Here is the only statistic you need to know right now.

If NVIDIA (NVDA) continues growing at the same rate it has for the last year it will be larger than the entire global economy by 2030, about $100 trillion, up from the current $2 trillion.

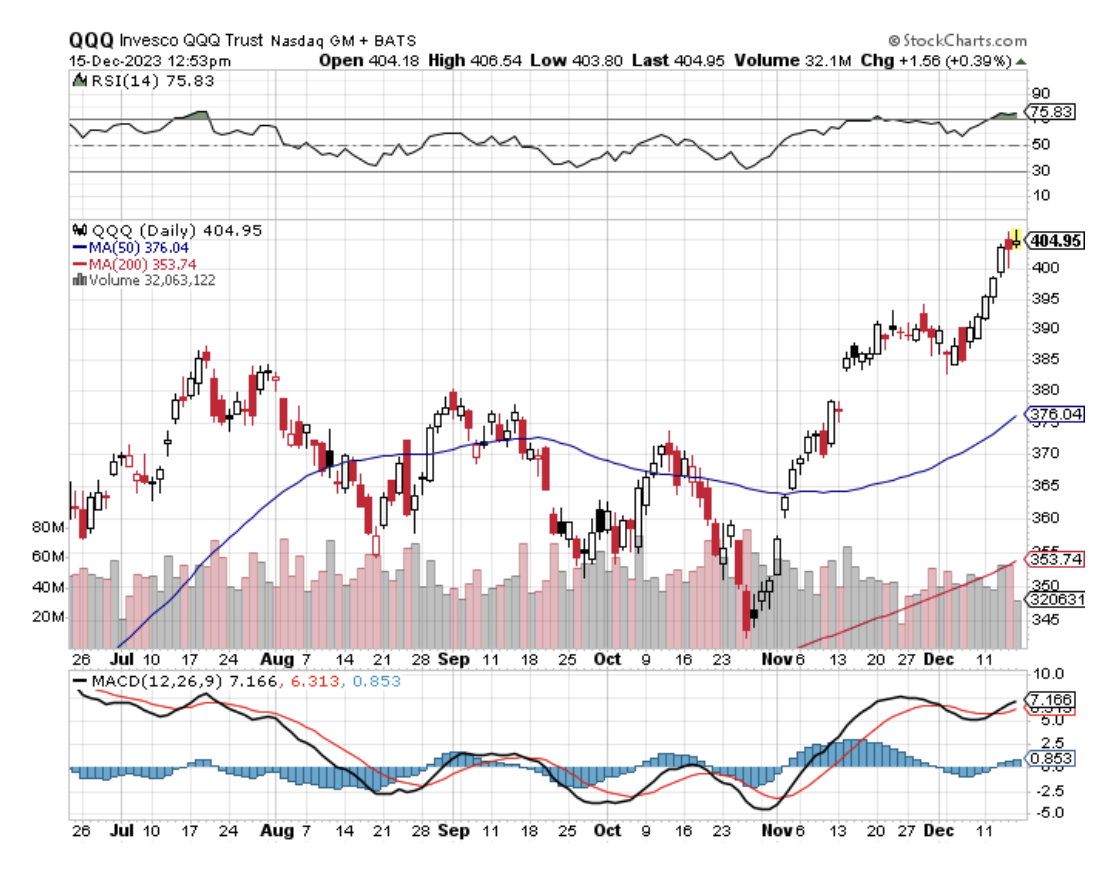

Which suggests that it might not actually achieve that lofty goal. Others have reached the same conclusion as I and the stock held up remarkably well in the face of absolutely massive profit-taking last week.

I have been through past market cycles when other stocks seemed to want to go to infinity. There was Apple (AAPL) in the 1980s which went ballistic, then died, was reborn, and then went ballistic again. It is now capped out at a $2.7 trillion market valuation.

Then we all had a great time trading Tesla, which exploded from a split-adjusted $2.35 to $424 and now seems mired in one of its periodic 80% corrections. But mark my word, it is headed to $1,000 someday, taking it up to a $3.2 trillion valuation.

So if NVIDIA isn’t going to $100 trillion what else should be buying right now?

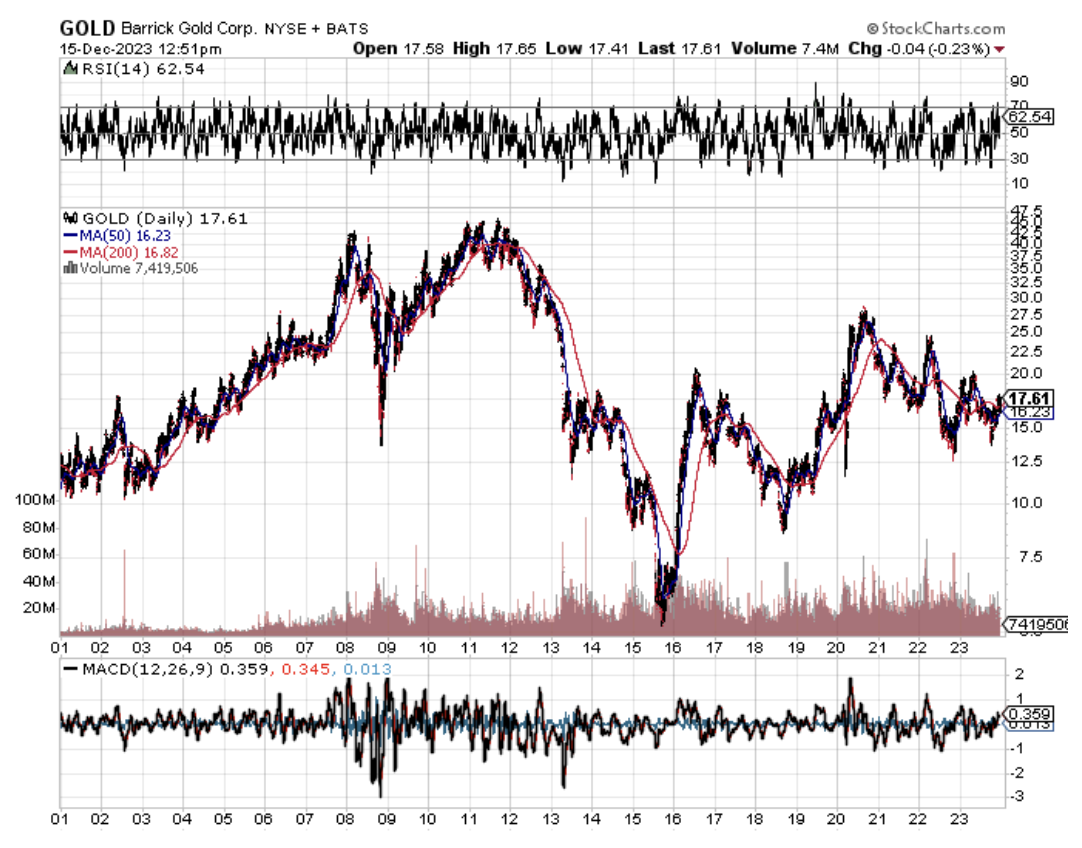

The answer has been apparent in the market for the past two weeks. Interest rate-sensitive commodities have been on a tear, rising 15%-20% across the board. Investors have been using expensive stocks like (NVDA), (MSFT), (AAPL), (META), and (GOOGL) as ATMs to fund purchases of cheap stocks which in some cases have not moved for years.

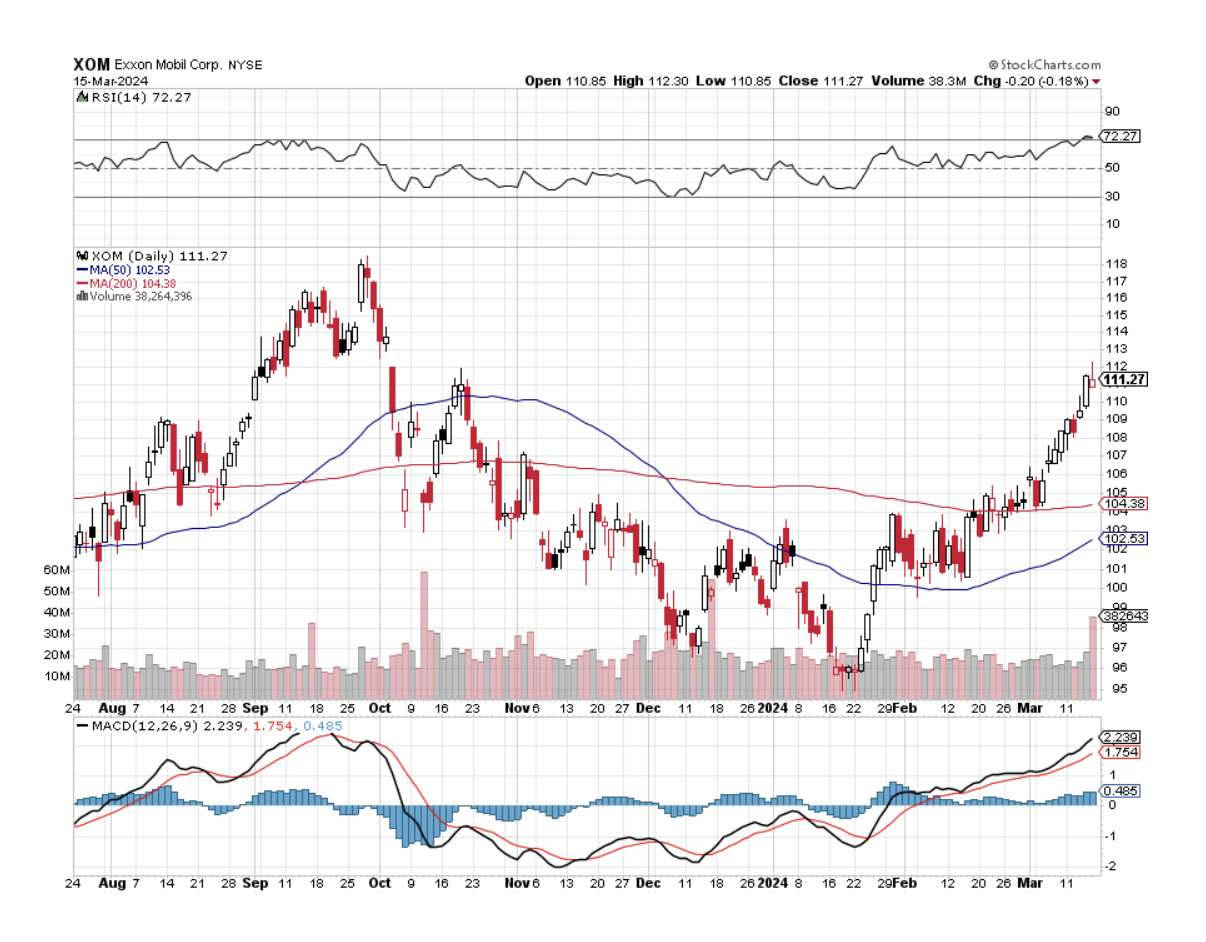

It really has been an across-the-board move with money pouring into the entire interest rate-sensitive sectors, including copper (FCX), gold (GOLD), silver (WPM), lithium (ALB), Aluminum (AA), and energy (XOM).

It has spread to other economically sensitive stocks like Union Pacific (UNP) and FedEx (FDX). There seems to be an American economic recovery underway, and the bull market is broadening out. The good news is that it’s not too late to get involved.

A lot of it is investor psychology. Investors fear looking stupid more than they fear losing money. If you buy NVIDIA here on top of a one-year tripling and it tanks you will look like an idiot. If you buy commodities here and they grind up for the rest of 2024 you will look like a genius.

While many of you got slaughtered by the collapse of natural gas this winter, with (UNG) cratering from $32 down to a lowly $15, there is in fact a silver lining to this cloud. Cheap energy costs are now permeating throughout the entire global economy and are filtering down to the bottom lines of companies, municipalities, and even governments.

This has been made possible by the growth of US natural gas production from 1 trillion MM BTUs to 7.5 trillion in just the past ten years. The US is now the largest gas and oil producer in the world by a large margin. Replacing Russia as Europe’s largest energy source in just a year was thought impossible and is now a fact and is also enabling the Continent to stand up to Russian Aggression.

There is hope after all.

One question I constantly received during last week’s Mad Hedge Traders & Investors Summit was “When will Tesla (TSLA) shares bottom? The answer is a very firm “Not yet!”

I have been trading the shares of Elon Musk’s creation for 15 years and can tell you that big surges in the stock always precede major generational changes at the company.

We had a nice run from my $2.35 split-adjusted cost when the first Model S came out (I got chassis number 125 off the assembly line), replacing the toy-like two-seat Tesla Roadster, which was built on a cute little Lotus Elise body from England.

The next big run came with the advent of the much cheaper Model 3 in 2017. The ballistic melt up to $424 began with the launch of the small SUV Model Y in 2020, now the biggest-selling car in the world. All we needed was for Elon Musk to sell $10 billion worth of his own stock by early 2022 to put the final top in.

Which raises the question of when the next major generational change at Tesla. That would be the introduction of the $25,000 Model 2 in 2025. Since everything at Tesla happens late (Elon uses deadlines to flog his staff), it better count on late 2025. That means you should start scaling in around the summer. I am already running the numbers on call spreads and LEAPS now.

Can it fall more in the meantime? Absolutely. $150 a share looks like a chip shot. But to only focus on the EV business, which will account for a mere 10% of Tesla’s final total profits, is to miss Elon’s long-term grand vision of a carbon-free world.

Tesla is in the process of becoming the largest electric power utility in the US, eventually providing charging for 150 million cars. It is taking over the car insurance business. My own premiums on my Model X have plunged by 90%.

It's on the way to becoming the world’s largest processor and recycler of lithium. Tesla has a massive large-scale power storage business that no one knows about.

I fully expect Tesla to become the world’s largest company in a decade. Tesla at $1,000 a share here we come. And while the car business may be slow to turn around, the ingredients that go into the cars, like copper (FCX), Aluminum (AA), and lithium (ALB) are starting to move now.

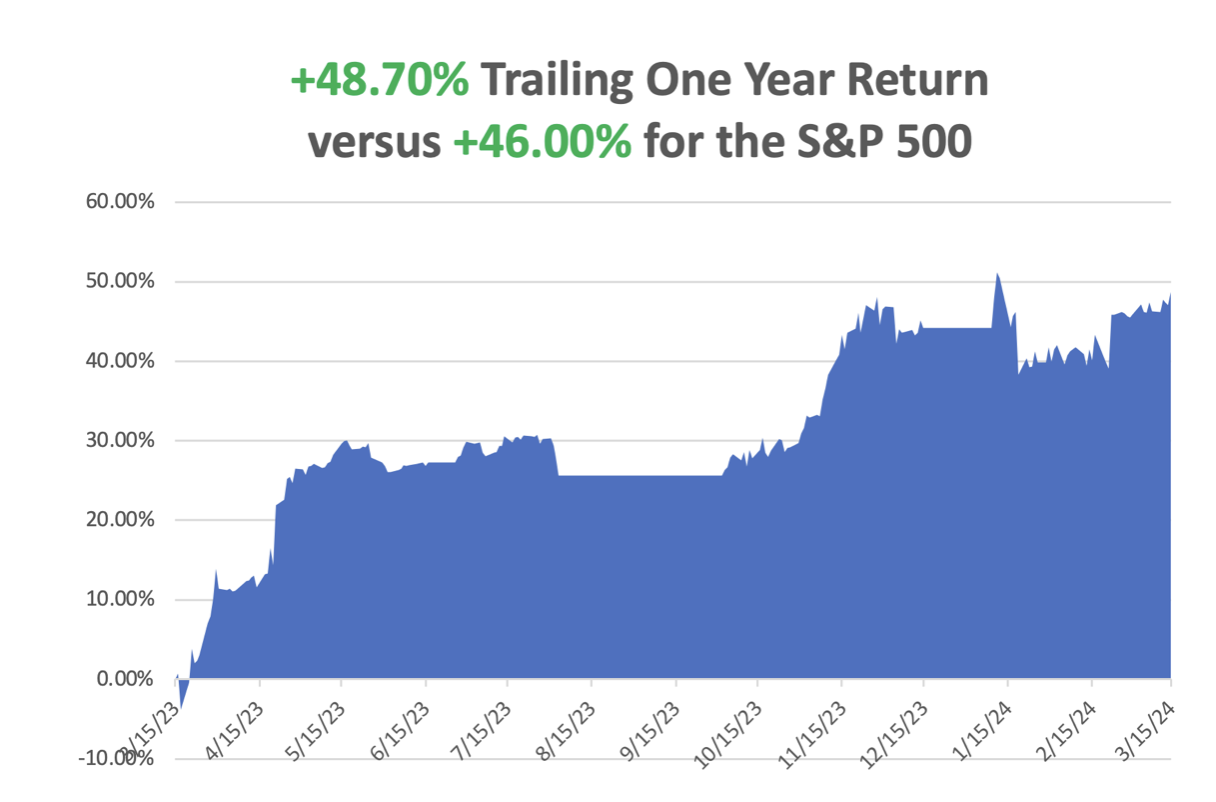

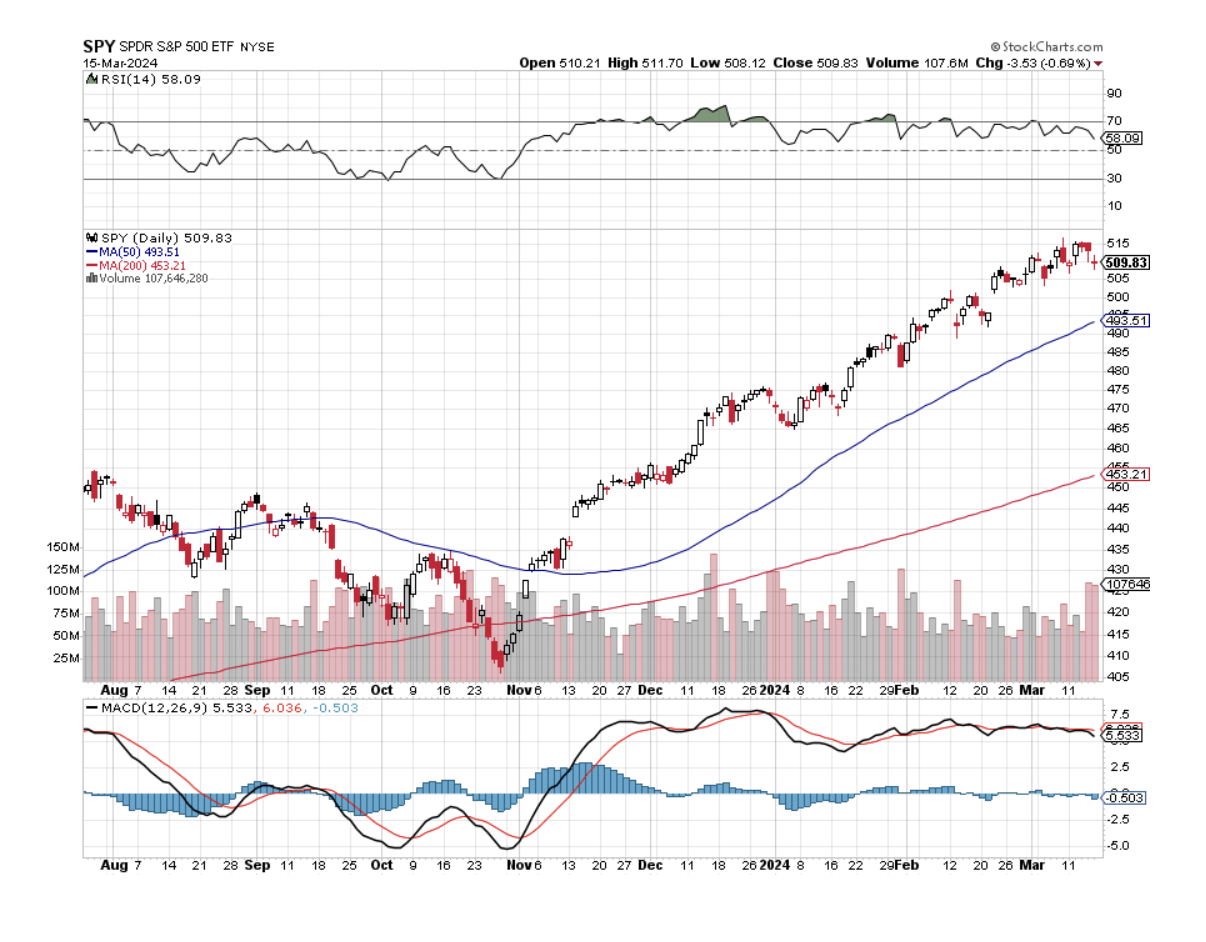

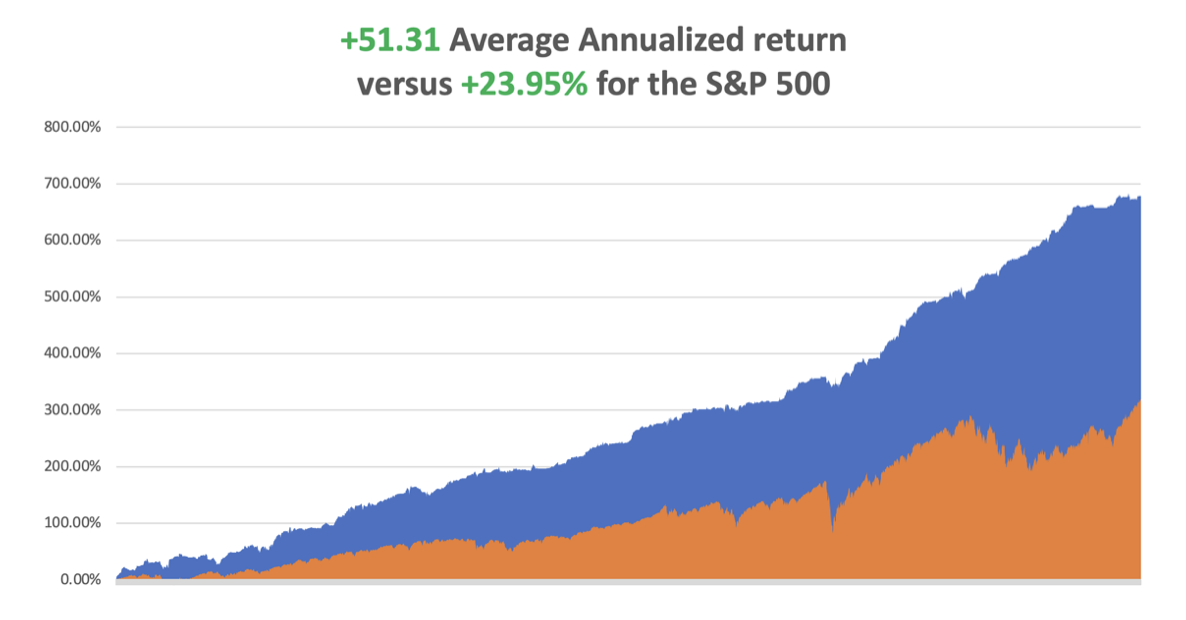

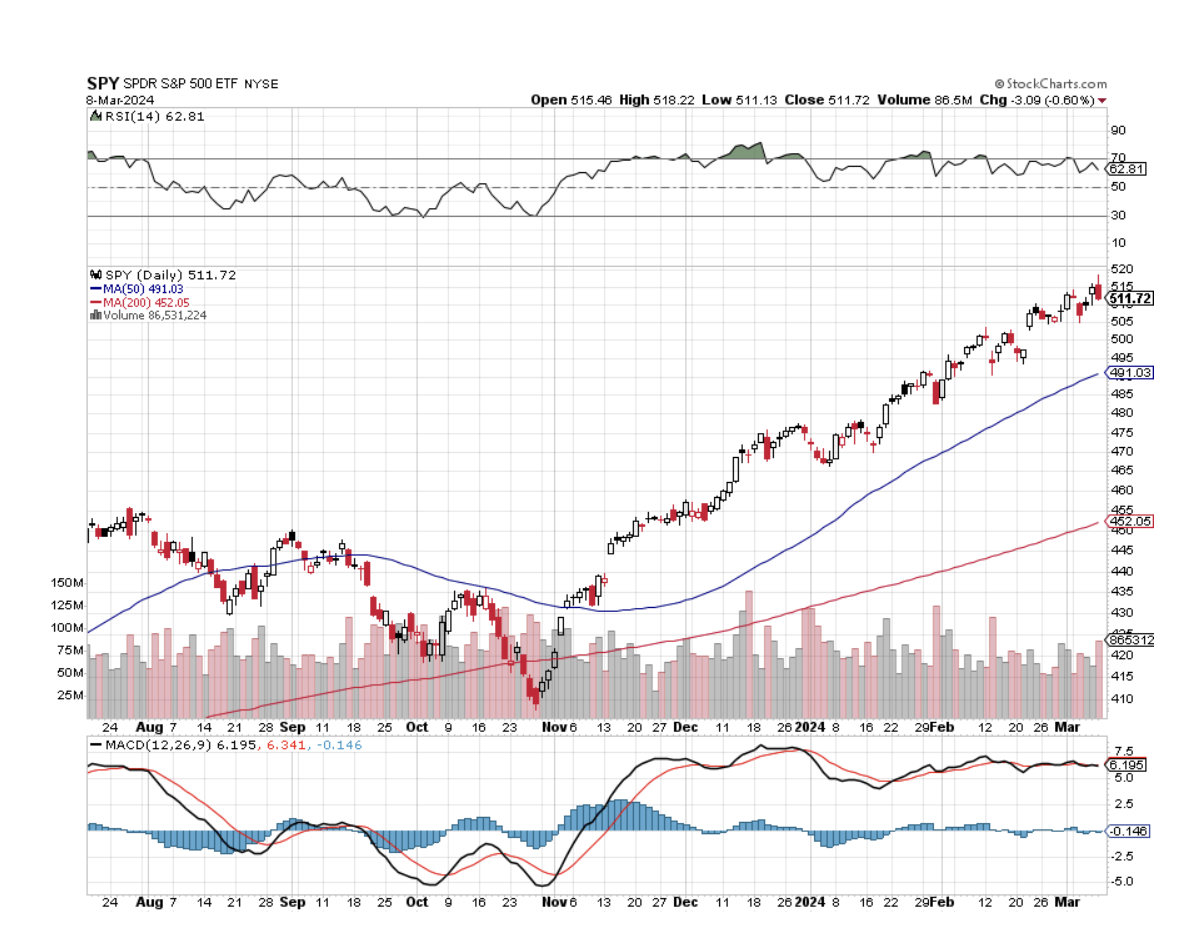

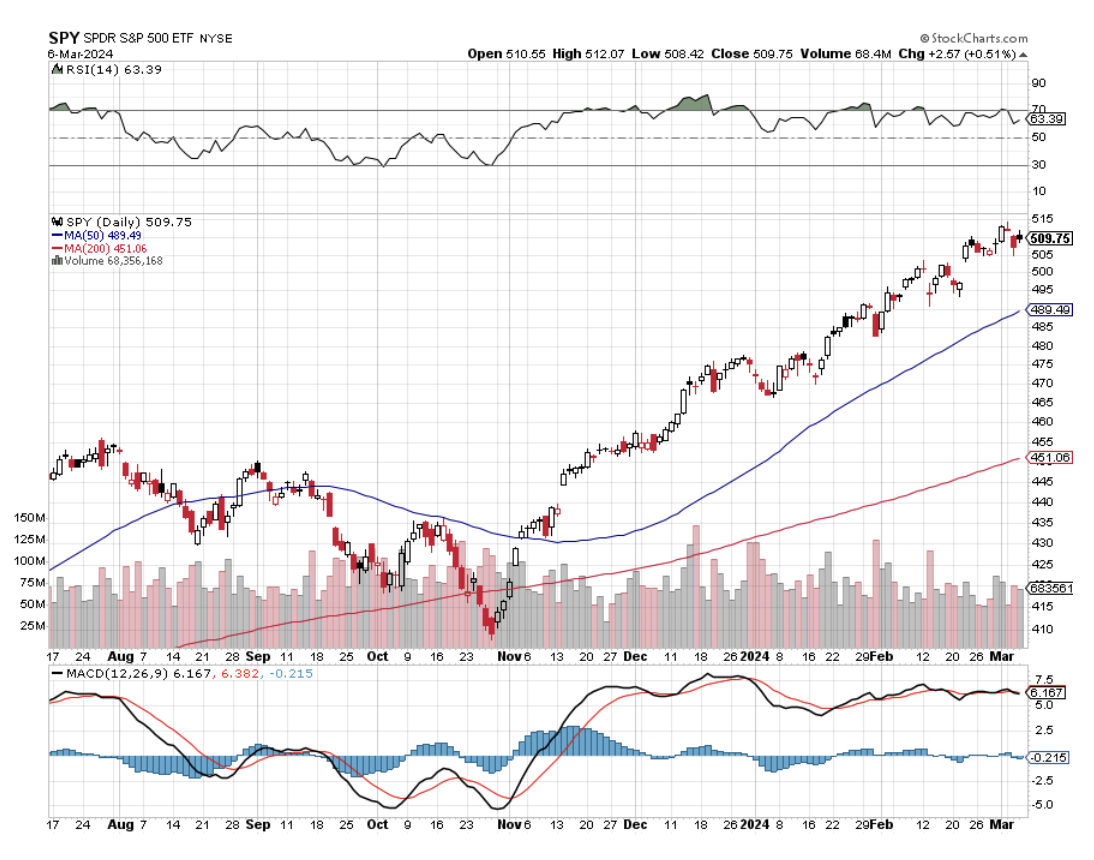

In February we closed up +7.42%. So far in March, we are up +1.34%. My 2024 year-to-date performance is at +4.48%. The S&P 500 (SPY) is up +6.92% so far in 2024. My trailing one-year return reached +48.70% versus +27.25% for the S&P 500.

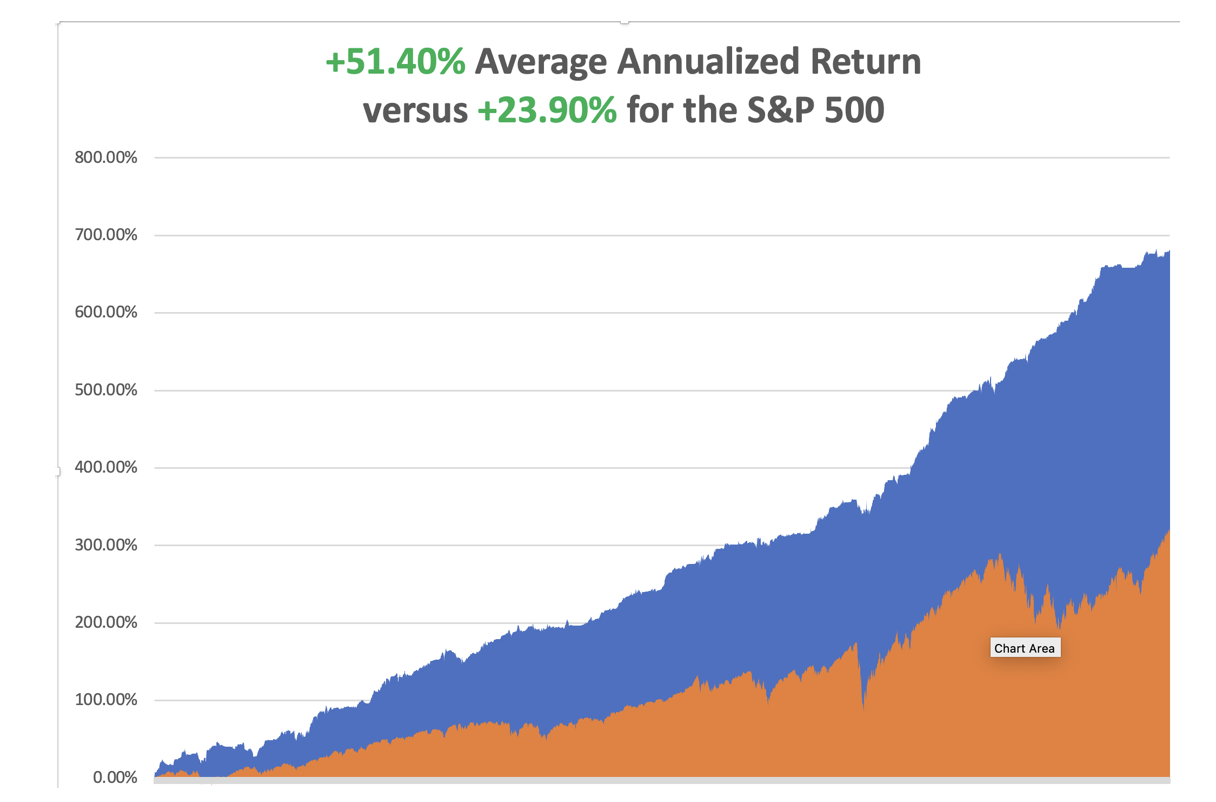

That brings my 16-year total return to +681.11%. My average annualized return has recovered to +51.40%.

Some 63 of my 70 round trips were profitable in 2023. Some 11 of 19 trades have been profitable so far in 2024.

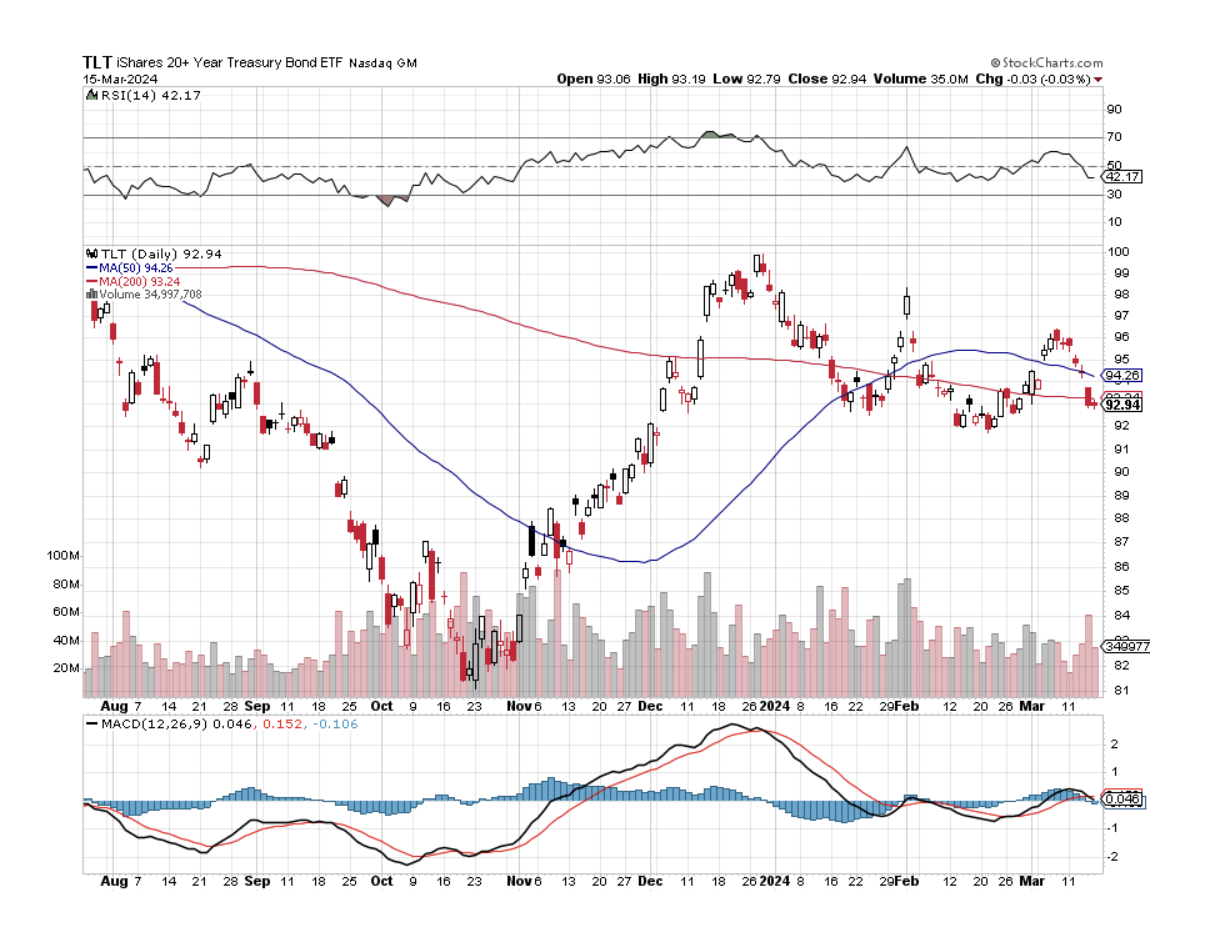

I stopped out of my position in Snowflake (SNOW) for a small loss figuring that the tech rally’s days may be number after the most heroic move in history. I then rotated the money into new longs in Freeport McMoRan (FCX) and ExxonMobile (XOM). I also took profits on my short in bonds (TLT) after a $3.50 point dive there. I am maintaining a long in (TLT). I am 70% in cash and am looking for new commodity plays to pile into.

CPI Comes in Hot at 0.4% in February. YOY inflation crawled up to 3.2% to 3.1% expected. Higher shelter and gasoline prices are to blame. Bonds tank as interest rate cuts get pushed back. So do stocks. The market was ripe for a correction anyway.

PPI Comes in Hotter than Hot, at 0.6%. That was higher than the 0.3% forecast from Dow Jones and comes after a 0.3% increase in January. Stocks dipped for two minutes and then rocketed back up. Bad news is good news. Go figure.

Weekly Jobless Claims Dip, to 209,000 to an expected 218,000, and down 1,000 from the previous week. It’s a go-nowhere number.

Next-Generation Boeing Delayed Until 2027, says Delta Airlines, a major customer. The 737-10, Boeing's biggest Max plane with a maximum seating capacity of 230 passengers, is pending certification by the U.S. Federal Aviation Administration (FAA). Expect a hard look. Buy (BA) on the next meltdown.

BYD Launches its $12,500 Car, the Model e2 Hatchback, firing another shot across Tesla’s Bow. The EV will initially be available only in China, Tesla’s biggest market, and then in emerging countries without vehicle standards. Don’t expect to see them in the US.

Toyota Agrees to Biggest Wage Hike in 25 Years. Toyota, the world's biggest carmaker and traditionally a bellwether of the annual talks, said it agreed to the demands of monthly pay increases of as much as 28,440 yen ($193) and record bonus payments. Is the Bank of Japan about to raise interest rates? Is the Japanese yen about to rocket?

Inverted What? Economists are going up on the Inverted Yield Curve as a recession indicator. Short-term interest rates have been higher than long-term ones for two years now, but the recession never showed. Relying on obsolete data analysis can be fatal to your wealth.

My Ten -Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, March 18, at 7:00 AM EST, the NAHB Housing Index is announced.

On Tuesday, March 19 at 8:30 AM, Housing Starts for February are released.

On Wednesday, March 20 at 11:00 AM, the Federal Reserve Interest rate decision is published

On Thursday, March 21 at 8:30 AM, the Weekly Jobless Claims are announced.

On Friday, March 15 At 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, with all of the hoopla over the Oppenheimer movie winning six Academy Awards, including one for best picture, I thought I’d recall my own experience with the nuclear establishment buried in my long and distant past.

If you were good at math there were only two career choices during the early 1970s: teaching math or working for the Dept of Defense. Since I was sick of university after six years, I chose the latter.

That decision sent me down a long bumpy, dusty road in Mercury Nevada headed for the Nuclear Test Site. There was no sign. You could only find the turnoff from US Highway 95 marked by four trailers owned by the nearest hookers to the top-secret base.

Oppenheimer himself had died three years earlier, a victim of throat cancer induced by the chain-smoking of Luck Strikes that was common in those days. But everyone on the base knew him as they had all worked on the Manhattan Project when they were young men. They worshiped him like a god.

I did meet Edward Teller, who argued in the movie that the atomic bomb was a waste of time because his design of a hydrogen bomb was 100 times more powerful. The problem was that there was no target big enough to justify a bomb of that size (there still isn’t).

As I watched the film with my kids, now junior scientists in their own right, I kept pointing out “I knew him,” except they were gnarly old and white-haired by the time I met them. Of course, they are all gone now.

My memories of the Nuclear Test Site were never to ask questions, my visit to the Glass Desert where the sand had been turned into glass by above-ground tests in the fifties, and skinny dipping with the female staff in the small swimming pool at midnight.

The MPs were pissed.

With the signing of the SALT I Treaty in 1972, underground testing moved to computer models and I lost my job. So I was sent to Hiroshima to interview survivors and write a 30-year after-action report. These were some of the most cheerful people I ever met. If an atomic bomb can’t kill you, then nothing can.

When the Cold War ended in 1992, the United States judiciously stepped in and bought the collapsing Soviet Union’s entire uranium and plutonium supply.

For good measure, my hedge fund client George Soros provided a $50 million grant to hire every unemployed Soviet nuclear engineer. The fear then was that starving scientists would go to work for Libya, Iraq, North Korea, or Pakistan, which all had active nuclear programs. They ended up in the US instead.

That provided the fuel to run all US nuclear power plants and warships for 20 years. That fuel has now run out and chances of a resupply from Russia are zero. The Department of Defense attempted to reopen our last plutonium factory in Amarillo, Texas, a legacy of the Johnson administration.

But the facilities were deemed too old and out of date, and it is cheaper to build a new factory from scratch anyway. What better place to do so than Los Alamos, which has the greatest concentration of nuclear expertise in the world.

Los Alamos is a funny sort of place. It sits at 7,320 feet on a mesa on the edge of an ancient volcano so if things go wrong, they won’t blow up the rest of the state. The homes are mid-century modern built when defense budgets were essentially unlimited. As a prime target in a nuclear war, there are said to be miles of secret underground tunnels hacked out of solid rock.

You need to bring a Geiger counter to garage sales because sometimes interesting items are work castaways. A friend almost bought a cool coffee table which turned out to be part of an old cyclotron. And for a town designing the instruments to bring on the possible end of the world, it seems to have an abnormal number of churches. They’re everywhere.

I have hundreds of stories from the old nuclear days passed down from those who worked for J. Robert Oppenheimer and General Leslie Groves, who ran the Manhattan Project in the early 1940s. They were young mathematicians, physicists, and engineers at the time, in their 20’s and 30’s, who later became my university professors. The A-bomb was the most important event of their lives.

Unfortunately, I couldn’t relay this precious unwritten history to anyone without a security clearance. So, it stayed buried with me for a half century, until now.

Some 1,200 engineers will be hired for the first phase of the new plutonium plant, which I got a chance to see. That will create challenges for a town of 13,000 where existing housing shortages already force interns and graduate students to live in tents. It gets cold at night and dropped to 13 degrees F when I was there.

I was allowed to visit the Trinity site at the White Sands Missile Test Range, the first visitor to do so in many years. This is where the first atomic bomb was exploded on July 16, 1945. The 20-kiloton explosion set off burglar alarms for 200 miles and was double to ten times the expected yield.

Enormous targets hundreds of yards away were thrown about like toys (they are still there). Some scientists thought the bomb might ignite the atmosphere and destroy the world but they went ahead anyway because so much money had been spent, 3% of US GDP for four years. Of the original 100-foot tower, only a tiny stump of concrete is left (picture below).

With the other visitors, there was a carnival atmosphere as people worked so hard to get there. My Army escort never left me out of their sight. Some 79 years after the explosion, the background radiation was ten times normal, so I couldn’t stay more than an hour.

Needless to say, that makes uranium plays like Cameco (CCJ), NextGen Energy (NXE), Uranium Energy (UEC), and Energy Fuels (UUUU) great long-term plays, as prices will almost certainly rise all of which look cheap. US government demand for uranium and yellow cake, its commercial byproduct, is going to be huge. Uranium is also being touted as a carbon-free energy source needed to replace oil.

At Ground Zero in 1945

What’s Left of a Trinity Target 200 Yards Out

Playing With My Geiger Counter

Atomic Bomb No.3 Which was Never Used in Tokyo

What’s Left from the Original Test

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader