Global Market Comments

June 20, 2018

Fiat Lux

Featured Trade:

(ANNOUNCING THE MAD HEDGE LAKE TAHOE, NEVADA, CONFERENCE, OCTOBER 26-27, 2018),

(THE CHINA TRADE WAR TURNS HOT),

(GM), (AAPL), (SOYB), (WEAT), (CORN)

Tag Archive for: (GM)

The trade war with China has suddenly gone from small beer to a big deal. In just two months, we have gone from campaign promises to threats, to an increase in duties from $50 billion to $250 billion worth of Chinese imports.

The risk of destroying the current strength of the economy and the stock market is now on the table. Already, the Dow Average has given up all its 2018 gains and is now down 1.1% on the year.

All we will be left with is a big tax cut for corporations, $3 trillion in new government debt, and a recession.

As a result, the current rally in the stock market will fail, and a test of the 2018 lows is on the menu. My 2018 range for stocks until the midterm election lives!

Of the past 10 years, China has generated 50% of global economic growth, the U.S. 35%, and the rest of the world the balance. Imports from the U.S. to China were already on a sharp upswing, and it is now our third largest trading partner.

Imports of U.S. autos has soared from 125,356 units in 2011 to 267,473 in 2017, and that doesn't count American cars, such as the GM Buick, built in China. It now looks like all of this will suddenly grind to a halt.

Not only will Chinese middle-class consumers buy European and Japanese going forward, the American brand has been destroyed by our open hostility and insults. Apple (AAPL) sells more iPhones in China than the U.S., but I'm not sure that will last either.

China only imported $150 billion worth of goods from the U.S. last year. That means to implement a tit-for-tat, dollar-for-dollar retaliation China will have to hit the U.S. services sector hard. Similarly, you can bet that Chinese investment in the U.S. will be sharply curtailed.

The true cost of the trade war isn't in the dollar amounts involved ... yet. But the impact on business confidence has been catastrophic.

Investment globally is slowing because nobody knows if their industry, or their company will get hit next by American off-the-cuff policies. Just ask any soybean (SOYB) farmer who is looking at a de facto ban on Chinese purchases of their products. The price of their commodity has collapsed by 16% in a week.

In the end, Trump will get what he wants, a lower U.S. trade deficit. But it will come in the form of collapsing demand from U.S. consumers generated by the next recession. That is the only way the American trade deficit has fallen for the past century.

Be careful what you wish for.

Mad Hedge Technology Letter

June 7, 2018

Fiat Lux

Featured Trade:

(THE NEW TECHNOLOGY PLAY YOU'VE NEVER HEARD OF),

(GM), (UBER), (WMT), (GOOGL)

Welcome to the new cutting-edge high-tech play - General Motors (GM).

The tectonic shifts permeating through the tech landscape seem like there is no end.

Another blockbuster announcement hit the airwaves melding together a brand-new partnership between SoftBank and GM's self-driving unit Cruise.

SoftBank invested an eye-popping $2.25 billion into Cruise for a 19.6% stake, adding to its scintillating arsenal of big data assets focusing on transportation including Uber, India's Ola, China's DiDi, and Southeast Asia's Grab.

GM disclosed it will divvy up a further $1.1 billion into the deal.

The Mad Hedge Technology Letter has been an astute follower of the autonomous driving technology race because the technology will be the next proprietary technology to change the world, creating enormous windfalls for the few involved.

The timeline commences later this year, when Waymo, a subsidiary of Alphabet (GOOGL), rolls out a robo-taxi commercial service.

General Motors is right on Waymo's heels rolling out its own commercial service "sometime in 2019."

This momentous investment by SoftBank solidifies (GM) as the No. 2 industry player going forward.

This is a huge victory.

The historic shift symbolizes the next gap up in the technology movement.

Tech stocks have been on a tear of late leaving other equities in the dust.

Waymo was the first mover and confidently never relinquished the top-dog position while avoiding any big disasters along the way.

The unparalleled success of Waymo's self-driving unit has led analysts to put a valuation figure ranging anywhere from $75 billion to $125 billion.

GM paid a measly $1 billion for Cruise in 2016, which is peanuts in today's thriving tech landscape.

Analysts estimated the valuation of Cruise at $4 billion just before the SoftBank investment. The almost 20% stake for $2.25 billion puts the new valuation number over $11 billion, three times more than analysts initially speculated.

Tech acquisitions have exploded in 2018 and show no signs of slowing down.

The hallmarks of Waymo's operation hinge on safety-first initiatives, which went a long way to upholding its industry leader position.

The safety-second attitude led Uber to attempt to short circuit its way to the top from a position of weakness to ill effect.

Uber's technology failed, and the result of the Phoenix, Arizona, casualty was a suspended operation.

Game over.

To stick the blade cleanly through the back, Uber CEO Dara Khosrowshahi revealed that talks are ongoing between Waymo and Uber to add Waymo's technology to Uber's broker app service.

This revelation is interesting considering Uber infuriated Waymo. It means Uber will effectively recede itself from competing with Waymo in self-driving technology.

The company doesn't need to anymore and it burns too much cash.

The protracted court ruling revealed Uber had stolen trade secrets using poached Waymo engineers.

This time, it really is the nail in the coffin for Uber's self-driving technology.

It will change strategy and refine its core app that made them famous in the first place.

The SoftBank investment into Cruise has clear synergies with Uber.

If Waymo refuses to go into bed with Uber, the natural logical step would be for the GM Cruise technology to be integrated with the Uber platform since they are both SoftBank investments.

SoftBank's management will clearly push for this arrangement. It makes no sense to use the Lyft platform with the GM Cruise division.

The tie up with GM Cruise was the catalyst for Uber seeking "talks" with Waymo, knowing very well if talks failed, a backup plan was hatched and would be able to partner up with Cruise's technology.

This is the luxury Uber has now since it is part of the SoftBank umbrella along with the GM Cruise division.

This nullifies the existential threat Uber was anxious about as it is guaranteed a certain slice of the pie leading to material future revenue stream post IPO.

The SoftBank investment is a stamp of approval for the quality of GM self-driving technology.

SoftBank only invests in the most innovative firms.

The conundrum with legacy car companies is that the bulk of revenue is reliant on selling combustion-engine cars that will soon become obsolete.

Any large commitment to R&D, unfocused on its main profits levers, hurt margins. Investors do not buy American car manufacturers that operate at a loss.

Therefore, legacy companies are penalized for spending on new businesses that could be hit or miss.

They stick with their bread and butter through thick and thin because that is what investors expect them to do. This was why Walmart (WMT) sold off when it acquired a stake in Flipkart.

A certain type of Walmart investor would be aghast at this unexpected new direction and amount of dollars drained.

In support of Walmart, CEO Doug McMillon has been positively vocal about the pivot to tech and e-commerce.

It should not be a surprise.

Old technology gets swept into the dustbin of history. Examples are legion.

Let me explain why.

The shift from horse-drawn carriages to the automobile was an equally jaw-dropping development at the time.

Not all horse-drawn carriage manufacturers were able to make the massive leap from creating simple horse-carriage passenger vehicles to automotive vehicles with combustion engines.

When Abraham Lincoln was transported to the Ford Theatre the night of his assassination, he was rolling in a Studebaker horse-drawn carriage.

Studebaker, which was established in 1852 with $68 of capital and a tool belt, was the only top-notch horse-drawn carriage manufacturer to make the gigantic shift from horse-drawn carriage builder to automotive producer.

The other players shriveled up and waved the white flag.

Studebaker actually manufactured both horse-drawn carriages and cars from 1902-1920.

The company mutated again during World War II making military vehicles, M29, M29C, and engines for B-17 bombers.

Financial mismanagement ruined the company. In 1963 it shuttered its South Bend, Indiana, factory and then went out of business by 1967, missing out on a chance to take on Uber and Waymo by about 55 years.

Such are the annals of history.

(GM) is the first American legacy car company to make the complicated transition from traditional American car producer to self-driving technology player.

And it could be the only one.

The deal will raise the price range for the Uber IPO planned for 2019. The (GM) cruise division will report financials separately from the rest of the (GM) balance sheet, which could be the precursor to spinning it out as its own company creating more shareholder value.

No matter how you dice this up, (GM) is the real deal. Investors voted with their feet causing the stock to explode skyward closing 13% higher on the news of the investment.

Buy (GM) on the next sell-off instead of chasing the bolted stallion out of the starting gate.

_________________________________________________________________________________________________

Quote of the Day

"Indian software engineers are the best in the world; even in Silicon Valley, the best software engineers are Indians," - said CEO of Softbank Masayoshi Son

Mad Hedge Technology Letter

June 4, 2018

Fiat Lux

Featured Trade:

(THE INNOVATOR'S DILEMMA),

(UBER), (WMT), (SNAP), (MSFT), (GOOGL), (AAPL), (GM), (IBM)

I must confess, innovation can't be taught.

You are innovative, or you aren't. Don't pretend otherwise.

Innovation drives companies to outperform.

The economic environment becomes more cutthroat by the day rendering complacent companies obsolete.

Top-quality innovation leading to outstanding entrepreneurship is a well-traversed theme transcending industries across the American economic landscape.

The reservoir of innovation in 2018 is primarily flowing from one narrow source - the tech sector.

This is the primary motive for many adjacent industries to incorporate tech expertise into existing and commonly ancient legacy systems.

Tech promises laggards a ride atop the gravy chain.

In many instances, these companies are grappling with existential threats from all directions.

The best example is Walmart (WMT), which effectively mutated into the next FANG with its majority stake in Indian e-commerce juggernaut Flipkart. This deal followed its purchase of Jet.com in 2016, which was its first foothold in the e-commerce world.

Traditional companies are becoming tech companies because of the ability to innovate all leads through the fingertips of talented coders.

When all roads lead to Rome, you will have to go through Rome.

The hunger for innovation has had major implications to the financial side of technology.

The story picks up from a recent report disclosing the 2017 remuneration of co-founder and CEO of Instagram competitor Snapchat (SNAP) Evan Spiegel.

The $637.8 million he received in 2017 was the third-highest annual compensation ever to be collected by a CEO.

Snapchat has tanked following its 2017 IPO and the main reason is Facebook is stealing its lunch and leaving Snap the crumbs on which to nibble.

Instagram, using a cunning strategy of cloning Snap's best features, single-handedly bludgeoned Snap's share price cutting it by half after the successfully launched IPO.

Snap has been an unequivocal sell on the rallies stock since the inception of the Mad Hedge Technology Letter and the disastrous redesign did no favors either.

My first risk off recommendation was Snapchat and at the time it was trading at $19. To revisit the story, please click here.

Microsoft (MSFT) is a great stock because it posts accelerated revenue and earnings, while Snapchat is a terrible company because it produces accelerated losses and lousy user growth.

A company almost 100 times smaller than Microsoft should not be struggling to grow.

It's a failure of epic proportions.

Small companies expand briskly because the law of numbers is leveraged in their favor and the tiniest bump of additional business has a larger effect on the bottom line.

As it stands, Snapchat lost $373 million in 2015, and followed that up with a disastrous $514 million loss in 2016, and a gigantic $3.45 billion loss in 2017.

Losses accelerated by 800% but annual revenue only doubled last year.

It was no shocker that the poor relative performance resulted in the sacking of 100 Snapchat developers.

Smart people would assume an annual salary of this magnitude (Spiegel's) would be the result of excellent performance.

Why else would a CEO get a lavish payout?

I'll explain.

The demand for tech knows no bounds.

In this environment, venture capitalists will pay up for brilliant ideas.

The problem is that brilliant ideas don't grow on trees.

The few cutting-edge ideas have stacks of money thrown at them.

In this sellers' market, founders can cherry-pick the best financing deal that will enrich them the quickest and empower them the most.

Multiple offers have become the norm just as with the Silicon Valley housing market.

The consequences are the premium for these brilliant ideas keeps rising and investors keep paying higher prices without a second thought.

Therefore, founders and CEOs are opting for the financial packages that offer them bulletproof voting shares, allowing the innovators to control operations to the very last detail.

The founders are responsible for leading innovation, and investors are offering glorious pay terms for this innovation because it can't be substituted. Low-quality tech has less of a premium because the technology can easily be rebranded and substituted.

Technology from the ground up is slowly being automated away leaving runaway valuations the norm.

Giving the keys to the Ferrari makes sense as tech companies formulate long-term strategies based on scale. And securing job security without the threat of an activist takeover offers peace of mind for CEOs who are focused on the daily grind.

Knowing their baby won't get stolen from the carriage goes a long way in tech land.

Venture capitalists are reticent about following through with proper governance because they do not want to alienate the innovators who could choose to stop innovating.

These investors also know that tech is the least regulated industry in the world, so it's better to turn a blind eye to cunning growth strategies that push the border of regulation.

The competition to fund these emerging tech companies is borderline criminal.

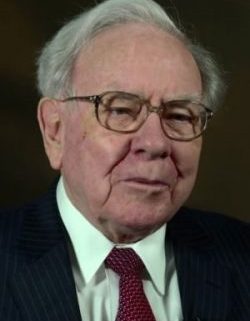

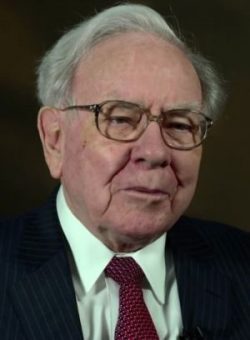

Uber declined a $3 billion investment by no other than the Oracle of Omaha Warren Buffett.

Buffett described himself as a "great admirer" of Uber CEO Dara Khosrowshahi.

Uber is one of the most unlikely Warren Buffett investments because it doesn't create anything and burns cash faster than a Kardashian.

Buffett's faith in Uber underscores the reliance on tech to fuel the stock market to new heights.

Buffett also admitted mistakes on missing out on Alphabet (GOOGL) and Apple (AAPL).

Rightly so.

Then add in the mix of SoftBank's $100 billion vision fund that just announced an upcoming sequel with another $100 billion vision fund.

Where is all this money flowing into?

Of the tech companies that went through an IPO last year backed by venture capitalist money, 67% relinquished superior voting rights to key founders, a rise of 54% since 2010.

Compare that to non-tech companies that only allow 10% to 15% of CEOs to institute a voting structure that will put them in charge indefinitely.

In many instances, the persona of these ultra-famous tech CEOs has taken on a life of its own.

Elon Musk, CEO of Tesla, is the most prominent example of a celebrity tech innovator milking every possible penny from his shareholders and is not shy about flaunting it.

News has it that Musk needs to go back to the well for another stage of financing later this year.

Don't worry, the money will be there in this climate.

Buffett's rejection was due to losing out to SoftBank, which beat out Buffett to invest in Uber.

SoftBank just announced a $3.35 billion investment into GM's (GM) autonomous driving unit called Cruise enhancing the best big data portfolio in the world.

At this pace, CEO of SoftBank Masayoshi Son will have a piece of every major big data company in the world.

This all bodes well for tech equities as the insatiable hunt for emerging, innovative tech spills over into daily equity market driving up the prices for all the top innovating public companies such as Salesforce, Amazon, Microsoft and Netflix.

Buffett, down on his luck after being shafted by Uber, picked up more Apple shares.

He sold all his IBM (IBM) shares after reading the Mad Hedge Technology Letter advising him to stay away from legacy companies.

Smart move, Warren. You can pick up the tab for our next lunch date.

If you have a few billion to throw around, expect multiple offers over the asking price for any high-grade tech innovation.

The going rate is shooting through the roof and you might NEVER be able to sack the founder.

Caveat emptor.

_________________________________________________________________________________________________

Quote of the Day

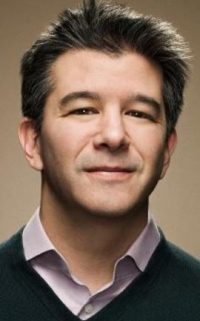

"We knew that Lyft was going to raise a ton of money. And we went (to their investors): 'Just so you know, we're going to be fund-raising after this, so before you decide whether you want to invest in them, just make sure you know that we are going to be fund-raising immediately after.' " - said former CEO and founder of Uber Travis Kalanick when asked how he copes with competition.

Global Market Comments

May 31, 2018

Fiat Lux

Featured Trade:

(MONDAY, JUNE 11, 2018, FORT WORTH, TEXAS, GLOBAL STRATEGY LUNCHEON),

(ARE WE SEEING "PEAK AUTO SALES"?),

(GM), (TM), (F), (HMC), (TSLA) (NSANY),

(TESTIMONIAL)

Mad Hedge Technology Letter

April 3, 2018

Fiat Lux

Featured Trade:

(THE BIG WINNER FROM THE PHOENIX CAR CRASH),

(WAYMO), (TSLA), (GOOGL), (AAPL), (AMZN), (UBER), (GM), (FB)

In 2014, the juicy sound clips recorded by NFL legend Chris Carter at the annual NFL rookie symposium would be enough for those at league headquarters to have nervous breakdowns.

During a keynote speech, Chris Carter recommended that every rookie about to kick-start a sports career should find a "fall guy" just in case they found themselves on the wrong side of the law.

Carter later rescinded his comments and sincerely apologized for insinuating marginal tactics.

Lo and behold, it seems the most attentive listeners at the symposium weren't the players but the swashbuckling chauffeur-share service that has become the "fall guy" of Big Tech, none other than Uber.

The great thing (read: sarcastic here) for Uber about killing a pedestrian with autonomous vehicle technology is that it does not need to change its Silicon Valley mind-set of "move fast and break things."

Everything Uber touches seems to turn to mush. At least lately.

This revelation is extremely bullish for the other big players in the A.I. (Artificial Intelligence) driverless car space, mainly Waymo and General Motors (GM).

Granted, Uber came late to the party, but that cannot be an excuse for the myriad of shortcuts it promotes to build its business.

Waymo, the autonomous subsidiary of Google (GOOGL), has been honing its software, algorithms, and sensors for the past nine years like a sage samurai swordsmith from Kyoto. This type of detailed nurturing has led Waymo to rack up more than 5 million miles of testing on live roads.

The company recently commenced the first niche ride-hailing service in Phoenix, AZ, and just announced that it will purchase up to 20,000 electric cars from Jaguar Land Rover in a $1 billion deal to outfit with its cutting-edge technology.

Every day is a joyous day for Waymo because the first mover advantage is in full effect.

GM, another laggard, though considered in the top three, won't commence its robotic car fleet until late 2019. However, by that time, Waymo could be on the verge of mass rollouts if there are no setbacks.

The cherry on top for Waymo is Uber's knack of making a dog's breakfast of anything it pursues, magnifying an insurmountable lead for Waymo to possess.

Granted, the autonomous vehicle brain trust expected casualties, and the firm that made news for this mishap would be stuck with this label along with suspended operations.

Waymo missed a direct hit thanks to Uber and Tesla.

Tesla also took a direct hit when it announced that Walter Huang, an Apple engineer, sadly was killed in a Model X accident last weekend while his car was on autopilot.

It capped a horrible week by announcing a comprehensive recall of every Model S made before April 2016 for a faulty part. After fighting tooth and nail to maintain the $300 support level, Tesla swiftly sold off down to $250.

The disruption fetish permeating the ranks of the tech industry has its merits. Often the end result manifests through cheaper prices and better consumer services.

However, Uber's over-aggressiveness has placed it at the forefront of the regulation backlash along with Facebook (FB).

Google has certainly been playing its cards right, and having not run over a pedestrian consolidates its leading position

Luckily, the National Transportation Safety Board does not punish every participant using this technology.

No news is good news.

An extensive review of internal processes will hit team morale, and the burden of blame with fall upon the engineers.

The fallout from the tragic incidents will set back Tesla and Uber at least three to six months.

The suspension of their operations is akin to a white flag because Waymo is currently leaps ahead and plans to ramp up the mass rollout in the next two years with technology that is best of breed.

The running joke in the industry is that Uber's autonomous vehicle engineers are comprised of Waymo rejects.

Waymo already has more than 600 for-profit vehicles in operation in Arizona. And as every day without a fatality is considered a success, the Jaguars are next in line to be tricked-out with sensors and software.

Unceremoniously, Waymo has focused on safety as the pillar of its autonomous driving operation. Its conservative attitude toward danger will serve it well in the future. Waymo even spouted that its technology would have avoided the Uber accident.

Waymo has no desire to physically produce cars, but it aspires to sell licenses to the technology that could be installed in trucks and delivery vehicles, too.

The licenses could act as de-facto SaaS (software as a service) reoccurring revenue that has catapulted cloud companies to untold heights.

Google would also be able to integrate Google Maps, Google Docs, and all Google services into the robot-cab experience. The robo-taxi would merely serve as an incubation chamber to use the plethora of Google services while being transported from point A to point B.

And with Uber temporarily wiped off the map, Waymo seems like a great bet to monetize this segment at massive scale.

Google is truly on a roll as of late, even finding the perfect fall guy for the big data leak that has roiled the tech world, inducing a wicked tech sell-off - Facebook.

Instead of extracting data from user-posted content, Google's search builds a profile on users' search tendencies, and it is just as culpable in this ordeal.

Ironically, all the heat is coming down on Facebook's plate, and Mark Zuckerberg's lack of tactical PR noise is cause for investor concern.

The mountains of cash vaulted up over the years has made barriers of entry into new fields simple.

For example, Amazon's desire to lead health care came out of left field, and 10 years ago nobody ever thought the iPod company would make smart watches.

The interesting development in broader tech is the disintegration of unity that once supported the backbone of these firms.

Tim Cook, chief executive officer of Apple, railed on Facebook's business model and trashed Mark Zuckerberg's blatant disregard for privacy in order to profit from people's personal lives.

Large cap tech has never had as much overlap as it does now, and the new normal is throwing others under the bus.

If Google is dragged into the Facebook regulatory orbit, the silver lining is that the world's best autonomous driving technology will soon transform its narrative and put its incredibly profitable search business on the back burner.

Markets are forward looking and reward outstanding growth stories.

Tech is growth.

Morgan Stanley issued a report claiming the repercussions of mass-integrating this technology would be to the tune of about half a trillion dollars. That includes the $18 billion saved in annual health costs to automotive injuries. Also, 42% of police work ignites from a simple traffic stop. This would vanish overnight as well as concrete parking garages that blight cities. Car insurance is another industry that will be swept into the dustbin of ancient history.

Yes, tech has evolved that fast when Google can start claiming its revered search business as the daunted L word - legacy business.

The fog of war is starting to burn off and the visible winner is Waymo.

The shaping of its autonomous vehicle business is starting to take concrete form and although this won't affect earnings in the next few years, it will be a game changer of monumental proportions.

Uber is seriously in the throes of having an existential problem because of Waymo's outperformance. Venture capitalists heavily invested in Uber because of the promises of autonomous vehicle technology.

This is its entire growth story of the future.

Without it, it is a simple taxi company run on an app. There is no competitive advantage.

Waymo is on the verge of creating a scintillating growth business that is effectively Uber without a driver while simultaneously destroying Uber.

Ouch!

It speaks volumes to the ascendancy. And if Waymo miraculously capitulates, Google can always call Chris Carter and find another "fall guy."

__________________________________________________________________________________________________

Quote of the Day

Asked what he would do if he was Mark Zuckerberg, Apple CEO Tim Cook said, "I wouldn't be in this situation."

Global Market Comments

March 23, 2018

Fiat Lux

Featured Trade:

(DON'T MISS THE MARCH 28 GLOBAL STRATEGY WEBINAR),

(FRIDAY, APRIL 6, INCLINE VILLAGE, NEVADA, STRATEGY LUNCHEON)

(WHY US BONDS LOVE CHINESE TARIFFS),

(TLT), (TBT), (SOYB), (BA), (GM)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.