One of my Concierge clients holds a weekly staff meeting. Each employee is told his family is being held hostage and can only be rescued if they recommend the top-performing stock for the coming week. Then everyone throws in their two cents worth.

Last week, for the first time in the company’s history, no one could come up with a single name, even if it meant sacrificing their family (nobody was really sacrificed).

That speaks volumes.

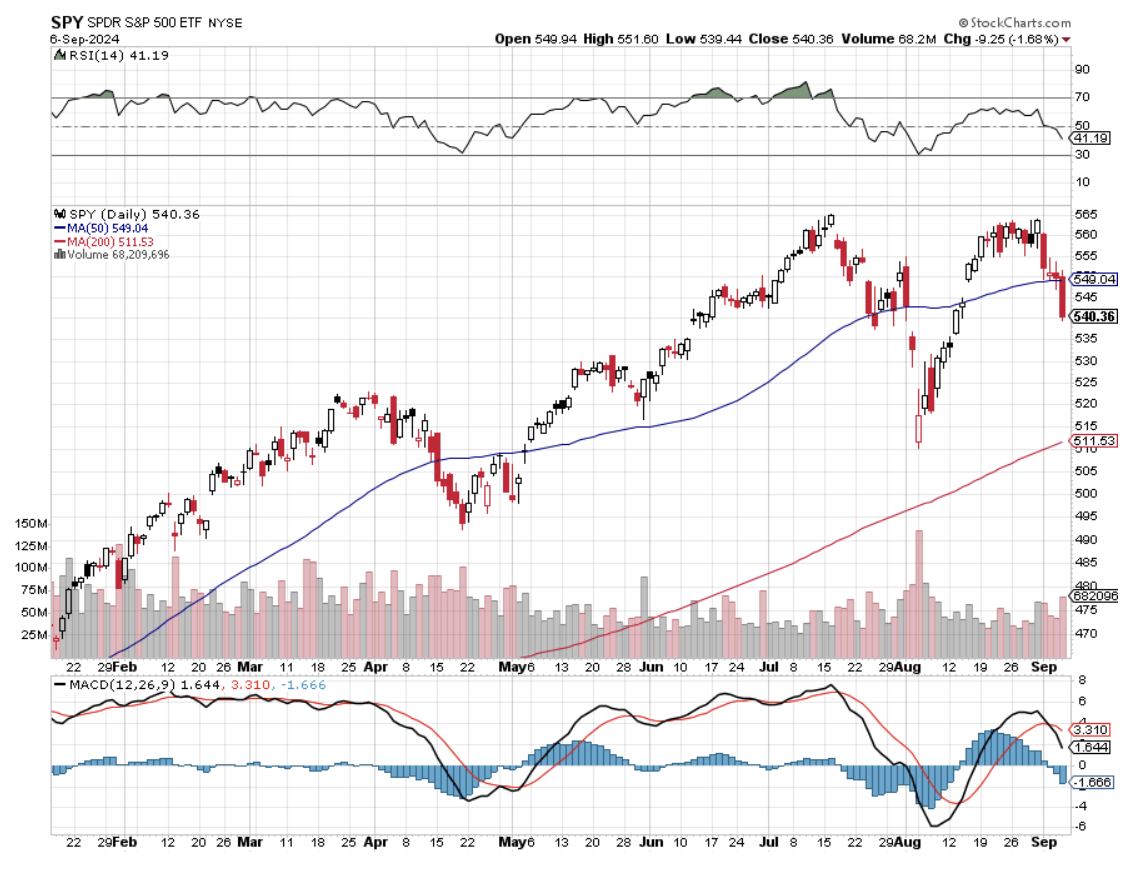

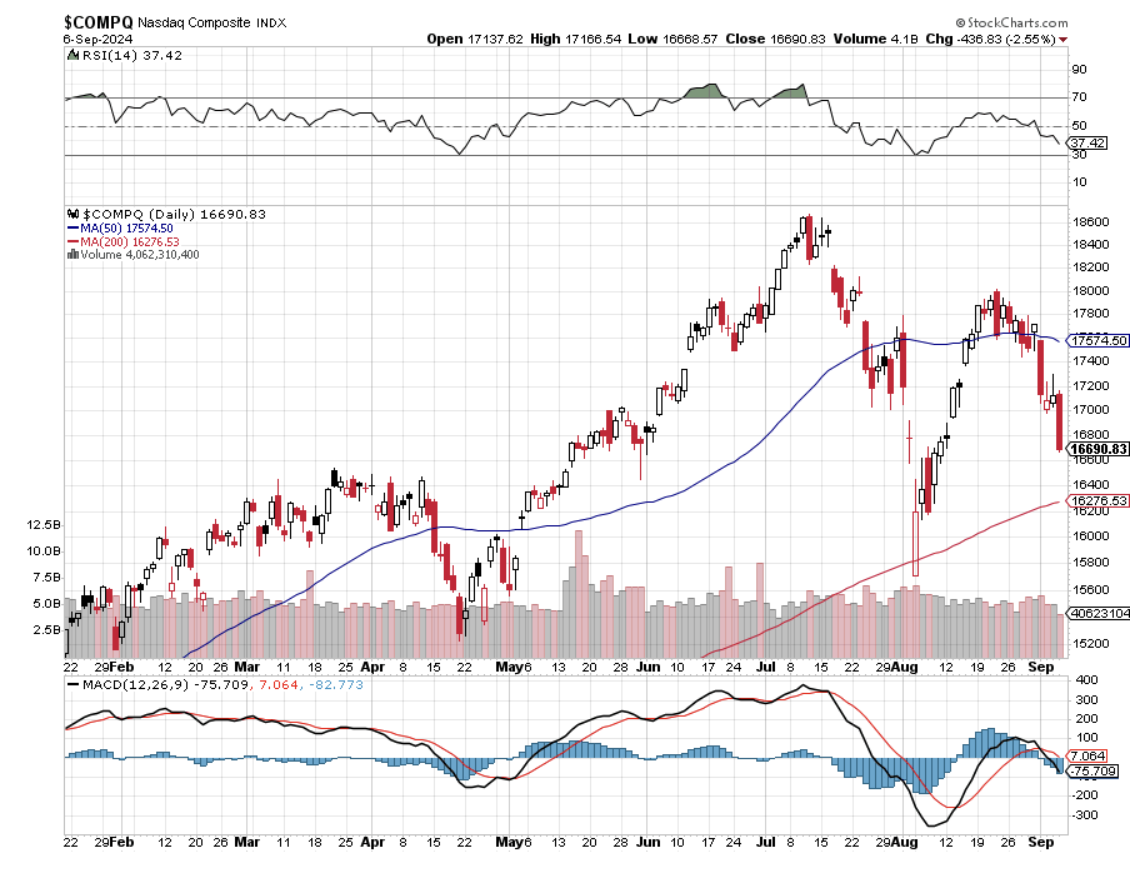

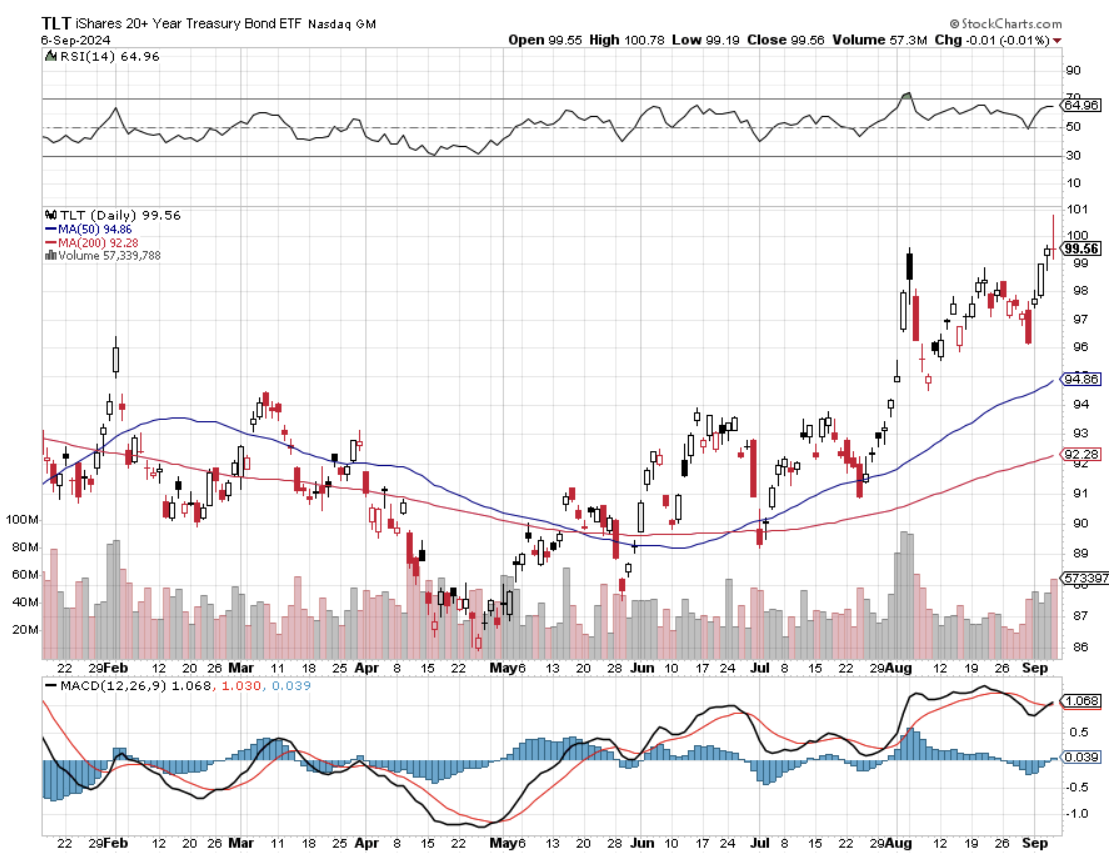

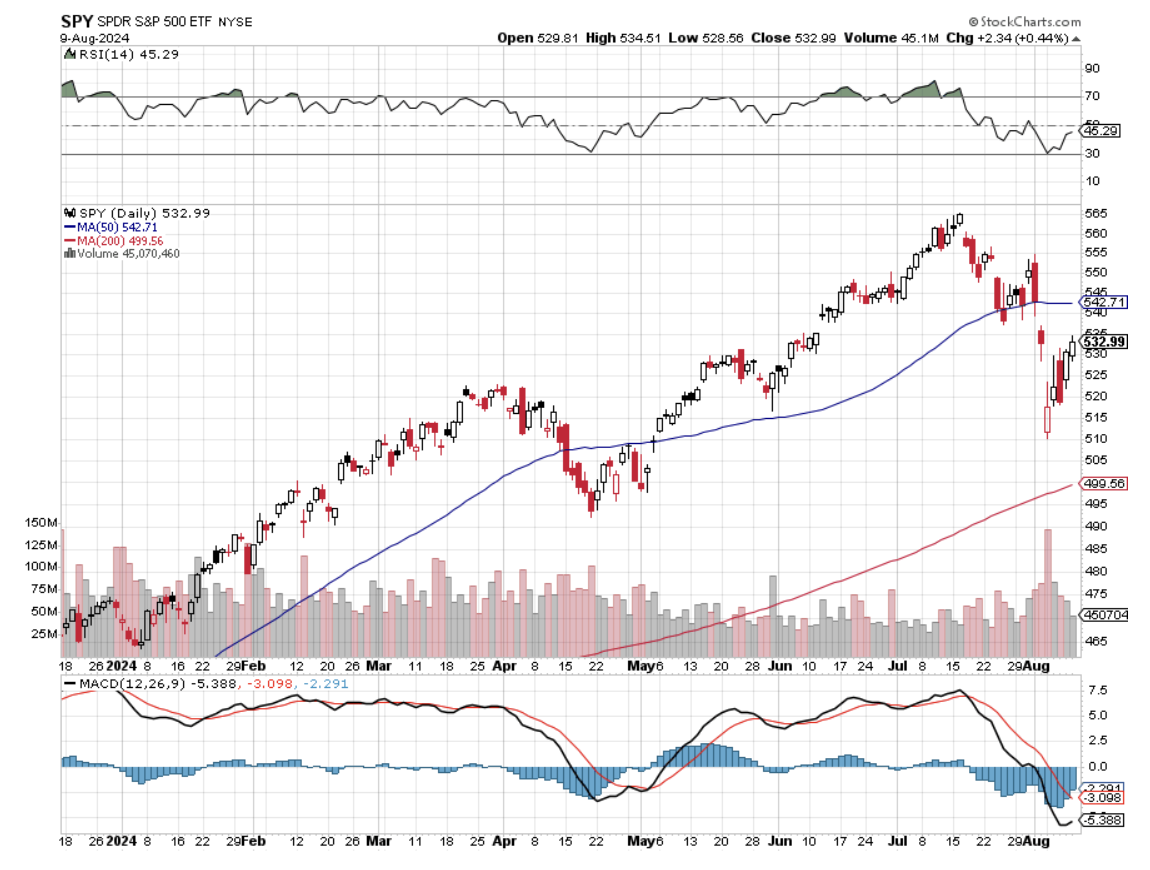

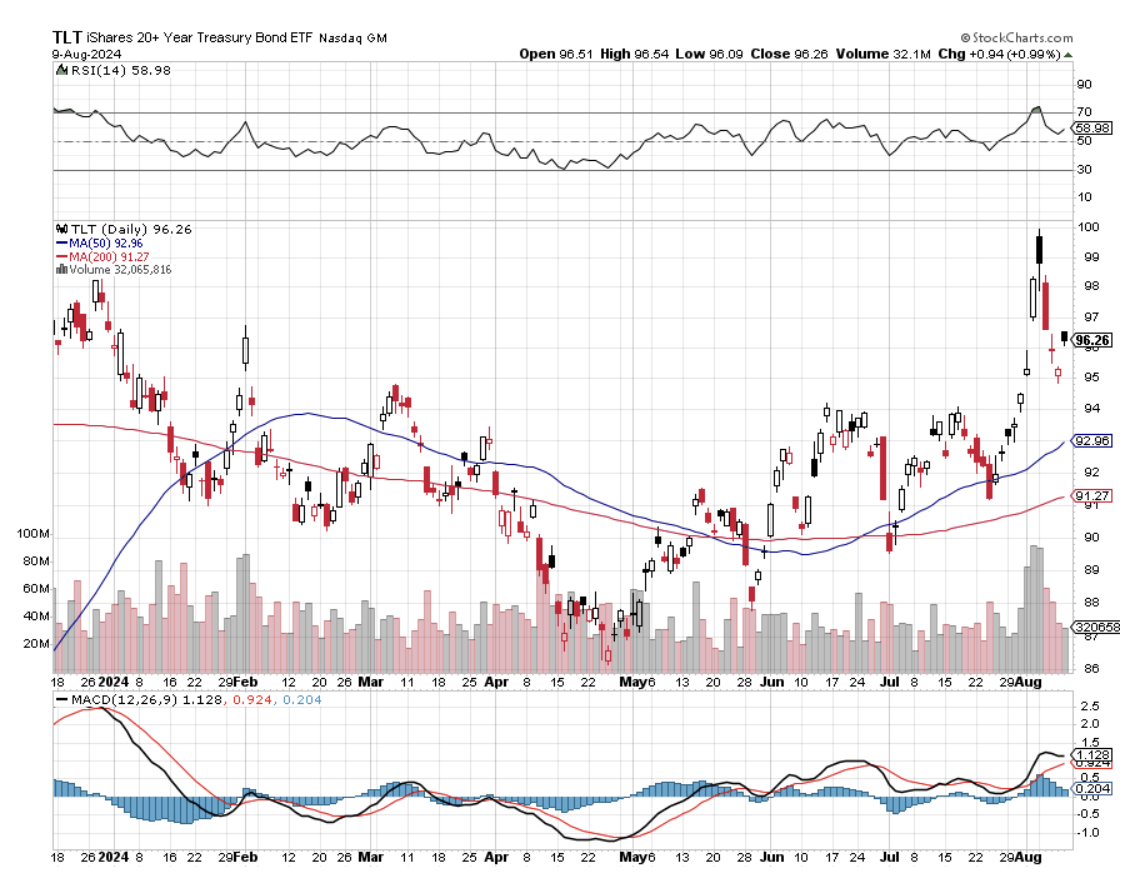

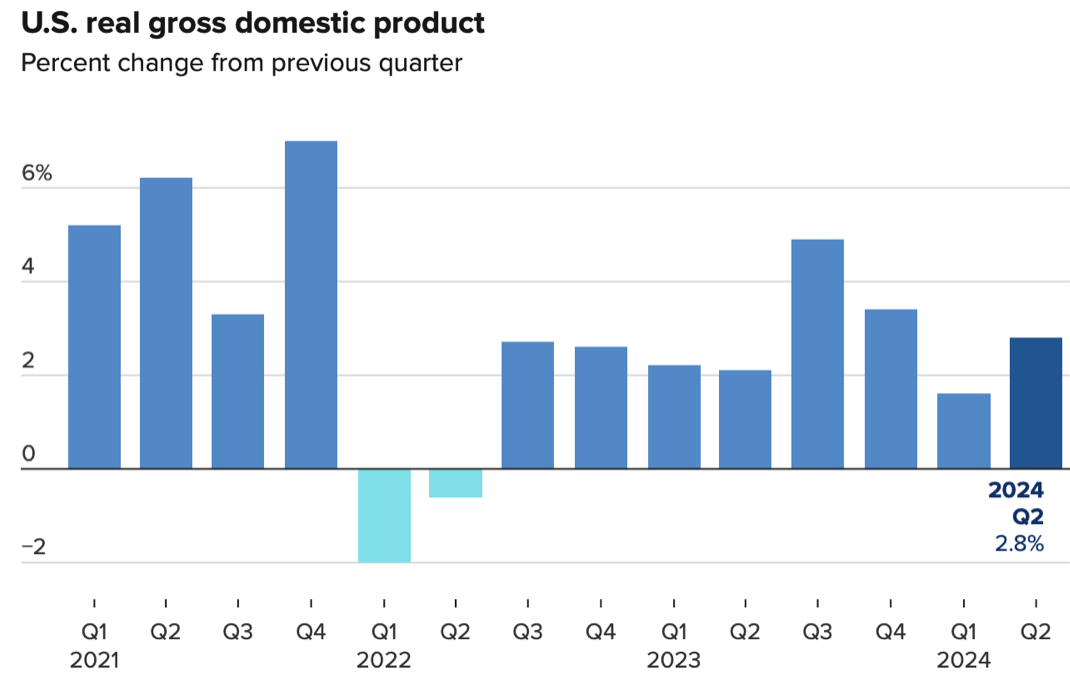

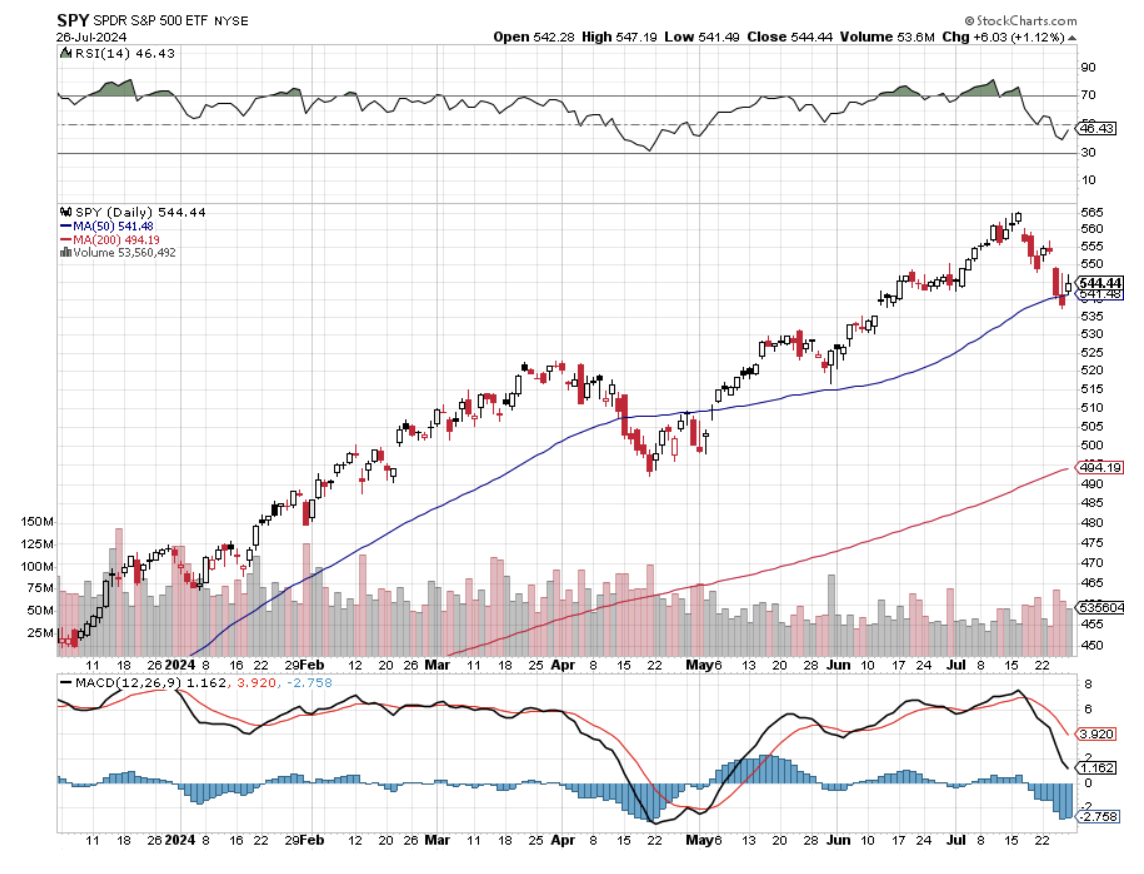

In fact, until last week, every asset class in the market was discounting an imminent recession: Commodities (COPX), energy (USO), real estate (ARE), and the US dollar (UUP). Reliable recession hideouts like bonds (TLT), fixed income (JNK), and gold (GLD) caught an endless bid. Only the stock market (SPY), (NASD) wasn’t reading from the same music sheet.

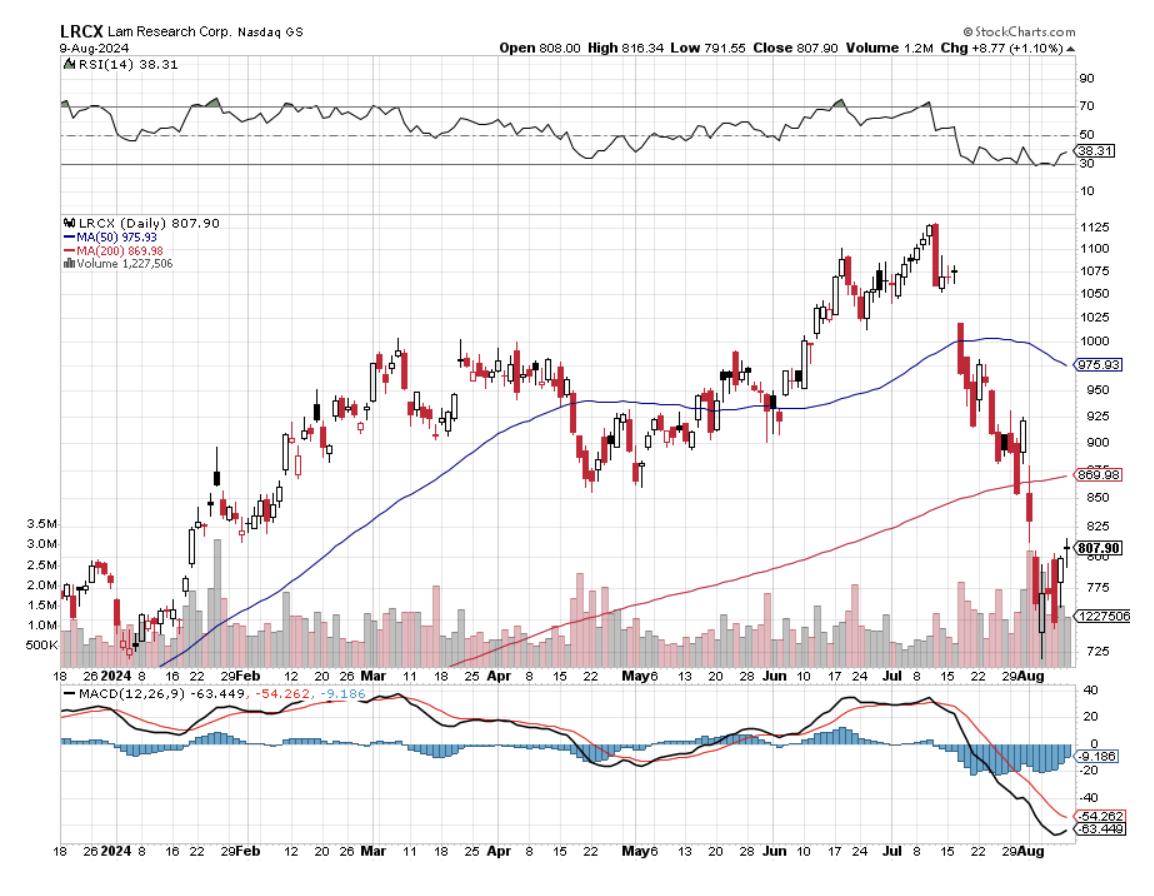

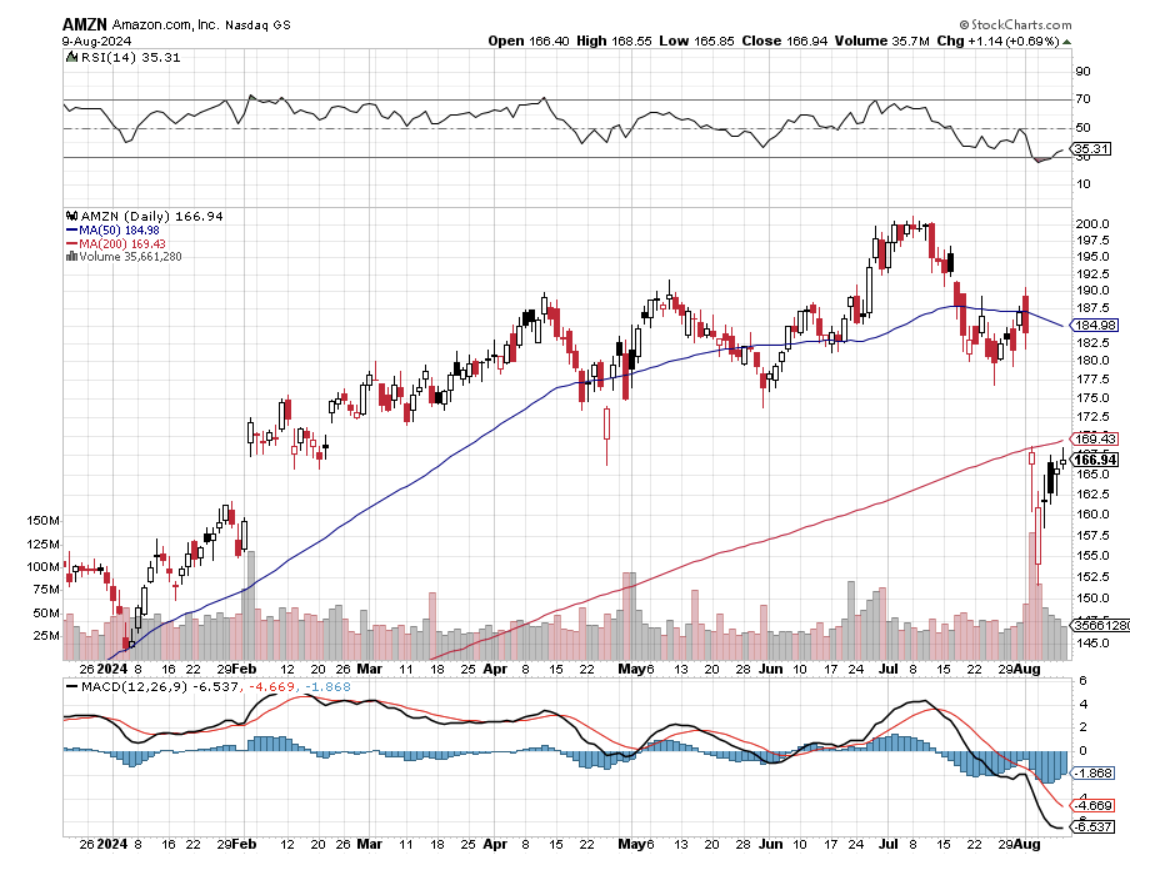

Well, stocks finally got the memo, delivering the worst week in 2 ½ years. Suddenly, the glass has gone from half full to half empty. Permabears have suddenly morphed from complete idiots to maybe having something to say. Here it is only September 9 and the Month from Hell is already living up to its awful reputation. Is the stock market the slow learner in the bunch?

I came back from Europe in August rested, refreshed, invigorated, and in a near state of panic. The last 11% rally in the (SPY) made absolutely no sense to me whatsoever. Either the September jobs data would come in hot, canceling the Fed’s expected interest rate cut. Or, the data would come in cold, proving that the Fed waited too long to cut rates and inviting a recession, causing stocks to tank.

It would have been one of the worst self-inflicted wounds and own goals of all time.

What was especially dangerous was that we were going into the worth trading month of the year, September, with the (SPY) showing a crystal-clear double top on the charts.

It was a perfect lose/lose situation.

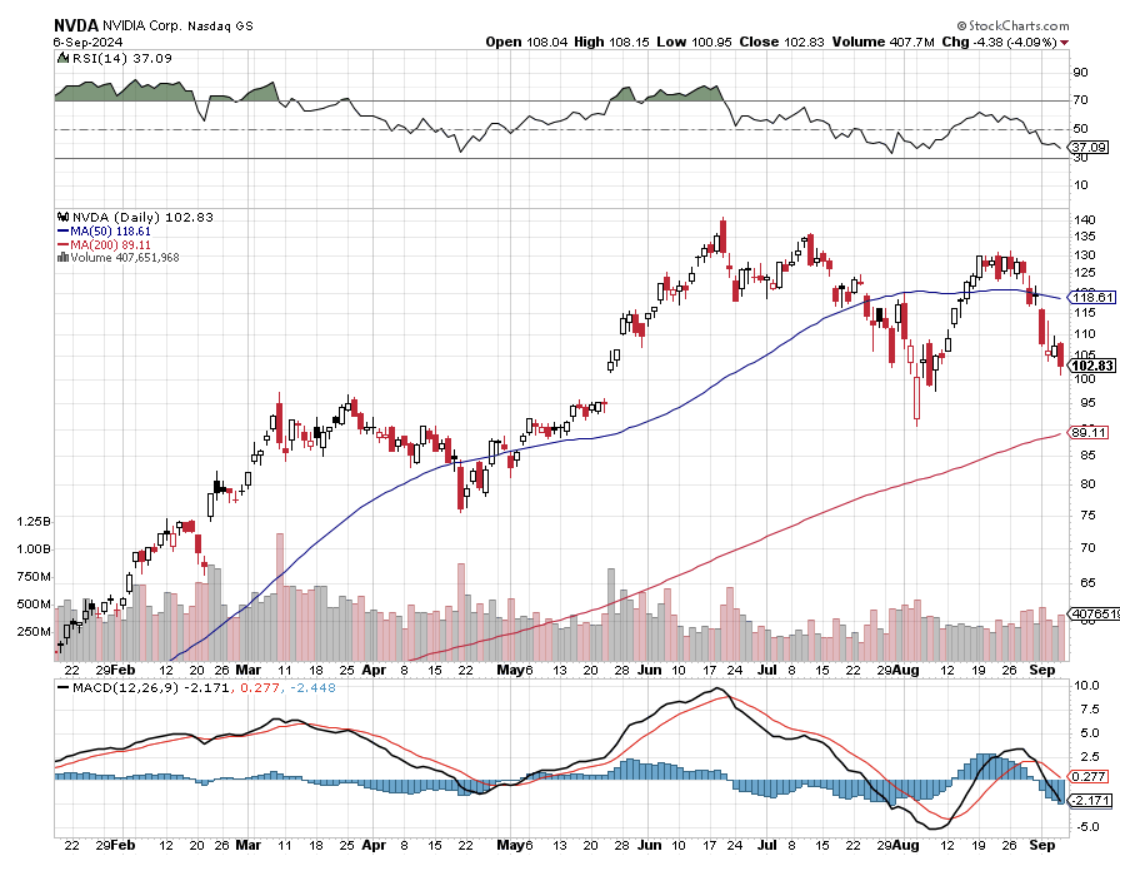

Seasonals are important, especially this month. This is because most mutual funds run an annual year that ends on September 30. To window dress their books and those glossy marketing brochures, they sell all their losers (think energy) in September and use the cash to buy more of their winners in October. (NVDA) yes, (XOM) not so much. This creates a swing in the indexes every year of 10%-20%.

To learn more about the seasonals, read tomorrow’s letter in detail, IF YOU SELL IN MAY AND GO AWAY, WHAT TO DO IN SEPTEMBER?

So I did what I usually do when the market refuses to give me marching orders. I let all my positions expire with the August 16 options expiration, took back the cash, and then sat on my hands. Suddenly, a 100% cash position was looking like a stroke of genius. It cleared the cobwebs, moved the fog away from my eyes, and took the monkey off my back all in one fell swoop.

And you know what? After surveying my big hedge fund clients, I learned they were doing exactly the same thing.

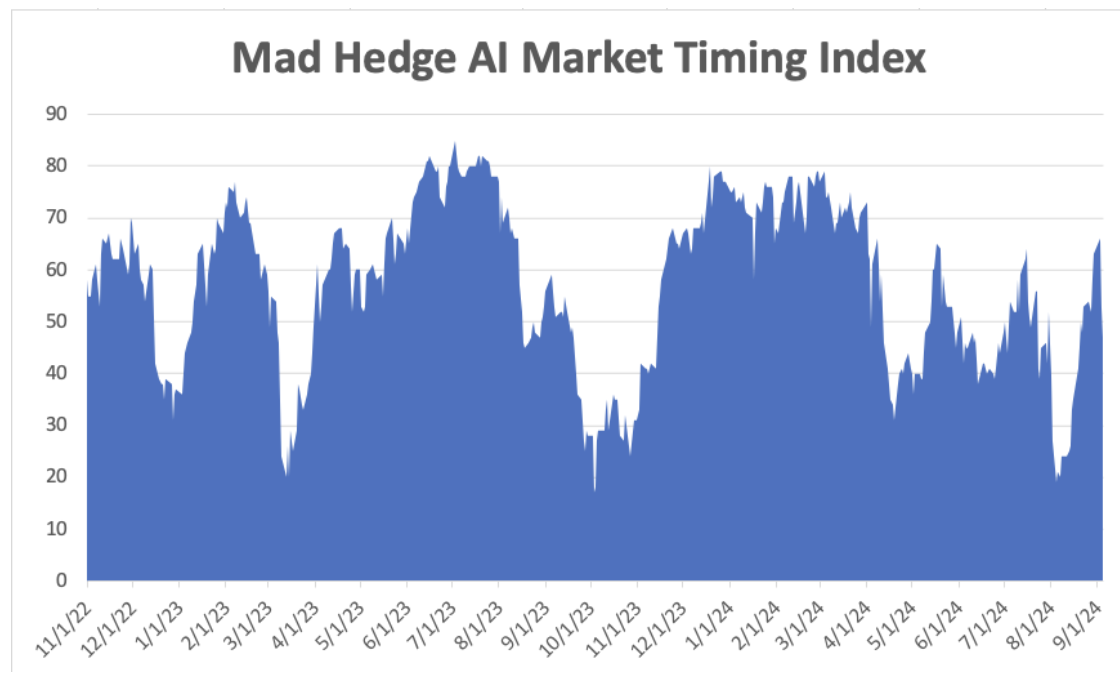

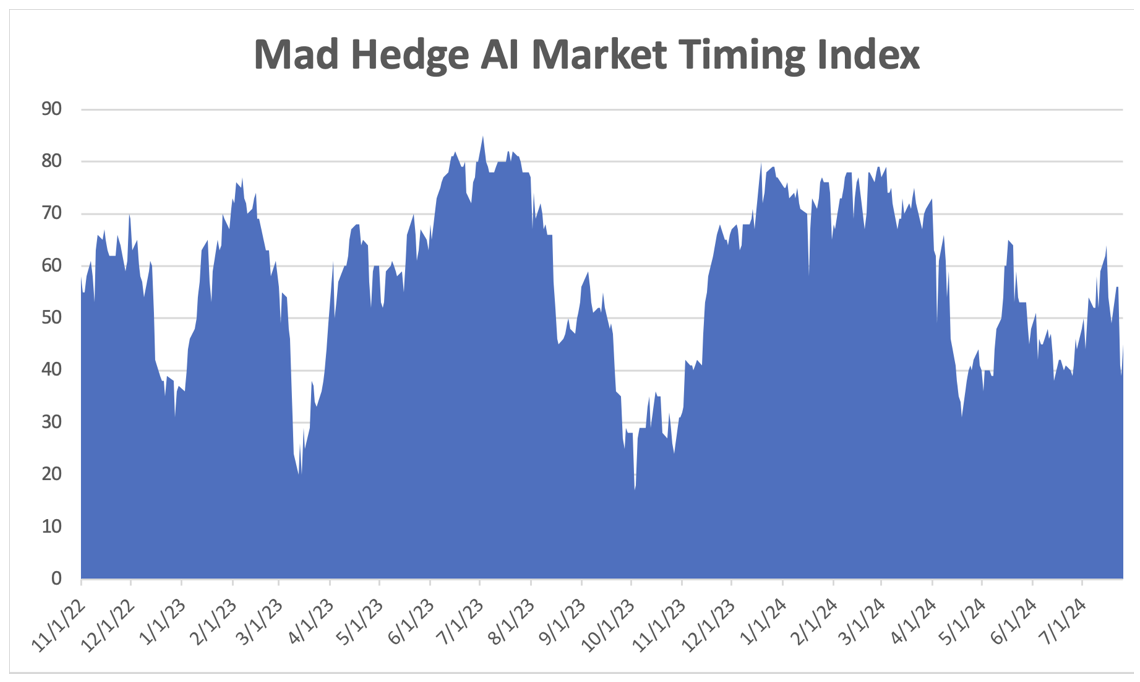

Let me pass on another piece of interesting intel. All of the many algorithms the hedge fund industry follows are bunching up around two specific bottoms for the stock market in coming months: September 18, the Fed rate cut day, and October 22, two weeks before the presidential election.

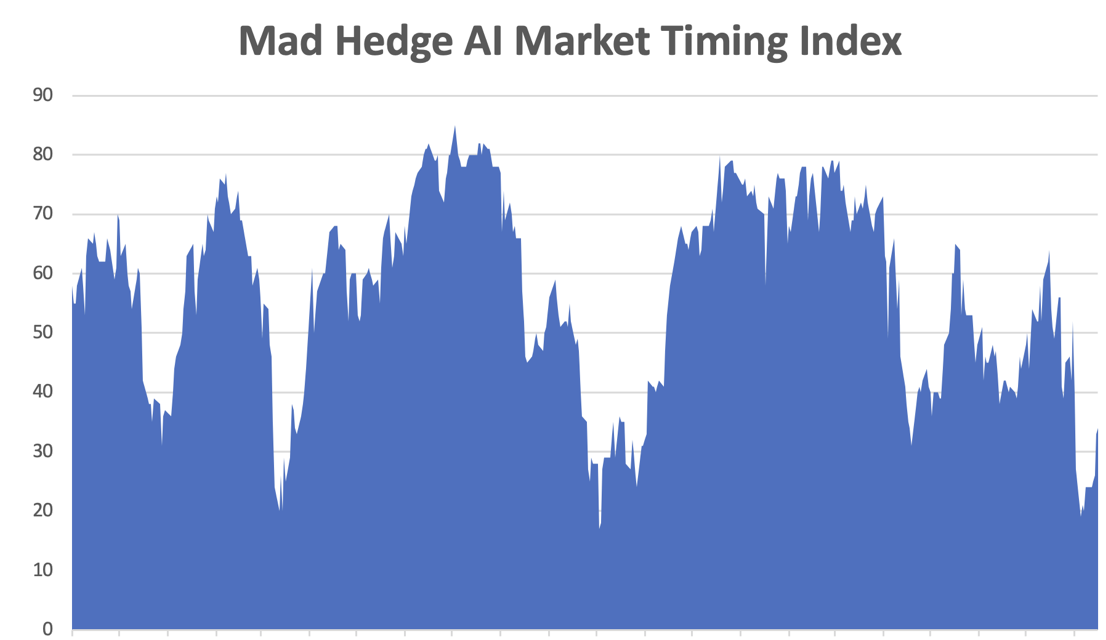

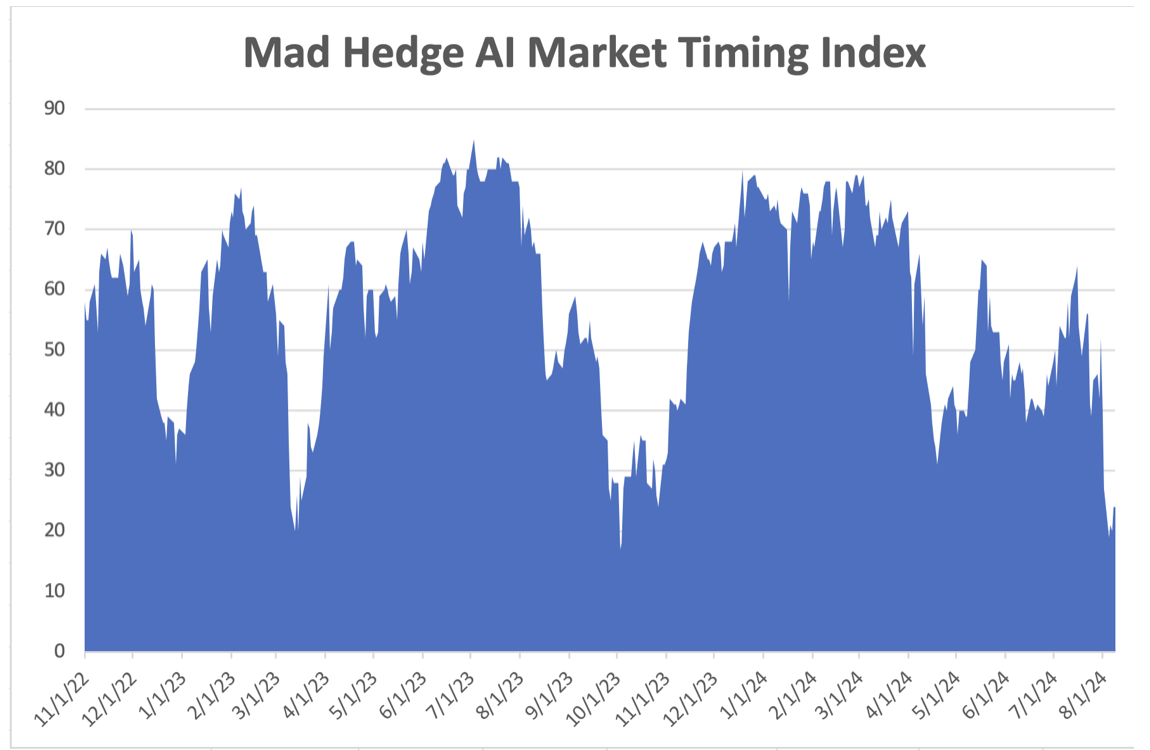

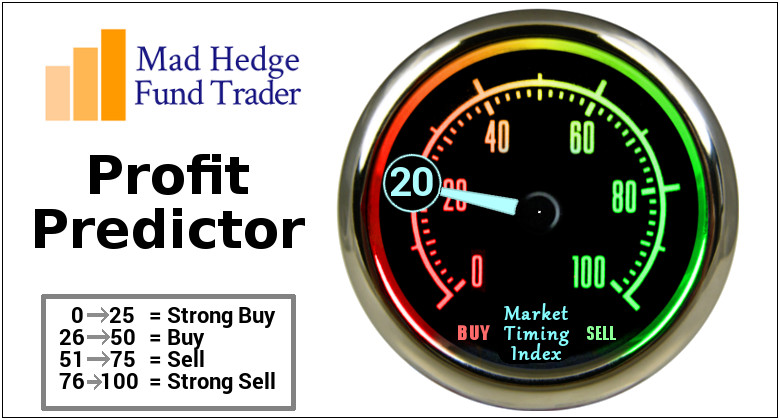

With any luck, other classic “BUY” signals will kick in at the same time with the Mad Hedge Market Timing Index below 20 by then and the Volatility Index ($VIX) over $30. It could be the best entry point of the year.

What has been fascinating is how much money has been pouring into the interest rate plays I have been banging the table about for the last six months. When was the last time the stock market has been led by AT&T (T), Altria (MO), and Crown Castle International (CCI)? You might have to look behind the radiator to find some old, dusty research on these names.

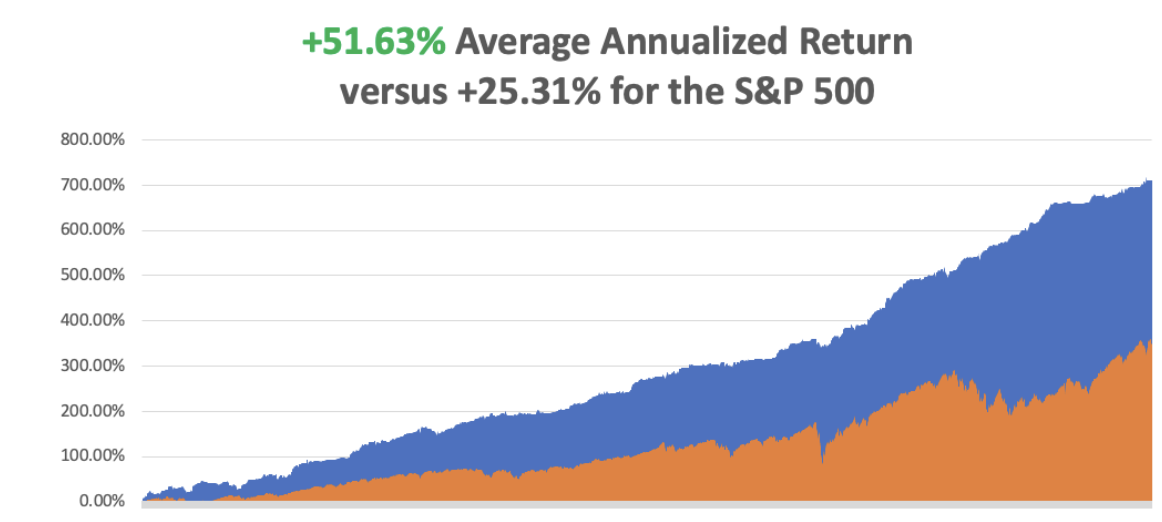

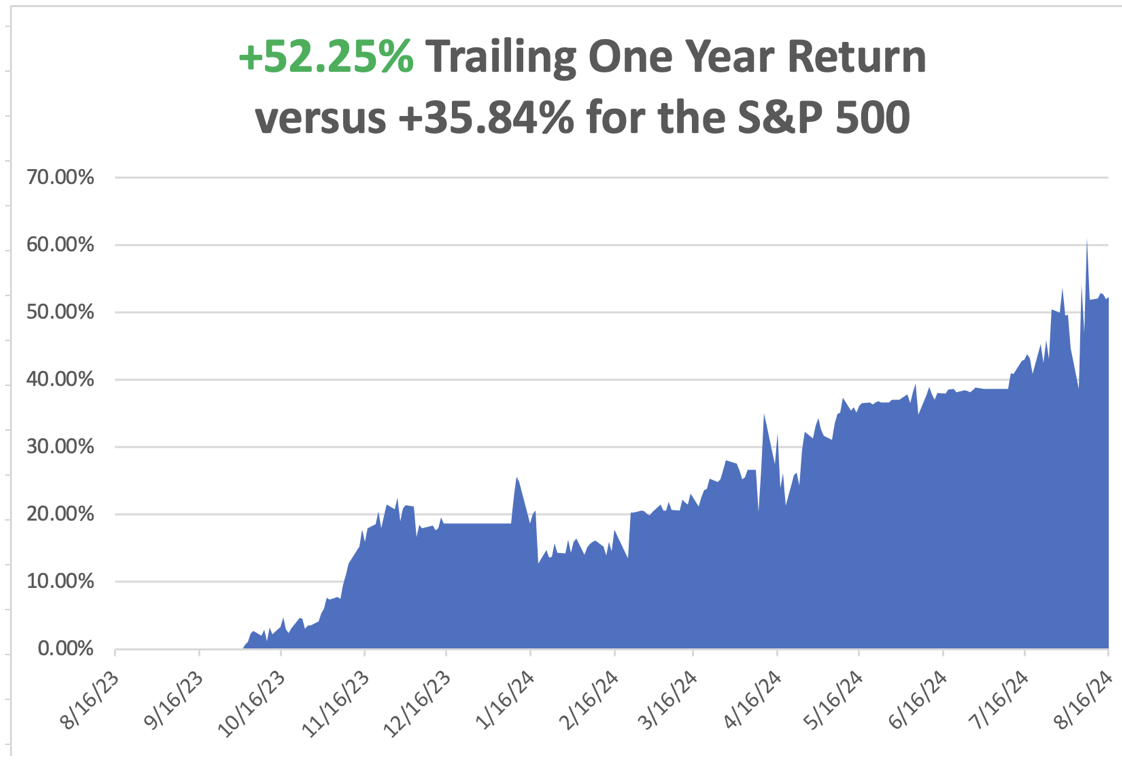

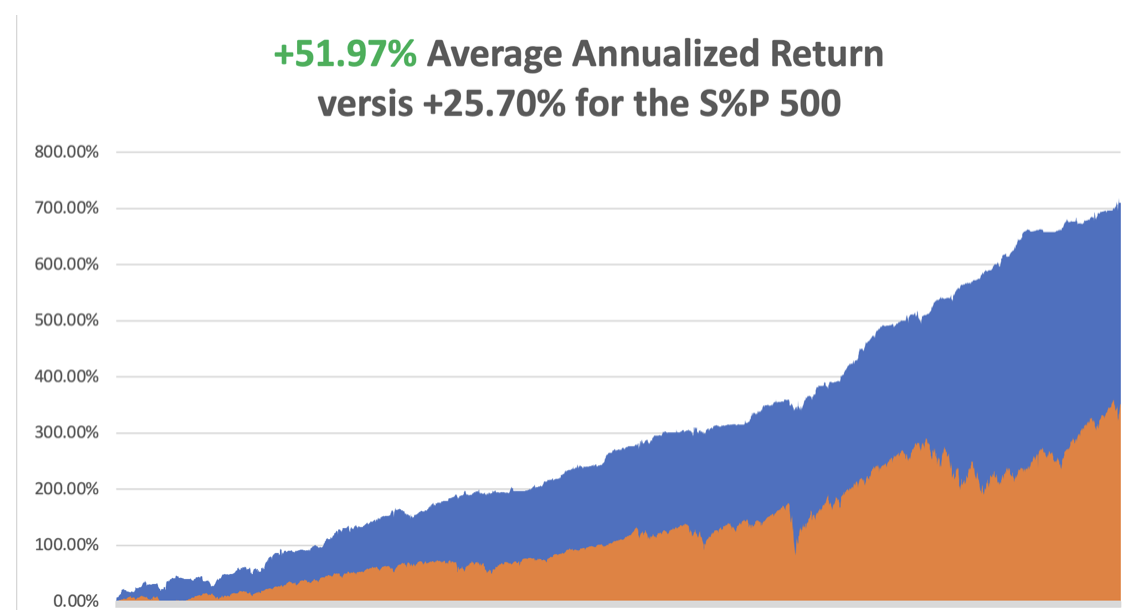

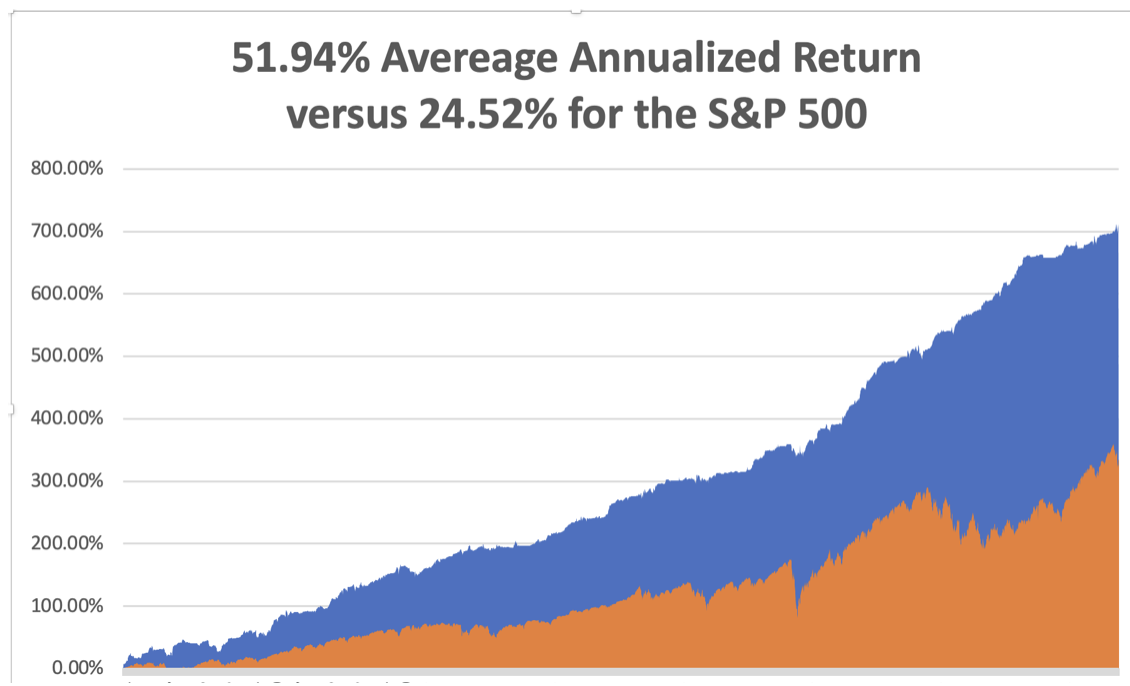

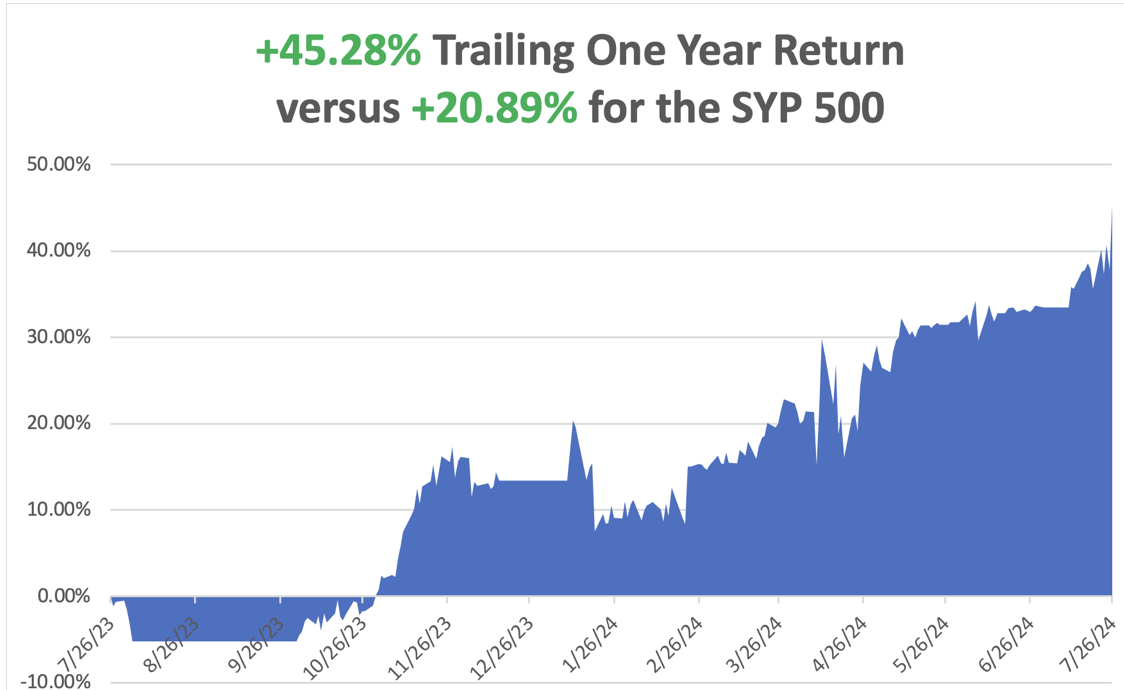

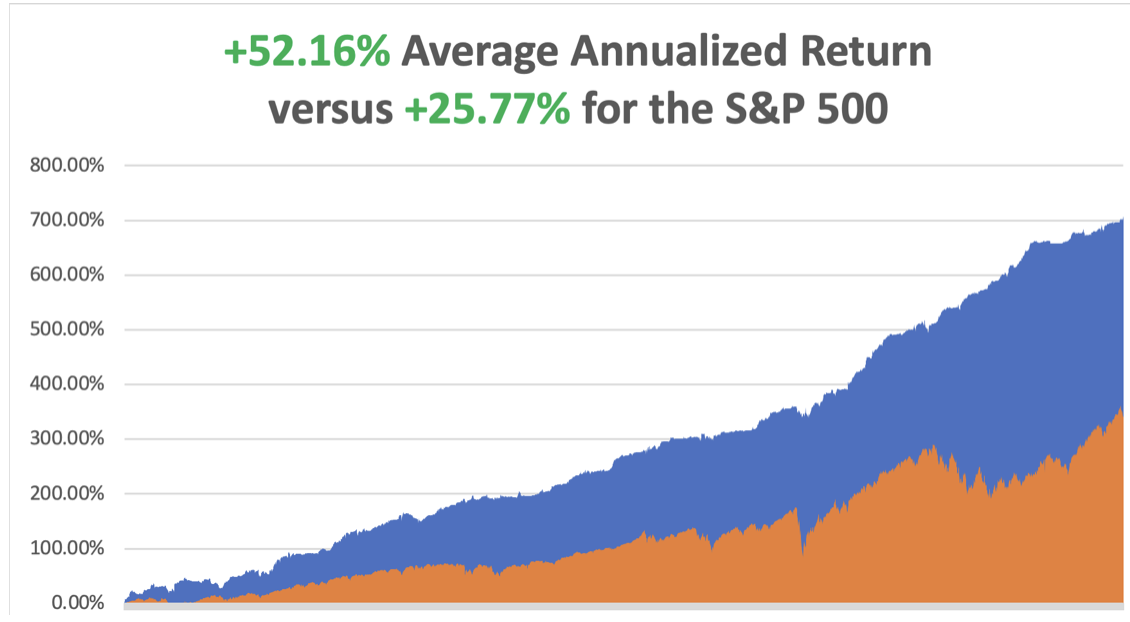

So far in September, we are down by -1.21%. My 2024 year-to-date performance is at +33.49%. The S&P 500 (SPY) is up +13% so far in 2024. My trailing one-year return reached +51.89. That brings my 16-year total return to +710.12. My average annualized return has recovered to +51.63%.

I executed only one trade last week, covering a short in Tesla at cost. I am now maintaining a 100% cash position. I’ll text you next time I see a bargain in any market. Now there is none. There is no law dictating that you have to have a position every day of the year. Only your broker wants you to trade every day.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 47 of 66 trades have been profitable so far in 2024, and several of those losses were really break-even. That is a success rate of +72.24%.

Try beating that anywhere.

Nonfarm Payroll Report Fades at 142,000, but the Headline Unemployment Rate stays at 4.2%. More shocking is that the previous two months saw substantial downward revisions. The BLS cut July’s total by 25,000, while June fell to 118,000, a downward revision of 61,000. If the Fed doesn’t cut by 0.50% on September 18, the stock market will crash.

Broadcom Beats and Stock Tanks driven by strong sales of its AI products and VMware software. But management’s guidance for the current quarter disappointed investors, sending shares of the chipmaker down nearly 7% in the after-market. This is too harsh of a reaction to an otherwise solid print. Buy (AVGO) on dips.

ADP Employment Change Report Hits 3 ½-Year Low, up only 99,000 in August. Economists polled had forecast private employment would advance by 145,000 positions after a previously reported gain of 122,000.

Biden Blocks Nippon Steel Takeover of US Steel, no doubt to save the jobs these deals usually destroy. Good thing we got out of the (X) LEAPS a year ago at max profit. (X) dropped 20% on the news. Not a good time to concentrate on industry.

No Subpoenas Here Says NVIDIA, refuting rumors that it was the target of an antitrust action. Don’t believe everything you read on the internet.

The Yield Curve has De-Inverted, meaning that short-term interest rates have fallen below long-term ones. Two-year interest rates at 3.72% are now 0.03% lower than ten-year ones at 3.75%. It’s a clear signal to the Fed that rates must be cut soon.

Weekly Jobless Claims Drop 5,000 to 227,000. The weekly jobless claims report from the Labor Department on Thursday, the most timely data on the economy's health, also showed unemployment rolls shrinking to levels last seen in mid-June. It reduces the urgency for the Federal Reserve to deliver a 50-basis points interest rate cut this month.

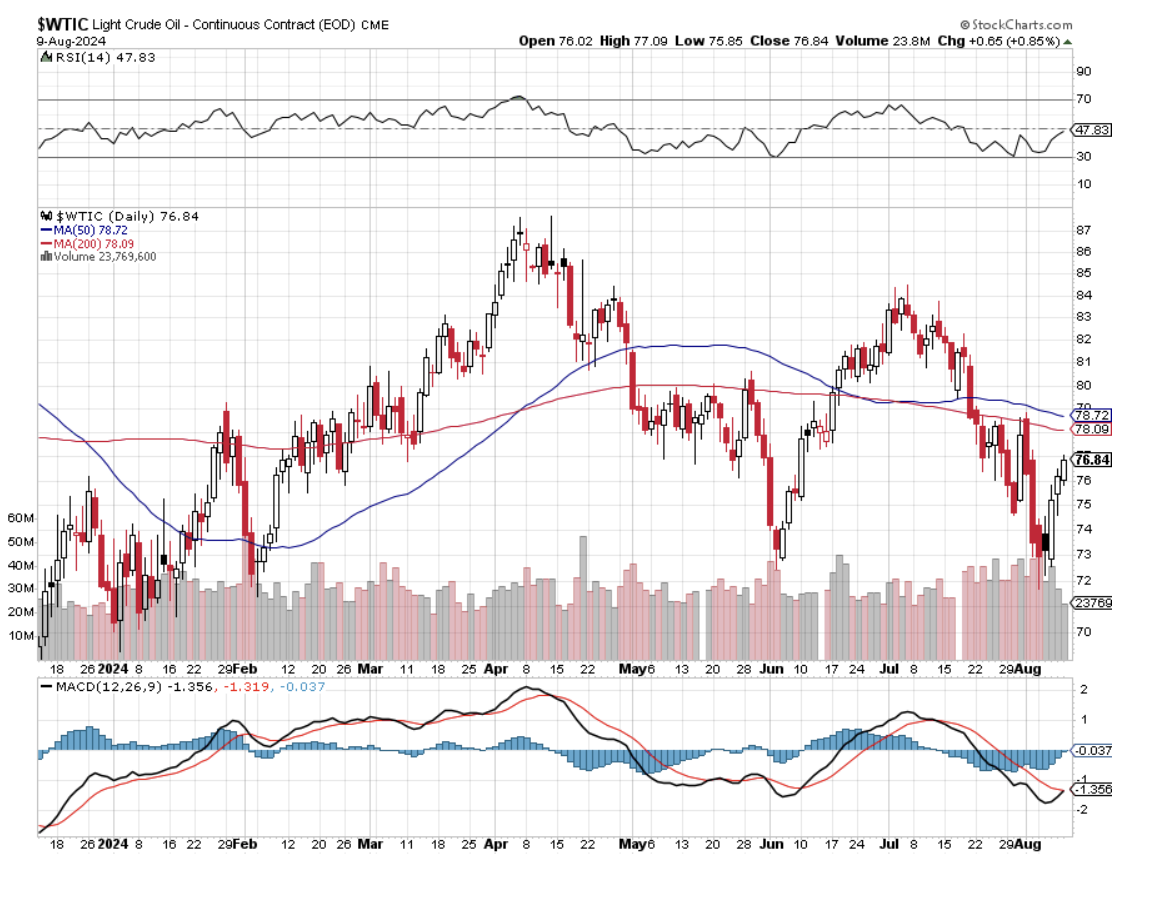

US Oil Production Hits All-Time High. In August 2024, U.S. oil production hit a record 13.4 million barrels per day according to the U.S. Energy Information Administration. Big Oil has become more productive as horizontal drilling and hydraulic fracturing, which is also known as fracking, have seen technological breakthroughs. The fossil fuel industry benefits from tax incentives, such as the intangible drilling costs tax credit, that are built into the tax code. The intangible drilling costs tax break is expected to benefit oil and gas companies by $1.7 billion in 2025 and $9.7 billion through 2034

Crude Oil Now Down on the Year, after a precipitous weekend selloff. Blame a weak China, lost OPEC discipline, and overproduction by Iraq. The bearish Goldman Sachs commodities report was also a factor. Avoid the worst-performing asset class in the market.

Eli Lilly is now a trillion-dollar stock, the first Biotech to do so. The drug giant is riding the wave of Mounjaro and Zepbound, its blockbuster injectable GLP-1 medications for weight loss. The drugs are also used to treat diabetes and cardiovascular disease. Eli Lilly’s shares have soared 65% this year.

Goldman Goes Big on Gold. Central banks in emerging market countries are continuing to buy gold — with purchases tripling since the middle of 2022 amid fears of U.S. financial sanctions and a mountain of sovereign debt. Goldman is taking a more selective approach to commodity investing as soft demand in China weighs on crude oil and copper prices. The investment bank has slashed its Brent oil outlook by $5 to a range of $70 to $85 per barrel and delayed its copper target of $12,000 per metric ton until after 2025.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, September 9 at 3:00 PM EST, Consumer Inflation Expectations are out

On Tuesday, September 10 at 6:00 AM, the NFIB Business Optimism Index is released.

On Wednesday, September 11 at 7:30 AM, the Core CPI is printed.

On Thursday, September 12 at 8:30 AM, the Weekly Jobless Claims are announced. We also get the Producer Price Index.

On Friday, September 13 at 8:30 AM, the University of Michigan Consumer Sentiment. At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, I was having lunch at the Paris France casino in Las Vegas at Mon Ami Gabi, one of the top ten-grossing restaurants in the United States. My usual waiter, Pierre from Bordeaux, took care of me with his typical ebullient way, graciously letting me practice my rusty French.

As I finished an excellent, but calorie packed breakfast (eggs Benedict, caramelized bacon, hash browns, and a café au lait), I noticed an elderly couple sitting at the table next to me. Easily in their 80s, they were dressed to the nines and out on the town.

I told them I wanted to be like them when I grew up.

Then I asked when they first went to Paris, expecting a date sometime after WWII. The gentleman responded, “Seven years ago.”

And what brought them to France?

“My father is buried there. He’s at the American Military Cemetery at Colleville-sur-Mer along with 9,386 other Americans. He died on Omaha Beach on D-Day. I went for the D-Day 70th anniversary.” He also mentioned that he never met his dad, as he was killed in action weeks after he was born.

I reeled with the possibilities. First, I mentioned that I participated in the 40-year D-Day anniversary with my uncle, Medal of Honor winner Mitchell Paige, and met with President Ronald Reagan.

We joined the RAF fly-past in my own private plane and flew low over the invasion beaches at 200 feet, spotting the remaining bunkers and the rusted-out remains of the once floating pier. Pont du Hoc is a sight to behold from above, pockmarked with shell craters like the moon. When we landed at a nearby airport, I taxied over railroad tracks that were the launch site for the German V1 “buzzbomb” rockets.

D-Day was a close-run thing and was nearly lost. Only the determination of individual American soldiers saved the day. The US Navy helped too, bringing destroyers right to the shoreline to pummel the German defenses with their five-inch guns. Eventually, battleships working in concert with very lightweight Stinson L5 spotter planes made sure that anything the Germans brought to within 20 miles of the coast was destroyed.

Then the gentleman noticed the gold Marine Corps pin on my lapel and volunteered that he had been with the Third Marine Division in Vietnam. I replied that my father had been with the Third Marine Division during WWII at Bougainville and Guadalcanal and that I had been with the Third Marine Air Wing during Desert Storm.

I also informed him that I had led an expedition to Guadalcanal two years ago looking for some of the 400 Marines still missing in action. We found 30 dog tags and sent them to the Marine Historical Division at Quantico, Virginia for tracing. I proudly showed them my pictures.

When the stories came back it, turned out that many survivors were children now in their 80s who had never met their fathers because they were killed in action on Guadalcanal.

Small world.

I didn’t want to infringe any further on their fine morning out, so I excused myself. He said Semper Fi, the Marine Corps motto, thanked me for my service, and gave me a fist pump and a smile. I responded in kind and made my way home.

Oh and say “Hi” when you visit Mon Ami Gabi. Tell Pierre that John Thomas sent you and give him a big tip. It’s not easy for a Frenchman to cater to all these loud Americans.

Third Marine Air Wing

The D-Day Couple

The American Military Cemetery at Colleville-sur-Mer

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader