with rising electric car production around the world, and with Tesla building a second Gigafactory in Nevada, there would be a high demand for Lithium.

But, it turns out Lithium is not that rare; it’s actually one of the most common elements in the world. What is rare is cheap labor and the lack of environmental controls in the processing.

However, it’s not a terrible idea to buy a position in Sociedad Química y Minera (SQM), the major Chilean Lithium producer, but only if you have a nice long-term view, like well into next year. (SQM) was an old favorite of mine during the last commodity boom, when we caught a few doubles. (Check our research data base).

Q: How can the U.S. debt be resolved? Or can we continue on indefinitely with this level of debt?

A: Actually, we can go on indefinitely with this level of debt; what we can’t do is keep adding a trillion dollars a year, which the current federal budget is guaranteed to deliver. At some point the government will crowd out private borrowers, including you and me, out of the market, which will eventually cause the next recession.

Q: Time to rotate out of stocks?

A: Not yet; all we have to do is rotate out of one kind of stock into another, i.e. out of technology and into consumer staple and value stocks. We will still get that performance, but remember we are 9.5 years into what is probably a 10-year bull market.

So, keep the positions small, rotate when the sector changes, and you’ll still make money. But, let's face it the S&P 500 isn’t 600 anymore, it’s 2,800 and the pickings are going to get a lot slimmer from here on out. Watch the movie but stay close to the exit to escape the coming flash fire.

Q: What kind of time frame does Amazon (AMZN) double?

A: The only question is whether it happens now or on the other side of the next recession. We can assume five years for sure.

Q: More upside to Home Depot (HD)?

A: Absolutely, yes. The high home prices lead to increases in home remodeling, and now that Orchard Hardware has gone out of business, all that business has gone to Home Depot. Home Depot just went over $204 a couple days ago.

Q: Do you still like India (PIN)?

A: If you want to pick an emerging market to enter, that’s the one. It’s a Hedge Fund favorite and has the largest potential for growth.

Q: What about oil stocks (USO)?

A: You don’t want to touch them at all; they look terrible. Wait for Texas tea to fall to $60 at the very least.

Q: What would you do with Netflix (NFLX)?

A: I would probably start scaling into buy right here. If you held a gun to my head, the one trade I would do now would be a deep in the money call spread in Netflix, now that they’ve had their $100 drop. And I can’t wait to see how the final season of House of Cards ends!

Q: If yields are going up, why are utilities doing so well?

A: Yields are going down right now, for the short term. We’ve backed off from 3.05% all the way to 2.81%; that’s why you’re getting this rally in the yield plays, but I think it will be a very short-lived event.

Q: Do you see retail stocks remaining strong from now through Christmas?

A: I don’t see this as part of the Christmas move going on right now; I think it’s a rotation into laggard plays, and it’s also very stock specific. Stocks like Nordstrom (JWN) and Target (TGT) are doing well, for instance, while others are getting slaughtered. I would be careful with which stocks you get into.

Good luck and good trading

John Thomas

CEO & Publisher

Diary of a Mad Hedge Fund Trader

Global Market Comments

June 14, 2018

Fiat Lux

SPECIAL GOLD ISSUE

Featured Trade:

(GUESS WHO'S BEEN BUYING GOLD?),

(GLD), (GDX), (SLV), ($SSEC),

(WILL GOLD COINS SUFFER THE FATE OF THE $10,000 BILL?),

(GLD), (GDX),

(TESTIMONIAL)

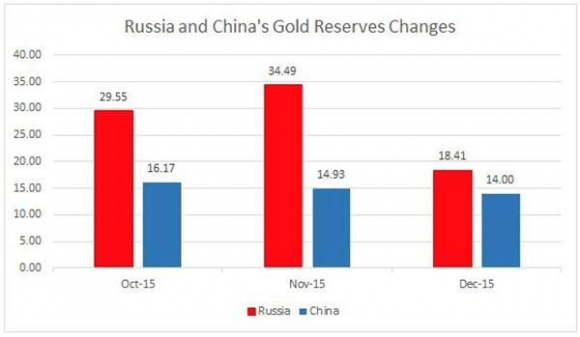

Gold bugs, conspiracy theorists, and permabears had some unfamiliar company last year.

While traders, individuals, and ETFs have been unloading gold for the past five years, central banks have been steady buyers.

Who had the biggest appetite for the barbarous relic?

Russia, which has been accumulating the yellow metal to avoid economic sanctions imposed by the United States in the wake of its invasion of the Ukraine.

Hot on its heels was China, which has flipped to a large net importer of gold to meet insatiable demand from domestic investors. China appears to be buying about 20 metric tonnes a month of the barbarous relic.

It seems the Chinese stocks markets ($SSEC) were not the great trading opportunity that they were hyped to be, which plunged 30% during the first two months of 2016, and is now 60% off its all-time high.

That's a big deal in a country that has no social safety net.

Many Chinese now prefer to buy gold instead of stocks, which are now considered too risky for a personal nest egg.

They are facilitated by the ubiquitous precious metal coin stores, which have recently sprung up like mushrooms in every city.

Only a few years ago, private ownership of gold resulted in China having your organs harvested by the government.

Central bank sellers have been few and far between. Venezuela has dumped about half its reserve to head off a recurring liquidity crisis.

Middle Eastern sovereign wealth funds cashed in some chips to deal with the oil price crash.

Canada has also been selling for reasons unknown to us south of the border.

All of this poses a really interesting question. Gold fell for the four consecutive years that central banks were buying, and the rest of the world was selling.

What happens when the rest of the world flips to the buy side?

My guess is that it goes up, which is why I have issued long side Trade Alerts on gold this year.

The conspiracy theorists will love this one.

Buried deep in the bowels of the 2,000-page health care bill was a new requirement for gold dealers to file Form 1099s for all retail sales by individuals over $600.

Specifically, the measure can be found in section 9006 of the Patient Protection and Affordable Care Act of 2010.

For foreign readers unencumbered by such concerns, Internal Revenue Service Form 1099s are required to report miscellaneous income associated with services rendered by independent contractors and self-employed individuals.

The IRS has long despised the barbaric relic (GLD) as an ideal medium to make invisible large transactions. Don't you ever wonder what happened to $500, $1,000, $5,000, $10,000, and $100,000 bills of your youth?

The $100,000 bill was only used for reserve transfers among banks and was never seen by the public. The other high denomination bills were last printed in 1945 and withdrawn from circulation in 1969.

Although the Federal Reserve claims on its website that they were withdrawn because of lack of use, the word at the time was that they disappeared to clamp down on money laundering operations by the mafia.

IN FACT, THE GOAL WAS TO FLUSH OUT MONEY FROM THE REST OF US.

Dan Lungren, a republican from California's third congressional district, a rural gerrymander east of Sacramento that includes the gold bearing Sierras, has introduced legislation to repeal the requirement, claiming that it places an unaffordable burden on small business.

Even the IRS is doubtful that it can initially deal with the tidal wave of paper that the measure would create.

Currency trivia question of the day: Whose picture is engraved on the $10,000 bill? You guessed it, Salmon P. Chase, Abraham Lincoln's Secretary of the Treasury.

Ever Wonder Where The $10,000 Bill Went?

Global Market Comments

May 24, 2018

Fiat Lux

Featured Trade:

(FRIDAY, JULY 27, 2018, ZERMATT, SWITZERLAND GLOBAL STRATEGY SEMINAR),

(ANNOUNCING THE MAD HEDGE TESTIMONIAL CONTEST),

(THE SECRET FED PLAN TO BUY GOLD),

(GLD), (GDX), (PALL), (PPLT)

The Armageddon crowd must be slitting their wrists today watching gold hit a new four month low in the wake of the global interest rate rally.

No flight to safety here.

The Armageddon crowd are the guys who are perennially predicting the collapse of the dollar, the default of the US government, hyperinflation, and the end of the world.

Better to keep all your assets in gold and silver, store at least a year?s worth of canned food, and keep your guns well oiled and supplied with ammo, preferably in high capacity magazines.

If you followed their advice, you lost your shirt.

I have broken many of these wayward acolytes of their money-losing habits. But not all of them. There seems to be an endless supply emanating from the hinterlands.

The Oracle of Omaha, Warren Buffet, often goes to great lengths to explain why he despises the yellow metal.

The sage doesn't really care about gold whatever the price. He sees it primarily as a bet on fear.

If investors are more afraid in a year than they are today, then you make money on gold. If they aren't, then you lose money.

The only problem now is that fear ain't working.

If you took all the gold in the world, it would form a cube 67 feet on a side, worth $5 trillion. For that same amount of money, you could own other assets with far greater productive earning power including:

*All the farmland in the US, about 1 billion acres, which is worth $2.5 trillion.

*8 Apples (AAPL), the largest capitalized company in the world, at $634 billion.

Instead of producing any income or dividends, gold just sits there and shines, making you feel like King Midas.

I don't know. With the stock market at an all time high, and oil trading at $50/barrel, a bet on fear looks pretty good to me right now.

I'm still sticking with my long term forecast of the old inflation-adjusted high of $2,300/ounce.

It is just a matter of time before emerging market central bank buying pushes it up there.

And who knows? Fear might make a comeback too.

Maybe Feeling Like King Midas is Not So Bad

Loyal followers of the Mad Hedge Fund Trader are well aware that I have been bearish on gold for the past five years.

However, it may be time for me to change that view.

A number of fundamental factors are coming into play that will have a long-term positive influence on the price of the barbarous relic. The only question is not if, but when the next bull market in the yellow metal will begin.

All of the positive arguments in favor of gold all boil down to a single issue: they?re not making it anymore.

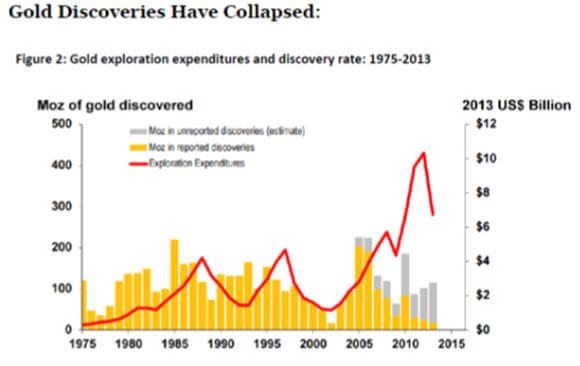

Take a look at the chart below and you?ll see that new gold discoveries are in free fall. That?s because falling prices have caused exploration budgets to fall off a cliff.

Gold production peaked in the fourth quarter of 2015, and is expected to decline by 20% for the next four years.

The industry average cost is thought to be around $1,400 and ounce, although some legacy mines can produce for as little as $600. So why dig out more of the stuff if it means losing more money?

It all sets up a potential turn in the classic commodities cycle. Falling prices demolish production, and wipe out investors. This inevitably leads to supply shortages.

When the buyers finally return, there is none to be had and price spikes can occur which can continue for years. In other words, the cure for low prices is low prices.

Worried about new supply quickly coming on-stream and killing the rally?

It can take ten years to get a new mine started from scratch by the time you include capital rising, permits, infrastructure construction, logistics and bribes. It turns out that the brightest prospects for new gold mines are all in some of the world?s most inaccessible, inhospitable, and expensive places.

Good luck recruiting for the Congo!

That?s the great thing about commodities. You can?t just turn on a printing press and create more, as you can with stocks and bonds.

Take all the gold mined in human history, from the time of the ancient pharaohs to today, and it could comprise a cube 63 feet on a side. That includes the one-kilo ($38,720) Nazi gold bars stamped with German eagles upon them, which I saw in Swiss bank vaults during the 1980?s.

In short, there is not a lot to spread around.

The long-term argument in favor of gold never really went away. That involves emerging nation central banks, especially those in China and India, raising gold bullion holdings to western levels. That would require them to purchase several thousand tonnes of the yellow metal!

So watch the iShares Emerging Market ETF (EEM). A bottom there could signal the end of the bear market for gold as well.

Sovereign wealth funds from the Middle East have recently been dumping gold to raise money. The collapse of oil prices has made it impossible to meet their wildly generous social service obligations.

Hint: governments in that part of the world that fail to deliver on promises are often taken out and shot.

When this selling abates, it also could well signal the final low in gold. That?s why I have been strongly advising readers to watch the price of Texas tea careful, as both it an gold should bottom on the same day.

Let me throw out one more possibility for you to cogitate over. Another big winner of rising precious metal prices is residential real estate, which people rush to buy as an inflation hedge. Remember inflation?

Tally ho!

Looks Like A ?BUY? to Me

Looks Like A ?BUY? to Me

I have not done a gold trade in yonks. That?s because it has been the asset class from hell for the past five years, dropping some 46% from its 2011 $1,927 high.

However, we are now in a brave new, and scarier world.

Given the extreme volatility of financial markets in recent months, all of a sudden keeping hedges on board looks like a good idea. I?m sure the next time stocks take a big dive, the barbarous relic will post a double digit gain.

So, this makes it an excellent hedge for my outstanding long S&P 500 (SPY) and short Treasury (TLT) ?RISK ON? positions.

Also supporting the yellow metal is what I call the ?Big Figure Syndrome?. And there is no bigger number than $1,000, the upper strike on this trade.

While rising interest rates is always bad for gold, the realization is sinking in that it is definitely NOT off to the raises now that the Federal Reserve has at last begun a tightening cycle.

Personally, I expect ?one and done? to gain credence by midyear, once implications of six months of Fed inaction starts to sink in. As long as rates rise slowly, or not at all, we have a gold positive environment.

The Treasury bond market has already figured this out, with yields now lower than when the Fed carried out its 25 basis point snugging.

In addition, gold has recently found some new friends. Russia has come out of nowhere in recent months and emerged as one of the world?s largest buyers. This is because economic sanctions brought down upon them by the invasion of Crimea and the Ukraine is steering them away from dollar assets.

Keep in mind that this is only a trade worth about $200 to the upside. Then, I?ll probably sell it again.

I am avoiding the Market Vectors Gold Miners ETF (GDX) for now, as the next stock market swoon will take it down as well, no matter what the yellow metal does.

But get me a good price and a rising stock market, and I?ll be in there with another Trade Alert.

My interest might even expand to include the world?s largest gold miners, Barrick Gold (ABX) and Newmont Mining (NEM).

The new bull market in gold is still at least five years off. That?s when it picks up a huge tailwind from a massive demographic expansion by the Millennials, which eventually leads to much higher inflation.

Also by then, China and other emerging nations will begin to raise their gold reserve holdings to western levels. This will require the purchase of several thousand metric tonnes! That?s when my long-term forecast of $5,000/ounce will finally come true.

With conditions as grim as they were in 2015, you would have thought the price of gold was going to zero.

It didn?t.

While no one was looking, the average price of gold production has soared from $5 in 1920 to $1,300 today. Over the last 100 years, the price of producing gold has risen four times faster than the underlying metal.

It?s almost as if the gold mining industry is the only one in the world which sees real inflation, which has seen costs soar at a 15% annual rate for the past five years.

This is a function of what I call ?peak gold.? They?re not making it anymore. Miners are increasingly being driven to higher risk, more expensive parts of the world to find the stuff.

You know those tires on heavy dump trucks? They now cost $200,000 each. Barrick Gold (ABX) didn?t try to mine gold at 15,000 feet in the Andes, where freezing water is a major problem, because they like the fresh air.

What this means is that when the spot price of gold falls below the cost of production, miners will simply shout down their most marginal facilities, drying up supply. That has recently been happening on a large scale.

This inevitably leads to a shortage of supply, and a new bull market, i.e., the cure for low prices is low prices.

They can still operate and older mines carry costs that go all the way down to $600. No one is going to want to supply the sparkly stuff at a loss.

That should prevent gold from falling dramatically from here.

I am constantly barraged with emails from gold bugs who passionately argue that their beloved metal is trading at a tiny fraction of its true value, and that it is really worth $5,000, $10,000 or even $50,000 an ounce.

They claim the move in the yellow metal we are seeing is only the beginning of a 30-fold rise in prices similar to what we saw from 1972 to 1979, when it leapt from $32 to $950.

To match the 1936 monetary value peak, when the monetary base was collapsing and the double top in 1979 when gold futures first tickled $950, this precious metal has to increase in value by eight times, or to $9,600 an ounce.

I am long term bullish on gold, other precious metals, and virtually all commodities for that matter.

The seven year spike up in prices we saw in the seventies, which found me in a very long line in Johannesburg, South Africa to unload my own Krugerrand's in 1979, was triggered by a number of one off events that will never be repeated.

Some 40 years of demand was unleashed when Richard Nixon took the US off the gold standard and decriminalized private ownership in 1972. Inflation then peaked around 20%. Newly enriched sellers of oil had a strong historical affinity with gold.

South Africa, the world?s largest gold producer, was then a boycotted international pariah and teetering on the edge of disaster. We are nowhere near the same geopolitical neighborhood today, and hence my more subdued forecast.

But then again, I could be wrong.

The previous bear market in gold lasted 18 years, from 1980 to 1998, so don?t hold your breath.

What should we look for? When your friends start getting surprise, out of the blue pay increases, the largest component of the inflation calculation. That is happing now in the technology and the new US oil fields, but nowhere else.

It could be a long wait, possibly into the 2020?s, until shocking wage hikes spread elsewhere.

Ready For a Bounce

Ready For a Bounce

One of the most impressive moves in the wake of the Fed?s Thursday move to maintain ultra low interest rates was to be found in gold.

In the run up to the flash headline on the Fed non-announcement, the yellow metal rocketed $40. The action was even more impressive in silver (SLV), which tacked on 90 cents, or 6.6%.

Now, here is the really bad new.

The fundamentals for the barbarous relic are about to turn from bad to worse. The prospect is sending perma bulls rushing to update their life insurance policies.

This is the dilemma. To sell, or not to sell?

Gold does well when interest rates are low or falling. That reduces the opportunity cost of owning the barbarous relic, which doesn?t pay any interest or dividends. It just sits there, shines, and collects dust.

It also runs up storage and insurance fees, effectively hampering it with a real negative yield.

So what happens when the fundamentals flip from good to bad?

WARNING: if you have been carefully salting away one ounce American gold eagle coins in your safe deposit box for the past several years, you are not going to want to read this.

If I am right, and we have put in a generational high in bond prices and a low in yields, interest rates are going to rise. Initially, for the first couple of years, they may not do it a lot. But eventually they will.

That is terrible news for gold owners.

The market clearly thinks this is happening. Take a look at the charts below. Gold is making its third run at support at $1,100 over the past 18 months. Break this and cascading, stop loss selling will ensue, taking gold down to $1,000.

That, by the way, is my jeweler?s downside.

Caution: My jeweler is always right. There he plans to load the boat with bullion, which his business consumes in creating baubles for clients, like me.

It wasn?t supposed to be like this, as the arguments in favor of buying the yellow metal were so clear five years ago.

The exploding national debt was about to force the US government to default on its debt. It almost did, thanks to congressional gamesmanship.

Massive trade deficits with China and the Middle East were supposed to collapse the value of the US dollar.

The election of Barack Obama was predicted to lead to the creation of a socialist paradise. We were all going to need gold coins to bribe the border guards in order to get out of the country with only what we could carry.

The problem is that none of this happened.

The US budget deficit is falling at the fastest rate in history, from a $1.5 trillion peak to as low as $400 billion this year. Foreign capital pouring into the US has pushed the greenback to multiyear highs, and loftier altitudes beckon.

Since the 2009 inauguration, the S&P 500 has tripled off its intraday low. This has enriched the 1% more than any other group, who have seen their wealth increase at the fastest pace on record.

The trade deficit with China is now balancing out with America?s own burgeoning surpluses in services and education. As for the Middle East, we make our own oil now, thanks to fracking, so why bother.

To see such dismal price action in the barbarous relic now is particularly disturbing. Traditionally, the Indian ?Diwali? gift giving season heralded the beginning of a multi month bull run in gold. It ain?t happening.

In fact the dumping of speculative long positions by long-term traders used to this is accelerating the melt down. That?s because gold, silver, or any other inflation hedges have no place in a deflationary, reach for yield world.

Mind you, I don?t think gold is going down forever.

Eventually, emerging central banks will bid it back up, as they have to buy an enormous amount just to bring their reserve ownership up to western levels. Inflation is likely to return in the 2020?s, as my ?Golden Age? scenario picks up speed.

In the meantime, you might want to give those gold eagles to your grand kids. By the time they go to college, they might be worth something.

?

Better to Look than to Buy

Better to Look than to Buy

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.