Global Market Comments

September 26, 2018

Fiat Lux

SPECIAL CAR ISSUE

Featured Trade:

(SAY GOODBYE TO THAT GAS GUZZLER),

(GM), (F), (TSLA), (GOOGL), (AAPL)

Global Market Comments

September 26, 2018

Fiat Lux

SPECIAL CAR ISSUE

Featured Trade:

(SAY GOODBYE TO THAT GAS GUZZLER),

(GM), (F), (TSLA), (GOOGL), (AAPL)

Do you want to get in on the ground floor of another major new trend?

Well, here’s another new trend. Get this one right and your retirement funds should multiple like rabbits.

There have been some pretty amazing announcements by governments lately.

The United Kingdom has banned the use of gasoline-powered engines by 2040.

China is considering doing the same by 2035.

And now the State of California is targeting 100% alternative energy use by 2040. That’s only 22 years away.

The only unknown is what such a planned obsolescence program will look like, and how soon it will be implemented.

With 20% of the U.S. car market, don’t take the Golden State’s ruminations lightly.

California was the first state to require safety glass, seat belts, and catalytic converters, and the other 49 eventually had to follow. Some 20% of the market is just too big to ignore.

The death of the car is now upon us, and it is still early, very early.

This is a very big deal.

Earlier in my lifetime, car production directly and indirectly accounted for about one-third of the U.S. economy.

Much of the growth during our earlier Golden Ages, in the 1920s and the 1950s, were driven by a never-ending cycle of upgrades of our favorite form of transportation, and the countless ancillary products and services needed to support them. Tail fins, radios, and tons of chrome assured you always had to have the next new model.

Today, 253 million automobiles and trucks prowl America’s roads, about half the world’s total, with an average age of 11.4 years.

The demise of this crucial industry started during the 2008 crash, when (GM) and Chrysler (owned by Fiat) went bankrupt. Only more conservatively run, family owned Ford (F) survived on its own.

The government stepped in with massive bailouts. That was the cheaper option for the Feds, as the cost of benefits for an entire unemployed industry was far greater than the cost of the companies absorbed.

If it hadn’t done so, the auto industry would have decamped for a new base near the technology hubs in California, and today would be a decade closer to their futures than they are now.

And remember, the government made billions of dollars of profits from its brief foray into the auto industry as an investor. It was one of the best returns on investment in history in major size.

I’ll breakout the major directions the industry is now taking. Hint: It doesn’t have much to do with traditional metal bashing.

The Car as a Peripheral

The important thing about a car today is not the car, but the various doodads, doohickeys, gizmos, and gadgets they stick in them.

In this category you can include 24/7 4G wireless, full Internet access, mapping software, artificial intelligence, and learning programs.

(GM) is now installing more than 100 microprocessors in its vehicles to control and monitor various functions.

Good luck doing your own tune-ups.

The Car as a Service

When you think about it, automobile ownership is a wildly inefficient use of capital. It is usually a family’s second largest expense, after their home, running $30,000 to $80,000.

It then sits unused in garages or public parking for 96% to 98% of the day. Insurance, maintenance, and liability costs can be off the charts.

What if your car was used 24/7, as is machinery in well-run industrial plants? Your cost drops by 96% to 98% to the point where it is almost free.

The sharing economy is the way to accomplish this.

We are already seeing several start-ups attempting to achieve this in major U.S. cities, such as Zipcar, Car2Go, Getaround, RelayRides, and City CarShare.

What happens to conventional car companies when consumers shift from ownership to sharing? Demand plunges by 96% to 98%.

Perhaps that is why auto shares (GM), (F) have performed so abysmally this year relative to technology and the main market.

Self-Driving Technology

This is the hottest development area in the industry, with Apple (AAPL), Alphabet (GOOG), and the big European carmakers committing thousands of engineers.

Let’s say your car is now comfortably driving you to work, allowing you to read the morning papers and catch up on your email. Or maybe you’re lazy and would rather watch the season finale of Game of Thrones.

What else is possible?

How about if, instead of parking, your car drops you off, saving that exorbitant fee.

Then it joins Uber, picking up local riders and paying for its own way. It then dutifully returns to pick you up at your office when it’s time to go home.

Since the crash rate for computers is vastly lower than for humans, car insurance rates will collapse, gutting that industry.

Ditto for life insurance, as 35,000 people a year will no longer die in car crashes.

Half of all emergency room visits are the result of car accidents, so that business disappears too, dramatically shrinking health care costs in the process.

I have been letting my new Tesla S-1 drive me since last year, and I can assure you that the car can drive better than I can, especially at night.

What better way to get home after I have downed a bottle of Caymus cabernet at a city restaurant?

Driverless electric cars are totally silent, increasing the value of land near freeways.

Nor do they require much maintenance, as they have so few moving parts. Exit the car repair industry.

I could go on and on, but you get the general idea.

For more on the topic, please read “Test Driving Tesla's Self Driving Technology” by clicking here.

Virtual Reality

After 30 years of inadequate infrastructure budgets, trying to get into any America city center is a complete nightmare.

Only last week, a cattle truck turned over on the Golden Gate Bridge, bringing traffic to a halt. Fortunately, a cowboy traveling to a nearby rodeo was able to unload his horse and lasso the errant critters (no, it wasn’t me!).

Even if you get into the city, you will be greeted by a $40 tab for a parking space. Hopefully, no one will smash your windows and steal your laptop (happened to me last year).

Why bother?

Thirty years ago, teleconferencing services pitched themselves as replacing the airplane.

Today, we are taking the next step, using Skype and GoToMeeting to conduct even local meetings, as we do at the Mad Hedge Fund Trader.

Virtual reality is clearly the next step, providing a 3D, 360 degree experience that makes you feel like you and your products are actually there.

Better to leave that car in the garage where it can get a top up on its charge. BART is cheaper anyway, when it runs.

New Materials

We are probably five years away from adopting the carbon fiber technology now used in the aircraft industry for mass-market cars. Carbon has one-tenth the weight of steel, with five times the strength.

The next great leap forward for electric cars won’t be through better batteries. It will come through a 70% reduction of the mass of a car, tripling ranges with existing technology.

San Francisco Becomes the Car Capital of the World

This will definitely NOT happen, as sky-high rents assure that the city by the bay will never attract large, labor-intensive industries.

Instead, the industry will develop much as the one for smartphones. The high value-added aspects, design and programming, will stay in California.

The assembly of the chassis, the body, and the rest of the vehicle will be best done in low-cost, tax-free states with a lot of land, such as Texas and Nevada.

What will happen to Detroit? It has already become a favored destination of new venture capital financial start-ups - the cost of offices and housing is virtually free.

Global Market Comments

September 4, 2018

Fiat Lux

Featured Trade:

(WEDNESDAY, OCTOBER 17, 2018, HOUSTON GLOBAL STRATEGY LUNCHEON),

(DON’T MISS THE SEPTEMBER 5 GLOBAL STRATEGY WEBINAR),

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or

THE WAR WITH CANADA STARTS ON TUESDAY),

(MSFT), (VXX), (TLT), (AAPL), (KO), (GM), (F)

I have spent all weekend sitting by the phone, waiting for the call from Washington D.C. to re-activate my status as a Marine combat pilot.

Failure of the administration to reach a new NAFTA trade agreement by the Friday deadline makes such a conflict with Canada inevitable.

And while you may laugh at the prospect of an invasion from the North, the last time this happened Washington burned. You can still see the black scorch marks inside the White House today.

This is all a replay for me, when in 1991, I enjoyed an all-expenses paid vacation courtesy of Uncle Sam. That’s when I spent a year shuttling American fighter pilots from RAF Lakenheath to forward bases at Ramstein, Aviano, Cyprus, and Dharan, Saudi Arabia.

It may seem unlikely that our nation’s military would require the services of a decrepit 66-year-old. However, in my last conflict I ran into another draftee who was then 66. It seems that the Air Force then had a lot of F-111 fighter bombers left over from Vietnam that no one knew how to fly.

That’s the great thing about the military. It never throws anything away. Not even me. The life of our remaining B-52 Stratofortress bombers at their final retirement in 2050 will be 100 years.

Perhaps Canada will decide that discretion is the better part of valor, and simply wait for the World Trade Organization to declare the Trump tariffs illegal, which they obviously all are.

That would then force the administration to withdraw from the organization the U.S. created at the end of WWII to regulate fair trade and go rogue. But then what else is new?

And while there was immense media time devoted to the NAFTA talks, which only oversees trade with partners with around $2 trillion each, China, the 800-pound gorilla, is still lurking out there. It has a $12.2 trillion GDP and Trump is imposing tariffs on another $200 billion of their imports there today.

The corner that Trump has painted himself into is that he has made himself SO unpopular abroad, insulting virtually everyone but Russia, that no leader is willing to risk doing a deal with him lest they get kicked out of office.

I certainly felt this in Europe this summer where the discussion was all about Trump all of the time. When you insult a nation’s leader you insult everyone in that country. I haven’t received that kind of treatment since the Vietnam War was running hot and heavy in 1968.

I’ll tell you, I’d much rather be flying combat missions over enemy territory without a parachute than trading a market like we had last week. For months now, it has been utterly devoid of low risk/high return entry points for all asset classes.

It’s been a slow-motion melt-up virtually every day against the most horrific news backdrop imaginable. Such is the wonder of massive global excess liquidity. It Trumps everything.

NASDAQ topped 8,000, proving that if you aren’t loaded to the gills with technology stocks, as I have been pleading all year, you are out of your freaking mind. If you don’t own Apple, you are doubly screwed.

I doubt that such data is available, but I bet the illiterate and the uneducated have been beating more literate types in performance by a huge margin.

The unresponsiveness to news isn’t the only thing afflicting this market. As the summer coughs and sputters its way to a close, we enter September, notorious as the most horrific trading month of the year. And we are launching into it with the Mad Hedge Market Timing Index stuck in the 70s, overbought territory, for weeks now.

Blockbuster earnings, the principal impetus for rising share prices in 2018, are now firmly in the rearview mirror, and won’t make a reappearance for another month. Then they die completely in 2019.

Perhaps this is why my long volatility position in the (VXX) is doing moderately well, even though the indexes have been hitting new all-time highs, with the S&P 500 briefing kissing $292. I rather practice my golf swing rather than try to outtrade this market, even though I don’t play golf.

Other than NAFTA, there was little to trade off of last week. Apple (AAPL) shares continue to break new records, hitting an incredible $228, in front of their big iPhone launch this month. Trump announced he was freezing wages on 1 million-plus federal employees next year. That will solve their tax problems for sure.

Coca-Cola (KO) bought British owned Costa for $5 billion, where I regularly breakfast while traveling abroad, in the hopes that perhaps its 501st new drink launch this year will be successful.

Amazon (AMZN) is within sofa change of becoming the next $1 trillion market cap company, making the parents of founder Jeff Bezos the most successful angel investors in history, worth $30 billion.

U.S. auto sales are in free fall. Car company shares (GM), (F) continued their slide as they are pummeled on every side by administration economic policies. One has to ask the question of how long the American economy can survive after losing a major leg like this one. Home sales, another vital component, are also suddenly awful.

Trump attacked big tech. The market yawned.

With the Mad Hedge Market Timing Index at 71 and bounces around in the 70s all week, I am not inclined to reach for trades here. All three of my current positions are making money, my longs in Microsoft (MSFT) and volatility (VXX) and my short in the U.S. Treasury bond market (TLT).

August finally brought in a performance burst in the final days, leaving us with a respectable return of 2.13%. My 2018 year-to-date performance has clawed its way back up to 25.30% and my nine-year return appreciated to 303.48%. The Averaged Annualized Return stands at 34.35%. The more narrowly focused Mad Hedge Technology Fund Trade Alert performance is annualizing now at an impressive 28.59%.

This coming week housing statistics will give the most important insights on the state of the economy.

On Monday, September 3, there was a national holiday, Labor Day.

On Tuesday, September 4, at 9:45 AM the PMI Manufacturers Index is out. August Construction Spending is out at 10:00 AM.

On Wednesday, September 5 at 7:00 AM, we learn MBA Mortgage Applications for the previous week.

Thursday, September 6 leads with the Weekly Jobless Claims at 8:30 AM EST, which saw a rise of 3,000 last week to 213,000. Also announced at 9:45 AM are the August PMI Services Index.

On Friday, September 7 the Baker Hughes Rig Count is announced at 1:00 PM EST.

As for me, the high point of my weekend was the funeral services for Senator John McCain. Boy, the Squids really know how to put on a ceremony. I suspect it may market a turning point for our broken American politics.

In the meantime, King Canute sits in his throne at the seashore ordering the tide not to rise.

Good luck and good trading.

Global Market Comments

August 23, 2018

Fiat Lux

Featured Trade:

(WHY THE DOW IS GOING TO 120,000),

(X), (IBM), (GM), (MSFT), (INTC), (DELL),

($INDU), (NFLX), (AMZN), (AAPL), (GOOGL),

(THE MAD HEDGE CONCIERGE SERVICE HAS AN OPENING),

(TESTIMONIAL)

For years, I have been predicting that a new Golden Age was setting up for America, a repeat of the Roaring Twenties. The response I received was that I was a permabull, a nut job, or a conman simply trying to sell more newsletters.

Now some strategists are finally starting to agree with me. They too are recognizing that a ganging up of three generations of investment preferences will combine to drive markets higher during the 2020s, much higher.

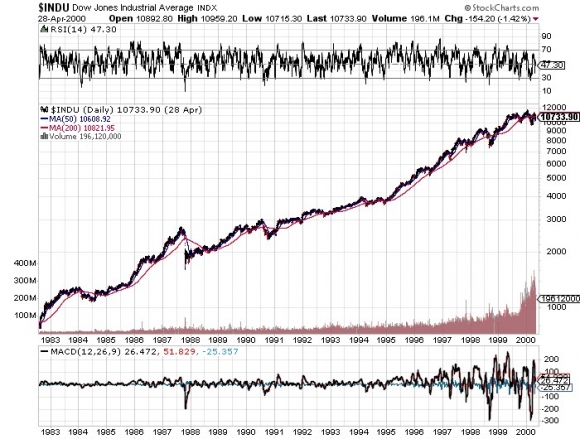

How high are we talking? How about a Dow Average of 120,000 by 2030, up another 465% from here? That is a 20-fold gain from the March 2009 bottom.

It’s all about demographics, which are creating an epic structural shortage of stocks. I’m talking about the 80 million Baby Boomers, 65 million from Generation X, and now 85 million Millennials. Add the three generations together and you end up with a staggering 230 million investors chasing stocks, the most in history, perhaps by a factor of two.

Oh, and by the way, the number of shares out there to buy is actually shrinking, thanks to a record $1 trillion in corporate stock buybacks.

I’m not talking pie in the sky stuff here. Such ballistic moves have happened many times in history. And I am not talking about the 17th century tulip bubble. They have happened in my lifetime. From August 1982 until April 2000 the Dow Average rose, you guessed it, exactly 20 times, from 600 to 12,000, when the Dotcom bubble popped.

What have the Millennials been buying? I know many, like my kids, their friends, and the many new Millennials who have recently been subscribing to the Diary of a Mad Hedge Fund Trader. Yes, it seems you can learn new tricks from an old dog. But they are a different kind of investor.

Like all of us, they buy companies they know, work for, and are comfortable with. During my Dad’s generation that meant loading your portfolio with U.S. Steel (X), IBM (IBM), and General Motors (GM).

For my generation that meant buying Microsoft (MSFT), Intel (INTC), and Dell Computer (DELL).

For Millennials that means focusing on Netflix (NFLX), Amazon (AMZN), Apple (AAPL), and Alphabet (GOOGL).

That’s why these four stocks account for some 40% of this year’s 7% gain. Oh yes, and they bought a few Bitcoin along the way too, to their eternal grief.

There is one catch to this hyper-bullish scenario. Somewhere on the way to the next market apex at Dow 120,000 in 2030 we need to squeeze in a recession. That is increasingly becoming a topic of market discussion.

The consensus now is that an impending inverted yield curve will force a recession sometime between August 2019 to August 2020. Throwing fat on the fire will be a one-time only tax break and deficit spending that burns out sometime in 2019. These will be a major factor in U.S. corporate earnings growth dramatically slowing down from 26% today to 5% next year.

Bear markets in stocks historically precede recessions by an average of seven months so that puts the next peak in top prices taking place between February 2019 to February 2020.

When I get a better read on precise dates and market levels, you’ll be the first to know.

To read my full research piece on the topic please click here to read “Get Ready for the Coming Golden Age.”

Global Market Comments

August 10, 2018

Fiat Lux

Featured Trade:

(AUGUST 8 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (TBT), (PIN), (ISRG), (EDIT), (MU), (LRCX), (NVDA),

(FXE), (FXA), (FXY), (BOTZ), (VALE), (TSLA), (AMZN),

(THE DEATH OF THE CAR),

(GM), (F), (TSLA), (GOOG), (AAPL)

One of the goals of the Diary of a Mad Hedge Fund Trader is to identify major changes in the global economy early enough to get investors into the impacted shares early.

The death of the car is one of those trends, and it is still early, very early.

This is a very big deal.

Earlier in my lifetime, car production directly and indirectly accounted for about one-third of the U.S. economy.

Much of the growth during our earlier Golden Ages, in the 1920s and the 1950s, were driven by a never-ending cycle of upgrades of our favorite form of transportation and the countless ancillary products and services needed to support them.

Today, 253 million automobiles and trucks prowl America's roads, about half the world's total, with an average age of 11.4 years.

The demise of this crucial industry started during the 2008 crash, when (GM) and Chrysler (owned by Fiat) went bankrupt. Only more conservatively run, family owned Ford (F) survived on its own.

The government stepped in with massive bailouts. That was the cheaper options for the Feds, as the cost of benefits for an entire unemployed industry was far greater than the cost of the companies absorbed.

If it hadn't done so, the auto industry would have decamped for a new base near the technology hub in California, and today would be a decade closer to their futures than they are now.

And remember, the government made billions of dollars of profits from its brief foray into the auto industry. It was one of the best returns on investment in history.

I'll breakout the major directions the industry is now taking. Hint: It doesn't have much to do with traditional metal bashing.

The Car as a Peripheral

The important thing about a car today is not the car, but the various doodads, doohickeys, gizmos, and gadgets they stick in them.

In this category you can include 24/7 4G wireless, full Internet access, mapping software, artificial intelligence, and learning programs. 5G will accelerate this functionality tenfold.

(GM) is now installing more than 100 microprocessors in its vehicles to control and monitor various functions.

Good luck doing your own tune-ups.

The Car as a Service

When you think about it, automobile ownership is a wildly inefficient use of capital. It is usually a family's second-largest expense, after their home, running $30,000-$80,000.

It then sits unused in garages or public parking for 96%-98% of the day. Insurance, maintenance, and liability costs can be off the charts.

What if your car was used 24/7, as is machinery in well-run industrial plants? Your cost drops by 96%-98% to the point where it is almost free.

The sharing economy is the way to accomplish this.

We are already seeing several start-ups in major U.S. cities attempting to achieve this such as Zipcar, Car2Go, Getaround, Turo (formerly RelayRides), and City CarShare.

What happens to conventional car companies when consumers shift from ownership to sharing? Demand plunges by 96%-98%.

Perhaps that is why auto shares (GM), (F) have performed so abysmally this year relative to technology and the main market.

Self-Driving Technology

This is the hottest development area in the industry, with Apple (AAPL), Alphabet (GOOG), and the big European car makers committing thousands of engineers.

Let's say your car is now comfortably driving you to work, allowing you to read the morning papers and catch up on your email. Or maybe you're lazy and would rather watch the season finale for Game of Thrones.

What else is possible?

How about if, instead of parking, your car drops you off, saving that exorbitant fee.

Then it joins Uber, picking up local riders and paying for its own way. It then dutifully returns to pick you up at your office when it's time to go home.

Since the crash rate for computers is vastly lower than for humans, car insurance rates will collapse, gutting that industry.

Ditto for life insurance, as 35,000 people a year will no longer die in car crashes.

Half of all emergency room visits are the result of car accidents, so that business disappears too, dramatically shrinking health care costs in the process.

I have been letting my new Tesla S-1 drive me since last year, and I can assure you that the car can drive better than I can, especially at night.

What better way to get home after I have downed a bottle of Caymus cabernet at a city restaurant?

Driverless electric cars are totally silent, increasing the value of land near freeways.

Nor do they require much maintenance, as they have so few moving parts. Exit the car repair industry.

I could go on and on, but you get the general idea.

For more on the topic, please read "Test Driving Tesla's Self Driving Technology" by clicking here.

Virtual Reality

After 30 years of inadequate infrastructure budgets, trying to get into any American city center is a complete nightmare.

Only last week, a cattle truck turned over on the Golden Gate Bridge, bringing traffic to a halt. Fortunately, a cowboy traveling to a nearby rodeo was able to unload his horse and lasso the errant critters (no, it wasn't me!).

Even if you get into the city, you will be greeted by a $40 tab for a parking space. Hopefully, no one will smash your windows and steal your laptop (happened to me last year).

Why bother?

Thirty years ago, teleconferencing services pitched themselves as replacing the airplane.

Today, we are taking the next step, using Skype and GoToMeeting to conduct even local meetings, as we do at the Mad Hedge Fund Trader.

Virtual reality is clearly the next step, providing a 3-D, 360-degree experience that makes you feel like you and your products are actually there.

Better to leave that car in the garage where it can get a top up on its charge. BART is cheaper anyway, when it runs.

New Materials

We are probably five years away from adopting the carbon fiber technology now used in the aircraft industry for mass-market cars. Carbon has one-tenth the weight of steel, with five times the strength.

The next great leap forward for electric cars won't be through better batteries. It will come through a 70% reduction of the mass of a car, tripling ranges with existing technology.

San Francisco Becomes the Car Capital of the World

This will definitely NOT happen, as sky-high rents assure that the city by the bay will never attract large, labor-intensive industries.

Instead, the industry will develop much as the one for smartphones. The high value-added aspects, design and programming, will stay in California.

The assembly of the chassis, the body, and the rest of the vehicle will be best done in low-cost, tax-free states with a lot of land, such as Texas and Nevada.

What will happen to Detroit? It has already become a favored destination of new venture capital financial start-ups. The cost of offices and housing is virtually free.

Mad Hedge Technology Letter

June 21, 2018

Fiat Lux

Featured Trade:

(WHY NETFLIX IS UNSTOPPABLE),

(NFLX), (CAT), (AMZN), (CMCSA), (DIS), (FOX), (TWX), (GM), (WMT), (TGT)

Trade war? What trade war?

Apparently, nobody told Netflix (NFLX) that we are smack dab in a tit-for-tat trade war between two of the greatest economic powers to grace mankind.

No matter rain or shine, Netflix keeps powering on to new highs.

The Mad Hedge Technology Letter first recommended this stock on April 23, 2018, when I published the story "How Netflix Can Double Again," (click here for the link) and at that time, shares were hovering at $334.

Since, then it's off to the races, clocking in at more than $413 as of today, a sweet 19% uptick since my recommendation.

It seems the harder I try, the luckier I get.

What separates the fool's gold from the real yellow bullion are challenging market days like yesterday.

The administration announced a new set of tariffs on $200 billion worth of Chinese imports.

The day began early on the Shanghai exchange dropping a cringeworthy 3.8%.

The Hong Kong Hang Seng Market didn't fare much better cratering 2.78%.

Investors were waiting for the sky to drop when the minutes counted down to the open in New York and futures were down big premarket.

Just as expected, the Dow Jones Index plummeted on the open, and in a flash the Dow was down 410 points intraday.

The risk off appetite toyed with traders' nerves and American companies with substantial China exposure being rocked the hardest such as Caterpillar (CAT).

After the Dow hit an intraday low, a funny thing happened.

The truth revealed itself and U.S. equities reacted in a way that epitomizes the nine-year bull market.

Tar and feather a stock as much as you want and if the stock keeps going up, it's a keeper.

Not only a keeper, but an undisputable bullish signal to keep you from developing sleep apnea.

In the eye of the storm, Netflix closed the day up a breathtaking 3.73%. The overspill of momentum continued with Netflix up another 2% and change today.

This company is the stuff of legends and reasons to buy them are legion.

As subscriber surveys flow onto analysts' desks, Netflix is the recipient of a cascade of upgrades from sell side analysts scurrying to raise targets.

Analysts cannot raise their targets fast enough as Netflix's price action goes from strength to hyper-strength.

Chip stocks have the opposite problem when surveys, portraying an inaccurate picture of the 30,000-foot view, prod analysts to downgrade the whole sector.

That is why they are analysts, and most financial analysts these days are sacked in the morning because they don't understand the big picture.

Quality always trumps quantity. Period.

Netflix has stockpiled consecutive premium shows from titles such as Stranger Things, The Crown, Unbreakable Kimmy Schmidt, and Orange is the New Black.

This is in line with Netflix's policy to spend more on non-sports content than any other competitors in the online streaming space.

In 2017, Netflix ponied up $6.3 billion for content and followed that up in 2018, with a budget of $8 billion to produce original in-house shows.

Netflix hopes to increase the share of original content to 50%, decoupling its reliance on traditional media stalwarts who hate Netflix's guts with a passion.

A good portion of this generous budget will be deployed to make 30 new anime shows and 80 new original films all debuting by the end of 2018.

Amazon's (AMZN) Manchester by the Sea harvested two Oscars for its screenplay and Casey Affleck's performance, foreshadowing the opportunity for Netflix to win awards next time around, potentially boosting its industry profile.

It will only be a matter of time because of the high quality of production.

Netflix's content budget will dwarf traditional media companies by 2019, creating more breathing room against the competitors who have been late to the party and scrambling for scraps.

This is what Disney's futile attempts to take on Netflix, which raised its offer for Fox to $71.3 billion to galvanize its content business.

Disney's (DIS) bid came on the heels of Comcast Corp. (CMCSA) bid for Disney at $65 billion.

The sellers' market has boosted all content assets across the board.

Remember, content is king in this day and age.

In 2017, Time Warner (TWX) and Fox (FOX) spent $8 billion each and Disney slightly lagged with a $7.8 billion spend on non-sports programming.

Netflix will certainly announce a sweetened content outlay of somewhere close to $9.5 billion next year attracting the best and brightest to don the studios of Netflix.

What's the whole point of creating the best content?

It lures in the most eyeballs.

Subscriber growth has been nothing short of spectacular.

Expectations were elevated, and Netflix delivered in spades last quarter adding quarterly total subscribers to the tune of 7.41 million versus the 6.5 million expected by analysts.

Not only a beat, but a blowout of epic proportions.

Inside the numbers, rumors were adrift of Netflix's domestic numbers stagnating.

Consensus was proved wrong again, with domestic subscribers surging to 1.96 million versus the 1.48 million expected.

The cycle replays itself over. Lather, rinse, repeat.

Quality content attracts a wave of new subscribers. Robust subscriber growth fuels more spending, which paves the way for more quality content.

This is Netflix's secret formula to success.

Netflix has executed this strategy systemically to the aghast of traditional media companies that are stuck with legacy businesses dragging them down and making it decisively difficult to compete with the nimble online streaming players.

Turning around a legacy business is tough work because investors expect profits and curse the ends of the earth if companies spend big on new projects removing the prospects of dividend hikes.

Netflix and the tech darlings usually don't make a profit but have a license to spend, spend, and spend some more because investors are on board with a specific narrative prioritizing market share and posting rapid growth.

The cherry on top is the booming secular story happening as we speak in Silicon Valley.

Effectively, all other sectors that are not tech have become legacy sectors thanks in large part to the high degree of innovation and cross-functionality of big cap tech companies.

The future legacy winners are the legacy stocks and sectors reinventing themselves as new tech players such as General Motors (GM), Walmart (WMT), and Target (TGT).

The rest will die a miserably and excruciatingly slow death.

The Game of Thrones M&A battle with the traditional media companies is a cry of desperate search for these dinosaurs.

They were too late to react to the Netflix threat and were punished to full effect.

Halcyon days are upon Netflix, and this company controls its own destiny in the streaming wars and online streaming content industry.

As history shows, nobody executes better than CEO Reed Hastings at Netflix, which is why Netflix maintains its grade as a top 3 stock in the eyes of the Mad Hedge Technology Letter.

_________________________________________________________________________________________________

Quote of the Day

"I got the idea for Netflix after my company was acquired. I had a big late fee for Apollo 13. It was six weeks late and I owed the video store $40. I had misplaced the cassette. It was all my fault," - said cofounder and CEO of Netflix Reed Hastings.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.