The last six months have been the most successful in my 52 years of trading. The only thing that comes close were the last six months of 1989 when the Tokyo market went straight up and hit a 30-year peak.

Everything I tried worked. The trades I only thought about worked. And the 50 trade alerts I abandoned on the floor because the market moved too fast worked as well. That’s how I missed Facebook (FB) and Amazon (AMZN).

It is believed that if you set a team of monkeys loose, randomly hitting keys on typewriters, they would eventually produce Romeo and Juliet. In this market, they have been producing the entire works of Shakespeare on a daily basis.

It has been that good.

President Biden has been looking pretty good too, having presided over the best starting three-month stock market results since 1933. That is no accident. The massive stimulus and the remaking of the country he has proposed have Franklin Roosevelt’s New Deal-inspired handwriting all over them.

Yet, traders have been puzzled, perplexed, and befuddled by companies that announce the best earnings in history only to see their shares sell-off dramatically. However, the market has shown its hand.

We’ve now seen three quarters of tremendously improving earnings and stock dives. It’s a 12-week cycle that keeps repeating. Shares rally hard for six weeks into earnings, peak, and then go nowhere for six weeks. Wash, rinse, repeat, then go to new all-time highs.

But stocks don’t fall enough to justify getting out and back in again, especially on an after-tax basis. Therefore, it’s just best to lie back and think of England while your stocks do nothing.

If my analysis is correct, then it's best to imagine the rolling green hills of Kent and Wiltshire, the friendly neighborhood pub, and Westminster Cathedral until June. If you want to get aggressive, you might even sell short an out-of-the-money call option or two to protect your portfolio.

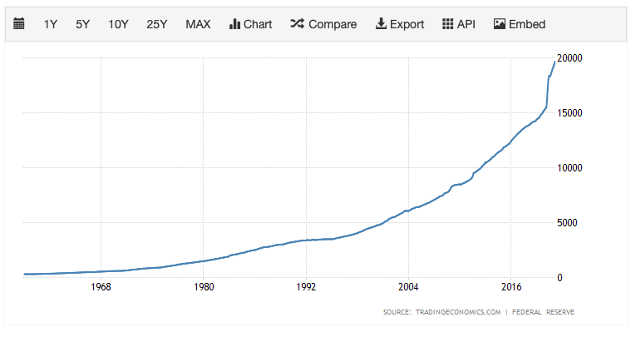

The Fed leaves rates unchanged, indicating that the economy is improving, but that interest rates are going nowhere. No surprise here. Jay Powell is still going for maximum dove. Strong Biden policy support and the rollout of the vaccine are major positives. $120 billion in bond buying continues. The Fed will keep interest rates at zero until the US economy reaches maximum employment by adding 8.4 million jobs. That could be a long wait as I suspect those jobs have already been destroyed by technology. Stocks popped on the news. The Bull lives!

Q1 GDP eExploded by 6.4%, and upward revisions are to come. That explains the 25% gain in the stock market during the first three months of the Biden administration, the best in 75 years. Coming quarters will show even stronger growth as the economy shakes off the pandemic and massive government spending kicks in. We will recover 2019 GDP peaks in the next quarter. Virtually, all economic data points will set records for the rest of 2021. Buy everything on dips.

Weekly Jobless Claims dive again to 553,000, a new post-pandemic low. One of a never-ending series of perfect data. It augurs well for next week’s April Nonfarm Payroll Report.

New Home Sales up a ballistic 20.7% YOY in March on the basis of a signed contract. This is in the face of rising home mortgage interest rates. The flight to the suburbs continues. Homebuilder stocks took off like a scalded chimp. Buy (LEN), (KBH), and (PHM) on dips.

Pending Home Sales fell 1.9%, far below expectations, but are still up 23% YOY. Higher prices and record low supply are the problems. The Midwest leads.

Amazon sales soar by 44% in Q1, producing some of the best earnings in American corporate history. Jeff is expecting sales to reach a staggering $110-$116 billion in Q2. That’s why he hired 500,000 last year, the most of any company since WWII. Prime subscribers have grown to 200 million, including me. Ad revenues jumped an eye-popping 77%. The shares of the huge pandemic winner leaped $140 on the news. It’s all another step toward my $5,000 target.

Tesla revenues explode for 74%, and earnings soar to an eye-popping $438 million. Sales are to double or more in 2021 and are up 104% YOY. Q1 is usually the slowest quarter of the year for the auto industry. Global demand is increasing far beyond production levels. It is ducking around chip shortages by designing in a new generation that is currently available. Production of high-end X and S Models has ceased to allow more focus on the profitable Y and 3 Models. Those will resume in Q3. The shares were unchanged on the news. Keep buying (TSLA) on dips. It’s headed for $10,000.

Copper hits new 10-year high, lighting a fire under Freeport McMoRan (FCX) which we are long. We still are in the early innings of a major commodity supercycle. The green revolution goes nowhere without increasing copper supplies tenfold. A copper shock is imminent.

US Capital Spending leaps ahead, up 0.9% in March and up 10.4% YOY. The stimulus spending is working. All is well in manufacturing land, which is 12% of the US economy.

Case-Shiller explodes to the upside, the National Home Prices Index soaring 12% in February. That’s the best report in 15 years. Phoenix (+17.4), San Diego (+17.0%), and Seattle (15.4%) continue to be the big winners. This was in the face of a 50-basis point jump in home mortgage interest rates during the month. The rush to buy homes is pulling forward future demand. The perfect storm continues.

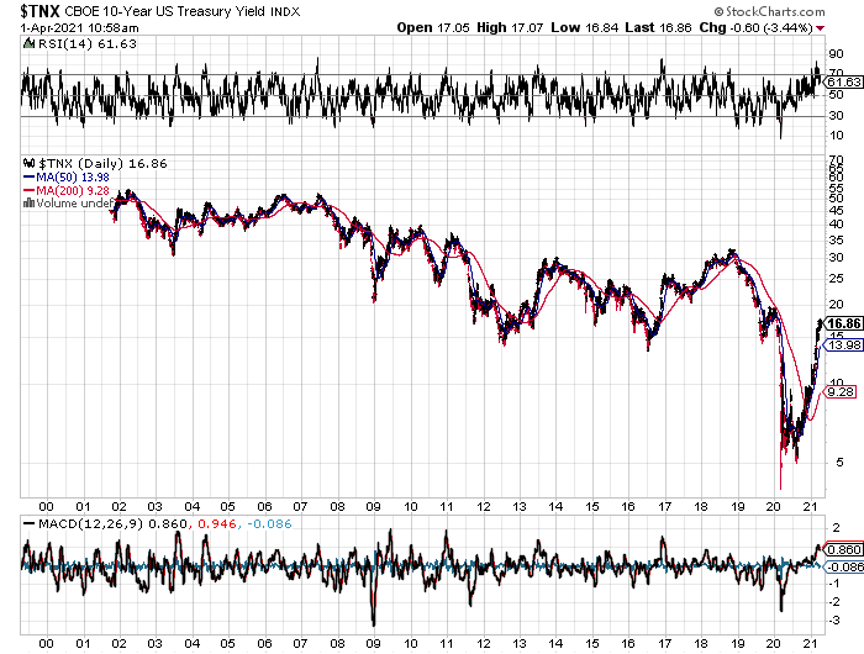

The Fed could start tapering its $120 billion a month in bond purchases as early as October, believes the Blackrock’s (BLK) Rick Rieder. When it does, expect the sushi to hit the bond market. Keep piling on those bond shorts, as I have been doing monthly, and am currently running a triple short position. Keep selling short the (TLT) on every opportunity.

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

My Mad Hedge Global Trading Dispatch profit reached 13.54% gain during April on the heels of a spectacular 20.60% profit in March.

I used the post-earnings dip in Microsoft (MSFT) to add a new position there. I also picked up some Delta Airlines (DAL) taking advantage of a pullback there.

That leaves me 100% invested, as I have been for the last six months.

My 2021 year-to-date performance soared to 57.63%. The Dow Average is up 11.8% so far in 2021.

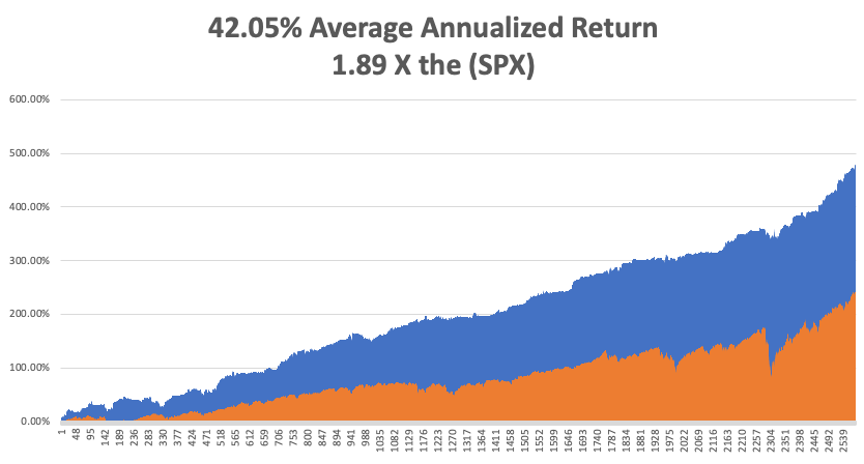

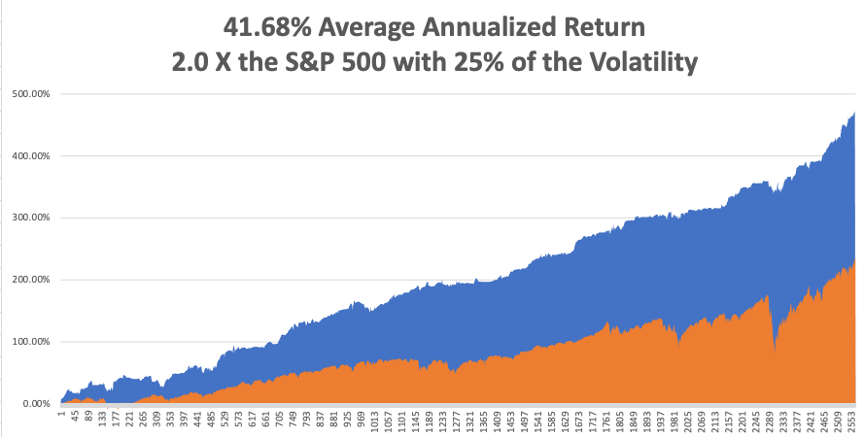

That brings my 11-year total return to 480.18%, some 2.00 times the S&P 500 (SPX) over the same period. My 11-year average annualized return now stands at an unbelievable 42.05%, easily the highest in the industry.

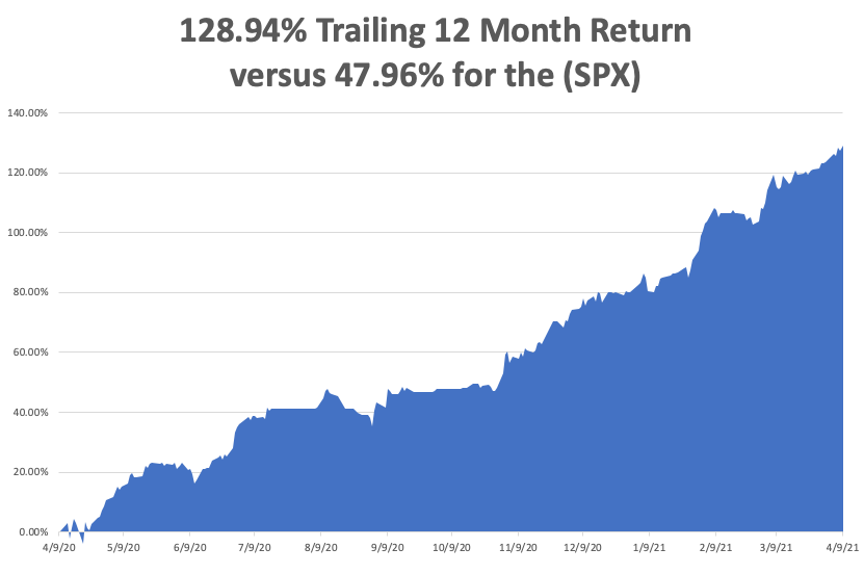

My trailing one-year return exploded to positively eye-popping 133.91%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 31.9 million and deaths topping 570,000, which you can find here.

The coming week will be big on the data front, with a couple of historic numbers expected.

On Monday, May 3, at 10:00 AM, the US ISM Manufacturing Index is published. Merck (MRK) and Estee Lauder (EL) report.

On Tuesday, May 4, at 8:00 AM, total US Vehicle Sales for April are out. Union Pacific (UNP) and Pfizer (PFE) report.

On Wednesday, May 5 at 2:00 PM, the ADP Private Employment Report is released. General Motors (GM) and PayPal (PYPL) report.

On Thursday, May 6 at 8:30 AM, the Weekly Jobless Claims are printed. Regeneron (REGN) and Roku (ROKU) report.

On Friday, May 7 at 8:30 AM, we learn the all-important April Nonfarm Payroll Report. At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, I received calls from six readers last week saying I remind them of Earnest Hemingway. This, no doubt, was the result of Ken Burns’ excellent documentary about the Nobel prize-winning writer on PBS last week.

It is no accident.

My grandfather drove for the Italian Red Cross on the Alpine front during WWI, where Hemingway got his start, so we had a connection right there.

Since I read Hemingway’s books in my mid-teens, I decided I wanted to be him and became a war correspondent. In those days, you traveled by ship a lot, leaving ample time to finish off his complete works.

I visited his homes in Key West and Ketchum Idaho. His Cuban residence is high on my list, now that Castro is gone.

I used to stay in the Hemingway Suite at the Ritz Hotel on Place Vendome in Paris where he lived during WWII. I had drinks at the Hemingway Bar downstairs where war correspondent Earnest shot a German colonel in the face at point-blank range. I still have the ashtrays.

Harry’s Bar in Venice, a Hemingway favorite, was a regular stopping-off point for me. I have those ashtrays too.

I even dated his granddaughter from his first wife, Hadley, the movie star Mariel Hemingway, before she got married, and when she was still being pursued by Robert de Niro and Woody Allen. Some genes skip generations and she was a dead ringer for her grandfather. She was the only Playboy centerfold I ever went out with. We still keep in touch.

So, I’ll spend the weekend watching Farewell to Arms….again, after I finish my writing.

Oh, and if you visit the Ritz Hotel today, you’ll find the ashtrays are glued to the tables.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Life is a Bed of Roses Right Now